Professional Documents

Culture Documents

Life Link Super Pension

Life Link Super Pension

Uploaded by

hyderabadCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Life Link Super Pension

Life Link Super Pension

Uploaded by

hyderabadCopyright:

Available Formats

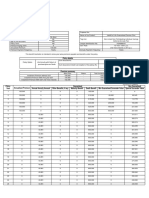

Standard Benefit Illustration

(For unit-linked policies)

Name of Customer

Application No.:

Tick if chosen LifeLink Super Pension (Illustrative values) (All Figures in Rs.)

Premium : Rs 25,000, Pension Flexi Balanced II / Pension Balancer II Fund : 100%

Scenario 1 - @ 10% p.a. return Scenario 2 - @ 6% p.a. return

Surrender Surrender

Premium Policy Total Fund Policy Total Fund

Policy Total Value at Death Total Value at Death

Age Allocation admin Value at admin Value at

Year Charges the end of Benefit Charges the end of Benefit

Charges charges Year end charges Year end

the year the year

1 35 2,000 240 2,240 24,786 - 24,786 240 2,240 23,884 - 23,884

2 36 - 240 240 26,730 - 26,730 240 240 24,812 - 24,812

3 37 - 240 240 28,848 27,694 28,848 240 240 25,786 24,755 25,786

4 38 - 240 240 31,154 30,531 31,154 240 240 26,808 26,272 26,808

5 39 - 240 240 33,665 33,665 33,665 240 240 27,881 27,881 27,881

10 44 - 240 240 50,000 50,000 50,000 240 240 34,092 34,092 34,092

15 49 - 240 240 75,018 75,018 75,018 240 240 41,997 41,997 41,997

20 54 - 240 240 113,335 113,335 113,335 240 240 52,057 52,057 52,057

Premium : Rs 50,000, Pension Flexi Balanced II / Pension Balancer II Fund : 100%

Scenario 1 - @ 10% p.a. return Scenario 2 - @ 6% p.a. return

Surrender Surrender

Premium Policy Total Fund Policy Total Fund

Policy Total Value at Death Total Value at Death

Age Allocation admin Value at admin Value at

Year Charges the end of Benefit Charges the end of Benefit

Charges charges Year end charges Year end

the year the year

1 35 3,000 240 3,240 50,922 - 50,922 240 3,240 49,070 - 49,070

2 36 - 240 240 55,192 - 55,192 240 240 51,242 - 51,242

3 37 - 240 240 59,843 57,449 59,843 240 240 53,522 51,381 53,522

4 38 - 240 240 64,908 63,610 64,908 240 240 55,914 54,795 55,914

5 39 - 240 240 70,423 70,423 70,423 240 240 58,484 58,424 58,484

10 44 - 240 240 106,298 106,298 106,298 240 240 72,963 72,963 72,963

15 49 - 240 240 161,242 161,242 161,242 240 240 91,465 91,465 91,465

20 54 - 240 240 245,394 245,394 245,394 240 240 115,012 115,012 115,012

The above illustrations are standardized benefit illustrations, not customized according to your age, premium, sum assured, term or fund choices. To obtain a illustration which

is customized according to your needs, please contact your financial advisor.

For the purpose of illustrations. we have used 10% and 6% as the higher and the lower rates of investment returns respectively, in the calculations. These are in accordance with the

guidelines issued by the Life Insurance Council and in no way signify our expectations of investment return on the six funds. For each of the funds, the actual investment return may

be higher or lower than the above rates based on the asset classes and the risk taken.

The investments in the units are subject to market and other risks and there can be no assurance that the objectives of any of the fund will be achieved

Tax Benefits under Section 80CCC would be available as per the prevailing Income Tax laws.

The fund options do not offer a guaranteed or assured return

The unit value of the units of each of the funds can go up or down depending on the factors and forces affecting the financial markets from time to time and may also be affected by

changes in the general level of interest rates.

For any further clarifications, please feel free to contact your advisor/FSC or e-mail us on lifeline@iciciprulife.com

The above information must be read in conjunction with the product brochure.

SERVICE TAX AND EDUCATION CESS WOULD BE LEVIED AS PER APPLICABLE TAX LAWS.

Customer’s Signature:

Insurance is the subject matter of the solicitation. © 2007, ICICI Prudential Life Insurance Company Limited. Date:

LifeLink Super Pension Form No.: U44, UIN:105L057V01.

You might also like

- Combi C2I & Sanchay - BrochureDocument6 pagesCombi C2I & Sanchay - BrochurePiyush100% (2)

- Assumptions - : Amazon Cashflow & Profit ForecastDocument22 pagesAssumptions - : Amazon Cashflow & Profit Forecastlengyianchua206No ratings yet

- Y U RanchDocument2 pagesY U RanchHibo RiazNo ratings yet

- 2014 Afr Goccs Volume IDocument479 pages2014 Afr Goccs Volume IRomel TorresNo ratings yet

- Sba Form 413Document2 pagesSba Form 413David WaringNo ratings yet

- Clarifications (Insurance)Document11 pagesClarifications (Insurance)gerrard3896No ratings yet

- Great Eastern Life Assurance (Malaysia) Berhad: MR EngineerDocument31 pagesGreat Eastern Life Assurance (Malaysia) Berhad: MR EngineerLeong VicNo ratings yet

- LIC S Jeevan Rekha 512N211V01Document4 pagesLIC S Jeevan Rekha 512N211V01Ramu448No ratings yet

- 945 - Jeevan UmangDocument6 pages945 - Jeevan UmangSaro SaravananNo ratings yet

- Combo IllustrationDocument5 pagesCombo IllustrationInvest Aaj for kal Life insuranceNo ratings yet

- Sufyan Bhai 12 Years PlanDocument4 pagesSufyan Bhai 12 Years Planسفیان علیNo ratings yet

- Benefit Illustration LIC's Amrit BaalDocument3 pagesBenefit Illustration LIC's Amrit BaalVENKATESHNo ratings yet

- IFLGuaranteed Pension PlanDocument3 pagesIFLGuaranteed Pension PlanAshutosh JaiswalNo ratings yet

- Sales-Brochure 48Document3 pagesSales-Brochure 48Tushar ChaudharyNo ratings yet

- Projections For 2 Bed - Park Gate Residences Tower BDocument1 pageProjections For 2 Bed - Park Gate Residences Tower BMueed ShahzadNo ratings yet

- Sr3 Minerals - Fin Model - 22 MayDocument39 pagesSr3 Minerals - Fin Model - 22 MayghouseNo ratings yet

- LIC S Jeevan Samridhi - 512N215V01Document6 pagesLIC S Jeevan Samridhi - 512N215V01azizsultanNo ratings yet

- PSPR210116124918Document5 pagesPSPR210116124918Manikandan ManoharNo ratings yet

- IllustrationDocument2 pagesIllustrationInvest Aaj for kal Life insuranceNo ratings yet

- Zohaib FaridDocument6 pagesZohaib Faridhuzaifazifi1432No ratings yet

- Great Eastern Life Assurance (Malaysia) Berhad: MR Liew Kian HungDocument31 pagesGreat Eastern Life Assurance (Malaysia) Berhad: MR Liew Kian HungLiewKianHongNo ratings yet

- LIC's Jeevan Utsav (Plan No. 871) : Benefit IllustrationDocument5 pagesLIC's Jeevan Utsav (Plan No. 871) : Benefit Illustrationmohan730463No ratings yet

- Illustration On Projects AppraisalDocument6 pagesIllustration On Projects AppraisalAsmerom MosinehNo ratings yet

- LIC's New Money Back Plan - 20 Years (T-920) : Benefit IllustrationDocument3 pagesLIC's New Money Back Plan - 20 Years (T-920) : Benefit IllustrationSài TejaNo ratings yet

- Goodwill Finance FM FinalDocument231 pagesGoodwill Finance FM Finalmeenal_smNo ratings yet

- Life Insurance: Policy DetailDocument1 pageLife Insurance: Policy Detailswathikomati7870No ratings yet

- SBI GUC FormatDocument3 pagesSBI GUC FormatVikkuNo ratings yet

- PV & FV Calculater: Compound Annual Growth Rate ChartDocument1 pagePV & FV Calculater: Compound Annual Growth Rate CharthoshenskillsNo ratings yet

- Report Ms. SAMPLE 936 21 15 Age 35 SA 1000000Document5 pagesReport Ms. SAMPLE 936 21 15 Age 35 SA 1000000sandyNo ratings yet

- MboDocument4 pagesMboSum WhosinNo ratings yet

- Assumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4Document2 pagesAssumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4PranshuNo ratings yet

- 4449b8b1-0f05-4bd3-be90-44b82775ee5eDocument2 pages4449b8b1-0f05-4bd3-be90-44b82775ee5eFawzar SabirNo ratings yet

- Methods of Calculating Depreciation ExerciseDocument17 pagesMethods of Calculating Depreciation ExerciseASMARA HABIBNo ratings yet

- HRMODocument4 pagesHRMOSum WhosinNo ratings yet

- S A 2 X 25032024191816Document2 pagesS A 2 X 25032024191816Kiran JohnNo ratings yet

- Year Ended 31 March, 2017 Post-Retirement Medical Benefits Schemes (PRMBS) Leave EncashmentDocument2 pagesYear Ended 31 March, 2017 Post-Retirement Medical Benefits Schemes (PRMBS) Leave Encashmentsiva kumarNo ratings yet

- Cayden GMXDocument10 pagesCayden GMX智全No ratings yet

- EnergyBalance CPDocument3 pagesEnergyBalance CPLiora Vanessa DopacioNo ratings yet

- Life Insurance: This Shall Form A Part of The Policy ContractDocument3 pagesLife Insurance: This Shall Form A Part of The Policy ContractgoluNo ratings yet

- MlcroDocument4 pagesMlcroSum WhosinNo ratings yet

- Inari Financial Result Q1 FY2024Document17 pagesInari Financial Result Q1 FY2024GZHNo ratings yet

- Benefit Illustration StarComprehensiveInsurancePolicyDocument1 pageBenefit Illustration StarComprehensiveInsurancePolicyNanda KumarNo ratings yet

- 7 - FFDocument25 pages7 - FFCecil Mae CaballeroNo ratings yet

- ABM Guide Sales Projection Financial Plan - Entrep - RevisedDocument5 pagesABM Guide Sales Projection Financial Plan - Entrep - RevisedKianyaNo ratings yet

- Muskan Nagar - FM AssignmentDocument33 pagesMuskan Nagar - FM AssignmentMuskan NagarNo ratings yet

- Financial Aspect: Total Project Cost 3,00,000.00Document3 pagesFinancial Aspect: Total Project Cost 3,00,000.00kartik DebnathNo ratings yet

- Corporate Sales Units Aug'23Document3 pagesCorporate Sales Units Aug'23Shabaz ShaikhNo ratings yet

- Page 1 of 6Document6 pagesPage 1 of 6Siva SankarNo ratings yet

- 2022 Benefits Summary For FA EE'sDocument6 pages2022 Benefits Summary For FA EE'sFrancisca VigilNo ratings yet

- MDRRMODocument4 pagesMDRRMOSum WhosinNo ratings yet

- AgricultureDocument4 pagesAgricultureSum WhosinNo ratings yet

- Senthil Kumar MR IncomeShield 25.04.2019 19.23.38Document3 pagesSenthil Kumar MR IncomeShield 25.04.2019 19.23.38nataraj maxNo ratings yet

- Capital BudgetingDocument22 pagesCapital BudgetingCorporate Accountant Marayo BankNo ratings yet

- LIC's New Money Back Plan - 25 Years (T-921) : Benefit IllustrationDocument3 pagesLIC's New Money Back Plan - 25 Years (T-921) : Benefit IllustrationSài TejaNo ratings yet

- MPDCDocument4 pagesMPDCSum WhosinNo ratings yet

- Argent Research: Merger & Acquisition Modelling - Vertical Integration ModelDocument31 pagesArgent Research: Merger & Acquisition Modelling - Vertical Integration ModeltmendisNo ratings yet

- CoopDocument4 pagesCoopSum WhosinNo ratings yet

- BenefitIllustartion Early Cash PlanDocument2 pagesBenefitIllustartion Early Cash PlanvikasNo ratings yet

- IllustrationDocument2 pagesIllustrationInvest Aaj for kal Life insuranceNo ratings yet

- AccountingDocument4 pagesAccountingSum WhosinNo ratings yet

- SFH Rental AnalysisDocument6 pagesSFH Rental AnalysisA jNo ratings yet

- 1t Chan Activity2Document14 pages1t Chan Activity2irish chanNo ratings yet

- Sri Subbarama Dikshitar WordDocument19 pagesSri Subbarama Dikshitar WordhyderabadNo ratings yet

- Sangitha Sampradaya Priyadarshini Cakram5-6 PDFDocument420 pagesSangitha Sampradaya Priyadarshini Cakram5-6 PDFhyderabad100% (1)

- WILD LIFE StoryDocument4 pagesWILD LIFE StoryhyderabadNo ratings yet

- Sri Subbarama Dikshitar - BiographyDocument19 pagesSri Subbarama Dikshitar - BiographyhyderabadNo ratings yet

- Sangitha Sampradaya Priyadarshini Cakram1-4 PDFDocument664 pagesSangitha Sampradaya Priyadarshini Cakram1-4 PDFhyderabadNo ratings yet

- Veeramachineni DIET PLANDocument14 pagesVeeramachineni DIET PLANhyderabad0% (1)

- Android User Manual 9 PDFDocument45 pagesAndroid User Manual 9 PDFhyderabadNo ratings yet

- Ahuthi by Yeddanapudi PDFDocument196 pagesAhuthi by Yeddanapudi PDFhyderabadNo ratings yet

- GIMP Shortcuts NewDocument2 pagesGIMP Shortcuts Newmrinal570No ratings yet

- Calculate Age in Excel AccuratelyDocument4 pagesCalculate Age in Excel AccuratelyhyderabadNo ratings yet

- Psychometrictests 121028030257 Phpapp01Document17 pagesPsychometrictests 121028030257 Phpapp01hyderabad100% (1)

- How Effective Are Psychometric Tests?: By: Group 5 Members: Hannah Cha, Reza Fallah, Weng ShuanDocument16 pagesHow Effective Are Psychometric Tests?: By: Group 5 Members: Hannah Cha, Reza Fallah, Weng ShuanhyderabadNo ratings yet

- Caucasus Central AsiaDocument22 pagesCaucasus Central Asiazepeng wuNo ratings yet

- Pautang AuditDocument4 pagesPautang AuditWyeth Earl Padar EndrianoNo ratings yet

- Go Fin 268 02 pg630Document2 pagesGo Fin 268 02 pg630R.p. VenkatNo ratings yet

- Equip. Note PDFDocument16 pagesEquip. Note PDFhailush girmay100% (1)

- Besing, Jessa Mae - ESSAYDocument5 pagesBesing, Jessa Mae - ESSAYJessa Mae Saguran BesingNo ratings yet

- Budget Imp Qs PDFDocument13 pagesBudget Imp Qs PDFkritikaNo ratings yet

- Chapter 2 - Cost Concepts and Design Economics SolutionsDocument31 pagesChapter 2 - Cost Concepts and Design Economics SolutionsArin Park100% (1)

- Exam MockDocument9 pagesExam MockJim Akino100% (1)

- Project Report ON Study ofDocument78 pagesProject Report ON Study ofSana MoidNo ratings yet

- FR & SR - List of RulesDocument5 pagesFR & SR - List of RulesPC Watson100% (1)

- Microeconomics. Pindyck, Robert S. - Rubinfeld, Daniel L. (2018) - 474Document1 pageMicroeconomics. Pindyck, Robert S. - Rubinfeld, Daniel L. (2018) - 474rifkaindiNo ratings yet

- MBA IV ImpQDocument6 pagesMBA IV ImpQsushma gangulaNo ratings yet

- Review of Schuler and Jackson Model of StrategicDocument10 pagesReview of Schuler and Jackson Model of StrategicAlex Munyaka100% (2)

- Labor Laws and Legislation Lecture 2019Document13 pagesLabor Laws and Legislation Lecture 2019Marvin OngNo ratings yet

- Preliminary ChapterDocument8 pagesPreliminary ChapterShams GalibNo ratings yet

- Constrained Cost MinimisationDocument3 pagesConstrained Cost MinimisationYogish PatgarNo ratings yet

- Lumpsum LDocument20 pagesLumpsum LCharles LaspiñasNo ratings yet

- Accounting For Government and Non Profit Organizations - ASSESSMENTSDocument21 pagesAccounting For Government and Non Profit Organizations - ASSESSMENTSArn KylaNo ratings yet

- CJ Diesel Refilling Gasoline StationDocument47 pagesCJ Diesel Refilling Gasoline StationMaricar Oca de LeonNo ratings yet

- Client StoryDocument1 pageClient StorybernabethNo ratings yet

- Banking Unbound Origins To The Digital FrontiersDocument229 pagesBanking Unbound Origins To The Digital FrontiersUmar WyneNo ratings yet

- Demat (1) .Docx2Document54 pagesDemat (1) .Docx2Barath RamNo ratings yet

- Construction Schedule Contracts ManagementDocument46 pagesConstruction Schedule Contracts ManagementB PUHAZHENDHINo ratings yet

- Series LLC SPV PPMDocument62 pagesSeries LLC SPV PPMLV IbeNo ratings yet

- Intro To Topic: Module 2.1 ObjectivesDocument3 pagesIntro To Topic: Module 2.1 ObjectivesMeilin Denise MEDRANANo ratings yet

- Payslip 4 2022Document1 pagePayslip 4 2022Sunil B R SunilshettyNo ratings yet

- Comparative Ratio Analysis: Ford and Nissan - : Financial Statement Analysis, FINA 3314Document15 pagesComparative Ratio Analysis: Ford and Nissan - : Financial Statement Analysis, FINA 3314Enkhmunkh EnkhboldNo ratings yet