Professional Documents

Culture Documents

Business Transactions: VAT-Exempt and OPT-Exempt Transactions

Business Transactions: VAT-Exempt and OPT-Exempt Transactions

Uploaded by

Lhorene Hope DueñasOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Transactions: VAT-Exempt and OPT-Exempt Transactions

Business Transactions: VAT-Exempt and OPT-Exempt Transactions

Uploaded by

Lhorene Hope DueñasCopyright:

Available Formats

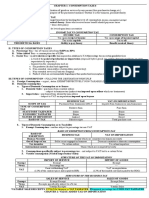

VAT-Exempt and OPT-Exempt

BUSINESS TRANSACTIONS Transactions

-Importation of:

VAT Transactions ZERO-VAT Rated

*fuel, goods, and supplies by persons engaged in int’l

Transactions transportation.

*Personal Household effects of belonging to

Allowed w/ input Export sales paid in acceptable resident of the PH returned, and NC settle in the

vat foreign currency PH(goods are Except from custom)

*Professional Instrument and implements, wearing

Includes: apparel, domestic animals, and personal household

-sales or gross receipts of Vat- SALE OF: effects (for use, not for sale)

registered business. -Goods from the Philippines to Foreign country

-Raw materials or packing materials to a nonresident buyer for delivery to

-on consumptions or transfer of VAT-

a residents in he Philippines.

Registered business, deemed sales Export sales of Non-Vat registered business

-Goods, Supplies, fuel, services, leases f Property to international

shipping/air transport.

-Raw materials and services performed by subcontractor to export

oriented enterprise (sales more than 70% of production) Sales of:

Not Allowed with Input

-Considered export sales under:

-Agricultural and marine foods products

*Article 23&77 of EO No.226(omnibus Investment code)

*Special Law Such as R.A. 7227. -Fertilizers, seeds, seedlings, fingerlngs, fish,

-Annual Sales/Gross Receipts exceeds P1,919,500. prawn, livestocks and poultry feeds.

-Non-Vat Franchise grantees of radio and television

broadcasting Gross Rec. of more than P10,000,000.

-Importations except under Sec. 4. 109-1 Effectively Zero-rated sales Transactions with the

-Local payment of rent vessel or carriers owned by Printing or publishing books, magazines, review

NRF entity. Government Units

or bulletin.

Sale of power or fuel through

renewable sources of energy

Service of:

Gross receipts of a domestic corporation -Agricultural contract growers and milling.

Sale to the following people: -Medicals except:Professional rendered.

-Enterprise registered in (SBMA), -Private Schools accredited by DepEd, CHed, TESDA.

-Transport of passengers and cargo by (CDA) and (PEZA) -ROHQ established in the PH

-Final VAT of 5%(VAT)

air/sea vessels fr. PH to foreign -Asian Development Bank -Transactions which are exempt from international

registered

-Services are paid for in acceptance of -International Rice Research Institute agreement

-Percentage tax 3%(Non-VAT

BSP regulations

subj to OPT 3%)

Sales or Receipts of cooperatives that are duly

Sale of Gold to Banko Sentral ng Pilipinas Withheld the ff: registered with CDA

-1% n purchases of Goods

-2% on purchase of

Foreign currency denominated sale ESTEVES

services

(except automobile)

GABRIEL

GERBANO

You might also like

- VAT - CPA Reviewer in Taxation - Enrico D. Tabag PDFDocument103 pagesVAT - CPA Reviewer in Taxation - Enrico D. Tabag PDFDGAENo ratings yet

- Teradata MLDMDocument9 pagesTeradata MLDMhaiderabbaskhattakNo ratings yet

- Personal Effectiveness in The Work Place (QQI Level 5) - Unit 1v1Document47 pagesPersonal Effectiveness in The Work Place (QQI Level 5) - Unit 1v1OzPaper HelpNo ratings yet

- Manufacturing Cycle EfficiencyDocument1 pageManufacturing Cycle EfficiencyLhorene Hope DueñasNo ratings yet

- Chapter 3 - MethodologyDocument3 pagesChapter 3 - MethodologyLhorene Hope Dueñas67% (3)

- Exam Content Manual: Effective March 14, 2020Document36 pagesExam Content Manual: Effective March 14, 2020Kamaljeet SinghNo ratings yet

- Business TaxDocument3 pagesBusiness Taxsharlica1990No ratings yet

- Business TaxesDocument98 pagesBusiness TaxesAbigailRefamonteNo ratings yet

- Output Vat Zero-Rated Sales ch8Document3 pagesOutput Vat Zero-Rated Sales ch8Marionne GNo ratings yet

- Concept of Consumption and Consumption Taxes and Vat On ImportationDocument4 pagesConcept of Consumption and Consumption Taxes and Vat On ImportationJamaica DavidNo ratings yet

- Txtrbus NotesDocument14 pagesTxtrbus NotesMARIA VERNADETTE SHARISSE LEGASPINo ratings yet

- Persons Liable To VAT: Value Added Tax (Vat)Document2 pagesPersons Liable To VAT: Value Added Tax (Vat)aaron filoteoNo ratings yet

- Export Sale of Goods (Sec. 106 (A) (2) (B) ) : Effectively Zero-Rated SalesDocument13 pagesExport Sale of Goods (Sec. 106 (A) (2) (B) ) : Effectively Zero-Rated SalesTricia Rozl PimentelNo ratings yet

- Intro To Business TaxesDocument4 pagesIntro To Business TaxesHyascintheNo ratings yet

- Business and Transfer Taxation by BanggawanDocument1 pageBusiness and Transfer Taxation by BanggawanwktxlsrkfNo ratings yet

- Importation Refers To The Purchase of Goods or Services by The Philippine Residents From Non-Resident SellersDocument1 pageImportation Refers To The Purchase of Goods or Services by The Philippine Residents From Non-Resident Sellersfrancis dungcaNo ratings yet

- MSA 2 - Taxation NotesDocument19 pagesMSA 2 - Taxation NotesadilfarooqaNo ratings yet

- TRAIN (Changes) ???? Pages 12, 14, 16, 17Document4 pagesTRAIN (Changes) ???? Pages 12, 14, 16, 17blackmail1No ratings yet

- Tax Particulars National Internal Revenue Code of 1997 R. A. No. 10963Document5 pagesTax Particulars National Internal Revenue Code of 1997 R. A. No. 10963blackmail1No ratings yet

- Percentage Tax in The PhilippinesDocument3 pagesPercentage Tax in The PhilippinesfrazieNo ratings yet

- Special Incentive LawsDocument5 pagesSpecial Incentive LawsCrizryshel Loreen P. DeramaNo ratings yet

- General Table of The Main Taxes in Force in BoliviaDocument2 pagesGeneral Table of The Main Taxes in Force in BoliviaScribdTranslationsNo ratings yet

- VatDocument3 pagesVatGlensh Reigne CarlitNo ratings yet

- Lesson 3 - VAT On ImportationDocument5 pagesLesson 3 - VAT On ImportationVince TablacNo ratings yet

- Tax Ch6 VAT BinaluyoDocument6 pagesTax Ch6 VAT Binaluyomavrhyck.21No ratings yet

- Business: Chapter 16: Nature and Concept of Buness TaxesDocument4 pagesBusiness: Chapter 16: Nature and Concept of Buness TaxesAnamir Bello CarilloNo ratings yet

- Business Taxes: Certified Accounting Technician NIAT Office 2015Document33 pagesBusiness Taxes: Certified Accounting Technician NIAT Office 2015Anonymous Lz2qH7No ratings yet

- Tax3. Lecture 1 - Value Added Tax SCDocument40 pagesTax3. Lecture 1 - Value Added Tax SCsuzyshii 888No ratings yet

- Value Added Tax: Scope of ApplicationsDocument5 pagesValue Added Tax: Scope of ApplicationsNguyen Duy Khanh QP0073No ratings yet

- Tax Particulars National Internal Revenue Code of 1997 R. A. No. 10963Document4 pagesTax Particulars National Internal Revenue Code of 1997 R. A. No. 10963blackmail1No ratings yet

- Business Tax Chapter 7 ReviewerDocument2 pagesBusiness Tax Chapter 7 ReviewerMurien LimNo ratings yet

- Tax Particulars National Internal Revenue Code of 1997 R. A. No. 10963Document4 pagesTax Particulars National Internal Revenue Code of 1997 R. A. No. 10963blackmail1No ratings yet

- Jpia-Hau: Business and Transfer TaxationDocument12 pagesJpia-Hau: Business and Transfer Taxationronniel tiglaoNo ratings yet

- CTT Examination Reviewer (Notes) Page A - 30Document13 pagesCTT Examination Reviewer (Notes) Page A - 30Seneca GonzalesNo ratings yet

- Exempt Sale of Goods ch4Document2 pagesExempt Sale of Goods ch4Marionne GNo ratings yet

- Value Added Tax: A. Business TaxesDocument3 pagesValue Added Tax: A. Business TaxesNerish PlazaNo ratings yet

- Vat System and OptDocument15 pagesVat System and Optlyra21No ratings yet

- Business and Transfer Taxation by BanggawanDocument1 pageBusiness and Transfer Taxation by BanggawanwktxlsrkfNo ratings yet

- Business and Transfer Taxes: Vat On ImportationDocument23 pagesBusiness and Transfer Taxes: Vat On ImportationAngelo Delos SantosNo ratings yet

- Importation by Importers) : Income Tax Vs Consumption TaxDocument2 pagesImportation by Importers) : Income Tax Vs Consumption TaxMark LapidNo ratings yet

- Tax 2 NotesDocument2 pagesTax 2 NotesMark LapidNo ratings yet

- Input VatDocument3 pagesInput Vatyatot carbonelNo ratings yet

- Notes On Excise TaxesDocument19 pagesNotes On Excise TaxesMark FredNo ratings yet

- Tax 43 - Business TaxationDocument8 pagesTax 43 - Business TaxationFemie AmazonaNo ratings yet

- Module 8 - Value Added TaxDocument28 pagesModule 8 - Value Added TaxKyrah Angelica DionglayNo ratings yet

- Business TaxesDocument20 pagesBusiness TaxesAnime ScreenshotsNo ratings yet

- Business TaxesDocument51 pagesBusiness TaxesLuna CakesNo ratings yet

- Sec. 109 VAT Exempt TransactionsDocument2 pagesSec. 109 VAT Exempt TransactionsDis Cat100% (1)

- Excise Tax Notes TabagDocument9 pagesExcise Tax Notes TabagApple Joy SamonteNo ratings yet

- 05 Input TaxesDocument4 pages05 Input TaxesJaneLayugCabacunganNo ratings yet

- Business and Transfer Taxes: An Introduction To Consumption TaxesDocument16 pagesBusiness and Transfer Taxes: An Introduction To Consumption TaxesAngelo Delos SantosNo ratings yet

- Rationale of Consumption TaxDocument3 pagesRationale of Consumption Taxmy miNo ratings yet

- Async 2022 VAT UPDATEDocument8 pagesAsync 2022 VAT UPDATEBogs QuitainNo ratings yet

- Tax Midterms Reviewer - VatDocument8 pagesTax Midterms Reviewer - VatAgot GaidNo ratings yet

- Sale of Goods or PropertiesDocument2 pagesSale of Goods or PropertiesNYSHAN JOFIELYN TABBAYNo ratings yet

- Business TaxesDocument47 pagesBusiness TaxesJoyce MorganNo ratings yet

- VAT Exempt SalesDocument5 pagesVAT Exempt SalesNEstandaNo ratings yet

- Powerpoint-03 19 22Document126 pagesPowerpoint-03 19 22CrizziaNo ratings yet

- BUSTAXADocument9 pagesBUSTAXATitania ErzaNo ratings yet

- Value Added TaxDocument4 pagesValue Added Taxhenrygardo0No ratings yet

- Percentage Taxes: Transfer of Goods or ServicesDocument10 pagesPercentage Taxes: Transfer of Goods or ServicesCPAREVIEWNo ratings yet

- Transfer and Business Taxation - MIDTERMDocument14 pagesTransfer and Business Taxation - MIDTERMYvette Pauline JovenNo ratings yet

- Introduction To Business TaxesDocument3 pagesIntroduction To Business Taxesyatot carbonelNo ratings yet

- Flexible BudgetDocument2 pagesFlexible BudgetLhorene Hope DueñasNo ratings yet

- Activity Based Costing TestbankDocument7 pagesActivity Based Costing TestbankLhorene Hope DueñasNo ratings yet

- Standard CostingDocument1 pageStandard CostingLhorene Hope DueñasNo ratings yet

- Variance Costing and Activity Based Cotsing Test PrepDocument3 pagesVariance Costing and Activity Based Cotsing Test PrepLhorene Hope DueñasNo ratings yet

- Price Variance: W CompanyDocument2 pagesPrice Variance: W CompanyLhorene Hope DueñasNo ratings yet

- Variance 1Document2 pagesVariance 1Lhorene Hope DueñasNo ratings yet

- Flexible BudgetDocument4 pagesFlexible BudgetLhorene Hope Dueñas100% (1)

- Standard Costing and Flexible Budget 10Document5 pagesStandard Costing and Flexible Budget 10Lhorene Hope DueñasNo ratings yet

- Standard Costing 1.1Document3 pagesStandard Costing 1.1Lhorene Hope DueñasNo ratings yet

- Activity Based Costing Test PrepationDocument5 pagesActivity Based Costing Test PrepationLhorene Hope DueñasNo ratings yet

- Standard Costing QuizDocument2 pagesStandard Costing QuizLhorene Hope Dueñas100% (1)

- ABC and Flexible BudgetDocument6 pagesABC and Flexible BudgetLhorene Hope DueñasNo ratings yet

- Flexible Budget and Activity Based Costing Test BankDocument2 pagesFlexible Budget and Activity Based Costing Test BankLhorene Hope DueñasNo ratings yet

- Flexible Budgetand Activity Based CostingDocument13 pagesFlexible Budgetand Activity Based CostingLhorene Hope DueñasNo ratings yet

- This Part Shows The Step-By-Step-Process Followed by The Business in Connection With Its Sales and DisbursementDocument11 pagesThis Part Shows The Step-By-Step-Process Followed by The Business in Connection With Its Sales and DisbursementLhorene Hope DueñasNo ratings yet

- Flexible Budget and VarianceDocument8 pagesFlexible Budget and VarianceLhorene Hope DueñasNo ratings yet

- Standrad Costing 2.1Document2 pagesStandrad Costing 2.1Lhorene Hope DueñasNo ratings yet

- English Grammar and Correct Usage Part 3Document3 pagesEnglish Grammar and Correct Usage Part 3Lhorene Hope DueñasNo ratings yet

- Standard Costing Ang Variance AnalysisDocument3 pagesStandard Costing Ang Variance AnalysisLhorene Hope DueñasNo ratings yet

- Abc 3Document13 pagesAbc 3Lhorene Hope DueñasNo ratings yet

- English Grammar and Correct Usage Part 2 2 PDFDocument3 pagesEnglish Grammar and Correct Usage Part 2 2 PDFLhorene Hope DueñasNo ratings yet

- Cash Advances For TravelDocument10 pagesCash Advances For TravelLhorene Hope DueñasNo ratings yet

- Analysis of Variance - PPTX Generyn ReportDocument6 pagesAnalysis of Variance - PPTX Generyn ReportLhorene Hope DueñasNo ratings yet

- Chapter 3Document5 pagesChapter 3Lhorene Hope DueñasNo ratings yet

- Psychosocial Behavior of Students With Incarcerated ParentsDocument5 pagesPsychosocial Behavior of Students With Incarcerated ParentsLhorene Hope DueñasNo ratings yet

- Chapter 3 IPDocument5 pagesChapter 3 IPLhorene Hope DueñasNo ratings yet

- Constitution: Name: Charlynn Joy T. ChavezDocument1 pageConstitution: Name: Charlynn Joy T. ChavezLhorene Hope DueñasNo ratings yet

- Binsooiiii Tax 7 PangitDocument1 pageBinsooiiii Tax 7 PangitLhorene Hope DueñasNo ratings yet

- CV Template - PG Creative 1Document3 pagesCV Template - PG Creative 1New BooksNo ratings yet

- Europe Is Home To 35% of Global Fallen Angels and 10 Potential AdditionsDocument13 pagesEurope Is Home To 35% of Global Fallen Angels and 10 Potential Additionsapi-227433089No ratings yet

- Pricing of Hospital EquipmentDocument2 pagesPricing of Hospital Equipmentaarti HingeNo ratings yet

- LAURI NURUL AZKIA-resumeDocument2 pagesLAURI NURUL AZKIA-resumeshitalampart3815No ratings yet

- Saif Textile MillsDocument3 pagesSaif Textile Millszainab lahoreNo ratings yet

- Online Marketplace Analysis:: Micro-EnvironmentDocument48 pagesOnline Marketplace Analysis:: Micro-Environmentjoe91bmw100% (2)

- Problem 1Document3 pagesProblem 1Beverly MindoroNo ratings yet

- Arslan CV UpdatedDocument4 pagesArslan CV UpdatedArslanHafeezNo ratings yet

- Account2 BDocument20 pagesAccount2 BamitpriyashankarNo ratings yet

- SAP CRM Tax ConfigurationDocument18 pagesSAP CRM Tax Configurationtushar_kansaraNo ratings yet

- Literature Review: Effects of Employee Relation On OrganizationDocument5 pagesLiterature Review: Effects of Employee Relation On OrganizationHameeda ShoukatNo ratings yet

- RazorFish Analytics ReportDocument41 pagesRazorFish Analytics ReportAngie DzwonkiewiczNo ratings yet

- MBA Syllabus Fourth Semester - 115236Document19 pagesMBA Syllabus Fourth Semester - 115236Deepak BordoloiNo ratings yet

- Jyoti Pathak 11910540 BSLDocument15 pagesJyoti Pathak 11910540 BSLJyoti Arvind Pathak100% (1)

- Aviation Quality Management and AuditingDocument2 pagesAviation Quality Management and AuditingГеорги ПетковNo ratings yet

- Chapter 4Document2 pagesChapter 4Jao FloresNo ratings yet

- Borrowing Costs: (International Accounting Standard (IAS) 23)Document25 pagesBorrowing Costs: (International Accounting Standard (IAS) 23)অরূপ মিস্ত্রী বলেছেনNo ratings yet

- KB61 - Repost Line Items: Cost Center Accounting Cost Center AccountingDocument7 pagesKB61 - Repost Line Items: Cost Center Accounting Cost Center AccountingZakir ChowdhuryNo ratings yet

- Case Study 2Document7 pagesCase Study 2mariam bhattiNo ratings yet

- Oracle® Process Manufacturing: Product Development User's Guide Release 12.1Document390 pagesOracle® Process Manufacturing: Product Development User's Guide Release 12.1mahfuzNo ratings yet

- M Waqas Resume CSDocument2 pagesM Waqas Resume CSjoxax95901No ratings yet

- Bar Qna - Partnership & AgencyDocument15 pagesBar Qna - Partnership & AgencyRound Round100% (3)

- MSK Q3 2019 FinancialsDocument24 pagesMSK Q3 2019 FinancialsJonathan LaMantiaNo ratings yet

- T5-The Core Process of Enterprise ArchitectureDocument38 pagesT5-The Core Process of Enterprise ArchitectureZul Harith ZainolNo ratings yet

- Douglas County School District Board of Trustees Agenda: Sept. 9Document9 pagesDouglas County School District Board of Trustees Agenda: Sept. 9cvalleytimesNo ratings yet

- Managing in A Global Environment: Learning ObjectivesDocument27 pagesManaging in A Global Environment: Learning ObjectivesaroojNo ratings yet

- Notification of The Bank of Thailand No. Sornorsor. 95/2551 Re: Regulation On Minimum Capital Requirement For Operational RiskDocument24 pagesNotification of The Bank of Thailand No. Sornorsor. 95/2551 Re: Regulation On Minimum Capital Requirement For Operational Riskmi nguyenNo ratings yet