Professional Documents

Culture Documents

Sreits 100903 Oir

Sreits 100903 Oir

Uploaded by

explicitCopyright:

Available Formats

You might also like

- Written Assignment Unit 4Document9 pagesWritten Assignment Unit 4Mike StevenNo ratings yet

- P7Document2 pagesP7Andreas Brown0% (1)

- Cache Logistics Trust: Current Price: S$0.935 Fair Value: S$1.03Document18 pagesCache Logistics Trust: Current Price: S$0.935 Fair Value: S$1.03KyithNo ratings yet

- Breakfast Presentation Jan 26 2010Document23 pagesBreakfast Presentation Jan 26 2010vanessa3937No ratings yet

- India FDI August 2010Document9 pagesIndia FDI August 2010Ankit GargNo ratings yet

- Healthcare REITS 110310 OIRDocument6 pagesHealthcare REITS 110310 OIRKyithNo ratings yet

- China Property Sector: Stress Test For Major DevelopersDocument7 pagesChina Property Sector: Stress Test For Major Developersdohad78No ratings yet

- Property - M-Reits: Corporate HighlightsDocument6 pagesProperty - M-Reits: Corporate HighlightsRhb InvestNo ratings yet

- MiningDocument37 pagesMiningannisa lahjieNo ratings yet

- General Catalog - E PMI PDFDocument142 pagesGeneral Catalog - E PMI PDFTong Quang AnhNo ratings yet

- Aprea Reit 2019 - Az FinalDocument33 pagesAprea Reit 2019 - Az FinalJuan Edmundo ReyesNo ratings yet

- Highlights Nsenews Aug2010Document2 pagesHighlights Nsenews Aug2010Swanand KastureNo ratings yet

- Bcom 6 Sem Financial Accounting 5 5505 Summer 2019Document8 pagesBcom 6 Sem Financial Accounting 5 5505 Summer 2019AlankritaNo ratings yet

- Indian FDI September2010Document9 pagesIndian FDI September2010Rakesh RanjanNo ratings yet

- SIP Is King Jan 09 FinalDocument3 pagesSIP Is King Jan 09 FinaltpsuryaNo ratings yet

- October 1st CFTC DataDocument3 pagesOctober 1st CFTC Dataderailedcapitalism.comNo ratings yet

- Bank of America Merrill Lynch Q3 2010 Hedge Fund Industry OverviewDocument31 pagesBank of America Merrill Lynch Q3 2010 Hedge Fund Industry OverviewYA2301No ratings yet

- Arpeni Pratama Ocean Line Tbk. ) : Company Report: July 2015 As of 31 July 2015Document3 pagesArpeni Pratama Ocean Line Tbk. ) : Company Report: July 2015 As of 31 July 2015Muh Zulfikar Ismail FabanyoNo ratings yet

- RHB Equity 360° (Mah Sing, IJM, KNM Technical: Top Glove) - 15/04/2010Document3 pagesRHB Equity 360° (Mah Sing, IJM, KNM Technical: Top Glove) - 15/04/2010Rhb InvestNo ratings yet

- SEA TECH One-Pager ENDocument3 pagesSEA TECH One-Pager ENmani narayananNo ratings yet

- India FDI October2010Document10 pagesIndia FDI October2010Roshan NairNo ratings yet

- Weekly - S REITS - Tracker 2020 06 01 PDFDocument8 pagesWeekly - S REITS - Tracker 2020 06 01 PDFBubblyDeliciousNo ratings yet

- School Update Feb09 - TOWNHALLDocument18 pagesSchool Update Feb09 - TOWNHALLanthony.restar1251No ratings yet

- Trends of Fdi in India After 1991Document11 pagesTrends of Fdi in India After 1991Sajal SinghNo ratings yet

- Investment Issues Surrounding Investment Issues Surrounding Europe and IndiaDocument40 pagesInvestment Issues Surrounding Investment Issues Surrounding Europe and IndiaSukhchain SinghNo ratings yet

- 333 Review PKGDocument36 pages333 Review PKGjennifer weiNo ratings yet

- Edelweiss Capital: July 2010Document41 pagesEdelweiss Capital: July 2010Piyush SharmaNo ratings yet

- Incomplete Records and Single Entry Book KeepingDocument36 pagesIncomplete Records and Single Entry Book KeepingangaNo ratings yet

- Community Building Through Community BankingDocument64 pagesCommunity Building Through Community BankingVaibhav DafaleNo ratings yet

- 31.2. Real EstateDocument42 pages31.2. Real EstateLa DarmaNo ratings yet

- Resources For Maximising Retarns at A Given Isk. Combining Service ND ResDocument5 pagesResources For Maximising Retarns at A Given Isk. Combining Service ND ResTaimur AleemNo ratings yet

- September 24th CFTC DataDocument3 pagesSeptember 24th CFTC Dataderailedcapitalism.comNo ratings yet

- FD20191021 PDFDocument1 pageFD20191021 PDFDarren ValienteNo ratings yet

- Meezan Islamic Islamic Income FundDocument40 pagesMeezan Islamic Islamic Income FundSalman ArshadNo ratings yet

- Aditya Birla Sun Life Equity FundDocument9 pagesAditya Birla Sun Life Equity FundArun TNo ratings yet

- RHB Equity 360° (Timber, Banks Technical: Ramunia, Petra Perdana) - 05/04/2010Document3 pagesRHB Equity 360° (Timber, Banks Technical: Ramunia, Petra Perdana) - 05/04/2010Rhb InvestNo ratings yet

- Valencia Reginald Audit Excercise On InvestmentsDocument6 pagesValencia Reginald Audit Excercise On InvestmentsReginald ValenciaNo ratings yet

- 2011-Feb-17 - OCBC - Lippo-MapletreeDocument4 pages2011-Feb-17 - OCBC - Lippo-MapletreeKyithNo ratings yet

- Argo Pantes TBK Argo: Company History Dividend AnnouncementDocument3 pagesArgo Pantes TBK Argo: Company History Dividend AnnouncementJandri Zhen TomasoaNo ratings yet

- SK Energy NDR PT 20100407Document62 pagesSK Energy NDR PT 20100407Thierno Samassa LyNo ratings yet

- CH 2 in ClassDocument2 pagesCH 2 in ClassMAINY RYANNo ratings yet

- SAITO History - Jan2017Document7 pagesSAITO History - Jan2017Jingxian BaoNo ratings yet

- A. Hercules Poirot, P.I., Sa Worksheet For The Quarter Ended March 31, 2017 Account Titles Trial Balance Adjustmnets Adjusted Trial BalanceDocument5 pagesA. Hercules Poirot, P.I., Sa Worksheet For The Quarter Ended March 31, 2017 Account Titles Trial Balance Adjustmnets Adjusted Trial BalancevaldaNo ratings yet

- New MBA SpecimenDocument2 pagesNew MBA SpecimenvinodasimNo ratings yet

- A Tale of Two CurvesDocument5 pagesA Tale of Two CurvesnitishsiNo ratings yet

- Date Cash Supplies Equipment A/C Payble Notes Payable Capital Remarks Accounts ReceivableDocument15 pagesDate Cash Supplies Equipment A/C Payble Notes Payable Capital Remarks Accounts ReceivablesnigdhaNo ratings yet

- JPMorgan - 6 Januari 2009Document5 pagesJPMorgan - 6 Januari 2009intan ochtavianiNo ratings yet

- Digi PDFDocument2 pagesDigi PDFdhannu yogaNo ratings yet

- Georgia and Harriet Are in Partnership, Sharing Profits and Losses Equally. No Interest Is Paid OnDocument3 pagesGeorgia and Harriet Are in Partnership, Sharing Profits and Losses Equally. No Interest Is Paid OnSCRIBDerNo ratings yet

- Final Account of Joint Stock CompanyDocument8 pagesFinal Account of Joint Stock CompanyanupsuchakNo ratings yet

- LNL Iklcqd /: Employee Share Employer Share Employee Share Employer ShareDocument2 pagesLNL Iklcqd /: Employee Share Employer Share Employee Share Employer Sharehr pslNo ratings yet

- How Much Can Small Sovereigns Borrow?: 10 January, 2009Document15 pagesHow Much Can Small Sovereigns Borrow?: 10 January, 2009irisheconomyNo ratings yet

- Chapter 1 - Basic Considerations and Formation (Part 2)Document10 pagesChapter 1 - Basic Considerations and Formation (Part 2)Paw VerdilloNo ratings yet

- Baring Fund Fact SheetDocument2 pagesBaring Fund Fact SheetElaine FergusonNo ratings yet

- Final Paper 2Document258 pagesFinal Paper 2chandresh0% (1)

- Accounting INDIVIDUAL ASSIGNMENTDocument17 pagesAccounting INDIVIDUAL ASSIGNMENTHajara SaleethNo ratings yet

- Assignment of SAPMDocument12 pagesAssignment of SAPMPayal ParasharNo ratings yet

- Seminar 09 Calculating NCInt Simple Example ColourDocument2 pagesSeminar 09 Calculating NCInt Simple Example Colour金鑫No ratings yet

- Mirror Images in Different Frames?: Johor, the Riau Islands, and Competition for Investment from SingaporeFrom EverandMirror Images in Different Frames?: Johor, the Riau Islands, and Competition for Investment from SingaporeNo ratings yet

- Soneri BankDocument28 pagesSoneri Bankfahadali966No ratings yet

- Form 32 Return by Management CompanyDocument2 pagesForm 32 Return by Management CompanyolingirlNo ratings yet

- Mutual Funds E Book v2.5Document50 pagesMutual Funds E Book v2.5Aarna FinNo ratings yet

- Tatiana Boroditskaya - UBSDocument13 pagesTatiana Boroditskaya - UBSSid KaulNo ratings yet

- MK 2Document3 pagesMK 2Henry Ogi Juve HardiyatnoNo ratings yet

- Financial Management June 2013 Marks Plan ICAEWDocument7 pagesFinancial Management June 2013 Marks Plan ICAEWMuhammad Ziaul HaqueNo ratings yet

- The Impactof Credit Rating ChangesDocument17 pagesThe Impactof Credit Rating ChangesArpita ArtaniNo ratings yet

- Blueprint For Professional TradingDocument44 pagesBlueprint For Professional Tradingneha 3632No ratings yet

- Trust LineDocument106 pagesTrust LineGuman SinghNo ratings yet

- Securities Analysis and Portfolio ManagementDocument50 pagesSecurities Analysis and Portfolio ManagementrimonasharmaNo ratings yet

- HBL Final ReportDocument31 pagesHBL Final ReportAamir KhanNo ratings yet

- 240 Bar Code Part 1 PDFDocument69 pages240 Bar Code Part 1 PDFParthMair100% (1)

- Clearing-Settlement and Risk Management of BATS at ISLAMABADDocument4 pagesClearing-Settlement and Risk Management of BATS at ISLAMABADhafsa1989No ratings yet

- Internship Report ON "Foreign Exchange System of Rupali Bank Limited"Document37 pagesInternship Report ON "Foreign Exchange System of Rupali Bank Limited"Shakhauat HossainNo ratings yet

- Cases Digest BankingDocument10 pagesCases Digest BankingKarlNo ratings yet

- Equity Derivatives Beginners Module PDFDocument66 pagesEquity Derivatives Beginners Module PDFadityalal0% (4)

- Income Tax ProblemsDocument1 pageIncome Tax ProblemsPam Otic-ReyesNo ratings yet

- A Client S Conundrum 012507Document4 pagesA Client S Conundrum 012507Abhijit NaikNo ratings yet

- International Monetary SystemDocument7 pagesInternational Monetary SystemkocherlakotapavanNo ratings yet

- 16.72 US Dollars To Indonesia Rupiahs. Convert USD in IDR (Currency Matrix)Document1 page16.72 US Dollars To Indonesia Rupiahs. Convert USD in IDR (Currency Matrix)Fahira AnwarNo ratings yet

- Jim Cramers 10 Rules of InvestingDocument15 pagesJim Cramers 10 Rules of Investing2008cegs100% (2)

- NAZARRY ROSLI - Increasing Your Profits Using The Moving Averages Method (Advanced)Document32 pagesNAZARRY ROSLI - Increasing Your Profits Using The Moving Averages Method (Advanced)joekaledaNo ratings yet

- Greenfield vs. AcquisitionDocument16 pagesGreenfield vs. AcquisitionManash HazarikaNo ratings yet

- Nasdaq Composite White PaperDocument8 pagesNasdaq Composite White PaperavaresearchNo ratings yet

- Financial MarketDocument8 pagesFinancial Marketindusekar83No ratings yet

- IDBIDocument63 pagesIDBIghagsonaNo ratings yet

- List of ProjectDocument6 pagesList of ProjectPradeep BiradarNo ratings yet

- Jakarta Ind 1q16Document2 pagesJakarta Ind 1q16JarjitUpinIpinJarjitNo ratings yet

- CLS Market DataDocument24 pagesCLS Market DataKostas PapadopoulosNo ratings yet

Sreits 100903 Oir

Sreits 100903 Oir

Uploaded by

explicitOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sreits 100903 Oir

Sreits 100903 Oir

Uploaded by

explicitCopyright:

Available Formats

SINGAPORE Company

SINGAPORE Update Results

Sector Update MITA

MITANo.

No.010/06/2009

016/06/2010

3 September 2010

S-REITS

Neutral Bringing up to date, Maintain Neutral

Recovery Cycle: The Singapore REITs sector saw good growth

in the first half of 2010. The total market capitalization of S-

REITs surged by 39% YoY to S$32b as of end Aug 2010.

According to the recent CBRE "REITs Around Asia 1H10"

4000 FSTREI 1000

3500 900 report, Singapore REITs market capitalization also came in

800

3000 STI 700 second highest in Asia; Japan was top at S$43b (US$32b). In

2500 600

500 addition, there was also a new S-REIT listing of Cache Logistics

2000

1500

400

300

Trust in Apr, which was well-received by the investment

1000 200 community and raised gross proceeds of S$417.2m. Previously

Apr-08

Apr-09

Apr-10

Jan-08

Jul-08

Oct-08

Jan-09

Jul-09

Oct-09

Jan-10

Jul-10

battered by the credit crunch, many were now able to ride on

the sector's recovery cycle. In fact, we see several S-REITs

raising capital once more to acquire assets and grow.

Acquisitions-no more sleepy backwater: The 1H10 saw

acquisitions activity by S-REITs rebound sharply with a total

value of S$4b (Exhibit 1). The credit freeze that made financing

almost impossible two years ago has also largely thawed.

Borrowing costs for most S-REITs are now sloping downwards

rather than upwards. YTD, we have seen public financing

issuances and transacted private placements amounting to

S$1.4b (Exhibit 2). Moving forward, we expect S-REITs to

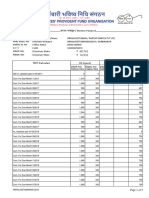

S-REIT Current Price/Book continue the refinancing process to take advantage of the

Price easing credit market, the low interest rate environment, and

(S$) opportunities to pacify investor jitters. Quality sponsors and

*Ascendas Real Estate Inv Trust 2.16 1.15 quality assets will continue to be crucial to securing

*Ascott Residence Trust 1.13 0.82 competitive pricing.

Cambridge Industrial Trust 0.51 0.83

*CapitaCommercial Trust 1.37 0.87 Regulatory risk-looming cloud on the horizon: The

*CapitaMall Trust 1.97 1.21 Singapore government remains highly active in the real estate

CapitaRetail China Trust 1.24 1.09 space. The spate of property cooling measures announced

CDL Hospitality Trusts 2.03 1.23 recently for the residential market is a case in point. Of all the

*Frasers Centrepoint Trust 1.46 1.05 new measures, we see the move to disallow concurrent

Frasers Commercial Trust 0.145 0.37 ownership of HDB flats and private residential properties within

K-REIT Asia 1.21 0.77 the MOP as the most significant. The market now expects

*Lippo-Mapletree Indonesia RE 0.47 0.57 private home prices and sales to be hit. Even though the

*Mapletree Logistics Trust 0.840 0.97 indirect impact on the S-REITs sector remains to be seen,

*Starhill Global REIT 0.580 0.61 this episode certainly demonstrated the extent of government

*Suntec REIT 1.41 0.73 influence on the real estate sector.

*Note: S-REITs under OIR coverage

Source: Bloomberg Focusing on value. Despite the still uncertain market

conditions, the FTSE REIT sub-index is, in fact, up 5.85%

YTD. This means that valuations for several S-REITs, especially

the larger cap plays, are trading at significant premium to

book value. But coupled with the risk of falling asset prices

should the government decide to get tough on the non-

Research Team

(65) 6531 9800 residential property market, we believe that these S-REITs

e-mail: info@ocbc-research.com are increasingly looking fairly priced. As such, we maintain a

NEUTRAL view on the sector.

Please refer to the important disclosures at the back of this document.

Sector Update

Exhibit 1: Top REITs' acquisitions in 2010

REIT Property Value (S$m)

Ascott Residence Trust 26 properties in Europe; One in Singapore and one in Vietnam. 1,390

Mapletree Logistics Trust Seven properties in Asia 460

Starhill Global REIT Lot 10, Starhill Gallery 444.3

K-REIT Asia 50% of 275 George Street, Brisbane Australia, 77 King Street Sydney Australia 353.6

Frasers Centrepoint Trust Northpoint 2; Yew Tee Point 290.2

CapitaMall Trust Clarke Quay 268

Ascendas REIT 31 Joo Koon Circle; DBS Asia Hub; Property in Jurong 228.5

CDL Hospitality Trust Five hotel properties in Brisbane & Perth 220.9

AIMS AMP Capital Industrial REIT 27 Penjuru Lane 161

Parkway Life REIT 11 nursing homes in Japan 107.3

Cambridge Industrial Trust 22 Chin Bee Drive; 1 & 2 Changi North Street 2 37.1

Source: Adapted from The Edge Singapore August 30, 2010

Page 2 3 September 2010

Sector Update

Exhibit 2: Public Financing & Private Placement Activities in 2010

REIT Financing Initiative Value ($m) Date of Announcement

AIMS AMP Capital Industrial REIT AIMS AMP plans S$79 million rights issue S$79 24-Aug-10

CapitaCommercial Trust Issue of Convertible Bonds due 2015 successfully closed S$219.9 21-Apr-10

CDL Hospitality Trust Establishment Of S$1,000,000,000 Multicurrency Medium Term Note S$1,000 23-Jul-10

Programme

CDL Hospitality Trust Issue Of 116,960,000 New Stapled Securities In CDL Hospitality Trusts S$200 01-Jul-10

Pursuant to The Private Placement

CapitaMall Trust Issuance Of S$150,000,000 2.85 Per Cent. Fixed Rate Notes Due 2014 S$300 01-Sep-10

And S$150,000,000 3.55 Per Cent. Fixed Rate Notes Due 2017

Pursuant To The S$2,500,000,000 Multicurrency Medium Term Note

Programme

CapitaMall Trust Prices S$150,000,000 2.85 Per Cent. Fixed Rate Notes Due 2014 And S$300 19-Aug-10

S$150,000,000 3.55 Per Cent. Fixed Rate Notes Due 2017 to Be Issued

Pursuant to The S$2,500,000,000 Multicurrency Medium Term Note

Programme

CapitaMall Trust Prices US$500.0 million 4.321% fixed rate notes due 2015. First series US$500 31-Mar-10

in US$2.0 billion Euro-Medium Term Note Programme

CapitaMall Trust Establishment Of US$2,000,000,000 Euro-Medium Term Note S$2,000 29-Mar-10

Programme

CapitaMall Trust Issuance Of S$100,000,000 3.85 Per Cent. Fixed Rate Notes Due 2017 S$100 15-Mar-10

Pursuant to The S$2,500,000,000 Multicurrency Medium Term Note

Programme

CapitaMall Trust Issuance Of S$100,000,000 3.288 Per Cent. Fixed Rate Notes Due S$100 28-Jan-10

2015 Pursuant to The S$2,500,000,000 Multicurrency Medium Term

Note Programme

Cambridge Industrial Trust Private Placement Of 83,683,000 New Units In Cambridge Industrial S$40 27-Aug-10

Trust ("CIT") to Non-Restricted investors At The issue Price Of S$0.478

per New Unit And (If Applicable) In Respect Of Restricted Investors At

The Restricted Investor Issue Price Of S$0.503 Per New Unit

Frasers Centrepoint Trust Issue Of (I) S$55 Million 2.83% Notes Due 2013 And (II) S$25 Million S$80 10-Feb-10

3.50% Notes Due 2015 Pursuant to The S$500 Million Multicurrency

Medium Term Note Programme

Frasers Centrepoint Trust Private Placement Of 137.0 Million New Units In Frasers Centrepoint S$182.2 04-Feb-10

Trust

Mapletree Logistics Trust S$1,000,000,000 Multi-Currency Medium Term Note Programme - Issue

Of Series 008 Notes comprising S$20,000,000 principal amount Fixed

Rate Notes due 2015

S$20 26-Mar-10

Parkway Life REIT Issue Of S$50 Million Floating Rate Notes Due 2013 Pursuant to The S$50 23-Mar-10

S$500 Million Multicurrency Medium Term Note Programme

Starhill Global REIT Issuance Of S$124,000,000 3.405% Notes Due 2015 Pursuant to The S$124 13-Jul-10

S$2,000,000,000 Multicurrency Medium Term Note Programme

Source: Company websites

Page 3 3 September 2010

Sector Update

SHAREHOLDING DECLARATION:

The analyst/analysts who wrote this report holds NIL shares in the above security.

RATINGS AND RECOMMENDATIONS:

OCBC Investment Research’s (OIR) technical comments and recommendations are short-term and trading

oriented.

- However, OIR’s fundamental views and ratings (Buy, Hold, Sell) are medium-term calls within a 12-month

investment horizon. OIR’s Buy = More than 10% upside from the current price; Hold = Trade within +/-10%

from the current price; Sell = More than 10% downside from the current price.

- For companies with less than S$150m market capitalization, OIR’s Buy = More than 30% upside from the

current price; Hold = Trade within +/- 30% from the current price; Sell = More than 30% downside from the

current price.

DISCLAIMER FOR RESEARCH REPORT

This report is solely for information and general circulation only and may not be published, circulated,

reproduced or distributed in whole or in part to any other person without our written consent. This report

should not be construed as an offer or solicitation for the subscription, purchase or sale of the securities

mentioned herein. Whilst we have taken all reasonable care to ensure that the information contained in this

publication is not untrue or misleading at the time of publication, we cannot guarantee its accuracy or

completeness, and you should not act on it without first independently verifying its contents. Any opinion or

estimate contained in this report is subject to change without notice. We have not given any consideration

to and we have not made any investigation of the investment objectives, financial situation or particular

needs of the recipient or any class of persons, and accordingly, no warranty whatsoever is given and no

liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of the recipient

or any class of persons acting on such information or opinion or estimate. You may wish to seek advice

from a financial adviser regarding the suitability of the securities mentioned herein, taking into consideration

your investment objectives, financial situation or particular needs, before making a commitment to invest in

the securities. OCBC Investment Research Pte Ltd, OCBC Securities Pte Ltd and their respective connected

and associated corporations together with their respective directors and officers may have or take positions

in the securities mentioned in this report and may also perform or seek to perform broking and other

investment or securities related services for the corporations whose securities are mentioned in this report

as well as other parties generally.

Privileged/Confidential information may be contained in this message. If you are not the addressee indicated

in this message (or responsible for delivery of this message to such person), you may not copy or deliver

this message to anyone. Opinions, conclusions and other information in this message that do not relate to

the official business of my company shall not be understood as neither given nor endorsed by it.

Co.Reg.no.: 198301152E

For OCBC Investment Research Pte Ltd

Carmen Lee

Published by OCBC Investment Research Pte Ltd Head of Research

Page 4 3 September 2010

You might also like

- Written Assignment Unit 4Document9 pagesWritten Assignment Unit 4Mike StevenNo ratings yet

- P7Document2 pagesP7Andreas Brown0% (1)

- Cache Logistics Trust: Current Price: S$0.935 Fair Value: S$1.03Document18 pagesCache Logistics Trust: Current Price: S$0.935 Fair Value: S$1.03KyithNo ratings yet

- Breakfast Presentation Jan 26 2010Document23 pagesBreakfast Presentation Jan 26 2010vanessa3937No ratings yet

- India FDI August 2010Document9 pagesIndia FDI August 2010Ankit GargNo ratings yet

- Healthcare REITS 110310 OIRDocument6 pagesHealthcare REITS 110310 OIRKyithNo ratings yet

- China Property Sector: Stress Test For Major DevelopersDocument7 pagesChina Property Sector: Stress Test For Major Developersdohad78No ratings yet

- Property - M-Reits: Corporate HighlightsDocument6 pagesProperty - M-Reits: Corporate HighlightsRhb InvestNo ratings yet

- MiningDocument37 pagesMiningannisa lahjieNo ratings yet

- General Catalog - E PMI PDFDocument142 pagesGeneral Catalog - E PMI PDFTong Quang AnhNo ratings yet

- Aprea Reit 2019 - Az FinalDocument33 pagesAprea Reit 2019 - Az FinalJuan Edmundo ReyesNo ratings yet

- Highlights Nsenews Aug2010Document2 pagesHighlights Nsenews Aug2010Swanand KastureNo ratings yet

- Bcom 6 Sem Financial Accounting 5 5505 Summer 2019Document8 pagesBcom 6 Sem Financial Accounting 5 5505 Summer 2019AlankritaNo ratings yet

- Indian FDI September2010Document9 pagesIndian FDI September2010Rakesh RanjanNo ratings yet

- SIP Is King Jan 09 FinalDocument3 pagesSIP Is King Jan 09 FinaltpsuryaNo ratings yet

- October 1st CFTC DataDocument3 pagesOctober 1st CFTC Dataderailedcapitalism.comNo ratings yet

- Bank of America Merrill Lynch Q3 2010 Hedge Fund Industry OverviewDocument31 pagesBank of America Merrill Lynch Q3 2010 Hedge Fund Industry OverviewYA2301No ratings yet

- Arpeni Pratama Ocean Line Tbk. ) : Company Report: July 2015 As of 31 July 2015Document3 pagesArpeni Pratama Ocean Line Tbk. ) : Company Report: July 2015 As of 31 July 2015Muh Zulfikar Ismail FabanyoNo ratings yet

- RHB Equity 360° (Mah Sing, IJM, KNM Technical: Top Glove) - 15/04/2010Document3 pagesRHB Equity 360° (Mah Sing, IJM, KNM Technical: Top Glove) - 15/04/2010Rhb InvestNo ratings yet

- SEA TECH One-Pager ENDocument3 pagesSEA TECH One-Pager ENmani narayananNo ratings yet

- India FDI October2010Document10 pagesIndia FDI October2010Roshan NairNo ratings yet

- Weekly - S REITS - Tracker 2020 06 01 PDFDocument8 pagesWeekly - S REITS - Tracker 2020 06 01 PDFBubblyDeliciousNo ratings yet

- School Update Feb09 - TOWNHALLDocument18 pagesSchool Update Feb09 - TOWNHALLanthony.restar1251No ratings yet

- Trends of Fdi in India After 1991Document11 pagesTrends of Fdi in India After 1991Sajal SinghNo ratings yet

- Investment Issues Surrounding Investment Issues Surrounding Europe and IndiaDocument40 pagesInvestment Issues Surrounding Investment Issues Surrounding Europe and IndiaSukhchain SinghNo ratings yet

- 333 Review PKGDocument36 pages333 Review PKGjennifer weiNo ratings yet

- Edelweiss Capital: July 2010Document41 pagesEdelweiss Capital: July 2010Piyush SharmaNo ratings yet

- Incomplete Records and Single Entry Book KeepingDocument36 pagesIncomplete Records and Single Entry Book KeepingangaNo ratings yet

- Community Building Through Community BankingDocument64 pagesCommunity Building Through Community BankingVaibhav DafaleNo ratings yet

- 31.2. Real EstateDocument42 pages31.2. Real EstateLa DarmaNo ratings yet

- Resources For Maximising Retarns at A Given Isk. Combining Service ND ResDocument5 pagesResources For Maximising Retarns at A Given Isk. Combining Service ND ResTaimur AleemNo ratings yet

- September 24th CFTC DataDocument3 pagesSeptember 24th CFTC Dataderailedcapitalism.comNo ratings yet

- FD20191021 PDFDocument1 pageFD20191021 PDFDarren ValienteNo ratings yet

- Meezan Islamic Islamic Income FundDocument40 pagesMeezan Islamic Islamic Income FundSalman ArshadNo ratings yet

- Aditya Birla Sun Life Equity FundDocument9 pagesAditya Birla Sun Life Equity FundArun TNo ratings yet

- RHB Equity 360° (Timber, Banks Technical: Ramunia, Petra Perdana) - 05/04/2010Document3 pagesRHB Equity 360° (Timber, Banks Technical: Ramunia, Petra Perdana) - 05/04/2010Rhb InvestNo ratings yet

- Valencia Reginald Audit Excercise On InvestmentsDocument6 pagesValencia Reginald Audit Excercise On InvestmentsReginald ValenciaNo ratings yet

- 2011-Feb-17 - OCBC - Lippo-MapletreeDocument4 pages2011-Feb-17 - OCBC - Lippo-MapletreeKyithNo ratings yet

- Argo Pantes TBK Argo: Company History Dividend AnnouncementDocument3 pagesArgo Pantes TBK Argo: Company History Dividend AnnouncementJandri Zhen TomasoaNo ratings yet

- SK Energy NDR PT 20100407Document62 pagesSK Energy NDR PT 20100407Thierno Samassa LyNo ratings yet

- CH 2 in ClassDocument2 pagesCH 2 in ClassMAINY RYANNo ratings yet

- SAITO History - Jan2017Document7 pagesSAITO History - Jan2017Jingxian BaoNo ratings yet

- A. Hercules Poirot, P.I., Sa Worksheet For The Quarter Ended March 31, 2017 Account Titles Trial Balance Adjustmnets Adjusted Trial BalanceDocument5 pagesA. Hercules Poirot, P.I., Sa Worksheet For The Quarter Ended March 31, 2017 Account Titles Trial Balance Adjustmnets Adjusted Trial BalancevaldaNo ratings yet

- New MBA SpecimenDocument2 pagesNew MBA SpecimenvinodasimNo ratings yet

- A Tale of Two CurvesDocument5 pagesA Tale of Two CurvesnitishsiNo ratings yet

- Date Cash Supplies Equipment A/C Payble Notes Payable Capital Remarks Accounts ReceivableDocument15 pagesDate Cash Supplies Equipment A/C Payble Notes Payable Capital Remarks Accounts ReceivablesnigdhaNo ratings yet

- JPMorgan - 6 Januari 2009Document5 pagesJPMorgan - 6 Januari 2009intan ochtavianiNo ratings yet

- Digi PDFDocument2 pagesDigi PDFdhannu yogaNo ratings yet

- Georgia and Harriet Are in Partnership, Sharing Profits and Losses Equally. No Interest Is Paid OnDocument3 pagesGeorgia and Harriet Are in Partnership, Sharing Profits and Losses Equally. No Interest Is Paid OnSCRIBDerNo ratings yet

- Final Account of Joint Stock CompanyDocument8 pagesFinal Account of Joint Stock CompanyanupsuchakNo ratings yet

- LNL Iklcqd /: Employee Share Employer Share Employee Share Employer ShareDocument2 pagesLNL Iklcqd /: Employee Share Employer Share Employee Share Employer Sharehr pslNo ratings yet

- How Much Can Small Sovereigns Borrow?: 10 January, 2009Document15 pagesHow Much Can Small Sovereigns Borrow?: 10 January, 2009irisheconomyNo ratings yet

- Chapter 1 - Basic Considerations and Formation (Part 2)Document10 pagesChapter 1 - Basic Considerations and Formation (Part 2)Paw VerdilloNo ratings yet

- Baring Fund Fact SheetDocument2 pagesBaring Fund Fact SheetElaine FergusonNo ratings yet

- Final Paper 2Document258 pagesFinal Paper 2chandresh0% (1)

- Accounting INDIVIDUAL ASSIGNMENTDocument17 pagesAccounting INDIVIDUAL ASSIGNMENTHajara SaleethNo ratings yet

- Assignment of SAPMDocument12 pagesAssignment of SAPMPayal ParasharNo ratings yet

- Seminar 09 Calculating NCInt Simple Example ColourDocument2 pagesSeminar 09 Calculating NCInt Simple Example Colour金鑫No ratings yet

- Mirror Images in Different Frames?: Johor, the Riau Islands, and Competition for Investment from SingaporeFrom EverandMirror Images in Different Frames?: Johor, the Riau Islands, and Competition for Investment from SingaporeNo ratings yet

- Soneri BankDocument28 pagesSoneri Bankfahadali966No ratings yet

- Form 32 Return by Management CompanyDocument2 pagesForm 32 Return by Management CompanyolingirlNo ratings yet

- Mutual Funds E Book v2.5Document50 pagesMutual Funds E Book v2.5Aarna FinNo ratings yet

- Tatiana Boroditskaya - UBSDocument13 pagesTatiana Boroditskaya - UBSSid KaulNo ratings yet

- MK 2Document3 pagesMK 2Henry Ogi Juve HardiyatnoNo ratings yet

- Financial Management June 2013 Marks Plan ICAEWDocument7 pagesFinancial Management June 2013 Marks Plan ICAEWMuhammad Ziaul HaqueNo ratings yet

- The Impactof Credit Rating ChangesDocument17 pagesThe Impactof Credit Rating ChangesArpita ArtaniNo ratings yet

- Blueprint For Professional TradingDocument44 pagesBlueprint For Professional Tradingneha 3632No ratings yet

- Trust LineDocument106 pagesTrust LineGuman SinghNo ratings yet

- Securities Analysis and Portfolio ManagementDocument50 pagesSecurities Analysis and Portfolio ManagementrimonasharmaNo ratings yet

- HBL Final ReportDocument31 pagesHBL Final ReportAamir KhanNo ratings yet

- 240 Bar Code Part 1 PDFDocument69 pages240 Bar Code Part 1 PDFParthMair100% (1)

- Clearing-Settlement and Risk Management of BATS at ISLAMABADDocument4 pagesClearing-Settlement and Risk Management of BATS at ISLAMABADhafsa1989No ratings yet

- Internship Report ON "Foreign Exchange System of Rupali Bank Limited"Document37 pagesInternship Report ON "Foreign Exchange System of Rupali Bank Limited"Shakhauat HossainNo ratings yet

- Cases Digest BankingDocument10 pagesCases Digest BankingKarlNo ratings yet

- Equity Derivatives Beginners Module PDFDocument66 pagesEquity Derivatives Beginners Module PDFadityalal0% (4)

- Income Tax ProblemsDocument1 pageIncome Tax ProblemsPam Otic-ReyesNo ratings yet

- A Client S Conundrum 012507Document4 pagesA Client S Conundrum 012507Abhijit NaikNo ratings yet

- International Monetary SystemDocument7 pagesInternational Monetary SystemkocherlakotapavanNo ratings yet

- 16.72 US Dollars To Indonesia Rupiahs. Convert USD in IDR (Currency Matrix)Document1 page16.72 US Dollars To Indonesia Rupiahs. Convert USD in IDR (Currency Matrix)Fahira AnwarNo ratings yet

- Jim Cramers 10 Rules of InvestingDocument15 pagesJim Cramers 10 Rules of Investing2008cegs100% (2)

- NAZARRY ROSLI - Increasing Your Profits Using The Moving Averages Method (Advanced)Document32 pagesNAZARRY ROSLI - Increasing Your Profits Using The Moving Averages Method (Advanced)joekaledaNo ratings yet

- Greenfield vs. AcquisitionDocument16 pagesGreenfield vs. AcquisitionManash HazarikaNo ratings yet

- Nasdaq Composite White PaperDocument8 pagesNasdaq Composite White PaperavaresearchNo ratings yet

- Financial MarketDocument8 pagesFinancial Marketindusekar83No ratings yet

- IDBIDocument63 pagesIDBIghagsonaNo ratings yet

- List of ProjectDocument6 pagesList of ProjectPradeep BiradarNo ratings yet

- Jakarta Ind 1q16Document2 pagesJakarta Ind 1q16JarjitUpinIpinJarjitNo ratings yet

- CLS Market DataDocument24 pagesCLS Market DataKostas PapadopoulosNo ratings yet