Professional Documents

Culture Documents

Customer Preferences Towards Patanjali Products A Study On Consumers With Reference To Mumbai Suburban District Ijariie3760

Customer Preferences Towards Patanjali Products A Study On Consumers With Reference To Mumbai Suburban District Ijariie3760

Uploaded by

subhash kumar jhaCopyright:

Available Formats

You might also like

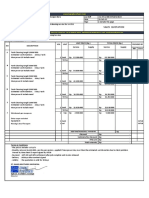

- 3.1.REV1 WATER STORAGE TANK CLEANING - Unit Pricing - MTLB-Medco PalembangDocument1 page3.1.REV1 WATER STORAGE TANK CLEANING - Unit Pricing - MTLB-Medco PalembangEko Prasetyo Wahyudi100% (1)

- A Project Report On ArambaghDocument34 pagesA Project Report On Arambaghavik0013100% (2)

- Consumer Behavior Towards The Homemade Food MarketDocument13 pagesConsumer Behavior Towards The Homemade Food Market27. Jyothika MaryNo ratings yet

- Lesson 1 (Tle6ie Oa 1)Document45 pagesLesson 1 (Tle6ie Oa 1)Guia Marie Diaz Brigino80% (10)

- MA3 Sample Exams Plus SolutionsDocument89 pagesMA3 Sample Exams Plus Solutionsbooks_sumiNo ratings yet

- Patanjali Products and Market Efficiency: Mahesh K.M Arabhi Krishna K.ADocument6 pagesPatanjali Products and Market Efficiency: Mahesh K.M Arabhi Krishna K.AKM MaheshNo ratings yet

- A Study On Consumer Behaviour Towards Aachi Masala and Sakthi Masala in Vaniyambadi TownDocument4 pagesA Study On Consumer Behaviour Towards Aachi Masala and Sakthi Masala in Vaniyambadi TownKaleeshwari KaleeshwariNo ratings yet

- CB Cia-3Document35 pagesCB Cia-3adhishree bhattacharyaNo ratings yet

- A Study On Customer's Perception Towards Patanjali Products With Special Reference To Coimbatore CityDocument3 pagesA Study On Customer's Perception Towards Patanjali Products With Special Reference To Coimbatore CityRambabu ArumugasamyNo ratings yet

- A Study of Consumer Perception Towards Patanjali Brand With Special Reference To Mohali CityDocument7 pagesA Study of Consumer Perception Towards Patanjali Brand With Special Reference To Mohali CityRizwan AkhtarNo ratings yet

- Ijrar Issue 20542862 PDFDocument7 pagesIjrar Issue 20542862 PDFmallathiNo ratings yet

- Reviews On First PDFDocument7 pagesReviews On First PDFdeepak rdmmNo ratings yet

- Ijrar Issue 20542862 PDFDocument7 pagesIjrar Issue 20542862 PDFkavin prasathNo ratings yet

- A Study On Customer Preference Towards Chocolates in CoimbatoreDocument5 pagesA Study On Customer Preference Towards Chocolates in Coimbatorekosov28578No ratings yet

- A Study On Women Consumer Attitude of Purchasing CosmeticsDocument7 pagesA Study On Women Consumer Attitude of Purchasing CosmeticsNive Palani100% (1)

- Consumers' Brand Preference and Buying Behaviour of Cosmetic Products at Coimbatore CityDocument8 pagesConsumers' Brand Preference and Buying Behaviour of Cosmetic Products at Coimbatore CityBhanu TejaNo ratings yet

- Pengaruh Kualitas Produk Dan Citra Merek Terhadap Keputusan Pembelian Konsumen Nature Republic Di SurabayaDocument12 pagesPengaruh Kualitas Produk Dan Citra Merek Terhadap Keputusan Pembelian Konsumen Nature Republic Di SurabayabembengNo ratings yet

- KMF Nandini Group ProjectDocument19 pagesKMF Nandini Group ProjectDileepkumar K DiliNo ratings yet

- 2018-2-July-Consumer Preference On Branded Fruit Drinks-Doi 10.59582250-0499.2018.00109.XDocument4 pages2018-2-July-Consumer Preference On Branded Fruit Drinks-Doi 10.59582250-0499.2018.00109.XSakthirama VadiveluNo ratings yet

- Ijrar Issue 20543248Document4 pagesIjrar Issue 20543248Gabriel FradzNo ratings yet

- Maggi Final Paper For PublicationDocument9 pagesMaggi Final Paper For Publicationrahul mhabdeNo ratings yet

- Chapter Four & Five CharityDocument11 pagesChapter Four & Five CharityRaytone Tonnie MainaNo ratings yet

- A Study On Factors Influencing Consumers Choice of FMCG Retail Store With Special Reference To Bangalore CityDocument7 pagesA Study On Factors Influencing Consumers Choice of FMCG Retail Store With Special Reference To Bangalore CityEswar RajNo ratings yet

- A Study On Buyer Behavior of Consumer Towards Kottakkal Arya Vaidya Sala Products Ijariie7008Document6 pagesA Study On Buyer Behavior of Consumer Towards Kottakkal Arya Vaidya Sala Products Ijariie7008anaswarasureshanaswaraNo ratings yet

- A Study of Consumer Perceptions of Three Retail Chains in Bangalore - Big Bazaar, Shoppers' Stop and Marks & SpencerDocument69 pagesA Study of Consumer Perceptions of Three Retail Chains in Bangalore - Big Bazaar, Shoppers' Stop and Marks & SpencerVishal MorariNo ratings yet

- Consumers' Shopping Behavior of Convenience Goods in Organised Retail StoresDocument9 pagesConsumers' Shopping Behavior of Convenience Goods in Organised Retail StoresNagunuri SrinivasNo ratings yet

- A Study of Consumer Perception Towards Patanjali Brand With Special Reference To Mohali CityDocument6 pagesA Study of Consumer Perception Towards Patanjali Brand With Special Reference To Mohali CityAnirudh Singh ChawdaNo ratings yet

- Patanjali ProjectDocument7 pagesPatanjali ProjectNidhiNo ratings yet

- Satisfaction of Consumers by Using Online Food Services: June 2019Document11 pagesSatisfaction of Consumers by Using Online Food Services: June 2019Aashish MathpalNo ratings yet

- Vol 6 Special IssueDocument4 pagesVol 6 Special IssueSukh SabNo ratings yet

- Consumer Buying Actions Concerning Himalaya Herbal Products With Reference To Coimbatore CityDocument12 pagesConsumer Buying Actions Concerning Himalaya Herbal Products With Reference To Coimbatore CityPoornima Devi A 21PCC008No ratings yet

- A Study On Brand Awareness of Sunfeast Yippee Noodles With Special Reference To Itc LTD in Salem DistrictDocument8 pagesA Study On Brand Awareness of Sunfeast Yippee Noodles With Special Reference To Itc LTD in Salem DistrictPavithran MNo ratings yet

- Consumers' Perception Towards Patanjali Products' With SpecialDocument5 pagesConsumers' Perception Towards Patanjali Products' With SpecialAnirudh Singh ChawdaNo ratings yet

- A Study On Consumer Preference Towards Skincare With Special Reference To Himalaya Herbal Products in Nilambur at Malappuram District of KeralaDocument4 pagesA Study On Consumer Preference Towards Skincare With Special Reference To Himalaya Herbal Products in Nilambur at Malappuram District of Keralaarcherselevators50% (2)

- Minor ReportDocument21 pagesMinor ReportaasthaaquaNo ratings yet

- Market SurveyDocument22 pagesMarket SurveyAnonymous 67dCNBNo ratings yet

- PPR No. 9 LifebouyDocument3 pagesPPR No. 9 LifebouyAmi DivechaNo ratings yet

- A Study On Brand Awareness in Rural Area With Special Reference To Health Food DrinksDocument6 pagesA Study On Brand Awareness in Rural Area With Special Reference To Health Food DrinksImpact Journals100% (1)

- A Study On Brand Awareness of Sunfeast Yippee Noodles With Special Reference To Itc LTD in Salem DistrictDocument8 pagesA Study On Brand Awareness of Sunfeast Yippee Noodles With Special Reference To Itc LTD in Salem DistrictTryambak GourNo ratings yet

- BRM ProjectDocument35 pagesBRM Projectshubhangi rautNo ratings yet

- Khadi ProductsDocument7 pagesKhadi Productsaabu28807No ratings yet

- Buying Decision Process of Fast Moving C PDFDocument17 pagesBuying Decision Process of Fast Moving C PDFSuraj GNo ratings yet

- Consumers Satisfaction Towards Online Food Delivery App Swiggy: The Study Special Reference With South ChennaiDocument10 pagesConsumers Satisfaction Towards Online Food Delivery App Swiggy: The Study Special Reference With South Chennainakulm416No ratings yet

- 123am 52.epra Journals-5709Document4 pages123am 52.epra Journals-5709priya saranNo ratings yet

- Consumer Awareness - Organic ProductsDocument31 pagesConsumer Awareness - Organic ProductsoceanicpollachiNo ratings yet

- A Study of Mothers' Satisfaction in Baby Care Products - Nagapattinam District PDFDocument4 pagesA Study of Mothers' Satisfaction in Baby Care Products - Nagapattinam District PDFInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- A Study of FMCG ProductsDocument11 pagesA Study of FMCG ProductsSAKTHIVEL KNo ratings yet

- A Study On Sales Promotion and Consumer Behaviour of Sai Lakshmi Milk Products Krishnagiri, Tamil NaduDocument4 pagesA Study On Sales Promotion and Consumer Behaviour of Sai Lakshmi Milk Products Krishnagiri, Tamil NaduSuryaprakash SuryaNo ratings yet

- Consumers' Perception On Fairness Creams in India Saumendra DasDocument12 pagesConsumers' Perception On Fairness Creams in India Saumendra DasSimran GuptaNo ratings yet

- A Study Onconsumer Behavior Towards Packaged Food & Beverages in The State of AssamDocument6 pagesA Study Onconsumer Behavior Towards Packaged Food & Beverages in The State of Assamneha agarwalNo ratings yet

- PDF Vadilal IcecreamDocument4 pagesPDF Vadilal Icecreamkishansinh chavdaNo ratings yet

- Chapter IIDocument30 pagesChapter IIMIMINo ratings yet

- A Study On Consumer Awareness and Preference Towards Ayurvedic Products in Coimbatore CityDocument6 pagesA Study On Consumer Awareness and Preference Towards Ayurvedic Products in Coimbatore CityGowtham RaajNo ratings yet

- Sakthi Masala - Customer Satisfaction PDFDocument4 pagesSakthi Masala - Customer Satisfaction PDFsujathalavi50% (2)

- IJRPR8512Document5 pagesIJRPR8512itssurajzz.06No ratings yet

- IJRPR18200Document5 pagesIJRPR18200Tejas KumbharNo ratings yet

- Sangeetha Achyuth-18MCO044-Merged PublicationDocument6 pagesSangeetha Achyuth-18MCO044-Merged PublicationNeenaNo ratings yet

- 4 Environmental AnalysisDocument6 pages4 Environmental AnalysiszaidkhanNo ratings yet

- JETIR2206763Document4 pagesJETIR2206763Ayush RajputNo ratings yet

- Quality Assurance: The Role of the Quality Assurance (QA) Professional in The Manufacture of Medical ProductsFrom EverandQuality Assurance: The Role of the Quality Assurance (QA) Professional in The Manufacture of Medical ProductsNo ratings yet

- A to Z of Pharmaceutical Marketing Volume 2: Worlds First and Only EncyclopediaFrom EverandA to Z of Pharmaceutical Marketing Volume 2: Worlds First and Only EncyclopediaNo ratings yet

- Final Project ReportDocument88 pagesFinal Project Reportsantu_khinchiNo ratings yet

- A Dent in Walmart Public ImageDocument26 pagesA Dent in Walmart Public Imagemeetkamal3No ratings yet

- Policies and Market Failures (PAM's Bottom Row) : Scott Pearson Stanford UniversityDocument16 pagesPolicies and Market Failures (PAM's Bottom Row) : Scott Pearson Stanford Universitysamantha glenn requilloNo ratings yet

- Differential Cost AnalysisDocument1 pageDifferential Cost AnalysisNinaNo ratings yet

- Money AU 09.2022Document92 pagesMoney AU 09.2022Aman SharmaNo ratings yet

- Humble Oil & Refining Co. V Westside Investment CorpDocument2 pagesHumble Oil & Refining Co. V Westside Investment Corpcrlstinaaa100% (1)

- Fundamental Analysis of Indian Automobile IndustryDocument17 pagesFundamental Analysis of Indian Automobile IndustryAnonymous tQKFAZvsvLNo ratings yet

- One Day Revision Notes CA InterDocument15 pagesOne Day Revision Notes CA InterAmitfusion R13No ratings yet

- Iip Report of Pranjal YadavDocument54 pagesIip Report of Pranjal YadavHarsh parasher (PGDM 17-19)No ratings yet

- Leumi Wire Form PDFDocument3 pagesLeumi Wire Form PDFGregory GilbertNo ratings yet

- Feasibility Study PRDocument33 pagesFeasibility Study PRprincess1129No ratings yet

- FM11 CH 15 Mini-Case Old12 Corp ValuationDocument6 pagesFM11 CH 15 Mini-Case Old12 Corp ValuationArafet NacefNo ratings yet

- FTX3044F Tutorial 1Document2 pagesFTX3044F Tutorial 1vrshaf001100% (1)

- Automotive HistoryDocument6 pagesAutomotive HistoryRamesh GowdaNo ratings yet

- F5 Practice Test 2 - Costing SystemsDocument4 pagesF5 Practice Test 2 - Costing SystemsBadhanNo ratings yet

- Ratio Proportion and Percentage - Lesson - 3Document7 pagesRatio Proportion and Percentage - Lesson - 3samsonNo ratings yet

- Eleanor Marx 1883Document11 pagesEleanor Marx 1883reader_jimNo ratings yet

- Bond Yield To Maturity (YTM) FormulasDocument2 pagesBond Yield To Maturity (YTM) FormulasIzzy BNo ratings yet

- Bus 5111 Financial Management Written Assignment Unit 7Document5 pagesBus 5111 Financial Management Written Assignment Unit 7Andika GintingNo ratings yet

- CH 06 - Macro Part 3Document18 pagesCH 06 - Macro Part 3Samar GrewalNo ratings yet

- Scert: 12 Economy Chapter-5Document23 pagesScert: 12 Economy Chapter-5tamilrockers downloadNo ratings yet

- Budgeting and Budgetary ControlDocument21 pagesBudgeting and Budgetary ControlShahid AmanNo ratings yet

- You Ur Flig GHT Co Onfirm Matio N: Hyij JJNDocument2 pagesYou Ur Flig GHT Co Onfirm Matio N: Hyij JJNBenny NahampunNo ratings yet

- Cap 10 Micro Teoría MicroeconómicaDocument39 pagesCap 10 Micro Teoría MicroeconómicaAbimNo ratings yet

- Housing BriefDocument6 pagesHousing BriefManish MishraNo ratings yet

- Retail BusinessDocument31 pagesRetail BusinessAshish Kumar PaniNo ratings yet

- Ma 1Document17 pagesMa 1Inkosi MacPherson Nchessie100% (2)

Customer Preferences Towards Patanjali Products A Study On Consumers With Reference To Mumbai Suburban District Ijariie3760

Customer Preferences Towards Patanjali Products A Study On Consumers With Reference To Mumbai Suburban District Ijariie3760

Uploaded by

subhash kumar jhaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Customer Preferences Towards Patanjali Products A Study On Consumers With Reference To Mumbai Suburban District Ijariie3760

Customer Preferences Towards Patanjali Products A Study On Consumers With Reference To Mumbai Suburban District Ijariie3760

Uploaded by

subhash kumar jhaCopyright:

Available Formats

Vol-3 Issue-1 2017 IJARIIE-ISSN(O)-2395-4396

Customer preferences towards Patanjali

products: A study on consumers with

reference to Mumbai Suburban district

Dr(Ca)Seema Gosher,Asst.Prof : Dept of Accountancy,

Smt.Mmp Shah Womens Of Arts And Commerce,338,R.A.Kidwai Road ,Matunga-400019

ABSTRACT

Indian consumer segment is broadly segregated into urban and rural markets, and is attracting marketers

from across the world. Global corporations view India as one of the key markets from where future growth is

likely to emerge. The growth in India’s consumer market would be primarily driven by a favorable

population composition and increasing disposable incomes. To purchase a product the customer will go

through a process of buying behavior. This study is carried out to know why customers prefer Patanjali

products. Patanjali Ayurveda home-grown firm in businesses such as food, consumer packaged goods and

healthcare. The company is expected to clock revenues of Rs.20,000 crore by fiscal year 2020(IIFL

Institutional Equities report).this study also aims at identifying customers perception towards present and

expected products from Patanjali.

Keyword: - consumer, prefer, factors, price, ayurvedic, herbal

1. Introduction: Patanjali Ayurveda started in 2007 and has benefited from close association with well-

known yoga guru Baba Ramdev. The company is different from a typical business and the stated philosophy

is to plough back profits into the company or to be used for social causes. The idea is to be present in as

many categories as possible in order to give consumers more choices, and profits are to be reinvested in

innovation and capacity expansion so pricing can be made more competitive. The firm, in fact, has priced its

product at a significant discount to others in a number of categories, which is helping drive sales. Patanjali is

also said to be benefiting from a shift in consumer preferences towards herbal and ayurvedic products which

are considered to be closer to nature. It has also positioned itself as a swadeshi brand, which has an appeal

among a category of consumers.

2. Objectives of the study

To know why consumer prefer Patanjali products

To examine purchasing behavior of the consumer gender wise and age wise

To know why customers are attached with Patanjali products

To know the source of consumer preference

To know the products customers are expecting from Patanjali

To understand why products are not repeatedly purchased by consumer.

3. Research methodology

Both primary and secondary data were collected for research survey and the primary instrument for data

collection used in this study was a questionnaire. Primary data was collected from 60 respondents from the

city of Mumbai suburban. The sampling method used in the study was random sampling. Data thus collected

3760 www.ijariie.com 965

Vol-3 Issue-1 2017 IJARIIE-ISSN(O)-2395-4396

was processed, analyzed and interpreted to draw the valid inferences. For analyzing the data and providing

the realities of the research outcomes suitable statistical techniques were employed.

4. Data Analysis

The collected data was analyzed by using simple statistical techniques the table 1 refers to age where

Patanjali products are being preferred by the age group of 36-45 followed by the age group 15-25.

Table 1:Age

Age in intervals No of respondents

15-25 17

26-35 13

36-45 18

46-55 08

56-65 04

60 total respondents

(Source questionnaire)

Fig:1-Age

The Following table indicate gender of the respondent. Among the respondents gender wise Male respondents were

38 and female were 22 (Table 2)

Table 2:Gender

Gender No of respondents

Male 38

Female 22

3760 www.ijariie.com 966

Vol-3 Issue-1 2017 IJARIIE-ISSN(O)-2395-4396

Total 60

Table 3 refers to the classification of occupation of the respondents among which 37% of the respondents are

employees followed by students who consist of 25% and 23% of the respondents were self employed

Table 3:Occupation

Occupation No of respondents

Employees 21

Business 13

Agriculture 03

students 14

House wives 09

60 Total

Table 4 refers the preferences of respondents towards Patanjali product where 8 factors were taken and based on the

frequency the ranking was allotted. Five Likert scale was used to measure the consumer response.53.3% of the

respondents says price is the factor which impact more over swadeshi is the factor which is impacting on consumer

63.3%. The following ranks are based on the frequency of the factor having impact on consumer.

Table 4: Factors impacting on consumer towards purchasing patanjali products

Factors Strongly Agree Agree Neutral Disagree Strongly Agree Total Ranking

Reasonable price 17(28.3%) 32 (53.3%) 5(8.3%) 3(5%) 3(5%) 60 (100%) 3

Good quality 23(38.3) 33(55%) 3(5%) 1(1.6%) 0((0%) 60(100%) 2

Healthy 23(38.3) 25(41.66%) 10(16.6%) 1(1.6%) 1(1.6%) 60(100%) 6

Brand 23(38.3) 20(33.3%) 15(25%) 1(1.6%) 1(1.6%) 60(100%) 8

Baba Ramdev 23(38.3) 25(41.66%) 7(11.6) 3(5%) 2(3.3%) 60(100%) 7

Swadeshi 38(63.3%) 13(21.6%) 1(1.6%) 4(6.6%) 4(6.6%) 60(100%) 1

Advertisement 10(16.6% 28(46.66%) 16(26.6) 3(5%) 3(5%) 60(100%) 4

3760 www.ijariie.com 967

Vol-3 Issue-1 2017 IJARIIE-ISSN(O)-2395-4396

Availability 26(43.3%) 26(43.3%) 2(3.3%) 3(5%)(5%) 3(5%) 60(100%) 5

Table 5 refers product preferences by the consumer, out of 60 respondents 65% of them prefer food, 61.6% prefer

cosmetics, 41.6% prefer ayurvedic products and 26.6% prefer detergents. Respondents are showing interest towards

beauty related and food related products from patanjali.

Table 5: types of products consumer purchases

Products No of respondents

Ayurvedic 25 (41.6%)

Cosmetics 37 (61.6%)

Food 39 (65%)

Detergents 16 (26.6%)

Table 6 refers to the expectation of products by the consumers in coming days from Patanjali. Respondents are very

much interested in cooking oil from patanjali 45% of them are looking, 40% of the respondents want rice and

clothes from Patanjali, 35% of respondents were preferring dry fruits from patanjali and 20% of them prefer

perfumes. Here also respondents are showing trust towards the quality of patanjali and are expecting rice and oil

which are the major components of Indian kitchens.

Table 6: Products expected by consumer in future from Patanjali

Products No of Consumers Preferred

Clothes 24 (40%)

Cooking oil 27 (45%)

Rice 24 (40%)

Dry fruits 21 (35%)

perfumes 12 (20%)

Table 7 refers to why you are expecting these products from patanjali. Majority of the respondents 65% opines that

the prices are less with Patanjali when compared to other similar products, 63.3% of the respondents perceive that

Patanjali products are healthy, 56.6% say they believe in the quality, 20% prefer as they are swadeshi and 20% have

trust in patanjali.

Table7: Reason for consumer expecting

Factors No of Respondents

Trust 12 (20%)

Quality 34 (56.6%)

3760 www.ijariie.com 968

Vol-3 Issue-1 2017 IJARIIE-ISSN(O)-2395-4396

Health 38 (63.3%)

Swadeshi 12 (20%)

price 39 (65%)

5. CONCLUSIONS

The study has revealed that the people between the age group of 15-45 are the major consumers of Patanjali

products. It was observed that between age group 0f 15-25 years are preferring cosmetics. The rest of the age groups

prefer food related products. Hence the mileage can be taken to drive the market as people are becoming more

health conscious by introducing healthy food products. It was observed in the study that noodles were not repeatedly

purchased from Patanjali. Respondents were showing less interest towards detergents but were interested towards

tooth paste. Price has become a significant factor along with ayurvedic and herbal. However Patanjali is entering

into much business it is suggested that it focus on more cosmetic, health and food related products.

6. REFERENCES

[1] Khare CP. Indian Medicinal Plants. 1 st ed. Berlin/Heidlburg: Springer verlang; 2007.

[2] Nadkarni KM, Nadkarni AK. Indian Materia Medica. 3 rd ed. Mumbai: Popular Prakashan; 2005.

[3] Kiritikar KR, Basu BD. Indian Medicinal Plants, Vol. 8. Dehradun: International Book Distributors; 1999

[4] Arya V, Kaur R. Kangrian medicinal flora. 1 st ed. Kangra, H.P.: Pranav Prakashan; 2012.

[5] Arya V, Kaur R, Kashyap CP, Sharma V. Therapeutic Potency of OcimumKilimandscharicumGuerke - A

Review. Global J Pharmacol 2011; 5(3):191-200.

[6] Gupta V.K, Arya V. A review on potential diuretics of Indian medicinal plants. J Chem Pharm Res 2011;

3(1):613-620. 7. www.jogindernagar.com [Accessed on 11th July 2012] 8.]

3760 www.ijariie.com 969

You might also like

- 3.1.REV1 WATER STORAGE TANK CLEANING - Unit Pricing - MTLB-Medco PalembangDocument1 page3.1.REV1 WATER STORAGE TANK CLEANING - Unit Pricing - MTLB-Medco PalembangEko Prasetyo Wahyudi100% (1)

- A Project Report On ArambaghDocument34 pagesA Project Report On Arambaghavik0013100% (2)

- Consumer Behavior Towards The Homemade Food MarketDocument13 pagesConsumer Behavior Towards The Homemade Food Market27. Jyothika MaryNo ratings yet

- Lesson 1 (Tle6ie Oa 1)Document45 pagesLesson 1 (Tle6ie Oa 1)Guia Marie Diaz Brigino80% (10)

- MA3 Sample Exams Plus SolutionsDocument89 pagesMA3 Sample Exams Plus Solutionsbooks_sumiNo ratings yet

- Patanjali Products and Market Efficiency: Mahesh K.M Arabhi Krishna K.ADocument6 pagesPatanjali Products and Market Efficiency: Mahesh K.M Arabhi Krishna K.AKM MaheshNo ratings yet

- A Study On Consumer Behaviour Towards Aachi Masala and Sakthi Masala in Vaniyambadi TownDocument4 pagesA Study On Consumer Behaviour Towards Aachi Masala and Sakthi Masala in Vaniyambadi TownKaleeshwari KaleeshwariNo ratings yet

- CB Cia-3Document35 pagesCB Cia-3adhishree bhattacharyaNo ratings yet

- A Study On Customer's Perception Towards Patanjali Products With Special Reference To Coimbatore CityDocument3 pagesA Study On Customer's Perception Towards Patanjali Products With Special Reference To Coimbatore CityRambabu ArumugasamyNo ratings yet

- A Study of Consumer Perception Towards Patanjali Brand With Special Reference To Mohali CityDocument7 pagesA Study of Consumer Perception Towards Patanjali Brand With Special Reference To Mohali CityRizwan AkhtarNo ratings yet

- Ijrar Issue 20542862 PDFDocument7 pagesIjrar Issue 20542862 PDFmallathiNo ratings yet

- Reviews On First PDFDocument7 pagesReviews On First PDFdeepak rdmmNo ratings yet

- Ijrar Issue 20542862 PDFDocument7 pagesIjrar Issue 20542862 PDFkavin prasathNo ratings yet

- A Study On Customer Preference Towards Chocolates in CoimbatoreDocument5 pagesA Study On Customer Preference Towards Chocolates in Coimbatorekosov28578No ratings yet

- A Study On Women Consumer Attitude of Purchasing CosmeticsDocument7 pagesA Study On Women Consumer Attitude of Purchasing CosmeticsNive Palani100% (1)

- Consumers' Brand Preference and Buying Behaviour of Cosmetic Products at Coimbatore CityDocument8 pagesConsumers' Brand Preference and Buying Behaviour of Cosmetic Products at Coimbatore CityBhanu TejaNo ratings yet

- Pengaruh Kualitas Produk Dan Citra Merek Terhadap Keputusan Pembelian Konsumen Nature Republic Di SurabayaDocument12 pagesPengaruh Kualitas Produk Dan Citra Merek Terhadap Keputusan Pembelian Konsumen Nature Republic Di SurabayabembengNo ratings yet

- KMF Nandini Group ProjectDocument19 pagesKMF Nandini Group ProjectDileepkumar K DiliNo ratings yet

- 2018-2-July-Consumer Preference On Branded Fruit Drinks-Doi 10.59582250-0499.2018.00109.XDocument4 pages2018-2-July-Consumer Preference On Branded Fruit Drinks-Doi 10.59582250-0499.2018.00109.XSakthirama VadiveluNo ratings yet

- Ijrar Issue 20543248Document4 pagesIjrar Issue 20543248Gabriel FradzNo ratings yet

- Maggi Final Paper For PublicationDocument9 pagesMaggi Final Paper For Publicationrahul mhabdeNo ratings yet

- Chapter Four & Five CharityDocument11 pagesChapter Four & Five CharityRaytone Tonnie MainaNo ratings yet

- A Study On Factors Influencing Consumers Choice of FMCG Retail Store With Special Reference To Bangalore CityDocument7 pagesA Study On Factors Influencing Consumers Choice of FMCG Retail Store With Special Reference To Bangalore CityEswar RajNo ratings yet

- A Study On Buyer Behavior of Consumer Towards Kottakkal Arya Vaidya Sala Products Ijariie7008Document6 pagesA Study On Buyer Behavior of Consumer Towards Kottakkal Arya Vaidya Sala Products Ijariie7008anaswarasureshanaswaraNo ratings yet

- A Study of Consumer Perceptions of Three Retail Chains in Bangalore - Big Bazaar, Shoppers' Stop and Marks & SpencerDocument69 pagesA Study of Consumer Perceptions of Three Retail Chains in Bangalore - Big Bazaar, Shoppers' Stop and Marks & SpencerVishal MorariNo ratings yet

- Consumers' Shopping Behavior of Convenience Goods in Organised Retail StoresDocument9 pagesConsumers' Shopping Behavior of Convenience Goods in Organised Retail StoresNagunuri SrinivasNo ratings yet

- A Study of Consumer Perception Towards Patanjali Brand With Special Reference To Mohali CityDocument6 pagesA Study of Consumer Perception Towards Patanjali Brand With Special Reference To Mohali CityAnirudh Singh ChawdaNo ratings yet

- Patanjali ProjectDocument7 pagesPatanjali ProjectNidhiNo ratings yet

- Satisfaction of Consumers by Using Online Food Services: June 2019Document11 pagesSatisfaction of Consumers by Using Online Food Services: June 2019Aashish MathpalNo ratings yet

- Vol 6 Special IssueDocument4 pagesVol 6 Special IssueSukh SabNo ratings yet

- Consumer Buying Actions Concerning Himalaya Herbal Products With Reference To Coimbatore CityDocument12 pagesConsumer Buying Actions Concerning Himalaya Herbal Products With Reference To Coimbatore CityPoornima Devi A 21PCC008No ratings yet

- A Study On Brand Awareness of Sunfeast Yippee Noodles With Special Reference To Itc LTD in Salem DistrictDocument8 pagesA Study On Brand Awareness of Sunfeast Yippee Noodles With Special Reference To Itc LTD in Salem DistrictPavithran MNo ratings yet

- Consumers' Perception Towards Patanjali Products' With SpecialDocument5 pagesConsumers' Perception Towards Patanjali Products' With SpecialAnirudh Singh ChawdaNo ratings yet

- A Study On Consumer Preference Towards Skincare With Special Reference To Himalaya Herbal Products in Nilambur at Malappuram District of KeralaDocument4 pagesA Study On Consumer Preference Towards Skincare With Special Reference To Himalaya Herbal Products in Nilambur at Malappuram District of Keralaarcherselevators50% (2)

- Minor ReportDocument21 pagesMinor ReportaasthaaquaNo ratings yet

- Market SurveyDocument22 pagesMarket SurveyAnonymous 67dCNBNo ratings yet

- PPR No. 9 LifebouyDocument3 pagesPPR No. 9 LifebouyAmi DivechaNo ratings yet

- A Study On Brand Awareness in Rural Area With Special Reference To Health Food DrinksDocument6 pagesA Study On Brand Awareness in Rural Area With Special Reference To Health Food DrinksImpact Journals100% (1)

- A Study On Brand Awareness of Sunfeast Yippee Noodles With Special Reference To Itc LTD in Salem DistrictDocument8 pagesA Study On Brand Awareness of Sunfeast Yippee Noodles With Special Reference To Itc LTD in Salem DistrictTryambak GourNo ratings yet

- BRM ProjectDocument35 pagesBRM Projectshubhangi rautNo ratings yet

- Khadi ProductsDocument7 pagesKhadi Productsaabu28807No ratings yet

- Buying Decision Process of Fast Moving C PDFDocument17 pagesBuying Decision Process of Fast Moving C PDFSuraj GNo ratings yet

- Consumers Satisfaction Towards Online Food Delivery App Swiggy: The Study Special Reference With South ChennaiDocument10 pagesConsumers Satisfaction Towards Online Food Delivery App Swiggy: The Study Special Reference With South Chennainakulm416No ratings yet

- 123am 52.epra Journals-5709Document4 pages123am 52.epra Journals-5709priya saranNo ratings yet

- Consumer Awareness - Organic ProductsDocument31 pagesConsumer Awareness - Organic ProductsoceanicpollachiNo ratings yet

- A Study of Mothers' Satisfaction in Baby Care Products - Nagapattinam District PDFDocument4 pagesA Study of Mothers' Satisfaction in Baby Care Products - Nagapattinam District PDFInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- A Study of FMCG ProductsDocument11 pagesA Study of FMCG ProductsSAKTHIVEL KNo ratings yet

- A Study On Sales Promotion and Consumer Behaviour of Sai Lakshmi Milk Products Krishnagiri, Tamil NaduDocument4 pagesA Study On Sales Promotion and Consumer Behaviour of Sai Lakshmi Milk Products Krishnagiri, Tamil NaduSuryaprakash SuryaNo ratings yet

- Consumers' Perception On Fairness Creams in India Saumendra DasDocument12 pagesConsumers' Perception On Fairness Creams in India Saumendra DasSimran GuptaNo ratings yet

- A Study Onconsumer Behavior Towards Packaged Food & Beverages in The State of AssamDocument6 pagesA Study Onconsumer Behavior Towards Packaged Food & Beverages in The State of Assamneha agarwalNo ratings yet

- PDF Vadilal IcecreamDocument4 pagesPDF Vadilal Icecreamkishansinh chavdaNo ratings yet

- Chapter IIDocument30 pagesChapter IIMIMINo ratings yet

- A Study On Consumer Awareness and Preference Towards Ayurvedic Products in Coimbatore CityDocument6 pagesA Study On Consumer Awareness and Preference Towards Ayurvedic Products in Coimbatore CityGowtham RaajNo ratings yet

- Sakthi Masala - Customer Satisfaction PDFDocument4 pagesSakthi Masala - Customer Satisfaction PDFsujathalavi50% (2)

- IJRPR8512Document5 pagesIJRPR8512itssurajzz.06No ratings yet

- IJRPR18200Document5 pagesIJRPR18200Tejas KumbharNo ratings yet

- Sangeetha Achyuth-18MCO044-Merged PublicationDocument6 pagesSangeetha Achyuth-18MCO044-Merged PublicationNeenaNo ratings yet

- 4 Environmental AnalysisDocument6 pages4 Environmental AnalysiszaidkhanNo ratings yet

- JETIR2206763Document4 pagesJETIR2206763Ayush RajputNo ratings yet

- Quality Assurance: The Role of the Quality Assurance (QA) Professional in The Manufacture of Medical ProductsFrom EverandQuality Assurance: The Role of the Quality Assurance (QA) Professional in The Manufacture of Medical ProductsNo ratings yet

- A to Z of Pharmaceutical Marketing Volume 2: Worlds First and Only EncyclopediaFrom EverandA to Z of Pharmaceutical Marketing Volume 2: Worlds First and Only EncyclopediaNo ratings yet

- Final Project ReportDocument88 pagesFinal Project Reportsantu_khinchiNo ratings yet

- A Dent in Walmart Public ImageDocument26 pagesA Dent in Walmart Public Imagemeetkamal3No ratings yet

- Policies and Market Failures (PAM's Bottom Row) : Scott Pearson Stanford UniversityDocument16 pagesPolicies and Market Failures (PAM's Bottom Row) : Scott Pearson Stanford Universitysamantha glenn requilloNo ratings yet

- Differential Cost AnalysisDocument1 pageDifferential Cost AnalysisNinaNo ratings yet

- Money AU 09.2022Document92 pagesMoney AU 09.2022Aman SharmaNo ratings yet

- Humble Oil & Refining Co. V Westside Investment CorpDocument2 pagesHumble Oil & Refining Co. V Westside Investment Corpcrlstinaaa100% (1)

- Fundamental Analysis of Indian Automobile IndustryDocument17 pagesFundamental Analysis of Indian Automobile IndustryAnonymous tQKFAZvsvLNo ratings yet

- One Day Revision Notes CA InterDocument15 pagesOne Day Revision Notes CA InterAmitfusion R13No ratings yet

- Iip Report of Pranjal YadavDocument54 pagesIip Report of Pranjal YadavHarsh parasher (PGDM 17-19)No ratings yet

- Leumi Wire Form PDFDocument3 pagesLeumi Wire Form PDFGregory GilbertNo ratings yet

- Feasibility Study PRDocument33 pagesFeasibility Study PRprincess1129No ratings yet

- FM11 CH 15 Mini-Case Old12 Corp ValuationDocument6 pagesFM11 CH 15 Mini-Case Old12 Corp ValuationArafet NacefNo ratings yet

- FTX3044F Tutorial 1Document2 pagesFTX3044F Tutorial 1vrshaf001100% (1)

- Automotive HistoryDocument6 pagesAutomotive HistoryRamesh GowdaNo ratings yet

- F5 Practice Test 2 - Costing SystemsDocument4 pagesF5 Practice Test 2 - Costing SystemsBadhanNo ratings yet

- Ratio Proportion and Percentage - Lesson - 3Document7 pagesRatio Proportion and Percentage - Lesson - 3samsonNo ratings yet

- Eleanor Marx 1883Document11 pagesEleanor Marx 1883reader_jimNo ratings yet

- Bond Yield To Maturity (YTM) FormulasDocument2 pagesBond Yield To Maturity (YTM) FormulasIzzy BNo ratings yet

- Bus 5111 Financial Management Written Assignment Unit 7Document5 pagesBus 5111 Financial Management Written Assignment Unit 7Andika GintingNo ratings yet

- CH 06 - Macro Part 3Document18 pagesCH 06 - Macro Part 3Samar GrewalNo ratings yet

- Scert: 12 Economy Chapter-5Document23 pagesScert: 12 Economy Chapter-5tamilrockers downloadNo ratings yet

- Budgeting and Budgetary ControlDocument21 pagesBudgeting and Budgetary ControlShahid AmanNo ratings yet

- You Ur Flig GHT Co Onfirm Matio N: Hyij JJNDocument2 pagesYou Ur Flig GHT Co Onfirm Matio N: Hyij JJNBenny NahampunNo ratings yet

- Cap 10 Micro Teoría MicroeconómicaDocument39 pagesCap 10 Micro Teoría MicroeconómicaAbimNo ratings yet

- Housing BriefDocument6 pagesHousing BriefManish MishraNo ratings yet

- Retail BusinessDocument31 pagesRetail BusinessAshish Kumar PaniNo ratings yet

- Ma 1Document17 pagesMa 1Inkosi MacPherson Nchessie100% (2)