Professional Documents

Culture Documents

2010-09-21 - Fed Side by Side Statements

2010-09-21 - Fed Side by Side Statements

Uploaded by

glerner133926Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2010-09-21 - Fed Side by Side Statements

2010-09-21 - Fed Side by Side Statements

Uploaded by

glerner133926Copyright:

Available Formats

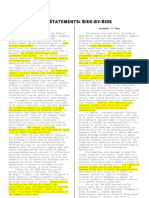

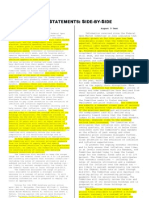

FOMC STATEMENTS: SIDE-BY-SIDE

September 21 Text August 10 Text

Information received since the Federal Information received since the Federal

Open Market Committee met in August indicates Open Market Committee met in June indicates

that the pace of recovery in output and that the pace of recovery in output and

employment has slowed in recent months. employment has slowed in recent months.

Household spending is increasing gradually, Household spending is increasing gradually,

but remains constrained by high unemployment, but remains constrained by high unemployment,

modest income growth, lower housing wealth, modest income growth, lower housing wealth,

and tight credit. Business spending on and tight credit. Business spending on

equipment and software is rising, though less equipment and software is rising; however,

rapidly than earlier in the year, while investment in nonresidential structures

investment in nonresidential structures continues to be weak and employers remain

continues to be weak. Employers remain reluctant to add to payrolls. Housing starts

reluctant to add to payrolls. Housing starts remain at a depressed level. Bank lending has

are at a depressed level. Bank lending has continued to contract. Nonetheless, the

continued to contract, but at a reduced rate Committee anticipates a gradual return to

in recent months. The Committee anticipates a higher levels of resource utilization in a

gradual return to higher levels of resource context of price stability, although the pace

utilization in a context of price stability, of economic recovery is likely to be more

although the pace of economic recovery is modest in the near term than had been

likely to be modest in the near term. anticipated.

Measures of underlying inflation are Measures of underlying inflation have

currently at levels somewhat below those the trended lower in recent quarters and, with

Committee judges most consistent, over the substantial resource slack continuing to

longer run, with its mandate to promote restrain cost pressures and longer-term

maximum employment and price stability. With inflation expectations stable, inflation is

substantial resource slack continuing to likely to be subdued for some time.

restrain cost pressures and longer-term

inflation expectations stable, inflation is The Committee will maintain the target

likely to remain subdued for some time before range for the federal funds rate at 0 to 1/4

rising to levels the Committee considers percent and continues to anticipate that

consistent with its mandate. economic conditions, including low rates of

resource utilization, subdued inflation

The Committee will maintain the target trends, and stable inflation expectations, are

range for the federal funds rate at 0 to 1/4 likely to warrant exceptionally low levels of

percent and continues to anticipate that the federal funds rate for an extended period.

economic conditions, including low rates of

resource utilization, subdued inflation To help support the economic recovery in

trends, and stable inflation expectations, are a context of price stability, the Committee

likely to warrant exceptionally low levels for will keep constant the Federal Reserve's

the federal funds rate for an extended period. holdings of securities at the current level by

The Committee also will maintain its existing reinvesting principal payments from agency

policy of reinvesting principal payments from debt and agency mortgage-backed securities in

its securities holdings. longer-term Treasury securities. (1) The

Committee will continue to roll over the

The Committee will continue to monitor Federal Reserve's holdings of Treasury

the economic outlook and financial securities as they mature.

developments and is prepared to provide

additional accommodation if needed to support The Committee will continue to monitor

the economic recovery and to return inflation, the economic outlook and financial

over time, to levels consistent with its developments and will employ its policy tools

mandate. as necessary to promote economic recovery and

price stability.

Voting for the FOMC monetary policy

action were: Ben S. Bernanke, Chairman; Voting for the FOMC monetary policy

William C. Dudley, Vice Chairman; James action were: Ben S. Bernanke, Chairman;

Bullard; Elizabeth A. Duke; Sandra Pianalto; William C. Dudley, Vice Chairman; James

Eric S. Rosengren; Daniel K. Tarullo; and Bullard; Elizabeth A. Duke; Donald L. Kohn;

Kevin M. Warsh. Sandra Pianalto; Eric S. Rosengren; Daniel K.

Tarul1o; and Kevin M. Warsh.

Voting against the policy was Thomas M. Voting against the policy action was

Hoenig, who judged that the economy continues Thomas M. Hoenig, who judged that the economy

to recover at a moderate pace. Accordingly, he is recovering modestly, as projected.

believed that continuing to express the Accordingly, he believed that continuing to

expectation of exceptionally low levels of the express the expectation of exceptionally low

federal funds rate for an extended period was levels of the federal funds rate for an

no longer warranted and will lead to future extended period was no longer warranted and

imbalances that undermine stable long-run limits the Committee's ability to adjust

growth. In addition, given economic and policy when needed. In addition, given

financial conditions, Mr. Hoenig did not economic and financial conditions, Mr. Hoenig

believe that continuing to reinvest principal did not believe that keeping constant the size

payments from its securities holdings was of the Federal Reserve's holdings of longer-

required to support the Committee's policy term securities at their current level was

objectives. required to support a return to the

Committee's policy objectives.

(1) The Open Market Desk will issue a

technical note shortly after the statement

providing operational details on how it will

carry out these transactions.

You might also like

- Indonesia Market Outlook 2024 by NielsenIQ & MECDocument37 pagesIndonesia Market Outlook 2024 by NielsenIQ & MECdiancahayanii100% (1)

- Manual RZ5Document294 pagesManual RZ5acandrei67% (3)

- 9 Theories - Research ActivityDocument143 pages9 Theories - Research Activityapi-2978344330% (1)

- Fed Statements Side by SideDocument1 pageFed Statements Side by SideTaylor CottamNo ratings yet

- FOMC0810Document2 pagesFOMC0810arborjimbNo ratings yet

- SidebysidefedDocument1 pageSidebysidefedandrewbloggerNo ratings yet

- FOMCstatementDocument2 pagesFOMCstatementCBNo ratings yet

- Fomc S: S - S: Tatements IDE BY IDEDocument3 pagesFomc S: S - S: Tatements IDE BY IDEarborjimbNo ratings yet

- Fed Statement June 2009Document2 pagesFed Statement June 2009andrewbloggerNo ratings yet

- Fomc S: S - S: Tatements IDE BY IDEDocument3 pagesFomc S: S - S: Tatements IDE BY IDEarborjimbNo ratings yet

- Fed Side by Side 20120125Document3 pagesFed Side by Side 20120125andrewbloggerNo ratings yet

- Fomc S: S - S: Tatements IDE BY IDEDocument3 pagesFomc S: S - S: Tatements IDE BY IDEandrewbloggerNo ratings yet

- FOMC Rate Decision 04.25.12Document1 pageFOMC Rate Decision 04.25.12Pensford FinancialNo ratings yet

- Fed SideDocument1 pageFed Sideannawitkowski88No ratings yet

- Fomc Statements - Side-By-sideDocument2 pagesFomc Statements - Side-By-sideurbanovNo ratings yet

- December 17, 2014 Compared With October 29, 2014 Jeremie Cohen-SettonDocument3 pagesDecember 17, 2014 Compared With October 29, 2014 Jeremie Cohen-Settonapi-273992067No ratings yet

- January - March FOMC Statement ComparisonDocument1 pageJanuary - March FOMC Statement Comparisonshawn2207No ratings yet

- Fed TalkDocument2 pagesFed TalkTelegraphUKNo ratings yet

- FOMC Redline MarchDocument2 pagesFOMC Redline MarchZerohedgeNo ratings yet

- FOMC RedLineDocument2 pagesFOMC RedLineEduardo VinanteNo ratings yet

- Fed 09212011Document2 pagesFed 09212011andrewbloggerNo ratings yet

- FOMC Side by Side 11022011Document2 pagesFOMC Side by Side 11022011andrewbloggerNo ratings yet

- September FOMC RedlineDocument2 pagesSeptember FOMC RedlineZerohedgeNo ratings yet

- Oct FOMC RedlineDocument2 pagesOct FOMC RedlineZerohedgeNo ratings yet

- Fomc StatmentDocument1 pageFomc Statmentapi-280585983No ratings yet

- FOMC Word For Word Changes. 05.01.13Document2 pagesFOMC Word For Word Changes. 05.01.13Pensford FinancialNo ratings yet

- Sidebyside 08092011Document1 pageSidebyside 08092011andrewbloggerNo ratings yet

- Press ReleaseDocument2 pagesPress Releaseapi-26018528No ratings yet

- FedDocument4 pagesFedandre.torresNo ratings yet

- Press Release: For Release at 2:00 P.M. EDTDocument2 pagesPress Release: For Release at 2:00 P.M. EDTTREND_7425No ratings yet

- FOMC Word For Word Changes 03.20.13Document2 pagesFOMC Word For Word Changes 03.20.13Pensford FinancialNo ratings yet

- Federal Reserve Issues FOMC Statement: ShareDocument2 pagesFederal Reserve Issues FOMC Statement: ShareTREND_7425No ratings yet

- Monetary 20240501 A 1Document4 pagesMonetary 20240501 A 1gustavo.kahilNo ratings yet

- Fomc Septiembre 2015Document2 pagesFomc Septiembre 2015cocoNo ratings yet

- Transcript of Chairman Bernanke's Press Conference April 25, 2012Document23 pagesTranscript of Chairman Bernanke's Press Conference April 25, 2012CoolidgeLowNo ratings yet

- Fomc Pres Conf 20141217Document23 pagesFomc Pres Conf 20141217JoseLastNo ratings yet

- Monetary 20230614 A 1Document4 pagesMonetary 20230614 A 1Jhony SmithYTNo ratings yet

- Fomc Pres Conf 20240501Document4 pagesFomc Pres Conf 20240501gustavo.kahilNo ratings yet

- FOMCpresconf 20210922Document26 pagesFOMCpresconf 20210922marcoNo ratings yet

- ChairDocument4 pagesChairandre.torresNo ratings yet

- Yellen TestimonyDocument7 pagesYellen TestimonyZerohedgeNo ratings yet

- Fed Meeting and USD Purchasing Power BlogDocument1 pageFed Meeting and USD Purchasing Power BloghweinermanNo ratings yet

- Yellen HHDocument7 pagesYellen HHZerohedgeNo ratings yet

- Unconventional Wisdom. Original Thinking.: Bulletin BoardDocument12 pagesUnconventional Wisdom. Original Thinking.: Bulletin BoardCurve123No ratings yet

- SystemDocument8 pagesSystempathanfor786No ratings yet

- Why Monetary Policy MattersDocument2 pagesWhy Monetary Policy MattersKatieYoungNo ratings yet

- 2018.01.31 FED Press ReleaseDocument2 pages2018.01.31 FED Press ReleaseTREND_7425No ratings yet

- Peso Balanced Fund: Investment ObjectiveDocument10 pagesPeso Balanced Fund: Investment ObjectiveErwin Dela CruzNo ratings yet

- US Fed FOMC Press Conference 18 September 2013 No TaperDocument26 pagesUS Fed FOMC Press Conference 18 September 2013 No TaperJhunjhunwalas Digital Finance & Business Info LibraryNo ratings yet

- Federal Reserve StatementDocument4 pagesFederal Reserve StatementTim MooreNo ratings yet

- Case 8:: Will Fed'S "Easy Money" Push Up Prices?Document19 pagesCase 8:: Will Fed'S "Easy Money" Push Up Prices?Keara MojicaNo ratings yet

- Fed Doves No Longer Rule The Roost: Economic and Financial AnalysisDocument5 pagesFed Doves No Longer Rule The Roost: Economic and Financial AnalysisOwm Close CorporationNo ratings yet

- Westpac - Fed Doves Might Have Last Word (August 2013)Document4 pagesWestpac - Fed Doves Might Have Last Word (August 2013)leithvanonselenNo ratings yet

- Ife - UsaDocument13 pagesIfe - Usagiovanni lazzeriNo ratings yet

- Interpret The Tone-FOMC Statements Answer Key: Advance Your CareerDocument3 pagesInterpret The Tone-FOMC Statements Answer Key: Advance Your CareerTarun TiwariNo ratings yet

- Q F F Q 2: 2014: Tanbic Oney Arket UNDDocument1 pageQ F F Q 2: 2014: Tanbic Oney Arket UNDOhiwei OsawemenNo ratings yet

- Monetary 20230201 A 1Document4 pagesMonetary 20230201 A 1tamhid nahianNo ratings yet

- Conduct of Monetary Policy: Tools, Goals, Strategy, and TacticsDocument30 pagesConduct of Monetary Policy: Tools, Goals, Strategy, and TacticsNaheed SakhiNo ratings yet

- The Feds New Monetary Policy Tools - SEDocument11 pagesThe Feds New Monetary Policy Tools - SEAndré M. TrottaNo ratings yet

- Felicia Irene - Week 5Document27 pagesFelicia Irene - Week 5felicia ireneNo ratings yet

- Monetary 20230726 A 1Document4 pagesMonetary 20230726 A 1Verónica SilveriNo ratings yet

- The Escape from Balance Sheet Recession and the QE Trap: A Hazardous Road for the World EconomyFrom EverandThe Escape from Balance Sheet Recession and the QE Trap: A Hazardous Road for the World EconomyRating: 5 out of 5 stars5/5 (1)

- Rydex Report For 5.3.11Document11 pagesRydex Report For 5.3.11glerner133926No ratings yet

- Morning News Notes:2011-07-21Document1 pageMorning News Notes:2011-07-21glerner133926No ratings yet

- Rydex Report For 4.5.11Document9 pagesRydex Report For 4.5.11glerner133926No ratings yet

- Rydex Report For 4.5.11Document9 pagesRydex Report For 4.5.11glerner133926No ratings yet

- Morning News Notes:2011-07-13Document1 pageMorning News Notes:2011-07-13glerner133926No ratings yet

- Morning News Notes: 2011-07-11Document1 pageMorning News Notes: 2011-07-11glerner133926No ratings yet

- Morning News Notes:2011-06-15Document1 pageMorning News Notes:2011-06-15glerner133926No ratings yet

- Morning News Notes:2011-07-19Document1 pageMorning News Notes:2011-07-19glerner133926No ratings yet

- Morning News Notes: 2011-06-16Document2 pagesMorning News Notes: 2011-06-16glerner133926No ratings yet

- Morning News Notes:2011-06-29Document1 pageMorning News Notes:2011-06-29glerner133926No ratings yet

- Morning News Notes:2011-06-14Document1 pageMorning News Notes:2011-06-14glerner133926No ratings yet

- Morning News Notes: 2011-03-31Document2 pagesMorning News Notes: 2011-03-31glerner133926No ratings yet

- Morning News Notes: 2011-04-21Document2 pagesMorning News Notes: 2011-04-21glerner133926No ratings yet

- Morning News Notes: 2011-06-09Document1 pageMorning News Notes: 2011-06-09glerner133926No ratings yet

- Morning News Notes: 2011-05-06Document1 pageMorning News Notes: 2011-05-06glerner133926No ratings yet

- Morning News Notes: 2011-06-13Document1 pageMorning News Notes: 2011-06-13glerner133926No ratings yet

- Web Layout v1 Slide 1-2Document1 pageWeb Layout v1 Slide 1-2glerner133926No ratings yet

- Morning News Notes: 2011-04-18Document1 pageMorning News Notes: 2011-04-18glerner133926No ratings yet

- Morning News Notes: 2011-05-04Document1 pageMorning News Notes: 2011-05-04glerner133926No ratings yet

- Morning News Notes: 2011-04-13Document1 pageMorning News Notes: 2011-04-13glerner133926No ratings yet

- London TelegraphDocument1 pageLondon Telegraphglerner133926No ratings yet

- Morning News Notes: 2011-03-29Document1 pageMorning News Notes: 2011-03-29glerner133926No ratings yet

- Achievements:: 'The Spirit of Wipro' Is Best Represented Through The Following Three StatementsDocument3 pagesAchievements:: 'The Spirit of Wipro' Is Best Represented Through The Following Three StatementsNitesh R ShahaniNo ratings yet

- Early AdulthoodDocument1 pageEarly AdulthoodCherry BobierNo ratings yet

- Classification of FolkdanceDocument2 pagesClassification of FolkdanceMica CasimeroNo ratings yet

- Fundamentals of Buddhist Psychotherapy (A Critical....Document65 pagesFundamentals of Buddhist Psychotherapy (A Critical....Rev NandacaraNo ratings yet

- Affirmations To Balance Meridians and EmotionsDocument2 pagesAffirmations To Balance Meridians and EmotionsMario L M Ramos100% (1)

- Cutting Opera Tion Takes Onl Y 24HRS: User ListDocument2 pagesCutting Opera Tion Takes Onl Y 24HRS: User ListNurSarahNo ratings yet

- 2011 Equipment Flyer 05272011updatedDocument24 pages2011 Equipment Flyer 05272011updatedChecho BuenaventuraNo ratings yet

- Link of Support Material Link 2020-21CLASSES 9 1 - 11 12Document2 pagesLink of Support Material Link 2020-21CLASSES 9 1 - 11 12naman mahawerNo ratings yet

- Activitiesclasswork Unit 2 Lesson 3 Great Civilizations Emerge Maya Religion Ans Social HierarchyDocument25 pagesActivitiesclasswork Unit 2 Lesson 3 Great Civilizations Emerge Maya Religion Ans Social Hierarchyapi-240724606No ratings yet

- s19 Secundaria 3 Recurso Ingles A2 Transcripciondeaudio PDFDocument2 pagess19 Secundaria 3 Recurso Ingles A2 Transcripciondeaudio PDFCristian Valencia Segundo0% (1)

- Basic ECG Interpretation Practice Test: DIRECTIONS: The Following Test Consists of 20 QuestionsDocument10 pagesBasic ECG Interpretation Practice Test: DIRECTIONS: The Following Test Consists of 20 Questionsmihaela_bondocNo ratings yet

- Personal Statement EdmundoDocument4 pagesPersonal Statement EdmundoAnca UngureanuNo ratings yet

- 21 Rev Der PR51Document7 pages21 Rev Der PR51takoNo ratings yet

- Roplasto English Presentation of The 7001 5 Chambers ProfileDocument4 pagesRoplasto English Presentation of The 7001 5 Chambers ProfileHIDROPLASTONo ratings yet

- A Film Review General Luna and Macario SDocument5 pagesA Film Review General Luna and Macario SjasminjajarefeNo ratings yet

- Kusama Artist Presentation 1Document9 pagesKusama Artist Presentation 1api-592346261No ratings yet

- Skills Framework For Design Technical Skills and Competencies (TSC) Reference DocumentDocument2 pagesSkills Framework For Design Technical Skills and Competencies (TSC) Reference DocumentdianNo ratings yet

- Teutonic Mythology v1 1000023511 PDFDocument452 pagesTeutonic Mythology v1 1000023511 PDFOlga SultanNo ratings yet

- Zeffere Ketema Paym FinalDocument186 pagesZeffere Ketema Paym FinalEphremHailuNo ratings yet

- TSB 2000010 Technical Overview of The STERILIZABLEBAGDocument4 pagesTSB 2000010 Technical Overview of The STERILIZABLEBAGdatinjacabNo ratings yet

- Comentary On Nostra AetateDocument11 pagesComentary On Nostra AetateJude nnawuiheNo ratings yet

- Mca MaterialDocument30 pagesMca MaterialsharmilaNo ratings yet

- Proc Q and A - 2022updated V1Document47 pagesProc Q and A - 2022updated V1dreamsky702243No ratings yet

- Ramanuja Srivaishnavism VisistaadvaitaDocument32 pagesRamanuja Srivaishnavism VisistaadvaitarajNo ratings yet

- Depression in Neurodegenerative Diseases - Common Mechanisms and Current Treatment OptionsDocument103 pagesDepression in Neurodegenerative Diseases - Common Mechanisms and Current Treatment OptionsAna Paula LopesNo ratings yet

- MTICDocument5 pagesMTICSonali TanejaNo ratings yet

- Die and Mould 2016 Exhibitors ListDocument19 pagesDie and Mould 2016 Exhibitors Listsentamil vigneshwaranNo ratings yet