Professional Documents

Culture Documents

Spe 489

Spe 489

Uploaded by

iyad.alsabiCopyright:

Available Formats

You might also like

- DAFinalReport DA2103221918Document2 pagesDAFinalReport DA2103221918Chaudhary HassanNo ratings yet

- Saudi Arabia AquacultureDocument53 pagesSaudi Arabia Aquacultureiyad.alsabiNo ratings yet

- Direct Immunization Pilot Project Charter 1.5Document11 pagesDirect Immunization Pilot Project Charter 1.5iyad.alsabiNo ratings yet

- Gold Coast University Hospital Business Case 20september 2008Document345 pagesGold Coast University Hospital Business Case 20september 2008iyad.alsabiNo ratings yet

- Banks Work As Intermediaries: Expanding From Intermediation To DistributionDocument13 pagesBanks Work As Intermediaries: Expanding From Intermediation To DistributionShantanu Suresh DeoNo ratings yet

- Accounting IQ TestDocument12 pagesAccounting IQ TestHarichandra Patil100% (3)

- Practice Problems - SolutionsDocument29 pagesPractice Problems - SolutionsTabassumAkhterNo ratings yet

- Subscription Agreement Form: Please Your SelectionDocument2 pagesSubscription Agreement Form: Please Your SelectionMaram SaeedNo ratings yet

- HHDReceipt 010328Document5 pagesHHDReceipt 010328muahmmad akbarNo ratings yet

- HHDReceipt 103415Document5 pagesHHDReceipt 103415muahmmad akbarNo ratings yet

- التكاليف كاملةDocument3 pagesالتكاليف كاملةOsamah AlrasheedNo ratings yet

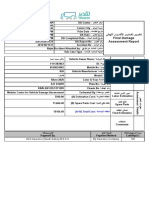

- ا رارــ ا رــ دــ ـ رـ رـ ـ Final Damage Assessment ReportDocument2 pagesا رارــ ا رــ دــ ـ رـ رـ ـ Final Damage Assessment Reportمحمد ال جهنيNo ratings yet

- DAFinalReport DA0405233467Document2 pagesDAFinalReport DA0405233467asd qweNo ratings yet

- Policy ScheduleDocument3 pagesPolicy ScheduleJithu ThomasNo ratings yet

- HHDReceipt 122758Document12 pagesHHDReceipt 122758AshrafNo ratings yet

- HHDReceipt 102917Document5 pagesHHDReceipt 102917muahmmad akbarNo ratings yet

- ا رارــ ا رــ دــ ـ رـ رـ ـ Final Damage Assessment ReportDocument2 pagesا رارــ ا رــ دــ ـ رـ رـ ـ Final Damage Assessment ReportFadi YasinNo ratings yet

- Sana Insurance PDFDocument6 pagesSana Insurance PDFDameer SanaNo ratings yet

- Siggel TejariDocument2 pagesSiggel Tejarijobaid islamNo ratings yet

- P ECH 23 3102 220649-ReceiptDocument1 pageP ECH 23 3102 220649-ReceiptLe RoiNo ratings yet

- التأمين ٢٠٢٢-٢٠٢٣Document2 pagesالتأمين ٢٠٢٢-٢٠٢٣lafamfatamNo ratings yet

- HHDReceipt 173723Document5 pagesHHDReceipt 173723muahmmad akbarNo ratings yet

- LawsuitDocument2 pagesLawsuitasem adelNo ratings yet

- ا رارــ ا رــ دــ ـ رـ رـ ـ Final Damage Assessment ReportDocument2 pagesا رارــ ا رــ دــ ـ رـ رـ ـ Final Damage Assessment Reportkalm Altalb BookNo ratings yet

- PQ InsuranceCard 637968096000000000Document2 pagesPQ InsuranceCard 637968096000000000راكان أحمد الشهريNo ratings yet

- Contract 1339348Document10 pagesContract 1339348mohnad altallaaNo ratings yet

- Policy ScheduleDocument1 pagePolicy Scheduletala hamNo ratings yet

- لقطة شاشة ٢٠٢٢-١١-٢٩ في ٥.٠٢.٣٦ مDocument1 pageلقطة شاشة ٢٠٢٢-١١-٢٩ في ٥.٠٢.٣٦ مH AlmozainihNo ratings yet

- HHDReceipt 143358Document5 pagesHHDReceipt 143358chjunaidchNo ratings yet

- A WALA 1 B 13 021: No Additional DriversDocument3 pagesA WALA 1 B 13 021: No Additional Driversmood271271No ratings yet

- HHDReceipt 122908Document11 pagesHHDReceipt 122908Naif AlajmiNo ratings yet

- Insurance 2020-2021 PDFDocument1 pageInsurance 2020-2021 PDFrajeshmsitNo ratings yet

- HHDReceipt 002117Document5 pagesHHDReceipt 002117ahmedhelail1No ratings yet

- Cash Reimbursement Claim Form : Claimant InformationDocument2 pagesCash Reimbursement Claim Form : Claimant InformationAbdullah AljufayrNo ratings yet

- DAFinalReport DA090720779Document2 pagesDAFinalReport DA090720779Ibrahim Mahmoud AliNo ratings yet

- NajmDocument2 pagesNajmAthar KhanNo ratings yet

- HHDReceipt 114859Document6 pagesHHDReceipt 114859Abo FrajNo ratings yet

- 54120Document1 page54120Marvie Magante LonggosNo ratings yet

- XXMOH HR EMP LETTER681897406 OutDocument1 pageXXMOH HR EMP LETTER681897406 OutAbdulaziz AlahdalNo ratings yet

- DA FinalDocument2 pagesDA Finalmahmoud mohamed100% (1)

- Invoice 7314301287 PDFDocument1 pageInvoice 7314301287 PDFfekry elbaklyNo ratings yet

- Motor Insurance Policy Schedule (Comprehensive Against Loss Damage and Third Party Liability) ( ) Policy NoDocument2 pagesMotor Insurance Policy Schedule (Comprehensive Against Loss Damage and Third Party Liability) ( ) Policy Nofaisal alkamali100% (1)

- وثيقة مشغل صباDocument2 pagesوثيقة مشغل صباJonalyn TamioNo ratings yet

- Taqdeer Center EstimateDocument2 pagesTaqdeer Center EstimateSourav Raha100% (1)

- MUHAMMAD's Health Passport 26-04-2022Document1 pageMUHAMMAD's Health Passport 26-04-2022Asif KhanNo ratings yet

- ا رارــ ا رــ دــ ـ رـ رـ ـ Final Damage Assessment ReportDocument2 pagesا رارــ ا رــ دــ ـ رـ رـ ـ Final Damage Assessment Reportراكان العزبNo ratings yet

- لقطة شاشة ٢٠٢٣-٠٢-٠٥ في ٥.٠٨.٣٣ مDocument1 pageلقطة شاشة ٢٠٢٣-٠٢-٠٥ في ٥.٠٨.٣٣ مadnan adnanNo ratings yet

- en ReportDocument7 pagesen ReportvenubhaskarNo ratings yet

- Vat CertificateDocument1 pageVat CertificateSuhail MohammedNo ratings yet

- HHDReceipt 172906Document7 pagesHHDReceipt 172906عادل الخليفهNo ratings yet

- LawsuitDocument2 pagesLawsuitيبرق البرقNo ratings yet

- DAFinalReport DA0204181035Document2 pagesDAFinalReport DA0204181035Athar Khan100% (1)

- Mohammad Parvez Nagra Ahmeddin Vehicle Insurance Certificate - Lexus 5038Document1 pageMohammad Parvez Nagra Ahmeddin Vehicle Insurance Certificate - Lexus 5038AhmedNo ratings yet

- MANOJ Dumptruck Driver Documents (6118 NBA)Document11 pagesMANOJ Dumptruck Driver Documents (6118 NBA)Dhanu NikkuNo ratings yet

- Po Licy Schedule: Vehicle DetailsDocument15 pagesPo Licy Schedule: Vehicle Detailsابو ملاذ100% (1)

- Ankit Dumptruck (5647 BXA) Driver DocumnetsDocument11 pagesAnkit Dumptruck (5647 BXA) Driver DocumnetsDhanu NikkuNo ratings yet

- Thank you ﻟ ﻚ ﺷ ﻜ ﺮاً: Dear زﻳ ﺪ اﺑ ﻮ ﻣ ﺤ ﻤ ﻮ د ﻣ ﺒﺎ ر ك اﺣ ﻤ ﺪ ﻋ ﺰﻳ ﺰ يDocument2 pagesThank you ﻟ ﻚ ﺷ ﻜ ﺮاً: Dear زﻳ ﺪ اﺑ ﻮ ﻣ ﺤ ﻤ ﻮ د ﻣ ﺒﺎ ر ك اﺣ ﻤ ﺪ ﻋ ﺰﻳ ﺰ يAhmed AbozaiedNo ratings yet

- XXMOH HR EMP LETTER-1987608716 Out PDFDocument1 pageXXMOH HR EMP LETTER-1987608716 Out PDFنواف الخوافNo ratings yet

- MOHAMMED's Health Passport 31-10-2021 3Document1 pageMOHAMMED's Health Passport 31-10-2021 3Mohammedr AldosrryNo ratings yet

- ALI's Health Passport 30-07-2022Document1 pageALI's Health Passport 30-07-2022Ali AqelNo ratings yet

- MemberPriceDocument1 pageMemberPriceregallydivineNo ratings yet

- DownloadDocument2 pagesDownloadmuqbil alwafiNo ratings yet

- خبرة واخلاء طرف حاتم الاقصمDocument1 pageخبرة واخلاء طرف حاتم الاقصمHatim AqNo ratings yet

- Insurance 2 PDFDocument2 pagesInsurance 2 PDFREEMANo ratings yet

- Motor Private Car Third Party Only: Drivers Named List ا ﻟ ﻤ ﺴ ﻤ ﯿ ﯿ ﻦ ا ﻟ ﺴ ﺎ ﺋ ﻘ ﯿ ﻦ ﻗ ﺎ ﺋ ﻤ ﺔDocument4 pagesMotor Private Car Third Party Only: Drivers Named List ا ﻟ ﻤ ﺴ ﻤ ﯿ ﯿ ﻦ ا ﻟ ﺴ ﺎ ﺋ ﻘ ﯿ ﻦ ﻗ ﺎ ﺋ ﻤ ﺔقظفممظفمطتذاذذةبكطغك غيلطامطمفمططفطمف100% (1)

- AIMSDocument3 pagesAIMSDharmendra SinghNo ratings yet

- Managed Entry Agreeement Policy MEADocument7 pagesManaged Entry Agreeement Policy MEAiyad.alsabiNo ratings yet

- Market Research Survey ReportDocument16 pagesMarket Research Survey Reportiyad.alsabiNo ratings yet

- EOI Info - Extended Care ProjectsDocument1 pageEOI Info - Extended Care Projectsiyad.alsabiNo ratings yet

- The Feedback Case - Bill and GraceDocument1 pageThe Feedback Case - Bill and Graceiyad.alsabiNo ratings yet

- Advertising To Children Full ReportDocument354 pagesAdvertising To Children Full Reportiyad.alsabiNo ratings yet

- The SAR 50 Billion E-Commerce Opportunity in Saudi Arabia: A BCG Whitepaper in Collaboration With MetaDocument24 pagesThe SAR 50 Billion E-Commerce Opportunity in Saudi Arabia: A BCG Whitepaper in Collaboration With Metaiyad.alsabiNo ratings yet

- Sfda Approved Drug Mar2021Document9 pagesSfda Approved Drug Mar2021iyad.alsabiNo ratings yet

- Market Research Proposal TemplateDocument3 pagesMarket Research Proposal Templateiyad.alsabiNo ratings yet

- VACCINES COVID-19 INVIGORATES A STAGNANT INDUSTRYresDocument22 pagesVACCINES COVID-19 INVIGORATES A STAGNANT INDUSTRYresiyad.alsabiNo ratings yet

- Improving Health in Saudi Arabia: Through Population Health ManagementDocument27 pagesImproving Health in Saudi Arabia: Through Population Health Managementiyad.alsabiNo ratings yet

- Study RB Future of HealthDocument24 pagesStudy RB Future of Healthiyad.alsabiNo ratings yet

- Opportunities For Pharma in GCCDocument40 pagesOpportunities For Pharma in GCCiyad.alsabiNo ratings yet

- Breast Cancer - Use of Screening Strategies For The Detection of Breast CancerDocument71 pagesBreast Cancer - Use of Screening Strategies For The Detection of Breast Canceriyad.alsabiNo ratings yet

- Getting To Know Internal Auditing: The Profession That Makes A DifferenceDocument16 pagesGetting To Know Internal Auditing: The Profession That Makes A Differenceiyad.alsabiNo ratings yet

- CMA Private Healthcare Report PDFDocument454 pagesCMA Private Healthcare Report PDFiyad.alsabiNo ratings yet

- Livestock and Products Annual Ankara Turkey 8-15-2017Document17 pagesLivestock and Products Annual Ankara Turkey 8-15-2017iyad.alsabiNo ratings yet

- Medis Dossier Portfolio Oct 2015 PDFDocument8 pagesMedis Dossier Portfolio Oct 2015 PDFiyad.alsabiNo ratings yet

- Physical TherapyDocument15 pagesPhysical Therapyiyad.alsabiNo ratings yet

- EXPOLRYSDocument11 pagesEXPOLRYSiyad.alsabiNo ratings yet

- UMC Business PlanDocument37 pagesUMC Business Planiyad.alsabiNo ratings yet

- 3rd Amended Complaint Against Former Stanford EmployeesDocument58 pages3rd Amended Complaint Against Former Stanford EmployeesAllenStanford100% (1)

- Chapter 13 (II) - Investing Surplus Fund (II) (Revised Version)Document3 pagesChapter 13 (II) - Investing Surplus Fund (II) (Revised Version)TAN YUN YUNNo ratings yet

- What The Heck Is Going On With LEAS and BBDADocument54 pagesWhat The Heck Is Going On With LEAS and BBDAtriguy_2010No ratings yet

- 27.leapfx ReviewDocument7 pages27.leapfx ReviewGanpath IyerNo ratings yet

- Blaw Review QuizDocument34 pagesBlaw Review QuizRichard de Leon100% (1)

- Customer Relationship Management Project ReportDocument102 pagesCustomer Relationship Management Project ReportJAI SINGHNo ratings yet

- 2GO Group IncDocument9 pages2GO Group IncPocari OnceNo ratings yet

- Differences Between Financial Accounting and Management AccountingDocument2 pagesDifferences Between Financial Accounting and Management AccountingAlexandra100% (1)

- Major Govt Schemes and Their AnalysisDocument6 pagesMajor Govt Schemes and Their AnalysisGaurav PrabhakerNo ratings yet

- Cape Mob Unit 1 IaDocument11 pagesCape Mob Unit 1 IaShae Conner100% (1)

- Stocks Bought by Investing Gurus That Now Trade 52-Week LowsDocument63 pagesStocks Bought by Investing Gurus That Now Trade 52-Week Lowsjga30328No ratings yet

- Michael Vanin - Layoffs On Wall Street Make It A Dead End For Some BrokersDocument4 pagesMichael Vanin - Layoffs On Wall Street Make It A Dead End For Some BrokersMichael VaninNo ratings yet

- Rolling and Jamming With BollingerDocument62 pagesRolling and Jamming With BollingerPrakashNo ratings yet

- Understanding Balance SheetsDocument26 pagesUnderstanding Balance SheetsAli AhmedNo ratings yet

- MemorialDocument26 pagesMemorialMandira PrakashNo ratings yet

- Minutes of The Board of Directors' Meeting Held On May 08, 2017Document2 pagesMinutes of The Board of Directors' Meeting Held On May 08, 2017JBS RINo ratings yet

- Oberoi Realty Limited - Red Herring ProspectusDocument452 pagesOberoi Realty Limited - Red Herring ProspectusShyam AgarwalNo ratings yet

- Merchant BankingDocument70 pagesMerchant BankingyakshNo ratings yet

- Nego LawwwDocument76 pagesNego LawwwLeeNo ratings yet

- Ch01.Ppt OverviewDocument55 pagesCh01.Ppt OverviewMohammadYaqoob100% (1)

- Poa Jan. 2002 Paper 2Document9 pagesPoa Jan. 2002 Paper 2Jerilee SoCute WattsNo ratings yet

- Perception of Investors Towards Online Trading: IntrodutionDocument64 pagesPerception of Investors Towards Online Trading: IntrodutionArjun S A100% (1)

- There Is Still Trust Property Registered in The Name of A Deregistered CompanyDocument3 pagesThere Is Still Trust Property Registered in The Name of A Deregistered CompanyMirandaNo ratings yet

- Investment Policy Statement Diocese of Brisbane2117Document21 pagesInvestment Policy Statement Diocese of Brisbane2117Dwitya Estu NurpramanaNo ratings yet

- Revenue Memorandum Circulars PDFDocument90 pagesRevenue Memorandum Circulars PDFJewellrie Dela CruzNo ratings yet

- Risk Management Summary: Calpers Trust Level ReviewDocument9 pagesRisk Management Summary: Calpers Trust Level ReviewOluwaloseyi SekoniNo ratings yet

- Iii Semester Endterm Examination October 2018 Subject: Security Analysis & Portfolio ManagementDocument2 pagesIii Semester Endterm Examination October 2018 Subject: Security Analysis & Portfolio ManagementGautam KumarNo ratings yet

Spe 489

Spe 489

Uploaded by

iyad.alsabiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Spe 489

Spe 489

Uploaded by

iyad.alsabiCopyright:

Available Formats

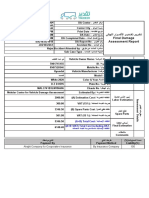

Results Summary of Listed Companies

in the Saudi Market November 2017

3Q2017 Please read Disclaimer on the back

Top 15 Companies Lowest P/E Top 15 Companies Highest D/Y

Company P/E TTM P/BV (x) D/Y (%)* Company D/Y(%)* P/Bv (x) P/E TTM (x)

(x)

Buruj Cooperative Insurance Co. 5.88 1.92 1.70% Saudi Cement Co. 12.99 2.12 11.05

Al-Babtain Co. 7.11 1.38 4.10 Yanbu Cement Co. 11.06 1.19 12.14

Gulf Union Cooperative Insurance Co. 7.32 1.48 -- Al Yamamah Steel Industries Co. 10.44 1.62 10.33

Arabian Shield Insurance Co. 7.46 2.24 4.83 Al Sagr Cooperative Insurance Co. 9.09 1.17 21.51

Bank Aljazira 7.48 0.70 3.28 Aseer Trading Co. 8.99 0.65 -

Altayyar Travel Group 7.69 0.80 2.18 National Shipping Co. 8.99 1.17 11.89

Saudi Investment Bank 7.99 0.77 3.22 Arabian Cement Co. 8.92 1.10 17.74

Solidarity Saudi Takaful Co. 8.19 1.73 -- Zamil Industrial Investment Co. 8.32 0.86 9.07

Saudi Arabian Insurance Co. 8.22 1.30 -- Saudi Chemical Co. 8.31 1.25 13.46

Trade Union Cooperative Insurance Co. 8.22 1.41 -- Arriyadh Development Co. 8.16 1.14 12.35

Arab National Bank 8.35 1.02 4.05 Qassim Cement Co. 7.81 2.06 13.06

United Cooperative Assurance Co. 8.52 1.35 -- Southern Province Cement Co. 7.68 1.93 14.34

Saudi United Insurance Co. 8.63 2.18 -- Al Hassan Ghazi Ibrahim Shaker Co. 7.43 0.66 -

Zamil Industrial Investment Co. 9.07 0.86 8.32 Saudi Airlines Catering Co. 7.43 4.85 13.13

Salama Cooperative Insurance Co. 9.26 2.41 -- Eastern Province Cement Co. 6.67 0.87 12.56

Source: Bloomberg, AlJazira Capital. Prices as of 19 November . * Trailing 12 months (TTM), ** Non recurring profit Source: Bloomberg, AlJazira Capital. Prices as of 19 November

Buruj Insurance Co., Al-Babtain Power and Telecommunication Co., and Gulf

Saudi Cement Co. had the highest dividend yield (12.99%) in the Saudi

Union Cooperative Insurance Co., posted the lowest P/E (5.88x-7.32x) in the

market. The Materials sector dominated the market in terms of dividend

Saudi market for the trailing 12 months (TTM), followed by Arabian Shield

yield, with 8 companies ranking among the top 15 companies.

Cooperative Insurance Co.(7.46x).

Overall, the dividend yield in the Saudi market stood at 3.48%

The average P/E for the Saudi market on a TTM basis stood at 14.75x.

Lowest 15 Companies Lowest P/BV Highest 15 Companies Accumulated Loss to Capital

Company P/Bv (x) P/E TTM D/Y (%)* Company Bk Value P/Bv (x) L/C (%)

(x)

Dar Alarkan Real Estate Development Co. 0.45 30.84 -- Saudi Industrial Export Co. 9.1 1.66 -90.9%

Saudi Ceramic Co. 0.63 - 456.2% Al Sorayai Trading and Industrial 6.0 1.25 -49.4%

Najran Cement Co. 0.64 283.09 -- Etihad Atheeb Telecommunication Co. 5.5 1.09 -45.1%

Saudi Real Estate Co. 0.65 18.68 5.38 MetLife AIG ANB Cooperative Co. 6.1 2.40 -38.6%

Aseer Trading Co. 0.65 - 8.99 Mobile Telecommunications Co. 6.2 0.97 -38.0%

Al Hassan Ghazi Ibrahim Shaker Co. 0.66 - 7.43 Saudi Paper Manufacturing Co. 7.2 1.02 -36.8%

Al Jouf Cement Co. 0.67 25.75 -- Saudi Cable Co. - - -33.8%

Abdullah A. M. Al-Khodari Sons Co. 0.67 - -- Saudi Fisheries Co. 6.7 4.05 -33.3%

Arabian Pipes Co. 0.67 60.93 -- Al-Ahlia Insurance Co. 6.9 1.56 -32.5%

Bank Aljazira 0.70 7.48 3.28 Allied Cooperative Insurance Group 6.8 2.18 -30.1%

Etihad Etisalat Co. 0.70 - -- Middle East Specialized Cables Co. 7.7 1.09 -28.5%

Saudi Arabian Amiantit Co. 0.75 - -- Anaam International Holding Group 7.4 1.74 -25.6%

Hail Cement Co. 0.76 22.33 4.98 Nama Chemicals Co. 11.9 1.42 -22.7%

Saudi Investment Bank 0.77 7.99 3.22 Tihama Advertising Co. 7.8 4.74 -21.7%

Saudi Re for Cooperative Reinsurance Co. 0.77 10.06 -- Saudi Enaya Cooperative insurance Co. 8.0 2.60 -19.7%

L /C refers to accumulated losses to capital Source: Bloomberg, AlJazira Capital. Prices as of 19 November

Source: Bloomberg, AlJazira Capital. Prices as of 19 November

Dar Alarkan Co. had the lowest P/BV (0.45x) in the Saudi market, followed

Saudi Industrial Export Co., Al Sorayai Trading Co., andEithad Atheeb Co.

by Saudi Ceramic Co. (0.63x).

lost 90.9%,49.4%, and 45.1% of capital , respectively.

The TTM P/BV for the Saudi market stood at 1.56x

1 © All rights reserved

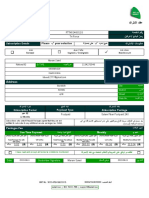

Results Summary of Listed Companies

in the Saudi Market November 2017

3Q2017 Please read Disclaimer on the back

Best 15 Companies Top price performers Worst 15 Companies Worst price performers

Company YTD % P/Bv (x) P/E TTM (x) Company YTD % P/Bv (x) P/E TTM (x)

United Electronics Co. 111.2% 3.93 18.17 Saudi Industrial Export Co. -57.6% 1.66 -

Salama Cooperative Insurance Co. 82.7% 2.41 9.26 The Mediterranean and Gulf Co. -55.6% 2.51 -

Jazan Development Co. 57.0% 1.53 94.90 Southern Province Cement Co. -48.6% 1.93 14.34

Al-Rajhi Company for Cooperative 55.3% 4.29 14.34 National Medical Care Co. -47.8% 1.59 -

AlJazira Mawten REIT 54.2% - - Saudi Cement Co. -46.2% 2.12 11.05

Arabia Insurance Cooperative Co. 54.0% 1.87 27.20 Al Sagr Cooperative Co. -45.0% 1.17 21.51

Saudi Research and Marketing 50.9% 4.32 39.29 Etihad Etisalat Co. -44.9% 0.70 -

Saudi Arabian Mining Co. 42.9% 2.51 73.81 United Wire Factories Co. -43.0% 1.26 24.33

National Agricultural Development Co. 32.6% 1.88 49.10 Nama Chemicals Co. -42.2% 1.42 -

Saudi Enaya Cooperative Co. 27.9% 2.60 - Saudi Ground Services Co. -42.0% 2.51 13.64

Dar Alarkan Real Estate Co. 25.4% 0.45 30.84 Al Hassan Ghazi Ibrahim Shaker Co. -41.4% 0.66 -

Saudi United Cooperative Co. 24.1% 2.18 8.63 Qassim Cement Co. -41.1% 2.06 13.06

Abdullah Al Othaim Markets Co. 23.9% 3.85 14.58 Arabian Pipes Co. -41.1% 0.67 60.93

Jarir Marketing Co. 23.2% 8.08 15.50 Knowledge Economic City -40.8% 1.18 1817.32

National commercial Bank 23.0% 1.71 11.08 Altayyar Travel Group -40.5% 0.80 7.69

Source: Bloomberg, AlJazira Capital. Prices as of 19 November Source: Bloomberg, AlJazira Capital. Prices as of 19 November

Unites Electronics Co. has been the best performing stock since the Saudi Industrial Export Co. has been the worst performer (down 57.6%

beginning of 2017 (up 111.2% YTD), followed by Salama Cooperative YTD), followed by The Mediterranean and Gulf Insurance and Reinsurance

Insurance Co. (up 82.7% YTD). Co. (down 55.6% YTD).

The list indicates that 15 companies appreciated in value of 23.0% or more, The list indicates that 15 companies lost 40.0% or more of their value since

since the start of 2017. the start of the year.

Top 15 Companies Weight to the market index Least 15 Companies Ratio of free to issued shares

No. of free Issued Free float

Company % of TASI float Shares P/E TTM (x) Company Shares (mn) (mn) F/I (%)

(mn)

Al Rajhi Bank 12.7% 1,625.0 11.87 Kingdom Holding Co. 3705.9 185.3 5.0%

Saudi Basic Industries Corp. 8.8% 3,000.0 15.53 Saudi Telecom Co. 2000.0 322.9 16.1%

Jabal Omar Development Co. 5.2% 929.4 427.54 Saudi Electricity Company 4167.0 712.0 17.1%

National Commercial Bank 5.0% 2,000.0 11.08 National Petrochemical Co. 480.0 82.3 17.1%

Samba Financial Group 3.3% 2,000.0 9.49 Saudi Basic Industries Corp 3000.0 629.8 21.0%

Saudi Telecom Co. 3.1% 2,000.0 14.33 Rabigh Refining and Petrochemical 876.0 190.2 21.7%

Almarai Co. 3.0% 1,000.0 24.95 Alawwal Bank 1143.1 314.4 27.5%

Saudi Arabian Mining Co. 2.9% 1,168.5 73.81 Middle East Healthcare Co. 92.0 27.2 29.5%

Banque Saudi Fransi 2.7% 1,205.4 10.67 Saudi Ground Services Co. 188.0 56.0 29.8%

Al Hammadi Co. 120.0 35.9 29.9%

Alinma Bank 2.6% 1,500.0 14.26

L’Azurde For Jewelry Co. 43.0 12.9 30.0%

Riyad Bank 2.5% 3,000.0 11.16

Aljazira Takaful Taawuni Co. 35.0 10.5 30.0%

Savola Group 2.5% 534.0 202.84

Zahrat Al Waha 15.0 4.5 30.0%

Saudi Electricity Co. 2.3% 4,167.0 9.84

Taleem RIET 28.5 8.6 30.0%

Jarir Marketing Co. 1.8% 90.0 15.50

Al Alamiya Cooperative Co. 40.0 12.0 30.0%

Saudi British Bank 1.8% 1,500.0 10.14

Source: Bloomberg, AlJazira Capital. Prices as of 19 November

Source: Bloomberg, AlJazira Capital. Prices as of 19 November F/I refers to free to issued shares

Al Rajhi Bank, at 12.7%, has the highest share of the Saudi market, followed

by Saudi Basic Industries Corp (8.8%), and Jabal Omar Development Co Kingdom Holding Co. has the lowest ratio of free-to-issued shares, with just

(5.2%). These three companies account for more than 26.7% of the market 5.0% of the shares issued being traded in the market.

index.

According to the data, four companies have less than 20.0% of free floats.

The most influential stocks in the Saudi market are from the Banking.

2 © All rights reserved

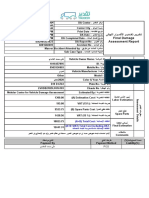

Results Summary of Listed Companies

in the Saudi Market November 2017

3Q2017 Please read Disclaimer on the back

Best 15 Companies Return on Equity (ROE) Best15 Companies Return on Assets (ROA)

Company YTD % P/Bv (x) ROE (%) Company YTD % P/Bv (x) ROA (%)

Jarir Marketing Co. 21.8% 8.08 52.1% Jarir Marketing Co. 21.8% 8.08 29.8%

Saudi Airlines Catering Co. -24.7% 4.85 37.0% Saudi Airlines Catering Co. -24.7% 4.85 24.9%

Buruj Cooperative Insurance Co. 21.5% 1.92 30.5% Saudia Dairy and Foodstuff Co. -1.2% 3.09 17.2%

Al-Rajhi Company for Insurance 54.8% 4.29 28.1% Advanced Petrochemical Co. -2.6% 2.86 16.3%

Arabian Shield Insurance Co. 1.6% 2.24 26.6% Herfy Food Services Co. -20.2% 3.50 14.8%

Abdullah Al Othaim Markets Co. 22.9% 3.85 26.5% Qassim Cement Co. -40.5% 2.06 14.0%

Zahrat Al Waha for Trading Co. -3.1% 3.79 25.4% Mouwasat Medical Services Co. 7.6% 5.78 13.8%

Herfy Food Services Co. -20.2% 3.50 25.3% Saudi Cement Co. -45.5% 2.12 13.6%

Salama Insurance Co. 80.9% 2.41 24.6% Saudi Ground Services Co. -41.5% 2.51 13.3%

Saudi Company for Hardware 20.0% 4.41 24.2% Saudi Arabia Fertilizers Co. -22.7% 3.61 13.3%

Advanced Petrochemical Co. -2.6% 2.86 23.9% Saudi Company for Hardware 20.0% 4.41 12.5%

The Company for Insurance 4.5% 3.85 23.6% Dallah Healthcare Co. 4.9% 3.68 12.1%

Saudi United Insurance Co. 23.5% 2.18 23.0% Middle East Healthcare Co. -27.7% 2.90 12.1%

Saudia Dairy and Foodstuff Co. -1.2% 3.09 22.9% National Gas and Industrialization Co. -14.7% 1.79 11.5%

Mouwasat Medical Services Co. 7.6% 5.78 22.3% Zahrat Al Waha for Trading Co. 3.1% 3.79 11.2%

Source: Bloomberg, AlJazira Capital. Prices as of 19 November Source: Bloomberg, AlJazira Capital. Prices as of 19 November

Jarir Marketing Co. and Saudi Airlines Catering Co. registered the highest

Jarir Marketing Co. has the highest return on equity (RoE) at 52.1% on a

return on assets (RoA) in the Saudi market at 29.8% and24.9% on a TTM

TTM basis, followed by Saudi Airlines Catering Co. at 37.0%.

basis, followed by Saudia Dairy and Foodstuff Co. at 17.2%.

The top 6 companies have RoE of over 26.0%.

The top 4 companies have RoA of over 16.0%

Total net profit for listed companies in the Saudi Market

40,000 50.0%

38.9% 18.8%

40.0%

30,000 -7.3% 30.0%

20.0%

(SAR Mn)

20,000

10.0%

-10.8%

0.0%

10,000

-10.0%

0 -20.0%

4Q2015/2016 1Q2016/2017 2Q2016/2017 3Q2016/2017

Earnings (Prior Year TTM) Earnings (Current Year TTM) % YoY (RHS)

Source: Bloomberg, AlJazira Capital

The overall net earnings of the companies listed on the TASI increased 18.8% YoY to SAR 32.94bn in 3Q2017 from SAR 28.94bn in 3Q2016. Banks and Materials

accounted for 61.0% of total earnings. SABIC, Saudi Electrcity, and Saudi Telecom Company were major growth drivers, accounting for 17.6%,16.0%, and

8.0% share of earnings, respectively, in 3Q2017.

3 © All rights reserved

Results Summary of Listed Companies

in the Saudi Market November 2017

3Q2017 Please read Disclaimer on the back

Sectors Performance

-4.7% YTD

3Q2016 3Q2017 7500

Sector YoY

Net EPS Net EPS Change Sector profit

7300

Profit (SAR)

Profit (SAR) to Total 7100

(SARmn) (SARmn) 6900

Energy 121.7 0.09 784.8 0.59 545.2% 2.38% 6700

Materials 7,580.5 0.64 8,714.9 0.73 15.0% 26.46% 6500

Aug-17

Oct-17

Mar-17

Apr-17

Nov-17

Jan-17

Sep-17

Feb-17

May-17

Jul-17

Jun-17

Capital Goods -89.8 -0.15 1.4 0.00 -101.6% 0.00%

Commercial & Professional Svc. 127.7 0.90 125.8 0.89 -1.5% 0.38% YTD TASI Index Performance

Transportation 347.9 0.71 286.7 0.59 -17.6% 0.87%

Consumer Durables & Apparel -9.8 -0.04 -53.6 -0.21 447.9% -0.16%

Consumer Services 352.0 0.73 233.0 0.49 -33.8% 0.71% YTD 2017 Sector Performance

Media -103.3 -1.18 27.7 0.32 -126.9% 0.08% 30.0%

Retailing 322.7 0.67 262.2 0.54 -18.8% 0.80% 20.0%

Food & Staples Retailing 57.9 0.48 152.8 1.28 164.0% 0.46%

10.0%

Food & Beverages 980.5 0.52 1,591.1 0.85 62.3% 4.83%

Health Care Equipment & Svc. 276.5 0.64 291.9 0.68 5.6% 0.89% 0.0%

Pharma, Biotech & Life Science 7.5 0.06 8.2 0.07 9.3% 0.02% -10.0%

Banks 9,950.1 0.59 11,375.0 0.68 14.3% 34.53%

-20.0%

Diversified Financials -400.5 -0.10 261.5 0.07 -165.3% 0.79%

Food & Beverages

894.3 0.79 756.7 0.67 -15.4% 2.30%

Comm & Prof Svc

Insurance -30.0%

Cons Dura & App

Food & Stapl Ret

HC Equip & Svc

RE Mgmt & Dev

Transportation

Phar, Bio & LS

Consumer Svc

Capital Goods

Diversified Fin

Telecommunication Services 1,799.9 0.53 2,420.4 0.71 34.5% 7.35% -40.0%

Insurance

Utilities 4,958.8 1.17 5,300.6 1.25 6.9% 16.09%

Materials

Retailing

Tel Svc

Utilities

Energy

Banks

Media

Real Estate Mgmt & Dev't. 543.5 0.14 399.2 0.10 -26.6% 1.21%

Total Saudi Market 27,718.0 0.54 32,940.4 0.64 18.8% 100.0%

Source: Tadawul, Bloomberg, AlJazira Capital

hh The Saudi market’s net profit increased 18.8% YoY to SAR 32.9bn in 3Q2017 from SAR27.7bn in 3Q2016.

hh The market’s weighted-average earnings per share (EPS) in 3Q2017 stood at SAR 0.64.

hh Index heavyweights Banks and Materials contributed the most to total earnings (34.5% and 26.5%, respectively), while Consumer Durables &

Apparel contributed the least.

hh Energy sector was the best performer in the Saudi market, with a 545.2% YoY increase in net profit at SAR 784.8 mn in 3Q2017, compared with a net

profit of SAR121.7mn in 3Q2016.

hh In 3Q2017, 9 sectors witnessed YoY decline, while 10 sectors registered YoY increase in profit. The combined profit after tax (PAT) of the 19 sectors

increased 18.8%YoY, led by higher weightage of the Banks and Materials.

4 © All rights reserved

Results Summary of Listed Companies

in the Saudi Market November 2017

3Q2017 Please read Disclaimer on the back

Energy Sector

-24.8% YTD

3Q2016 3Q2017

5300

Company Name YoY 5000

Net EPS Net EPS Change P/E P/Bv

Profit (SAR)

Profit (SAR)

TTM (X) D/Y (%)* 4700

(SARmn) (SARmn) (x) 4400

4100

Saudi Arabia Refineries -1.3 -0.09 -0.3 -0.02 73.8% - 1.14 --

3800

Rabigh Refining -210.6 -0.24 706.5 0.81 - 12.23 1.28 -- 3500

National Shipping 315.4 0.80 60.5 0.15 -80.8% 11.89 1.17 9.0

Aug-17

May-17

Nov-17

Sep-17

Jun-17

Feb-17

Mar-17

Jan-17

Apr-17

Jul-17

Oct-17

Aldrees 18.1 0.36 18.2 0.36 0.6% 18.80 1.93 3.2

Total 121.7 0.09 784.8 0.59 545.2% 12.29 1.25 7.98%

Energy Sector

Source: Tadawul, Bloomberg, AlJazira Capital

* Trailing 12 months (TTM)

YTD 2017 Energy Sector

20%

Net earnings of Saudi Arabia’s Energy sector increased to SAR784.8mn in 3Q2017

10%

compared to SAR121.7mn in 3Q2016. The sector’s EPS stood at SAR 0.59 per share.

0%

RABIGH

hh National Shipping Company of Saudi Arabia was the worst performer during the -10% REFINING

quarter, dropping 80.8% in 3Q2017.

-20%

ALDREES

-30% SAUDI ARABIA

PETROLEU

REF

-40% NATIONAL

SHIPPIN

5 © All rights reserved

Results Summary of Listed Companies

in the Saudi Market November 2017

3Q2017 Please read Disclaimer on the back

Materials Sector

-5.0% YTD

3Q2016 3Q2017 5100

Company Name 5000

Net Net P/E

Profit EPS

(SAR)

Profit EPS

(SAR)

TTM P/Bv

(X)

D/Y

(%)*

4900

(SARmn) (SARmn) (x) 4800

4700

Sahara Petrochemical 108.7 0.25 165.1 0.38 51.9% 12.28 1.18 5.26

4600

Yanbu National Petro 568.3 1.01 644.6 1.15 13.4% 14.08 1.94 5.44 4500

Saudi Basic Industries 5230.0 1.74 5790.0 1.93 10.7% 15.53 1.85 4.00

Jun-17

Jul-17

Jan-17

Feb-17

Sep-17

Oct-17

May-17

Aug-17

Mar-17

Nov-17

Apr-17

Advanced Petrochemical 189.1 0.96 208.0 1.06 10.0% 12.01 2.86 6.22

Alujain Corporation 36.8 0.53 36.1 0.52 -1.9% 11.30 1.09 5.41

National Petrochemical 191.6 0.40 196.9 0.41 2.8% 21.28 1.22 3.05 Materials Sector

National Industrialization 107.94 0.16 191.6 0.29 77.5% 19.01 1.21 --

Saudi Industrial Investment Group -141.3 -0.31 226.5 0.50 -260.3% 13.57 1.32 2.65

Saudi Arabia Fertilizers 186.2 0.45 188.4 0.45 1.2% 22.32 3.61 2.97 % YTD 2017 Materials Sector

Saudi International Petrochemical -49.4 -0.13 121.6 0.33 - 16.53 0.97 --

-50%

-40%

-30%

-20%

-10%

0%

10%

20%

30%

40%

50%

Saudi Kayan 158.2 0.11 381.0 0.25 140.9% 13.40 0.94 --

SABIC

Methanol Chemicals -36.9 -0.31 -9.9 -0.08 73.2% - 0.81 --

MAADEN

Nama Chemicals -30.9 -1.31 -2.0 -0.09 93.5% - 1.42 -- YANSAB

Southern Province 173.6 1.24 57.2 0.41 -67.1% 14.34 1.93 7.68 SAFCO

Saudi Cement 202.0 1.32 87.0 0.57 -56.9% 11.05 2.12 12.99 Kayan

APPC

Hail Cement 19.3 0.20 0.7 0.01 -96.6% 22.33 0.76 4.98

TASNEE

City Cement 32.9 0.17 19.2 0.10 -41.5% 16.44 0.90 2.51 SIIG

Arabian Cement 97.2 0.97 29.5 0.30 -69.7% 17.74 1.10 8.92 Saudi Cement

Al Jouf Cement 14.9 0.10 5.8 0.04 -60.8% 25.75 0.67 -- Sahara Petrochemical

SPICHEM

Tabuk Cement 7.9 0.09 -12.2 -0.14 - 253.80 0.97 -- Yanbu Cement

Northern Region 30.1 0.17 12.5 0.07 -58.4% 31.04 0.83 -- Yamama Cement

Qassim Cement 69.5 0.77 51.2 0.57 -26.2% 13.06 2.06 7.81 Arabian Cement

Southern Cement

Yanbu Cement 92.0 0.58 18.0 0.11 -80.4% 12.14 1.19 11.06

Qassim Cement

Yamamah Cement 56.3 0.28 29.2 0.14 -48.2% 24.15 0.95 1.55 Eastern Cement

Eastern Province 42.0 0.49 13.9 0.16 -67.0% 12.56 0.87 6.67 Northern Cement

Najran Cement 15.6 0.09 -17.1 -0.10 - 283.09 0.64 -- Alujain Corp

PETROCHEM

Umm Al-Qura Cement -4.3 -0.08 5.1 0.09 - 26.16 1.59 -- Zamil Industrial

Takween Advanced 4.4 0.05 -49.1 -0.52 - - 1.04 -- Najran Cement

Middle East Paper 2.3 0.05 22.2 0.44 865.2% 36.77 1.41 3.79 City Cement

Basic Chemical 7.3 0.27 8.3 0.30 13.3% 12.58 1.09 5.30 Al Jouf Cement

Hail Cement

Saudi Arabian Mining 107.5 0.09 242.9 0.21 126.1% 155.89 2.51 -- Chemanol

United Wire Factories 14.3 0.33 7.2 0.16 -49.6% 24.33 1.26 4.39 ASLAK

Al Yamamah Steel ** 20.0 0.39 10.9 0.21 -45.5% 10.33 1.62 10.44 Tabuk Cement

Takween

Saudi Steel Pipe 5.2 0.10 -14.5 -0.28 - - 1.07 --

Arabian Pipes

National Gypsum 5.3 0.17 -4.2 -0.13 - - 0.79 4.55 Zoujaj

The National Glass 4.7 0.14 14.8 0.45 214.5% 10.52 1.04 2.47 UMM AL-QURA

FIPCO 0.1 0.01 0.5 0.04 264.3% 48.76 1.98 1.59 Basic Chemical Industries

Nama Chemicals

Arabian Pipes 4.4 0.11 6.6 0.17 49.5% 60.93 0.67 -- Middle East Paper

MAADANIYAH 1.5 0.05 -4.5 -0.16 - - 1.34 2.71 Maadaniyah

Zamil Industrial 41.2 0.69 21.9 0.37 -46.7% 9.07 0.86 8.32 FIPCO

Al Yamamah Steel

Saudi Paper -21.6 -0.48 -3.3 -0.07 84.8% - 1.02 --

Saudi Paper Manufacturing

Zahrat Al Waha 16.6 1.11 17.2 1.14 3.4% 14.94 3.79 #N/A National Gypsum

Total 7,580.5 0.6 8,714.9 0.73 15.0% 17.26 1.76 4.92% Saudi Steel Pipe

Source: Tadawul, Bloomberg, AlJazira Capital * Trailing 12 months (TTM), * * 4Q Ending in September 30th

The net profit of Saudi Arabia’s Materials sector increased 15.0% YoY to SAR8.7bn in 3Q2017 from SAR7.6bn in 3Q2016. Index heavyweight Saudi Basic

Industries Corp recorded an increase of 10.7%. Saudi Arabia Fertilizers Company reported an increase of 1.2% YoY. The sector’s EPS stood at SAR0.73

per share.

hh All cement companies in this sector registered a YoY decline in profit expect for Umm AlQura which recorded net income of SAR 5.1mn. Najran

Cement Company recorded a loss of SAR17.1mn, while Tabuk Cement loss was at SAR12.2mn.

6 © All rights reserved

Results Summary of Listed Companies

in the Saudi Market November 2017

3Q2017 Please read Disclaimer on the back

Capital Goods Sector

-23.0% YTD

3Q2016 3Q2017

5500

5300

Company Name Net Net P/E 5100

Profit EPS Profit EPS TTM P/Bv D/Y 4900

4700

(SARmn)

(SAR)

(SARmn)

(SAR)

(x) (X) (%)* 4500

4300

4100

Bawan Company 21.1 0.35 23.3 0.39 10.3% 14.87 1.22 5.34 3900

3700

Astra Industrial Group -25.3 -0.32 2.6 0.03 - 37.12 0.99 3.30 3500

ALKHODARI -54.4 -0.98 -22.9 -0.41 58.0% - 0.67 --

Jul-17

Apr-17

Mar-17

Jun-17

Jan-17

Aug-17

Sep-17

Oct-17

Feb-17

May-17

Nov-17

Saudi Ceramic Co. -46.9 -0.94 -39.2 -0.78 16.4% - 0.63 4.56

Saudi Cable Company 0.00 0.00 - - - 0.00 Capital Goods Sector

Al-Ahsa Development -2.5 -0.05 -1.1 -0.02 56.7% - 1.08 --

Saudi Arabian Amiantit -33.6 -0.29 6.4 0.06 - - 0.75 -- YTD 2017 Capital Goods Sector

Al-Babtain 34.6 0.81 30.0 0.70 -13.3% 7.11 1.38 4.10 0%

-10%

Saudi vitrified clay Pipes 12.1 0.81 1.3 0.09 -89.3% 22.45 2.15 6.38 -20%

Middle East Specialized Cables 3.9 0.07 0.2 0.00 -95.7% 56.69 1.09 -- -30%

-40%

Saudi Industrial Export -9.3 -0.86 -10.6 -0.98 -14.0% - 1.66 -- -50%

Al-Ahsa Development Co

Electric Industries 10.5 0.23 11.4 0.25 9.1% 16.45 1.44 4.59 -60%

Saudi Arabian Amiantit

AL BABTAIN POWER

SAUDI CERAMIC CO

-70%

MIDDLE EAST SPEC

ASTRA INDUSTRIAL

ELECTRICAL INDUS

SAUDI INDUS EXPO

Total -89.8 -0.15 1.4 0.00 - 15.71 1.07 4.53%

ABDULLAH A.M. AL

SAUDI CABLE CO

SAUDI VITRIFIED

Source: Tadawul, Bloomberg, AlJazira Capital

BAWAN CO

Net earnings of Saudi Arabia’s Capital Goods sector stood at SAR1.4mn during 3Q2017 compared to SAR89.8mn loss. Middle East Specialized Cables

decreased the most 95.7%YoY decline and stood at SAR0.2mn compared to SAR3.9mn in 3Q2016.

7 © All rights reserved

Results Summary of Listed Companies

in the Saudi Market November 2017

3Q2017 Please read Disclaimer on the back

Commercial & Professional Svc Sector

3Q2016 3Q2017 -21.4% YTD

5300

Company Name YoY

Net EPS Net EPS Change% P/E P/Bv D/Y

5000

Profit (SAR)

Profit (SAR)

TTM (X) (%)* 4700

(SARmn) (SARmn) (x) 4400

Saudi Printing and -11.5 -0.19 -4.6 -0.08 60.2% - 1.11 -- 4100

Packaging 3800

Saudi Airlines Catering 139.2 1.70 130.4 1.59 -6.3% 13.13 4.85 7.43 3500

Jul-17

Feb-17

Apr-17

Mar-17

May-17

Jan-17

Jun-17

Aug-17

Oct-17

Sep-17

Nov-17

Total 127.7 0.90 125.84 0.89 -1.5% 13.13 3.38 6.62%

Source: Tadawul, Bloomberg, AlJazira Capital

Commercial & Professional Services Sector

YTD 2017 Commercial & Professional Svc Sector

0%

-5%

Saudi Arabia’s Commericial & Professional Services sector recorded a 1.5%YoY decline in net

-10%

profit of SAR125.8mn in 3Q2017, as compared to net profit of SAR127.7mn in 3Q2016.

-15%

The sector’s EPS for the quarter stood at SAR 0.89 per share. -20%

Saudi Printing and

Packaging Co.

-25%

Saudi Airlines

-30% Catering

Transportation Sector

3Q2016 3Q2017 -27.4% YTD

YoY 5300

Company Name Net Net Change P/E 5100

Profit EPS Profit EPS % TTM P/Bv D/Y 4900

(SARmn)

(SAR)

(SARmn)

(SAR)

(x) (X) (%)* 4700

4500

Saudi Ground Services 193.7 1.03 160.1 0.85 -17.4% 13.64 2.51 6.66 4300

4100

Saudi Public Transport 88.2 0.71 63.3 0.51 -28.2% 15.05 1.02 3.70 3900

3700

United International Transportation 42.9 0.60 42.8 0.60 -0.3% 10.69 1.66 4.37 3500

Saudi Industrial Services 15.7 0.19 5.7 0.07 -63.7% 11.17 0.77 --

Jul-17

Jun-17

Jan-17

Aug-17

Sep-17

Oct-17

Feb-17

Apr-17

Nov-17

May-17

Mar-17

Batic Investments and Logistics 7.3 0.31 14.8 0.62 102.2% 58.36 3.90 0.45

Transport Sector

Total 347.9 0.71 286.7 0.59 -17.6% 14.21 1.84 4.49%

Source: Tadawul, Bloomberg, AlJazira Capital

YTD 2017 Transportation Sector

0%

-5%

The Transportation sector’s net profit declined 17.6% YoY to SAR286.7mn in 3Q2017 from -10%

Batic

-15%

SAR347.9mn in 3Q2016. The sector’s EPS stood at SAR 0.59 per share. -20%

SAPTCO

BUDGET

-25%

SISCO

Saudi Industrial Services showed a decrease of 63.7% YoY, while Batic Investments and -30%

-35%

Logistics showed an increase of 102.2% YoY. -40%

-45%

SGS

8 © All rights reserved

Results Summary of Listed Companies

in the Saudi Market November 2017

3Q2017 Please read Disclaimer on the back

Consumer Durables & Apparel Sector

3Q2016 3Q2017 -18.3% YTD

5300

Company Name YoY

Net EPS Net EPS Change% P/E P/Bv

5000

Profit (SAR)

Profit (SAR)

TTM (X) D/Y(%)* 4700

(SARmn) (SARmn) (x) 4400

Al Sorayai Trading Group -35.5 -0.95 -49.5 -1.32 -39.4% - 1.25 -- 4100

Saudi Industrial Dev. -7.7 -0.19 -3.6 -0.09 53.2% - 1.01 --

3800

AlAbdullatif Industrial Co 1.5 0.02 3.5 0.04 136.0% 110.36 0.82 4.05

3500

Lazurde Co. 28.7 0.67 0.5 0.01 -98.3% 23.82 1.79 2.96

Oct-17

Jul-17

Jun-17

Jan-17

Feb-17

Sep-17

Apr-17

Aug-17

Nov-17

Mar-17

May-17

Fitaihi Holding Group 3.1 0.06 -4.6 -0.08 - 35.52 0.89 --

Total -9.8 -0.04 -53.6 -0.21 -447.9% 29.00 1.04 3.66%

Source: Tadawul, Bloomberg, AlJazira Capital Consumer Durables & Apparel Sector

YTD 2017 Consumer Durables & Apparel Sector

0%

Saudi Arabia’s Consumer Durables & Apparel sector’s showed a loss of SAR 53.6mn in 3Q2017 -10%

compared to a net loss of SAR 9.8mn in 3Q2016. The sector’s EPS stood at SAR -0.21 per share.

FITAIHI HOLDING

-20%

SIDC

L'AZURDE CO FOR

ALABDULLATIF

The sector’s net loss was supported by Al Sorayai Trading Group and Fitaihi Holding Group -30%

ALSORAYAI

GROUP

which registered a loss of SAR 49.5mn and SAR 4.6mn, respectively, during 3Q2017.

-40%

Consumer Services Sector

3Q2016 3Q2017 -31.8% YTD

Company Name YoY 5500

Net EPS Net EPS Change% P/E P/Bv 5000

Profit (SAR)

Profit (SAR)

TTM (X) D/Y(%)*

(SARmn) (SARmn) (x) 4500

Dur Hospitality Co. 29.6 0.30 15.0 0.15 -49.3% 18.28 1.00 4.80 4000

Al-Tayyar Travel Group 186.8 0.89 131.8 0.63 -29.5% 7.69 0.80 2.18

3500

Tourism Enterprise Co. 0.5 0.05 0.3 0.03 -34.0% - 2.85 --

Herfy Food Services 59.3 0.92 56.0 0.87 -5.5% 13.82 3.50 4.67 3000

Sep-17

Feb-17

Apr-17

Oct-17

Mar-17

May-17

Jan-17

Nov-17

Jun-17

Alkhaleej Co. 20.0 0.50 20.9 0.52 4.6% 13.00 1.37 2.69

Jul-17

Aug-17

Abdulmohsen Alhokair 55.8 1.01 9.0 0.16 -83.9% 24.75 1.79 2.78

Total 352.0 0.73 233.0 0.49 -33.8% 11.04 1.18 2.95% Consumer Services Sector

Source: Tadawul, Bloomberg, AlJazira Capital

YTD 2017 Consumer Services Sector

0%

-10%

The net earnings of Saudi Arabia’s Consumer Services sector declined 33.8% YoY to SAR

AL KHALEEJ TRAIN

-20%

HERFY FOOD SERVI

233.0mn in 3Q2017 from SAR 352.0mn in 3Q2016. The sector’s EPS was SAR 0.49 per share. -30%

SHAMS

DUR HOSPITALITY

-40%

AL TAYYAR TRAVEL

ABDUL MOHSEN AL

-50%

The sector’s earnings were impacted by Abdulmohsen Alhokair net profit, which fell 83.9%

YoY to SAR9.0mn during 3Q2017.

9 © All rights reserved

Results Summary of Listed Companies

in the Saudi Market November 2017

3Q2017 Please read Disclaimer on the back

Media Sector

26.2% YTD

3Q2016 3Q2017

10500

Company Name YoY 9500

Net EPS Net EPS Change% P/E P/Bv

Profit (SAR)

Profit (SAR)

TTM (X) D/Y (%)* 8500

(SARmn) (SARmn) (x) 7500

6500

Saudi Research -80.6 -1.01 25.5 0.32 - 39.3 4.32 --

5500

Tihama Adv. & PR* -22.7 -3.03 2.2 0.30 - - 4.74 -- 4500

Total -103.3 -1.18 27.7 0.32 - 39.288 4.35 0.0% 3500

Oct-17

Feb-17

Aug-17

Jun-17

Sep-17

Jul-17

Nov-17

Jan-17

Apr-17

Mar-17

May-17

Source: Tadawul, Bloomberg, AlJazira Capital

* 4Q Ending March 2017

Media Sector

YTD 2017 Media Sector

Saudi Arabia’s Media sector recorded a net profit of SAR27.7mn in 3Q2017, as compared to a

60%

loss of SAR 103.3mn in 3Q2016.

40%

The sector’s EPS for the quarter stood at SAR 0.32 per share. 20%

0%

SAUDI RESEARCH

-20%

-40%

TIHAMA

-60%

Retailing Sector

9.9% YTD

3Q2016 3Q2017

6500

Company Name YoY 6300

Net EPS Net EPS Change% P/E P/Bv 6100

Profit (SAR)

Profit (SAR)

TTM (X) D/Y (%)* 5900

(SARmn) (SARmn) (x) 5700

5500

Shaker Co. 4.0 0.06 -49.2 -0.78 - - 0.66 7.43 5300

Extra 6.2 0.15 26.1 0.62 321.0% 18.17 3.93 1.58 5100

4900

Saudi Co. for Hardware 21.1 0.88 22.8 0.95 8.2% 18.24 4.41 3.16 4700

Oct-17

Feb-17

Aug-17

Jun-17

Sep-17

Jul-17

Nov-17

Jan-17

Apr-17

Mar-17

May-17

Saudi Automotive 6.7 0.12 9.1 0.17 36.6% 29.02 1.20 --

Jarir Marketing Co. 217.9 2.42 246.5 2.74 13.1% 15.50 8.08 5.55

Retailing Sector

Fawaz AlHokair Co.* 66.8 0.32 6.8 0.03 -89.8% 16.02 1.93 --

Total 322.7 0.67 262.2 0.54 -18.8% 16.39 3.34 5.21%

Source: Tadawul, Bloomberg, AlJazira Capital YTD 2017 Retailing Sector

* 2Q ending September 2017 120%

90%

60%

Saudi Arabia’s Retailing sector recorded a net profit of SAR262.2mn in 3Q2017. The sector’s

30%

EPS stood at SAR 0.54 per share. 0%

Saudi Company

United Electronics

JARIR MARKETING

-30%

SASCO

for Hardware

Hokair

Jarir Marketing Company dominated the sector earnings, the net profit was up 13.1%

Shaker Co.

-60%

YoY to SAR 246.5mn in 3Q2017. In addition, United Electronics Co. registered net profit of

SAR26.1mn compared to SAR 6.2mn in 3Q2016.

10 © All rights reserved

Results Summary of Listed Companies

in the Saudi Market November 2017

3Q2017 Please read Disclaimer on the back

Food & Staples Retailing Sector

7.8% YTD

3Q2016 3Q2017 6100

Company Name YoY 5900

Net EPS Net EPS Change% P/E P/Bv D/Y(%)* 5700

Profit (SAR)

Profit (SAR)

TTM (X) 5500

(SARmn) (SARmn) (x) 5300

5100

Abdullah Al Othaim 36.2 0.80 150.6 3.35 316.2% 14.58 3.85 3.28

4900

Saudi Marketing Co. 23.2 0.52 7.2 0.16 -68.9% 15.21 1.59 4.42 4700

Anaam International -2.8 -0.14 -7.3 -0.37 -160.7% - 1.74 -- 4500

National Agriculture 1.3 0.13 2.2 0.22 73.2% 816.29 2.51 --

Oct-17

Jul-17

Feb-17

Jun-17

Jan-17

Sep-17

Apr-17

Aug-17

Nov-17

Mar-17

May-17

Total 57.9 0.48 152.8 1.28 164.0% 15.31 3.04 3.42%

Source: Tadawul, Bloomberg, AlJazira Capital Food & Staples Retailing Sector

% YTD 2017 Food & Staples Retailing Sector

30%

20%

Net earnings of Saudi Arabia’s Food & Staples sector increased by 164.0% YoY to SAR 10%

0%

152.8mn in 3Q2017 from SAR57.9mn in 3Q2016. The sector’s EPS stood at SAR1.28 per share.

Abdullah Al Othaim

-10%

Abdullah Al Othaim Co. was the best performer during the quarter, reporting a net profit of

-20%

SAR150.6mn in 3Q2017.

Saudi Marketing

-30%

Anaam

Thimar

-40%

Food & Beverages Sector

-2.7% YTD

3Q2016 3Q2017 6500

YoY 6300

Company Name Net Net Change P/E 6100

Profit EPS

(SAR)

Profit EPS

(SAR)

% TTM P/Bv D/Y(%)*

(X)

5900

5700

(SARmn) (SARmn) (x) 5500

5300

Qassim Agriculture Co. 1.4 0.05 1.5 0.05 5.7% 145.98 1.13 2.09 5100

Saudia Dairy and Foodstuff Co.* 81.0 2.49 74.7 2.30 -7.8% 13.51 3.09 3.27 4900

4700

Wafrah for Industry -9.3 -0.47 -8.3 -0.41 11.6% - 2.26 -- 4500

Halwani Bros 22.4 0.78 18.8 0.66 -16.1% 35.70 2.48 5.63

Jul-17

Oct-17

Feb-17

Jun-17

Jan-17

Sep-17

Apr-17

Aug-17

Nov-17

Mar-17

May-17

Almarai Company 664.3 0.66 667.0 0.67 0.4% 24.95 4.39 1.34

Al-Jouf Agriculture 32.9 1.10 11.5 0.38 -65.1% 11.49 0.95 4.23 Food & Beverages Sector

NADEC 28.7 0.34 17.3 0.20 -39.5% 49.10 1.88 --

Jazan Development 6.5 0.13 6.7 0.13 2.6% 94.90 1.53 2.74

Savola Group 179.5 0.34 829.0 1.55 361.8% 202.84 2.17 0.67 % YTD 2017 Food & Beverages Sector

Sharqiya Dev Co. -5.7 -0.76 -4.7 -0.62 18.1% - 1.35 -- 60%

Tabuk Agriculture -11.3 -0.25 -14.4 -0.32 -28.2% - 1.01 -- 40%

Saudi Fisheries Co. -9.9 -0.49 -8.0 -0.40 19.2% - 4.05 -- 20%

Total 980.5 0.52 1,591.1 0.85 62.3% 30.87 3.12 1.31% 0%

Source: Tadawul, Bloomberg, AlJazira Capital, * 4Q Ending in March 2017 -20%

JAZAN DEVELOPMEN

TABUK AGRICULTUR

WAFRAH FOR INDUS

-40%

NATIONAL AGRICUL

AL QASSIM AGRICU

HALWANI BROS CO

SAUDI FISHERIES

Ash-Sharqiyah

ALMARAI CO

SADAFCO

AL JOUF

SAVOLA

Saudi Arabia’s Food & Beverages sector recorded a net profit of SAR1.59bn in 3Q2017

compared to SAR980.5mn in 3Q2016. The sector’s EPS stood at SAR 0.95 per share.

The sector’s increase in earnings was due to an increase in the net profit of index

heavyweights Savola Group (up 361.8%YoY) and Almarai Company (up 0.4% YoY). National

Agricultural Development Co. declined 39.5%YoY to SAR 17.3mn compared to SAR28.7mn in

3Q2016.

11 © All rights reserved

Results Summary of Listed Companies

in the Saudi Market November 2017

3Q2017 Please read Disclaimer on the back

Health Care Equipment & Svc Sector --13.8% YTD

5200

3Q2016 3Q2017 5000

YoY

Company Name Net Net Change% P/E

4800

Profit EPS Profit EPS TTM P/Bv D/Y 4600

(SARmn)

(SAR)

(SARmn)

(SAR)

(x) (X) (%)*

4400

Dallah Healthcare 60.8 1.03 76.8 1.30 26.3% 21.12 3.68 1.97

4200

National Medical Care 27.6 0.61 27.0 0.60 -2.0% - 1.59 --

Oct-17

Feb-17

Aug-17

Jun-17

Sep-17

Nov-17

Jul-17

Jan-17

Apr-17

Mar-17

May-17

Mouwasat Medical 49.4 0.99 76.7 1.53 55.3% 25.91 5.78 1.55

Middle East Healthcare 99.6 1.08 60.0 0.65 -39.8% 15.33 2.90 3.88 Health Care Equipment & Services Sector

Al Hammadi 20.7 0.17 23.6 0.20 13.7% 47.05 2.86 --

Saudi Chemical 18.4 0.29 27.9 0.44 51.2% 13.46 1.25 8.31

Total 276.5 0.64 291.9 0.68 5.6% 21.91 3.08 3.33% % YTD 2017 Health Care Equipment & Svc Sector

Source: Tadawul website, AlJazira Capital 10%

National

Medical Care

0%

Mouwasat Dallah

-10% Medical Healthcare

The Health Care Equipment & Services sector’s net profit increased 5.6% YoY to SAR 291.9mn -20%

AlHammadi

in 3Q2017 compared to SAR 276.5mn in 3Q2016. The sector’s EPS stood at SAR 0.68 per share.

-30% Saudi

Middle East Healthcare Company’s profit (down 39.8% YoY) declined the most. While Saudi Chemical Co

-40% Middle East

Chemical increased the most (up 51.2%YoY).

Healthcare

-50%

Pharma, Biotech & Life Scie. Sector -29.9% YTD

5400

3Q2016 3Q2017 5100

Company Name Net Net YoY P/E 4800

Profit EPS Profit EPS Change% TTM P/Bv D/Y (%)*

(SARmn)

(SAR)

(SARmn)

(SAR)

(x) (X) 4500

4200

Saudi 3900

7.5 0.06 8.2 0.07 9.3% 9.21 1.30 3.49

Pharmaceutical

3600

Total 7.5 0.06 8.2 0.07 9.3% 100.00 1.30 3.49%

Oct-17

Jul-17

Feb-17

Jun-17

Sep-17

Jan-17

Aug-17

Apr-17

Nov-17

Mar-17

May-17

Source: Tadawul, Bloomberg, AlJazira Capital

Pharma, Biotech & Life Science Sector

% YTD 2017Pharma, Biotech & Life Science Sector

0%

-10%

Saudi Arabia’s Pharma, Biotech & Life Science sector increased 9.3% YoY to post a net profit

of SAR8.2mn in 3Q2017 compared to SAR 7.5mn in 3Q2016. The sector’s EPS stood at SAR -20%

0.07 per share.

-30%

SAUDI

-40% PHARMACEUT

12 © All rights reserved

Results Summary of Listed Companies

in the Saudi Market November 2017

3Q2017 Please read Disclaimer on the back

Banks Sector

5.3% YTD

3Q2016 3Q2017 5800

YoY 5500

Company Name Net Net Change%

Profit EPS Profit EPS P/E P/Bv 5200

(SARmn)

(SAR)

(SARmn)

(SAR) TTM (x) (X) D/Y(%)* 4900

4600

Alinma Bank 311.6 0.21 541.8 0.36 73.9% 14.26 1.30 2.86 4300

Al Rajhi Bank 2009.0 1.24 2265.0 1.39 12.7% 11.87 1.93 4.71 4000

Oct-17

Feb-17

Aug-17

Jun-17

Sep-17

Nov-17

Jul-17

Jan-17

Apr-17

Mar-17

May-17

NCB 1962.0 0.98 2126.0 1.06 8.4% 11.08 1.71 3.98

Banks Sector

Banque Saudi Fransi 1010.0 0.84 1001.0 0.83 -0.9% 10.67 1.17 5.03

Riyad Bank 729.0 0.24 1077.0 0.36 47.7% 11.16 0.96 5.35

%-10.0%

YTD 2017 Banks Sector

Saudi British Bank 994.8 0.66 1083.3 0.72 8.9% 10.14 1.19 4.07 25.0%

20.0%

Alawwal Bank 262.8 0.2 363.0 0.32 38.1% 17.37 0.99 -- 15.0%

10.0%

Samba Financial 1341.0 0.7 1308.0 0.65 -2.5% 9.49 1.06 5.38 5.0%

0.0%

Arab National Bank 721.7 0.72 775.5 0.78 7.5% 8.35 1.02 4.05 -5.0%

SAUDI INVESTMENT

-10.0%

BANQUE SAUDI FR

SAUDI BRITISH BK

ARAB NATL BANK

NATIONAL COMM

AlBilad Bank 227.8 0.38 248.1 0.41 8.9% 11.90 1.46 4.30 -15.0%

BANK AL JAZIRA

AL RAJHI BANK

BANK ALBILAD

-20.0%

ALINMA BANK

ALAWWAL BANK

RIYAD BANK

Saudi Investment Bank 219.4 0.29 358.4 0.48 63.4% 7.99 0.77 3.22

SAMBA

Bank AlJazira 161.0 0.31 228.0 0.44 41.6% 7.48 0.70 3.28

Total 9,950.1 0.59 11,375.0 0.68 14.3% 10.86 1.32 4.45%

Source: Tadawul website, AlJazira Capital

The Banking sector’s net profit increased 14.3% YoY to SAR11.4bn in 3Q2017. The sector’s EPS stood at SAR0.68 per share.

Alinma Bank registered the highest growth of 73.9%YoY while Samba Financial Group showed the worst performance with a decline of 2.5%YoY during

3Q2017.

13 © All rights reserved

Results Summary of Listed Companies

in the Saudi Market November 2017

3Q2017 Please read Disclaimer on the back

Diversified Financials Sector

3Q2016 3Q2017 -26.2% YTD

5300

5000

Company Name Net Net YoY Change% P/E

Profit EPS Profit EPS TTM P/Bv D/Y 4700

(SARmn)

(SAR)

(SARmn)

(SAR)

(x) (X) (%)* 4400

4100

Saudi Adv. Ind. Co. 2.5 0.05 9.8 0.20 291.2% 25.84 0.77 2.11 3800

AlBaha 0.0 0.00 -0.3 -0.01 - - 2.69 --

3500

Kingdom Holding Co. -355.0 -0.10 247.5 0.07 - 49.46 1.01 5.92

Oct-17

Jul-17

Feb-17

Jun-17

Jan-17

Sep-17

Apr-17

Aug-17

Nov-17

Mar-17

May-17

Aseer Trading Co. -48.1 -0.38 4.4 0.03 - - 0.65 8.99

Total -400.5 -0.10 261.5 0.07 - 48.63 1.00 6.04%

Diversified Financials Sector

Source: Tadawul, Bloomberg, AlJazira Capital

% YTD 2017 Diversified Financials Sector

0%

Al-Baha Development

-15%

Saudi Advanced Industries

Saudi Arabia’s Diversified Financials sector recorded a net profit of SAR261.5mn in 3Q2017

-30%

compared to a loss of SAR400.5mn in 3Q2016. The sector’s EPS stood at SAR 0.07 per share

Kingdom Holding

Aseer Trading Tourism

-45%

in 3Q2017.

14 © All rights reserved

Results Summary of Listed Companies

in the Saudi Market November 2017

3Q2017 Please read Disclaimer on the back

Insurance Sector

3Q2016 3Q2017 -6.8% YTD

5600

Company Name Net Profit YoY 5400

EPS Net Profit EPS Change% P/E P/Bv

Before (SAR)

Before (SAR)

TTM (X) D/Y (%)* 5200

Zakat(SARmn) Zakat(SARmn) (x) 5000

4800

Saudi Indian Co. 8.7 0.71 -3.6 -0.29 - 17.56 1.90 --

4600

Al Sagr Co-op Ins 26.7 1.07 7.5 0.30 -71.7% 21.51 1.17 9.09

4400

Arabia Insurance Co. -1.7 -0.06 3.9 0.15 - 27.20 1.87 --

Oct-17

Feb-17

Jun-17

Aug-17

Sep-17

Nov-17

Jul-17

Jan-17

Apr-17

May-17

Mar-17

Arabian Shield Co-op 18.7 0.94 23.1 1.16 23.6% 7.46 2.24 4.83

Insurance Sector

Saudi Arabian Co-op 17.4 0.69 16.4 0.66 -5.7% 8.22 1.30 --

United Cooperative 26.1 0.53 -2.2 -0.04 - 8.52 1.35 --

Buruj Insurance Co. 8.6 0.34 24.0 0.96 180.6% 5.88 1.92 1.70 % YTD 2017 Insurance Sector

Al-Rajhi Company 29.6 0.74 58.7 1.47 98.5% 14.34 4.29 --

-70%

-50%

-30%

-10%

10%

30%

50%

70%

90%

Salama Cooperative 8.7 0.35 22.0 0.88 152.1% 9.26 2.41 --

TAWUNIYA

CHUBB Arabia Co. 9.5 0.47 7.8 0.39 -17.6% 11.29 1.84 -- Bupa Arabia

Allied Insurance Co. 4.7 0.24 3.9 0.20 -16.6% 33.57 2.18 -- Walaa

Al Alamiya 12.2 0.31 8.8 0.22 -27.8% 24.29 2.54 -- Al Rajhi Takaful

Arabian Shield

Solidarity Saudi 14.1 0.56 19.6 0.78 39.1% 8.19 1.73 -- Saudi Re

Aljazira Takaful 6.4 0.18 6.8 0.20 6.9% 28.28 2.25 2.03 Buruj

AXA Cooperative 11.2 0.25 12.6 0.28 12.5% 15.70 1.54 -- UCA

MEDGULF

Tawuniya Insurance Co. 283.3 2.27 159.7 1.28 -43.6% 14.79 3.85 4.33 Al Sagr

Allianz Saudi Fransi 6.3 0.32 8.0 0.40 26.5% 22.25 2.71 -- AXA

Alahli Takaful Co. 7.1 0.43 8.7 0.52 22.4% 13.33 2.20 1.63 Trade Union

Al Alamiya

Bupa Arabia 260.4 3.25 217.0 2.71 -16.7% 13.23 3.49 1.53

Salama

SABB Takaful 2.8 0.08 2.1 0.06 -25.1% 91.17 2.12 -- Saudi Arabian

Trade Union Co-op Ins 27.2 0.99 16.7 0.61 -38.6% 8.22 1.41 -- Solidarity Takaful

SABB Takaful

Amana Cooperative 7.9 0.57 14.7 1.05 -85.2% 13.26 2.48 --

Alinma Tokio Marine

Gulf General Co-op 7.0 0.35 4.6 0.23 -33.4% 11.80 1.44 -- Alahli Takaful Co

Wataniya Insurance 8.1 0.40 8.2 0.41 1.9% 9.91 2.40 -- AlJazira Takaful

Amana

The Mediterranean Co. 60.1 1.50 60.1 1.50 0.1% - 2.51 --

Arabia Insurance Cooperative

Malath Co-op Ins 1.3 0.03 11.1 0.22 730.91% - 5.79 -- Wataniya

Saudi Re Co. 2.7 0.03 -0.3 0.00 - 10.06 0.77 -- Saudi Enaya

Chubb Arabia

Al-Ahlia Insurance Co. -8.6 -0.54 3.2 0.20 - 19.81 1.56 --

Allianz SF

Saudi Enaya -6.3 -0.31 0.7 0.04 - - 2.60 -- Malath

Alinma Tokio Marine -1.1 -0.04 -3.2 -0.11 -194.5% - 1.93 -- WAFA

Gulf General

Gulf Union Co-op Ins -0.2 -0.02 2.0 0.13 - 7.32 1.48 --

METLIFE

Walaa Insurance Co. 40.0 1.00 44.4 1.11 11.0% 8.63 2.18 -- Gulf Union

MetLife AIG ANB Co. -4.2 -0.12 -10.4 -0.30 -146.3% - 2.40 -- Allied Cooperative

Total 894.3 0.79 756.7 0.67 -15.4% 13.14 2.62 3.23% Al-Ahlia

Source: Tadawul, Bloomberg, AlJazira Capital

The Insurance sector’s net profit decreased 15.4% YoY to SAR 756.7mn in 3Q2017 from SAR 894.3mn in 3Q2016. The sector’s EPS stood at SAR 0.67 per

share during the quarter.

Sector heavyweights, Bupa Arabia for Cooperative Insurance’s net profit (before zakat) decreased 16.7% YoY to SAR217.0mn in 3Q2017 from SAR 260.4mn

in 3Q2016. The Company for Cooperative Insurance (TAWUNIYA) reported a net profit of SAR159.7mn in 3Q2017 compared to SAR 260.4mn in 3Q2016.

In terms of YoY gain in net profit,Malath Co-op Insurance (up 730.9% YoY), Buruj Cooperative Insurance Co. (up 180.6% YoY), and Salama Cooperative (up

152.1% YoY), were the best performers.

15 © All rights reserved

Results Summary of Listed Companies

in the Saudi Market November 2017

3Q2017 Please read Disclaimer on the back

Telecommunication Sector

3Q2016 3Q2017 -17.3% YTD

5200

YoY

Company Name Net Net Change% P/E 5000

Profit EPS Profit EPS TTM P/Bv D/Y(%)* 4800

(SARmn)

(SAR)

(SARmn)

(SAR)

(x) (X) 4600

4400

Saudi Telecom 2216.9 1.11 2621.3 1.31 18.2% 14.33 2.24 5.77 4200

Mobile Telecomm Co. -266.1 -0.46 3.4 0.01 - - 0.97 -- 4000

3800

Etihad Atheeb Telecom* 15.4 0.24 -29.8 -0.47 - - 1.09 --

Oct-17

Feb-17

Aug-17

Sep-17

Jun-17

Jul-17

Jan-17

Nov-17

Apr-17

Mar-17

May-17

Etihad Etisalat Co -166.3 -0.22 -174.5 -0.23 -4.9% - 0.70 --

Total 1,799.9 0.53 2,420.4 0.71 34.5% 14.33 1.91 5.29% Telecommunication Services Sector

Source: Tadawul, Bloomberg, AlJazira Capital

*4Q Ending March 2017

% YTD 2017 Telecommunication Sector

-0%

-10%

Saudi Telecom Co

-20%

Telecommunication Co

Net earnings of Saudi Arabia’s Telecommunication Services sector surged 34.5% YoY to -30%

Mobile Telecommunications

-40%

SAR2.4bn in 3Q2017 from SAR 1.8bn in 3Q2016. The sector’s EPS stood at SAR 0.71 per share.

Etihad Atheeb

-50%

Etihad Etisalat Co

Saudi Telecom Co. recorded net income of SAR2.6bn during 3Q2017.

Co Saudi Arabi

Utilities Sector

4.2% YTD

3Q2016 3Q2017 5600

Company Name Net Net YoY P/E 5400

Profit EPS Profit EPS Change% TTM P/Bv D/Y (%)* 5200

(SARmn)

(SAR)

(SARmn)

(SAR)

(x) (X)

5000

National Gas & 4800

30.4 0.40 38.7 0.52 27.5% 11.48 1.79 4.97

Industrialization Co. 4600

Saudi Electricity Co. 4928.4 1.18 5261.9 1.26 6.77% 9.84 1.28 2.94 4400

Total 4,958.8 1.17 5,300.6 1.25 6.89% 9.87 1.29 3.1% 4200

Oct-17

Feb-17

Sep-17

Jun-17

Jul-17

Aug-17

Jan-17

Nov-17

Apr-17

Mar-17

May-17

Source: Tadawul website, AlJazira Capital،

Utilities Sector

% YTD 2017 Utilities Sector

Saudi Arabia’s Utilities sector recorded net income of SAR5.3bn in 3Q2017 compared to 10%

SAR4.9bn in 3Q2016. The sector’s EPS stood at SAR 1.25 per share. 5%

0%

SAUDI ELECTRICIT

-5%

-10%

-15%

National Gas &

Industrialization Co

-20%

16 © All rights reserved

Results Summary of Listed Companies

in the Saudi Market November 2017

3Q2017 Please read Disclaimer on the back

Real Estate Mgmt & Dev’t Sector -18.9% YTD

5200

3Q2016 3Q2017 5000

4800

Company Name Net Net YoY P/E

Profit EPS Profit EPS Change% TTM P/Bv D/Y (%)*

4600

(SARmn)

(SAR)

(SARmn)

(SAR)

(x) (X) 4400

4200

Arriyadh Development 37.1 0.28 45.6 0.34 23.0% 12.35 1.14 8.16 4000

Oct-17

Feb-17

Aug-17

Jun-17

Sep-17

Nov-17

Jul-17

Jan-17

Apr-17

Mar-17

May-17

Emaar 69.0 0.08 27.0 0.03 -60.9% 60.15 1.31 --

Taiba Holding Co. 82.9 0.55 64.8 0.43 -21.8% 22.02 1.40 4.73 Real Estate Mgmt & Dev't Sector

Alandalus Property Co. 26.4 0.38 26.4 0.38 0.2% 9.73 1.25 --

% YTD 2017 Real Estate Mgmt & Dev’t Sector

Dar Alarkan 112.5 0.10 209.6 0.19 86.4% 30.84 0.45 -- 30%

20%

Saudi Real Estate Co. 36.2 0.30 20.6 0.17 -43.1% 18.68 0.65 5.38 10%

0%

Makkah Construction* 113.8 0.69 106.4 0.65 -6.5% 32.11 1.11 4.42 -10%

Dar Al Arkan

Makkah Construction

Jabal Omar* 63.4 0.07 -60.8 -0.07 - 427.54 5.65 -- -20%

Alandalus Property

Taiba Holding

Jabal Omar

-30%

Red Sea Housing 10.5 0.18 -12.7 -0.21 - 520.00 1.23 4.12

Arriyadh Dev.

-40%

Emaar

SRECO

Knowledge Economic -8.1 -0.02 -27.8 -0.08 -243.1% 1817.32 1.18 --

Red Sea Intl.

-50%

Knowledge

Total 543.5 0.14 399.2 0.10 -26.6% 66.45 1.72 5.15%

Source: Tadawul, Bloomberg, AlJazira Capital, * Hijri Calender

The net profit of Saudi Arabia’s Real Estate Mgmt & Dev’t sector decreased 26.6% YoY to SAR 399.2mn in 3Q2017 from SAR 543.5mn in 3Q2016. The

sector’s EPS for the quarter was at SAR 0.10 per share.

Knowledge Economic City (down 243.1% YoY), Emaar Company (down 60.9% YoY) and Saudi Real Estate Co. (down 43.1% YoY) led the decrease in the

sector’s net profit during 3Q2017.

17 © All rights reserved

Acting Head of Research Analyst Analyst

RESEARCH DIVISION

Talha Nazar Sultan Al Kadi, CAIA Jassim Al-Jubran

+966 11 2256250 +966 11 2256374 +966 11 2256248

t.nazar@aljaziracapital.com.sa s.alkadi@aljaziracapital.com.sa j.aljabran@aljaziracapital.com.sa

Analyst Analyst

Waleed Al-jubayr Muhanad Al-Odan

+966 11 2256146 +966 11 2256115

W.aljubayr@aljaziracapital.com.sa M.alodan@aljaziracapital.com.sa

BROKERAGE AND INVESTMENT

CENTERS DIVISION

General Manager – Brokerage Services & AGM-Head of international and institutional AGM- Head of Western and Southern Region Investment

sales brokerage Centers

Alaa Al-Yousef Luay Jawad Al-Motawa Mansour Hamad Al-shuaibi

+966 11 2256060 +966 11 2256277 +966 12 6618443

a.yousef@aljaziracapital.com.sa lalmutawa@aljaziracapital.com.sa m.alshuaibi@aljaziracapital.com.sa

AGM-Head of Sales And Investment Centers AGM-Head of Qassim & Eastern Province

Central Region

Sultan Ibrahim AL-Mutawa Abdullah Al-Rahit

+966 11 2256364 +966 16 3617547

s.almutawa@aljaziracapital.com.sa aalrahit@aljaziracapital.com.sa

AlJazira Capital, the investment arm of Bank AlJazira, is a Shariaa Compliant Saudi Closed Joint Stock company and

operating under the regulatory supervision of the Capital Market Authority. AlJazira Capital is licensed to conduct

securities business in all securities business as authorized by CMA, including dealing, managing, arranging, advisory,

RESEARCH

DIVISION

and custody. AlJazira Capital is the continuation of a long success story in the Saudi Tadawul market, having occupied

the market leadership position for several years. With an objective to maintain its market leadership position, AlJazira

Capital is expanding its brokerage capabilities to offer further value-added services, brokerage across MENA and

International markets, as well as offering a full suite of securities business.

1. Overweight: This rating implies that the stock is currently trading at a discount to its 12 months price target.

Stocks rated “Overweight” will typically provide an upside potential of over 10% from the current price levels

over next twelve months.

TERMINOLOGY

2. Underweight: This rating implies that the stock is currently trading at a premium to its 12 months price target.

Stocks rated “Underweight” would typically decline by over 10% from the current price levels over next twelve

RATING

months.

3. Neutral: The rating implies that the stock is trading in the proximate range of its 12 months price target. Stocks

rated “Neutral” is expected to stagnate within +/- 10% range from the current price levels over next twelve

months.

4. Suspension of rating or rating on hold (SR/RH): This basically implies suspension of a rating pending further

analysis of a material change in the fundamentals of the company.

Disclaimer

The purpose of producing this report is to present a general view on the company/economic sector/economic subject under research, and not to recommend a buy/sell/hold for

any security or any other assets. Based on that, this report does not take into consideration the specific financial position of every investor and/or his/her risk appetite in relation

to investing in the security or any other assets, and hence, may not be suitable for all clients depending on their financial position and their ability and willingness to undertake

risks. It is advised that every potential investor seek professional advice from several sources concerning investment decision and should study the impact of such decisions on

his/her financial/legal/tax position and other concerns before getting into such investments or liquidate them partially or fully. The market of stocks, bonds, macroeconomic or

microeconomic variables are of a volatile nature and could witness sudden changes without any prior warning, therefore, the investor in securities or other assets might face

some unexpected risks and fluctuations. All the information, views and expectations and fair values or target prices contained in this report have been compiled or arrived at by

Aljazira Capital from sources believed to be reliable, but Aljazira Capital has not independently verified the contents obtained from these sources and such information may be

condensed or incomplete. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on the fairness, accuracy, completeness

or correctness of the information and opinions contained in this report. Aljazira Capital shall not be liable for any loss as that may arise from the use of this report or its contents or

otherwise arising in connection therewith. The past performance of any investment is not an indicator of future performance. Any financial projections, fair value estimates or price

targets and statements regarding future prospects contained in this document may not be realized. The value of the security or any other assets or the return from them might

increase or decrease. Any change in currency rates may have a positive or negative impact on the value/return on the stock or securities mentioned in the report. The investor might

get an amount less than the amount invested in some cases. Some stocks or securities maybe, by nature, of low volume/trades or may become like that unexpectedly in special

circumstances and this might increase the risk on the investor. Some fees might be levied on some investments in securities. This report has been written by professional employees

in Aljazira Capital, and they undertake that neither them, nor their wives or children hold positions directly in any listed shares or securities contained in this report during the

time of publication of this report, however, The authors and/or their wives/children of this document may own securities in funds open to the public that invest in the securities

mentioned in this document as part of a diversified portfolio over which they have no discretion. This report has been produced independently and separately by the Research

Division at Aljazira Capital and no party (in-house or outside) who might have interest whether direct or indirect have seen the contents of this report before its publishing, except

for those whom corporate positions allow them to do so, and/or third-party persons/institutions who signed a non-disclosure agreement with Aljazira Capital. Funds managed by

Aljazira Capital and its subsidiaries for third parties may own the securities that are the subject of this document. Aljazira Capital or its subsidiaries may own securities in one or more

of the aforementioned companies, and/or indirectly through funds managed by third parties. The Investment Banking division of Aljazira Capital maybe in the process of soliciting

or executing fee earning mandates for companies that is either the subject of this document or is mentioned in this document. One or more of Aljazira Capital board members or

executive managers could be also a board member or member of the executive management at the company or companies mentioned in this report, or their associated companies.

No part of this report may be reproduced whether inside or outside the Kingdom of Saudi Arabia without the written permission of Aljazira Capital. Persons who receive this report

should make themselves aware, of and adhere to, any such restrictions. By accepting this report, the recipient agrees to be bound by the foregoing limitations.

Asset Management | Brokerage | Corporate Finance | Custody | Advisory

Head Office: King Fahad Road, P.O. Box: 20438, Riyadh 11455, Saudi Arabia، Tel: 011 2256000 - Fax: 011 2256068

Aljazira Capital is a Saudi Investment Company licensed by the Capital Market Authority (CMA), license No. 07076-37

You might also like

- DAFinalReport DA2103221918Document2 pagesDAFinalReport DA2103221918Chaudhary HassanNo ratings yet

- Saudi Arabia AquacultureDocument53 pagesSaudi Arabia Aquacultureiyad.alsabiNo ratings yet

- Direct Immunization Pilot Project Charter 1.5Document11 pagesDirect Immunization Pilot Project Charter 1.5iyad.alsabiNo ratings yet

- Gold Coast University Hospital Business Case 20september 2008Document345 pagesGold Coast University Hospital Business Case 20september 2008iyad.alsabiNo ratings yet

- Banks Work As Intermediaries: Expanding From Intermediation To DistributionDocument13 pagesBanks Work As Intermediaries: Expanding From Intermediation To DistributionShantanu Suresh DeoNo ratings yet

- Accounting IQ TestDocument12 pagesAccounting IQ TestHarichandra Patil100% (3)

- Practice Problems - SolutionsDocument29 pagesPractice Problems - SolutionsTabassumAkhterNo ratings yet

- Subscription Agreement Form: Please Your SelectionDocument2 pagesSubscription Agreement Form: Please Your SelectionMaram SaeedNo ratings yet

- HHDReceipt 010328Document5 pagesHHDReceipt 010328muahmmad akbarNo ratings yet

- HHDReceipt 103415Document5 pagesHHDReceipt 103415muahmmad akbarNo ratings yet

- التكاليف كاملةDocument3 pagesالتكاليف كاملةOsamah AlrasheedNo ratings yet

- ا رارــ ا رــ دــ ـ رـ رـ ـ Final Damage Assessment ReportDocument2 pagesا رارــ ا رــ دــ ـ رـ رـ ـ Final Damage Assessment Reportمحمد ال جهنيNo ratings yet

- DAFinalReport DA0405233467Document2 pagesDAFinalReport DA0405233467asd qweNo ratings yet

- Policy ScheduleDocument3 pagesPolicy ScheduleJithu ThomasNo ratings yet

- HHDReceipt 122758Document12 pagesHHDReceipt 122758AshrafNo ratings yet

- HHDReceipt 102917Document5 pagesHHDReceipt 102917muahmmad akbarNo ratings yet

- ا رارــ ا رــ دــ ـ رـ رـ ـ Final Damage Assessment ReportDocument2 pagesا رارــ ا رــ دــ ـ رـ رـ ـ Final Damage Assessment ReportFadi YasinNo ratings yet

- Sana Insurance PDFDocument6 pagesSana Insurance PDFDameer SanaNo ratings yet

- Siggel TejariDocument2 pagesSiggel Tejarijobaid islamNo ratings yet

- P ECH 23 3102 220649-ReceiptDocument1 pageP ECH 23 3102 220649-ReceiptLe RoiNo ratings yet

- التأمين ٢٠٢٢-٢٠٢٣Document2 pagesالتأمين ٢٠٢٢-٢٠٢٣lafamfatamNo ratings yet

- HHDReceipt 173723Document5 pagesHHDReceipt 173723muahmmad akbarNo ratings yet

- LawsuitDocument2 pagesLawsuitasem adelNo ratings yet

- ا رارــ ا رــ دــ ـ رـ رـ ـ Final Damage Assessment ReportDocument2 pagesا رارــ ا رــ دــ ـ رـ رـ ـ Final Damage Assessment Reportkalm Altalb BookNo ratings yet

- PQ InsuranceCard 637968096000000000Document2 pagesPQ InsuranceCard 637968096000000000راكان أحمد الشهريNo ratings yet

- Contract 1339348Document10 pagesContract 1339348mohnad altallaaNo ratings yet

- Policy ScheduleDocument1 pagePolicy Scheduletala hamNo ratings yet

- لقطة شاشة ٢٠٢٢-١١-٢٩ في ٥.٠٢.٣٦ مDocument1 pageلقطة شاشة ٢٠٢٢-١١-٢٩ في ٥.٠٢.٣٦ مH AlmozainihNo ratings yet

- HHDReceipt 143358Document5 pagesHHDReceipt 143358chjunaidchNo ratings yet

- A WALA 1 B 13 021: No Additional DriversDocument3 pagesA WALA 1 B 13 021: No Additional Driversmood271271No ratings yet

- HHDReceipt 122908Document11 pagesHHDReceipt 122908Naif AlajmiNo ratings yet

- Insurance 2020-2021 PDFDocument1 pageInsurance 2020-2021 PDFrajeshmsitNo ratings yet

- HHDReceipt 002117Document5 pagesHHDReceipt 002117ahmedhelail1No ratings yet

- Cash Reimbursement Claim Form : Claimant InformationDocument2 pagesCash Reimbursement Claim Form : Claimant InformationAbdullah AljufayrNo ratings yet

- DAFinalReport DA090720779Document2 pagesDAFinalReport DA090720779Ibrahim Mahmoud AliNo ratings yet

- NajmDocument2 pagesNajmAthar KhanNo ratings yet

- HHDReceipt 114859Document6 pagesHHDReceipt 114859Abo FrajNo ratings yet

- 54120Document1 page54120Marvie Magante LonggosNo ratings yet

- XXMOH HR EMP LETTER681897406 OutDocument1 pageXXMOH HR EMP LETTER681897406 OutAbdulaziz AlahdalNo ratings yet

- DA FinalDocument2 pagesDA Finalmahmoud mohamed100% (1)

- Invoice 7314301287 PDFDocument1 pageInvoice 7314301287 PDFfekry elbaklyNo ratings yet

- Motor Insurance Policy Schedule (Comprehensive Against Loss Damage and Third Party Liability) ( ) Policy NoDocument2 pagesMotor Insurance Policy Schedule (Comprehensive Against Loss Damage and Third Party Liability) ( ) Policy Nofaisal alkamali100% (1)

- وثيقة مشغل صباDocument2 pagesوثيقة مشغل صباJonalyn TamioNo ratings yet

- Taqdeer Center EstimateDocument2 pagesTaqdeer Center EstimateSourav Raha100% (1)

- MUHAMMAD's Health Passport 26-04-2022Document1 pageMUHAMMAD's Health Passport 26-04-2022Asif KhanNo ratings yet

- ا رارــ ا رــ دــ ـ رـ رـ ـ Final Damage Assessment ReportDocument2 pagesا رارــ ا رــ دــ ـ رـ رـ ـ Final Damage Assessment Reportراكان العزبNo ratings yet

- لقطة شاشة ٢٠٢٣-٠٢-٠٥ في ٥.٠٨.٣٣ مDocument1 pageلقطة شاشة ٢٠٢٣-٠٢-٠٥ في ٥.٠٨.٣٣ مadnan adnanNo ratings yet

- en ReportDocument7 pagesen ReportvenubhaskarNo ratings yet

- Vat CertificateDocument1 pageVat CertificateSuhail MohammedNo ratings yet

- HHDReceipt 172906Document7 pagesHHDReceipt 172906عادل الخليفهNo ratings yet

- LawsuitDocument2 pagesLawsuitيبرق البرقNo ratings yet

- DAFinalReport DA0204181035Document2 pagesDAFinalReport DA0204181035Athar Khan100% (1)

- Mohammad Parvez Nagra Ahmeddin Vehicle Insurance Certificate - Lexus 5038Document1 pageMohammad Parvez Nagra Ahmeddin Vehicle Insurance Certificate - Lexus 5038AhmedNo ratings yet

- MANOJ Dumptruck Driver Documents (6118 NBA)Document11 pagesMANOJ Dumptruck Driver Documents (6118 NBA)Dhanu NikkuNo ratings yet

- Po Licy Schedule: Vehicle DetailsDocument15 pagesPo Licy Schedule: Vehicle Detailsابو ملاذ100% (1)

- Ankit Dumptruck (5647 BXA) Driver DocumnetsDocument11 pagesAnkit Dumptruck (5647 BXA) Driver DocumnetsDhanu NikkuNo ratings yet

- Thank you ﻟ ﻚ ﺷ ﻜ ﺮاً: Dear زﻳ ﺪ اﺑ ﻮ ﻣ ﺤ ﻤ ﻮ د ﻣ ﺒﺎ ر ك اﺣ ﻤ ﺪ ﻋ ﺰﻳ ﺰ يDocument2 pagesThank you ﻟ ﻚ ﺷ ﻜ ﺮاً: Dear زﻳ ﺪ اﺑ ﻮ ﻣ ﺤ ﻤ ﻮ د ﻣ ﺒﺎ ر ك اﺣ ﻤ ﺪ ﻋ ﺰﻳ ﺰ يAhmed AbozaiedNo ratings yet

- XXMOH HR EMP LETTER-1987608716 Out PDFDocument1 pageXXMOH HR EMP LETTER-1987608716 Out PDFنواف الخوافNo ratings yet

- MOHAMMED's Health Passport 31-10-2021 3Document1 pageMOHAMMED's Health Passport 31-10-2021 3Mohammedr AldosrryNo ratings yet

- ALI's Health Passport 30-07-2022Document1 pageALI's Health Passport 30-07-2022Ali AqelNo ratings yet