Professional Documents

Culture Documents

Electrotherm India LTD.: Kamal Steel Mills-Swot Analysis

Electrotherm India LTD.: Kamal Steel Mills-Swot Analysis

Uploaded by

doraisteelOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Electrotherm India LTD.: Kamal Steel Mills-Swot Analysis

Electrotherm India LTD.: Kamal Steel Mills-Swot Analysis

Uploaded by

doraisteelCopyright:

Available Formats

KAMAL STEEL MILLS-SWOT analysis

SWOT Analysis

The following diagram shows how a SWOT analysis fits into a strategic situation analysis.

Situation Analysis

/ \

Internal Analysis External Analysis

/ \ / \

Strengths Weaknesses Opportunities Threats

|

SWOT Profile

Internal Analysis:

The internal analysis is a comprehensive evaluation of the internal environment's potential strengths and

weaknesses. Factors should be evaluated across the organization in areas such as:

Company culture

Company image

Organizational structure

Key staff

Access to natural resources

Position on the experience curve

Operational efficiency

Operational capacity

Brand awareness

Market share

Financial resources

Exclusive contracts

Patents and trade secrets

The SWOT analysis summarizes the internal factors of the firm as a list of strengths and weaknesses.

External Analysis:

An opportunity is the chance to introduce a new product or service that can generate superior returns.

Opportunities can arise when changes occur in the external environment. Many of these changes can be

perceived as threats to the market position of existing products and may necessitate a change in product

specifications or the development of new products in order for the firm to remain competitive. Changes in the

external environment may be related to:

Customers

Competitors

Market trends

Suppliers

Partners

Social changes

New technology

Economic environment

Political and regulatory environment

ELECTROTHERM INDIA LTD.

KAMAL STEEL MILLS-SWOT analysis

Introduction

Kamal Steel was incorporated in Tanzania (East Africa) in 2004, through Tanzania Investment Center (TIC) under

the foreign investment scheme. With an experience over a decade in India, The Mills will be installed with the

techno economic assistance by ELECTROTHERM INDIA LIMITED, which came into operations in stages during

1986.

The foundation stone of this vital and gigantic project was laid on July, 2010 by the President of Tanzania

Mr. Kikwete. The project will completed at a capital cost of USD 490 million. Its construction will be carried out by

a consortium of KAMAL construction companies , Electrotherm India Limited And TIM Engineering & technologies

limited under the overall supervision of Electrotherm experts.

KAMAL Steel is located at a distance of 45 km Southeast of Bog at A multiproduct EPZ, promoted by Kamal

Steels Ltd. is coming up in 300 acres in the Bagamoyo District close to Dar-es-Salaam near Port Zanjibar.

KAMAL Steel is spread out over an area of 300 acres. It marked KAMAL's entry into the elite club of iron and

steel producing nation

STRENGTH:

1. LARGE FINANCIAL RESOURCES:

The project will be completed at a capital cost of USD 490 million. It has enough financial resources to increase its

plant and supplies of products. It is patronized by the government of Tanzania which provide aid when needed

2. LARGE SIZE.

It is one of Tanzania‘s largest industrial unit. It provides jobs to thousands of workers. It is will produce enormous

steel products for customers both local and international. So it will earn more revenue than any other organization.

3. GREAT COPMETETIVE SKILLS:

It has been working consistently in steel production sector so it has achieved great competitive skills. It has ability

to face strong competition.

4. ECONOMIES OF LARGE SCALES

It will be enjoying the benefits of large scales. Due to large production its cost of production is kept at minimum.

5. EXPERT EMPLOYEES

Continuity of operations will be enabled by its employees to achieve great operational skills. Its employees will be

very skilled than other related industries.

6. GOVERNMENT SUPPORT

It enjoys the patronage of government of Tanzania.

8. EFFICIENT FUNCTIONING

It is functioning efficiently under quality administration. It is following internationally recommended principles in its

controlling.

9. PERFECT LOCATION

ELECTROTHERM INDIA LTD.

KAMAL STEEL MILLS-SWOT analysis

It was found to be an ecologically preferable location, alongside a tidal creek and having a wind direction away

from the city of Dar -e -salam. It is located on a very critical location. It is located near sea port and also linked to

major highways. So it has no difficulty in transportation.

10. RELATIONS

It enjoys strong relations with government officials. It also enjoys good relations with its customers both local and

foreign.

11. COMPETETIVE ADVANTAGE

Its business model has enabled it to achieve competitive advantage. Its products are very innovative and

relatively cheap.

12. INNOVATIVE

It’s will be pioneer in steel production in Tanzania so it will be very innovative after its commencement.

13. BY PRODUCTS

Galvanizing Unit to add to its profits.

14. MONOPLY

It will enjoy monopoly in steel products for years and earn lots of profits. There will be no match to its expertise in

steel production.

15. EXPANSION

It is an integrated mill with an annual capacity of 2 million tons of raw steel production with a built in potential for

expansion

WEAKNESS

ELECTROTHERM INDIA LTD.

KAMAL STEEL MILLS-SWOT analysis

OPPORTUNITIES

1. DIVERSITY IN PRODUCTS

Since it has been working for a very long time so it has achieved high skills to produce a large variety of products.

So it has ability to satisfy many wants of its customers and increase its profits.

2. WEAK COMPETITORS

Its competitors will be new to the market so they may not threatening its profits that much. It may producing more

types of goods than its competitors so it is ale to earn more profits.

3. HIGH BARGAINING POWER

Due to large scale of production it purchases raw materials in bulk quantities so it has high bargaining power and

enjoys discount from its suppliers. It also produces sophiscated products so it charges comparatively high prices

from its customers.

4. CUSTOMER TRUST

As it is a pioneer to the market its customers trust on its products. People prefer to buy its products. So it will

generating more revenue than its competitors.

5. MARKET DOMINAMCE

There have been no competitors in market for a period so it can achieve dominance in the market. The

customers will prefer its products.

6. INTRNATIONAL SCOPE

It is also supplying its products to neighboring & GCC Countries. So it will enjoy higher profits than its competitors.

Is equipped with all the necessary facilities, conforming to International standards.

7. SUB UNITS

It also has capacity to build its sub units. So it can produce a variety of goods than others in the business.

8. INCREASING DEMAND FOR PRODUCTS

The demand for steel products is will always on the rise. So it has the opportunities to generate revenues.

9. RELATED GOODS

It has the ability to produce related goods demanded by its customers. It has a great scope to increase its sales.

10. NATURAL DISASTERS

There has been an increased demand for its products due to natural disasters. Its products have the ability to

guard against natural disaster like earthquake. The people are building their homes with the support of steel

products so demand for its products is increasing and so are its profits.

ELECTROTHERM INDIA LTD.

KAMAL STEEL MILLS-SWOT analysis

11. SUB INDUSTRIES

There are many industries that use its products as raw materials to produce their goods. So demand for its

products is ever rising

12. FAST MARKET GROWTH

Due to heavy labor force and large capital it has the ability to increase supply of its products when demand for its

products increases.

13. ORGANIZATIONAL GOALS

It is fully committed to become no.1 organization in steel products in south East Asia. So it tempting its employees

to work hard

THREATS

1. NEW COPMETITORS

With the entrance of new competitors the sales decrease.

2. GOVERNMENT POLICIES

The previous government took many wrong steps like selling of PSM at lower rates. These kinds of policies are

threat to its existence. It was being privatized in indecent haste, ignoring profitability aspect and assets of the mills

by the financial adviser before its evaluation.

3. ECONOMIC CRISES

The current economic crises have a bad impact on profitability. There has been a considerable decrease in

demand for its products due to low people’s income.

4. ADVERSE DEMOGREPHIC CONDITIONS

The demand for steel products is ever changing. The people are switching to substitutions. So it may harm

company’s profits.

5. GROWING COMPETITION

The number of competitors in steel products is increasing.

ELECTROTHERM INDIA LTD.

KAMAL STEEL MILLS-SWOT analysis

6. LABOR UNIONS

Labor unions always a threat to a company. Labor unions may go to strike when their demands are not fulfilled.

Strikes may affect badly its working

7. RISE IN OIL/RAW MATERIAL PRICES

The rise in oil/raw material prices increased its cost of production. It was forced to sell its products at higher

prices which decreased demand for its products.

8. WITHDRAWAL OF GOVERNMENT SUPPORT

The government may withdraw its support..

9. INADEQUATE HUMAN RESOURCE MANAGEMENT

Since Kamal Steel is working on a large scale it needs highly educated people to control its labor efficiently. But

due to non availability of these people it is not working at a level where it should so it is a great threat to its profits.

10. GLOBALIZATION

It is a major threat to its profits. With the introduction of multinational companies in Tanzania its revenues may

decrease.

11. FREE MARKET ECONOMY

Free market economy may cause it to lower its product prices. Its profits may decrease.

15. POLITICAL INSATABILITY

Tanzania may suffer from political instability So it really has a negative effect.

ELECTROTHERM INDIA LTD.

You might also like

- Kering CaseDocument3 pagesKering CaseValentin PicavetNo ratings yet

- Bokaro Steel Plant - ProjectDocument72 pagesBokaro Steel Plant - Projectchandan97150% (2)

- Chapter 10: Answers To Questions and Problems: Strategy A B A BDocument8 pagesChapter 10: Answers To Questions and Problems: Strategy A B A Bdt830250% (2)

- Steel MillDocument13 pagesSteel MillSyed Hassan RazaNo ratings yet

- Rating Criteria For Steel IndustryDocument5 pagesRating Criteria For Steel IndustryBinod Kumar PadhiNo ratings yet

- ReportDocument44 pagesReportDivya Ramraj60% (5)

- Case Study: Industry: Steel Company: AmrelisteelsDocument15 pagesCase Study: Industry: Steel Company: AmrelisteelswaleedNo ratings yet

- Strategic Management Project On Tata SteelDocument18 pagesStrategic Management Project On Tata SteelRonak GosaliaNo ratings yet

- Tata Steel: Q1. Apply PESTLE, FIVE FORCES & SWOT Analysis On Following Tata BusinessDocument51 pagesTata Steel: Q1. Apply PESTLE, FIVE FORCES & SWOT Analysis On Following Tata BusinessAnsh AnandNo ratings yet

- Fsapm AssignmentDocument19 pagesFsapm AssignmentAnkita DasNo ratings yet

- SWOT Analysis BSRM Steels LTD BangladeshDocument4 pagesSWOT Analysis BSRM Steels LTD BangladeshMd Tarek RahmanNo ratings yet

- Steeple Analysis of Iron and Steel Industry: Social FactorDocument8 pagesSteeple Analysis of Iron and Steel Industry: Social FactorVijesh ShahNo ratings yet

- Case Study NIM FinalDocument12 pagesCase Study NIM Finalsujay13780No ratings yet

- Presentation On SAL Steel LTDDocument52 pagesPresentation On SAL Steel LTDChandan PahelwaniNo ratings yet

- Sarthak Metals Ltd.Document21 pagesSarthak Metals Ltd.saggttjsNo ratings yet

- Financial Analysis of Sail: A Little Bit of SAIL in Everybody's LifeDocument28 pagesFinancial Analysis of Sail: A Little Bit of SAIL in Everybody's LifeYashas PariharNo ratings yet

- MAHRD (Project)Document16 pagesMAHRD (Project)nitesh chauhanNo ratings yet

- BHUSHAN INDUSTRIAL VISIT ChandigarhDocument43 pagesBHUSHAN INDUSTRIAL VISIT ChandigarhManthan Ashutosh Mehta100% (1)

- 16 Sevices Marketing ('Mba18ge06) 225012301368 SwotDocument4 pages16 Sevices Marketing ('Mba18ge06) 225012301368 SwotNursing Superintendent (SH)No ratings yet

- Gupta Power Infrasture LTDDocument12 pagesGupta Power Infrasture LTDNitish KumarNo ratings yet

- Payable Extensions To Missed Payrolls and Loan DefaultsDocument66 pagesPayable Extensions To Missed Payrolls and Loan DefaultsPriety Mahajan DhekneNo ratings yet

- My Industrial TourDocument21 pagesMy Industrial TourRashedul Hasan RashedNo ratings yet

- Plaza Auto CastDocument56 pagesPlaza Auto Castcharmin patelNo ratings yet

- SAIL (Final)Document41 pagesSAIL (Final)SuhailUltronNo ratings yet

- Project Brand Awareness at Gasha SteelsDocument79 pagesProject Brand Awareness at Gasha SteelsMahaManthra0% (2)

- Steel Authority of India Limited Salem Steel PlantDocument42 pagesSteel Authority of India Limited Salem Steel Plantmonisha selvamNo ratings yet

- SRM Report For M BaDocument42 pagesSRM Report For M BasuhailNo ratings yet

- Identifying A Steel StockDocument4 pagesIdentifying A Steel Stockanalyst_anil14No ratings yet

- MBA, Organization Study report/SIFL-Karthika T KDocument90 pagesMBA, Organization Study report/SIFL-Karthika T Kkarthika89% (27)

- Ism AssignmentDocument7 pagesIsm AssignmentYASH ALMALNo ratings yet

- A Project Report On Marketing Of: Submitted ToDocument43 pagesA Project Report On Marketing Of: Submitted Toakjm52No ratings yet

- 08 - An Analysis On Financial Performance of Tata Steel LimitedDocument5 pages08 - An Analysis On Financial Performance of Tata Steel Limitedkritika agarwalNo ratings yet

- Swot AnalysisDocument28 pagesSwot Analysistixege4232No ratings yet

- Rishabh JainDocument18 pagesRishabh Jainrishabh5897No ratings yet

- ChandanDocument15 pagesChandanpankajsaniNo ratings yet

- Inventory ManagementDocument30 pagesInventory Managementavnishchauhan8_46499100% (1)

- An Overview of Indian Foundry IndustryDocument2 pagesAn Overview of Indian Foundry IndustryGarima100% (1)

- KSRMDocument10 pagesKSRMslsakib801No ratings yet

- 8th To REST FinalDocument31 pages8th To REST FinalSonalisurveNo ratings yet

- Avez Marketing Project PDFDocument29 pagesAvez Marketing Project PDFGanesh MahendrakarNo ratings yet

- Peb Brochure SteelDocument40 pagesPeb Brochure SteelChamila RajapakshaNo ratings yet

- AartiDocument60 pagesAartiSahil KumarNo ratings yet

- Business Plan For Salma Enterprises: SubmittedDocument15 pagesBusiness Plan For Salma Enterprises: SubmittedEmmanuelNo ratings yet

- JSW Steel LTD Vishwanth 06124Document66 pagesJSW Steel LTD Vishwanth 06124HemanthSKF100% (2)

- SWOT of Cement Industried IndiaDocument9 pagesSWOT of Cement Industried IndiaFaraz HossainNo ratings yet

- Background of The StudyDocument24 pagesBackground of The StudySanjay MuraliNo ratings yet

- Assignment - IDocument11 pagesAssignment - IBhupendra SoniNo ratings yet

- National Aluminium Company LimitedDocument6 pagesNational Aluminium Company Limitediasgaming2105No ratings yet

- Developing A Growth Strategy For The CompanyDocument11 pagesDeveloping A Growth Strategy For The CompanyAbhinandan ChatterjeeNo ratings yet

- Bba Project Report On Human ResourceDocument64 pagesBba Project Report On Human Resourcechinmayshinde47No ratings yet

- ReportDocument18 pagesReportKrishna KKNo ratings yet

- Working CapitalDocument113 pagesWorking CapitalVivek JhaNo ratings yet

- Tour Report BSRMDocument57 pagesTour Report BSRMGakiya SultanaNo ratings yet

- Manali Project Report - Customer SatisfactionDocument81 pagesManali Project Report - Customer Satisfactionroma hudedamaniNo ratings yet

- Analysis of Working Capital Management On NALCODocument51 pagesAnalysis of Working Capital Management On NALCOsachinshinde_tex100% (1)

- "Human Resource Management": Summer Training Project Report OnDocument37 pages"Human Resource Management": Summer Training Project Report OnRavi SharmaNo ratings yet

- Sail InterpretationDocument444 pagesSail InterpretationRakesh KumarNo ratings yet

- Performance Divergence and Financial Dis PDFDocument12 pagesPerformance Divergence and Financial Dis PDFSindhu GNo ratings yet

- Full Report in GXMR Eningeering WorksDocument59 pagesFull Report in GXMR Eningeering Worksk eswariNo ratings yet

- Revised Investors Presentation 11 11 2023Document41 pagesRevised Investors Presentation 11 11 2023sunilmall87No ratings yet

- A Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessFrom EverandA Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessNo ratings yet

- A Study of the Supply Chain and Financial Parameters of a Small BusinessFrom EverandA Study of the Supply Chain and Financial Parameters of a Small BusinessNo ratings yet

- Ping An Good DoctorDocument27 pagesPing An Good DoctorALNo ratings yet

- F3 - ACCA Chapter-24-1Document29 pagesF3 - ACCA Chapter-24-1Nile NguyenNo ratings yet

- Analysis of The General Environment of GUCCIDocument12 pagesAnalysis of The General Environment of GUCCIhajar jawharaNo ratings yet

- Industrial Economics Homework Assignment 1 Plus SolutionDocument4 pagesIndustrial Economics Homework Assignment 1 Plus SolutionbenNo ratings yet

- Unit 9 Investment in Leisure and TourismDocument2 pagesUnit 9 Investment in Leisure and Tourismram poudelNo ratings yet

- Pricing Strategies Maximizing Profitability and Value PropositionDocument2 pagesPricing Strategies Maximizing Profitability and Value PropositionEC Virtual DeskNo ratings yet

- Lecture 3 - Chapter 2Document21 pagesLecture 3 - Chapter 2Ali AlluwaimiNo ratings yet

- Will The Internet Destroy The News MediaDocument20 pagesWill The Internet Destroy The News MediaJoshua GansNo ratings yet

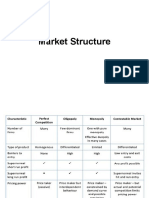

- Market StructureDocument19 pagesMarket StructureSri HarshaNo ratings yet

- FCI-Management Discipline QuestionsDocument9 pagesFCI-Management Discipline QuestionsAnnie AnzNo ratings yet

- ACI Company AnalysisDocument7 pagesACI Company Analysisalfaz shaikhNo ratings yet

- SM Chapter 3 NotesDocument8 pagesSM Chapter 3 NotesAnns AhmadNo ratings yet

- Wilkerson Company Case Study: Managerial AccountingDocument14 pagesWilkerson Company Case Study: Managerial AccountingRupanshi JaiswalNo ratings yet

- Problem 1Document2 pagesProblem 1Heaven HeartNo ratings yet

- Chapter 1 - Understanding The Supply ChainDocument29 pagesChapter 1 - Understanding The Supply Chainissafakhoury0318No ratings yet

- Cee 10Document58 pagesCee 10Muhammad Irfan MalikNo ratings yet

- SOL BA Program 1st Year Economics Study Material and Syllabus in PDFDocument87 pagesSOL BA Program 1st Year Economics Study Material and Syllabus in PDFShamim Akhtar100% (1)

- Corrección Del Quiz de Vocabulario: Economy and BusinessDocument2 pagesCorrección Del Quiz de Vocabulario: Economy and BusinessAngelica Duarte BecerraNo ratings yet

- CHP 2 SolDocument17 pagesCHP 2 SolZakiah Abu KasimNo ratings yet

- David Ricardo: History of Economic ThoughtDocument30 pagesDavid Ricardo: History of Economic ThoughtBrendan RiceNo ratings yet

- Quiz 2-1 Mang 2024Document4 pagesQuiz 2-1 Mang 2024Mahmoud KassemNo ratings yet

- Integration The Growth Strategies of Hotel ChainsDocument14 pagesIntegration The Growth Strategies of Hotel ChainsTatiana PosseNo ratings yet

- Ch18 - Parkin - Econ - Lecture PresentationDocument52 pagesCh18 - Parkin - Econ - Lecture PresentationImam AmbaryNo ratings yet

- Group Assignment 3 KellogsDocument8 pagesGroup Assignment 3 KellogsRambo DeyNo ratings yet

- Marketing ch4Document32 pagesMarketing ch4Reenad AlshuailyNo ratings yet

- Tutorial - Chapter 5 - Perfect Competition - QuestionsDocument4 pagesTutorial - Chapter 5 - Perfect Competition - QuestionsNandiie0% (1)

- 01 Managerial Economics & Business StrategyDocument17 pages01 Managerial Economics & Business StrategyMuthia El NinoNo ratings yet

- Williamson in 1964, and He Describes Managers' Utility Versus Profit Maximisation inDocument5 pagesWilliamson in 1964, and He Describes Managers' Utility Versus Profit Maximisation inndmudhosiNo ratings yet