Professional Documents

Culture Documents

Risk Refers To The Uncertainty That Surrounds Future Events and Outcomes

Risk Refers To The Uncertainty That Surrounds Future Events and Outcomes

Uploaded by

Gangadhara RaoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Risk Refers To The Uncertainty That Surrounds Future Events and Outcomes

Risk Refers To The Uncertainty That Surrounds Future Events and Outcomes

Uploaded by

Gangadhara RaoCopyright:

Available Formats

What is Risk?

The term risk originates from the Italian term ‘riskare’ (or risicare), which means

‘to dare’. Risk refers to the uncertainty that surrounds future events and outcomes. Uncertainty is not known

what will happen in the future. If there is the greater the uncertainty, there is greater the risk. For each

decision there is a risk-return trade-off. Anytime there is a possibility of loss (risk), there should also be an

opportunity for profit.

Definition:

Risk can be defined as “the possibility of loss or an unfavourable outcome associated with an

action”.

(Loss: Any negative consequence or adverse effect, financial)

Risk is defined as “the chance of something happening that will have a negative impact on

objectives”.

Sources of Risk in Business Investment?

If we talk only about return on investment without talking about the risk on

investment, it will not be sensible (done in accordance with wisdom). Return on investment and business

risk always move together and at any stage of our business life cycle, our return may turn into loss. So it is

really important to know about all the sources of risk that may impact our business. There are certain sources

of risks that make financial asset quite risky.

1. Interest rate Risk

2. Market Risk

3. Inflation Risk

4. Business Risk

5. Financial Risk

6. Liquidity Risk

7. Exchange rate Risk

8. Country Risk

1. Interest Rate Risk: The variability in returns of a security which result from changes in the level of

interest rates is referred to as interest rate risk. Generally securities are inversely affected by such

changes. This means that the price of security moves inversely to the interest rate provided, other

things being equal.

This type of risk is most apparent in the bond market because bonds are issued at

specific interest rates. Generally, a rise in interest rates will cause a decline in market prices of existing

bonds, while a decline in interest rates tends to cause bond prices to rise.

For example, you buy a 10-year bond today with a 6% annual yield. If interest

rates rise, a new 10-year bond may be issued with an 8% annual yield. The price of your bond drops

because investors aren’t willing to pay full value for a bond that yields less than the current rate of

interest.

i. Price risk: Price risk arises due to the possibility that the price of the shares, commodity,

investment, etc. may decline or fall in the future.

ii. Reinvestment rate risk: Reinvestment rate risk results from fact that the interest or

dividend earned from an investment can' t be reinvested with the same rate of return as it

was acquiring earlier.

For example, an investor constructs a portfolio of bond at a time when prevailing

yields are running around 5%. Among his bond purchases, the investor buys a 5-year Rs.100,000

treasury note, with the expectation of receiving Rs.5,000 a year in annual income.

In the course of that five-year period, however, prevailing rates on this particular

bond class fall to 2%. The good news is that the bondholder receives all scheduled 5% interest

payments, as agreed, and at maturity receives full Rs.100,000 of principal, also as agreed. So what's

the problem?

The problem is that if now the investor buys another bond in the same class, he'll no

longer receive 5% interest payments. The investor has to put the cash back to work at the lower

rates. Now, that same Rs.100,000 generates only Rs.2,000 each year rather the Rs.5,000 annual

payments he received on the earlier note.

2. Market Risk: The variability in returns of a security which result from changes in the prices of

financial instruments is referred to as market risk. It arises due to rise or fall in the trading price of

listed shares or securities in the stock market. Market risk can be classified as Directional

Risk and Non - Directional Risk.

i. Directional risk: Directional risks are those risks where the loss arises from an exposure

(experience) to the particular assets of a market. For e.g. an investor holding some shares

experience a loss when the market price of those shares falls down.

ii. Non- directional risk: Non- Directional risk arises where the method of trading is not

consistently followed by the trader. For eg. The dealer will buy and sell the share

simultaneously to mitigate (diminish) the risk.

3. Inflation Risk: Inflation risk is also known as Purchasing power risk, this risk arises from the decline in

value of securities cash flow due to inflation, which is measured in terms of purchasing power.

The risk that the rate of inflation will exceeds the rate of return on an investment. For

example, if the rate of inflation is 5% over a year and the rate of return is 3%, then the investor has

effectively taken a loss even though he/she has made a profit in absolute terms. Inflation risk applies

especially to fixed-return securities as there is no possibility that the rate of return will increase to

surpass inflation. The types of inflationary risk are listed below:

i. Demand inflation risk: Demand inflation risk arises due to increase in price, which result from

an excess of demand over supply. It occurs when supply fails to cope with (manage) the

demand and hence cannot expand anymore. (In other words, demand inflation occurs when

production factors are under maximum utilization.)

ii. Cost inflation risk: Cost inflation risk arises due to sustained (constant) increase in the prices of

goods and services. It is actually caused by higher production cost. A high cost of production

inflates (increases) the final price of finished goods consumed by people.

4. Business Risk: Business risk is also known as liquidity risk. This type of risk arises out of

inability to execute transactions. Liquidity risk can be classified into Asset Liquidity Risk and Funding

Liquidity Risk.

i. Asset liquidity risk: Asset liquidity risk is due to losses arising from an inability to

sell assets at. For e.g. Assets sold at a lesser value than their book value.

ii. Funding liquidity risk: Funding liquidity risk exists for not having an access to the

sufficient- funds to make a payment on time. For e.g. When commitments made to

customers are not fulfilled as discussed in the SLA (service level agreements).

You might also like

- HiltonPlatt 11e TB Ch15Document77 pagesHiltonPlatt 11e TB Ch15Jay Han100% (1)

- Concept of Return and RiskDocument6 pagesConcept of Return and Risksakshigo100% (7)

- How To Determine When A Reversal Is Going To Take PlaceDocument43 pagesHow To Determine When A Reversal Is Going To Take PlacesyNo ratings yet

- Assignment 2Document3 pagesAssignment 2Arnica TradersNo ratings yet

- Module 2Document15 pagesModule 2ytmandar29No ratings yet

- Sr. No. Particulars Pg. No.: IndexDocument23 pagesSr. No. Particulars Pg. No.: IndexOmer AsifNo ratings yet

- Chapter 5: Managing Investment RiskDocument13 pagesChapter 5: Managing Investment RiskMayank GuptaNo ratings yet

- IAPM AssignmentDocument29 pagesIAPM Assignmentpreeti royNo ratings yet

- Risk and Return: Financial ManagementDocument3 pagesRisk and Return: Financial Managementharish chandraNo ratings yet

- Midterm Assignment 6: Frando, Maria Teresa S. OL33E63Document3 pagesMidterm Assignment 6: Frando, Maria Teresa S. OL33E63Maria Teresa Frando CahandingNo ratings yet

- DP 2 3Document10 pagesDP 2 3khayyumNo ratings yet

- Unit - 1 Risk Meaning, Types, Risk Analysis in Capital BudgetingDocument19 pagesUnit - 1 Risk Meaning, Types, Risk Analysis in Capital BudgetingPra ModNo ratings yet

- FRM NotesDocument13 pagesFRM NotesNeeraj LowanshiNo ratings yet

- Unit 2Document20 pagesUnit 2vijay SNo ratings yet

- 1.introduction To Risk 2Document34 pages1.introduction To Risk 2leamae.cuarenta.20No ratings yet

- Sr. No. Particulars Pg. No.: IndexDocument25 pagesSr. No. Particulars Pg. No.: IndexjansimumNo ratings yet

- Introduction To Finance-Risk and Concept of RiskDocument17 pagesIntroduction To Finance-Risk and Concept of RiskBOL AKETCHNo ratings yet

- ACFrOgCV6T8JDBWHJVLlqAZ6QtEZdCNWdQHiotVcbMLPjSpZsndByWDjam8WNEalNIHxp6nmWcchJCv1nmBz7TyLDN4ChFJtvfNXRmYo8xkpmXsN41bnxzj5G79DuN 3LAzsoB5xTo4H5BDAH9VLDocument25 pagesACFrOgCV6T8JDBWHJVLlqAZ6QtEZdCNWdQHiotVcbMLPjSpZsndByWDjam8WNEalNIHxp6nmWcchJCv1nmBz7TyLDN4ChFJtvfNXRmYo8xkpmXsN41bnxzj5G79DuN 3LAzsoB5xTo4H5BDAH9VLjeneneabebe458No ratings yet

- FRM Chap1Document8 pagesFRM Chap1SangeethaNo ratings yet

- Chapter 3Document59 pagesChapter 3Lakachew GetasewNo ratings yet

- Module 2Document12 pagesModule 2zoyaNo ratings yet

- Chapter 1 Introduction: Risk & ReturnDocument32 pagesChapter 1 Introduction: Risk & ReturnMaridasrajanNo ratings yet

- Risks in Financial MarketsDocument25 pagesRisks in Financial MarketsPriya100% (1)

- Investment Return Standard Deviation Historical Returns Average ReturnsDocument12 pagesInvestment Return Standard Deviation Historical Returns Average ReturnsAnushya RamanNo ratings yet

- Introduction To FRMDocument7 pagesIntroduction To FRMRavinder Kumar AroraNo ratings yet

- Financial Markets and Institutions Unit 3Document9 pagesFinancial Markets and Institutions Unit 3Nitin PanwarNo ratings yet

- Risk Return Analysis-IIFLDocument131 pagesRisk Return Analysis-IIFLPrathapReddy100% (1)

- What Are 'Marketable Securities': Default Risk Is The Chance That Companies or Individuals Will Be Unable To MakeDocument11 pagesWhat Are 'Marketable Securities': Default Risk Is The Chance That Companies or Individuals Will Be Unable To MakeSheila Mae AramanNo ratings yet

- Risk Analysis in Capital BudgetingDocument10 pagesRisk Analysis in Capital BudgetingChinnu PreranaNo ratings yet

- Q # 1: ANS: Types of Market Risk, 1Document4 pagesQ # 1: ANS: Types of Market Risk, 1Alisha KhanNo ratings yet

- Risk and Return Trade OffDocument14 pagesRisk and Return Trade OffDebabrata SutarNo ratings yet

- Lecture Handout No. 2 Risk and DiversificationDocument9 pagesLecture Handout No. 2 Risk and DiversificationJessa ArellagaNo ratings yet

- Risk in Financial ServicesDocument5 pagesRisk in Financial ServicesMouni SharonNo ratings yet

- Portfolio Management Final HandoutDocument58 pagesPortfolio Management Final HandoutPavan Kumar MylavaramNo ratings yet

- Risk Associated With Investing in Fixed Income SecuritiesDocument28 pagesRisk Associated With Investing in Fixed Income SecuritiesviolettaNo ratings yet

- Investment Risk and Portfolio ManagementDocument20 pagesInvestment Risk and Portfolio ManagementJUNENo ratings yet

- Investmment Chapter TwoDocument10 pagesInvestmment Chapter Twosamuel debebeNo ratings yet

- The Sources of RiskDocument8 pagesThe Sources of RiskDarkknightNo ratings yet

- Risk & Ret P-I (2022)Document6 pagesRisk & Ret P-I (2022)hardik jainNo ratings yet

- Risk and InvestmanagementDocument5 pagesRisk and InvestmanagementDeepak ParidaNo ratings yet

- Wealth ManagementDocument10 pagesWealth Managementmaitree sanghaniNo ratings yet

- Lecture: Risk, Return and ProfitsDocument7 pagesLecture: Risk, Return and ProfitsTanishq JainNo ratings yet

- Chapter 2 Risk and ReturnDocument15 pagesChapter 2 Risk and ReturnAbel HailuNo ratings yet

- A.P.S Iapm Unit 2Document21 pagesA.P.S Iapm Unit 2vinayak mishraNo ratings yet

- RISKSDocument23 pagesRISKSShruti Savant DodaniNo ratings yet

- RiskDocument3 pagesRiskMayank GoyalNo ratings yet

- Types of Investment RiskDocument3 pagesTypes of Investment RiskRenese LeeNo ratings yet

- Course Work SapmDocument9 pagesCourse Work SapmloganathanNo ratings yet

- RiskDocument6 pagesRiskvarunasdf0No ratings yet

- Financial System RiskDocument4 pagesFinancial System RiskAntonio ReyesNo ratings yet

- Concept of Return and RiskDocument3 pagesConcept of Return and RiskNabila SadiaNo ratings yet

- Fundamentals of InvestmentDocument5 pagesFundamentals of Investmentdelight zoneNo ratings yet

- Financial RiskDocument13 pagesFinancial RiskHitesh Pant50% (2)

- Investment (Risk and Return) Chapter 2Document10 pagesInvestment (Risk and Return) Chapter 2Ambachew MotbaynorNo ratings yet

- UNIT 3 RiskDocument4 pagesUNIT 3 RiskAnkush SharmaNo ratings yet

- Security Analysis Portfolio Management AssignmentDocument4 pagesSecurity Analysis Portfolio Management AssignmentNidhi ShahNo ratings yet

- CHAPTER - II Risk and ReturnDocument13 pagesCHAPTER - II Risk and Returnsamrawithagos2002No ratings yet

- Basics of InvestingDocument22 pagesBasics of InvestingopulencefinservNo ratings yet

- Risk and Return PDFDocument14 pagesRisk and Return PDFluv silenceNo ratings yet

- 10 - Chapter 4 PDFDocument14 pages10 - Chapter 4 PDFNithin DanielNo ratings yet

- Risk ManagementDocument35 pagesRisk Managementfafese7300No ratings yet

- Unit 1Document40 pagesUnit 1amritaagarwal23No ratings yet

- MS Assignment QuestionsDocument1 pageMS Assignment QuestionsGangadhara RaoNo ratings yet

- Management Science PrefaceDocument1 pageManagement Science PrefaceGangadhara RaoNo ratings yet

- LSCM Unit-IiDocument21 pagesLSCM Unit-IiGangadhara RaoNo ratings yet

- MS Question BankDocument4 pagesMS Question BankGangadhara RaoNo ratings yet

- Unit-1: Conceptual Lesson Plan For Management ScienceDocument6 pagesUnit-1: Conceptual Lesson Plan For Management ScienceGangadhara RaoNo ratings yet

- Unit-Iv: The Sourcing DecisionsDocument31 pagesUnit-Iv: The Sourcing DecisionsGangadhara Rao100% (1)

- LSCM Unit-VDocument28 pagesLSCM Unit-VGangadhara RaoNo ratings yet

- Proposed Topics For PH.DDocument2 pagesProposed Topics For PH.DGangadhara RaoNo ratings yet

- Role of BanksDocument4 pagesRole of BanksGangadhara RaoNo ratings yet

- SM 2nd UnitDocument8 pagesSM 2nd UnitGangadhara RaoNo ratings yet

- Competency MappingDocument5 pagesCompetency MappingGangadhara RaoNo ratings yet

- SM 11st UnitDocument13 pagesSM 11st UnitGangadhara RaoNo ratings yet

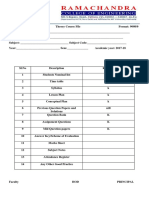

- Theory Course File FormatDocument1 pageTheory Course File FormatGangadhara RaoNo ratings yet

- Andhra Loyola Institute of Engineering and TechnologyDocument1 pageAndhra Loyola Institute of Engineering and TechnologyGangadhara RaoNo ratings yet

- What Is Customer Knowledge?Document27 pagesWhat Is Customer Knowledge?Gangadhara RaoNo ratings yet

- SFM Course FileDocument14 pagesSFM Course FileGangadhara RaoNo ratings yet

- Financial Institution: U. Gangadhar - Assoc - Professor - Dept. of Management StudiesDocument16 pagesFinancial Institution: U. Gangadhar - Assoc - Professor - Dept. of Management StudiesGangadhara RaoNo ratings yet

- JNTUK R16 I Year MBA I SEMESTER SYLLABUS PDFDocument28 pagesJNTUK R16 I Year MBA I SEMESTER SYLLABUS PDFGangadhara RaoNo ratings yet

- New Krupararao Mini ProjectDocument38 pagesNew Krupararao Mini ProjectGangadhara RaoNo ratings yet

- Entrepreneurial Life Skills in India: Dr.K.Kalyan Chakravarthy, Dr.B.Shanta KumarDocument6 pagesEntrepreneurial Life Skills in India: Dr.K.Kalyan Chakravarthy, Dr.B.Shanta KumarGangadhara RaoNo ratings yet

- PoseDocument1 pagePoseGangadhara RaoNo ratings yet

- Presentasi EOS Week 12Document38 pagesPresentasi EOS Week 12ELVIRA ABIDINNo ratings yet

- Iub-Micro-Course OutlineDocument2 pagesIub-Micro-Course OutlineBiswajit ChowdhuryNo ratings yet

- Financial Leverage and Capital Structure Policy: Conducted by Ranjika Perera & Chanaka KarunasenaDocument53 pagesFinancial Leverage and Capital Structure Policy: Conducted by Ranjika Perera & Chanaka Karunasenacharitha007No ratings yet

- Basic and Non Basic Activity Economic RegionalDocument17 pagesBasic and Non Basic Activity Economic Regionalsara100% (2)

- Cash and Cash EquivDocument5 pagesCash and Cash EquivInvisible CionNo ratings yet

- Sec A - VZG16 - HectorDocument21 pagesSec A - VZG16 - HectorSumitNo ratings yet

- Exercise 6 - 1 Multiple Choice QuestionsDocument3 pagesExercise 6 - 1 Multiple Choice QuestionsYrica100% (1)

- OpTransactionHistory08 09 2019 PDFDocument6 pagesOpTransactionHistory08 09 2019 PDFNehal PatodiNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument30 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancemayur ahirNo ratings yet

- 07 Chapter 7 - Technology Assessment Strategy MakingDocument36 pages07 Chapter 7 - Technology Assessment Strategy MakingHustling MillionaireNo ratings yet

- Integrated Marketing CommunicationDocument41 pagesIntegrated Marketing Communicationvrekhavasu100% (12)

- SDP Prospectus (Part4)Document565 pagesSDP Prospectus (Part4)Mazlinda Md RaisNo ratings yet

- Entrepreneurship ArtículoDocument27 pagesEntrepreneurship ArtículoYosoyNo ratings yet

- Managerial Economics: 8. Nature of Industry (Baye Chapter 7)Document13 pagesManagerial Economics: 8. Nature of Industry (Baye Chapter 7)Afrita de LimaNo ratings yet

- Pricing Fundamentals See Where Your Pricing Needs To GoDocument7 pagesPricing Fundamentals See Where Your Pricing Needs To Gomatthias lenerNo ratings yet

- Boeing Strategy AnalysisDocument16 pagesBoeing Strategy Analysisradkris914100% (1)

- Pharmacy Career OptionsDocument19 pagesPharmacy Career OptionscoutinhoeNo ratings yet

- Gold MarketDocument25 pagesGold MarketVirendra Jha100% (1)

- Financial Statement Analysis: K R Subramanyam John J WildDocument40 pagesFinancial Statement Analysis: K R Subramanyam John J WildStory pizzieNo ratings yet

- Chapter 16 AssignmentDocument13 pagesChapter 16 Assignmentshoaiba1No ratings yet

- FM09-CH 17Document5 pagesFM09-CH 17Mukul KadyanNo ratings yet

- Brenner 1998Document23 pagesBrenner 1998Catalina AcostaNo ratings yet

- Structured Products Nov 2019 EIBSDocument38 pagesStructured Products Nov 2019 EIBSAli AkberNo ratings yet

- Oria, Maybelyn S. Cfas - Sec 10: What Total Amount Should Be Reported As Shareholders' Equity?Document52 pagesOria, Maybelyn S. Cfas - Sec 10: What Total Amount Should Be Reported As Shareholders' Equity?May OriaNo ratings yet

- Project Finance ModuleDocument120 pagesProject Finance Modulesureshsadasivam20031433No ratings yet

- BizSim Presentation Template 2016Document8 pagesBizSim Presentation Template 2016Benzamin DangNo ratings yet

- New Investment Avenues in India: Wealth InsightDocument50 pagesNew Investment Avenues in India: Wealth InsightSayed WahabNo ratings yet