Professional Documents

Culture Documents

Finalratio

Finalratio

Uploaded by

api-2901689920 ratings0% found this document useful (0 votes)

18 views1 pageSerenity Airlines' current ratio is 0.2, meaning for every $1 of current liabilities it has $0.2 of current assets, indicating liquidity issues. Its debt to equity ratio is 7.76, meaning it has $7.76 of total debt for every $1 of shareholder equity, showing high leverage. The return on sales is -0.41, meaning it loses $0.41 for every $1 of revenue, demonstrating poor profitability.

Original Description:

Original Title

finalratio

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSerenity Airlines' current ratio is 0.2, meaning for every $1 of current liabilities it has $0.2 of current assets, indicating liquidity issues. Its debt to equity ratio is 7.76, meaning it has $7.76 of total debt for every $1 of shareholder equity, showing high leverage. The return on sales is -0.41, meaning it loses $0.41 for every $1 of revenue, demonstrating poor profitability.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

18 views1 pageFinalratio

Finalratio

Uploaded by

api-290168992Serenity Airlines' current ratio is 0.2, meaning for every $1 of current liabilities it has $0.2 of current assets, indicating liquidity issues. Its debt to equity ratio is 7.76, meaning it has $7.76 of total debt for every $1 of shareholder equity, showing high leverage. The return on sales is -0.41, meaning it loses $0.41 for every $1 of revenue, demonstrating poor profitability.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

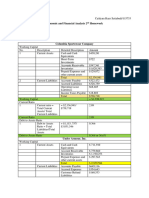

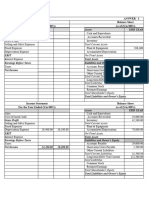

Serenity Airlines Financial Ratios

Current Assets Current Liabilities

Accounts

Common Stock $1,500,000 $1,238,623

Payable

Short-Term

Accounts Receivable $1,485,277 $15,124,003

Debt D4

Total current

$16,362,626

Total current Assets B5 $2,985,277 Liabilities

Common Stock capital $1,500,000

Retained Earnings -$3,642,590 long-term $255,241

Total Equity B8 -$2,142,590 Total debt D8 $16,617,867

Total Operating Expenses $ (4,387,494)

Total Net Revenue B10 $ 3,081,749

Operating Profit or Loss $ (1,305,745)

Other Income $ 32,490

Net Income, Net Profit/loss B13 $ (1,273,255)

Serenity Airlines Analysis of Ratios

Current Ratio Current assets/Current Liabilities (liquidity)

meaning B5/D4 0.20 0.2 per $1 relationship

Debt to Equity Total Debt/Total Equity (leverage)

meaning D8/B8 7.76 8 to 1

return of shareholders investment in the firm

Return on Sales Net profit or loss/Net Revenues (profitability)

ROS -0.41 minus 41.3%

net income earned, loss B13/B10 for each $1 of Sales (revenues)

Net Operating Profit Margin -41.30% additional funding needed

Comparison with the Industry Serenity Industry

Current Ratio 0.200 1.271

Debt to Equity 8 0.11

Return on Sales -0.41 -0.12

Comparison Chart on Ratios

Return on Sales

Debt to Equity

Current Ratio

-1.000 0.000 1.000 2.000 3.000 4.000 5.000 6.000 7.000 8.000

Industry Serenity

You might also like

- Ventura, Mary Mickaella R Chapter 4 - MinicaseDocument5 pagesVentura, Mary Mickaella R Chapter 4 - MinicaseMary Ventura100% (1)

- Genius 20 en Ver 1.2Document307 pagesGenius 20 en Ver 1.2Kristoffer BarkmanNo ratings yet

- 167 A 2Document3 pages167 A 2hira malik0% (1)

- The Balance Sheet and Income StatementDocument3 pagesThe Balance Sheet and Income Statementdhanya1995100% (1)

- Assigment EFADocument3 pagesAssigment EFAResty Arum100% (1)

- Colligative Properties and AnswerDocument3 pagesColligative Properties and AnswerTai PanNo ratings yet

- Chapter 03 - Intro FinDocument39 pagesChapter 03 - Intro FinSivan JacksonNo ratings yet

- 1 Courier C128574 R3 TCK0 ADocument2 pages1 Courier C128574 R3 TCK0 AAgz HrrfNo ratings yet

- Chapter Review and Self-Test Problems: 3.1 Sources and Uses of CashDocument11 pagesChapter Review and Self-Test Problems: 3.1 Sources and Uses of CashVincentDenhereNo ratings yet

- Extra Ex QTTC28129Document4 pagesExtra Ex QTTC28129Quang TiếnNo ratings yet

- Annual Report: Balance SheetDocument2 pagesAnnual Report: Balance Sheetshruthi sainathNo ratings yet

- Annual Report: Balance SheetDocument2 pagesAnnual Report: Balance Sheetdummy GoodluckNo ratings yet

- Nama: Aliea Yenemia Putri NPM: 120110210003 P4-19 A. Randy & Wiskers Enterprises Pro Forma Balance Sheet December 31, 2019 Assets Liabilities and Stockholders' EquityDocument10 pagesNama: Aliea Yenemia Putri NPM: 120110210003 P4-19 A. Randy & Wiskers Enterprises Pro Forma Balance Sheet December 31, 2019 Assets Liabilities and Stockholders' EquityAliea YenemiaNo ratings yet

- Account StatementsDocument10 pagesAccount Statementsharisnaeem612No ratings yet

- Revised - Econ and Financial Analysis 2nd HomeworkDocument3 pagesRevised - Econ and Financial Analysis 2nd HomeworkcaitlynnsetiabudiNo ratings yet

- Annual StatementsDocument10 pagesAnnual Statementsbcsf22m026No ratings yet

- Kelompok 8 - (Wup 9-12) - Week 13 PDFDocument4 pagesKelompok 8 - (Wup 9-12) - Week 13 PDFYefinia OpianaNo ratings yet

- Case 1 Format IdeaDocument5 pagesCase 1 Format IdeaMarina StraderNo ratings yet

- DifferenceDocument10 pagesDifferencethalibritNo ratings yet

- Handout 1 (B) Ratio Analysis Practice QuestionsDocument5 pagesHandout 1 (B) Ratio Analysis Practice QuestionsMuhammad Asad AliNo ratings yet

- FM I Test 2022Document5 pagesFM I Test 2022Hussien AdemNo ratings yet

- NEBCO Year 1 Financials and RatiosDocument1 pageNEBCO Year 1 Financials and RatiosBupe ChaliNo ratings yet

- Balance Sheet: Annual ReportDocument2 pagesBalance Sheet: Annual ReportekanshjiNo ratings yet

- Financial Statements, Cash Flows & TaxesDocument26 pagesFinancial Statements, Cash Flows & TaxesCathrene Jen Balome100% (1)

- Fin Man - Intro To FsDocument16 pagesFin Man - Intro To FsdanicaNo ratings yet

- Financial StatementDocument48 pagesFinancial StatementPhan Hải YếnNo ratings yet

- Financial Statements, Cash Flow AnalysisDocument41 pagesFinancial Statements, Cash Flow AnalysisMinhaz Ahmed0% (1)

- Assignment 1 - Financial Statement Analysis: Assets 2012Document4 pagesAssignment 1 - Financial Statement Analysis: Assets 2012kartika tamara maharaniNo ratings yet

- Financial Management Assignment 1Document3 pagesFinancial Management Assignment 12K22DMBA67 kushankNo ratings yet

- Practice Problems Chapter 4 Solutions 2Document19 pagesPractice Problems Chapter 4 Solutions 2Hope Trinity EnriquezNo ratings yet

- Chapter 2 - Financial Analysis (S202.)Document33 pagesChapter 2 - Financial Analysis (S202.)ha.nguyensanasNo ratings yet

- Ch02-20 ModDocument4 pagesCh02-20 ModDaniel BalchaNo ratings yet

- Assessment 3Document11 pagesAssessment 3Vinay SehrawatNo ratings yet

- Keown10 PPT 04Document49 pagesKeown10 PPT 04aseelNo ratings yet

- Soal Latihan Analisis Rasio KeuanganDocument7 pagesSoal Latihan Analisis Rasio Keuanganjoeng jaehyunNo ratings yet

- CH4 MinicaseDocument4 pagesCH4 Minicasemervin coquillaNo ratings yet

- Comp XMDocument1 pageComp XMlogeshkounderNo ratings yet

- Balance Sheet: INPUT DATA SECTION: Historical Data Used in The AnalysisDocument8 pagesBalance Sheet: INPUT DATA SECTION: Historical Data Used in The AnalysisMikkoNo ratings yet

- The Examiner's Answers F2 - Financial Management March 2013: Section ADocument18 pagesThe Examiner's Answers F2 - Financial Management March 2013: Section Amd salehinNo ratings yet

- Pert. Ke 3. Analisa Kinerja KeuanganDocument25 pagesPert. Ke 3. Analisa Kinerja KeuanganYULIANTONo ratings yet

- Revisi Tugas Cash Flow AnalysisDocument29 pagesRevisi Tugas Cash Flow AnalysisNovilia FriskaNo ratings yet

- CLWY Q1 2019 FinancialsDocument3 pagesCLWY Q1 2019 FinancialskdwcapitalNo ratings yet

- Annual Report - Capstone WebAppDocument2 pagesAnnual Report - Capstone WebAppSaurabh KhopadeNo ratings yet

- Accounting Statements and Cash Flow: Corporate FinanceDocument48 pagesAccounting Statements and Cash Flow: Corporate FinanceNguyễn Thùy LinhNo ratings yet

- Assignment Financial Management: Student Id Unit CodeDocument7 pagesAssignment Financial Management: Student Id Unit CodeAdrian ContilloNo ratings yet

- Chapter 5 - Financial StatementDocument31 pagesChapter 5 - Financial StatementQUYÊN VŨ THỊ THUNo ratings yet

- Ch03 ShowDocument54 pagesCh03 ShowMahmoud AbdullahNo ratings yet

- Exercises For Chapter 23 EFA2Document13 pagesExercises For Chapter 23 EFA2tuananh leNo ratings yet

- FIN202 - SU23 - Individual AssignmentDocument8 pagesFIN202 - SU23 - Individual AssignmentÁnh Dương NguyễnNo ratings yet

- 5.2 Monahan Manufacturing: Preparing and Interpreting A Statement of Cash FlowsDocument2 pages5.2 Monahan Manufacturing: Preparing and Interpreting A Statement of Cash FlowsvedeshNo ratings yet

- (123doc) Question Financial Statement AnalysisDocument9 pages(123doc) Question Financial Statement AnalysisUyển's MyNo ratings yet

- Test 2 Financial - Analysis (Bervie Rondonuwu)Document5 pagesTest 2 Financial - Analysis (Bervie Rondonuwu)Bervie RondonuwuNo ratings yet

- Ch02 Mini CaseDocument11 pagesCh02 Mini CaseCarl GarrettNo ratings yet

- Ch03 Tool Kit 2017-09-11Document20 pagesCh03 Tool Kit 2017-09-11Roy HemenwayNo ratings yet

- ALKLK Tugas 1 3Document11 pagesALKLK Tugas 1 3Rizdianka Ismi Yana FirmiadiNo ratings yet

- Colgate Estados Financieros 2021Document3 pagesColgate Estados Financieros 2021Lluvia RamosNo ratings yet

- Analysis of Financial StatementsDocument9 pagesAnalysis of Financial StatementsViren DeshpandeNo ratings yet

- CF Chap002Document37 pagesCF Chap002Anissa Rianti NurinaNo ratings yet

- Lecture 2 - FMDocument37 pagesLecture 2 - FMJack JackNo ratings yet

- FM I Test 2022 - Financial Management TestDocument5 pagesFM I Test 2022 - Financial Management Testhatenon1415No ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- CollageDocument5 pagesCollageapi-290168992No ratings yet

- Welcomeafc Tech Chair 2 1Document1 pageWelcomeafc Tech Chair 2 1api-290168992No ratings yet

- Search ResultsDocument2 pagesSearch Resultsapi-290168992No ratings yet

- Search ResultsDocument1 pageSearch Resultsapi-290168992No ratings yet

- Afc 2019 MDC Elected Officers3Document1 pageAfc 2019 MDC Elected Officers3api-290168992No ratings yet

- Search ResultsDocument3 pagesSearch Resultsapi-290168992No ratings yet

- WhyjoinnowDocument2 pagesWhyjoinnowapi-290168992No ratings yet

- WestnewsletterDocument1 pageWestnewsletterapi-290168992No ratings yet

- Flyer Broadway Latin Twist-4Document1 pageFlyer Broadway Latin Twist-4api-290168992No ratings yet

- The 5 Short Vowel SoundsDocument4 pagesThe 5 Short Vowel Soundsapi-290168992No ratings yet

- Research Article: Linkage Between Economic Value Added and Market Value: An AnalysisDocument14 pagesResearch Article: Linkage Between Economic Value Added and Market Value: An Analysiseshu agNo ratings yet

- Themes of "Waiting For Godot" - Thematic ConceptDocument10 pagesThemes of "Waiting For Godot" - Thematic ConceptMuhammad IsmailNo ratings yet

- Then Shall Ye Return: Malachi 3:18Document3 pagesThen Shall Ye Return: Malachi 3:18Paul Richard AbejuelaNo ratings yet

- Session 1 - Advancement Technologies in Pyro-ProcessingDocument85 pagesSession 1 - Advancement Technologies in Pyro-Processingmahendra sen100% (1)

- SP Initial 1-5K - ManualDocument37 pagesSP Initial 1-5K - ManualkobochanstoreNo ratings yet

- Xtensa Lx7 Data BookDocument755 pagesXtensa Lx7 Data Booklucian.ungureanNo ratings yet

- Seminar Topics NameDocument10 pagesSeminar Topics NameNilesh ThanviNo ratings yet

- 30+ Types of Project RiskDocument1 page30+ Types of Project RiskSulemanNo ratings yet

- Focus2 2E Workbook Answers PDFDocument1 pageFocus2 2E Workbook Answers PDFРоксоляна Бубон0% (1)

- Biopolitics and The Spectacle in Classic Hollywood CinemaDocument19 pagesBiopolitics and The Spectacle in Classic Hollywood CinemaAnastasiia SoloveiNo ratings yet

- DEL ROSARIO-Labreport-3-Canning-of-carrotDocument6 pagesDEL ROSARIO-Labreport-3-Canning-of-carrotlorina p del rosarioNo ratings yet

- Economic Mineral Deposits of PakistanDocument12 pagesEconomic Mineral Deposits of PakistanOolasyar Khattak67% (12)

- Spec Merlin Gerin MCCBDocument85 pagesSpec Merlin Gerin MCCBTen ApolinarioNo ratings yet

- VSP Final ReportDocument53 pagesVSP Final ReportAnand GautamNo ratings yet

- Prevention of Sexual Harassment at WorkplaceDocument62 pagesPrevention of Sexual Harassment at WorkplaceNitesh kumar singhNo ratings yet

- Brainstorming 2Document14 pagesBrainstorming 2AmierahIzzatiAisyahNo ratings yet

- Murat by Alexandre DumasDocument48 pagesMurat by Alexandre DumasEdina OrbánNo ratings yet

- MarineDocument16 pagesMarinehhhhhNo ratings yet

- Poa mmc1Document1 pagePoa mmc1Airaa ShaneNo ratings yet

- CBSE Class 6 Science Chapter 2 Components of Food Important Questions 2023-24Document3 pagesCBSE Class 6 Science Chapter 2 Components of Food Important Questions 2023-24Aiyana PraveshNo ratings yet

- Listofpractical 22 23Document24 pagesListofpractical 22 23Urvashi RaoNo ratings yet

- DVD Stereo System SC-VKX60: Operating InstructionsDocument27 pagesDVD Stereo System SC-VKX60: Operating InstructionsSeb FacuNo ratings yet

- Jan 22 P1R QPDocument36 pagesJan 22 P1R QPAbirNo ratings yet

- Silo - Tips - American Sportworks Parts Price List Effective 5 1 11Document45 pagesSilo - Tips - American Sportworks Parts Price List Effective 5 1 11boomissyNo ratings yet

- Assignment 1 Victorian Poetry MA-3Document3 pagesAssignment 1 Victorian Poetry MA-3Nayyab AbidNo ratings yet

- Stellar Gold Event Guide 2021Document7 pagesStellar Gold Event Guide 2021CozmynNo ratings yet

- Outsiders B1 BookletDocument82 pagesOutsiders B1 BookletKakali MallianNo ratings yet

- PedodonticsDocument2 pagesPedodonticsjunquelalaNo ratings yet