Professional Documents

Culture Documents

North Mississippi Medical Clinics 990

North Mississippi Medical Clinics 990

Uploaded by

Anna Wolfe0 ratings0% found this document useful (0 votes)

61 views47 pagesNorth Mississippi Medical Clinics 2016 990 report

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentNorth Mississippi Medical Clinics 2016 990 report

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

61 views47 pagesNorth Mississippi Medical Clinics 990

North Mississippi Medical Clinics 990

Uploaded by

Anna WolfeNorth Mississippi Medical Clinics 2016 990 report

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 47

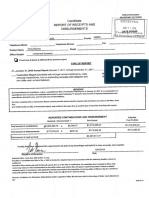

[efile GRAPHIC print DO NOT PROCESS [As Filed Data -] DLN: 93495226022767

990 Return of Organization Exempt From Income Tax JoMe aT 36520087

Form

x

2015

Crs

poe

Under section 501(c), 527, oF 4947(a)(1) of the Internal Revenue Code (except private

foundations)

Do not enter social secuty numbers on this form as it may be made public

> Information about Form 990 and ts instructions 1s at winy IRS gou/Torm990,

‘for the 2015 calendar year, or tax year beginning 40-01-2015 —, and ending 09-30-2016

rca faotsie Yor Hass Meal Ces We

[ems exnae

se wrisTy ouxe 64-0787918

TFintel naa

Fina Totephone number

dunftmnesed | RERERE ERTS Bae a Baar Hea

Frenened rum (662) 377-3978

Trookaton penne] ERGY gate © BOWE GRDEY, TF OTOH DRT SE

F Name and aderess ofprincipalofice’

SHARON NOBLES

830 South Glo

Tupelo, MS 38801

Ts this a group return for

subordinates? Proves &

No

Hib) Are all subordinates Pres ne

T Tewevematatins Fy soxeyay [7 sou) ( ) ser 0) asuais) «527 trcluced?

eee 2 a ee

3 Website: > www amhs net/elnies php

Street

ach alist (see instructions)

He) Group exemption aumber ®

K Form of orgamzation FY Corporation [~ Trust [~ Assaaaton [~ other TTS

POSe summer

‘rely descnbe the organisations mation or mort agnfcant actives

North issasipl Medial Chncs, Ine operates 90 medica ics located nnath Misisipp1

:

5 | 2 check ns box » [tthe organaation @iscontnaea ts operations or claporea of more than 25% ofite net assets

3

x2 | 2 Number otvoting members ofthe governing body (Pa VI line 3a) 3

$ | 4 number otinependent voting members ofthe governing body PartVI,Ine 38). ss ee Dw 4

© | 5 total number of dividuals employed in calendar year 2015 (PartV, line 2a) 3 B04

| 6 rotatsumper orvotnteers estimate necessary) é 4

27m Total unrelated business revenue rom Part Vit, column (), tine 12 7 A

b_Net unrelated business taxable income fom Form 990-1, ine 24 7

Prior Vear curent Year

Contnbutons and grants (PaRLVIIE tne th). we we : 1391455 23,500

2 Program service revenue (Part VIE, line 20) s+ ew ee 7 75,091,519] 56,209,412

§ |10 investment income (Part VIII, column (A), lines 3,4, and 74 } 3.957]

© Jaa Other revenue (Part VIIT, column (A), lines 5, 64, Be, 9e, 10¢, and 116) 1,559,866]

22 Total revenue~add ines @ trough L! (must equal Part VIE, column (A) ine Sanaa

uh

33 Grants and similar amounts pad (Park IX, column (A) mes 1-3) =~ a

44 Benes pad oor for members (Pat 1x, column (A) ie 4) a ni

og [28 Selegssotercompansoten,empye berets Pat D4 column (a) nes a caaonsar

£ | s60rroiessionattuncaisng fees (Part X,column A). le tte). sv es a a

& | & raattuntaing exene (ran % coumn 0), ne 25) mD

47 Other expenses (Part 1K, column (A), ines 18-186, 11-246) «| 50865,757] 1979283

48 Total expenses Adeines 13-17 (must equal Par 1, column (A) hie 25) 97,637 666 71,261,830

19 _Revenveless exsenses Subtract ine 18 from ine 12... a 19,590,969 12,736,537

sf Jsoiming of current Your] End of Year

ee

$8 |20 total assets (Pare x, he 16) wo766.A58 3233085

Bl 21 totatvapies (arex,ine26) . Poe. 32,871,577 15,670,265

Bo | 22 net assets ord paances Subtract ine 21 fom line 20 7,915,261 16,659,920

Signature Block

Under penalfies of perjury, I declare that | have examined this return, nchiding accompanying schedules and statements, and tothe best oF

my knowledge and belie, itis true, correct, and complete Declaration of preparer (other than officer) 1s based on all information of whieh

preparer has any knowedge

Nan overseer Co Mans Overtest CPA ar9-0p-as| cheer [~ | pora7a004

Paid seF-empioyed

Pee = —_.

Wes ony) ckeon, MS_392012190

May the IRS discuss this return with the preparer shown above? (see instructions) Wes [No

For Paperwork Reduction Act Notice, see the separate instructions. Cat No 112827 Form990(2015)

Form 990 (2015) Page 2

‘Statement of Program Service Accomplishments

(Check Schedule O contains a response or note to any line mths Part IL r

T Brieliy describe the organdation’s mission

NORTH MISSISSIPPI MEDICAL CLINICS, INC (CLINICS) OWNS AND OPERATES 30 PRIMARY CARE AND INTERNAL MEDICINE

MISSISSIPPI HEALTH SERVICES (NMHS) ORGANIZATION THE MISSION OF NMHS IS TO CONTINUOUSLY IMPROVE THE HEALTH

OF THE PEOPLE OF OUR REGION CLINICS WORKS TO ACHIEVE THIS CORPORATE MISSION TO IMPROVE THE HEALTH OF THE

PEOPLE OF THIS REGION BY PROVIDING CONVE!

2 Did the organization undertake any significant program services during the year which were not listed on

the pnor Farm 990 ar 990. oe Se ao + Pves ine

1f*¥es," descnbe these new services on Schedule 0

3 _Did the organization cease conducting, ar make significant changes in how it conducts, any program

services? ves no

If "Yes," descnbe these changes on Schedule O

4 pesenbe the organization's program service accomplishments for each of ts three largest program services, as measured by

expenses Section $01 (c)(3) and 501 (c)(4) organizations are required to report the amount of grants and allocations to others,

the total expenses, and revenue, if any, for each program service reperted

ae code rors HOHE wang ga oFe 7 (Revenue & se2004i2)

“a (code Yepesas § vrcuaing ans oFs Vikevenue S| 7

ae (code Yespensas § vecuaing gris oFs ViRevenue S| y

“44 Other program services (Describe m Schedule 0)

(Expenses $ Including grants of {Revenue $ D

“de __ Total program service expenses $5,530 316

eee

Form 990 (2015) Page

Checklist of Required Schedules

Yes | No

A. Is the organization descnbed in section 504 (c)(3) or 4947(a)(1) (other than a prwvate foundation)? IF "Yes," Yes

complete scneauleAD ee

2. 1s the organization required to complete Schedule B, Schedule af Contributors (see structions)? . =. 2 Ne

3. Did the organization engage in director indirect political campaign activities on behalf of arin opposition to No

candidates for public office? If "Yes," complete ScheduleG Ptl se ee ee ee ee ee LB

4 Section 503(c)(3) organizations.

Did the organzation engage in lobbying actwities, or have a section S041(h) election in effect during the tax year?

1 "¥es," complete ScheduleC, Patil. + et et ee et ee 4 No

5 15 the organization a section $01(c4), 504 (c}(5), oF $03 (c)(6) organvzation that receives membershup dues,

assessments, or similar amounts as defined in Revenue Procedure 98-19? 7

Te "Yes," complete ScheduleG, PatIT es eee et 5 2

6 id the organization maintain any donor advised funds or any simular funds or accounts for which donors have the

hight to provide advice on the distidutian ar investment of amounts in Such funds or accounts?

1 "¥es,"complete ScheduleD, Pat WD... 6 ae

7 Did the organization receive or hold a conservation easement, including easements to preserve open space, ho

the environment, histone land areas, or historic structures? If "Yes," complete Schedule, Partin)... | 7

8 id the organization maintain collections of works of at, histoncal treasures, or other similar assets? a

11 "¥es,"complete ScheduleD, Pat WD... ee 8

9 Did the organization report an amount in Part X, ne 21 for escrow or custodial account lability, serve as

‘custodian for amounts not listed in Part X, of provide credit counseling, debt management, credit repait, oF debt ho

negotiation services It "Yes,"camplete Schedule D,fatV%J. 2... ee ee ee LB

40 Did the orgamzation, directly or through a related organization, hold assets in temporarily restricted endowments,| 10 No

Permanent endowments, or quast-endowments? If "Yes," complete Schedule D, Patv 3). . ss «+

AL Ifthe organization's answer to any ofthe following questions 15 "Yes," then complete Schedule D, Parts VE, VI,

VIIT, 1x, oF X as applicable

{id the orgamzation report an amount far land, buildings, and equipment in Part X, line 107 y.

10 "Yes," complete ScheduleD, Pat VI De ee ee ee [tte YE

'b_ Did the organization report an amount far investments other securities in Part X, ine 12 that 1s 59% or more of ho

Its total assets reported in Part X, ine 167 If "Yes," complete Schedule D, Part VII 9... . - we a1b

{© Did the organization report an amount for investments program celated in Part X, line 13 that 16 5% or more of a

its total assets reported in Part X, line 167 IF "Yes,"complete ScheduleD, Patil J... - . . - (Ae 0

4. Did the organization report an amount far other assets in Part X, line 15 that 1s 5% or more ofits total assets ves

reported in Part x, line 167 It "Yas," complate Schedule D, Part IX. 6 ee ee ew ww ee La

© id the organization report an amount for other abilties in Part X, line 25? If “Yes,” complete Schedule b, Pax [ae] yo

f Did the organization's separate or consolidated financial statements for the tax year include a footnote that en

addresses the organrzation’ abi

16 "Yes," complete Schedule D, Part X

42a Did the organization obtain separate, independent audited financial statements for the tax year?

It "Yes," complete Schedule 0, Parts x1 andxit . . os ee LR No.

fr uncertain tax positions under FIN 48 (ASC 740)?

'b Was the organization included 1n consolidated, independent audited financial statements forthe tax year?

11 "¥es,"and ifthe organization answered "No" to me 12a, then completing Schedule, Parts XI and XII 1s optinat “tJ 428 | Yes

13. 1s the organization a school described in section 1 70(0)(1)(A un)? If "Yes," complete Schedule E 3 ho

{4a Did the organization maintain an office, employees, or agents outside of the United States? . . . . . [aga No

bid the orgamzation have aggregate revenues or expenses of more than $10,000 from grantmaking, fundraising,

business, investment, and program service actwities outside the United States, or aggregate foreign investments

valued at $100,000 armore? If Yee," complete Schedule f, Parts Tand IV. 0. ee sw ss 4b No

15 Did the orgamzation report on Part IX, column (A), line 3, more than $5,000 of grants or other assistance to or h

for any foreign organization? It "Yes," complete Schedule, Parts iT and IV... ss 3 10

16 Did the organization report on Part 1X, column (A), line 3, more than $5,000 of aggregate grants or other h

assistance to or for foreign individuals? If "Yes, "camplete Schedule Pats III andIV. 16 2

47 Did the organization report a total of more than $15,000 of expenses for professional fundraising services on Parl 47. No

1X, column (A), lines 6 and 112” IF "Yes," complete Schedule G, Part I (See instructions) +»

48 Did the organization report more than $5,000 total of fundraising event gross income and contributions on Part

VIII lines 1 and 8a? TF "Yes," complete Schedule G,PutI set se te et ete 18 No

39 bid the organization report more than $15,000 of gross income from gaming actwities on Part VEIt, ine 9a7 1F [4g h

‘Yes,"complete ScheduleG, Pat vse ee ee te 2

20a Did the organization operate one or more hospital facilities? IF "Yas," complete Schedule... a aa

1 °¥ 5" to line 208, did the organization attach a copy ofits audited financial statements £o this return?

bi 20a, did the organization at py of ts audited fi statements to this ret ‘0b

TES

Form 990 (2015) paged

FAME Checklist of Required Schedules (continued)

21 Did the organization report more than $5,000 of grants or other assistance to any domestic organization oF A Ne

domestic government an Part IX, column (A), line 2? f "Yes, "complete Schedule, Parts Tardis. ++

22 Did the organzation report more than $5,000 of grants ar other assistance to or for domestic mnaividuals on Part | 9p h

1X, column (A), line 2? F "Yes," complete Schedule, alts f andi. ses ws 2

23. Did the organization answer "Yes" to Part VII, Section A, line 3, 4, oF § about compensation ofthe organization's v.

Current and former officers, directors, trustees, key employees, and highest compensated employees? If "ves," | 23 | Yes

complete Schedule ve ee SD

24a. Did the organization have a tax-exempt bond issue with an outstanding principal amount of more than $100,000,

as of the last day of the year, that mas sued after December 31, 2002? If "Yes,"answer ines 240 through 34d h

‘nd complete Schedule K TF"No,"gotolme25a- s+ ss we ee a 2a 2

1b id the organization invest any proceeds of tax-exempt bonds beyond a temporary period exception? . .

a 2ab

Did the organization maintain an escrow account other than a efunding escrow at any time during the year

tadetease any tax-exempt bonds? eee 2ae

Did the organization act as an "an behalf of esuer for bonds outstanding at any time during tre year? . «| 29g

25a. Section 501(€)(3), 501(¢)(4), and 501(¢)(29) organizations.

Did tne organizatton engage in an excess Deneft transaction wth a disqvaliied person dung the year? IF "Yes," | ag 1h

complete Schedule, PTT ee ee 2

bb 1s the organization aware that it engaged in an excess Denefit transaction with a cisqualfied person in a prior

Year, and thatthe transaction has not been reported on any of the organization's prior Forms 990 or 990°E2? | 256 No

Ir "¥es,"complete Schedule, Put. vse tn tt te eh ee

26 Did the organization report any amount an Part X, line S, 6, or 22 for receivables from or payables to any current

or former officers, directors, trustees, key employees, highest compensated employees, or disqualified persons? | 26 [0

1 "Yes," complete Schedule UCIT vv ete te te te ee

27 Did the organization provide a grant or other assistance to an officer, director, trustee, Key employee, substantial

Contributor or employee thereof, @ grant selection committee member, or to a.35% controlieg entity or farmly | 27 No

member of any of these persons? If "Yes," complete Schedule, Part Ili. a

28 was the organization a party to a business transaction with one of the folloming parties (see Schedule L, Part 1V

instructions for applicable fling thresholds, conditions, and exceptions}

A current or former officer, director, trustee, or key employee? If "Yes," complete Schedule ,

pative Coe tn eae ae ea na

b A family member of a current or former officer, director, trustee, or key employee? If "Yes," complete Schedule L,

Parte et ee ee ee ee en te 2b No

An entity of which a current of former officer, cirector, trustee, or key employee (ora Family member thereof) was

an officer, airector, trustee, or director indirect owner? If "Yes," complete Schedule, Part IV... « 20 No

29 Did the organization recewve more than $25,000 1n non-cash contnbutions? If "Yes," complete Schedule . . | 99 No

30 Did the organization receive contributions of art histoncal treasures, or other similar assets, or qualified

conservation contributions? If "Yes,"complete Schedule. ee ee ee ee 30 ne

31 bid the organization liqucate, terminate, or dissolve and cease operations? If “Yes," complete Schedule N, art! -

a No

32 pid the organization sell, exchange, dispose of, oF transfer more than 25% of is net assets? h

IF "Yes," complete Schedule N, Pat IT wy we we fi 2 0

33. Did the organzation own 100% of an entity cisregarced as separate from the organization under Regulations y.

sections 301 7701-2 and 301 7701-37 If "Yes,"complete Schedule, Part 2 + 2 we 33 | Yee

34, Was the organization related to any tax-exempt or taxable entity? If "Yes," complete Schedule R, Pa 11. HH ert¥. | ay | y,

and Pa VED et =

35a _Did the organization have a controlled entity within the meaning of section $12(b}(13)? ae es)

b IP Yes'to line 354, did the organization receive any payment from ar engage in any transaction with @ controlled

entity mthin the meaning of section $12(b\13)? JF "vas," camplate Schedule R, Part V, ine 2... oes)

36 Section 501(c)(3) organizations. 014 the organization make any transfers to an exempt non-charitable relgted ho

organization? Jf "Yes," complete Schedule R, Part V,iine2 . . «1 + we ee @ 36

137 bid the organization conduct more than S‘% of ts activities through an entity that isnot 2 related organization h

and that 1s treated as a partnership for federal income tax purposes? If "Yes,” complete Schedule R, Par VI 7 io

38 Did the organization complete Schedule O and provide explanations in Schedule O for Part VI, lines 11b and 19? y.

Note, All Form 990 filers are required to complete Schedules. vv + vs ses 3a | ves

renee

Form 990 (2015),

Statements Regarding Other IRS Filings and Tax Compliance

Check if Schedule O contains 2 response or note to any ine inthis PartV.. ss

te

»

Gross receipts, ncluded on Form 990, Part VIII, ine 12, for public use or club [0b

u

1b Gross income from other sources (D0 not net amounts due or paid to other sources

12

Enter the number reported in Box 3 of Form 1096 Enter-0- ifnot applicable . | ta 43

Enter the number of Forms W-2G included inline ta Enter -0-fnot applicable | ab 2

id the organization comply with backup withholding rules for reportable payments to vendors and reportable

gaming (gambling) winnings to praewinners? vs ee ee ee te ee et

Enter the number of employees reported on Form W-3, Transmittal of Wage and

‘Tax Statements, fled for the calendar year ending with or within the year covered

bythisreturn eee ee ee Le 804

fat least one is reported on ine 2a, did the organization file all required federal employment tax returns?

Note.t' the sum of lines La and 2a 1s greater than 250, you may be required to e-fle (see mstructions)

Did the organization have unrelated ousiness gross income af $1,000 or more dunng the year? .

No

1F°¥e," has i led a Form 990-T for this year?JF "No" tole 2b, provide an explanation in Schedule...

2b

At any time during the celendar year, did the organization have an interest in, of signature or other authority

over, 2 financial account in a foreign country (such as @ bank account, securities account, or other financial

account)? .

e

No

1FYes," enter the name ofthe foreign country

See instructions for fling requirements for FINCEN Form 114, Report of Foreign Bank and Financial Accounts

(rBaR)

Was the organvzation a party to a prohibited tax shelter transaction at any time during the tax year. «

We

Did any taxable party natty the organvzation that it was oF 1s @ party to a prohibited tax shelter transaction?”

No

1F*Yes," to line Sa or Sb, did the organization file Form 8886-17... ee ee

Does the organization have annual gross receipts that are normally greater than $100,000, and did the

organization soliit any contributions that were not tax ceductible as chantable contributions? .

ely |e |e

No

1f*¥es," did the organization include with every solieitation an express statement that such contributions oF gifts

werenottax deductible? eve ee ee ee et te ne en

e

Organizations that may receive deductible contributions under section 170(¢).

Did the organization receive a payment in excess of $75 made partly as a contribution and partly for goods and

fservices] provided oltre payor 2a fers ger eat ee feat h- reareterea vel ares Friat

7

If *¥5," dd the organization notiy the donor ofthe value of the goods or services provided?» .

id the organization sell, exchange, or otherwise dispose of tangible personal property for which it was required tl

fle Form 82827 2 ee ee nnn

re

No

1f*Yes," indicate the number of Forms #282 fled dunngthe year... | 7

Did the orgamzation receive any funds, diectly er ineirectly, to pay premiums on 2 personal benefit contract?

Je

No

id the organization, dunng the year, pay premiums, directly orindiracty, on a personal benef contract? .

No

1 the organization received a contnbution of qualified intellectual property, did the organization hile Form 8999 as|

re cs ara Rat a Nar nea A

7a

If the organization received a contnbution of cars, boats, airplanes, or other vehicles, did the organization file a

Form1098-c?. oe eee ee es ao

™

‘Sponsoring organizations maintaining donor advised funds.

Did e dorer advised fund maintained by the spansoring organization have excess business holdings at any time

dunngthe year? svt ete ee ten tne tet een

id the sponsoring organization make any taxable distnbutions under section 49667...

id the sponsoring organization make a distr

ution to a donor, donor adviser, or related person? . .

slele

Section 501(c)(7) organizations. Enter

Inrtiation fees and capital contnbutions included on Part VIII, line 12... | 40a

facilities

Section 501(c)(42) organizations. Enter

Gross income from members orsharsholders ss 2 ses [ata

against amounts due arreceived fromthe). s+ se ee es LAR

Section 4947(a)(3) non-exempt charitable trusts.ts the organization fling Form 990 in leu of Form 10417

120

1f*¥5," enter the amount of tax-exempt interest received or accrued dunng the

year 32

Section 501(c)(28) qualified nonprofit health insurance issuers.

15 the organization licensee to 1ssue qualified health plans in more than one state?Nate. See the instructions for

additional information the organization must report on Schedule 0

Enter the amount of reserves the organization 1s required to maintain by he states

Inwwhich the organization is licensed to issue qualified health plans... 336

Enter the amount of reserves on hand... se ee we ee Lae

Did the organization receive any payments for ndaor tanning services dunng the taxyear?. ~~

aaa

No

1F"¥95," has it filed a Form 720 to report these payments?/f "No," provide an explanation in Schedule. «

sab

Form 990 (2015)

Form 990 (2015) Page 6

Governance, Management, and Disclosure

For each "Yes" response to ines 2 through 7b below, and for a "No” response to lines 8a, 8b, or 10D below,

desenbe the circumstances, processes, or changes in Schedule O. See instructions.

Check it Schedule O contame response ornotetoanyinernths Pat. ws ss

Section A. Governing Gody and Management

Yes | No

4a Enter the number of voting members ofthe governing body at the end ofthetax — | 4, 7

year

If there are matenal diferences 1n voting nights among members ofthe governing

body, or ithe governing body delegated broad authorty to an executive committee

or similar committee, explain in Seredule 0

'b Enter the number of voting members included in line La, above, whe are

ngependent » 4

2 Did any ofcer, director, trustee, or key employee have a family relationship of business relationship with any

other officer, diector, trustee, or key employee? vv ee ee et ee ee ee ee LR No

3 Did the organzation delegate control over management duties customarily performed by or under the direct 3 ho

supervision of oficers, directors or trustees, or key employaes toa management company or other person?

4 Did the organization make any significant changes to its governing documents since the prior Form 990 was

ia ee a RB 4 No

5 Did the organization become aware during the year of significant diversion ofthe organization's assets? « 5 No

6 Did the orgamzation have members or stockholders? . ss ee ee ee ee ee ee [6 vee

7a Did the organization have members, stockholders, or other persons who had the power to elect or appoint one or

more members ofthe governing body? vw ee we ee ee ee we | Pa | Yes

bb Are any governance decisions of the organization reserved to (or subject to approval by) members, stockhalders,| 7b | Yes

for persons other than the governingbody? vs ste tt te et ee te en

18 Did the organization contemporaneously document the meetings held or wnitten actions undertaken during the

year By the following

Ini ne governing body apart Yareat tat ie Ver ge at gear een ae eee sa | ves

b Each committee with authority to act on behalf ofthe governing body? . ss ss ss ss ss «| Bb] Yes

9 1s there any officer, ditector, trustee, of key employee listed n Part VI, Section A, who cannot be reached at the|

organization's mailing address? IP "Yes," provide the naries and addresses in Schedule O : ° No

Section B. Policies (Thys Section 8 requests formation about polices not required by the Internal Revenue Code.)

Yer.

0a Did the organization have local chapters, branches, orattlates? . ss ee ee ee [ate No

b 1F*¥es," did the organization have wntten policies and procedures governing the activities of such chapters,

affliates, and branches to ensure their operations are consistent with the organization's exempt purposes? 0b

{1a Has the organization provided a complete copy ofthis Form 990 to all members of ts governing body before

them ef Aa No

b Describe in Schedule O the process, any, used by the organization to review this Form990. 5.

2a Did the organization have a written conflict of interest policy? If "No," gotoline 13, ao : ia | vee

b Were officers, directors, or trustees, and key employees required to disclose annually interests that could give

Nsetoconficts? sv te te te et ee ee te te ee [4b | Yes

© Did the organization regularly and consistently moniter and enforce compliance with the policy? If "Yes," describe

InSchedule Ohow this Was done vv ye et ee te et tte ee ane | ves

13 Didthe organization have a written whistleblower policy? ss + + ee ee ee ee w+ [a | Yes

44 Did the organization have a written document retention and destruction policy? . . ss ss ss « [44] Yer

15 Did the process for determining compensation of the following persons include a review and approval by

Independent persons, comparability data, and contemporaneous substantiation of the deliberation and decision?

The organization's CEO, Executive Director, ortop management oficial. . . - . . +. + + + {aBa| Yes

b Other oficers orkey employees of the erganzation » ee eee ee ee we we ee api) ves

1f*Ye5" to line 159 oF 15b, descnbe the process in Schedule O (see instructions)

46a Did the organization invest in, contnbute assets to, or participate n a Joint venture or similar arrangement with a

taxable entity dunng the year”. ot Of Sere [368 No

1b 1f "Yes," did the organization follow a written policy or procedure requiring the organization to evaluate its

participation in mnt venture arrangements under applicable federal tax law, and take steps to safeguard the

organization's exempt status with respect to such arrangements? . ves tte tes Ley

‘Section €. Disclosure

7 List the States with which a copy ofthis Form 990 15 required to be flea

48 Section 6104 requires an organization to make its Form 1023 (or 1024 i applicable), 990, and 990-1 (SOAle)

Gis only) avatladle for public inspection Indicate how you made these available Check all that apply

own website [Another's website [Upon request [Other (explain in Schedule 0)

49 Describe in Schedule O whether (and if 50, how) the organization made its governing documents, conflict of

Interest policy, and financral statements available tothe public during the tax year

20 State the name, address, and telephone number ofthe person who possesses the organization's books and records

PRRISTY DUKE €30 SOUTH GLOSTER STREET. Tupelo, MS 38801 (662) 377-2977

eee

Form 990 (2015) page 7

[ZIERZN compensation of Officers, Directors Trustees, Key Employees, Highest Compensated

Employees, and Independent Contractors

Check Schedule 0 contams a response of note to any ine inthis Part VIL. or

Section A. Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees

3a Complete ts table for all persons requved tobe listed Report compensation forthe calendar year encing wth or within the organization

tax year

# Lista of the organization’ current officers, directors, trustees (whether individuals or organvzations), regardless of amount

‘of compensation Enter -0- im columns (0), (E), and {F) ifn compensation was paid

(© List al ofthe organization’ current key employees, ifany See instructions for definition af "key employee

# List the organization’ five current highest compensated employees (other than an officer, director, trustee or key employee)

who received reportable compensation (Box 5 af Form W-2 and/or Box 7 of Form 1093-MISC) of more than $100,000 from the

organization and any related organizations

List all ofthe organization’ former oficers, Key employees, or highest compensated employees who received more than $100,000

‘of reportable compensation from the organization and any related organizations

List al ofthe organization’ former directors or trustees that received, n the capacity as a former director or trustee of the

organization, more than $10,000 ofrepertable compensation from the organization and any related organizations

List persons inthe following order individual trustees or directors, institutional trustees, officers, key employees, highest

compensated employees, and former such persons

check ths box ifreither the organization nor any related orgamization compensated any current officer, rector, or truste

“ Oy © © ©) io)

Name'and Title average | Position (donotcheck | Reporeable | Reportable | estimated

ours per more than one box, unless | compensation | compensation | amount of

weet fist "person's bot anoftcer | tromene. | tromrelates. | other

anyrours | ‘andadrectorfrustec) | organization | organizations | compensation

Grretotea = STEEP ive z/i099- | (we2/1099- | ~ fromthe

organizations [2 3] 5/818 (BS |Z] misc) Misc) ‘organization

veiow |22/ 3/2 fe (Sz [2 ‘and related

dotted tine) [BE] 2 |* | = |E organizations

z ae

g

(yoo Robeson

) Renny Young MB

(Sy aren Knavey WO

Genk bes HO

Obed ter

(@) ere Topp

(By eseph a Reper

(10) Charles M King bch

Form 990 (2015)

EEMEWE Section A. Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees (continued)

Page 8

“ @) © ©) © °

Name and Title Average | Position (donot check Reportable Reportable Estimated

hours per [more than one box, unless | compensation | compensation | amount of other

week (ist | "person is both an officer ‘rom the from elated | compensation

any hours | ‘anda dvectorftrustee) | organization (W- | organizations (W-] from the

forrelated STE EE Tp] tsetse |272099-misc) | organizavon ond

*pelow 212 le FE |2 organizations

dotted tine) eB" |g eS |F

e| |e 3

=| [8/3

Sub-Total Se eae _

€ Total from continuation sheets to Part VIT, Section A »

Total (add fines tb and te) paneseera err ae) Se ua Ear

2 Total number of dividuals (including but not hited fo those listed above) who received more than

$100,000 of reportable compensation from the organization ® 160

3 Did the organization ist ary former officer, director or trustee, Key employee, ar highest compensated employee

online 1a? If Yes,"complete Schedule }forsuch mdwvidual vss +e ve ew ee ew Lg ma

4 Forany individual listed on line 12, 18 the sum of reportable compensation and other compensation from the

organization an related organizations greater than $150,000" If "Yes," complete Schedule I er such

5 bid any person sted on line 1a receive or accrue compensation from any unrelated organization oF individual for

services renderee to the organtzation?If "Yes," complete Schedule far such persen ss + +s + + + | g na

‘Section 8. Independent Contractors

1

Complete this table for your five highest compensated independent contractors that received more than $100,000 of

Compensation fom the organization Report compensation fr the calendar year ending with or within the organization's tax year

a @,

©

‘Compheat ivan Sannces

inmeath Tense, Jransapn See

Total number of adependent contractors (including bik Rot imted to those leted above) who received more than

$100,000 of compensation from the organization P26

ceeeeeeeeeeeeeee

Form 990 (2015)

Page ®

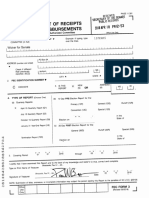

‘Statement of Revenue

Check Schedule © contams aresgonse ornate oarylne mths PatViII 2)

a 7) G o

oralitenue | reitaor | unites | nelere

rem, | business. | excluded tom

est

ia Federmed campagne 7

ge

BET b wemterhodues ss 2. ab

ge —

GE] c rundronmgevens os. te

ae

S| ¢ einecorsencatons . . «4a

BF | 5 covmmentenms tombe) te m0

Be |e mamas om guy at

25) 1 sancummataess

BB |g Sennm commer nce me

Eo iets.

BE] n raadsinesio 0 oes ase

BE | 6 rota ses nes 1034 :

y Tanmant Code

: 2a _Net Pabent Service Revenue 200099} 135,414,880] 35,414,680

E | ine toottome = ac

Ee

2].

§ |e Mamermogansencereene

& g Total.Addiines2a-2f . . 1 1 ee a 36,209,412]

3 —nvesiment income (nelodng drwdends teres, _

and other similaramounts). - - se ee 3,767) 376

4 emer mrenranet wr ermel end rene 1 4

3B Rote ee 7

eal OE

2 Grose rete

ban al

¢ kenugeme 7 |

aay

4. Weteotal neon areas] se :

(secon ee

za cs snout

comune ‘seo

nese

ay

b tam autor

te wea

crea) a7

@ Netgamor (oss) yyy and

| % cross income om undrasna

: vents (nt nea

5 oo

5 Siconmmoters ported ontne te)

é Steraivsine iB

Fj 7

3 Db Less cwrect expenses . »|

€ Netincome or oss) fom arising eveRIS TP d

5 on come tom gamiog acten

Secretive

> Less cuectenpenses ss. b

Netincome or oss} am giming atges 7 F

»

108 ross sales of ventory ess

fetes and allowances

» Less costotgoods sold. sb

€_Netincome of oss) tom sales ot meany 7 d

Toreenreoor Revenue oe

Tis REBATE INCOME ay staan ssean

‘Other Miscellaneous Revenue 900099) 371,983] 371,383)

© Clinical Trial Revenue ‘s00088} 144,738] 194,798

Blotterrevense © Ta ara

Taal Adding Lei ee. —

12 Totalreveve, see Instrutons

Total See Instructs >| 58,545,293) 56,209,412] 2,242,361]

Form 990 (2015)

Form 990 (2015)

Statement of Funetional Expenses

‘Section $07 (€)(3) and 501 (€]/4) organizations must complete all columns Allether organwations must Complete column (Al

Page 10

(Check if Schedule © contains a response or note fo any line inthis Part IX.

cn

Bootes ere tes, a a

7b, 8b, 9b, and 0b of Part VIII. ‘expenses | general expanses | _expenaay

Scustameieein cea ;

ieeeneraet

reported in colurnn (8) jont costs from a combined

‘edvcatianal campaign and fundrarsing solicitation

Check here ® [-iffollowing SOP $8-2 (ASC 958-720)

rn

Form 990 (2015) Page 11

HES falance Sheet

Check Schedule © contams a response ornote to anyline nthe PaRtK we ee ee ee

w eo

sepnning ot year endityear

2 savings and temporaryeash investments Tsu] 2 251080

3 Pledges and grants recenable,net se we vee om a

5 Loans andotherrecewables trom cuenta former oficers,crectors, trustees,

key employees, and highest compensated employees, Complete Parti of

Sore eee eee ee eeeee eee eee

as °

«Loans and sther receivables from other disqulied persons (as dened under

section 4338(0(1)), persons descned insection @958(O(0), 20

Centntutng employers and sponsonng organaations of secon $03(6)9)

Voluntary employees’ beneficiary erganatvons (see instructions) Complete Par

2 Torsenewtet

$ os 0

ie Notes andioans recewableynet 6... ee oz a

2 inventones raters vee ee ee wae 8 Tae

9 Prepa expenses and defered charges sv ee ee ee ae ma] 9 waar

40 Land, bugs, and equipment cost or other basis

Complete Pat VI ef Schedule D 10 a4 0

b Less accumulates depreciation... 0b ae00 zoa0n26) 10. tnstes7

11 investments—publcly traded secummies ss 5. yy of a8 o

12. Investmentsothersecunties See ParIV linet ee = oa 3

23° Investments—program-related See PartV,ine 11» v= + a as o

we inangileassets we ee alse o

15. otherassets See PartiV.tne ii. « a a ECO aeons

16 Total asseteAAdd ines 1 through 15 (mustequaline 34) vs ss To. 0] a6 230.108

47 Aecounts payable and accrued expenses =. = 2 vr vw aras03) 47 Tn 361

18 Gromspoyable of a °

19 beferedreverse of 49 o

20 Taw-cnempthonétabiites al 20 o

2A Escrow or custodial account lablty Complete Port 1V of Schedule D of at 3

& |22 Loans and ather payables to current and former oficets, directors trustees,

A Kev employees, nghest compensated employees and dstuaned

3 persons Complete PartITofScheduleL . . . ee ee ee 2 o

Jas secued mortgages and notes payable to uneated thd pares. a2 o

24 Unsecured notes and lans payable tounrelated thd partes «+ + a] 30 o

25 other uate (ncluting federal income tax, payables to related thd partes,

fnd other labities not clade on ines 17-24)

Complete Part X of ScheculeD

26 Total lates Add Ines 17 thowgh2s vv vv ss ss wana] 26 ieerozee

Organization tat follow SFAS 347 (ASC958), check here Py and complete

2 tines 27 trough 2, and lines 33 and 3

B Jae vemporanyrestnctednetassets weasel 20 18.8

E |29 rermanentyestactednet assets vv vw ww wwe al 29 o

é Organizations that donot follow SFAS 147 (ASC 958), check here [~ and

3 Complete lines 30 through 3

¢ 30 Capital stock or trust principal, or current funds noe we 30

$ |spatd-morcaptal surplus, orfand, bulding orequipment tind. sss a

& [aa netamned earings, endowment, accumulated come, or other nds 3

B [an rowinetassets ortundbatances se ee Tosa] 33 eae

24 Total abies and nt assete/tnd balances =v = + + = Toxrene| 34 2.80108

eee

Form 990 (2015)

Reconcilliation of Net Assets

Page 12

Check # Schedule O contains a response or note toanyline mths PatXI . . - . +. - + +. ss

A Total revenue (must equal Part VITI, column (A), 12) . + ew ee ee

1 58,545,203

2 Total expenses (must equal Part Ix, column (A), line 25) ome oa os

2 71,281,830

3 Revenue less expenses Subtractline 2frominet . 6 ee ee

2 -12,736,537

4 Net assets or fund balances at beginning of year (must equal Part x, line 33, column (A) «+

4 7,915,261

5 Net unrealized gains (losses) on investments ©. 2 2 eee ee ee

5

© Donated services anduse offaciities 6 6. ee ee

6

7 Investmentexpenses . 6 2. 2 ee

z

1B Prorpenod achustments s - 6 ee ee

e

9 Other changes in net assets ot fund balances (explain im Schedule)... os

° 21,481,196

10 Net assets or fund balances at end of year Combine lines 3 through 9 (must equal Part X, ine 33,

column (8), 10 16,659,920

Financial Statements and Reporting

check i Schedule O contains a response arnote to anyineinths Pan Xl... ss

Accounting method used to prepare the Form 950 Fcash accrual other:

Ifthe organization changed its method of accounting from a pri year or checked “Other,” éxplain im

Schedule 0

Were the organization’ financial statements compiled or reviewed by an independent accountant?

If-¥es,"check 2 60x below to indicate whether the financial statements forthe year were compiled or reviewed on

a separate basis, consol

fated basis, or both

F-separate basis [Consolidated basis Both consolidated and separate basis

Were the organization’ financial statements audited by an independent accountant?

1F'¥es,/check a box below to indicate whether the financial statements forthe year were audited on a separate

basis, consoligated basis, or bath

[separate basis [FConscldatedbasis [Bath consolidated and separate basis

1f*¥e5," to hne 2a oF 20, does the organrzation have a committee that assumes responsibilty for oversight

ofthe audit, review, ar compilation ots financial statements and selection of an independent accountant?

1fthe organization changed either Its oversight pracess or selection process during the tax year, explain in

Schedule 0

[As a result ofa federal anard, was the organization required to undergo an audit or audits as set forth inthe

Single Audit Act and OMB Circular A-133?

IF"¥e5," did the organization undergo the required audit oF audits? Ifthe organization did not undergo the

Fequired audit or audits, explain why in Schedule O and describe any steps taken to undergo such audits

Yer

da No

2 | ves

2c | ves

aa No

2b

Form 5502015)

Additional Data

Software 1D:

Software Version:

EIN: 64-0787918,

Name: North Mississippi Medical Clinics Inc

Form 990, Part I11, Line 4a

a (code Y eapesas 6 GS SDO GIS wang gs of Y Revenues 3505, )

Cine sve te 2¢countaen north Masesipp ang northwest Alabama that make up the NHS sre area_In fecal year 2086, Cl served the population of

{he tea wth 435,17) wets ta he physoane. The omannaton operates 7) agonal primary ar ana tera) medics nck

Form 990, Part III, Line 4b

>

(Code Yeas § vnc aes ViRevene S| 7

(ne of the primary ways Cince serves the communty by providing care ts venous populations fr which eens no compensation or ecewves compensation at

‘ates sgnfcandy less than eaablahed ates The bard of rectors of Chnes het extabiahed» palsy under winch the eeganastionprodes caer witout carpe 12

heady members of community” The chant cae okey sates tat Cine wl provide necessary serves fo pallens fe of charge with Housel income level,

Based on the medion neome for Mussspocarpared to the median sname nalonaiy. The Vsstspp Austad Povey Guleles approximately 75% of te

federal povery rte The poly futher odes pabante wh househols nome levels above the Mase: Adjusted Poverty Coidanas willbe able for pa more

than he smoune that ther pousehels come excaeds the apoteable feral poverty guidlines Tne poley apptes to reduls whe reste Me county where the

Ssppieabierine'slocetna,Peverta fom ous the county may sto be gamed chacty care base onthe jedoment of Cimcs menagamertaepering on et

Indvidulcreumatancat Th ply aba rages the pabert ta coperata ‘uly wit Cie Teguest for norton wth whch to vey the patent egy

Faoving that gate, lines matin acods to ny ehd momor te ave of tnformation about schedule A (Porm 990 oF 990-£2) and Its Instructions at

Deparment of he twanirs 200 /forms90.

bul Revene servo

Name of the organization

Cres

paved

Employer identification number

s4.07879%8

[EEEER_ Reason for Public Charity Status (Al orgenitatons must complete this part.) See instructors

The otanzatons nota prvate foundation Because ts (Forlnes 1 trough 11, check only one box}

1 [7A church, convantion of churches, or assoctation of churches described in section 470(6)(4)(A)(1)-

2 [7A school described in section 170(b)(1)(A)(H).(Attach Schedule € (Form 890 oF 980-£z))

3 [YA nospital ora cooperative hospital service organization describe in sectlon 470(b)(41)(A (IN).

4 FF A medical research organization operated in conyunction with @ hespital described in section 170(b)(4)(A)( Ii). Enter the

hospitals name, city, and state

5 [-_Anorganzation operated for tie Benett ofa college ov university Owned or opeTated by a Governmental unt described n section

470(b)(1)(A){iv). (Complete Part 11 )

6 [7A federsi, state, oF local government or governmental unit described in section 470(b)(4)(A)(¥).

7 [- Ancrganization that normally eceives a substantial part of ts support fram a governmental uni or from the general public

Gescribed in section 170(b)(2)(A) (wi). (Complete Part I}

8 _ Acommunity trust cescribes in section 470(B)(4)(A)(wi) (Complete Part IT )

9 F_ Anorganization that normally receives (1) more than 331/3% ofits support from contributions, membership fees, and gross

eceipts from activities related to its exempt functions —subyect to certain exceptions, and (2) Ao more than 331/3% ofits support

ffom gross investment income and unrelated business taxable income (less section 511 tax) from businesses acquired by the

organization after June 30, 1975, Seesection 509(a)(2). (Complete Part III )

10 Anarganization organized and operated exclusively to test for pubic salety See section 509(a)(4).

11 Anerganzation organized and operated exclusively for the benetit of, to perform the functions of, orto carry out the purpases of

fone oF more publicly supported organizations described in section §09(a){1) oF section 509(a)(2) See section 509(a)(3).c heck

the box in lines 113 through 114 that describes the type of supporting organization and complete lines ite, 121, and 1ig

2 Type. A supporting organization operated, supervised, or controlled by ts supported organization(s), typicaly by giving the

supported organization(s) the power to regularly appoint or elect a majority ofthe directors or trustees of the supporting

organization You must complete Part IV, Sections A and 8.

b Type .a supporting organization supervised or controled in connection with its supported organization(s), by having control or

management of the supporting organization vested in the same persons that control or manage the supported organization(s) You

‘must complete Part 1V, Sections A and C.

[Type dit functionally integrated. A supporting organization operated in connection wth, and functionally integrated with, is

supported organization(s) (see instructions) You must complete Part TV, Sections A, D, and E

4 [Type 11K non-functionally integrated. A supporting organization operated in connection with ts supported organization(s) that is

not functionally integrated The organization genetaly must satisfy a distnbution requirement and an attentiveness requirement

(See instructions) You must complete Part IV, Sections A and D, and Part V.

© [Check this box ifthe organization received a wtten cetermination rom the IRS that tis a Type I, Type 11, Type III functionally

tegrated, or Type III nen-funetionally integrated supporting organization

Enter the number of supported organizations . er

q Provide the following information about the supported organreation(s}

oO ne oD) ™ o oy

Name of supported organization Type of Is the organization Amount of Amount ot ther

organzation | listed n yourgoverning | monetary support | support (see

(escribed on lines document? (ee mstructions) | instructions)

1-9 above (see

structions)

Yes No

Total

For Paperwork Reduction Act Notice, se the Instructions for Form 990 or 99062, Cat No 112956

‘Schadule A (Form 990 or 990-£Z) 2015.

Schedule A (Form 990 or 990-EZ) 2015 Page 2

‘Support Schedule for Organizations Described in Sections 170(b)(1)(A)(Wv) and 170(b)(A)(A)(vi)

(Complete only f you checked the box on line 5, 7, or 8 of Pare | or f the organizaton failed to quaify under

Pare II, If the organization fails to qualify under the tests listed below, please complete Part II.

‘Section A. Public Support

Calendar year : :

en ene port | wore | erois [mora | ce201s | enter

2 Gifts, grants, contributions, and

membership fes recewvea (00

not nclude any unusual grants )

2. Taxrevenves levied forthe

argorizatin’s benefit ad ether

aid to or expended on ts behalt

3 Thevalue of services or facies

fumed by 2 governmental unt

to the organization wathout charge

4 Total, Add lines 1 through 2

5 The portion of total contributions

by each person (other than a

governmental unt or pubitely

Supported organzeion)incided

aniine 1 that exceeds 25 ofthe

mount shown online 21, column

o

6 Public suppor. subtaet ine

from ine

Saction 6. Total Support

Calendar year 2011 2012 (2013 2044 22015 ata

(or fiscal year beginning in) & ce ce Ss &

7 Amounts from tine 4

8 Gross income from interest,

dividends, payments received on

Secunties loans, rents, royalties

9 Netincome ftom untelated

business activites, whether oF

not the Business is regularly

20 Otherincome Do not clude

gain or oss from the sale of

Gapital assets (Explain n Part

wt)

31, Total support. Aca lines 7

through 0

12° Gross receipts fom related actwies, ele (Bee matUCTORS) Fy

33 First five years the Form 990 is forthe organization's fst Second, thd, fourth oF ft tax year as 2 section SOT (E13 organation,

check ths box and stop here aC

Section €. Computation of Public Support Percentage

F4_Pubiec support percentage for 2015 (ine 6, column (f) divided by he Ta, Coun a

25 Public suppor percentage for 2014 Schedule A, Par Il, line 14 15

the box on line 13, and line 14 15 33 1/3% oF more, Check this bax

ed organization a

b 33.1/2% support test—2044.1 the organization did not check a box an line 13 oF L6a, and line 15 16 33 1/2% or more, check this

box and stop here. The organization qualifies as a publicly supported organization >

17a 10%-facts-and-circumstances test—2015. the organization did net check a box on line 13, 16a, oF 16b, and line 14

is 1096 oF more, and ithe organization meets the facts-and-circumstances test, check this box and step here. Explain

‘in Part VI how the erganrzation meets the cfacts-and-evrcumstances" test The organization qualifies 3¢ a publicly supported

organzation or

b 0%efacts-and-circumstances test—2014.f the organization dis not check a box on line 13, 16a, 168, oF 17, an line

15 15 10% armore, and irthe orgamzation meets the “facts-and-circumstances” test, check this box and stop here.

Explain in Part VI how the organization meets the "facts-and-circumstances” test. The erganization qualifies as a publicly

16333 1/3% support test—2015.1f the organization did not che:

{and stop here. The organization qualifies as a publicly suppar’

supported organization mr

18 Private foundation.I! the organization did not check a box on line 13, 162, 16b, 17, oF 178, check this box ane see

Instructions: >

eT

Schedule A (Form 990 or 990-EZ) 2015 Page 3

EXMIETEE Support Schedule for Organizations Described in Section 509(a)(2)

(Complete only if you checked the box on line 9 of Part I or if the organization failed to qualify under Part

IT, If the organization fails to qualify under the tests listed below, please complete Part II.)

‘Section A. Public Support

Calender year ;

eee G01: | ew2012 | coors | @aore | cerors | enrotl

1 Gite, grants, conthbutons, and

membership fees received (00

hot include any “unusual grants *)

2 Grose receipts fom admissions,

Dertormed, or facies furshed

In-any acuity that is relates to

the organizations tax-exempt

purpose

3 Gross receipts ftom activites

business under section 513

4 Tax revenues levied for the

organization's beneht and either

Bald to or expended an t's bell

5 Thevalue ofservices oracles

{urmshea by a governmental unt

tothe orgamizetion without charge

6 Total, Add lines 1 chrough S

7a Amounts included on lines 1,2,

and 3 received from disqualiied

persons

bb Amounts inluded on ines 2 and

3 rece fram other than

dqualed persons that excees

the greater of $5,000 oF 135 of

the amount on ine 13 forthe year

€ Addiines 72 and7®

{8 Public support. (Subtract ne 7¢

fromline

‘Section B. Total Support

Calendar year ayo 2012 2013 2044 22015 Total

(or fiscal year begining in) cw @ a & we cai

‘Amounts from ine 6

202 Gross income fom terest,

dividends, payments received on

Secunties ans, rents, royalties

and income from simular sources

b Unrelated business taxable

sneome less section 511 taxes)

fTom businesses acquires ater

Add ines 108 and 105

11 Netincome tom unveated

inne 10b, whether or not the

business 1s regulary cared on

42, Othermeome Do natinclude

gain or loss from the sate of

Capital assets (Explain m Part

vt)

13. Total support. (Add lines 9,1

3i,end2 }

14 Fits five years the Form 990 15 fOrthe organizations frat second, Hw, Tourth or AR ax year aya section SOITENS) organization,

check this box and stop here >

Section C. Computation of Public Support Percentage

TS Public suppor percentage for 7015 (ine 8, column (9 awided by Une 13, column) 5

16 Public support percentage from 2014 Schedule A, Part HI, hne 15 36

‘Section D. Computation of Investment Income Percentage

T7 Investment income percentage for 2085 [ine 10c, column ) aviced by ine T3, coumn TH) 7

48 Investment income percentage trom 2014 Schedule A, Part IIL, ne 17 18

198 33:1/3% support tests2035.ithe organization didnot check the Box on line 14, and line 15 © more than 33 1/9%, ana ine 17 Te noe

more than 33 1/38, check this box and stop here. The organization qualifies as 2 publicly supperted organization >

bb 331/39 support tests—2014.f te organaation did not check 2 box on line 14 orline 193, and hne 26 vs more than 33 1/38 and ine

18 15 not mare than 33 1/38, check this box and stop here. Te organization qualities as @ publicly supperted organization >

20 private foundation the organization dd not check a Box on ine 14, 192, oF 19b, check this Box and see insteuctions >r

‘Schedule A (Form:

Eo)

‘Schedule A (Form 990 or 990-£Z) 2015 paged

Supporting Organizations

(Complete only you checked a box online 11 of Part Ifyou checked 13a of Par I, complete Sectans A and Ifyou checkea

Tarrant, Compete Sectors A and © If youchecked Ihc af Part, complete Sectons'A,D, and Ifyou checked 11d of Part

Lcomplete Sections A and D,and complete Part V

Section A. All Supporting Organizations

Yes | No

1. Are all ofthe organization’s supported organizations listed by name in the organization’: governing documents?

IF "No," describe n Part VE how the supported organizations are designated If designated by class or purpose,

eccrine the designation IF historic and continuing relationship, explain a

2. Did the organization have any supported organveation that does not have an IRS determination of status under

section $09(a)(L) or (2)?

1F-"Yes," explain im Pare VE how the organization determined thatthe supported organrzation was described in section |_2

509(a)(1) oF (2)

3a. id the organization have a supported organization described in section 501 (c)(4), (5), oF 6)?

IF "Yes, "answer (b) and (c) below 3a

bb Did the organization confirm that each supported organization qualified under section 501{¢)(4), (5), oF (6) and

satisfied the public support tests under section 509(2)(2)?

11 "Yes," describe m Pare VE when and how the organization made the determination

€ Did the organization ensure that al support to such organizations was used exclusively for section £70(c)(21(8)

purposes?

11 "Yes," explain in Part VE what controls he organization put m place to ensure such use

44a Was any supported organization not organized in the United States ("foreign Supported organization)?

If Vas" and if you checked {1a ar 11b 1m Part I, answar (b) and (c) below a

bb Did the organization have ultimate contral ané discretion in deciding whether to make grants to the foreign

Supported organization?

In Yes," describe i Part VI how the eiganizatin had such contral and discretion despite being controlled er supervised|

Dy or 1 connection with ts supparted erganvzations

{€ Did the organization support any foreign supported organization that does not have an IRS determination under

sections §01(€)(3) and 509(a)(2) oF (2)?

11 "Yes," explain in Part VI what controls the organization used to ensure that all suppart tothe foreign supported

organization wes used exclusively for section 170(¢)(2)(8) purposes

5a. Did the organization add, substitute, or remove any supported organizations during the tax year?

11 "es, answer (b) and (c) below (i applicable) Also, provide detail in Part VI, including (1) the names and EIN

humbers ofthe supported organizations added, substituted, or removed, ()) he reasans for each such actin, (i) the

Buthonty under the organization's argantaing document authorizing such actien, and (iv) how the action Was,

accomplished (such as by amendment tothe organizing document)

4b

bb Type I or Type If only. Was any added or substituted supported organization part ofa class already designated in

the organization's organizing document? Sb

{¢ Substitutions oniy. Was the substitution the result ofan event beyond the organization's control?

g

6 Did the organization provide support (hether in the form of grants oF the provision of services or facilities) to

Anyone other tnan (a) i's supparted organizations, (b) individuais that are part of the charitable class Denefited by

{ane of more af ts supported organizations, or (c)ather supporting organizations that also support or benefit one

or more ofthe filing organization’: supportad organizations? If "Yes, "provide detail m Part VI. 6

7 Did the organization provide a grant, loan, compensation, or other similar payment to a substantial contnbutor

(defined in IRC 4958(c)(3}C)), 2 family member of a substantial contnbutor or a 35-percent controlled entity,

wth regard to a substantial contnbutor? If “Yes,” camplete Part of Schadulel (Ferm 990) 2

8 Did the organization make a loan toa disqualified person (a5 defined in section 4958) not described inline 77

11 "Yes," complete Part If of Schedule L (Form 990) 8

98 Was the organization controled directly or indirectly at any time during the tax year by one or more disqualified

persons as defined in section 4946 (other than foundation managers ané organizations described in section S09

(a)(2) or (2))? 1F"¥es," provide detain Pare VE. oa

bb Did one or more disqualified persons (as defined in ine 9(a)) hold a controling interest in any entity in which the:

supporting organization had an interest? If "Yes," provide deta in Part VI.

9

Dida disqualified person (as defined in line 9{a)) have an ownership interest in, or derive any personal benefit,

from, assets in nhich the supporting organization also had an interest? If “Ves,” plovide deta! m Part VE. =

loa was the organization subject to the excess business holdings rules of IRC 4943 because of IRC 4943(1)

(regarsing certain Type {1 supporting organzations, ang all Type III non-functionally integrated supporting

organizations) 7 "Ves," answer b below 300

bb Did the organization have any excess business holdings in the tax year? (Use Schedule G, Form 4720, to determine

Whether the erganrzation had excess business holdings)

0b

41 Has the organization accepted a gift or contribution trom any of the following persons?

‘9 A person who directly or indirectly contrals, either alone or together with persons described in (b) and (c) below,

the governing boay of a supported organization? tia

A family member of a person described in (a) above? Fry

€ A 359% controlled entity of a person described in (a) oF (b) above7It "Yes" to, v, orc, providedetai im pat vi | ae

ree

‘Schedule A (Form 990 of 990-£Z) 2015 Page 5

TEX7_ Supporting Organizations (continued)

‘Section B. Type I Supporting Organizations

1 Did the directors, trustees, oF membersinp of one oF more supported organrzations have the power to regularly

appoint or elect at least 2 majority ofthe organization ditectors or trustees at all times dunng the tax year?

11a" describe in Part VE how the supported organization(s) effectively ope'ated, supervised, or controlled the

‘organieation®s activities If the organieation id more than one supported organization, describe hew the powers £0

‘appoint and/or emove directors or trustees mere allocated among the supported organvzations and what conditions or

Festnictions, if any, applied to Such powers during the tax year a

2.__Did the organization operate for the benefit of any supported organization other than the supported organtzation(s

that operated, supervised, or controlled the supporting organization?

Ir "Yes," explain im Part VE hou providing such benefit carried out the purposes ofthe supported organization(s) that

operated, supervised or controlled the supparting organization

‘Section €. Type 11 Supporting Organizations

Yes | No

A. Were @ mayonty ofthe organization’ directors or trustees during the tax year also @ majonty of the directors or

trustees of each of the organveation’s supported organization(s?

11", describe n Bart VE how control ar management of the Supporting evoanrzation was vested inthe same persons

that controled or managed the supparted organizaten(s) 1

‘Section D. All Type III Supporting Organizations

1. Did the organization provide to each of ts supported organizations, by the last day of the fith month of the

organization's tax year, (1) a written notice describing the type and amount of support provided during the prior

tax year, (2) copy of the Form 990 that was mast recently filed as of the date of notification, and (3) copies of

the organization's governing dacuments in effect on the date of notification, ta the extent not previously proviced?| 2

2 Were any of the organization’ officers, directors, or trustees either (1) appointed or elected by the supported

organization(s) of (i) serving on the governing body ofa supported organization?

1F "No," explain m Pare VE how the organization mamntained a cose and cantinucus working relatianstyp with the A

Supported organization(s)

3. By reason of the relationship descnbed in (2), did the organization's supported organizations have a significant

voice m the organization’ investment policies and in girecting the use of the organigation’ income or assets at

alltumes during the tax year?

Ir "Yes," describe m Part VE the rte the organtzation’s supported ot ganizatiens played in this regard 3

‘Section E. Type II Functionally- Integrated Supporting Organizations

1. Check the box next fa the method that the organization used to satisty the Integral Part Test curing the year (see instructions)

‘a [The organization satisfied the Activities Test Complete line 2 below

1b [F—_The organization is the parent of each of ts supported organizations Complete line 3 below

© [7 The organization supported a governmental entity Describe in Part VI how you supported 2 government entity (see

instructions)

2 Actites Test_Answer (a) and (b) below. Yes | No

22 Did substantially all of the organvzation’s activites during the tax year directly further the exempt purposes ofthe

supported organization(s) to which the organization was responsive?

11 "Yes," then n Bart VE identify those supported organizations and explain how these activites directly

furthered ther exempt purposes, how the arganization wae responsive fo those supported arganizatons, and how the

organization determined that these activites constituted substantially al f 1 activities 2a

bb Did the activities descnbed in (a) constitute activities that, but for the organization's involvement, one or more of

the organization's supported organization(s) would have been engaged in?

1 "Yes," explain in Part VE the reasons for the erganrzatin’s position that Its Supported argantzation(s) would have

‘engaged in these actvitias but far ens organizations involvement 2b

3 Parent of Supported Organizations __ Answer (a) and (b) below.

2 Did the organization have the power to regularly appoint or elect a mayonty ofthe oficers, directors, or trustees of

each of the supported organizations? Provide details Part VI Ed

bb Did the organization exercise a substantial degree of direction over the policies, programs and activities of each

ofits supported organizations? if "Yes," describein Fart VI the role played by the organization 1n ths regard 3b

ee!

Schedule A (Form 990 or 990-EZ) 2035 Page 6

MEHR Type 111 Non-Functionally Integrated 509(a)(3) Supporting Organizations:

YT Check here i the organisation satisied the Integral Part Test as a qualifying trust on Nov 20,1570 See instructions: Al other

Type 111 non-functionally itegrated supporting organizations must complete Sections A through E Cc

Section A - Adjusted Net Income (#9 Prox Year eptonad,

Net short-term capital gain

Recoveries of pnor-year distributions

Other gross income (see instructions)

Add tines 4 through 3

Deprectation and depletion

Portion of operating expenses paid or incurreé for production or collection of

gross income or for management, conservation, or maintenance of property

held for praduetion of income (see instructions:

Other expenses (see instructions)

Adjusted Net Income (subtract lines 5, 6 and 7 from ne 4)

Section B - Minimum Asset Amount (ay enor Year eptonal,

Aggregate fair market value ofall non-exempt-use assets (see

instructions for short tax year or assets held for part of year) 1

Average monthly value of secunties te

Average monthly cash balances wb

Fair market value of other non-exempt-use assets 1c

Total (add lines 12, 1b, and 1¢) FA

{explain in detail in Part V1)

Acquisition indebtedness appicable to non-exempt use assets

3 Subtract line 2 from ine 14

cash deemed held for exempt use Enter 1-1/2%6 of ine 3 (for greater

Net value of non-exempt-use assets (subtract line 4 from line 3)

Multiply tine 5 by 035

Recoveres of prior-year aistnbutions

Minimum Asset Amount (add line 7 to line 6)

Section C - Distributable Amount Cine Year

Adusted net income for pnor year (from Section A, ine B, Column A)

Enter 85% of line 1

Minimum asset amount for prior year (rom Section @, line &, Column A)

Enter greater of ine 2 oF line 3

ncome tax imposed in aior year

Distributable Amount. Subtract line 5 from line 4, unless subject to

emergency temporary reduction (see instructions) ‘

7 Check here ifthe current year is the organization's first as a non-functionally-integrated Type TI Supporting organization (eee

instructions) [~

eee

Schedule A (Form 990 or 990-EZ) 2035

Page 7

KEEN Type 111 Non-Functionally Integrated 509(a)(3) Supporting Organizations (continued)

‘Section D - Distributions

4_Amounts pard to supported organizations to accomplish exempt purposes

2 Amounts patd to perform activity that directly furthers exempt purposes of supported organizations, 1n

excess of meame from actity

3_ Administrative expenses paid to accomplish exempt purposes of supported organtzations

4 Amounts paid to acquire exemptuse assets

5 Qualified set-aside amounts (prior IRS approval required)

6 Other distributions (descnbe n Part VI) See instructions

7_ Total annual distributions. Acd lines 1 through 6

8 Distnbutions to attentive supportes organizations to which the organization 1s responsive (provide

details in Part vi) See mstiuctions

9 bistnbutable amount for 2015 fram Section C, line 6

10 _Line 8 amount divided by Line 8 amount

Section E - Distribution Allocations (see 0

G

instructions) Excess Distributions Underdistributions,

re-2015

a

Distributable

Amount for 2015

T Distributable amount fer 2015 from Section ©, bine

6

2 Underdistnbutions, any, for years pror to 2015

(reasonable cause required--see instructions)

3 Excess distributions carryover, any, to 2025,

ny

‘@ From ola)

# Total of ines Ja through ©

‘9 Applied to underdistributions of pnor years

Th Applied to 2015 distributable amount

¥ Carryover from 2010 not applied (see

instructions}

Remainder subtract ines 39, 3h, and 31 from SP

% Distributions for 2015 from Section D, me 7

"Applied to undereistributions of pror years

'b Applied to 2015 distnburable amount

© Remainder Subtract lines 4a and 4b from 4

3 Remaining undercistributions for years prior to

2015, any Subtract lines 39 and 4a from line 2

(ifamount greater than zero, see instructions)

@ Ramaning underdistnbutions for 2015 Subtract

lines 3h and 4b from line 1 (if amount greater than

zero, see instruction

7 Excess distributions carryover to 2016. Ada lines

3yand 4c

‘B_Breakdonn of me 7

Excess from 2015

From 2014, 7 yy

‘Schedule A (Form 990 or 990-EZ) (7015)

Schedule A (Form 990 or 990-EZ) 2025

[ZERZ Supplemental Information.

Provide the explanations required by Part II, line 10; Part Il, ine 17a or 179; Part II, line 12; Part IV,

Section A, lines 1, 2, 3b, 3c, 4b, 4c, 5a, 6, 92, 9b, 9¢, 11a, 11b, and 11¢; Part IV, Section B, lines 1 and 2;

Part IV, Section C, line 1; Part IV, Section D, ines 2 and 3; Pert IV, Section E, lines 1c, 2a, 2b, 3a and 3b;

Part V, line 1; Part V, Section B, line Le; Part V Section D, lines 5, 6, and 8; and Part V, Secuon E, lines 2, 5,

and 6. Also complete this part for any additional information. (See instructions)

Page 8

Facts And Circumstances Test

Schedule A (Form 990 or 990-EZ) 2015.

[efile GRAPHIC print DO NOT PROCESS [As Filed Data -] DLN: 93495226022767

SCHEDULE D Supplemental Financial Statements 2 0 15

(Form 990)

> complete if the organization answered “Yes,” on Form 980,

rT

art IV, line 6 7, 8,9, 20, 11a, 11b, 116, 184, 13¢, 181, 120, oF 12D,

'» Attach to Form 990.

Treasuy Information about Schedule D (Form 960) and its instructions is at wwwirs.gov/tormoso. [ieee

‘Name of the organization Employer Identification number

64-0787918

‘Organizations Maintaining Donor Advised Funds or Other Similar Funds or Accounts,

Complete if the organization answered "Yes" on Form 990, Part IV, line 6.

(a) Donor advised funds (b)Funds end other accounts

1 Total number at end of year

2 Aggregate value of contributions te (during

yea")

3 Aggregate value of grants from (during year)

4 Agaregate value at end of year

Did the orgameation inform all donors and donor advisors in writing thatthe assets held in donor advised

funds are the organization's property, subject to the organization's exclusive legal contral? Pres Co

{6 bid the orgamzation inform all grantees, donors, and donor advisors in wting that grant funds can be

lused only for charitable purposes and not for the benefit of the donor ar dont advisor, or for any ather purpose

conferring impermissible private benefit? [ver [no

Conservation Easements. Complete if tne organization answered "Yes" on Form 990, Part IV, line 7

1 Purpose(s) of conservation easements held by the organization (check all that apply)

[Preservation of land for public use (e g recreation or

education) [7 Preservation ofan histoncally important land area

TF Protection of natural habitat TT Preservation ofa certified histone structure

TF Preservation of open space

2 Complete limes 2a through 2¢ ifthe organization held a qualified conservation contnbution inthe form of a conservation

easement on the last day ofthe tax year

Held at the End of the Year

bb Total acreage restricted by conservation easements 2

‘€ Number of conservation easements on a certified histone structure included in (a) ze

1d Number of conservation easements included in (c) acquired after 8/17/06, and not on @

histone structure listed inthe National Register 2a

3 Number of conservation easements modifie, transferred, released, extinguished, or terminated by the organization dunng the

tax year >,

4 Number of states where property subject to conservation easement is located P.

oes the organization have a written policy regarding the periodie monitoring, inspection, handling of

‘lolations, and enforcement of the conservation easements it olds? ves [No

6 _Stafand volunteer hours devoted to monitoring, nspecting, handling of violations, and enforcing conservation easements during the

year

»

7 Amount of expenses incurred in monitoring, inspecting, handling of violations, and enforcing conservation easements during the year

ms

18 Does each conservation easement reported on line 2(8) above satisty the requirements of section 170(h)(4)

(Bj(s ane section 170(h}¢4 (B)(u)> Pves [No

9 InPare XI11, describe how the organization reports conservation easements in its revenue and expense statement, and

balance sheet, and mclude, applicable, the text of tne footnote to the organization’ financial statement that describes

the organization's accounting for conservation easements

[EIEEIH Organizations Maintaining Collections of Art, Historical Treasures, or Other Similar Assets,

Complete if the organization answered "Yes" on Form 990, Part 1V, line 8.

ta Ifthe organization elected, as permitted under SFAS 116 (ASC 958), not to report in its revenue statement and balance sheet

works of art, historieal treasures, or other similar assets held for public exhibition, education, or research in furtherance of public

Service, provide, in Part XII], the text of the footnote to its financial statements that describes these Cems

bb Ifthe organization elected, as permitted under SFAS 116 (ASC 958), to report in its revenue statement and balance sheet

works of art, historical treasures, or other siilar assets held for public exhibition, education, or research in furtherance of public

Service, provide the following amounts relating to these items

() revenue included on Form 999, Part VIII, ine 1 ms

(0 Assets included in Form 990, Pact X bs

2 _ Ifthe organization received or held works of art, histoncal treasures, or other similar assets for financial gain, provide the

fallowng amounts required to be reported under SPAS 116 {ASC 958) relating to these items

Revenue included on Form 890, Part VIET ine ms

Assets includes in Form 990, Part X oa

For Paperwork Reduction Act Notice, cee the Instructions for Form 990. Ss eo oor

Schedule (Form 390) 2015 Page 2

‘Organizations Maintaining Collections of Art, Historical Treasures, or Other Similar Assets

conned}

3 Using the organization’ acquisition, accession, and other records, check any of the following that are a significant use of ts

colleezion items (check all that apply)

2 Public exhibition 4 TH Loanorexchange programs

© scholarly research © other

© 7 Preservation for future generations

4 Provige a descnption of the organzations collections and explain how they further the organvzatian’s exempt purpose in

Part xUtT

5 During the year, did the organization solicit or recerve donations of art, historical treasures or other similar

assets to be sold to fase funds rather than to be mamntained a part of the organization's collection? Eves [No

Escrow and Custodial Arrangements.

Complete the organization answered "Yes" on Form 990, Part 1V, lie 9, or reported an amount on Form 990,

Part X, line 21.

{421s the organization an agent, trustee, custodian or other intermediary for contributions or other assets not

tncluded on Form 990, Part X? [ves No

b_1F°¥es," explain the arrangement in Part XI11 and complete the following table ‘Amount

© Beginning balance Fa

4 Additions during the year a

© bistnbutions dunng the year te

# ending balance at