Professional Documents

Culture Documents

HSBC Credit Card Cashback

HSBC Credit Card Cashback

Uploaded by

Naveen KumarCopyright:

Available Formats

You might also like

- UI 2 - 8 Authorisation Pay Benefits Into Banking AccountDocument1 pageUI 2 - 8 Authorisation Pay Benefits Into Banking AccountVernonNo ratings yet

- Cardlytics Loyalty Whitepaper FinalDocument13 pagesCardlytics Loyalty Whitepaper FinalRachit ParekhNo ratings yet

- AmarBill - Online Flexiload Bangladesh - Grameenphone, Banglalink, Airtel, Robi, Citycell Mobile RechargeDocument6 pagesAmarBill - Online Flexiload Bangladesh - Grameenphone, Banglalink, Airtel, Robi, Citycell Mobile RechargeJm RedwanNo ratings yet

- Electronic Bank StatementDocument6 pagesElectronic Bank StatementMukesh Sharma100% (1)

- Macroeconomics SolutionsDocument4 pagesMacroeconomics SolutionsralsNo ratings yet

- Functions Sales ManagementDocument31 pagesFunctions Sales ManagementSeth ValdezNo ratings yet

- General Mills Inc-Yoplait BDocument2 pagesGeneral Mills Inc-Yoplait BSabyasachi SahuNo ratings yet

- $2,731,323 - Experian Credit ReportDocument1 page$2,731,323 - Experian Credit Reportlarry-612445No ratings yet

- Opening My Account: Statement of AcceptanceDocument21 pagesOpening My Account: Statement of Acceptanceasdf asdaNo ratings yet

- An Automated Ordering SystemDocument1 pageAn Automated Ordering SystemPratyoosh DwivediNo ratings yet

- ATM Card Application Holder HDFC BankDocument1 pageATM Card Application Holder HDFC BankSagar PithadiyaNo ratings yet

- How To Make Money With AliExpress Affiliate Program PDFDocument23 pagesHow To Make Money With AliExpress Affiliate Program PDFrudywahNo ratings yet

- EpayitonlineDocument4 pagesEpayitonlineAleem Ahmad RindekharabatNo ratings yet

- Import and Export Bank AccountsDocument6 pagesImport and Export Bank AccountsYazeed_GhNo ratings yet

- Sap Fico Materials Accounts PayableDocument10 pagesSap Fico Materials Accounts PayableGUDALANo ratings yet

- Oasis Bank Account Details.Document1 pageOasis Bank Account Details.NandhaNo ratings yet

- Contract Account No: Account Name Service Address 46 13Th ST Villamor Air Base Subd Airmens Vill PasayDocument1 pageContract Account No: Account Name Service Address 46 13Th ST Villamor Air Base Subd Airmens Vill PasayAnnamae Therese MartinezNo ratings yet

- Invoices Queries InvoiceDocument7 pagesInvoices Queries InvoicePiyush GadeNo ratings yet

- Open Zero Balance Savings Account Online - Kotak 811Document124 pagesOpen Zero Balance Savings Account Online - Kotak 811ANUJ SINGH100% (1)

- Process For Letter of CreditDocument2 pagesProcess For Letter of Creditraju_srinu06No ratings yet

- Unit 2 - Sbaa7001 Banking Products and ServicesDocument38 pagesUnit 2 - Sbaa7001 Banking Products and ServicesGracyNo ratings yet

- 2020 6 StatementDocument7 pages2020 6 StatementChad Schell100% (1)

- Diamond AccountDocument2 pagesDiamond AccountJagadeesh YathirajulaNo ratings yet

- SMS Internet Banking FormDocument4 pagesSMS Internet Banking FormSayed InsanNo ratings yet

- Lori Hutchison May 30 2020 EXP PDFDocument15 pagesLori Hutchison May 30 2020 EXP PDFLarryNo ratings yet

- Credit Card Enrollment FormDocument2 pagesCredit Card Enrollment FormcenonNo ratings yet

- AmazonPayBalance TermsAndConditions 2020Document2 pagesAmazonPayBalance TermsAndConditions 2020Manohar ManuNo ratings yet

- Account PayableDocument24 pagesAccount Payableaniruddha_2012No ratings yet

- Make Global Settings For Electronic Bank StatementDocument6 pagesMake Global Settings For Electronic Bank StatementGraciano JacobeNo ratings yet

- What Is A Bank Identification Number (BIN), and HDocument1 pageWhat Is A Bank Identification Number (BIN), and HYogeshwaran.sNo ratings yet

- Tenant Access Urls: in ProcessDocument29 pagesTenant Access Urls: in ProcessNimmi KakkanattNo ratings yet

- IDS Fortune Next ExpressDocument8 pagesIDS Fortune Next ExpressseenubhaiNo ratings yet

- Website Payment Technology GuideDocument18 pagesWebsite Payment Technology GuideYashNo ratings yet

- XXXXXXXXX430XXX0923 500004 20042015Document3 pagesXXXXXXXXX430XXX0923 500004 20042015Subrahmanyam SudiNo ratings yet

- PayWay API Developers GuideDocument48 pagesPayWay API Developers GuideSimbwa PhillipNo ratings yet

- MoneyLive Ebook 2022Document14 pagesMoneyLive Ebook 2022Balamurugan VedhamoorthiNo ratings yet

- Procure To Pay Cycle Accounting EntriesDocument7 pagesProcure To Pay Cycle Accounting Entriesrajeev200362No ratings yet

- April 23, 2021 Strathmore TimesDocument12 pagesApril 23, 2021 Strathmore TimesStrathmore TimesNo ratings yet

- Simple FinanceDocument84 pagesSimple Financepriya kumarNo ratings yet

- S 10 - E PaymentsDocument37 pagesS 10 - E PaymentsAninda DuttaNo ratings yet

- AR AP ConfigDocument147 pagesAR AP Configchirag jainNo ratings yet

- ICMarketsGlobal Funding InstructionsDocument1 pageICMarketsGlobal Funding InstructionsAina RasalemaNo ratings yet

- How To Register As A Telemarketing CompanyDocument3 pagesHow To Register As A Telemarketing CompanyArmaan Chhaproo100% (2)

- Cardholder Agreement Ge Money WalmartDocument7 pagesCardholder Agreement Ge Money WalmartAngie MottoNo ratings yet

- MOU 3-15k Amazon and Flipkart 2 2Document4 pagesMOU 3-15k Amazon and Flipkart 2 2Raghu NandanNo ratings yet

- Super Merchant Current Account New Account & Migration ProcessDocument2 pagesSuper Merchant Current Account New Account & Migration ProcessDileep KumarNo ratings yet

- SAP Credit Card Configuration: Set Up Credit Control AreasDocument5 pagesSAP Credit Card Configuration: Set Up Credit Control Areasdd_reddy5192No ratings yet

- Credit Card Bank Alfalah (Imran Dilbar Gill)Document20 pagesCredit Card Bank Alfalah (Imran Dilbar Gill)Tiffany JohnsonNo ratings yet

- Damida OID-00269713Document3 pagesDamida OID-00269713AIMIDA WOOONo ratings yet

- Outward RemittanceDocument49 pagesOutward Remittancemanishjethva2009No ratings yet

- Stripe 2022 UpdateDocument10 pagesStripe 2022 UpdateNesNosssNo ratings yet

- Accounts Payables 3 DocumentsDocument4 pagesAccounts Payables 3 DocumentsHerald GangcuangcoNo ratings yet

- Sample Reports For OfficeDocument9 pagesSample Reports For OfficeAdnan DiampuanNo ratings yet

- Metrobank Money Market FundDocument3 pagesMetrobank Money Market FundExequielCamisaCrusperoNo ratings yet

- Oracle WLS On Amazon EC2Document12 pagesOracle WLS On Amazon EC2Ajit DonthiNo ratings yet

- Personal Credit Card Ts and CsDocument5 pagesPersonal Credit Card Ts and CsDarren HulmeNo ratings yet

- Saving AccountDocument29 pagesSaving AccountramshaNo ratings yet

- JDocument109 pagesJMiguel ChavezNo ratings yet

- Check Stub Template-1-2Document118 pagesCheck Stub Template-1-2Liza GeorgeNo ratings yet

- PNC Bank - Virtual Wallet Student FeesDocument5 pagesPNC Bank - Virtual Wallet Student FeesBobNo ratings yet

- Study of Cash Management at Standard Chartered BankDocument115 pagesStudy of Cash Management at Standard Chartered BankVishnu Prasad100% (2)

- List of All Fees Associated With Your Paypal Prepaid MastercardDocument1 pageList of All Fees Associated With Your Paypal Prepaid Mastercardmira bucketNo ratings yet

- HSBC Credit Card Cashback PDFDocument1 pageHSBC Credit Card Cashback PDFSampath ReddyNo ratings yet

- Vending Machine: Supreeth SK Balaji ADocument6 pagesVending Machine: Supreeth SK Balaji AAshik GRNo ratings yet

- Bangkok Condominium Market Report Q2 2010Document15 pagesBangkok Condominium Market Report Q2 2010Colliers International ThailandNo ratings yet

- 2736 Conversation Corner at The MarketDocument2 pages2736 Conversation Corner at The MarketErnelda VigoNo ratings yet

- MBA 801 Production and Operations ManagementDocument308 pagesMBA 801 Production and Operations ManagementZaid Chelsea0% (1)

- Case StudyDocument3 pagesCase StudyEnna rajpoot100% (1)

- Sport Obermeyer, LTD.: Case SummaryDocument3 pagesSport Obermeyer, LTD.: Case SummaryMinahil JavedNo ratings yet

- Benetton Logistics AssignmentDocument8 pagesBenetton Logistics AssignmentBibhuti PrasadNo ratings yet

- Price and Value Communication: Strategies To Influence Willingness-To-Pay Session 4 ElkanaezekielDocument29 pagesPrice and Value Communication: Strategies To Influence Willingness-To-Pay Session 4 ElkanaezekielIMTG Hostel CommitteeNo ratings yet

- Storage & Warehousing: The Role of Warehousing in Supply ChainDocument31 pagesStorage & Warehousing: The Role of Warehousing in Supply ChainAnonymous hNDqdzC6No ratings yet

- Agric Value Chain ProposalDocument14 pagesAgric Value Chain ProposalChike ChukudebeluNo ratings yet

- Reliance Fresh Vs More FinalDocument4 pagesReliance Fresh Vs More FinalVijay SharmaNo ratings yet

- Business Model TemplateDocument5 pagesBusiness Model TemplatethecluelessNo ratings yet

- Introduction To E-CommerceDocument4 pagesIntroduction To E-CommerceHO SAI ENGNo ratings yet

- Company ProfileDocument2 pagesCompany ProfileAnshu EnterprisesNo ratings yet

- Sushil ReportDocument110 pagesSushil ReportRaj VishawkarmaNo ratings yet

- Bote BoteDocument3 pagesBote BoteEarnswell Pacina TanNo ratings yet

- Consumer Awareness Through StatisticsDocument7 pagesConsumer Awareness Through StatisticssamairaNo ratings yet

- Slogans in AdvertisingDocument3 pagesSlogans in AdvertisingLavita EBellaNo ratings yet

- Supply Chain - Kraft CheeseDocument8 pagesSupply Chain - Kraft CheeseBahar RoyNo ratings yet

- The Business Journal October 2009Document68 pagesThe Business Journal October 2009BizJournalNo ratings yet

- ILSCMDocument26 pagesILSCMDeepak MeenaNo ratings yet

- KFC ND MC'DDocument54 pagesKFC ND MC'DRamandeep SinghNo ratings yet

- A Staffing Agency For Events, Exhibitions & Promotional ActivitiesDocument2 pagesA Staffing Agency For Events, Exhibitions & Promotional Activitiessaurabh rajNo ratings yet

- Episode 1: Overview of Vietnam'S Retail MarketDocument2 pagesEpisode 1: Overview of Vietnam'S Retail MarketLinh Huynh100% (1)

- Consignment Sale Guidelines 2013 FinalDocument15 pagesConsignment Sale Guidelines 2013 Finalapi-46055224No ratings yet

- Mob U2m1 WorksheetsDocument28 pagesMob U2m1 WorksheetsDeirdra LalchanNo ratings yet

- ChanelDocument27 pagesChanelmonuab67% (3)

HSBC Credit Card Cashback

HSBC Credit Card Cashback

Uploaded by

Naveen KumarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HSBC Credit Card Cashback

HSBC Credit Card Cashback

Uploaded by

Naveen KumarCopyright:

Available Formats

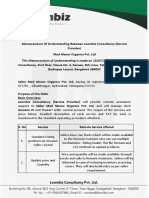

Credit Card (launch mailer) – Terms and Conditions

1. The cashback offer has been provided by The Hongkong and Shanghai Banking Corporation

Limited, India (HSBC/Bank) to its New to Bank (NTB) HSBC Platinum primary Credit Cardholders

(hereinafter referred to as ‘Cardholders’) who have applied for and have been issued a HSBC

Platinum Credit Card under this offer between the period of 26 December 2017 to 30 June 2018.

2. Participation in the offer is voluntary. This offer is valid for Resident Indian customers only.

3. This offer is also valid for the existing HSBC Credit Cardholders who have applied for an upgrade

to new HSBC Platinum Credit Card.

4. Under this offer, the Cardholders will be entitled to 10% cashback in the first 90 days of issuance

of the Credit Card on a minimum sp end of ₹10,000 across 9 transactions subject to a maximum of

₹3,000 as cashback (Offer).

5. The 10% cashback offer is valid only once per platinum card per customer. If a customer applies

for another platinum card he or she will not be eligible for this offer.

6. Appended illustrations explain how the cashback works.

Month No. of transactions Value of transactions Cashback

Jan 2* 12000 0

Feb 3 5000 0

Mar 3 3000 0

8 Total 0

* Since the no of transactions is <9 in January, February and March, no cashback will be credited.

Month No. of transactions Value of transactions Cashback

Jan 0 0 0

Feb 0 0 0

Mar 9 30000 3000

9 Total 3000

Month No. of transactions Value of transactions Cashback

Jan 7 *8000 0

Feb 2 *1000 0

Mar 0 0 0

9 Total 0

*Since the total value of the transactions is less than ₹10,000 in January, February and March,

no cashback will be credited.

7. The month period is considered as 30 days and will be counted from the Credit Card issuance date.

8. This is a limited period offer and HSBC in its sole discretion reserves the right to add, alter, modify,

change, or vary all or any of these terms and conditions or to replace, wholly or in part, this

programme by another programme, whether similar to this programme or not, or to withdraw it

altogether at any point in time by providing appropriate intimation to the cardholder.

9. Under this offer, the Cardholder will not be eligible for the fuel surcharge waiver benefit for the first 90

days from the Credit Card issuance.

10. Eligible cashback amount will be credited within 45 days after completion of 90 days from Credit

Card issuance. The eligible cashback amount will be credited to the Credit Card account of the

Cardholder.

11. Cardholders are required to fulfil the respective spending requirements of minimum 9 transactions

within 90 calendar days of the date of issuance of the new Credit Card. The amount spent is

calculated based on the spending of ₹10,000 or more made by the newly approved Credit

Card and refers to all types of sales transactions (including but without limitation, bill payments,

online purchases, mail and telephone orders and insurance payments). Non-sales transactions,

including but without limitation, finance charges, cash advance and cash advance charges, late

payment charges, balance transfer or annual fees are not included.

12. Cancelled or refunded transactions are also not included in the spending amount calculation.

13. Cardholders cannot combine any other welcome offer/introductory offer with this cashback offer.

14. HSBC Credit Cardholders, who have not made the payment of their minimum amount due, even after

30 days of the last payment due date (mentioned on the card statement) will not be eligible for this

offer.

15. As a part of Credit Card application procedure, New to Bank HSBC Platinum Credit Card applicants

will be required to provide recent passport size photograph; PAN card copy, address proof and self-

attested copy of valid photo identity document. The applicants will be contacted by the Bank for

collection of these documents. The documents submitted along with the application will be kept with

the Bank for record purposes and will not be returned.

16. Issuance of the Credit Card is at the sole discretion of the Bank and is subject to the Bank's internal

approval norms.

17. Interest needs to be shown and express consent must be provided in writing/calling on the toll free

number or by providing an SMS to be called in relation to the offer.

18. When the Cardholder shows any interest in the Offer by reaching out to the Bank by way of any of the

above modes such as writing/calling on the toll free number or by providing an SMS, the said

communication shall be treated as explicit and express consent to HSBC (including its

representatives, group companies and service providers) to call the Cardholder on the contact

number provided by the Cardholder in relation to the HSBC Credit Card irrespective of whether the

Cardholder is a part of National Do Not Call registry/Do Not Call registry/National Customer

Preference Register.

19. All conditions of the HSBC Credit Card shall apply on this offer. Please visit www.hsbc.co.in for

detailed terms and conditions.

20. The offer is subject to force majeure events.

21. Tax liability, if any, will be borne by the Cardholder.

22. Disputes, if any, arising out of or in connection with or as a result of the above offer or otherwise

relating hereto shall be subject to the exclusive jurisdiction of the competent courts/tribunals in

Mumbai only.

23. By participating in this offer, the Cardholders shall be deemed to have accepted all the

aforementioned terms and conditions.

Cleartrip Offer – Terms & Conditions

1. This offer is brought to you by The Hongkong and Shanghai Banking Corporation Limited, India

(‘HSBC’), in association with Cleartrip (India) Private Limited (“Cleartrip”), and any participation in

the said offer is voluntary.

2. The offer is applicable to new HSBC Credit Cardholders (Primary and add-on customers), excluding

Corporate Cardholders (hereinafter referred to as the 'Cardholders') who apply for a Credit Card

between 1st April 2018 and 30th June 2018 (“Offer Period”) and have the card issued subsequently

i.e. by 20 July 2018.

3. Under this offer, a new HSBC Credit Cardholders (Primary and add-on customers), excluding

Corporate Cardholders (hereinafter referred to as the 'Cardholders') will be provided 2 vouchers of

`1000 each through an SMS and/or email within 60 days of completing their first transaction on the

HSBC Credit Card. The first transaction should be executed by 5th Aug 2018. The first transaction

should be executed successfully and should not be cancelled or reversed subsequently.

4. The two voucher codes received should be used within 60 days of receipt on the Cleartrip Website

i.e www.Cleartrip.com or Cleartrip mobile application to avail an instant discount for purchase of

roundtrip Domestic flights only. The residual amount of the booking should be made by using a valid

HSBC Credit Card.

5. One voucher code can be used for one transaction only, two voucher codes cannot be combined for

a single transaction.

6. In case of full/partial cancellation the offer stands void and Cardholder will not be eligible for

discount. If the Cardholder cancels round trip domestic flight booking after the discount amount is

applied, Cleartrip will deduct the discount amount from the net bill amount. Cancellation charges

shall apply and the net amount will be refunded to the customer.

7. If the coupon code is not entered correctly, the transaction will not be eligible for the discount.

8. This offer cannot be clubbed with any other offer on Cleartrip.

9. The offer is valid only for bookings done by visiting website Cleartrip.com or downloading the

Cleartrip Mobile Application available for iOS on the App Store and for Android on Google Play

Store.

10. This Offer can be availed only if the full payment is made using an HSBC Credit Card. Transactions

where payment (partial or full) is made using any other mode of payment (Cleartrip Wallet, e-

vouchers, 3rd party wallets, COD, Pay Pal, net banking payments or other bank cards) will not be

eligible for the discount.

11. Prior to using the Cleartrip website and the mobile application, the Cardholder should read and

understand the user agreement of the said website and the mobile application and proceed only if

the Cardholder agrees to abide by the same. The Cardholder will be required to give personal

information and other details online. The Cardholder should read and understand the privacy policy

on the website and the mobile application, prior to providing any such information. Any disclosure of

information made by the Cardholder towards availing of or fulfilment of the Offer is at the sole

discretion of the Cardholder and HSBC will not be responsible for the same.

12. The offer is subject to the terms and conditions of Cleartrip and the Cardholders are required to

refer, read, understand, accept and agree to be bound by them prior to availing the offer.

13. Cleartrip reserves the sole right to decide on whether a purchase transaction meets the eligibility

criteria as listed above. All decisions in respect of the Offer will be at the sole discretion of Cleartrip

and the same shall be final, binding and non-contestable.

14. HSBC and Cleartrip reserve the right to add, alter, modify, change or vary all or any of these terms

and conditions or to replace, wholly or in part, these offers by another offer, whether similar to this

offer or not, or to withdraw it altogether at any point in time by providing appropriate notice. The offer

may/may not be extended as mutually agreed by HSBC and Cleartrip.

15. HSBC does not make any warranties or representation about the quality, merchantability, suitability

or availability of the services offered under these offers. Any dispute regarding these must be

addressed in writing, by the Cardholder, directly to Cleartrip.

16. HSBC will not be liable for any direct or indirect loss or damage whatsoever that may be suffered,

as a result of participating in the offer.

17. The usage of the credit cards is governed by the applicable terms and conditions. Please visit

www.hsbc.co.in for the same.

18. The Offer is subject to force majeure events.

19. Tax liability, if any will be borne by the Cardholder.

20. Please note that basis Goods and Services Tax (GST) regulations and notified GST rates, Central

GST and State/Union Territory GST or Inter-State GST, will be levied on the discounted price, as

applicable.

21. Any dispute arising out of or in connection with this offer shall be subject to the exclusive jurisdiction

of the courts in Mumbai only. The existence of a dispute, if any, shall not constitute any claim

against HSBC

22. By participating in this offer, the Cardholders shall be deemed to have accepted all the terms and

conditions in totality.

Issued by The Hongkong and Shanghai Banking Corporation Limited, India. Incorporated in Hong Kong SAR w ith

limited liability.

Privacy and Security | Terms of use | Hyperlink Policy

© Copyright 2018. The Hongkong and Shanghai Banking Corporation Limited, India. Incorporated in

Hong Kong SAR w ith limited liability. All rights reserved.

You might also like

- UI 2 - 8 Authorisation Pay Benefits Into Banking AccountDocument1 pageUI 2 - 8 Authorisation Pay Benefits Into Banking AccountVernonNo ratings yet

- Cardlytics Loyalty Whitepaper FinalDocument13 pagesCardlytics Loyalty Whitepaper FinalRachit ParekhNo ratings yet

- AmarBill - Online Flexiload Bangladesh - Grameenphone, Banglalink, Airtel, Robi, Citycell Mobile RechargeDocument6 pagesAmarBill - Online Flexiload Bangladesh - Grameenphone, Banglalink, Airtel, Robi, Citycell Mobile RechargeJm RedwanNo ratings yet

- Electronic Bank StatementDocument6 pagesElectronic Bank StatementMukesh Sharma100% (1)

- Macroeconomics SolutionsDocument4 pagesMacroeconomics SolutionsralsNo ratings yet

- Functions Sales ManagementDocument31 pagesFunctions Sales ManagementSeth ValdezNo ratings yet

- General Mills Inc-Yoplait BDocument2 pagesGeneral Mills Inc-Yoplait BSabyasachi SahuNo ratings yet

- $2,731,323 - Experian Credit ReportDocument1 page$2,731,323 - Experian Credit Reportlarry-612445No ratings yet

- Opening My Account: Statement of AcceptanceDocument21 pagesOpening My Account: Statement of Acceptanceasdf asdaNo ratings yet

- An Automated Ordering SystemDocument1 pageAn Automated Ordering SystemPratyoosh DwivediNo ratings yet

- ATM Card Application Holder HDFC BankDocument1 pageATM Card Application Holder HDFC BankSagar PithadiyaNo ratings yet

- How To Make Money With AliExpress Affiliate Program PDFDocument23 pagesHow To Make Money With AliExpress Affiliate Program PDFrudywahNo ratings yet

- EpayitonlineDocument4 pagesEpayitonlineAleem Ahmad RindekharabatNo ratings yet

- Import and Export Bank AccountsDocument6 pagesImport and Export Bank AccountsYazeed_GhNo ratings yet

- Sap Fico Materials Accounts PayableDocument10 pagesSap Fico Materials Accounts PayableGUDALANo ratings yet

- Oasis Bank Account Details.Document1 pageOasis Bank Account Details.NandhaNo ratings yet

- Contract Account No: Account Name Service Address 46 13Th ST Villamor Air Base Subd Airmens Vill PasayDocument1 pageContract Account No: Account Name Service Address 46 13Th ST Villamor Air Base Subd Airmens Vill PasayAnnamae Therese MartinezNo ratings yet

- Invoices Queries InvoiceDocument7 pagesInvoices Queries InvoicePiyush GadeNo ratings yet

- Open Zero Balance Savings Account Online - Kotak 811Document124 pagesOpen Zero Balance Savings Account Online - Kotak 811ANUJ SINGH100% (1)

- Process For Letter of CreditDocument2 pagesProcess For Letter of Creditraju_srinu06No ratings yet

- Unit 2 - Sbaa7001 Banking Products and ServicesDocument38 pagesUnit 2 - Sbaa7001 Banking Products and ServicesGracyNo ratings yet

- 2020 6 StatementDocument7 pages2020 6 StatementChad Schell100% (1)

- Diamond AccountDocument2 pagesDiamond AccountJagadeesh YathirajulaNo ratings yet

- SMS Internet Banking FormDocument4 pagesSMS Internet Banking FormSayed InsanNo ratings yet

- Lori Hutchison May 30 2020 EXP PDFDocument15 pagesLori Hutchison May 30 2020 EXP PDFLarryNo ratings yet

- Credit Card Enrollment FormDocument2 pagesCredit Card Enrollment FormcenonNo ratings yet

- AmazonPayBalance TermsAndConditions 2020Document2 pagesAmazonPayBalance TermsAndConditions 2020Manohar ManuNo ratings yet

- Account PayableDocument24 pagesAccount Payableaniruddha_2012No ratings yet

- Make Global Settings For Electronic Bank StatementDocument6 pagesMake Global Settings For Electronic Bank StatementGraciano JacobeNo ratings yet

- What Is A Bank Identification Number (BIN), and HDocument1 pageWhat Is A Bank Identification Number (BIN), and HYogeshwaran.sNo ratings yet

- Tenant Access Urls: in ProcessDocument29 pagesTenant Access Urls: in ProcessNimmi KakkanattNo ratings yet

- IDS Fortune Next ExpressDocument8 pagesIDS Fortune Next ExpressseenubhaiNo ratings yet

- Website Payment Technology GuideDocument18 pagesWebsite Payment Technology GuideYashNo ratings yet

- XXXXXXXXX430XXX0923 500004 20042015Document3 pagesXXXXXXXXX430XXX0923 500004 20042015Subrahmanyam SudiNo ratings yet

- PayWay API Developers GuideDocument48 pagesPayWay API Developers GuideSimbwa PhillipNo ratings yet

- MoneyLive Ebook 2022Document14 pagesMoneyLive Ebook 2022Balamurugan VedhamoorthiNo ratings yet

- Procure To Pay Cycle Accounting EntriesDocument7 pagesProcure To Pay Cycle Accounting Entriesrajeev200362No ratings yet

- April 23, 2021 Strathmore TimesDocument12 pagesApril 23, 2021 Strathmore TimesStrathmore TimesNo ratings yet

- Simple FinanceDocument84 pagesSimple Financepriya kumarNo ratings yet

- S 10 - E PaymentsDocument37 pagesS 10 - E PaymentsAninda DuttaNo ratings yet

- AR AP ConfigDocument147 pagesAR AP Configchirag jainNo ratings yet

- ICMarketsGlobal Funding InstructionsDocument1 pageICMarketsGlobal Funding InstructionsAina RasalemaNo ratings yet

- How To Register As A Telemarketing CompanyDocument3 pagesHow To Register As A Telemarketing CompanyArmaan Chhaproo100% (2)

- Cardholder Agreement Ge Money WalmartDocument7 pagesCardholder Agreement Ge Money WalmartAngie MottoNo ratings yet

- MOU 3-15k Amazon and Flipkart 2 2Document4 pagesMOU 3-15k Amazon and Flipkart 2 2Raghu NandanNo ratings yet

- Super Merchant Current Account New Account & Migration ProcessDocument2 pagesSuper Merchant Current Account New Account & Migration ProcessDileep KumarNo ratings yet

- SAP Credit Card Configuration: Set Up Credit Control AreasDocument5 pagesSAP Credit Card Configuration: Set Up Credit Control Areasdd_reddy5192No ratings yet

- Credit Card Bank Alfalah (Imran Dilbar Gill)Document20 pagesCredit Card Bank Alfalah (Imran Dilbar Gill)Tiffany JohnsonNo ratings yet

- Damida OID-00269713Document3 pagesDamida OID-00269713AIMIDA WOOONo ratings yet

- Outward RemittanceDocument49 pagesOutward Remittancemanishjethva2009No ratings yet

- Stripe 2022 UpdateDocument10 pagesStripe 2022 UpdateNesNosssNo ratings yet

- Accounts Payables 3 DocumentsDocument4 pagesAccounts Payables 3 DocumentsHerald GangcuangcoNo ratings yet

- Sample Reports For OfficeDocument9 pagesSample Reports For OfficeAdnan DiampuanNo ratings yet

- Metrobank Money Market FundDocument3 pagesMetrobank Money Market FundExequielCamisaCrusperoNo ratings yet

- Oracle WLS On Amazon EC2Document12 pagesOracle WLS On Amazon EC2Ajit DonthiNo ratings yet

- Personal Credit Card Ts and CsDocument5 pagesPersonal Credit Card Ts and CsDarren HulmeNo ratings yet

- Saving AccountDocument29 pagesSaving AccountramshaNo ratings yet

- JDocument109 pagesJMiguel ChavezNo ratings yet

- Check Stub Template-1-2Document118 pagesCheck Stub Template-1-2Liza GeorgeNo ratings yet

- PNC Bank - Virtual Wallet Student FeesDocument5 pagesPNC Bank - Virtual Wallet Student FeesBobNo ratings yet

- Study of Cash Management at Standard Chartered BankDocument115 pagesStudy of Cash Management at Standard Chartered BankVishnu Prasad100% (2)

- List of All Fees Associated With Your Paypal Prepaid MastercardDocument1 pageList of All Fees Associated With Your Paypal Prepaid Mastercardmira bucketNo ratings yet

- HSBC Credit Card Cashback PDFDocument1 pageHSBC Credit Card Cashback PDFSampath ReddyNo ratings yet

- Vending Machine: Supreeth SK Balaji ADocument6 pagesVending Machine: Supreeth SK Balaji AAshik GRNo ratings yet

- Bangkok Condominium Market Report Q2 2010Document15 pagesBangkok Condominium Market Report Q2 2010Colliers International ThailandNo ratings yet

- 2736 Conversation Corner at The MarketDocument2 pages2736 Conversation Corner at The MarketErnelda VigoNo ratings yet

- MBA 801 Production and Operations ManagementDocument308 pagesMBA 801 Production and Operations ManagementZaid Chelsea0% (1)

- Case StudyDocument3 pagesCase StudyEnna rajpoot100% (1)

- Sport Obermeyer, LTD.: Case SummaryDocument3 pagesSport Obermeyer, LTD.: Case SummaryMinahil JavedNo ratings yet

- Benetton Logistics AssignmentDocument8 pagesBenetton Logistics AssignmentBibhuti PrasadNo ratings yet

- Price and Value Communication: Strategies To Influence Willingness-To-Pay Session 4 ElkanaezekielDocument29 pagesPrice and Value Communication: Strategies To Influence Willingness-To-Pay Session 4 ElkanaezekielIMTG Hostel CommitteeNo ratings yet

- Storage & Warehousing: The Role of Warehousing in Supply ChainDocument31 pagesStorage & Warehousing: The Role of Warehousing in Supply ChainAnonymous hNDqdzC6No ratings yet

- Agric Value Chain ProposalDocument14 pagesAgric Value Chain ProposalChike ChukudebeluNo ratings yet

- Reliance Fresh Vs More FinalDocument4 pagesReliance Fresh Vs More FinalVijay SharmaNo ratings yet

- Business Model TemplateDocument5 pagesBusiness Model TemplatethecluelessNo ratings yet

- Introduction To E-CommerceDocument4 pagesIntroduction To E-CommerceHO SAI ENGNo ratings yet

- Company ProfileDocument2 pagesCompany ProfileAnshu EnterprisesNo ratings yet

- Sushil ReportDocument110 pagesSushil ReportRaj VishawkarmaNo ratings yet

- Bote BoteDocument3 pagesBote BoteEarnswell Pacina TanNo ratings yet

- Consumer Awareness Through StatisticsDocument7 pagesConsumer Awareness Through StatisticssamairaNo ratings yet

- Slogans in AdvertisingDocument3 pagesSlogans in AdvertisingLavita EBellaNo ratings yet

- Supply Chain - Kraft CheeseDocument8 pagesSupply Chain - Kraft CheeseBahar RoyNo ratings yet

- The Business Journal October 2009Document68 pagesThe Business Journal October 2009BizJournalNo ratings yet

- ILSCMDocument26 pagesILSCMDeepak MeenaNo ratings yet

- KFC ND MC'DDocument54 pagesKFC ND MC'DRamandeep SinghNo ratings yet

- A Staffing Agency For Events, Exhibitions & Promotional ActivitiesDocument2 pagesA Staffing Agency For Events, Exhibitions & Promotional Activitiessaurabh rajNo ratings yet

- Episode 1: Overview of Vietnam'S Retail MarketDocument2 pagesEpisode 1: Overview of Vietnam'S Retail MarketLinh Huynh100% (1)

- Consignment Sale Guidelines 2013 FinalDocument15 pagesConsignment Sale Guidelines 2013 Finalapi-46055224No ratings yet

- Mob U2m1 WorksheetsDocument28 pagesMob U2m1 WorksheetsDeirdra LalchanNo ratings yet

- ChanelDocument27 pagesChanelmonuab67% (3)