Professional Documents

Culture Documents

Financial Highlights

Financial Highlights

Uploaded by

Anushka SinhaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Highlights

Financial Highlights

Uploaded by

Anushka SinhaCopyright:

Available Formats

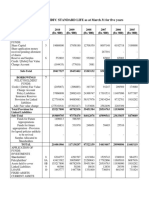

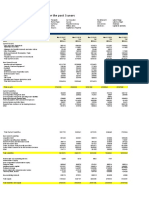

FINANCIAL HIGHLIGHTS

(` in lacs)

2015-16 2014-15 2013-14 2012-13 2011-12 2010-11 2009-10 2004-05

OPERATING RESULTS

Turnover 376842 369217 347792 299434 259682 243681 238707 134264

Surplus before Depreciation, Finance

Cost & Tax Expenses (EBITDA) 44899 45755 38138 51995 47856 55502 84342 14522

Finance Cost 8159 7837 8559 6486 5251 5263 2697 2169

Surplus after Finance Cost but

before Depreciation &

Amortisation & Exceptional Items 36740 37918 29579 45509 42605 50239 81645 12353

Depreciation and Amortisation 14903 15346 13258 10439 8000 6483 5564 2983

Exceptional Items 3149 1284 1093 - - - - -

Income/Deferred Tax/Income Tax Refund (Net) 2953 3744 2252 8088 10684 11768 20363 683

Net Profit 15735 17544 12976 26982 23921 31988 55718 8687

Dividend Payout 5561 5561 5406 6292 5370 5377 5395 1317

Dividend Percentage 60.00 60.00 60.00 70.00 60.00 60.00 60.00 15.00

Retained Earning 10174 11983 7570 20690 18551 26611 50323 7370

ASSETS & LIABILITIES

Fixed Assets :

Gross Block 345684 327139 307691 290887 271073 220945 175779 98104

Net Block 208817 204527 200652 196140 186216 143393 102645 40297

Other Assets 306591 294599 286060 256409 219745 216911 190390 37439

Total Assets 515408 499126 486712 452549 405961 360304 293035 77736

Represented by :

Share Capital 7701 7701 7701 7701 7701 7701 7701 7701

Reserves & Surplus 263221 254710 244907 237305 216637 198091 171422 23578

Net Worth 270922 262411 252608 245006 224338 205792 179123 31279

Borrowings 93766 124261 107941 117527 112433 93769 70919 24156

Other Liabilities & Provisions 150720 112454 126163 90016 69190 60743 42993 22301

Key Indicators

Earning per Ordinary Share (`) 20.43 22.78 16.85 35.04 31.06 41.54 72.36 11.28

Cash Earning per Ordinary

Share (`) (annualised) 43.62 48.23 36.99 59.10 41.45 49.96 79.58 15.15

Net Worth per Ordinary Share (`) 351.82 340.77 328.00 318.17 291.33 267.24 232.61 40.62

Debt Equity Ratio (on long-term loans) 0.31:1 0.42:1 0.26:1 0.39:1 0.34:1 0.29:1 0.23:1 0.31:1

Current Ratio 2.61 3.65 2.58 2.21 2.51 2.64 1.96 1.28

12

You might also like

- John M CaseDocument10 pagesJohn M Caseadrian_simm100% (1)

- Ratios HW 1 Template-5 Version 1Document14 pagesRatios HW 1 Template-5 Version 1api-506813505No ratings yet

- M&a PresentationDocument12 pagesM&a PresentationAnushka SinhaNo ratings yet

- Ratio Analysis FMCG Industry FinalDocument4 pagesRatio Analysis FMCG Industry Finalnishant50% (2)

- SOLUTION DEC 2018 No TicksDocument8 pagesSOLUTION DEC 2018 No Ticksanis izzatiNo ratings yet

- 2017 18 PDFDocument244 pages2017 18 PDFthirsheel balajiNo ratings yet

- Supreme Annual Report 16 17Document152 pagesSupreme Annual Report 16 17adoniscalNo ratings yet

- Square Pharma - ValuationDocument55 pagesSquare Pharma - ValuationFarhan Ashraf SaadNo ratings yet

- Nel HydrogenDocument23 pagesNel HydrogenJayash KaushalNo ratings yet

- Business Analysis and Valuation (BAV) : Assignment OnDocument6 pagesBusiness Analysis and Valuation (BAV) : Assignment OnDaniel2341No ratings yet

- Business Analysis and Valuation (BAV) : Assignment OnDocument6 pagesBusiness Analysis and Valuation (BAV) : Assignment OnDaniel2341No ratings yet

- Atlas Honda: Financial ModellingDocument19 pagesAtlas Honda: Financial ModellingSaqib NasirNo ratings yet

- Performance at A GlanceDocument7 pagesPerformance at A GlanceLima MustaryNo ratings yet

- Fa Analysis - Group 1Document18 pagesFa Analysis - Group 1ananthNo ratings yet

- Exhibit 1Document1 pageExhibit 1Vijendra Kumar DubeyNo ratings yet

- L&T Standalone FinancialsDocument4 pagesL&T Standalone FinancialsmartinajosephNo ratings yet

- BALANCE SHEET For ABC LTD As at March 31,: All Amount in Rs MillionsDocument4 pagesBALANCE SHEET For ABC LTD As at March 31,: All Amount in Rs MillionsAanchal MahajanNo ratings yet

- Nishat Chunian Limited Balance Sheet: Equities and LiabilitiesDocument6 pagesNishat Chunian Limited Balance Sheet: Equities and Liabilities3795No ratings yet

- Beneish M ScoreDocument11 pagesBeneish M ScorePuneet SahotraNo ratings yet

- Spread Sheet of AbbotDocument2 pagesSpread Sheet of AbbotAhmad RazaNo ratings yet

- Federal Urdu University of Arts, Science and Technology, Islamabad Department of Business Administration Final Project Bba-3 SEMESTER Autumn-2020Document7 pagesFederal Urdu University of Arts, Science and Technology, Islamabad Department of Business Administration Final Project Bba-3 SEMESTER Autumn-2020Qasim Jahangir WaraichNo ratings yet

- Loganathan Exp 5Document2 pagesLoganathan Exp 5loganathanloganathancNo ratings yet

- Crescent Fibres Income Statement For Years 2005-2009Document54 pagesCrescent Fibres Income Statement For Years 2005-2009Aaima SarwarNo ratings yet

- Ratio Analysis of WALMART INCDocument5 pagesRatio Analysis of WALMART INCBrian Ng'enoNo ratings yet

- Hinopak MotorsDocument8 pagesHinopak MotorsShamsuddin SoomroNo ratings yet

- Biocon Valuation - Nov 2020Document35 pagesBiocon Valuation - Nov 2020Deepak SaxenaNo ratings yet

- Module-10 Additional Material FSA Template - Session-11 vrTcbcH4leDocument6 pagesModule-10 Additional Material FSA Template - Session-11 vrTcbcH4leBhavya PatelNo ratings yet

- Eidul Hussain 12Document103 pagesEidul Hussain 12Rizwan Sikandar 6149-FMS/BBA/F20No ratings yet

- Cash Flow ValuationDocument11 pagesCash Flow ValuationprashantNo ratings yet

- Cash Flow ValuationDocument11 pagesCash Flow ValuationprashantNo ratings yet

- Balance Sheet of HDFC STANDARD LIFE As at March 31 For Five Years1Document3 pagesBalance Sheet of HDFC STANDARD LIFE As at March 31 For Five Years1Sunil RAYALASEEMA GRAPHICSNo ratings yet

- 2004 2005 2006 2007 Share Capital and Reserves: Fixed Assets - Property, Plant and EquipmentDocument10 pages2004 2005 2006 2007 Share Capital and Reserves: Fixed Assets - Property, Plant and Equipmentshabbir270No ratings yet

- Christ University Christ UniversityDocument7 pagesChrist University Christ UniversityBharathNo ratings yet

- Ramco Cement BsDocument6 pagesRamco Cement BsBharathNo ratings yet

- ATH Case CalculationDocument4 pagesATH Case CalculationsasNo ratings yet

- SolvedDocument3 pagesSolvedlohithagowda122001No ratings yet

- Attock CementDocument18 pagesAttock CementDeepak MatlaniNo ratings yet

- Ratio Analysis of Kohinoor Textile Mill and Compare With Textile Industry of PakistanDocument17 pagesRatio Analysis of Kohinoor Textile Mill and Compare With Textile Industry of Pakistanshurahbeel75% (4)

- HUL Day 7Document21 pagesHUL Day 7Juzer JiruNo ratings yet

- BALANCE SHEET For ABC LTD As at March 31,: All Amount in Rs MillionsDocument2 pagesBALANCE SHEET For ABC LTD As at March 31,: All Amount in Rs MillionsNeelu AggrawalNo ratings yet

- Alok Indsutry: Notes Consolidated Figures in Rs. Crores / View StandaloneDocument7 pagesAlok Indsutry: Notes Consolidated Figures in Rs. Crores / View StandaloneJatin NandaNo ratings yet

- Fin3320 Excelproject sp16 TravuobrileDocument9 pagesFin3320 Excelproject sp16 Travuobrileapi-363907405No ratings yet

- Calculation of Ratios of Yum 2014 2015 1. Profitability RatiosDocument7 pagesCalculation of Ratios of Yum 2014 2015 1. Profitability RatiosRajashree MuktiarNo ratings yet

- Financial Profile Region4aDocument1 pageFinancial Profile Region4aJose ManaloNo ratings yet

- S BqFC2 - T5KgahQtv8 SXQ - Module 3 7 iMBA Example LBO TypeDocument8 pagesS BqFC2 - T5KgahQtv8 SXQ - Module 3 7 iMBA Example LBO TypeharshNo ratings yet

- Balance Sheet of Instrumentation LimitedDocument8 pagesBalance Sheet of Instrumentation Limited94629No ratings yet

- F.Anal 1Document4 pagesF.Anal 1Arslan QadirNo ratings yet

- Group 14 - Bata ValuationDocument43 pagesGroup 14 - Bata ValuationSUBHADEEP GUHA-DM 20DM218No ratings yet

- Industry AvaragesDocument81 pagesIndustry Avaragessandeep kumarNo ratings yet

- Model 2 TDocument6 pagesModel 2 TVidhi PatelNo ratings yet

- Report F.MDocument12 pagesReport F.MMuhammad Waseem Anjum Muhammad Waseem AnjumNo ratings yet

- Sony Corporation Balance Sheet For The Past 5 YearsDocument7 pagesSony Corporation Balance Sheet For The Past 5 YearsJOHN VL FANAINo ratings yet

- Manor Sir Cost AnalysisDocument4 pagesManor Sir Cost AnalysisSunielNo ratings yet

- Colgate DCF ModelDocument19 pagesColgate DCF Modelshubham9308No ratings yet

- Annual Report 2015-16: Beml LimitedDocument154 pagesAnnual Report 2015-16: Beml LimitedNihit SandNo ratings yet

- Data Sheet TTK PRESTIGEDocument4 pagesData Sheet TTK PRESTIGEpriyanshu guptaNo ratings yet

- Interpretation of Comparative Balance Sheet and Income StatementDocument4 pagesInterpretation of Comparative Balance Sheet and Income Statementshruti jainNo ratings yet

- Assets: Muslim Commercial Bank Limited Balance Sheet As On 31st DecemberDocument6 pagesAssets: Muslim Commercial Bank Limited Balance Sheet As On 31st DecemberMuhammad ShafiqueNo ratings yet

- Project AnalysisDocument10 pagesProject AnalysisJawad FarooqNo ratings yet

- Statement of Profit & Loss of TTK Prestige For The Year Ending Mar 31Document4 pagesStatement of Profit & Loss of TTK Prestige For The Year Ending Mar 31Neelu AggrawalNo ratings yet

- Analysis IncDocument44 pagesAnalysis IncAakash KapoorNo ratings yet

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- Cipla LTD Swot AnalysisDocument14 pagesCipla LTD Swot AnalysisAnushka SinhaNo ratings yet

- 5 6093869036024627378Document5 pages5 6093869036024627378Anushka SinhaNo ratings yet

- Vintage (In Months) : Bin FrequencyDocument2 pagesVintage (In Months) : Bin FrequencyAnushka SinhaNo ratings yet

- 1 Sample 9931 Sample SQDocument1 page1 Sample 9931 Sample SQAnushka SinhaNo ratings yet

- Sales Share For FMCG Products For Jan 2018: Soap 8.42% Toothpaste 11.23% Shampoo 11.23% Perfume 10.83% Tea 9.62%Document3 pagesSales Share For FMCG Products For Jan 2018: Soap 8.42% Toothpaste 11.23% Shampoo 11.23% Perfume 10.83% Tea 9.62%Anushka SinhaNo ratings yet

- Academic Calendar 2018-19 M CDocument2 pagesAcademic Calendar 2018-19 M CAnushka SinhaNo ratings yet

- District Industrial Profile SatnaDocument14 pagesDistrict Industrial Profile SatnaAnushka SinhaNo ratings yet

- National Institute of Bank Management: Pune, INDIADocument8 pagesNational Institute of Bank Management: Pune, INDIAAnushka SinhaNo ratings yet

- UTIB0000573 Axis Bank LTD Mira Road EastDocument2 pagesUTIB0000573 Axis Bank LTD Mira Road EastAnushka SinhaNo ratings yet

- Compliance Report On Corporate GovernanceDocument5 pagesCompliance Report On Corporate GovernanceAnushka SinhaNo ratings yet

- Congratulations... : PNR Number Name User IdDocument1 pageCongratulations... : PNR Number Name User IdAnushka SinhaNo ratings yet

- Annual Report 15 16Document198 pagesAnnual Report 15 16Anushka SinhaNo ratings yet

- Indian Institute of Management Ranchi: Final Placement 2014-16Document11 pagesIndian Institute of Management Ranchi: Final Placement 2014-16Anushka SinhaNo ratings yet

- Corporate Financial Statements, A Product of The Market and Political ProcessesDocument23 pagesCorporate Financial Statements, A Product of The Market and Political ProcessesrainNo ratings yet

- LD Branch Package - Auditing Leases (FINAL)Document91 pagesLD Branch Package - Auditing Leases (FINAL)Jefri SNo ratings yet

- Vimal Dairy MbaDocument81 pagesVimal Dairy MbaViral Chaudhari0% (1)

- GlossaryDocument45 pagesGlossarysilvi88No ratings yet

- Quiz 1 - Limited CompaniesDocument2 pagesQuiz 1 - Limited CompaniesELIZABETH MARGARETHANo ratings yet

- Depreciation Accounting-6Document19 pagesDepreciation Accounting-6rohitsf22 olypmNo ratings yet

- Financial Statements: Nine Months Ended 31 March, 2009Document22 pagesFinancial Statements: Nine Months Ended 31 March, 2009Muhammad BakhshNo ratings yet

- Cash Flow StatementsDocument4 pagesCash Flow StatementsKehkashanNo ratings yet

- Accountancy Notes Not For Profit Organisation Problems and SolutionsDocument7 pagesAccountancy Notes Not For Profit Organisation Problems and SolutionsGod乡 DekuNo ratings yet

- EXAM3 Capital Budjeting and Asset ManagementDocument11 pagesEXAM3 Capital Budjeting and Asset ManagementbhagNo ratings yet

- 0452 s05 QP 1Document12 pages0452 s05 QP 1Kenzy99No ratings yet

- Laporan Keuangan PT BTEL 31 Des 2021Document141 pagesLaporan Keuangan PT BTEL 31 Des 2021Muhammad Mahdi HakimNo ratings yet

- Capital and Revenue ExpenditureDocument3 pagesCapital and Revenue ExpenditureSushank Kumar 7278No ratings yet

- Page 18 To 19Document2 pagesPage 18 To 19Judith CastroNo ratings yet

- Chapter 5 - Capital AllowancesDocument14 pagesChapter 5 - Capital AllowancesHema DarshiniNo ratings yet

- Group 1. Stem DDocument58 pagesGroup 1. Stem Dlenard adiaNo ratings yet

- CRS Sweet Potato Report Edited From RSR As of 112514 - 0Document80 pagesCRS Sweet Potato Report Edited From RSR As of 112514 - 0JOVITA SARAOSNo ratings yet

- Statement of Financial PositionDocument5 pagesStatement of Financial Positionbobo tangaNo ratings yet

- Solution Practice 9 Business Combinations and ImpairmentDocument8 pagesSolution Practice 9 Business Combinations and ImpairmentGuinevereNo ratings yet

- London Examinations GCE: Accounting (Modular Syllabus) Advanced Subsidiary/Advanced LevelDocument16 pagesLondon Examinations GCE: Accounting (Modular Syllabus) Advanced Subsidiary/Advanced LevelSadman DibboNo ratings yet

- Practical AccountingDocument13 pagesPractical AccountingDecereen Pineda RodriguezaNo ratings yet

- How To: Settling Internal Orders and Wbs Elements Costs To Different Assets Under ConstructionDocument5 pagesHow To: Settling Internal Orders and Wbs Elements Costs To Different Assets Under ConstructionBiswajit GhoshNo ratings yet

- 1 - Nike Cost of CapitalDocument8 pages1 - Nike Cost of CapitalJayzie LiNo ratings yet

- AS01 Create Change Display AssetDocument10 pagesAS01 Create Change Display AssetPallavi ChawlaNo ratings yet

- Unit 7 PDFDocument22 pagesUnit 7 PDFSatti NagendrareddyNo ratings yet

- Coa C2015-002Document71 pagesCoa C2015-002Pearl AudeNo ratings yet

- PpeDocument2 pagesPpeanano22No ratings yet

- Coco Fresh-Manendra ShuklaDocument50 pagesCoco Fresh-Manendra ShuklaAdityaKumarNo ratings yet

- Accounting Concepts & PrinciplesDocument8 pagesAccounting Concepts & PrinciplesJonalyn abesNo ratings yet