Professional Documents

Culture Documents

23-05-2017........... 500 Words

23-05-2017........... 500 Words

Uploaded by

Pankaj KhannaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

23-05-2017........... 500 Words

23-05-2017........... 500 Words

Uploaded by

Pankaj KhannaCopyright:

Available Formats

One-Tel became a massive company with a large base of customers.

To achieve and establish its position

in the market, the company applied several strategies within a short span of time. But in longer run the

company was not able to maintain its position and ultimately it collapsed. After a detailed assessment of

the company and its financial report it was identified that there were multiple factors that contributed to

an enhanced inherent assessment risk.

Firstly, it was observed that the Board of Directors declared to pay dividend and bonus to its shareholders

even though the company is suffering from huge losses of approximately $291millions.This gives rise to

the fact that the Board of Directors lacks vision and were not working in the best interest of the company.

In the financial report, too many misleading information was provided to the shareholders of the

company. Since the Board of Directors were not effectively engaged with the management there

appeared a serious lacuna and proper communication was missing that led to the current situation. Earlier

in 1999 approx. 48 flaws were observed in the financial report. This indicates that the company has not

performed to the best of its ability and needs a urgent and a major attention by the management and its

Board of Directors.

Secondly, That the company was reeling under severe cash crunch and long aging debtors which was

noticed from the financial report of the company, which proved that it was not operating efficiently and

properly. Such responsibility totally lies with the Chartered Accountant and Auditors of the company to

point out about the financial health of the company in their report and suggest corrective measures. As

the Charted Accountant of the company, it is their duties to point out such things and give proper

suggestions and guidance to take corrective measure to be addressed urgently.

Thirdly, the Management of One-Tel did not take any corrective measures urgently henceforth

aiding to the increase intrinsic risk to the company along with inefficient internal controls. This gives rise

to the fact that the Board of Directors and top management of One-Tel were not performing their duties

in the best interest of the company and are inefficient in managing at the helm of affairs. Going through

the financial statement it was observed that the Management of the company made sure that the

company had sufficient funds to run the company to the shareholders hiding the actual conditions.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Module 7 - Revenue Recognition - StudentsDocument10 pagesModule 7 - Revenue Recognition - StudentsLuisito CorreaNo ratings yet

- 03 InterestRateSwapsDocument123 pages03 InterestRateSwapstniravNo ratings yet

- Derivatives Title - Impact of Derivatives On The Non-Financial Firms in UKDocument15 pagesDerivatives Title - Impact of Derivatives On The Non-Financial Firms in UKPankaj KhannaNo ratings yet

- Assignment2revised1Document5 pagesAssignment2revised1Pankaj KhannaNo ratings yet

- Business Continuity: With Today's Highly Globalized Division ofDocument3 pagesBusiness Continuity: With Today's Highly Globalized Division ofPankaj KhannaNo ratings yet

- Session 6: The Measurement of RiskDocument29 pagesSession 6: The Measurement of RiskPankaj KhannaNo ratings yet

- Presentation BriefDocument1 pagePresentation BriefPankaj KhannaNo ratings yet

- Lessons From The Global Financial Crisis: Date 9 August 2012Document1 pageLessons From The Global Financial Crisis: Date 9 August 2012Pankaj KhannaNo ratings yet

- King'S Own Institute Success in Higher Education: Acc303 Contemporary Issues in Accounting T120Document18 pagesKing'S Own Institute Success in Higher Education: Acc303 Contemporary Issues in Accounting T120Pankaj KhannaNo ratings yet

- Corporate Governance CodesDocument31 pagesCorporate Governance CodesPankaj KhannaNo ratings yet

- Business Ethics in Ensuring Corporate GovernanceDocument16 pagesBusiness Ethics in Ensuring Corporate GovernancePankaj KhannaNo ratings yet

- Assignment2CDocument4 pagesAssignment2CPankaj KhannaNo ratings yet

- GroupAssignmentQuestion2Document2 pagesGroupAssignmentQuestion2Pankaj KhannaNo ratings yet

- Corporate Governance - Introduction: Business Ethics Corporate Leadership Psychological Contract Nudge TheoryDocument33 pagesCorporate Governance - Introduction: Business Ethics Corporate Leadership Psychological Contract Nudge TheoryPankaj KhannaNo ratings yet

- Dragon Credit CrisisDocument6 pagesDragon Credit CrisisPankaj KhannaNo ratings yet

- Introduction To Business Law: Study GuideDocument52 pagesIntroduction To Business Law: Study GuidePankaj KhannaNo ratings yet

- Birth Control Essay MLADocument7 pagesBirth Control Essay MLAPankaj KhannaNo ratings yet

- Overview of Legal Liability of CpaDocument15 pagesOverview of Legal Liability of CpaPankaj KhannaNo ratings yet

- Happiness - The Internal MeaningDocument6 pagesHappiness - The Internal MeaningPankaj KhannaNo ratings yet

- Choosing An Optimal Forex Rate Keyword - Forex RateDocument2 pagesChoosing An Optimal Forex Rate Keyword - Forex RatePankaj KhannaNo ratings yet

- Civil Procedure Some Terms Adversarial System Offers of CompromiseDocument77 pagesCivil Procedure Some Terms Adversarial System Offers of CompromisePankaj KhannaNo ratings yet

- Project Feasibility On Househelp Agency in Zamboanga CityDocument92 pagesProject Feasibility On Househelp Agency in Zamboanga CityJay ArNo ratings yet

- 24 DIGEST Metrobank v. BA FinanceDocument2 pages24 DIGEST Metrobank v. BA FinancePrincess Aileen EsplanaNo ratings yet

- 4 - 06-11-2021 - 16-08-22 - Statistical Methods (20ECO21C5)Document59 pages4 - 06-11-2021 - 16-08-22 - Statistical Methods (20ECO21C5)Sunil Sunil Kumar DhankaNo ratings yet

- Risk and Opportunity Assessment 1564904566Document6 pagesRisk and Opportunity Assessment 1564904566Ssnovita31100% (1)

- LIFFE-Bond Futures and OptionsDocument47 pagesLIFFE-Bond Futures and Optionsviktor1500No ratings yet

- Trade and Commerce in IslamDocument4 pagesTrade and Commerce in IslamAamir SadiqNo ratings yet

- RMC No 24-2019 Submission of Bir Form 2316Document2 pagesRMC No 24-2019 Submission of Bir Form 2316joelsy100100% (1)

- Engineering EconomyDocument7 pagesEngineering Economyelijah namomoNo ratings yet

- Management Accounting Exam Paper May 2012Document23 pagesManagement Accounting Exam Paper May 2012MahmozNo ratings yet

- Rositano Resume 1Document1 pageRositano Resume 1api-438359259No ratings yet

- Why Are These MNCs Thriving in MalaysiaDocument2 pagesWhy Are These MNCs Thriving in MalaysiaDharshini KumarNo ratings yet

- 01 - Overview Bisnis Internasional PDFDocument26 pages01 - Overview Bisnis Internasional PDFannisaNo ratings yet

- My BillDocument3 pagesMy BillYogesh GoyalNo ratings yet

- Planning and Development ActDocument48 pagesPlanning and Development ActVishwajeet UjhoodhaNo ratings yet

- A Study On Hiring & Interview Processes at Deloitte, GurgaonDocument32 pagesA Study On Hiring & Interview Processes at Deloitte, GurgaonRohan MamtaniNo ratings yet

- Description: - TXN Date ValueDocument25 pagesDescription: - TXN Date ValueUday GurijalaNo ratings yet

- Research Methodology On System Analysis and DesignDocument17 pagesResearch Methodology On System Analysis and Designstarvamsi123No ratings yet

- Sarvagya e Pro Services Private LimitedDocument15 pagesSarvagya e Pro Services Private Limitedmanish kanodiaNo ratings yet

- DLL Sept23-27 EntrepDocument4 pagesDLL Sept23-27 EntrepJudel Aquino LumberaNo ratings yet

- M Commerce SlideDocument13 pagesM Commerce Slideharibkp1985No ratings yet

- TCT Transfer ProcedureDocument3 pagesTCT Transfer ProcedureForiel FrancoNo ratings yet

- Shang Properties DigestDocument3 pagesShang Properties DigestJesstonieCastañaresDamayoNo ratings yet

- Dena Bank DenaDocument40 pagesDena Bank DenaRashmi ShettyNo ratings yet

- Catalogue - DingZing DZ Seals Catalogue-E-SDocument94 pagesCatalogue - DingZing DZ Seals Catalogue-E-SKeron TrotzNo ratings yet

- Market Mix WorksheetDocument4 pagesMarket Mix WorksheetPhyllis StrawderNo ratings yet

- BMC RFPDocument545 pagesBMC RFPBiswa Prakash NayakNo ratings yet

- LOREALDocument56 pagesLOREALitsmeshubhammNo ratings yet

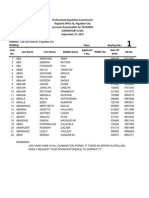

- Pagadian Room Assignment Elementary LETDocument278 pagesPagadian Room Assignment Elementary LETTheSummitExpress75% (4)