Professional Documents

Culture Documents

Itl - Letter of Credit

Itl - Letter of Credit

Uploaded by

Sonal SahayCopyright:

Available Formats

You might also like

- Design and Implementation of Online Event Management SystemDocument55 pagesDesign and Implementation of Online Event Management SystemAchiever74% (23)

- Kathryn Jones Presentation KitDocument219 pagesKathryn Jones Presentation KitFeliciana ValenzuelaNo ratings yet

- Valuation For Merger: DR Pepper Snapple Group & Keurig Green MountainDocument72 pagesValuation For Merger: DR Pepper Snapple Group & Keurig Green Mountainrk_ravindraNo ratings yet

- The Term Alternate Delivery ChannelDocument4 pagesThe Term Alternate Delivery ChannelIftekhar Abid Fahim100% (1)

- Consumer Lending Audit Program For ACUIADocument8 pagesConsumer Lending Audit Program For ACUIAMisc EllaneousNo ratings yet

- Four Organizational Culture TypesDocument4 pagesFour Organizational Culture TypesALTERINDONESIA100% (1)

- Consumer Lending - Whitepaper PDFDocument3 pagesConsumer Lending - Whitepaper PDFAbhinavNo ratings yet

- Auto-Sweep Facility in Your Savings Bank AccountDocument14 pagesAuto-Sweep Facility in Your Savings Bank Accountpradeepverma84No ratings yet

- STANDARD Cash Management Solutions Presentation-08202019Document88 pagesSTANDARD Cash Management Solutions Presentation-08202019Anonymous CMaI3m9i5100% (1)

- Letter of CreditDocument113 pagesLetter of CredithumairashehlaNo ratings yet

- IBM Banking: Our Payments Framework Solution For Financial Services Helps Simplify Payments OperationsDocument4 pagesIBM Banking: Our Payments Framework Solution For Financial Services Helps Simplify Payments OperationsIBMBankingNo ratings yet

- E BankingDocument41 pagesE Bankingchandni babunuNo ratings yet

- Banking Products & Services IDocument34 pagesBanking Products & Services IAinnur HaziqahNo ratings yet

- KYC New ProjectDocument42 pagesKYC New ProjectNisha RathoreNo ratings yet

- Radhika Growth of Banking SectorDocument36 pagesRadhika Growth of Banking SectorPranav ViraNo ratings yet

- Letter of CreditDocument28 pagesLetter of Creditefty silswaNo ratings yet

- Accenture Banking Retail LendingDocument16 pagesAccenture Banking Retail LendingRaunak MotwaniNo ratings yet

- Rights Vs DutiesDocument2 pagesRights Vs Dutiesnakul_sehgal_2No ratings yet

- Investment LawDocument6 pagesInvestment LawVarsha ThampiNo ratings yet

- Prevention Ofmoney Laundering Act-2002 (PMLA)Document25 pagesPrevention Ofmoney Laundering Act-2002 (PMLA)vikramNo ratings yet

- Islamic Treasury Risk Management ProductsDocument4 pagesIslamic Treasury Risk Management ProductsjjangguNo ratings yet

- UNIT 2 - 16th September 2020Document42 pagesUNIT 2 - 16th September 2020GracyNo ratings yet

- Documentary CreditDocument15 pagesDocumentary CreditArmantoCepongNo ratings yet

- Local Print: Argentina COMPANY GROUP 1Document4 pagesLocal Print: Argentina COMPANY GROUP 1Luis Maria CepedaNo ratings yet

- Pssbooklet PDFDocument142 pagesPssbooklet PDFForkLogNo ratings yet

- JBL Full - S. M. Abdul MukitDocument50 pagesJBL Full - S. M. Abdul MukithabibNo ratings yet

- Pool Management: Muhammad Zeeshan Khan Product Manager Summit Bank Islamic EmailDocument31 pagesPool Management: Muhammad Zeeshan Khan Product Manager Summit Bank Islamic EmailAsad MemonNo ratings yet

- 2-Notes On Banking Products & Services-Part 1Document16 pages2-Notes On Banking Products & Services-Part 1Kirti GiyamalaniNo ratings yet

- What Is A Financial MarketDocument1 pageWhat Is A Financial Marketamitrao1983No ratings yet

- Chapter 1 - Introduction To Digital Banking - V1.0Document17 pagesChapter 1 - Introduction To Digital Banking - V1.0prabhjinderNo ratings yet

- Interview Questions For Bank in BangladeDocument7 pagesInterview Questions For Bank in BangladeKhaleda Akhter100% (1)

- Master Circular-Guarantees, Co-Acceptances & Letters of Credit - UcbsDocument14 pagesMaster Circular-Guarantees, Co-Acceptances & Letters of Credit - Ucbskalik goyalNo ratings yet

- Camca Group - Trade Finance SolutionsDocument13 pagesCamca Group - Trade Finance Solutionstajanan7240No ratings yet

- Corporate BankingDocument21 pagesCorporate BankingPadma NarayananNo ratings yet

- Depository System in IndiaDocument92 pagesDepository System in Indiasumesh894No ratings yet

- Final-General Banking .Document27 pagesFinal-General Banking .Salman AhmedNo ratings yet

- Unit 3: Commercial Bank Sources of Funds: 1. Transaction DepositsDocument9 pagesUnit 3: Commercial Bank Sources of Funds: 1. Transaction Depositsመስቀል ኃይላችን ነውNo ratings yet

- Emergence of Doorstep Banking - Merits and DemeritsDocument11 pagesEmergence of Doorstep Banking - Merits and Demeritsmani100% (1)

- Project On International BankingDocument53 pagesProject On International BankingSathvik ReddyNo ratings yet

- Customer Perception On Internet Banking and Their Impact On Customer Satisfaction Loyalty A Study in Indian Context PDFDocument5 pagesCustomer Perception On Internet Banking and Their Impact On Customer Satisfaction Loyalty A Study in Indian Context PDFNayana N Nagaraj100% (1)

- Kinds of Banks and Their Functions: School of LAW Guru GhasidasDocument20 pagesKinds of Banks and Their Functions: School of LAW Guru GhasidasNilam100% (1)

- Project by BrincyDocument64 pagesProject by BrincyJeeva VargheseNo ratings yet

- Customer Service in Banks - RBI RulesDocument15 pagesCustomer Service in Banks - RBI RulesRAMESHBABUNo ratings yet

- Sources of Funds For A BankDocument9 pagesSources of Funds For A BankViral ElaviaNo ratings yet

- Case Studies On The Letters of CreditDocument3 pagesCase Studies On The Letters of Creditomi0855100% (1)

- Trade Finance - Week 7-2Document15 pagesTrade Finance - Week 7-2subash1111@gmail.comNo ratings yet

- VISADocument29 pagesVISAShimaa Abou SreeNo ratings yet

- Fund - Transfer - Pricing - E&Y PDFDocument24 pagesFund - Transfer - Pricing - E&Y PDFsreeks456No ratings yet

- Swift Whitepaper Supply Chain Finance 201304Document8 pagesSwift Whitepaper Supply Chain Finance 201304Rami Al-SabriNo ratings yet

- Case Study Barclays FinalDocument13 pagesCase Study Barclays FinalShalini Senglo RajaNo ratings yet

- Report On Bank IslamiDocument25 pagesReport On Bank IslamiFaseeh-Ur-RehmanNo ratings yet

- Mergers and Acquisitions in Banking SectorDocument2 pagesMergers and Acquisitions in Banking SectorCharu Garg100% (1)

- Presentation - Payment BanksDocument14 pagesPresentation - Payment BanksAstral HeightsNo ratings yet

- Islamic Letter of Credit PDFDocument25 pagesIslamic Letter of Credit PDFHamdan Hassin0% (1)

- CAF 03 ExaminableSupplement BusinessLaw2015Document15 pagesCAF 03 ExaminableSupplement BusinessLaw2015Azhar QayyumNo ratings yet

- BNY MellonDocument3 pagesBNY MellonRajat SharmaNo ratings yet

- Mode of OperationsDocument5 pagesMode of OperationsArchana SinhaNo ratings yet

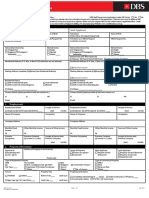

- DBS Mortgage All-In-One Application Form 2016Document3 pagesDBS Mortgage All-In-One Application Form 2016Viola HippieNo ratings yet

- AECBDocument25 pagesAECBHoussem TimoumiNo ratings yet

- Exim BankDocument48 pagesExim BankAnonymous w7zJFTwqiQNo ratings yet

- IMF (FinTech Notes) Blockchain Consensus Mechanisms - A Primer For SupervisorsDocument18 pagesIMF (FinTech Notes) Blockchain Consensus Mechanisms - A Primer For SupervisorsMuning AnNo ratings yet

- Erp AxisDocument19 pagesErp AxisAman7190No ratings yet

- Market Profile-Futures TradingDocument6 pagesMarket Profile-Futures TradingAlp Dhingra100% (2)

- Ashu C VDocument3 pagesAshu C VashutoshbalkiNo ratings yet

- The Future of Bank Risk Management Full ReportDocument32 pagesThe Future of Bank Risk Management Full ReportChristian John RojoNo ratings yet

- AutoInvoiceExecution - Auto Invoice Execution ReportDocument97 pagesAutoInvoiceExecution - Auto Invoice Execution Reportahmedmhrous0000No ratings yet

- BMAN71171 Portfolio Investment Lecture 2a: Intuition On Portfolio Selection Chris Godfrey (Christopher - Godfrey@manchester - Ac.uk)Document27 pagesBMAN71171 Portfolio Investment Lecture 2a: Intuition On Portfolio Selection Chris Godfrey (Christopher - Godfrey@manchester - Ac.uk)Nazmul H. PalashNo ratings yet

- Business CommunicationDocument214 pagesBusiness Communicationrajeshpavan92% (13)

- CBM 4 - Let's Check Activity 1 ULO A & B (1-20)Document2 pagesCBM 4 - Let's Check Activity 1 ULO A & B (1-20)CHARLYN MAE SALASNo ratings yet

- Promotion of "Classmate" Exercise Copies & Ideas For India' CampaignDocument22 pagesPromotion of "Classmate" Exercise Copies & Ideas For India' CampaignDebojyoti GhoshNo ratings yet

- Swot Analysis StrengthsDocument2 pagesSwot Analysis StrengthsAmir AmirthalingamNo ratings yet

- Demand in A Perfectly Competitive MarketDocument4 pagesDemand in A Perfectly Competitive MarketCrisielyn BuyanNo ratings yet

- MGT1500 HI AssignmentDocument1 pageMGT1500 HI Assignmentishaankakade21No ratings yet

- Event Marketing: Measuring An Experience?Document27 pagesEvent Marketing: Measuring An Experience?Cyril ScariaNo ratings yet

- Stock Market in NepalDocument9 pagesStock Market in Nepalusha_nccNo ratings yet

- The Shell Company V National Labor Union DigestDocument1 pageThe Shell Company V National Labor Union DigestwewNo ratings yet

- Software Testing All Questions and AnswersDocument98 pagesSoftware Testing All Questions and AnswersSeun -nuga DanielNo ratings yet

- Apollo Hospitals - Presentation (ETOP)Document24 pagesApollo Hospitals - Presentation (ETOP)p_sonera0% (1)

- Gross Margin Calculation in OMDocument12 pagesGross Margin Calculation in OMKapil Karwal100% (1)

- Application /request For Quotation: (Please Use Additional Sheets If Required) (Site 2) (Site 2) (Site 2)Document1 pageApplication /request For Quotation: (Please Use Additional Sheets If Required) (Site 2) (Site 2) (Site 2)joko marwotoNo ratings yet

- Idea Cellular LTDDocument495 pagesIdea Cellular LTDlijeshchandran100% (1)

- 01 Intro EkomigDocument8 pages01 Intro EkomigClaviano LeiwakabessyNo ratings yet

- PercentagesDocument10 pagesPercentagesLisa DiasNo ratings yet

- Devyani Lisa JardineDocument2 pagesDevyani Lisa Jardineapi-491372529No ratings yet

- Accenture ITP End To End Implementation of A Product Lifecycle Management SolutionDocument2 pagesAccenture ITP End To End Implementation of A Product Lifecycle Management Solutionsdhiraj1No ratings yet

- Commissioner of Internal Revenue vs. Hawaiian-Philippine Company G.R. No. L-16315Document2 pagesCommissioner of Internal Revenue vs. Hawaiian-Philippine Company G.R. No. L-16315ellaNo ratings yet

- Islamic Finance Ngos IndiaDocument18 pagesIslamic Finance Ngos Indiashreepal19No ratings yet

Itl - Letter of Credit

Itl - Letter of Credit

Uploaded by

Sonal SahayOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Itl - Letter of Credit

Itl - Letter of Credit

Uploaded by

Sonal SahayCopyright:

Available Formats

CHANAKYA

NATIONAL

LAW

UNIVERSITY

LETTER OF CREDIT: AN EFFECTIVE MODE OF

TRANSACTION

Submitted to: Dr. P.P. Rao

Faculty of ITL

Submitted by: Ankit Anand

Roll: 917

6th semester

LETTER OF CREDIT: AN EFFECTIVE MODE OF TRANSACTION

Table of Contents

ACKNOWLEDGEMENT .............................................................................................. 3

AIMS AND OBJECTIVE .............................................................................................. 4

RESEARCH METHODOLOGY ................................................................................... 4

SOURCE OF DATA ...................................................................................................... 4

HYPOTHESIS ................................................................................................................ 4

1.INTRODUCTION ....................................................................................................... 5

2.WHAT IS LETTER OF CREDIT AND ITS TYPES ................................................. 7

3.PARTIES TO ANDASSOCIATION OF LETTER OF CREDIT............................. 11

4. ADVANTAGE AND DISADVANTAGE OF USING A LETTER OF CREDIT .. 13

5. CONCLUSION ........................................................................................................ 17

BIBLIOGRAPHY ........................................................................................................ 18

CHANAKYA NATIONAL LAW UNIVERSITY 2|Page

LETTER OF CREDIT: AN EFFECTIVE MODE OF TRANSACTION

ACKNOWLEDGEMENT

Making a project is one of the most significant academic

challenges I have ever faced. Any attempt at any level can't be

satisfactorily completed without the support and guidance of

learned people. I am overwhelmed with my gratitude to

acknowledge all those who have helped me put these ideas, well

above the level of simplicity and into something concrete

effectively and moreover on time.

I am very thankful to my subject teacher Dr. P. P. RAO for his

valuable help. He was always there to show me the right track

whenever I needed his help. He lent his valuable suggestions,

guidance and encouragement, on different matters pertaining to

the topic. He has been very kind and patient while suggesting me

the outlines of this project and clearing my doubts. I thank him

for his overall support without which I would not have been able

to complete this project. I would also like to thank my

colleagues, who often helped and gave me support at critical

junctures, during the making of this project. Last but not the

least, I would like to thank my family members for their

emotional support.

CHANAKYA NATIONAL LAW UNIVERSITY 3|Page

LETTER OF CREDIT: AN EFFECTIVE MODE OF TRANSACTION

AIMS AND OBJECTIVE

The main aim objective of the researcher is to know what is letter of credit. How much it is

important in International trade. And also its advantage and disadvantage to exporter and

importer.

RESEARCH METHODOLOGY

The researcher has adopted the doctrinal method of research for the project.

SOURCE OF DATA

The following sources of data have been used in the project are:

1 .Books

2. Websites

3. Articles

HYPOTHESIS

Researcher hypotheses that the letter of credit is always advantageous to both importer and

exporter.

CHANAKYA NATIONAL LAW UNIVERSITY 4|Page

LETTER OF CREDIT: AN EFFECTIVE MODE OF TRANSACTION

1.INTRODUCTION

Every business transaction consist of at least two parties that are the importer and exporter. In

addition, some of the transactions involve not only the buyer and seller, but also the banks of

the parties, government customs agencies and freight forwarders as well. Profiting from the

transaction and being exposed to the smallest risk are the common concern of both parties.

However, in all transactions buyers and sellers exposed to the risk somehow. Domestic

transactions are stable, transparent, secure or reliable as compared to international

transactions that are risky because of changing dynamics at the time of sale and expected

time of payment. Therefore, the seller always prefer to be paid at delivery or prior to it. The

seller has made investment in the time of manufacturing the product and does not prefer

bearing the cost of transportation as well. On the other hand, the buyer aware of the fact that

it can take one or two months before goods had arrived. Goods will be ready for export,

trucked or sent by rail to the port, export cleared, shipped to the final port, warehoused

awaiting customs clearance, inspected, customs cleared, sent overland to the final destination,

and finally became inventory at warehouse of buyer Therefore, both buyer and seller prefer

that other party finance the transaction and pay for the cost. Domestic payments primarily use

credit cards and checks. International payments primarily use Commercial Letters of Credit

and Documentary Collections or open account.1

The English name “letter of credit” derives from the French word “accreditif”, a power to do

something, which in turn is derivative of the Latin word “accreditivus”, meaning trust.

A letter of credit is basically a document issued by a bank guaranteeing a client's ability to

pay for goods or services. A bank or finance company issues a letter of credit on behalf of a

buyer, authorizing the seller to obtain payment within a specified timeframe once the terms

and conditions outlined in the letter of credit are met. The letter of credit acts like an

insurance contract for both the buyer and seller and practically eliminates the credit risk for

both parties, while at the same time reducing payment delays. A letter of credit provides the

seller with the greatest degree of safety when extending credit. It is useful when the buyer is

not well known and when exchange restrictions exist or are possible.

1

http://www.lawteacher.net/free-law-essays/commercial-law/documentary-letter-of-credit-commercial-law-

essay.php

CHANAKYA NATIONAL LAW UNIVERSITY 5|Page

LETTER OF CREDIT: AN EFFECTIVE MODE OF TRANSACTION

The LC can also be the source of payment for a transaction, meaning that a will get paid by

redeeming the letter of credit. Letters of credit are used primarily in international trade

transactions of significant value, for deals between a supplier in one country and a customer

in another. The parties to a letter of credit are usually a beneficiary who is to receive the

money, the issuing bank of whom the applicant is a client, and the advising bank of whom the

beneficiary is a client. Almost all letters of credit are irrevocable, i.e., cannot be amended or

cancelled without prior agreement of the beneficiary, the issuing bank and the confirming

bank, if any. In executing a transaction, letters of credit incorporate functions common

Traveler's cheques.

The letter of credit is a specified documentation particularly required to enjoy the facility of

credit for an international business transaction. These documents are tendered by the seller to

the advising bank. These documents must agree strictly in accordance with the fundamental

principle of strict compliance of the terms of the transaction. If the doctrine of strict

compliance is fully observed then no issue arises. According the provisions of the UCP 600,

the banks are only obliged to make payments on LCs if the documents presented completely

comply with the terms and conditions of the credit.

If the strict compliance standard is not observed in the credit documents strictly, the banks

need not to pay to the beneficiary on these ‘afflicted’ documents (UCP 600).

CHANAKYA NATIONAL LAW UNIVERSITY 6|Page

LETTER OF CREDIT: AN EFFECTIVE MODE OF TRANSACTION

2.WHAT IS LETTER OF CREDIT AND ITS TYPES

A Letter of Credit, simply defined, is a written instrument issued by a bank at the request

of its customer, the Importer (Buyer), whereby the bank promises to pay the Exporter

(Beneficiary) for goods or services, provided that the Exporter presents all documents

called for, exactly as stipulated in the Letter of Credit, and meet all other terms and

conditions set out in the Letter of Credit. A Letter of Credit is also commonly referred to as

a Documentary Credit.2

Letter of Credit is a commercial document issued by a bank in normal course of business

which carries a payment guarantee obligation in case of adverse situation arises. A bank

issue LC on the request of its client in favour of a third party (beneficiary). It is important

instrument to the extent that it smoothens & secures the transactions ensuring to the party in

whose favour the LC is opened that if any adverse situation arises and its client failed to

make the payment than the issuing bank will pay subject to the terms and conditions

mentioned at the time of issue of LC. This document is most important in case both the

parties doing business first time. These parties can do business without any or very low risk,

as bank gives a safety assurance to both the parties, involved with the transaction.3

There are several types of Letters of Credit: revocable and irrevocable. A revocable Letter of

Credit can be revoked without the consent of the Exporter, meaning that it may be cancelled

or changed up to the time the documents are presented. A revocable Letter of Credit affords

the Exporter little protection; therefore, it is rarely used. An irrevocable Letter of Credit

cannot be cancelled or changed without the consent of all parties, including the Exporter.

Unless otherwise stipulated, all Letters of Credit are irrevocable.

2

http://www.abhinavjournal.com/images/Commerce_&_Management/Dec13/10.pdf

3

http://www.abhinavjournal.com/images/Commerce_&_Management/Dec13/10.pdf

CHANAKYA NATIONAL LAW UNIVERSITY 7|Page

LETTER OF CREDIT: AN EFFECTIVE MODE OF TRANSACTION

Another type of Letter of Credit is confirmed and unconfirmed. A confirmed letter of credit is

one where a second bank agrees to pay the letter of credit at the request of the issuing bank.

While not usually required by law, an issuing bank might be required by court order to only

issue confirmed letters of credit if they are in receivership. As you might guess,

an unconfirmed letter of credit is guaranteed only by the issuing bank. This is the most

common form with regard to confirmation.

A letter of credit may also be a transferrable letter of credit. These are commonly used when

the beneficiary is simply an intermediary for the real supplier of the goods and services or is

one of a group of suppliers. It allows the named beneficiary to present its own documentation

but transfer all or part of the payment to the actual suppliers. As you might guess, an un-

transferrable letter of credit does not allow transfer of payments to third parties.4

A further differentiation is made between Letters of Credit, depending on the payment terms.

If payment is to be made at the time documents are presented, this is referred to as a sight

Letter of Credit. Alternatively, if payment is to be made at a future fixed time from

presentation of documents (e.g. 60 days after sight), this is referred to as a term, or deferred

payment Letter of Credit.5

The International Chamber of Commerce (ICC) publishes internationally agreed-upon rules,

definitions and practices governing Letters of Credit, called “Uniform Customs and Practice

for Documentary Credits” (UCP). The UCP facilitates standardization of Letters of Credit

among all banks in the world that subscribe to it. These rules are updated from time to time;

the last revision became effective January 1, 1994, and is referred to as UCP 500. Copies of

the UCP 500 are available from your TD branch or Global Trade Finance office. Please refer

to the back cover of this guide for a listing of these offices.6

4

http://study.com/academy/lesson/what-is-a-letter-of-credit-definition-types-example.html

5

https://buyerscreditconsultant.wordpress.com/2014/10/22/letter-of-credit/#more-200212

6

International Chamber of Commerce, Uniform Customs and Practices for Documentary Credits, I.C.C. Pub.

No. 400 (1993) [hereinafter U.C.P. 500]. The names for each party may differ in different jurisdictions .

CHANAKYA NATIONAL LAW UNIVERSITY 8|Page

LETTER OF CREDIT: AN EFFECTIVE MODE OF TRANSACTION

The following is a step-by-step description of a typical Letter of Credit

transaction:

1.An Importer (Buyer) and Exporter (Seller) agree on a purchase and sale of goods

where payment is made by Letter of Credit.

2.The Importer completes an application requesting its bank (Issuing Bank) to issue a

Letter of Credit in favour of the Exporter. Note that the Importer must have a line of

credit with the Issuing Bank in order to request that a Letter of Credit be issued.

3.The Issuing Bank issues the Letter of Credit and sends it to the Advising Bank by

telecommunication or registered mail in accordance with the Importer’s instructions. A

request may be included for the Advising Bank to add its confirmation. The Advising

Bank is typically located in the country where the Exporter carries on business and may

be the Exporter’s bank.

4.The Advising Bank will verify the Letter of Credit for authenticity and send a copy to

the Exporter.

5.The Exporter examines the Letter of Credit to ensure:

(a) it corresponds to the terms and conditions in the purchase and sale agreement;

(B) documents stipulated in the Letter of Credit can be produced; and

(C) the terms and conditions of the Letter of Credit may be fulfilled.

6.If the Exporter is unable to comply with any term or condition of the Letter of Credit or if

the Letter of Credit differs from the purchase and sale agreement, the Exporter should

immediately notify the Importer and request an amendment to the Letter of Credit.

CHANAKYA NATIONAL LAW UNIVERSITY 9|Page

LETTER OF CREDIT: AN EFFECTIVE MODE OF TRANSACTION

7.When all parties agree to the amendments, they are incorporated into the terms of the Letter

of Credit and advised to the Exporter through the Advising Bank. It is recommended that the

Exporter does not make any shipments against the Letter of Credit until the required

amendments have been received.

8.The Exporter arranges for shipment of the goods, prepares and/or obtains the documents

specified in the Letter of Credit and makes demand under the Letter of Credit by presenting

the documents within the stated period and before the expiry date to the “available with”

Bank. This may be the Advising/Confirming Bank. That bank checks the documents against

the Letter of Credit and forwards them to the Issuing Bank. The drawing is negotiated, paid

or accepted as the case may be.

9.The Issuing Bank examines the documents to ensure they comply with the Letter of Credit

terms and conditions. The Issuing Bank obtains payment from the Importer for payment

already made to the “available with” or the Confirming Bank.

10.Documents are delivered to the Importer to allow them to take possession of the goods

from the transport company. The trade cycle is complete as the Importer has received its

goods and the Exporter has obtained payment.

CHANAKYA NATIONAL LAW UNIVERSITY 10 | P a g e

LETTER OF CREDIT: AN EFFECTIVE MODE OF TRANSACTION

3.PARTIES TO ANDASSOCIATION OF LETTER OF CREDIT

1. Applicant

The applicant is the party who requests and instructs the issuing bank to open a letter of

credit in favour of the beneficiary. The applicant usually is the importer or the buyer of goods

and/or services. The applicant can also be another party acting on behalf of the importer, such

as a confirming house. The confirming house is equivalent to a buying office, it acts as an

intermediary between buyer and seller, and it can be located in a third country or in the

seller’s country.7

2.Beneficiary

The beneficiary is entitled to payment as long as he can provide the documentary evidence

required by the letter of credit. The letter of credit is a distinct and separate transaction from

the contract on which it is based. All parties deal in documents and not in goods. The issuing

bank is not liable for performance of the underlying contract between the customer and

beneficiary. The issuing bank's obligation to the buyer, is to examine all documents to insure

that they meet all the terms and conditions of the credit. Upon requesting demand for

payment the beneficiary warrants that all conditions of the agreement have been complied

with. If the beneficiary (seller) conforms to the letter of credit, the seller must be paid by the

bank.8

3.Issuing Bank

The issuing bank's liability to pay and to be reimbursed from its customer becomes absolute

upon the completion of the terms and conditions of the letter of credit. Under the provisions

of the Uniform Customs and Practice for Documentary Credits, the bank is given a

reasonable amount of time after receipt of the documents to honour the draft. The issuing

banks' role is to provide a guarantee to the seller that if compliant documents are presented,

the bank will pay the seller the amount due and to examine the documents, and only pay if

these documents comply with the terms and conditions set out in the letter of credit.

7

http://howtoexportimport.com/8-parties-involved-in-an-LC-Letter-of-Credit-LC-423.aspx

8

http://www.letterofcredit.biz/Parties_to_Letters_of_Credit.html

CHANAKYA NATIONAL LAW UNIVERSITY 11 | P a g e

LETTER OF CREDIT: AN EFFECTIVE MODE OF TRANSACTION

Typically the documents requested will include a commercial invoice, a transport document

such as a bill of lading or airway bill and an insurance document; but there are many others.

Letters of credit deal in documents, not goods.9

4.Advising Bank

An advising bank, usually a foreign correspondent bank of the issuing bank will

advise the beneficiary. Generally, the beneficiary would want to use a local bank to

insure that the letter of credit is valid. In addition, the advising bank would be

responsible for sending the documents to the issuing bank. The advising bank has

no other obligation under the letter of credit. If the issuing bank does not pay the

beneficiary, the advising bank is not obligated to pay.

5.Confirming Bank

The correspondent bank may confirm the letter of credit for the beneficiary. At the

request of the issuing bank, the correspondent obligates itself to insure payment

under the letter of credit. The confirming bank would not confirm the credit until it

evaluated the country and bank where the letter of credit originates. The confirming

bank is usually the advising bank.10

9

http://www.effective-business-letters.com/Parties-Involved-in-A-Letter-of-Credit-Transaction.html

10

http://howtoexportimport.com/8-parties-involved-in-an-LC-Letter-of-Credit-LC-423.aspx

CHANAKYA NATIONAL LAW UNIVERSITY 12 | P a g e

LETTER OF CREDIT: AN EFFECTIVE MODE OF TRANSACTION

4. ADVANTAGE AND DISADVANTAGE OF USING A LETTER OF

CREDIT

Advantages to the Importer

While accepting a LC, the supplier guarantees to meet the terms and conditions of letter of

credit with documentary proof. This is one of the major advantages of LC to an

importer/buyer. This assurance provides security to buyer for future business plan.

Since buyer is the holder of Letter of credit, Bank acts on behalf of buyer. Opening bank

remits amount only after satisfaction of all terms and conditions of letter of credit with

documentary proof. This arrangement protects importer and minimize time, as bank acts on

behalf of him.

A letter of credit transaction reduces the risk of non performance by the supplier, as the

supplier prefers LC than other transactions due to various reasons which protect him than the

buyer. This is an advantage for the buyer on fulfilment of meeting commitments on

shipments.

Another advantage of letter of credit to a buyer/importer is that the exporter/seller receives

payment of exported goods only after shipment and meeting of all necessary requirements

under LC terms and conditions with presentation of documentary proof including evidence of

shipment.

Unlike other shipments, a shipment under Letter of credit is treated with most care to meet

delivery schedule and other required parameters by the exporter. The documents receive by

buyer promptly and quickly with complete sets. Unless meeting delivery schedule and

prompt documentation, the supplier does not get his payment from opening bank. This is one

of the major advantages of LC for an importer is concerned.

An importer/buyer is concerned; he can plan his payment schedule properly by anticipating

the requirements under letter of credit. This arrangement makes importer for easier planning.

Based on timely delivery schedule, buyer receives goods on time thereby he can execute his

business plan smoothly and efficiently, in turn satisfying his clients promptly and

effectively.11

11

http://howtoexportimport.com/Advantages-of-LC-letter-of-credit-%E2%80%93-to-Importers--427.aspx

CHANAKYA NATIONAL LAW UNIVERSITY 13 | P a g e

LETTER OF CREDIT: AN EFFECTIVE MODE OF TRANSACTION

Disadvantages to the Importer

One of the major disadvantages of letter of credit is that LC is operated on the basis of

documentation and not on the basis of physical verification of goods on its quality, quantity

or other parameters. In other words, an LC issuing bank can effect payment to beneficiary of

LC on the basis of documentation produced as per the terms and conditions of letter of credit.

The parties under letter of credit do not have any right to physically verify the contents of

goods. So, if the buyer needs to confirm and satisfy on the quality of goods he buys, he can

appoint an inspection agency of international repute and instruct exporter to enclose

certificate of such inspection by mentioning a condition in letter of credit.

Once opened a confirmed and irrevocable letter of credit, the importer/buyer already tied up

with the said business credit line and can not change in between. Due to various reasons,

especially on selling price variation, if buyer needs to stop his export order he can not do so.

Compared to other payment mode of transactions, cost of operating letter of credit procedures

and formalities are more, which may be an additional expenses to an importer especially on

amendment, negotiation etc.

Currency fluctuation is another disadvantage of Letter of credit. Normally buyer/importer

places purchase orders once in a year and opens letter of credit accordingly. The exchange

rate may differ at the time of effecting payment. So, if any loss due to fluctuations in foreign

currency contracted under letter of credit, need to be beard by him. This is also one of the

major demerits of LC.

Currency fluctuations may also effect on price variation in local market. The demand of

imported goods may reduce due to such fluctuation of foreign currency. So currency

fluctuation also is a threat under letter of credit which is treated as other disadvantages of

letter of credit.12

12

http://howtoexportimport.com/Disadvantages-of-LC-letter-of-Credit-to-Importer--429.aspx

CHANAKYA NATIONAL LAW UNIVERSITY 14 | P a g e

LETTER OF CREDIT: AN EFFECTIVE MODE OF TRANSACTION

Advantages to the Exporter

One of the best methods after advance mode of payment for any business transaction is Letter

of Credit (LC) mode, as buyer’s bank guarantees payment to seller through seller’s bank on

presentation of required documents as per LC.

The major advantage of Letter of credit to a supplier is minimizing of credit risk. In an import

and export trade, the geographical distance between importer and exporter is very far; hence

ascertaining credit worthiness of buyer is a major threat. In a mode of Letter of credit, such

risk can be avoided.

Buyer can not deny payment by raising dispute on quality of goods, as letter of credit terms

and conditions are based on documentation. This is a major advantage of Letter of Credit in

terms of seller point of view. Some of the fraudulent buyers deliberately delays or hold

payments by complaining on quality of goods. In a letter of credit terms of business

transactions, rejection of export payment by raising complaint on quality of goods can not be

effected.

LC provides a security to exporter which is another advantage of a letter of credit. Based on

such security, the exporter can pre-plan his further business activities to strengthen his

business world.

In a letter of credit, any dispute in transaction can be settled easily, as LC terms and

conditions are under the guidelines of uniform customs and practice of documentary credit.

This is another advantage of a LC for an exporter.

In a letter of credit, all required documents have been mentioned well in advance of shipment

and there is no confusion or misunderstanding to the importer (buyer) to inform supplier to

act in between. This is a good advantage for a supplier to pre-plan efficiently which saves

time.

Against a Letter of Credit, an exporter can avail pre shipment finance from banks or other

financial institutions. This is another advantage of Letter of credit for a seller. Many banks

extend financial assistance with minimum bank interest, as letter of credit is a ‘safe export

order’.

Assurance to receive money in full is another advantage of letter of credit. During my career,

I had bitter experience on some of the transactions that I had short received invoice amount

under a non LC transaction by informing us one of the other reasons by buyer. In a letter of

credit, an exporter can ensure that he receives full amount as per LC which helps seller to

plan future business ideas.

CHANAKYA NATIONAL LAW UNIVERSITY 15 | P a g e

LETTER OF CREDIT: AN EFFECTIVE MODE OF TRANSACTION

Another advantage under a Letter of Credit transaction is that the exporter receives money on

time. As you know, ‘finance at right time’ is a prime factor for any business transaction. So if

a business man receives his anticipated amount on time, he can plan his business activities

smoothly without wasting time. This is one of the major advantages of letter of credit.

Assurance to receive money on time is one of the major advantages to supplier/exporter in a

Letter of credit terms.13

Disadvantages to the Exporter

While accepting a letter of credit, the exporter guarantees to meet the requirements of

buyer as mutually agreed as per the terms and conditions mentioned in letter of credit. So the

liability of meeting all required parameters are with supplier failing which bank may not

accept documents under such transaction. Bank may debit certain charges against the

discrepancy of documents also if proper documentary proof has not been submitted along

with other shipping documents. So, if the exporter does not follow strictly with the terms and

conditions of letter of credit with 100% compliance of documentation, the payment will not

be effected by bank.

Under letter of credit opening procedures, there are certain bank charges and other costs. If

buyer insists seller to pay such costs, the said charges will be additional expenses for the

supplier.

If exporter is aware that the credit worthiness of buyer is favourable and sound, he does not

need to open a letter of credit to transact with such buyers. However, he agrees on opening

LC based on the requirements of buyer to enjoy the advantage of opening LC by buyer. In

such cases, meeting of all terms and conditions under letter of credit is the major

responsibility of exporter. Apart from meeting additional documentation procedures, exporter

needs to spend additional expenses also.14

13

http://howtoexportimport.com/Advantages-of-Letter-of-Credit-LC-for-exporters-426.aspx

14

http://howtoexportimport.com/Disadvantages-of-Letter-of-credit-LC-for-Exporter-428.aspx

CHANAKYA NATIONAL LAW UNIVERSITY 16 | P a g e

LETTER OF CREDIT: AN EFFECTIVE MODE OF TRANSACTION

5. CONCLUSION

From the above brief discussion on Letter of credit researcher reached to the conclusion that

the Letters of credit is very important instruments in the field of international trade. They

provide security for both the Importer, which he can ensure to get the goods and for the

Exporter, which he can ensure to get payment when he sends the goods. Letters of credit

also makes the transactions very smoothly. It gives the mechanism stability; especially from

the Importer and the Exporter’s perspective. For instance, there is little or no previous

trading relationship among the parties; the letters of credit provide them to work with

confidence and security. Letter of credit is an effective mode of transaction in International

trade. And the researcher hypothesis that the letter of credit is always advantageous to both

exporter and importer is partially correct because as mentioned above it is sometimes

advantageous to the exporter and sometimes to the importer. Also, sometimes it is

disadvantageous to the exporter and importer. Still Letter of credit is an effective mode of

transaction in International trade because domestic transactions are stable, transparent,

secure or reliable as compared to international transactions that are risky because of

changing dynamics at the time of sale and expected time of payment. And Therefore, the

seller always prefer to be paid at delivery or prior to it. On the other hand, the buyer aware

of the fact that it can take one or two months before goods had arrived. Therefore, both

buyer and seller prefer that other party finance the transaction and pay for the cost. Domestic

payments primarily use credit cards and checks. International payments primarily use

Commercial Letters of Credit and Documentary Collections or open account. The letter of

credit acts like an insurance contract for both the buyer and seller and practically eliminates

the credit risk for both parties, while at the same time reducing payment delays. A letter of

credit provides the seller with the greatest degree of safety when extending credit. It is

useful when the buyer is not well known and when exchange restrictions exist or are

possible. It is important instrument to the extent that it smoothens & secures the transactions

ensuring to the party in whose favour the LC is opened that if any adverse situation arises

and its client failed to make the payment than the issuing bank will pay subject to the terms

and conditions mentioned at the time of issue of LC. This document is most important in

case both the parties doing business first time. These parties can do business without any or

very low risk, as bank gives a safety assurance to both the parties, involved with the

transaction.

CHANAKYA NATIONAL LAW UNIVERSITY 17 | P a g e

LETTER OF CREDIT: AN EFFECTIVE MODE OF TRANSACTION

BIBLIOGRAPHY

BOOKS REFERED:-

International Trade law, 2005, Indira carr

The International Trade system by Alice Landau

Advanced International trade: Theory and evidence by Robert C Feenstra

WEBSITES:-

http://howtoexportimport.com/Disadvantages-of-LC-letter-of-Credit-to-Importer--

429.aspx

https://www.crfonline.org/orc/cro/cro-9-1.html

http://www.effective-business-letters.com/Parties-Involved-in-A-Letter-of-Credit-

Transaction.html

http://www.letterofcredit.biz/Parties_to_Letters_of_Credit.html

http://study.com/academy/lesson/what-is-a-letter-of-credit-definition-types-

example.html

https://buyerscreditconsultant.wordpress.com/2014/10/22/letter-of-credit/#more-

200212

CHANAKYA NATIONAL LAW UNIVERSITY 18 | P a g e

You might also like

- Design and Implementation of Online Event Management SystemDocument55 pagesDesign and Implementation of Online Event Management SystemAchiever74% (23)

- Kathryn Jones Presentation KitDocument219 pagesKathryn Jones Presentation KitFeliciana ValenzuelaNo ratings yet

- Valuation For Merger: DR Pepper Snapple Group & Keurig Green MountainDocument72 pagesValuation For Merger: DR Pepper Snapple Group & Keurig Green Mountainrk_ravindraNo ratings yet

- The Term Alternate Delivery ChannelDocument4 pagesThe Term Alternate Delivery ChannelIftekhar Abid Fahim100% (1)

- Consumer Lending Audit Program For ACUIADocument8 pagesConsumer Lending Audit Program For ACUIAMisc EllaneousNo ratings yet

- Four Organizational Culture TypesDocument4 pagesFour Organizational Culture TypesALTERINDONESIA100% (1)

- Consumer Lending - Whitepaper PDFDocument3 pagesConsumer Lending - Whitepaper PDFAbhinavNo ratings yet

- Auto-Sweep Facility in Your Savings Bank AccountDocument14 pagesAuto-Sweep Facility in Your Savings Bank Accountpradeepverma84No ratings yet

- STANDARD Cash Management Solutions Presentation-08202019Document88 pagesSTANDARD Cash Management Solutions Presentation-08202019Anonymous CMaI3m9i5100% (1)

- Letter of CreditDocument113 pagesLetter of CredithumairashehlaNo ratings yet

- IBM Banking: Our Payments Framework Solution For Financial Services Helps Simplify Payments OperationsDocument4 pagesIBM Banking: Our Payments Framework Solution For Financial Services Helps Simplify Payments OperationsIBMBankingNo ratings yet

- E BankingDocument41 pagesE Bankingchandni babunuNo ratings yet

- Banking Products & Services IDocument34 pagesBanking Products & Services IAinnur HaziqahNo ratings yet

- KYC New ProjectDocument42 pagesKYC New ProjectNisha RathoreNo ratings yet

- Radhika Growth of Banking SectorDocument36 pagesRadhika Growth of Banking SectorPranav ViraNo ratings yet

- Letter of CreditDocument28 pagesLetter of Creditefty silswaNo ratings yet

- Accenture Banking Retail LendingDocument16 pagesAccenture Banking Retail LendingRaunak MotwaniNo ratings yet

- Rights Vs DutiesDocument2 pagesRights Vs Dutiesnakul_sehgal_2No ratings yet

- Investment LawDocument6 pagesInvestment LawVarsha ThampiNo ratings yet

- Prevention Ofmoney Laundering Act-2002 (PMLA)Document25 pagesPrevention Ofmoney Laundering Act-2002 (PMLA)vikramNo ratings yet

- Islamic Treasury Risk Management ProductsDocument4 pagesIslamic Treasury Risk Management ProductsjjangguNo ratings yet

- UNIT 2 - 16th September 2020Document42 pagesUNIT 2 - 16th September 2020GracyNo ratings yet

- Documentary CreditDocument15 pagesDocumentary CreditArmantoCepongNo ratings yet

- Local Print: Argentina COMPANY GROUP 1Document4 pagesLocal Print: Argentina COMPANY GROUP 1Luis Maria CepedaNo ratings yet

- Pssbooklet PDFDocument142 pagesPssbooklet PDFForkLogNo ratings yet

- JBL Full - S. M. Abdul MukitDocument50 pagesJBL Full - S. M. Abdul MukithabibNo ratings yet

- Pool Management: Muhammad Zeeshan Khan Product Manager Summit Bank Islamic EmailDocument31 pagesPool Management: Muhammad Zeeshan Khan Product Manager Summit Bank Islamic EmailAsad MemonNo ratings yet

- 2-Notes On Banking Products & Services-Part 1Document16 pages2-Notes On Banking Products & Services-Part 1Kirti GiyamalaniNo ratings yet

- What Is A Financial MarketDocument1 pageWhat Is A Financial Marketamitrao1983No ratings yet

- Chapter 1 - Introduction To Digital Banking - V1.0Document17 pagesChapter 1 - Introduction To Digital Banking - V1.0prabhjinderNo ratings yet

- Interview Questions For Bank in BangladeDocument7 pagesInterview Questions For Bank in BangladeKhaleda Akhter100% (1)

- Master Circular-Guarantees, Co-Acceptances & Letters of Credit - UcbsDocument14 pagesMaster Circular-Guarantees, Co-Acceptances & Letters of Credit - Ucbskalik goyalNo ratings yet

- Camca Group - Trade Finance SolutionsDocument13 pagesCamca Group - Trade Finance Solutionstajanan7240No ratings yet

- Corporate BankingDocument21 pagesCorporate BankingPadma NarayananNo ratings yet

- Depository System in IndiaDocument92 pagesDepository System in Indiasumesh894No ratings yet

- Final-General Banking .Document27 pagesFinal-General Banking .Salman AhmedNo ratings yet

- Unit 3: Commercial Bank Sources of Funds: 1. Transaction DepositsDocument9 pagesUnit 3: Commercial Bank Sources of Funds: 1. Transaction Depositsመስቀል ኃይላችን ነውNo ratings yet

- Emergence of Doorstep Banking - Merits and DemeritsDocument11 pagesEmergence of Doorstep Banking - Merits and Demeritsmani100% (1)

- Project On International BankingDocument53 pagesProject On International BankingSathvik ReddyNo ratings yet

- Customer Perception On Internet Banking and Their Impact On Customer Satisfaction Loyalty A Study in Indian Context PDFDocument5 pagesCustomer Perception On Internet Banking and Their Impact On Customer Satisfaction Loyalty A Study in Indian Context PDFNayana N Nagaraj100% (1)

- Kinds of Banks and Their Functions: School of LAW Guru GhasidasDocument20 pagesKinds of Banks and Their Functions: School of LAW Guru GhasidasNilam100% (1)

- Project by BrincyDocument64 pagesProject by BrincyJeeva VargheseNo ratings yet

- Customer Service in Banks - RBI RulesDocument15 pagesCustomer Service in Banks - RBI RulesRAMESHBABUNo ratings yet

- Sources of Funds For A BankDocument9 pagesSources of Funds For A BankViral ElaviaNo ratings yet

- Case Studies On The Letters of CreditDocument3 pagesCase Studies On The Letters of Creditomi0855100% (1)

- Trade Finance - Week 7-2Document15 pagesTrade Finance - Week 7-2subash1111@gmail.comNo ratings yet

- VISADocument29 pagesVISAShimaa Abou SreeNo ratings yet

- Fund - Transfer - Pricing - E&Y PDFDocument24 pagesFund - Transfer - Pricing - E&Y PDFsreeks456No ratings yet

- Swift Whitepaper Supply Chain Finance 201304Document8 pagesSwift Whitepaper Supply Chain Finance 201304Rami Al-SabriNo ratings yet

- Case Study Barclays FinalDocument13 pagesCase Study Barclays FinalShalini Senglo RajaNo ratings yet

- Report On Bank IslamiDocument25 pagesReport On Bank IslamiFaseeh-Ur-RehmanNo ratings yet

- Mergers and Acquisitions in Banking SectorDocument2 pagesMergers and Acquisitions in Banking SectorCharu Garg100% (1)

- Presentation - Payment BanksDocument14 pagesPresentation - Payment BanksAstral HeightsNo ratings yet

- Islamic Letter of Credit PDFDocument25 pagesIslamic Letter of Credit PDFHamdan Hassin0% (1)

- CAF 03 ExaminableSupplement BusinessLaw2015Document15 pagesCAF 03 ExaminableSupplement BusinessLaw2015Azhar QayyumNo ratings yet

- BNY MellonDocument3 pagesBNY MellonRajat SharmaNo ratings yet

- Mode of OperationsDocument5 pagesMode of OperationsArchana SinhaNo ratings yet

- DBS Mortgage All-In-One Application Form 2016Document3 pagesDBS Mortgage All-In-One Application Form 2016Viola HippieNo ratings yet

- AECBDocument25 pagesAECBHoussem TimoumiNo ratings yet

- Exim BankDocument48 pagesExim BankAnonymous w7zJFTwqiQNo ratings yet

- IMF (FinTech Notes) Blockchain Consensus Mechanisms - A Primer For SupervisorsDocument18 pagesIMF (FinTech Notes) Blockchain Consensus Mechanisms - A Primer For SupervisorsMuning AnNo ratings yet

- Erp AxisDocument19 pagesErp AxisAman7190No ratings yet

- Market Profile-Futures TradingDocument6 pagesMarket Profile-Futures TradingAlp Dhingra100% (2)

- Ashu C VDocument3 pagesAshu C VashutoshbalkiNo ratings yet

- The Future of Bank Risk Management Full ReportDocument32 pagesThe Future of Bank Risk Management Full ReportChristian John RojoNo ratings yet

- AutoInvoiceExecution - Auto Invoice Execution ReportDocument97 pagesAutoInvoiceExecution - Auto Invoice Execution Reportahmedmhrous0000No ratings yet

- BMAN71171 Portfolio Investment Lecture 2a: Intuition On Portfolio Selection Chris Godfrey (Christopher - Godfrey@manchester - Ac.uk)Document27 pagesBMAN71171 Portfolio Investment Lecture 2a: Intuition On Portfolio Selection Chris Godfrey (Christopher - Godfrey@manchester - Ac.uk)Nazmul H. PalashNo ratings yet

- Business CommunicationDocument214 pagesBusiness Communicationrajeshpavan92% (13)

- CBM 4 - Let's Check Activity 1 ULO A & B (1-20)Document2 pagesCBM 4 - Let's Check Activity 1 ULO A & B (1-20)CHARLYN MAE SALASNo ratings yet

- Promotion of "Classmate" Exercise Copies & Ideas For India' CampaignDocument22 pagesPromotion of "Classmate" Exercise Copies & Ideas For India' CampaignDebojyoti GhoshNo ratings yet

- Swot Analysis StrengthsDocument2 pagesSwot Analysis StrengthsAmir AmirthalingamNo ratings yet

- Demand in A Perfectly Competitive MarketDocument4 pagesDemand in A Perfectly Competitive MarketCrisielyn BuyanNo ratings yet

- MGT1500 HI AssignmentDocument1 pageMGT1500 HI Assignmentishaankakade21No ratings yet

- Event Marketing: Measuring An Experience?Document27 pagesEvent Marketing: Measuring An Experience?Cyril ScariaNo ratings yet

- Stock Market in NepalDocument9 pagesStock Market in Nepalusha_nccNo ratings yet

- The Shell Company V National Labor Union DigestDocument1 pageThe Shell Company V National Labor Union DigestwewNo ratings yet

- Software Testing All Questions and AnswersDocument98 pagesSoftware Testing All Questions and AnswersSeun -nuga DanielNo ratings yet

- Apollo Hospitals - Presentation (ETOP)Document24 pagesApollo Hospitals - Presentation (ETOP)p_sonera0% (1)

- Gross Margin Calculation in OMDocument12 pagesGross Margin Calculation in OMKapil Karwal100% (1)

- Application /request For Quotation: (Please Use Additional Sheets If Required) (Site 2) (Site 2) (Site 2)Document1 pageApplication /request For Quotation: (Please Use Additional Sheets If Required) (Site 2) (Site 2) (Site 2)joko marwotoNo ratings yet

- Idea Cellular LTDDocument495 pagesIdea Cellular LTDlijeshchandran100% (1)

- 01 Intro EkomigDocument8 pages01 Intro EkomigClaviano LeiwakabessyNo ratings yet

- PercentagesDocument10 pagesPercentagesLisa DiasNo ratings yet

- Devyani Lisa JardineDocument2 pagesDevyani Lisa Jardineapi-491372529No ratings yet

- Accenture ITP End To End Implementation of A Product Lifecycle Management SolutionDocument2 pagesAccenture ITP End To End Implementation of A Product Lifecycle Management Solutionsdhiraj1No ratings yet

- Commissioner of Internal Revenue vs. Hawaiian-Philippine Company G.R. No. L-16315Document2 pagesCommissioner of Internal Revenue vs. Hawaiian-Philippine Company G.R. No. L-16315ellaNo ratings yet

- Islamic Finance Ngos IndiaDocument18 pagesIslamic Finance Ngos Indiashreepal19No ratings yet