Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

38 viewsPortfolio and Risk Management

Portfolio and Risk Management

Uploaded by

Daniel MontenegroThis document outlines the syllabus for a course on portfolio and risk management over 4 weeks. Week 1 introduces key concepts like the risk-return tradeoff. Week 2 covers modern portfolio theory and the capital asset pricing model. Week 3 discusses asset allocation, including strategic and tactical approaches. Week 4 focuses on risk management, defining and measuring risk, and hedging techniques. The course includes lectures, readings, discussions, and quizzes to educate students on building optimal portfolios and managing investment risk.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Coursera Course Outline For Finance For Non-Finance ProfessionalsDocument4 pagesCoursera Course Outline For Finance For Non-Finance ProfessionalsMai Mai0% (1)

- Korea-Birth Registration-English PDFDocument2 pagesKorea-Birth Registration-English PDFkitderoger_391648570No ratings yet

- 15.435x SyllabusDocument6 pages15.435x SyllabusAyon BhattacharyaNo ratings yet

- L&T Construction: Practice Aptitude Questions With Answer KeyDocument6 pagesL&T Construction: Practice Aptitude Questions With Answer KeyRamaDinakaranNo ratings yet

- Ve Kearns ProtractorDocument1 pageVe Kearns ProtractorJaime Mauricio González CNo ratings yet

- 2 Course Syllabus Understanding Financial MarketsDocument2 pages2 Course Syllabus Understanding Financial MarketsJesus KossonouNo ratings yet

- CourseOutline - Financial DerivativesDocument8 pagesCourseOutline - Financial DerivativesYaarbaileeNo ratings yet

- Course Outline For Portfolio TheoryDocument4 pagesCourse Outline For Portfolio Theoryshariz500No ratings yet

- Course Outline General Information: Department of Business Studies, Karachi CampusDocument8 pagesCourse Outline General Information: Department of Business Studies, Karachi CampusAli MehdiNo ratings yet

- Sapm IvDocument7 pagesSapm IvShivangi BhasinNo ratings yet

- Security Analysis Portfolio Management CourseraDocument2 pagesSecurity Analysis Portfolio Management CourseraSteafan HarryNo ratings yet

- PDFs 20Document8 pagesPDFs 20Rodrigo FujimotoNo ratings yet

- FRM Syllabus of AUDocument9 pagesFRM Syllabus of AUMeer Mazhar AliNo ratings yet

- CO Derivative ManagementDocument8 pagesCO Derivative ManagementAbhinav MahajanNo ratings yet

- Macro 2 SyllabusDocument5 pagesMacro 2 Syllabussofo mghebrishviliNo ratings yet

- International Business Management (EN) HKT8.2023Document6 pagesInternational Business Management (EN) HKT8.2023Duyen LeNo ratings yet

- FM300 C..19Document230 pagesFM300 C..19包金叶No ratings yet

- Economics Module HandbookDocument36 pagesEconomics Module HandbookKarolina KaczmarekNo ratings yet

- PdfjoinerDocument28 pagesPdfjoinerAnisha SapraNo ratings yet

- MScFE 620 Discrete-Time Stochastic Processes SyllabusDocument14 pagesMScFE 620 Discrete-Time Stochastic Processes SyllabusKerem SezerNo ratings yet

- IFM Course Plan 2017Document8 pagesIFM Course Plan 2017Eby Johnson C.No ratings yet

- IFM Course Plan 2017Document6 pagesIFM Course Plan 2017Eby Johnson C.No ratings yet

- Syllabus - IMD - MMSS16 - 2020-21 (Online)Document13 pagesSyllabus - IMD - MMSS16 - 2020-21 (Online)Thảo ViNo ratings yet

- Background Ch2Document32 pagesBackground Ch2Đặng DungNo ratings yet

- MECO111 CourseOutline PrinciplesMicroeconomics-UM Fall2019Document4 pagesMECO111 CourseOutline PrinciplesMicroeconomics-UM Fall2019Waris AliNo ratings yet

- California State University-Long BeachDocument4 pagesCalifornia State University-Long BeachSNo ratings yet

- Workbook : How To Prepare and Present ProposalsDocument118 pagesWorkbook : How To Prepare and Present ProposalsSamurawi HailemariamNo ratings yet

- BA 364 International Finance Course DescriptionDocument8 pagesBA 364 International Finance Course DescriptionJunior LemeNo ratings yet

- International Business Management (EN) HKT1.2022Document7 pagesInternational Business Management (EN) HKT1.2022Nguyễn Khánh Minh ChâuNo ratings yet

- Opfbj23 4Document7 pagesOpfbj23 4Yash SahuNo ratings yet

- IAPMDocument7 pagesIAPMrossNo ratings yet

- Business EconomicsDocument6 pagesBusiness EconomicsAlana KhanNo ratings yet

- Fixed Income and Derivative AnalysisDocument5 pagesFixed Income and Derivative AnalysisDaood AbdullahNo ratings yet

- UntitledDocument4 pagesUntitledJamal Haider NaqviNo ratings yet

- RMDocument23 pagesRMVarun MoodbidriNo ratings yet

- MN6903 in Company Project Module Outline May 2020Document11 pagesMN6903 in Company Project Module Outline May 2020Anna TrubetskayaNo ratings yet

- Portfolio Management - UpdatedDocument3 pagesPortfolio Management - UpdatedTHÀNH NGUYỄN THỊ MINHNo ratings yet

- Security Analysis and Portfolio ManagementDocument3 pagesSecurity Analysis and Portfolio Managementharsh dhuwaliNo ratings yet

- SyllabusDocument6 pagesSyllabusstoryNo ratings yet

- Syllabus Course: International Financial Management (3 Credits)Document4 pagesSyllabus Course: International Financial Management (3 Credits)Phạm Thúy Hằng100% (1)

- EMBA Derivatives (Zurack) FA2016Document6 pagesEMBA Derivatives (Zurack) FA2016veda20No ratings yet

- Course Outline - Portfolio ManagementDocument10 pagesCourse Outline - Portfolio ManagementSubhasish RoutNo ratings yet

- IB235 2013 OutlineDocument13 pagesIB235 2013 OutlineBenNo ratings yet

- BBA IV Investment AnanalysisDocument9 pagesBBA IV Investment Ananalysisshubham JaiswalNo ratings yet

- 0aaf8b05e2214e568eb2d8b673ec83c3Document109 pages0aaf8b05e2214e568eb2d8b673ec83c3anchal kumarNo ratings yet

- Investment and Portfolio Management SitiDocument99 pagesInvestment and Portfolio Management SitiKidist WoldemichaelNo ratings yet

- FIN4115 S1 2015 2016 Course Outlines Joseph CherianDocument6 pagesFIN4115 S1 2015 2016 Course Outlines Joseph CherianAnonymous RQQTvjNo ratings yet

- Financial Engineering - P C BiswalDocument5 pagesFinancial Engineering - P C BiswalRupaliVajpayeeNo ratings yet

- BAC3684 SIPM March 2011Document7 pagesBAC3684 SIPM March 2011chunlun87No ratings yet

- Security Analysis and Portfolio ManagementDocument4 pagesSecurity Analysis and Portfolio ManagementSrinita MishraNo ratings yet

- Investment Analysis CODocument4 pagesInvestment Analysis COMIKIYAS BERHENo ratings yet

- B3MIN1009 Alternative Investments Overview of Sessions 2023-2024 FinalDocument7 pagesB3MIN1009 Alternative Investments Overview of Sessions 2023-2024 Finallilpumpdidnothingwrong dNo ratings yet

- Investment Analysis, Portfolio Management & Wealth ManagementDocument5 pagesInvestment Analysis, Portfolio Management & Wealth Managementkonica chhotwaniNo ratings yet

- International Business Law 2023-2024 Module Handbook - Updated (Nov 23)Document17 pagesInternational Business Law 2023-2024 Module Handbook - Updated (Nov 23)Emane EbubeNo ratings yet

- AP Micro Syllabus - 20222023Document11 pagesAP Micro Syllabus - 20222023Sarah SeeharNo ratings yet

- ADMU Financial Management SyllabusDocument4 pagesADMU Financial Management SyllabusPhilip JosephNo ratings yet

- Post Graduate Programme in Management 2014-15 Term: V Title of The Course: Option, Futures and Other DerivativesDocument6 pagesPost Graduate Programme in Management 2014-15 Term: V Title of The Course: Option, Futures and Other DerivativesMISS_ARORANo ratings yet

- Iapm SyllabusDocument5 pagesIapm SyllabusAshish SinghNo ratings yet

- Finance Elective Syllabus Tri-IV Batch 2021-23Document9 pagesFinance Elective Syllabus Tri-IV Batch 2021-23sanket patilNo ratings yet

- Times, Your Participation Grade Will Be Reduced by 5%. Being Significantly Late or LeavingDocument4 pagesTimes, Your Participation Grade Will Be Reduced by 5%. Being Significantly Late or LeavingAnh Tú NgôNo ratings yet

- WTO E-Learning Course CatalogueDocument22 pagesWTO E-Learning Course Cataloguellhllh 578No ratings yet

- Macro EconomicsDocument62 pagesMacro EconomicsMarjorie Onggay MacheteNo ratings yet

- Hedge Funds: Quantitative InsightsFrom EverandHedge Funds: Quantitative InsightsRating: 3.5 out of 5 stars3.5/5 (3)

- 5BSW (Syllabus) Revised and Approved by The Board of Studies of Social WorkDocument18 pages5BSW (Syllabus) Revised and Approved by The Board of Studies of Social WorkRohit SinghNo ratings yet

- Dwnload Full Strategic Management Text and Cases 7th Edition Dess Solutions Manual PDFDocument35 pagesDwnload Full Strategic Management Text and Cases 7th Edition Dess Solutions Manual PDFsaucerbield61wpyn100% (13)

- Reversible Concrete MixerDocument6 pagesReversible Concrete MixerSUPERMIX EquipmentsNo ratings yet

- Amortization On A Simple Interest MortgageDocument470 pagesAmortization On A Simple Interest Mortgagesaxophonist42No ratings yet

- Revised-Manuscript (Sec 1 and 2) Plant DesignDocument332 pagesRevised-Manuscript (Sec 1 and 2) Plant DesignJose Daniel AsuncionNo ratings yet

- Lecture8 PDFDocument7 pagesLecture8 PDFPadmo PadmundonoNo ratings yet

- Business PlanDocument7 pagesBusiness PlanJealyn Gimotea ZamoraNo ratings yet

- Unit 1 & 2 Textbook (Year 11)Document484 pagesUnit 1 & 2 Textbook (Year 11)rasllkanelNo ratings yet

- CounterACT Switch Commands in Use by The Switch Plugin v8.9.4Document798 pagesCounterACT Switch Commands in Use by The Switch Plugin v8.9.4Thiên HoàngNo ratings yet

- Overview of DPP Basic Program Self-Paced Elearning CourseDocument44 pagesOverview of DPP Basic Program Self-Paced Elearning CourseAzwar NasutionNo ratings yet

- Ansell Annual Report 2018 FINAL For Website PDFDocument128 pagesAnsell Annual Report 2018 FINAL For Website PDFWilliam Veloz DiazNo ratings yet

- The Importance of Engineering To SocietyDocument29 pagesThe Importance of Engineering To Societybarat378680% (10)

- Design & Detailing of Bolts & Welds To BS5950-2000Document26 pagesDesign & Detailing of Bolts & Welds To BS5950-2000sitehab100% (4)

- An Introduction To DC Generator Using Matlab/Simulink: Debabrata PalDocument4 pagesAn Introduction To DC Generator Using Matlab/Simulink: Debabrata PalMohammad H Al-QaisiNo ratings yet

- Command ReferenceDocument5 pagesCommand ReferenceraidfucherNo ratings yet

- 2023 Grade 11 Term 3 Investigation Memo FINALDocument4 pages2023 Grade 11 Term 3 Investigation Memo FINALNISSIBETI0% (1)

- ISO Metric Screw Thread - WikipediaDocument6 pagesISO Metric Screw Thread - WikipediamarceloNo ratings yet

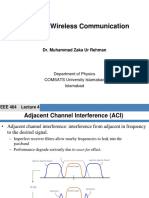

- Traffic Theory - Wireless Communication SystemsDocument25 pagesTraffic Theory - Wireless Communication SystemsMuhammad Zaka Ur Rehman100% (1)

- Alliances MergedDocument87 pagesAlliances MergedSiddhant SinghNo ratings yet

- Manual de Parte Bulldozer d8t Volumne 3Document28 pagesManual de Parte Bulldozer d8t Volumne 3henotharenasNo ratings yet

- Display and Data Logger S330 / S331Document6 pagesDisplay and Data Logger S330 / S331titodeviscarNo ratings yet

- DepthreconstructionDocument14 pagesDepthreconstructionZi WeiNo ratings yet

- PadillaDocument3 pagesPadillaNico PadillaNo ratings yet

- CostManagementBook Excerpt 3Document0 pagesCostManagementBook Excerpt 3yapsguanNo ratings yet

- Computer MCQ FOR BANK PO & CLERK EXAMDocument26 pagesComputer MCQ FOR BANK PO & CLERK EXAMShubhajit Nandi80% (5)

- The Dilemma For Team MembersDocument2 pagesThe Dilemma For Team Membersheinhtetsan425No ratings yet

- EURME 303 (Applied Termo Dynamics 1)Document2 pagesEURME 303 (Applied Termo Dynamics 1)Sri KayNo ratings yet

Portfolio and Risk Management

Portfolio and Risk Management

Uploaded by

Daniel Montenegro0 ratings0% found this document useful (0 votes)

38 views2 pagesThis document outlines the syllabus for a course on portfolio and risk management over 4 weeks. Week 1 introduces key concepts like the risk-return tradeoff. Week 2 covers modern portfolio theory and the capital asset pricing model. Week 3 discusses asset allocation, including strategic and tactical approaches. Week 4 focuses on risk management, defining and measuring risk, and hedging techniques. The course includes lectures, readings, discussions, and quizzes to educate students on building optimal portfolios and managing investment risk.

Original Description:

Portfolio and Risk Management emment

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines the syllabus for a course on portfolio and risk management over 4 weeks. Week 1 introduces key concepts like the risk-return tradeoff. Week 2 covers modern portfolio theory and the capital asset pricing model. Week 3 discusses asset allocation, including strategic and tactical approaches. Week 4 focuses on risk management, defining and measuring risk, and hedging techniques. The course includes lectures, readings, discussions, and quizzes to educate students on building optimal portfolios and managing investment risk.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

38 views2 pagesPortfolio and Risk Management

Portfolio and Risk Management

Uploaded by

Daniel MontenegroThis document outlines the syllabus for a course on portfolio and risk management over 4 weeks. Week 1 introduces key concepts like the risk-return tradeoff. Week 2 covers modern portfolio theory and the capital asset pricing model. Week 3 discusses asset allocation, including strategic and tactical approaches. Week 4 focuses on risk management, defining and measuring risk, and hedging techniques. The course includes lectures, readings, discussions, and quizzes to educate students on building optimal portfolios and managing investment risk.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

Portfolio and Risk Management – Syllabus

Week 1 : General Introduction and Key Concepts

o Lesson 1: Introduction

Lecture: Why you should choose this course

Lecture: Some common mistakes you will no longer make after this course –

Portfolio risk

Lecture: Some common mistakes you will no longer make after this course –

Free lunch

o Lesson 2: Useful things to know before this course

Reading: Glossary

Lecture: Distribution of returns – Graphical representation

Lecture: Distribution of returns – Numbers

Forum discussion: How would you build your portfolio?

Lecture: The risk-return trade-off – UBS guest speaker

Graded quiz: Graded quiz on the content of Week 1

Week 2: Modern Portfolio Theory and Beyond

o Lesson 1: Modern Portfolio Theory: The importance of diversification

Lecture: The impact of correlation – The benefits of diversification

Lecture: The impact of correlation – Maximizing diversification

Lecture: Reaching the efficient frontier – UBS guest speaker

Lecture: The efficient frontier with a risk-free asset

o Lesson 2: Modern Portfolio Theory: A step beyond

Lecture: Expending the asset universe – International diversification

Lecture: Expending the asset universe – Country versus industry diversification

Lecture: Do investors diversify internationally? – UBS guest speaker

Forum discussion: How much would you be willing to invest abroad?

Lecture: The impact of constraints on optimal portfolios

Lecture: The pitfalls of Modern Portfolio Theory – Assumptions

Lecture: The pitfalls of Modern Portfolio Theory – Investors

o Lesson 3: The Capital Asset Pricing Model

Lecture: Two-fund separation – Individual decision

Lecture: Two-fund separation – Market level

Lecture: Capital market equilibrium – The Capital Market Line

Lecture: Capital market equilibrium – The Capital Asset Pricing Model

Graded quiz: Graded quiz on the content of Week 2

Week 3: Asset Allocation

o Lesson 1: Investors’ goals and needs

Lecture: How our age and wealth affect our investment profile – Main views

Lecture: How our age and wealth affect our investment profile – Robo-advisors

Forum discussion: Would you follow the advice of a Robo-advisor?

Lecture: The path from an investor’s profile to his/her optimal investment

strategy – UBS guest speaker

o Lesson 2: Strategic asset allocation

Lecture: Strategic asset allocation: MPT in practice – Definitions

Lecture: Strategic asset allocation: MPT in practice – Implementation

Reading: The importance of asset allocation

Lecture: Asset allocation versus stock picking: what matters more? – UBS guest

speaker

Lecture: Rebalancing a portfolio to maintain the SAA – SAA versus TAA

Lecture: Rebalancing a portfolio to maintain the SAA – Weights and bounds

o Lesson 3: Tactical asset allocation

Lecture: Key drivers of tactical asset allocation – Goals

Lecture: Key drivers of tactical asset allocation – Implementation

Lecture: Timing the market with tactical asset allocation – Shiller’s CAPE

Lecture: Timing the market with tactical asset allocation – Macroeconomic tools

Lecture: How tactical asset allocation depends on macroeconomic fundamentals

– UBS guest speaker

Lecture: How to combine strategic and tactical asset allocations – UBS guest

speaker

Graded quiz: Graded quiz on the content of Week 3

Week 4: Risk Management

o Lesson 1: Defining risk

Lecture: Defining forwards and options - Forwards

Lecture: Defining forwards and options - Options

Lecture: Risk as volatility?

Lecture: What about illiquidity? – UBS guest speaker

Forum discussion: Would you pay for liquidity?

Lecture: Currency risk - Return

Lecture: Currency risk - Risk

o Lesson 2: Managing risk

Lecture: Defining the Value-at-Risk

Lecture: Computing the Value-at-Risk

Lecture: Defining the Expected Shortfall

Lecture: Computing the Expected Shortfall

Lecture: Risk management applied to portfolio allocation

Lecture: Banking regulation & Basel recommendations: How did we get there?

o Lesson 3: Hedging

Lecture: Hedging against market falls (using options)

Lecture: Hedging against currency risk (using forwards)

Graded quiz: Graded quiz on the content of Week 4

You might also like

- Coursera Course Outline For Finance For Non-Finance ProfessionalsDocument4 pagesCoursera Course Outline For Finance For Non-Finance ProfessionalsMai Mai0% (1)

- Korea-Birth Registration-English PDFDocument2 pagesKorea-Birth Registration-English PDFkitderoger_391648570No ratings yet

- 15.435x SyllabusDocument6 pages15.435x SyllabusAyon BhattacharyaNo ratings yet

- L&T Construction: Practice Aptitude Questions With Answer KeyDocument6 pagesL&T Construction: Practice Aptitude Questions With Answer KeyRamaDinakaranNo ratings yet

- Ve Kearns ProtractorDocument1 pageVe Kearns ProtractorJaime Mauricio González CNo ratings yet

- 2 Course Syllabus Understanding Financial MarketsDocument2 pages2 Course Syllabus Understanding Financial MarketsJesus KossonouNo ratings yet

- CourseOutline - Financial DerivativesDocument8 pagesCourseOutline - Financial DerivativesYaarbaileeNo ratings yet

- Course Outline For Portfolio TheoryDocument4 pagesCourse Outline For Portfolio Theoryshariz500No ratings yet

- Course Outline General Information: Department of Business Studies, Karachi CampusDocument8 pagesCourse Outline General Information: Department of Business Studies, Karachi CampusAli MehdiNo ratings yet

- Sapm IvDocument7 pagesSapm IvShivangi BhasinNo ratings yet

- Security Analysis Portfolio Management CourseraDocument2 pagesSecurity Analysis Portfolio Management CourseraSteafan HarryNo ratings yet

- PDFs 20Document8 pagesPDFs 20Rodrigo FujimotoNo ratings yet

- FRM Syllabus of AUDocument9 pagesFRM Syllabus of AUMeer Mazhar AliNo ratings yet

- CO Derivative ManagementDocument8 pagesCO Derivative ManagementAbhinav MahajanNo ratings yet

- Macro 2 SyllabusDocument5 pagesMacro 2 Syllabussofo mghebrishviliNo ratings yet

- International Business Management (EN) HKT8.2023Document6 pagesInternational Business Management (EN) HKT8.2023Duyen LeNo ratings yet

- FM300 C..19Document230 pagesFM300 C..19包金叶No ratings yet

- Economics Module HandbookDocument36 pagesEconomics Module HandbookKarolina KaczmarekNo ratings yet

- PdfjoinerDocument28 pagesPdfjoinerAnisha SapraNo ratings yet

- MScFE 620 Discrete-Time Stochastic Processes SyllabusDocument14 pagesMScFE 620 Discrete-Time Stochastic Processes SyllabusKerem SezerNo ratings yet

- IFM Course Plan 2017Document8 pagesIFM Course Plan 2017Eby Johnson C.No ratings yet

- IFM Course Plan 2017Document6 pagesIFM Course Plan 2017Eby Johnson C.No ratings yet

- Syllabus - IMD - MMSS16 - 2020-21 (Online)Document13 pagesSyllabus - IMD - MMSS16 - 2020-21 (Online)Thảo ViNo ratings yet

- Background Ch2Document32 pagesBackground Ch2Đặng DungNo ratings yet

- MECO111 CourseOutline PrinciplesMicroeconomics-UM Fall2019Document4 pagesMECO111 CourseOutline PrinciplesMicroeconomics-UM Fall2019Waris AliNo ratings yet

- California State University-Long BeachDocument4 pagesCalifornia State University-Long BeachSNo ratings yet

- Workbook : How To Prepare and Present ProposalsDocument118 pagesWorkbook : How To Prepare and Present ProposalsSamurawi HailemariamNo ratings yet

- BA 364 International Finance Course DescriptionDocument8 pagesBA 364 International Finance Course DescriptionJunior LemeNo ratings yet

- International Business Management (EN) HKT1.2022Document7 pagesInternational Business Management (EN) HKT1.2022Nguyễn Khánh Minh ChâuNo ratings yet

- Opfbj23 4Document7 pagesOpfbj23 4Yash SahuNo ratings yet

- IAPMDocument7 pagesIAPMrossNo ratings yet

- Business EconomicsDocument6 pagesBusiness EconomicsAlana KhanNo ratings yet

- Fixed Income and Derivative AnalysisDocument5 pagesFixed Income and Derivative AnalysisDaood AbdullahNo ratings yet

- UntitledDocument4 pagesUntitledJamal Haider NaqviNo ratings yet

- RMDocument23 pagesRMVarun MoodbidriNo ratings yet

- MN6903 in Company Project Module Outline May 2020Document11 pagesMN6903 in Company Project Module Outline May 2020Anna TrubetskayaNo ratings yet

- Portfolio Management - UpdatedDocument3 pagesPortfolio Management - UpdatedTHÀNH NGUYỄN THỊ MINHNo ratings yet

- Security Analysis and Portfolio ManagementDocument3 pagesSecurity Analysis and Portfolio Managementharsh dhuwaliNo ratings yet

- SyllabusDocument6 pagesSyllabusstoryNo ratings yet

- Syllabus Course: International Financial Management (3 Credits)Document4 pagesSyllabus Course: International Financial Management (3 Credits)Phạm Thúy Hằng100% (1)

- EMBA Derivatives (Zurack) FA2016Document6 pagesEMBA Derivatives (Zurack) FA2016veda20No ratings yet

- Course Outline - Portfolio ManagementDocument10 pagesCourse Outline - Portfolio ManagementSubhasish RoutNo ratings yet

- IB235 2013 OutlineDocument13 pagesIB235 2013 OutlineBenNo ratings yet

- BBA IV Investment AnanalysisDocument9 pagesBBA IV Investment Ananalysisshubham JaiswalNo ratings yet

- 0aaf8b05e2214e568eb2d8b673ec83c3Document109 pages0aaf8b05e2214e568eb2d8b673ec83c3anchal kumarNo ratings yet

- Investment and Portfolio Management SitiDocument99 pagesInvestment and Portfolio Management SitiKidist WoldemichaelNo ratings yet

- FIN4115 S1 2015 2016 Course Outlines Joseph CherianDocument6 pagesFIN4115 S1 2015 2016 Course Outlines Joseph CherianAnonymous RQQTvjNo ratings yet

- Financial Engineering - P C BiswalDocument5 pagesFinancial Engineering - P C BiswalRupaliVajpayeeNo ratings yet

- BAC3684 SIPM March 2011Document7 pagesBAC3684 SIPM March 2011chunlun87No ratings yet

- Security Analysis and Portfolio ManagementDocument4 pagesSecurity Analysis and Portfolio ManagementSrinita MishraNo ratings yet

- Investment Analysis CODocument4 pagesInvestment Analysis COMIKIYAS BERHENo ratings yet

- B3MIN1009 Alternative Investments Overview of Sessions 2023-2024 FinalDocument7 pagesB3MIN1009 Alternative Investments Overview of Sessions 2023-2024 Finallilpumpdidnothingwrong dNo ratings yet

- Investment Analysis, Portfolio Management & Wealth ManagementDocument5 pagesInvestment Analysis, Portfolio Management & Wealth Managementkonica chhotwaniNo ratings yet

- International Business Law 2023-2024 Module Handbook - Updated (Nov 23)Document17 pagesInternational Business Law 2023-2024 Module Handbook - Updated (Nov 23)Emane EbubeNo ratings yet

- AP Micro Syllabus - 20222023Document11 pagesAP Micro Syllabus - 20222023Sarah SeeharNo ratings yet

- ADMU Financial Management SyllabusDocument4 pagesADMU Financial Management SyllabusPhilip JosephNo ratings yet

- Post Graduate Programme in Management 2014-15 Term: V Title of The Course: Option, Futures and Other DerivativesDocument6 pagesPost Graduate Programme in Management 2014-15 Term: V Title of The Course: Option, Futures and Other DerivativesMISS_ARORANo ratings yet

- Iapm SyllabusDocument5 pagesIapm SyllabusAshish SinghNo ratings yet

- Finance Elective Syllabus Tri-IV Batch 2021-23Document9 pagesFinance Elective Syllabus Tri-IV Batch 2021-23sanket patilNo ratings yet

- Times, Your Participation Grade Will Be Reduced by 5%. Being Significantly Late or LeavingDocument4 pagesTimes, Your Participation Grade Will Be Reduced by 5%. Being Significantly Late or LeavingAnh Tú NgôNo ratings yet

- WTO E-Learning Course CatalogueDocument22 pagesWTO E-Learning Course Cataloguellhllh 578No ratings yet

- Macro EconomicsDocument62 pagesMacro EconomicsMarjorie Onggay MacheteNo ratings yet

- Hedge Funds: Quantitative InsightsFrom EverandHedge Funds: Quantitative InsightsRating: 3.5 out of 5 stars3.5/5 (3)

- 5BSW (Syllabus) Revised and Approved by The Board of Studies of Social WorkDocument18 pages5BSW (Syllabus) Revised and Approved by The Board of Studies of Social WorkRohit SinghNo ratings yet

- Dwnload Full Strategic Management Text and Cases 7th Edition Dess Solutions Manual PDFDocument35 pagesDwnload Full Strategic Management Text and Cases 7th Edition Dess Solutions Manual PDFsaucerbield61wpyn100% (13)

- Reversible Concrete MixerDocument6 pagesReversible Concrete MixerSUPERMIX EquipmentsNo ratings yet

- Amortization On A Simple Interest MortgageDocument470 pagesAmortization On A Simple Interest Mortgagesaxophonist42No ratings yet

- Revised-Manuscript (Sec 1 and 2) Plant DesignDocument332 pagesRevised-Manuscript (Sec 1 and 2) Plant DesignJose Daniel AsuncionNo ratings yet

- Lecture8 PDFDocument7 pagesLecture8 PDFPadmo PadmundonoNo ratings yet

- Business PlanDocument7 pagesBusiness PlanJealyn Gimotea ZamoraNo ratings yet

- Unit 1 & 2 Textbook (Year 11)Document484 pagesUnit 1 & 2 Textbook (Year 11)rasllkanelNo ratings yet

- CounterACT Switch Commands in Use by The Switch Plugin v8.9.4Document798 pagesCounterACT Switch Commands in Use by The Switch Plugin v8.9.4Thiên HoàngNo ratings yet

- Overview of DPP Basic Program Self-Paced Elearning CourseDocument44 pagesOverview of DPP Basic Program Self-Paced Elearning CourseAzwar NasutionNo ratings yet

- Ansell Annual Report 2018 FINAL For Website PDFDocument128 pagesAnsell Annual Report 2018 FINAL For Website PDFWilliam Veloz DiazNo ratings yet

- The Importance of Engineering To SocietyDocument29 pagesThe Importance of Engineering To Societybarat378680% (10)

- Design & Detailing of Bolts & Welds To BS5950-2000Document26 pagesDesign & Detailing of Bolts & Welds To BS5950-2000sitehab100% (4)

- An Introduction To DC Generator Using Matlab/Simulink: Debabrata PalDocument4 pagesAn Introduction To DC Generator Using Matlab/Simulink: Debabrata PalMohammad H Al-QaisiNo ratings yet

- Command ReferenceDocument5 pagesCommand ReferenceraidfucherNo ratings yet

- 2023 Grade 11 Term 3 Investigation Memo FINALDocument4 pages2023 Grade 11 Term 3 Investigation Memo FINALNISSIBETI0% (1)

- ISO Metric Screw Thread - WikipediaDocument6 pagesISO Metric Screw Thread - WikipediamarceloNo ratings yet

- Traffic Theory - Wireless Communication SystemsDocument25 pagesTraffic Theory - Wireless Communication SystemsMuhammad Zaka Ur Rehman100% (1)

- Alliances MergedDocument87 pagesAlliances MergedSiddhant SinghNo ratings yet

- Manual de Parte Bulldozer d8t Volumne 3Document28 pagesManual de Parte Bulldozer d8t Volumne 3henotharenasNo ratings yet

- Display and Data Logger S330 / S331Document6 pagesDisplay and Data Logger S330 / S331titodeviscarNo ratings yet

- DepthreconstructionDocument14 pagesDepthreconstructionZi WeiNo ratings yet

- PadillaDocument3 pagesPadillaNico PadillaNo ratings yet

- CostManagementBook Excerpt 3Document0 pagesCostManagementBook Excerpt 3yapsguanNo ratings yet

- Computer MCQ FOR BANK PO & CLERK EXAMDocument26 pagesComputer MCQ FOR BANK PO & CLERK EXAMShubhajit Nandi80% (5)

- The Dilemma For Team MembersDocument2 pagesThe Dilemma For Team Membersheinhtetsan425No ratings yet

- EURME 303 (Applied Termo Dynamics 1)Document2 pagesEURME 303 (Applied Termo Dynamics 1)Sri KayNo ratings yet