Professional Documents

Culture Documents

Apack Prod Doc FCUBS 12.0 Commitment

Apack Prod Doc FCUBS 12.0 Commitment

Uploaded by

narayanampCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Becker 1432 Info and MP3 ConversionDocument7 pagesBecker 1432 Info and MP3 ConversionMary JensenNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Information Document Bird AviaryDocument7 pagesInformation Document Bird AviarynarayanampNo ratings yet

- Swift Standards Sr2017 Cat3advanceinfoDocument169 pagesSwift Standards Sr2017 Cat3advanceinfonarayanampNo ratings yet

- Indian Institute of Banking & Finance: Diploma in Retail BankingDocument10 pagesIndian Institute of Banking & Finance: Diploma in Retail BankingnarayanampNo ratings yet

- Apack Prod Doc Fcubs 12.0 FTDocument73 pagesApack Prod Doc Fcubs 12.0 FTnarayanampNo ratings yet

- Capitalization and DepDocument8 pagesCapitalization and DepmohedNo ratings yet

- Dentist Invoice TemplateDocument1 pageDentist Invoice TemplatenarayanampNo ratings yet

- Aura Catalogue Price ListDocument4 pagesAura Catalogue Price ListNarayana ShasthriNo ratings yet

- Sudan University of Science & TechnologyDocument3 pagesSudan University of Science & TechnologyMazin OmarNo ratings yet

- Freebitco in 10000 ScriptDocument4 pagesFreebitco in 10000 Scripttips komputre90No ratings yet

- Rak Minimarket Standar - P90: Single Double Single Double Single Double Rincian Harga Jual Tebal ShelvingDocument6 pagesRak Minimarket Standar - P90: Single Double Single Double Single Double Rincian Harga Jual Tebal ShelvingAndi HadisaputraNo ratings yet

- Responsibilities of NOCDocument8 pagesResponsibilities of NOCRaghav100% (1)

- PLSQL 2 1 PracticeDocument4 pagesPLSQL 2 1 PracticePaola Valdez100% (1)

- IbusDocument5 pagesIbusPopescu IustinNo ratings yet

- ICT-CSS12 Q1 Mod1 PerformingComputerOperations Version1Document53 pagesICT-CSS12 Q1 Mod1 PerformingComputerOperations Version1Rainier DoctoleroNo ratings yet

- Blockchain SampleDocument3 pagesBlockchain SampleAna MedanNo ratings yet

- Department of Computer Science & Engineering: Bbdnitm LucknowDocument6 pagesDepartment of Computer Science & Engineering: Bbdnitm Lucknowneha ShuklaNo ratings yet

- User S Manual Fuel Dispenser EnG (087 116)Document30 pagesUser S Manual Fuel Dispenser EnG (087 116)sam tariqNo ratings yet

- Linux TrainingDocument35 pagesLinux Trainingktik11100% (1)

- Sepd2006 00Document26 pagesSepd2006 00jgmanaure3105No ratings yet

- CV - Vilma Tafilica 2Document2 pagesCV - Vilma Tafilica 2Vilma TafilicaNo ratings yet

- Soft Skills Project PlanDocument9 pagesSoft Skills Project Planapi-601533359No ratings yet

- 2013 PATH3206 Course Manual PDFDocument71 pages2013 PATH3206 Course Manual PDFTaonga ZuluNo ratings yet

- Innovate 3ZZ3 - Welcome and Survey On Team PreferencesDocument1 pageInnovate 3ZZ3 - Welcome and Survey On Team PreferencesDan KlausnerNo ratings yet

- Microsoft Official Course: Deploying and Managing Windows Server 2012Document38 pagesMicrosoft Official Course: Deploying and Managing Windows Server 2012Adela Milea100% (1)

- Iot Based Health Monitoring SystemDocument13 pagesIot Based Health Monitoring SystemSamuelNo ratings yet

- Birla Institute of Technology and Science, Pilani Pilani Campus Instruction DivisionDocument2 pagesBirla Institute of Technology and Science, Pilani Pilani Campus Instruction Divisiontourist101No ratings yet

- Nortel Meridian SL100 BrochureDocument4 pagesNortel Meridian SL100 BrochurescribphxNo ratings yet

- Unit 5 Gis Data Models and Spatial Data StructureDocument18 pagesUnit 5 Gis Data Models and Spatial Data Structuresarbodaya maviNo ratings yet

- Practical Guide To Cloud MigrationDocument124 pagesPractical Guide To Cloud MigrationRpl MarseilleNo ratings yet

- Arjeta Madre Ecs A960m-Mv (V1.0a) Tm-355317-6Document3 pagesArjeta Madre Ecs A960m-Mv (V1.0a) Tm-355317-6iraudyNo ratings yet

- Axapta Hardware Guide 250usersDocument14 pagesAxapta Hardware Guide 250usersRomeo AlamNo ratings yet

- EV07 GPRS ProtocolDocument21 pagesEV07 GPRS ProtocolJonathan ChoyNo ratings yet

- Informatica Power Exchange Architecture PDFDocument24 pagesInformatica Power Exchange Architecture PDFDacalty Dac50% (2)

- Edited Gfi Seminar ReportDocument18 pagesEdited Gfi Seminar Reportkerya ibrahimNo ratings yet

- HP Enterprise Seeburger BIS LINK PLUS Installation Guide - POLLINGDocument16 pagesHP Enterprise Seeburger BIS LINK PLUS Installation Guide - POLLINGTyas IdeNo ratings yet

- 1D2226UKDocument2 pages1D2226UKAndrei Demetrin BolovanNo ratings yet

Apack Prod Doc FCUBS 12.0 Commitment

Apack Prod Doc FCUBS 12.0 Commitment

Uploaded by

narayanampCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Apack Prod Doc FCUBS 12.0 Commitment

Apack Prod Doc FCUBS 12.0 Commitment

Uploaded by

narayanampCopyright:

Available Formats

ORACLE FLEXCUBE

Accelerator Pack – Product Catalogue

ORACLE

FINANCIAL SERVICES

Accelerator Pack – Product Catalogue Page 1 of 19

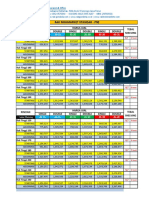

Contents

Product catalogue – Commitment (CL) ............................................................................................................. 4

1. Product Code – CLCM- Loan Commitment-(Commitment Product for CL) ..................................... 4

1.1 Introduction: ................................................................................................................................... 4

1.2 Business Scenario: .......................................................................................................................... 4

1.3 Synopsis: ......................................................................................................................................... 4

1.4 Detailed Coverage: .......................................................................................................................... 4

1.5 Events Covered: ............................................................................................................................... 5

1.6 Additional Information (UDF)/Special Maintenance ...................................................................... 5

2. Product Code – CLC1- Loan Commitment-(Commitment Product for CL) ...................................... 6

2.1 Introduction: .................................................................................................................................... 6

2.2 Business Scenario: ........................................................................................................................... 6

2.3 Synopsis: .......................................................................................................................................... 6

2.4 Detailed Coverage: .......................................................................................................................... 6

2.5 Events Covered: ............................................................................................................................... 8

2.6 Additional Information (UDF)/Special Maintenance ...................................................................... 8

3. Product Code – CLLM- Loan Limits Product (Commitment Limits Product for Loans) .................. 9

3.1 Introduction: .................................................................................................................................... 9

3.2 Business Scenario: ........................................................................................................................... 9

3.3 Synopsis: .......................................................................................................................................... 9

3.4 Detailed Coverage: .......................................................................................................................... 9

3.5 Events Covered: ............................................................................................................................. 10

3.6 Additional Information (UDF)/Special Maintenance .................................................................... 10

4. Product Code – MOCM - Mortgage Commitment-(Commitment Product for Mortgages) ............. 11

4.1 Introduction: .................................................................................................................................. 11

4.2 Business Scenario: ......................................................................................................................... 11

4.3 Synopsis: ........................................................................................................................................ 11

4.4 Detailed Coverage: ........................................................................................................................ 11

4.5 Events Covered: ............................................................................................................................. 13

4.6 Additional Information (UDF)/Special Maintenance .................................................................... 13

5. Product Code – MOC2 - Mortgage Commitment-(Commitment Product for Mortgages)............... 14

5.1 Introduction: .................................................................................................................................. 14

5.2 Business Scenario: ......................................................................................................................... 14

5.3 Synopsis: ........................................................................................................................................ 14

5.4 Detailed Coverage: ........................................................................................................................ 14

5.5 Events Covered: ............................................................................................................................. 15

5.6 Additional Information (UDF)/Special Maintenance .................................................................... 16

6. Product Code – MOLM - Mortgage Limits Commitment-(Commitment Limits Product for

Mortgages) ................................................................................................................................................... 17

6.1 Introduction: .................................................................................................................................. 17

6.2 Business Scenario: ......................................................................................................................... 17

6.3 Synopsis: ........................................................................................................................................ 17

Accelerator Pack – Product Catalogue Page 2 of 19

6.4 Detailed Coverage: ........................................................................................................................ 17

6.5 Events Covered: ............................................................................................................................. 18

6.6 Additional Information (UDF)/Special Maintenance .................................................................... 18

Accelerator Pack – Product Catalogue Page 3 of 19

Product catalogue – Commitment (CL)

1. Product Code – CLCM- Loan Commitment-(Commitment Product for CL)

1.1 Introduction:

Commitment is a loan amount that may be drawn-down or is due to be contractually funded

in the future. Loan commitments consist of both open-end (Revolving) and closed-end (Non-

Revolving) loans.

1.2 Business Scenario:

Commitments get utilized when loans are booked under the commitment.

Customer can prefer to take a Revolving or non-revolving kind of commitment:

o Revolving commitments get their amount financed reinitiated on payment of the

Loan linked to the commitment is done

o Non-Revolving commitments do not get their amount financed (commitment

balance) reinitiated on payment of the Loan linked to the commitment is done

Charges and Fee can also be charged based on the Utilization of the commitment.

1.3 Synopsis:

The product can be-used to create non-revolving and revolving commitments.

The disbursement mode is Auto.

Commitments created using this product can have Un-utilization fee (MAIN_INT) and

Utilization fee schedules can be booked with user defined formulae and on different

dates or in same dates.

Un-utilization fee calculation based on principal unutilized.

Utilization fee calculation based on difference of Loan Amount financed and commitment

Principal unutilized.

Processing charge is also handled in this product.

1.4 Detailed Coverage:

Preferences:

Disbursement Mode

o Auto

Rate (Cross currency transaction preference)

o Normal variance : 5

o Maximum variance: 15

o Standard Middle rate is used

Liquidation

o Auto liquidation

o Partial liquidation not allowed

Holiday treatment

o Schedule movement is move forward

o Ignore holidays

Account preferences

o Liquidate back value dated schedules allowed

o Interest statement is enabled

o Back period entry allowed

Principal Component:

Disbursement schedule starts from value date of contract and schedule frequency is

daily.

Main Interest Component:

Accelerator Pack – Product Catalogue Page 4 of 19

Formula type is User defined

Calculated based on Principal unutilized

Main component

Accrued daily

Verify funds enabled

Interest type can be fixed or floating

Repayment schedule starts from value date of contract and schedule frequency is

monthly.

Utilization fee component

Formula type is User defined

Calculated based on Amount financed - Principal unutilized(i.e. the Utilized Amount)

Accrued daily

Interest type can be fixed or floating

Repayment schedule starts from value date of contract and schedule frequency is

monthly

Processing charge component:

Minimum and maximum charges are maintained.

Any amount can be input during booking of contract.

Charge is calculated through a flat rate and it is based on the financed amount.

If calculated charge is less than minimum charge, then minimum charge is collected.

If calculated charge is more than maximum charge, then maximum charge is collected.

If calculated charge is neither less than minimum charge nor more than maximum

charge, then charge calculated based on amount financed is collected

1.5 Events Covered:

ACCR - Accrual

ALIQ - Automatic Liquidation

BOOK - Booking of contract

DSBR - Disbursement

INIT - Contract Initiation

MLIQ - Manual Liquidation

LINK - Linkage of commitment

DLNK - De-linkage of commitment

RACR - Reversal Accrual

CLOC - Closure of commitment

VAMI Value Dated Amendment Initiation

VAMB - Value Dated Amendment Booking

TRFR - Branch Transfer

TADJ - Branch Transfer Adjustment

1.6 Additional Information (UDF)/Special Maintenance

UDF:

Character UDF - CUSTOMER CATEGORY

MIS:

MIS Classes

o COS_CENTR

o LOAN_TYPE

o LOAN_TERM

Accelerator Pack – Product Catalogue Page 5 of 19

2. Product Code – CLC1- Loan Commitment-(Commitment Product for CL)

2.1 Introduction:

Commitment is a loan amount that may be drawn-down or is due to be contractually funded

in the future. Loan commitments consist of both open-end (Revolving) and closed-end (Non-

Revolving) loans.

2.2 Business Scenario:

Commitments get utilized when loans are booked under the commitment.

Customer can prefer to take a Revolving or non-revolving kind of commitment:

o Revolving commitments get their amount financed reinitiated on payment of the

Loan linked to the commitment is done

o Non-Revolving commitments do not get their amount financed (commitment

balance) reinitiated on payment of the Loan linked to the commitment is done

Charges and Fee can also be charged based on the Utilization of the commitment.

Assigning status to commitments based on overdue days.

2.3 Synopsis:

The product can be-used to create non-revolving and revolving commitments.

The disbursement mode is manual.

Commitments created using this product can have Un-utilization fee (MAIN_INT) and

Utilization fee schedules can be booked with user defined formulae and on different

dates or in same dates.

Un-utilization fee calculation based on principal unutilized.

Utilization fee calculation based on difference of Loan Amount financed and commitment

Principal unutilized.

Handling charge and Service tax collected during the commitment booking.

Processing charge collected during the commitment initiation.

2.4 Detailed Coverage:

Preferences:

Disbursement Mode

o Manual

Rate (Cross currency transaction preference)

o Normal variance : 5

o Maximum variance: 15

o Standard Middle rate is used

Liquidation

o Auto Liquidation

o Partial liquidation not allowed

Holiday treatment

o Local Holiday

o Schedule movement is move forward

Account preferences

o Liquidate back value dated schedules allowed

o Interest statement is enabled

o Back period entry allowed

Rollover

o Not Applicable.

Rekey Required

o Amount financed, Book date, Currency and Maturity date have to be entered

during the authorization for all the transactions on the commitment booked using

this product.

Accelerator Pack – Product Catalogue Page 6 of 19

Principal Component:

No Disbursement schedule maintained.

Main Interest Component:

Formula type is User defined

Calculated based on Principal unutilized

Main component

Accrued daily

Verify funds enabled

Repayment schedule starts from value date of contract and schedule frequency

is monthly

Utilization fee component

Formula type is User defined

Calculated based on Amount financed - Principal unutilized(i.e. the Utilized Amount)

Accrued daily.

Grace days allowed is 5 days.

Verify funds are enabled.

Repayment schedule starts from value date of contract and schedule frequency is

monthly

Processing charge component:

Minimum and maximum charges are maintained.

Any amount can be input during booking of contract.

Charge is calculated through a flat rate and it is based on the financed amount.

If calculated charge is less than minimum charge, then minimum charge is collected.

If calculated charge is more than maximum charge, then maximum charge is collected.

If calculated charge is neither less than minimum charge nor more than maximum

charge, then charge calculated based on amount financed is collected

Handling charge component:

Any amount can be input during booking of contract.

No repayment schedule.

Verify funds are enabled.

Calculation method is Actual / 365.

Service tax component:

Any rate can be input during booking of contract.

Service_tax is calculated through a flat rate and it is based on the processing charge rate

and amount financed.

No repayment schedule.

Verify funds are enabled.

Calculation method is Actual / 365.

Adhoc charge component:

• No repayment schedule.

• Verify funds are enabled.

• Calculation method is Actual / 365.

Accelerator Pack – Product Catalogue Page 7 of 19

2.5 Events Covered:

ACCR - Accrual

ALIQ - Automatic Liquidation

BOOK - Booking of contract

DSBR - Disbursement

INIT - Contract Initiation

MLIQ - Manual Liquidation

LINK - Linkage of commitment

DLNK - De-linkage of commitment

RACR - Reversal Accrual

CLOC - Closure of commitment

VAMI Value Dated Amendment Initiation

VAMB - Value Dated Amendment Booking

2.6 Additional Information (UDF)/Special Maintenance

MIS:

MIS Classes

o COS_CENTR

o LOAN_TYPE

o LOAN_TERM

Accelerator Pack – Product Catalogue Page 8 of 19

3. Product Code – CLLM- Loan Limits Product (Commitment Limits Product for

Loans)

3.1 Introduction:

This product can be used to create commitments through facilities and collaterals. If this

product is linked to a facility/collateral, a commitment contract will be created automatically

during the EOD. Commitments created using this product can have Un-utilization fee

(MAIN_INT) and Utilization fee schedules in different dates or in same dates.

3.2 Business Scenario:

Commitment contract can be created against a facility (credit line) or collateral

Loans with Un-utilization fee and Utilization fee can be booked with user defined

formulae.

Un-utilization fee calculation is based on principal unutilized.

Utilization fee is computed on the basis of difference of Loan Amount financed and

commitment Principal unutilized.

3.3 Synopsis:

This product is a “Limits Product”.

It can be used to create a revolving commitment.

Commitments are created automatically.

Commitments are utilized / re-instated whenever the corresponding facility/collateral is

utilized / re-instated.

3.4 Detailed Coverage:

Preferences:

Disbursement Mode

o Auto

Rate (Cross currency transaction preference)

o Normal variance : 5

o Maximum variance: 15

o Standard Middle rate is used

Liquidation

o Auto

o Partial Liquidation not allowed

Holiday treatment

o Schedule movement is move forward

o Ignore holidays

Account preferences

o Liquidate back value dated schedules allowed

o Interest statement is enabled

o Back period entry allowed

Limits Product

Principal Component:

Disbursement schedule starts from value date of contract and schedule frequency is

daily.

Accelerator Pack – Product Catalogue Page 9 of 19

Main Interest Component:

Formula type is User defined

Calculated based on Principal unutilized

Main component

Accrued daily

Verify funds enabled

Interest type can be fixed or floating

Repayment schedule starts from value date of contract and schedule frequency is

monthly.

Utilization fee component

Formula type is User defined

Calculated based on Amount financed - Principal unutilized (i.e. Utilized Amount)

Accrued daily

Interest type can be fixed or floating

Repayment schedule starts from value date of contract and schedule frequency is

monthly

3.5 Events Covered:

ACCR - Accrual

ALIQ - Automatic Liquidation

BOOK - Booking of contract

DSBR - Disbursement

INIT - Contract Initiation

MLIQ - Manual Liquidation

LINK - Linkage of commitment

DLNK - De-linkage of commitment

RACR - Reversal Accrual

CLOC - Closure of commitment

VAMI Value Dated Amendment Initiation

VAMB - Value Dated Amendment Booking

3.6 Additional Information (UDF)/Special Maintenance

MIS:

MIS Classes

o COS_CENTR

o LOAN_TYPE

o LOAN_TERM

Accelerator Pack – Product Catalogue Page 10 of 19

4. Product Code – MOCM - Mortgage Commitment-(Commitment Product for

Mortgages)

4.1 Introduction:

Commitment is a loan amount that may be drawn-down or is due to be contractually funded

in the future. Loan commitments consist of both open-end (Revolving) and closed-end (Non-

Revolving) loans.

4.2 Business Scenario:

Commitments get utilized when mortgages are booked under the commitment.

Customer can prefer to take a Revolving or non-revolving kind of commitment:

o Revolving commitments get their amount financed reinitiated on payment of the

mortgage linked to the commitment is done

o Non-Revolving commitments do not get their amount financed (commitment

balance) reinitiated on payment of the mortgage linked to the commitment is

done

Charges and Fee can also be charged based on the Utilization of the commitment.

4.3 Synopsis:

The product can be-used to create non-revolving and revolving commitments.

The disbursement mode is Auto

Commitments created using this product can have Un-utilization fee (MAIN_INT) and

Utilization fee schedules can be booked with user defined formulae and on different

dates or in same dates.

Un-utilization fee calculation based on principal unutilized.

Utilization fee calculation based on difference of Loan Amount financed and commitment

Principal unutilized.

Processing charge, Handling Charge, Adhoc charge and Service tax is also handled in

this product.

4.4 Detailed Coverage:

Preferences:

Disbursement Mode

o Auto

Rate (Cross currency transaction preference)

o Normal variance : 5

o Maximum variance: 10

o Standard Middle rate is used

Liquidation

o Auto liquidation

o Partial liquidation not allowed

Holiday treatment

o Ignore holidays

o Schedule movement is move forward

Account preferences

o Liquidate back value dated schedules allowed

o Interest statement is enabled

o Back period entry allowed

Rollover

o Not applicable .

Accelerator Pack – Product Catalogue Page 11 of 19

Principal Component:

Disbursement schedule starts from value date of contract and schedule frequency is

daily.

Main Interest Component:

Formula type is User defined

Calculated based on Principal unutilized

Main component

Accrued daily

Verify funds enabled

Repayment schedule starts from value date of contract and schedule frequency is

monthly.

Utilization fee component

Formula type is User defined

Calculated based on Amount financed - Principal unutilized(i.e. the Utilized Amount)

Accrued daily.

Verify funds are enabled.

Repayment schedule starts from value date of contract and schedule frequency is

monthly

Processing charge component:

Minimum and maximum charges are maintained.

Any amount can be input during booking of contract.

Charge is calculated through a flat rate and it is based on the financed amount.

If calculated charge is less than minimum charge, then minimum charge is collected.

If calculated charge is more than maximum charge, then maximum charge is collected.

If calculated charge is neither less than minimum charge nor more than maximum

charge, then charge calculated based on amount financed is collected

Handling charge component:

Any amount can be input during booking of contract.

No repayment schedule.

Verify funds are enabled.

Calculation method is Actual / 365.

Service tax component:

Any rate can be input during booking of contract.

Service_tax is calculated through a flat rate and it is based on the processing charge rate

and amount financed.

No repayment schedule.

Verify funds are enabled.

Calculation method is Actual / 365.

Adhoc charge component:

No repayment schedule.

Verify funds are enabled.

Calculation method is Actual / 365.

Accelerator Pack – Product Catalogue Page 12 of 19

4.5 Events Covered:

ACCR - Accrual

ALIQ - Automatic Liquidation

BOOK - Booking of contract

DSBR - Disbursement

INIT - Contract Initiation

MLIQ - Manual Liquidation

LINK - Linkage of commitment

DLNK - De-linkage of commitment

RACR - Reversal Accrual

CLOC - Closure of commitment

VAMI Value Dated Amendment Initiation

VAMB - Value Dated Amendment Booking

4.6 Additional Information (UDF)/Special Maintenance

UDF:

Character UDF - CUSTOMER CATEGORY

MIS:

MIS Classes

o COS_CENTR

o LOAN_TYPE

o LOAN_TERM

Accelerator Pack – Product Catalogue Page 13 of 19

5. Product Code – MOC2 - Mortgage Commitment-(Commitment Product for

Mortgages)

5.1 Introduction:

Commitment is a Mortgage amount that may be drawn-down or is due to be contractually

funded in the future. Mortgage commitments consist of both open-end (Revolving) and

closed-end (Non-Revolving) Mortgages.

5.2 Business Scenario:

Commitments get utilized when Mortgages are booked under the commitment.

Customer can prefer to take a Revolving or non-revolving kind of commitment:

o Revolving commitments get their amount financed reinitiated once the payment

of the Mortgage linked to the commitment is done

o Non-Revolving commitments do not get their amount financed (commitment

balance) reinitiated once the payment of the Mortgage linked to the commitment

is done

Charges and Fee can also be charged based on the Utilization of the commitment.

5.3 Synopsis:

The product can be-used to create non-revolving and revolving commitments.

The disbursement mode is Manual

Commitments created using this product can have Un-utilization fee (MAIN_INT) and

Utilization fee schedules can be booked with user defined formulae and on different

dates or in same dates.

Un-utilization fee calculation based on principal unutilized.

Utilization fee calculation based on difference of Mortgage Amount financed and

commitment Principal unutilized.

Processing charge, Handling Charge, Adhoc charge and Service tax is also handled in

this product.

5.4 Detailed Coverage:

Preferences:

Disbursement Mode

o Manual

Rate (Cross currency transaction preference)

o Normal variance : 5

o Maximum variance: 15

o Standard Middle rate is used

Liquidation

o Auto liquidation

o Partial liquidation not allowed

Holiday treatment

o Iocal holidays

o Schedule movement is move forward

Account preferences

o Liquidate back value dated schedules allowed

o Interest statement is enabled

o Back period entry allowed

Rollover

o Not applicable .

Accelerator Pack – Product Catalogue Page 14 of 19

Rekey Required

o Book date and Maturity date have to be entered during the authorization for all

the transactions on the commitment booked using this product.

Principal Component:

No disbursement schedule is maintained.

Main Interest Component:

Formula type is User defined

Calculated based on Principal unutilized

Main component

Accrued daily

Verify funds enabled

Repayment schedule starts from value date of contract and schedule frequency is

monthly.

Utilization fee component

Formula type is User defined

Calculated based on Amount financed - Principal unutilized(i.e. the Utilized Amount)

Accrued daily.

Grace days allowed is 5 days.

Verify funds are enabled.

Repayment schedule starts from value date of contract and schedule frequency is

monthly

Processing charge component:

Minimum and maximum charges are maintained.

Any amount can be input during booking of contract.

Charge is calculated through a flat rate and it is based on the financed amount.

If calculated charge is less than minimum charge, then minimum charge is collected.

If calculated charge is more than maximum charge, then maximum charge is collected.

If calculated charge is neither less than minimum charge nor more than maximum

charge, then charge calculated based on amount financed is collected

Handling charge component:

Any amount can be input during booking of contract.

No repayment schedule.

Verify funds are enabled.

Calculation method is Actual / 365.

Service tax component:

Any rate can be input during booking of contract.

Service_tax is calculated through a flat rate and it is based on the processing charge rate

and amount financed.

No repayment schedule.

Verify funds are enabled.

Calculation method is Actual / 365.

Adhoc charge component:

No repayment schedule.

Verify funds are enabled.

Calculation method is Actual / 365.

5.5 Events Covered:

ACCR - Accrual

ALIQ - Automatic Liquidation

Accelerator Pack – Product Catalogue Page 15 of 19

BOOK - Booking of contract

DSBR - Disbursement

INIT - Contract Initiation

MLIQ - Manual Liquidation

LINK - Linkage of commitment

DLNK - De-linkage of commitment

RACR - Reversal Accrual

CLOC - Closure of commitment

VAMI Value Dated Amendment Initiation

VAMB - Value Dated Amendment Booking

5.6 Additional Information (UDF)/Special Maintenance

MIS:

MIS Classes

o COS_CENTR

o LOAN_TYPE

o LOAN_TERM

Accelerator Pack – Product Catalogue Page 16 of 19

6. Product Code – MOLM - Mortgage Limits Commitment-(Commitment Limits

Product for Mortgages)

6.1 Introduction:

This product can be used to create mortgage commitments through facilities and collaterals.

If this product is linked to a facility/collateral, a commitment contract will be created

automatically during the EOD. This product can be used to create Mortgage Group

Commitments. Commitments created using this product can have Un-utilization fee

(MAIN_INT).

6.2 Business Scenario:

Commitment contract can be created against a facility (credit line) or collateral.

Commitment with Un-utilization fee can be booked with user defined formulae.

Un-utilization fee calculation is based on principal unutilized.

6.3 Synopsis:

This product is a “Limits Product”.

It can be used to create a revolving commitment.

Commitments are created automatically.

Commitments are utilized / re-instated whenever the corresponding facility/collateral is

utilized / re-instated.

6.4 Detailed Coverage:

Preferences:

Disbursement Mode

o Auto

Rate (Cross currency transaction preference)

o Normal variance : 5

o Maximum variance: 10

o Standard Middle rate is used

Liquidation

o Auto liquidation

o Partial liquidation not allowed

Holiday treatment

o Schedule movement is move forward

o Ignore holidays

Account preferences

o Liquidate back value dated schedules allowed

o Interest statement is enabled

o Back period entry allowed

Rollover

o Not applicable .

Limits Product

Principal Component:

Disbursement schedule starts from value date of contract and schedule frequency is

daily.

Main Interest Component:

Formula type is User defined

Calculated based on Principal unutilized

Main component

Accrued daily

Verify funds enabled

Interest type can be fixed or floating

Accelerator Pack – Product Catalogue Page 17 of 19

Repayment schedule starts from value date of contract and schedule frequency is

monthly.

Utilization fee component

Formula type is User defined

Calculated based on Amount financed - Principal unutilized(i.e. the Utilized Amount)

Accrued daily.

Grace days allowed is 5 days.

Verify funds are enabled.

Repayment schedule starts from value date of contract and schedule frequency is

monthly

6.5 Events Covered:

ACCR - Accrual

ALIQ - Automatic Liquidation

BOOK - Booking of contract

DSBR - Disbursement

INIT - Contract Initiation

MLIQ - Manual Liquidation

LINK - Linkage of commitment

DLNK - De-linkage of commitment

RACR - Reversal Accrual

CLOC - Closure of commitment

VAMI Value Dated Amendment Initiation

VAMB - Value Dated Amendment Booking

6.6 Additional Information (UDF)/Special Maintenance

MIS:

MIS Classes

o COS_CENTR

o LOAN_TYPE

o LOAN_TERM

Accelerator Pack – Product Catalogue Page 18 of 19

Oracle Financial Services Software Limited

Oracle Park

Off Western Express Highway

Goregaon (East)

Mumbai, Maharashtra 400 063

India

Worldwide Inquiries:

Phone: +91 22 6718 3000

Fax:+91 22 6718 3001

www.oracle.com/financialservices/

Copyright © [2007] , [2012] , Oracle and/or its affiliates. All rights reserved.

Oracle and Java are registered trademarks of Oracle and/or its affiliates. Other names may be trademarks of their respective

owners.

U.S. GOVERNMENT END USERS: Oracle programs, including any operating system, integrated software, any programs installed

on the hardware, and/or documentation, delivered to U.S. Government end users are “commercial computer software” pursuant to

the applicable Federal Acquisition Regulation and agency-specific supplemental regulations. As such, use, duplication, disclosure,

modification, and adaptation of the programs, including any operating system, integrated software, any programs installed on the

hardware, and/or documentation, shall be subject to license terms and license restrictions applicable to the programs. No other

rights are granted to the U.S. Government.

This software or hardware is developed for general use in a variety of information management applications. It is not developed or

intended for use in any inherently dangerous applications, including applications that may create a risk of personal injury. If you use

this software or hardware in dangerous applications, then you shall be responsible to take all appropriate failsafe, backup,

redundancy, and other measures to ensure its safe use. Oracle Corporation and its affiliates disclaim any liability for any damages

caused by use of this software or hardware in dangerous applications.

This software and related documentation are provided under a license agreement containing restrictions on use and disclosure and

are protected by intellectual property laws. Except as expressly permitted in your license agreement or allowed by law, you may not

use, copy, reproduce, translate, broadcast, modify, license, transmit, distribute, exhibit, perform, publish or display any part, in any

form, or by any means. Reverse engineering, disassembly, or de-compilation of this software, unless required by law for

interoperability, is prohibited.

The information contained herein is subject to change without notice and is not warranted to be error-free. If you find any errors,

please report them to us in writing.

This software or hardware and documentation may provide access to or information on content, products and services from third

parties. Oracle Corporation and its affiliates are not responsible for and expressly disclaim all warranties of any kind with respect to

third-party content, products, and services. Oracle Corporation and its affiliates will not be responsible for any loss, costs, or

damages incurred due to your access to or use of third-party content, products, or services.

Accelerator Pack – Product Catalogue Page 19 of 19

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Becker 1432 Info and MP3 ConversionDocument7 pagesBecker 1432 Info and MP3 ConversionMary JensenNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Information Document Bird AviaryDocument7 pagesInformation Document Bird AviarynarayanampNo ratings yet

- Swift Standards Sr2017 Cat3advanceinfoDocument169 pagesSwift Standards Sr2017 Cat3advanceinfonarayanampNo ratings yet

- Indian Institute of Banking & Finance: Diploma in Retail BankingDocument10 pagesIndian Institute of Banking & Finance: Diploma in Retail BankingnarayanampNo ratings yet

- Apack Prod Doc Fcubs 12.0 FTDocument73 pagesApack Prod Doc Fcubs 12.0 FTnarayanampNo ratings yet

- Capitalization and DepDocument8 pagesCapitalization and DepmohedNo ratings yet

- Dentist Invoice TemplateDocument1 pageDentist Invoice TemplatenarayanampNo ratings yet

- Aura Catalogue Price ListDocument4 pagesAura Catalogue Price ListNarayana ShasthriNo ratings yet

- Sudan University of Science & TechnologyDocument3 pagesSudan University of Science & TechnologyMazin OmarNo ratings yet

- Freebitco in 10000 ScriptDocument4 pagesFreebitco in 10000 Scripttips komputre90No ratings yet

- Rak Minimarket Standar - P90: Single Double Single Double Single Double Rincian Harga Jual Tebal ShelvingDocument6 pagesRak Minimarket Standar - P90: Single Double Single Double Single Double Rincian Harga Jual Tebal ShelvingAndi HadisaputraNo ratings yet

- Responsibilities of NOCDocument8 pagesResponsibilities of NOCRaghav100% (1)

- PLSQL 2 1 PracticeDocument4 pagesPLSQL 2 1 PracticePaola Valdez100% (1)

- IbusDocument5 pagesIbusPopescu IustinNo ratings yet

- ICT-CSS12 Q1 Mod1 PerformingComputerOperations Version1Document53 pagesICT-CSS12 Q1 Mod1 PerformingComputerOperations Version1Rainier DoctoleroNo ratings yet

- Blockchain SampleDocument3 pagesBlockchain SampleAna MedanNo ratings yet

- Department of Computer Science & Engineering: Bbdnitm LucknowDocument6 pagesDepartment of Computer Science & Engineering: Bbdnitm Lucknowneha ShuklaNo ratings yet

- User S Manual Fuel Dispenser EnG (087 116)Document30 pagesUser S Manual Fuel Dispenser EnG (087 116)sam tariqNo ratings yet

- Linux TrainingDocument35 pagesLinux Trainingktik11100% (1)

- Sepd2006 00Document26 pagesSepd2006 00jgmanaure3105No ratings yet

- CV - Vilma Tafilica 2Document2 pagesCV - Vilma Tafilica 2Vilma TafilicaNo ratings yet

- Soft Skills Project PlanDocument9 pagesSoft Skills Project Planapi-601533359No ratings yet

- 2013 PATH3206 Course Manual PDFDocument71 pages2013 PATH3206 Course Manual PDFTaonga ZuluNo ratings yet

- Innovate 3ZZ3 - Welcome and Survey On Team PreferencesDocument1 pageInnovate 3ZZ3 - Welcome and Survey On Team PreferencesDan KlausnerNo ratings yet

- Microsoft Official Course: Deploying and Managing Windows Server 2012Document38 pagesMicrosoft Official Course: Deploying and Managing Windows Server 2012Adela Milea100% (1)

- Iot Based Health Monitoring SystemDocument13 pagesIot Based Health Monitoring SystemSamuelNo ratings yet

- Birla Institute of Technology and Science, Pilani Pilani Campus Instruction DivisionDocument2 pagesBirla Institute of Technology and Science, Pilani Pilani Campus Instruction Divisiontourist101No ratings yet

- Nortel Meridian SL100 BrochureDocument4 pagesNortel Meridian SL100 BrochurescribphxNo ratings yet

- Unit 5 Gis Data Models and Spatial Data StructureDocument18 pagesUnit 5 Gis Data Models and Spatial Data Structuresarbodaya maviNo ratings yet

- Practical Guide To Cloud MigrationDocument124 pagesPractical Guide To Cloud MigrationRpl MarseilleNo ratings yet

- Arjeta Madre Ecs A960m-Mv (V1.0a) Tm-355317-6Document3 pagesArjeta Madre Ecs A960m-Mv (V1.0a) Tm-355317-6iraudyNo ratings yet

- Axapta Hardware Guide 250usersDocument14 pagesAxapta Hardware Guide 250usersRomeo AlamNo ratings yet

- EV07 GPRS ProtocolDocument21 pagesEV07 GPRS ProtocolJonathan ChoyNo ratings yet

- Informatica Power Exchange Architecture PDFDocument24 pagesInformatica Power Exchange Architecture PDFDacalty Dac50% (2)

- Edited Gfi Seminar ReportDocument18 pagesEdited Gfi Seminar Reportkerya ibrahimNo ratings yet

- HP Enterprise Seeburger BIS LINK PLUS Installation Guide - POLLINGDocument16 pagesHP Enterprise Seeburger BIS LINK PLUS Installation Guide - POLLINGTyas IdeNo ratings yet

- 1D2226UKDocument2 pages1D2226UKAndrei Demetrin BolovanNo ratings yet