Professional Documents

Culture Documents

Stock Update: LIC Housing Finance

Stock Update: LIC Housing Finance

Uploaded by

saran21Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Stock Update: LIC Housing Finance

Stock Update: LIC Housing Finance

Uploaded by

saran21Copyright:

Available Formats

Stock Update

Steady performer at reasonable valuation

Key points

LIC Housing Finance

Operating in-line performance: LIC housing

Reco: Buy | CMP: Rs547 Finance (LICHF) posted decent operating

performance for Q4FY2018. While net interest

income (NII) was down marginally by 1.4% y-o-y

Company details to Rs. 1,057.9 crore, NIMs bottomed out and

asset growth outlook brightened relatively.

Price target: Rs620

Market cap: Rs27,627 cr Net interest margins (NIM) for the quarter

increased by 16 BPS sequentially to 2.49%, even

52-week high/low: Rs794/477 though on a y-o-y basis, it declined by 48 BPS

NSE volume: (No of shares) 1.3 lakh due to increasing competition in the housing

finance space and hardening bond yields, which

BSE code: 500253 in turn impacted cost of funds (CoF). LICHF

has already increased its PLR in April 2018 by

NSE code: LICHSGFIN

20 BPS, which will help offset potential yield

Sharekhan code: LICHSGFIN compression impact due to rising costs. During

the next year, ~Rs. 21,000 crore of borrowing

Free float: (No of shares) 30.12 cr would be due for renewal; and we believe the

present interest rate scenario will not have an

adverse impact on NIMs. Non-interest income

Shareholding pattern

performance was better during the quarter, as

it grew by 74.6% to Rs. 33.2, driven by a 62.7%

y-o-y rise in fee income as the company revised

its pricing in the segment. Going forward as well,

we expect fee income to be healthy in FY2019E

Promoter both on base of revised pricing and lower base.

40.3% Provisions during the quarter declined by 68.5%

y-o-y to Rs. 28.1 crore, which helped net profit

Public for the quarter to remain flat at 1.9% y-o-y.

59.7%

Outlook: LICHF has been able to maintain its

growth momentum via higher disbursements,

notwithstanding the persistent pre-payments,

which have been coming down slightly.

Respectable asset quality with high PCR is a

Price chart positive. Sequentially better NIMs were offset

850 by higher CoF as volatile bond yields weighed

800 in on the spreads. However, the recent PLR

750 rate hike should be positive as it will lift overall

700 portfolio yield, support spreads and help offset

650 prepayments. While we believe NIMs have

600 bottomed out, we expect NIMs to remain range

550 bound due to increased competition and a

500 dynamic interest rate scenario. Nonetheless,

450 bottoming out of NIMs will be seen as a positive

400 for the HFC.

Apr-17

Apr-18

Aug-17

Dec-17

Valuation: LICHF trades at 1.9x its FY2019E

book value and is reasonably valued at these

levels, considering growth in the overall housing

Price performance

market, opportunity in affordable housing

(%) 1m 3m 6m 12m and non-salaried segment, among others. We

believe improved infrastructure and rural spend

Absolute 4.7 -4.5 -14.1 -16.5 and the government’s incentives for housing are

Relative to Sensex -1.4 -0.4 -19.4 -29.4

positives in its favour. We upgrade our rating to

Buy with a price target of Rs. 620.

April 25, 2018 2

Sharekhan Stock Update

Business growth steady: LICHF witnessed loan LICHF and we believe this can be an important

book growth of 15.1% y-o-y during Q4FY2018, growth driver for it. Disbursement growth during

which was largely similar to Q3FY2018 and the quarter was satisfactory at 14.5% y-o-y, with

Q2FY2018 y-o-y growth. However, while corporate loan disbursement higher at 83.9%

individual loan portfolio increased by 13.8% y-o-y. Management has guided better loan

y-o-y, developer loans jumped by 46.2% growth in FY2019E, driven by the individual

y-o-y, taking the contribution of such loans to segment. Asset quality improved for LICHF as

form 4.8% of total loan book. Individual loan GNPA ratio declined by 9 BPS on a sequential

portfolio stood at Rs. 1,58,270 crore (95.1% of basis to 0.78%, in which the individual loan

total loans), while developer loan portfolio segment’s GNPA stood at 0.42% (down 5 BPS

stood at Rs. 8,093 crore (4.8% of total loans). In q-o-q). However, due to increasing disbursal to

the individual segment, loan to self-employed the developer segment, we believe asset quality

segment stood at ~12% of total loan book for will be a key monitorable for investors.

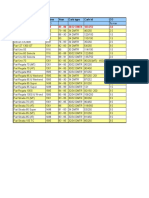

Results Rs cr

Particulars Q4FY18 Q4FY17 YoY (%) Q3FY18 QoQ (%)

Interest income 3,901.0 3,642.9 7.1 3,738.1 4.4

Interest expense 2,843.1 2,569.9 10.6 2,814.8 1.0

Net interest income 1,057.9 1,072.9 -1.4 923.3 14.6

Non-interest income 33.2 19.0 74.6 29.5 12.5

Net total income 1,091.1 1,091.9 -0.1 952.8 14.5

Operating expenses 224.2 196.5 14.1 147.7 51.8

Pre-provisioning profit 866.9 895.4 -3.2 805.0 7.7

Provisions 28.1 89.3 -68.5 48.4 -41.9

Profit before tax 838.7 806.1 4.0 756.6 10.9

Tax 299.4 276.9 8.1 265.5 12.8

Profit after tax 539.3 529.2 1.9 491.1 9.8

Asset Quality (%)

- Gross NPLs 0.78 0.43 35 bps 0.87 -9 bps

- Net NPLs 0.43 0.14 29 bps 0.49 -6 bps

Key Ratios (%)

-NIM 2.49 2.97 -48 bps 2.33 16 bps

Funding mix (%) Asset quality (%)

100% 1.0

0.9

80% 0.8

0.7

60% 0.6

0.5

40% 0.4

0.3

20% 0.2

0.1

0% -

Q4FY16 Q4FY17 Q4FY18 Q4FY16 Q4FY17 Q4FY18

Bank borrowings NCDs Others Gross NPL (%) Net NPL (%)

April 25, 2018 3

Sharekhan Stock Update

NIM (%) Loan book (Rs cr)

180,000 35%

3.0

160,000

140,000 30%

2.5

120,000

2.0 25%

100,000

1.5 80,000

20%

60,000

1.0 40,000 15%

20,000

0.5

0 10%

0.0 Q4FY16 Q4FY17 Q4FY18

Q4FY16 Q4FY17 Q4FY18 Loan book (Rs cr) growth (YoY, %)

Operating expenses (Rs cr) One-year forward P/BV SD band

250.0 30% 3.5

3.1

25%

200.0 2.7

20%

2.3

150.0 15% 1.9

10% 1.5

100.0

1.1

5%

0.7

50.0

0% 0.3

Apr-11

Apr-12

Apr-13

Apr-14

Apr-15

Apr-16

Apr-17

Apr-18

0.0 -5%

Q3FY17 Q4FY17 Q1FY18 Q2FY18 Q3FY18 Q4FY18

Operating expenses (Rs. Cr) Growth (%) PBV (x) +0.5 Mean 5 year rolling PBV mean -0.5 Mean

Profit and loss statement Rs cr

Particulars FY16 FY17 FY18 FY19E FY20E

Net Interest Income 3,089 3,694 3,835 4,230 4,936

Non Interest Income 89 155 113 198 232

Net Total Income 3,179 3,849 3,948 4,428 5,168

Operating expenses 469 612 648 766 907

Pre-provisioning profit 2,710 3,237 3,301 3,662 4,262

Provisions 146 281 239 294 347

Profit before tax 2,564 2,956 3,062 3,367 3,914

Tax 903 1,025 1,072 1,162 1,350

Profit after tax 1,661 1,931 1,990 2,206 2,564

Balance sheet Rs cr

Particulars FY16 FY17 FY18 FY19E FY20E

Shareholders' funds 9,146 11,077 12,691 14,486 16,573

Capital 101 101 101 101 101

Reserves & Surplus 9,045 10,976 12,590 14,385 16,472

Borrowings 96,099 111,326 119,606 151,107 178,278

Total sources of funds 105,245 122,403 132,297 165,593 194,852

Loan Book 125,173 144,534 166,363 196,242 231,530

Investments 277 527 987 1,085 1,194

Net other Assets -20,205 -22,658 -35,053 -31,735 -37,873

Total application of funds 105,245 122,403 132,297 165,593 194,852

April 25, 2018 4

Sharekhan Stock Update

Key ratios Rs cr

Particulars FY16 FY17 FY18 FY19E FY20E

Per share Data (Rs)

Earnings 32.9 38.2 39.4 43.7 50.8

Dividend 5.5 6.2 6.3 7.0 8.1

Book value 181.1 219.4 251.3 286.9 328.2

Adj. book value 171.1 213.2 244.6 279.5 320.1

Spreads (%)

Yield on assets 10.6 10.3 9.6 9.5 9.7

Cost of funds 9.7 9.9 9.6 9.6 9.6

Net interest margins 2.6 2.7 2.5 2.3 2.3

Risk Adj. NIM 2.5 2.5 2.3 2.2 2.1

Operating ratios (%)

Cost to income 14.7 15.9 16.4 17.3 17.5

Non interest income / net total 2.8 4.0 2.9 4.5 4.5

income

Assets/Equity (x) 14.0 13.3 13.3 14.2 14.3

Return ratios (%)

RoAE 19.6 19.1 16.7 16.2 16.5

RoAA 1.6 1.7 1.6 1.5 1.4

Asset quality ratios (%)

Gross NPA 0.57 0.43 0.78 0.47 0.44

Net NPA 0.40 0.14 0.43 0.19 0.18

Growth ratios (%)

Net interest income 31.0 19.6 3.8 10.3 16.7

Pre-provisioning profit 28.5 19.4 2.0 10.9 16.4

Profit after tax 19.8 16.3 3.0 10.9 16.2

Advances 15.5 15.5 15.1 18.0 18.0

Borrowings -0.5 15.8 7.4 26.3 18.0

Valuation ratios (x)

P/E 16.7 14.4 13.9 12.6 10.8

P/BV 3.0 2.5 2.2 1.9 1.7

P/ABV 3.2 2.6 2.2 2.0 1.7

Sharekhan Limited, its analyst or dependant(s) of the analyst might be holding or having a position in the companies mentioned in the article.

April 25, 2018 5

Know more about our products and services

For Private Circulation only

Disclaimer: This document has been prepared by Sharekhan Ltd. (SHAREKHAN) and is intended for use only by the person or entity

to which it is addressed to. This Document may contain confidential and/or privileged material and is not for any type of circulation

and any review, retransmission, or any other use is strictly prohibited. This Document is subject to changes without prior notice.

This document does not constitute an offer to sell or solicitation for the purchase or sale of any financial instrument or as an official

confirmation of any transaction. Though disseminated to all customers who are due to receive the same, not all customers may

receive this report at the same time. SHAREKHAN will not treat recipients as customers by virtue of their receiving this report.

The information contained herein is obtained from publicly available data or other sources believed to be reliable and SHAREKHAN

has not independently verified the accuracy and completeness of the said data and hence it should not be relied upon as such. While

we would endeavour to update the information herein on reasonable basis, SHAREKHAN, its subsidiaries and associated companies,

their directors and employees (“SHAREKHAN and affiliates”) are under no obligation to update or keep the information current. Also,

there may be regulatory, compliance, or other reasons that may prevent SHAREKHAN and affiliates from doing so. This document is

prepared for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Recipients

of this report should also be aware that past performance is not necessarily a guide to future performance and value of investments

can go down as well. The user assumes the entire risk of any use made of this information. Each recipient of this document should

make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies

referred to in this document (including the merits and risks involved), and should consult its own advisors to determine the merits and

risks of such an investment. The investment discussed or views expressed may not be suitable for all investors. We do not undertake to

advise you as to any change of our views. Affiliates of Sharekhan may have issued other reports that are inconsistent with and reach

different conclusions from the information presented in this report.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any

locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation

or which would subject SHAREKHAN and affiliates to any registration or licencing requirement within such jurisdiction. The securities

described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession

this document may come are required to inform themselves of and to observe such restriction.

The analyst certifies that the analyst has not dealt or traded directly or indirectly in securities of the company and that all of the views

expressed in this document accurately reflect his or her personal views about the subject company or companies and its or their

securities and do not necessarily reflect those of SHAREKHAN. The analyst further certifies that neither he nor his relatives has any

direct or indirect financial interest nor have actual or beneficial ownership of 1% or more in the securities of the company nor have

any material conflict of interest nor has served as officer, director or employee or engaged in market making activity of the company.

Further, the analyst has also not been a part of the team which has managed or co-managed the public offerings of the company and

no part of the analyst’s compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed

in this document.

Either SHAREKHAN or its affiliates or its directors or employees / representatives / clients or their relatives may have position(s), make

market, act as principal or engage in transactions of purchase or sell of securities, from time to time or may be materially interested

in any of the securities or related securities referred to in this report and they may have used the information set forth herein before

publication. SHAREKHAN may from time to time solicit from, or perform investment banking, or other services for, any company

mentioned herein. Without limiting any of the foregoing, in no event shall SHAREKHAN, any of its affiliates or any third party involved

in, or related to, computing or compiling the information have any liability for any damages of any kind.

Compliance Officer: Mr. Joby John Meledan; Tel: 022-61150000; For any queries or grievances kindly email

igc@sharekhan.com or contact: myaccount@sharekhan.com

Registered Office: Sharekhan Limited, 10th Floor, Beta Building, Lodha iThink Techno Campus, Off. JVLR, Opp. Kanjurmarg Railway

Station, Kanjurmarg (East), Mumbai – 400042, Maharashtra. Tel: 022 - 61150000. Sharekhan Ltd.: SEBI Regn. Nos.: BSE: INB/

INF011073351 / BSE-CD; NSE: INB/INF/INE231073330 ; MSEI: INB/INF261073333 / INE261073330 ; DP: NSDL-IN-DP-NSDL-233-2003 ;

CDSL-IN-DP-CDSL-271-2004; PMS-INP000005786 ; Mutual Fund-ARN 20669 ; Research Analyst: INH000000370; For any complaints

email at igc@sharekhan.com ; Disclaimer: Client should read the Risk Disclosure Document issued by SEBI & relevant exchanges and

the T & C on www.sharekhan.com ; Investment in securities market are subject to market risks, read all the related documents carefully

before investing.

You might also like

- Current Reality and Gsaps ReviewDocument21 pagesCurrent Reality and Gsaps Reviewapi-440230265No ratings yet

- Bajaj Finance: Long-Term Positives in PlaceDocument3 pagesBajaj Finance: Long-Term Positives in PlacedarshanmadeNo ratings yet

- Lic Housing FinanceDocument5 pagesLic Housing Financeabhilasha uikeNo ratings yet

- (Kotak) Reliance Industries, August 28, 2018Document9 pages(Kotak) Reliance Industries, August 28, 2018darshanmaldeNo ratings yet

- Kotak Daily 06.02.23 SBI BOB MnMFinDocument157 pagesKotak Daily 06.02.23 SBI BOB MnMFinApoorva ParikhNo ratings yet

- HDFC Bank: Fundamentals Stay Strong Amid UncertaintyDocument6 pagesHDFC Bank: Fundamentals Stay Strong Amid UncertaintydarshanmadeNo ratings yet

- Engineers India-ICICI DirectDocument5 pagesEngineers India-ICICI DirectSalman KhanNo ratings yet

- Bajaj Finance: Strong Fundamentals But Environment Appears ChallengingDocument4 pagesBajaj Finance: Strong Fundamentals But Environment Appears ChallengingdarshanmadeNo ratings yet

- StateBankofIndia ReportDocument13 pagesStateBankofIndia ReportTeja CharyNo ratings yet

- Kotak Mahindra Bank: Better and in Line PerformanceDocument9 pagesKotak Mahindra Bank: Better and in Line PerformancesuprabhattNo ratings yet

- Max Financial Services: Steady Quarter, Attractive ValuationsDocument5 pagesMax Financial Services: Steady Quarter, Attractive ValuationsdarshanmadeNo ratings yet

- DCB Bank Limited: Investing For Growth BUYDocument4 pagesDCB Bank Limited: Investing For Growth BUYdarshanmadeNo ratings yet

- ABB India: Strong Margin Expansion Valuations Remain ExpensiveDocument5 pagesABB India: Strong Margin Expansion Valuations Remain ExpensiveAmar DoshiNo ratings yet

- Indiabulls Housing Finance: CMP: INR949 TP: INR1,150 (+21%)Document12 pagesIndiabulls Housing Finance: CMP: INR949 TP: INR1,150 (+21%)Veronika AkheevaNo ratings yet

- Inox Leisure: Growth Outlook Healthy Despite Short-Term HiccupsDocument6 pagesInox Leisure: Growth Outlook Healthy Despite Short-Term HiccupsanjugaduNo ratings yet

- 1 State Bank of India 09may24 Kotak InstDocument17 pages1 State Bank of India 09may24 Kotak InstbhaskarbrvNo ratings yet

- State Bank of India: CMP: INR234 TP: INR300 (+28%)Document22 pagesState Bank of India: CMP: INR234 TP: INR300 (+28%)ktyNo ratings yet

- Dewan Housing Finance Corporation Limited 4 QuarterUpdateDocument7 pagesDewan Housing Finance Corporation Limited 4 QuarterUpdatesandyinsNo ratings yet

- Pakistan Insight - 20230519 - UBL PA - Asset Re-Pricing To Augment Bottom-LineDocument4 pagesPakistan Insight - 20230519 - UBL PA - Asset Re-Pricing To Augment Bottom-Linemuddasir1980No ratings yet

- @LJ LNT Fin Prabhudas 040518Document9 pages@LJ LNT Fin Prabhudas 040518Amey TiwariNo ratings yet

- Aditya Birla Capital: Performance HighlightsDocument3 pagesAditya Birla Capital: Performance HighlightsdarshanmadeNo ratings yet

- State Bank of India: ESG Disclosure ScoreDocument7 pagesState Bank of India: ESG Disclosure ScoredeveshNo ratings yet

- Kalpataru Power - 1QFY20 Result - EdelDocument14 pagesKalpataru Power - 1QFY20 Result - EdeldarshanmadeNo ratings yet

- HDFC Bank: Strong Performance Yet AgainDocument6 pagesHDFC Bank: Strong Performance Yet AgainTotmolNo ratings yet

- Power Finance Corporation LTD: Key HighlightsDocument6 pagesPower Finance Corporation LTD: Key HighlightsAjay SolankiNo ratings yet

- Axis Bank LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel BrokingDocument7 pagesAxis Bank LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- State Bank of India: ESG Disclosure ScoreDocument9 pagesState Bank of India: ESG Disclosure Scorepgrajan91No ratings yet

- Kotak Bank Edel 220118Document19 pagesKotak Bank Edel 220118suprabhattNo ratings yet

- Icici Bank: On Track To Regain Its MojoDocument5 pagesIcici Bank: On Track To Regain Its MojodarshanmadeNo ratings yet

- Bajaj Fin-May16 19Document4 pagesBajaj Fin-May16 19Rejo JohnNo ratings yet

- State Bank of India: CMP: INR487 TP: INR675 (+39%)Document26 pagesState Bank of India: CMP: INR487 TP: INR675 (+39%)bradburywillsNo ratings yet

- AngelBrokingResearch STFC Result Update 3QFY2020Document6 pagesAngelBrokingResearch STFC Result Update 3QFY2020avinashkeswaniNo ratings yet

- Banks - HBL - Valuation Update - TaurusDocument4 pagesBanks - HBL - Valuation Update - Taurusmuddasir1980No ratings yet

- Ujjivan Financial 1QFY20 Result Update - 190808 - Antique ResearchDocument4 pagesUjjivan Financial 1QFY20 Result Update - 190808 - Antique ResearchdarshanmadeNo ratings yet

- BFSI Q2FY22 - Earnings Preview - 08102021 Final (1) (1) - 08-10-2021 - 09Document13 pagesBFSI Q2FY22 - Earnings Preview - 08102021 Final (1) (1) - 08-10-2021 - 09slohariNo ratings yet

- Angel One - Update - Jul23 - HSIE-202307170719227368733Document9 pagesAngel One - Update - Jul23 - HSIE-202307170719227368733Ram JaneNo ratings yet

- Rel in HDFC SecuritiesDocument9 pagesRel in HDFC Securitiesopemperor06No ratings yet

- Bajaj Finance: Steady Performance, But Niggles On OutlookDocument6 pagesBajaj Finance: Steady Performance, But Niggles On Outlookvenkatachalapathy.thNo ratings yet

- HDFCDocument2 pagesHDFCshankyagarNo ratings yet

- Shriram Finance - Result update-Apr-24-NUVAMADocument11 pagesShriram Finance - Result update-Apr-24-NUVAMAchetanNo ratings yet

- Rural Electrification Corporation LTD: 11 February, 2011Document6 pagesRural Electrification Corporation LTD: 11 February, 2011jkingjamNo ratings yet

- JM Financial Update On NBFC Preview Strong Earnings Momentum ToDocument14 pagesJM Financial Update On NBFC Preview Strong Earnings Momentum ToMohammed Israr ShaikhNo ratings yet

- Centrum Suryoday Small Finance Bank Q3FY23 Result UpdateDocument10 pagesCentrum Suryoday Small Finance Bank Q3FY23 Result UpdateDivy JainNo ratings yet

- Idfc First Bank: IndiaDocument35 pagesIdfc First Bank: IndiaPraveen PNo ratings yet

- Accumulate HDFC Bank: Performance HighlightsDocument9 pagesAccumulate HDFC Bank: Performance Highlightsimran shaikhNo ratings yet

- Bank of Baroda - KRC - 15 10 09Document2 pagesBank of Baroda - KRC - 15 10 09sudhirbansalNo ratings yet

- State Bank of India (SBIN IN) : Q1FY21 Result UpdateDocument11 pagesState Bank of India (SBIN IN) : Q1FY21 Result UpdatewhitenagarNo ratings yet

- HDFCB 20240421 Mosl Ru PG014Document14 pagesHDFCB 20240421 Mosl Ru PG014punit.gorNo ratings yet

- Kotak Daily 22-Apr-24Document107 pagesKotak Daily 22-Apr-24Divyansh TiwariNo ratings yet

- Banks - HBL - Earnings Revision - BMADocument3 pagesBanks - HBL - Earnings Revision - BMAmuddasir1980No ratings yet

- Oracle Financial Services Software: Management Strategy and Key Highlights of FY20Document13 pagesOracle Financial Services Software: Management Strategy and Key Highlights of FY20Jeet SinghNo ratings yet

- IDirect BoI ShubhNivesh 15jan24Document4 pagesIDirect BoI ShubhNivesh 15jan24Naveen KumarNo ratings yet

- Spanco Telesystems Initiating Cov - April 20 (1) .Document24 pagesSpanco Telesystems Initiating Cov - April 20 (1) .KunalNo ratings yet

- ICICI Bank 1QFY20 Result Update - 190729 - Antique ResearchDocument10 pagesICICI Bank 1QFY20 Result Update - 190729 - Antique ResearchdarshanmadeNo ratings yet

- Axis Bank - 03 - 03 - 2023 - Khan030323Document7 pagesAxis Bank - 03 - 03 - 2023 - Khan030323Ranjan SharmaNo ratings yet

- Yes Bank: IndiaDocument9 pagesYes Bank: IndiabdacNo ratings yet

- State Bank of India: Q2 Fy 2021 ResultsDocument7 pagesState Bank of India: Q2 Fy 2021 ResultsRanjan BeheraNo ratings yet

- Iea Icicibank 27072020Document9 pagesIea Icicibank 27072020premNo ratings yet

- RBL Bank: Margin Expansion and Robust Growth in Advances in Line With ExpectationsDocument4 pagesRBL Bank: Margin Expansion and Robust Growth in Advances in Line With Expectationssaran21No ratings yet

- JM - RepcohomeDocument12 pagesJM - RepcohomeSanjay PatelNo ratings yet

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)From EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)No ratings yet

- HDFC 01 01 2023 KhanDocument7 pagesHDFC 01 01 2023 Khansaran21No ratings yet

- Britannia Industries 01 01 2023 KhanDocument7 pagesBritannia Industries 01 01 2023 Khansaran21No ratings yet

- APL Apollo Tubes 01 01 2023 KhanDocument7 pagesAPL Apollo Tubes 01 01 2023 Khansaran21No ratings yet

- Titan Company 01 01 2023 KhanDocument8 pagesTitan Company 01 01 2023 Khansaran21No ratings yet

- Dolat Capital Market's Research Report On Intellect Design-Intellect-Design-26-03-2021-dolatDocument22 pagesDolat Capital Market's Research Report On Intellect Design-Intellect-Design-26-03-2021-dolatsaran21No ratings yet

- Sharekhan's Research Report On JSW Steel-JSW-Steel-26-03-2021-khanDocument10 pagesSharekhan's Research Report On JSW Steel-JSW-Steel-26-03-2021-khansaran21No ratings yet

- Sharekhan's Research Report On Godrej Consumer Products-Godrej-Consumer-Products-26-03-2021-khanDocument9 pagesSharekhan's Research Report On Godrej Consumer Products-Godrej-Consumer-Products-26-03-2021-khansaran21No ratings yet

- KEC International 01 01 2023 PrabhuDocument7 pagesKEC International 01 01 2023 Prabhusaran21No ratings yet

- Fundamental Outlook Market Highlights: Indian RupeeDocument2 pagesFundamental Outlook Market Highlights: Indian Rupeesaran21No ratings yet

- Icici Bank: CMP: INR396 TP: INR520 (+31%)Document22 pagesIcici Bank: CMP: INR396 TP: INR520 (+31%)saran21No ratings yet

- Daily Currency Outlook: September 11, 2019Document7 pagesDaily Currency Outlook: September 11, 2019saran21No ratings yet

- Greenply Industries: Plywood Business Growing in Single-DigitsDocument8 pagesGreenply Industries: Plywood Business Growing in Single-Digitssaran21No ratings yet

- Housing Development Finance Corporation 27082019Document6 pagesHousing Development Finance Corporation 27082019saran21No ratings yet

- Somany Ceramics (SOMCER) : Multiple Triggers For Margin RevivalDocument4 pagesSomany Ceramics (SOMCER) : Multiple Triggers For Margin Revivalsaran21No ratings yet

- Ahluwalia Contracts: Industry OverviewDocument20 pagesAhluwalia Contracts: Industry Overviewsaran21No ratings yet

- Coal India (COAL IN) : Q4FY19 Result UpdateDocument6 pagesCoal India (COAL IN) : Q4FY19 Result Updatesaran21No ratings yet

- Teamlease Services (Team In) : Q4Fy19 Result UpdateDocument8 pagesTeamlease Services (Team In) : Q4Fy19 Result Updatesaran21No ratings yet

- Federal Bank LTD: Q3FY19 Result UpdateDocument4 pagesFederal Bank LTD: Q3FY19 Result Updatesaran21No ratings yet

- Dabur India (DABUR IN) : Analyst Meet UpdateDocument12 pagesDabur India (DABUR IN) : Analyst Meet Updatesaran21No ratings yet

- JK Lakshmi Cement 18062019Document6 pagesJK Lakshmi Cement 18062019saran21No ratings yet

- Coal India: CMP: INR234 Sputtering Production Growth Impacting VolumesDocument10 pagesCoal India: CMP: INR234 Sputtering Production Growth Impacting Volumessaran21No ratings yet

- South Indian Bank (SIB IN) : Q3FY19 Result UpdateDocument10 pagesSouth Indian Bank (SIB IN) : Q3FY19 Result Updatesaran21No ratings yet

- Zensar Technologies (ZENT IN) : Q3FY19 Result UpdateDocument8 pagesZensar Technologies (ZENT IN) : Q3FY19 Result Updatesaran21No ratings yet

- Bhel (Bhel In) : Q4FY19 Result UpdateDocument6 pagesBhel (Bhel In) : Q4FY19 Result Updatesaran21No ratings yet

- ODLI20181225 001 UPD en AA Standard Waranty Professional LED Lamps EuropeDocument4 pagesODLI20181225 001 UPD en AA Standard Waranty Professional LED Lamps Europesaran21No ratings yet

- Stock Update: Icici BankDocument3 pagesStock Update: Icici Banksaran21No ratings yet

- IME Echnoplast TD: P R - 100 T R .128 BUYDocument9 pagesIME Echnoplast TD: P R - 100 T R .128 BUYsaran21No ratings yet

- Confidence Petroleum India 020119Document17 pagesConfidence Petroleum India 020119saran21No ratings yet

- Bank of Baroda (BOB) BUY: Retail Equity ResearchDocument5 pagesBank of Baroda (BOB) BUY: Retail Equity Researchsaran21No ratings yet

- JK Tyre - Research - Note - 2017-06-06 - 06-08-51-000000Document9 pagesJK Tyre - Research - Note - 2017-06-06 - 06-08-51-000000saran21No ratings yet

- Case Digest - Asset Builders Vs StrongholdDocument3 pagesCase Digest - Asset Builders Vs StrongholdDianaVillafuerteNo ratings yet

- OS MCQsDocument11 pagesOS MCQsVaishNo ratings yet

- 134 Motion Pro Hac TantilloDocument6 pages134 Motion Pro Hac Tantillolarry-612445No ratings yet

- Stack-1531324837281 STKDocument4 pagesStack-1531324837281 STKRizalNo ratings yet

- Specification of ZXDC02 HP400Document2 pagesSpecification of ZXDC02 HP400huynhphucthoNo ratings yet

- Absorption CostDocument3 pagesAbsorption Costshahreen arshadNo ratings yet

- ZTE UMTS UR15 NodeB Uplink Interference Cancellation Feature GuideDocument34 pagesZTE UMTS UR15 NodeB Uplink Interference Cancellation Feature GuideNiraj Ram ShresthaNo ratings yet

- IIS Interview Questions and AnswersDocument14 pagesIIS Interview Questions and AnswerspallaravisankarNo ratings yet

- Pinpointer PetrapinDocument15 pagesPinpointer PetrapinNacer MezghicheNo ratings yet

- 2010 11 11 EreDocument3 pages2010 11 11 Eremet140No ratings yet

- Shorting SupernovasDocument10 pagesShorting SupernovasAlexNo ratings yet

- SmartWorks MFP - User Manual v3.50 - ENDocument133 pagesSmartWorks MFP - User Manual v3.50 - ENeserwisNo ratings yet

- PSR I455Document4 pagesPSR I455caronNo ratings yet

- WB9CYY HW8 Mods 20240403Document27 pagesWB9CYY HW8 Mods 20240403bcpsr7sc86No ratings yet

- HIRARCDocument21 pagesHIRARCAmirul Mukminin Zakaria SymantechNo ratings yet

- Agency Competition AnalysisDocument15 pagesAgency Competition Analysischauhan1983anupamNo ratings yet

- Using The SQL Transformation in An Informatica Developer MappingDocument10 pagesUsing The SQL Transformation in An Informatica Developer MappingShannonNo ratings yet

- Magpie Lab Student Guide Updated 2014 FinalDocument13 pagesMagpie Lab Student Guide Updated 2014 FinalAmanueNo ratings yet

- A Flight Fare Prediction Using Machine LearningDocument8 pagesA Flight Fare Prediction Using Machine LearningIJRASETPublicationsNo ratings yet

- Contract Act LawDocument8 pagesContract Act Lawmukmin09No ratings yet

- Midterm Exam DM 213 Fiscal ManagementDocument8 pagesMidterm Exam DM 213 Fiscal Managementbplo aguilarNo ratings yet

- DMTR DataDocument3 pagesDMTR DataŽiga PosediNo ratings yet

- BRKDCN 2035 PDFDocument117 pagesBRKDCN 2035 PDFJorge Alberto Largaespada GonzalezNo ratings yet

- 21st Century Nanoscience Vol 5Document489 pages21st Century Nanoscience Vol 5pedro100% (1)

- Summative Test gr.6 Health MedicineDocument2 pagesSummative Test gr.6 Health MedicineJINKY RAMIREZNo ratings yet

- Insolvency To Innovation: The Five-Year RecordDocument16 pagesInsolvency To Innovation: The Five-Year RecordGeorge RegneryNo ratings yet

- C9 Nazism+and+the+Rise+of+Hitler+ S1Document49 pagesC9 Nazism+and+the+Rise+of+Hitler+ S1raj kumarNo ratings yet

- Governance Modes in Supply Chains and Financial Performance at Buyer, Supplier and Dyadic Levels: The Positive Impact of Power BalanceDocument30 pagesGovernance Modes in Supply Chains and Financial Performance at Buyer, Supplier and Dyadic Levels: The Positive Impact of Power BalancegiovanniNo ratings yet