Professional Documents

Culture Documents

Property Subject To Taxation Exemptions: 2009 EDITION

Property Subject To Taxation Exemptions: 2009 EDITION

Uploaded by

Nicholas GreenCopyright:

Available Formats

You might also like

- Correct Your Status - The American States AssemblyDocument74 pagesCorrect Your Status - The American States AssemblyJohn67% (6)

- Circular Entitled RN Lax And: LocalDocument6 pagesCircular Entitled RN Lax And: Localjoseph iii goNo ratings yet

- Real Property Taxation: by Atty Agnes SantosDocument22 pagesReal Property Taxation: by Atty Agnes SantosJulienne A Argosino100% (1)

- FULLWAYDocument1 pageFULLWAYZMD INSURANCE SERVICESNo ratings yet

- Alaska House Bill 399Document6 pagesAlaska House Bill 399Anthony WrightNo ratings yet

- LGC of Quezon City Vs - Bayan TelDocument2 pagesLGC of Quezon City Vs - Bayan Telgeorge almedaNo ratings yet

- LGC of Quezon City Vs - Bayan Tel.Document2 pagesLGC of Quezon City Vs - Bayan Tel.george almedaNo ratings yet

- Alaska Senate Bill 265Document6 pagesAlaska Senate Bill 265Anthony WrightNo ratings yet

- GRI 300 Environmental Performance: Group 10 Robby Yumendra Romi HidayatDocument35 pagesGRI 300 Environmental Performance: Group 10 Robby Yumendra Romi HidayatRayhan Zuhra RinaldiNo ratings yet

- Real Property TaxDocument13 pagesReal Property TaxArgel Cosme100% (2)

- Judgementphp 4 478766Document16 pagesJudgementphp 4 4787668978961924No ratings yet

- 12 ExemptionsDocument28 pages12 Exemptionspandeyaman7608No ratings yet

- 31 306 General Regulations Governing US SecuritiesDocument374 pages31 306 General Regulations Governing US SecuritiestruthhurtsinillinoisNo ratings yet

- Disposal Land Rules 1979 PDFDocument207 pagesDisposal Land Rules 1979 PDFKulveer SinghNo ratings yet

- 5 - City Government of Cabanatuan Vs BayantelDocument7 pages5 - City Government of Cabanatuan Vs BayantelAnonymous CWcXthhZgxNo ratings yet

- GSIS v. City Treasurer of MNLDocument2 pagesGSIS v. City Treasurer of MNLanon_614984256No ratings yet

- 48 CFR Ch. 1 (10-1-14 Edition) 29.303: 29.304 Matters Requiring Special Con-SiderationDocument1 page48 CFR Ch. 1 (10-1-14 Edition) 29.303: 29.304 Matters Requiring Special Con-SiderationV C AgnihotriNo ratings yet

- Gutierrez Vs CIR Personal Expense 1Document12 pagesGutierrez Vs CIR Personal Expense 1Evan NervezaNo ratings yet

- Bir Ruling No. Ot-071-2023Document3 pagesBir Ruling No. Ot-071-2023Ren Mar CruzNo ratings yet

- Agricultural Districts Law Agricultural Districts Law Section 305 Section 305 - A & Section 308 A & Section 308Document10 pagesAgricultural Districts Law Agricultural Districts Law Section 305 Section 305 - A & Section 308 A & Section 308api-26300119No ratings yet

- City of Iriga V. Camsur Iii Elective Coop., Inc. Mactan Cebu International Airport Authority V. MarcosDocument2 pagesCity of Iriga V. Camsur Iii Elective Coop., Inc. Mactan Cebu International Airport Authority V. MarcosBea de LeonNo ratings yet

- Ra 9904Document17 pagesRa 9904sandeedandeeNo ratings yet

- Certificate Of: Land Use Rights Dwelling House Ownership and Other Assets Attached To LandDocument2 pagesCertificate Of: Land Use Rights Dwelling House Ownership and Other Assets Attached To LandAN ĐẶNGNo ratings yet

- Pottstown Beacon of Hope LetterDocument4 pagesPottstown Beacon of Hope LetterWHYY NewsNo ratings yet

- 11 Provincial Assessor of Agusan Del Sur v. Filipinas Palm Oil Plantation PDFDocument30 pages11 Provincial Assessor of Agusan Del Sur v. Filipinas Palm Oil Plantation PDFClarinda MerleNo ratings yet

- st2112040843 deDocument31 pagesst2112040843 desujaydas00123No ratings yet

- L MMH Acs 1020 DT 01012024Document465 pagesL MMH Acs 1020 DT 01012024Pranay KaulNo ratings yet

- Tha Key Indicators 2021Document56 pagesTha Key Indicators 2021Wen-Hsuan HsiaoNo ratings yet

- Approvals Required For Establishing An Industrial ProjectDocument4 pagesApprovals Required For Establishing An Industrial ProjectMohit BhatiaNo ratings yet

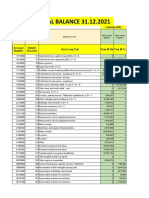

- Trial - Balance 2021-2Document24 pagesTrial - Balance 2021-2AlexandrinaCojocaruNo ratings yet

- Home Query Land Use Zone by Town Survey Number LogoutDocument1 pageHome Query Land Use Zone by Town Survey Number LogoutglobalwebcbeNo ratings yet

- Mactan Cebu International Airport Authority v. Marcos, Et Al 261 Scra 667Document11 pagesMactan Cebu International Airport Authority v. Marcos, Et Al 261 Scra 667Joshua RodriguezNo ratings yet

- Mpep 0200Document40 pagesMpep 0200shivam_desai_4No ratings yet

- 19 - 122207-2006-City - Government - of - Quezon - City - v. - Bayan20210505-12-1dqiyzlDocument11 pages19 - 122207-2006-City - Government - of - Quezon - City - v. - Bayan20210505-12-1dqiyzlalda hobisNo ratings yet

- CITY GOVERNMENT OF QUEZON CITY v. BAYAN TELECOMMUNICATIONSDocument15 pagesCITY GOVERNMENT OF QUEZON CITY v. BAYAN TELECOMMUNICATIONSJose Edmundo DayotNo ratings yet

- Income Tax AssignmentDocument7 pagesIncome Tax AssignmentDisha MohantyNo ratings yet

- Income Tax Law and Practice Renaissance Law College NotesDocument169 pagesIncome Tax Law and Practice Renaissance Law College NotesSiddhesh Vyas100% (1)

- Diplomatic Privileges (Vienna Convention) Act 1966 (Revised 2004) - Act 636Document19 pagesDiplomatic Privileges (Vienna Convention) Act 1966 (Revised 2004) - Act 636peterparker100% (1)

- Form - Authorized Training Center (ATC) V Sept-2020Document6 pagesForm - Authorized Training Center (ATC) V Sept-2020Shankker KumarNo ratings yet

- DT Nov 2022 PaperDocument26 pagesDT Nov 2022 PaperPoonam Sunil Lalwani LalwaniNo ratings yet

- Module 1. General Principles and Concepts of TaxationDocument214 pagesModule 1. General Principles and Concepts of TaxationCj SernaNo ratings yet

- Tax - SC & PWDDocument10 pagesTax - SC & PWDZaaavnn VannnnnNo ratings yet

- Bir Ruling 2021 - DST On Loan Exemption by PezaDocument5 pagesBir Ruling 2021 - DST On Loan Exemption by Pezajohn allen MarillaNo ratings yet

- 5.4 Batangas Power v. Batangas City, GR No. 152675, April 28, 2004Document1 page5.4 Batangas Power v. Batangas City, GR No. 152675, April 28, 2004Trickster100% (2)

- Case Digest Inn Tax1Document8 pagesCase Digest Inn Tax1Henry M. Macatuno Jr.No ratings yet

- NON ABMBusMath Semis 30 CopiesDocument17 pagesNON ABMBusMath Semis 30 CopiesAnthony John BrionesNo ratings yet

- fw9 PDFDocument4 pagesfw9 PDFAldar AltanbayarNo ratings yet

- Taxation: General PrinciplesDocument34 pagesTaxation: General PrinciplesKeziah A GicainNo ratings yet

- 3 Napocor Vs AlbayDocument5 pages3 Napocor Vs AlbayAivy Christine ManigosNo ratings yet

- M011-Consumer Mathematics (Taxation)Document5 pagesM011-Consumer Mathematics (Taxation)Tan Jun YouNo ratings yet

- ITR DocumentDocument6 pagesITR DocumentRamesh BabuNo ratings yet

- C.4. G.R. No. 214044-2019-University - of - The - Philippines - v. - City Treasurer QCDocument16 pagesC.4. G.R. No. 214044-2019-University - of - The - Philippines - v. - City Treasurer QCthebeautyinsideNo ratings yet

- Toshiba Information v. CIR G.R. No. 157594 March 9, 2010Document6 pagesToshiba Information v. CIR G.R. No. 157594 March 9, 2010Emrico CabahugNo ratings yet

- Republic vs. City of ParanaqueDocument17 pagesRepublic vs. City of ParanaqueMariaFaithFloresFelisartaNo ratings yet

- Lung Center vs. Quezon City and Constantino Rosas, 433 SCRA 119 (2004)Document12 pagesLung Center vs. Quezon City and Constantino Rosas, 433 SCRA 119 (2004)Christiaan CastilloNo ratings yet

- Examination Finals: Instruction: in Your Answer Sheet, Shade The Letter ThatDocument7 pagesExamination Finals: Instruction: in Your Answer Sheet, Shade The Letter ThatRandy ManzanoNo ratings yet

- Income Taxation of Trusts and EstatesDocument4 pagesIncome Taxation of Trusts and EstatesMilky CoffeeNo ratings yet

- Tax Digest Cañero PDFDocument9 pagesTax Digest Cañero PDFGreghvon MatolNo ratings yet

- Zubik, Et Al. V Burwell: Amicus Brief On Behalf of Dominican Sisters, Sisters of Life, and Judicial Education ProjectDocument71 pagesZubik, Et Al. V Burwell: Amicus Brief On Behalf of Dominican Sisters, Sisters of Life, and Judicial Education ProjectjudicialeducationprojectNo ratings yet

- Part 1 General PrincipleDocument26 pagesPart 1 General PrincipleRhea Joy OrcioNo ratings yet

- Docshare - Tips Taxpdf PDFDocument244 pagesDocshare - Tips Taxpdf PDFJustin Gabriel Ramirez LLanaNo ratings yet

- Pag - IbigDocument28 pagesPag - IbigfreeasdasdsdNo ratings yet

- Concise Tax Legislation 2020 Full ChapterDocument41 pagesConcise Tax Legislation 2020 Full Chaptereric.prather322100% (23)

Property Subject To Taxation Exemptions: 2009 EDITION

Property Subject To Taxation Exemptions: 2009 EDITION

Uploaded by

Nicholas GreenOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Property Subject To Taxation Exemptions: 2009 EDITION

Property Subject To Taxation Exemptions: 2009 EDITION

Uploaded by

Nicholas GreenCopyright:

Available Formats

Chapter 307

2009 EDITION

Property Subject to Taxation; Exemptions

GENERAL PROVISIONS (Institutional, Religious, Fraternal,

307.010 Definition of “real property” and “land”; Interment Properties)

timber and mineral interests in real prop- 307.130 Property of art museums, volunteer fire

erty departments or literary, benevolent,

307.020 Definition of “personal property”; inappli- charitable and scientific institutions

cability to certain utilities 307.134 Definition of fraternal organization

307.022 Status of limited liability companies 307.136 Property of fraternal organizations

owned by nonprofit corporations 307.140 Property of religious organizations

307.030 Property subject to assessment generally 307.145 Certain child care facilities, schools and

307.032 Maximum assessed value and assessed student housing

value of partially exempt property and

specially assessed property 307.147 Senior services centers

307.035 Publishing summary of certain exempt 307.150 Burial and crematory property

real property 307.155 When property exempt under ORS 65.855,

307.140 or 307.150 taxable; lien

EXEMPTIONS 307.157 Cemetery land acquired by eleemosynary

(Public Properties) or charitable institution; potential addi-

tional taxes

307.040 Property of the United States

307.160 Property of public libraries

307.050 Property of the United States held under

contract of sale 307.162 Claiming exemption; late claims; notifica-

tion of change to nonexempt use

307.060 Property of the United States held under

lease or other interest less than fee; de-

duction for restricted use (Leased Public or Institutional Property)

307.065 Property of the United States in pos- 307.166 Property leased by exempt institution, or-

session of contractor under federal de- ganization or public body to another ex-

fense or space contract empt institution, organization or public

body

307.070 Settled or claimed government land; im-

provements 307.168 State land under lease

307.080 Mining claims 307.171 Sports facility owned by large city

307.090 Property of the state, counties and other

municipal corporations; payments in lieu (Alternative Energy Systems)

of taxes on city-owned electric utility 307.175 Property equipped with alternative energy

property system

307.092 Property of housing authority; exception

307.095 State property rented for parking subject (Indian Properties)

to ad valorem taxation; computation 307.180 Property of Indians

307.100 Public property held by taxable owner 307.181 Land acquired by tribe within ancient

under contract of purchase tribal boundaries

307.107 Property used for natural gas pipeline ex-

tension project (Recreation Facilities and Summer

307.110 Public property leased or rented by taxa- Homes on Federal Land)

ble owner; exceptions 307.182 Federal land used by recreation facility

307.111 Property of shipyard used for ship repair, operators under permit

layup, conversion or construction 307.183 Summer homes on federal land occupied

307.112 Property held under lease, sublease or under permit

lease-purchase by institution, organiza- 307.184 Summer homes on federal land occupied

tion or public body other than state under lease

307.115 Property of nonprofit corporations held

for public parks or recreation purposes (Personal Property)

307.118 Wastewater and sewage treatment facili- 307.190 Tangible personal property held for per-

ties sonal use; inapplicability to property re-

307.120 Property owned or leased by municipal- quired to be registered, floating homes,

ities, dock commissions, airport districts boathouses and manufactured structures

or ports; exception; payments in lieu of 307.195 Household furnishings owned by nonprofit

taxes to school districts organization furnishing housing for stu-

307.123 Property of strategic investment program dents attending institutions of higher ed-

eligible projects; rules ucation

307.125 Property of forest protection agencies

307.126 Federal Communications Commission li- (Public Ways)

censes 307.200 Public ways

Title 29 Page 1 (2009 Edition)

REVENUE AND TAXATION

(Mobile Home or Manufactured (Commercial Facilities Under Construction)

Dwelling Parks) 307.330 Commercial facilities under construction

307.203 Mobile home or manufactured dwelling 307.340 Filing proof for cancellation of assess-

parks financed by Housing and Commu- ment; abatement

nity Services Department revenue bonds

(Nonprofit Homes for Elderly Persons)

(Railroad Properties)

307.370 Property of nonprofit homes for elderly

307.205 Property of railroad temporarily used for persons; limitation on lessee

public alternate transportation

307.375 Type of corporation to which exemption

(Water Associations) under ORS 307.370 applicable

307.210 Property of nonprofit mutual or cooper- 307.380 Claiming exemption under ORS 307.370

ative water associations; disqualification; 307.385 Credit to resident′s account with share of

application tax exemption; denial of exemption if

credit not given

(Telephone Services)

307.220 Property of nonprofit mutual or cooper- (Agricultural Equipment and Facilities)

ative telephone associations 307.390 Mobile field incinerators

307.230 Telephonic properties of persons not en- 307.391 Field burning smoke management equip-

gaged in public telephone service ment

307.240 Department of Revenue action required 307.394 Farm machinery and equipment; personal

for telephone association and telephonic property used in farm operations; limita-

property exemptions tion

307.397 Certain machinery and equipment used in

(Nonprofit Corporation Housing agricultural, aquacultural or fresh shell

for Elderly Persons) egg industry operations

307.241 Policy 307.398 Irrigation equipment

307.242 Property of nonprofit corporation provid-

ing housing to elderly persons; necessity (Inventory)

of filing claim to secure exemption 307.400 Inventory

307.243 Property to which exemption applies

307.244 Funded exemption; computation of rate (Beverage Containers)

of levy by county assessor; payments to 307.402 Beverage containers

county by department; proration

307.245 Denial of exemption for failure to reflect (Pollution Control Facilities)

exemption by rent reduction 307.405 Pollution control facilities; qualifications;

expiration; revocation; limitations

(Veterans, Surviving Spouses

and Dependent Children) 307.420 Filing claim and environmental certificate

for exemption; annual statements of own-

307.250 Property of veterans or surviving spouses ership

307.260 Claiming exemption; alternative proce- 307.430 Correction of assessment and tax rolls;

dure for surviving spouse termination of exemption

307.262 Tax years for which exemption may be

claimed upon receipt of federal certifica- (Beach Lands)

tion of disability; procedure; refund 307.450 Certain beach lands

307.270 Property to which exemption of ORS

307.250 applies (Food Processing Equipment)

307.280 Effect of exemption under ORS 307.250 on 307.453 Findings

prior tax levied

307.455 Definitions; application for exemption;

307.283 Homesteads of unmarried surviving exemption

spouses of veterans of Civil War or

Spanish War 307.457 Certification of eligibility of machinery

and equipment

(Active Duty Military Service) 307.459 Rules

307.286 Homestead exemption

(Egg Processing Equipment)

307.289 Claiming homestead exemption; alterna-

tive procedures following death of person 307.462 Definitions; application for exemption

qualifying for exemption 307.464 Certification of eligibility of machinery

and equipment

(Deciduous Plants; Agricultural Products)

307.466 Exemption limited to taxes of district

307.315 Nursery stock adopting ORS 307.462; rules

307.320 Deciduous trees, shrubs, plants, crops,

cultured Christmas trees or hardwood on (Student Housing)

agricultural land 307.471 Student housing exempt from school dis-

307.325 Agricultural products in possession of trict taxes; application procedure; dis-

farmer qualification

Title 29 Page 2 (2009 Edition)

PROPERTY SUBJECT TO TAXATION; EXEMPTIONS

(Hardship Situations) 307.606 Exemption limited to tax levy of city or

307.475 Relief when failure to file for exemption county that adopts ORS 307.600 to 307.637;

or cancellation of taxes or redetermi- designated areas; public hearings; stan-

nation of value was for good cause dards and guidelines for considering ap-

plications

(Farm Labor Camps; Child Care Facilities) 307.609 Applicability of ORS 307.600 to 307.637 in

307.480 Definitions for ORS 307.480 to 307.510 cities and certain counties

307.485 Farm labor camp and child care facility 307.612 Duration of exemption; exclusions

property 307.615 City or county to provide application

307.490 Payments in lieu of taxes; disposition of forms; contents of application form; filing

moneys received deadline; revision of application

307.495 Claiming exemption 307.618 City or county findings required for ap-

proval

307.500 Transmittal of claim to department and

other agencies; health code compliance 307.621 Approval or denial of applications; city or

county to state in writing reasons for de-

307.505 Inspection of farm labor camps; failure to nial of exemption; application fees

comply with health code

307.624 Termination of exemption for failure to

307.510 Appeal to tax court by taxpayer complete construction or noncompliance;

notice

(Low Income Rental Housing)

307.627 Termination of exemption

307.515 Definitions for ORS 307.515 to 307.523

307.631 Review of denial of application or termi-

307.517 Criteria for exemption nation of exemption; correction of assess-

307.518 Alternative criteria for exemption ment and tax rolls; owner′s appeal of

valuation; effective date of termination

307.519 Exemption limited to tax levy of govern- of exemption

ing body that adopts ORS 307.515 to

307.523; exception 307.634 Extension of deadline for completion of

307.521 Application for exemption; policies for construction, addition or conversion

approving application 307.637 Actions required by January 1, 2012, for

307.523 Time for filing application; certification exemption to be granted

of exemption

(Single-Unit Housing)

307.525 Action against landlord for failure to re-

duce rent 307.651 Definitions for ORS 307.651 to 307.687

307.527 Ordinance approving or disapproving ap- 307.654 Legislative findings

plication; application fee 307.657 Local government action to designate

307.529 Notice of proposed termination of ex- distressed areas; scope of exemption;

emption; grounds; ordinance terminating standards and guidelines

exemption 307.661 Median sales price

307.530 Termination if property held for future 307.664 Exemption; limitations

development or other purpose

307.667 Application for exemption

307.531 Termination of exemption without notice;

grounds; additional taxes after termi- 307.671 Approval criteria

nation 307.674 Application, approval and denial proce-

307.533 Review; correction of tax rolls; payment dures; filing with assessor; fee

of tax after exemption terminates 307.677 Extension of construction period; effect

307.535 Extension of deadline for completion; ex- of destruction of property

ception to imposition of additional taxes 307.681 Exemption termination for failure to meet

307.537 Application requirements; procedures

307.684 Immediate termination of exemption; ad-

(Nonprofit Corporation Low Income Housing) ditional tax

307.540 Definitions for ORS 307.540 to 307.548 307.687 Review of denial of application; proce-

307.541 Nonprofit corporation low income hous- dures following termination of exemption;

ing; criteria for exemption correction of tax roll; additional tax

307.543 Exemption limited to levy of governing

body adopting ORS 307.540 to 307.548; ex- (Rural Health Care Facilities)

ception 307.804 Rural health care facilities; claim proce-

307.545 Application for exemption dures; duration of exemption

307.547 Determination of eligibility; notice to 307.806 Exemption limited to taxes of district

county assessor adopting ORS 307.804; procedures

307.548 Termination of exemption

(Long Term Care Facilities)

(Property of Industry Apprenticeship 307.808 Findings and declarations

or Training Trust) 307.811 Essential community provider long term

307.580 Property of industry apprenticeship or care facilities

training trust 307.815 Exemption limited to taxes of district

adopting ORS 307.811

(Multiple-Unit Housing)

307.600 Legislative findings (Public Beach Access Sites)

307.603 Definitions for ORS 307.600 to 307.637 307.818 Beach access sites; claim procedures

Title 29 Page 3 (2009 Edition)

REVENUE AND TAXATION

307.821 Disqualification; additional taxes 307.847 Approval or disapproval of application

307.851 Criteria for designation of zone; notice to

(Environmentally Sensitive county assessor

Logging Equipment)

307.824 Findings and declarations 307.854 Acquisition, disposition and development

of real property within zone

307.827 Environmentally sensitive logging equip-

ment 307.857 Application for exemption; review; certi-

307.831 Skyline and swing yarders fication; fees

307.861 Monitoring of certified projects; decerti-

(Cargo Containers) fication

307.835 Cargo containers 307.864 Partial property tax exemption; disquali-

fication

VERTICAL HOUSING DEVELOPMENT

ZONES 307.867 Termination of zone; effect of termination

307.841 Definitions for ORS 307.841 to 307.867

307.844 Zone designation; application; special dis- PENALTIES

trict election to not participate in zone 307.990 Penalties

Title 29 Page 4 (2009 Edition)

PROPERTY SUBJECT TO TAXATION; EXEMPTIONS 307.032

GENERAL PROVISIONS (C) Media constituting business records,

computer software, files, records of accounts,

307.010 Definition of “real property” title records, surveys, designs, credit refer-

and “land”; timber and mineral interests ences, and data contained therein. “Media”

in real property. (1) As used in the property includes, but is not limited to, paper, film,

tax laws of this state: punch cards, magnetic tape and disk storage.

(a) “Land” means land in its natural (D) Goodwill.

state. For purposes of assessment of property

subject to assessment at assessed value un- (E) Customer lists.

der ORS 308.146, land includes any site de- (F) Contracts and contract rights.

velopment made to the land. As used in this (G) Patents, trademarks and copyrights.

paragraph, “site development” includes fill,

grading, leveling, underground utilities, (H) Assembled labor force.

underground utility connections and any (I) Trade secrets.

other elements identified by rule of the De- (b) “Personal property” means “tangible

partment of Revenue. personal property.”

(b) “Real property” includes: (c) “Tangible personal property” includes

(A) The land itself, above or under water; but is not limited to all chattels and mova-

bles, such as boats and vessels, merchandise

(B) All buildings, structures, improve- and stock in trade, furniture and personal

ments, machinery, equipment or fixtures effects, goods, livestock, vehicles, farming

erected upon, above or affixed to the land; implements, movable machinery, movable

(C) All mines, minerals, quarries and tools and movable equipment.

trees in, under or upon the land; (2) Subsection (1) of this section does not

(D) All water rights and water powers apply to any person, company, corporation or

and all other rights and privileges in any association covered by ORS 308.505 to

way appertaining to the land; or 308.665. [Amended by 1959 c.82 §1; 1977 c.602 §1; 1993

c.353 §1; 1997 c.154 §27; 2005 c.94 §30]

(E) Any estate, right, title or interest

whatever in the land or real property, less 307.022 Status of limited liability com-

than the fee simple. panies owned by nonprofit corporations.

For purposes of the property tax laws of this

(2) Where the grantor of land has, in the state, a limited liability company that is

instrument of conveyance, reserved or con- wholly owned by one or more nonprofit cor-

veyed: porations shall be an entity that qualifies for

(a) Any of the timber standing upon the an exemption or special assessment if and to

land, with the right to enter upon the ground the extent that all of the nonprofit corpo-

and remove the timber, the ownership of the ration owners of the limited liability com-

standing timber so reserved or conveyed is pany would qualify for the exemption or

an interest in real property. special assessment. [2005 c.688 §2]

(b) The right to enter upon and use any 307.030 Property subject to assess-

of the surface ground necessary for the pur- ment generally. (1) All real property within

pose of exploring, prospecting for, developing this state and all tangible personal property

or otherwise extracting any gold, silver, iron, situated within this state, except as other-

copper, lead, coal, petroleum, gases, oils or wise provided by law, shall be subject to as-

any other metals, minerals or mineral depos- sessment and taxation in equal and ratable

its in or upon the land, such right is an in- proportion.

terest in real property. [Amended by 1987 c.756 (2) Except as provided in ORS 308.505 to

§19; 1991 c.459 §37; 1997 c.541 §98; 2003 c.46 §10] 308.665, intangible personal property is not

307.020 Definition of “personal prop- subject to assessment and taxation. [Amended

by 1993 c.353 §2; 1997 c.154 §28]

erty”; inapplicability to certain utilities.

(1) As used in the property tax laws of this 307.032 Maximum assessed value and

state, unless otherwise specifically provided: assessed value of partially exempt prop-

erty and specially assessed property. (1)

(a) “Intangible personal property” or “in- Unless determined under a provision of law

tangibles” includes but is not limited to: governing the partial exemption that applies

(A) Money at interest, bonds, notes, to the property, the maximum assessed value

claims, demands and all other evidences of and assessed value of partially exempt prop-

indebtedness, secured or unsecured, includ- erty shall be determined as follows:

ing notes, bonds or certificates secured by (a) The maximum assessed value:

mortgages. (A) For the first tax year in which the

(B) All shares of stock in corporations, property is partially exempt, shall equal the

joint stock companies or associations. real market value of the property, reduced

Title 29 Page 5 (2009 Edition)

307.035 REVENUE AND TAXATION

by the value of the partial exemption, multi- and summarize the valuations of such prop-

plied by the ratio, not greater than 1.00, of erties in connection with the published sum-

the average maximum assessed value over mary of each year of assessed valuations of

the average real market value for the tax taxable properties of the county. [Formerly

year of property in the same area and prop- 307.310; 1993 c.777 §3; 1995 c.748 §8]

erty class.

(B) For each tax year after the first tax EXEMPTIONS

year in which the property is subject to the (Public Properties)

same partial exemption, shall equal 103 per-

cent of the property′s assessed value for the 307.040 Property of the United States.

prior year or 100 percent of the property′s Except as provided in ORS 307.050, 307.060,

maximum assessed value under this para- 307.070 and 307.080, all property of the

graph from the prior year, whichever is United States, its agencies or instrumental-

greater. ities, is exempt from taxation to the extent

that taxation thereof is forbidden by law.

(b) The assessed value of the property [Amended by 1953 c.698 §7]

shall equal the lesser of:

307.050 Property of the United States

(A) The real market value of the property held under contract of sale. Whenever real

reduced by the partial exemption; or and personal property of the United States

(B) The maximum assessed value of the or any department or agency of the United

property under paragraph (a) of this subsec- States is the subject of a contract of sale or

tion. other agreement whereby on certain pay-

(2) Unless determined under a provision ments being made the legal title is or may

of law governing the special assessment, the be acquired by any person and that person

maximum assessed value subject to special uses and possesses the property or has the

assessment and the assessed value of prop- right of present use and possession, then a

erty subject to special assessment shall be real market value for the property shall be

determined as follows: determined, as required under ORS 308.232,

without deduction on account of any part of

(a) The maximum assessed value: the purchase price or other sum due on such

(A) For the first tax year in which the property remaining unpaid. The property

property is specially assessed, shall equal the shall have an assessed value determined un-

specially assessed value of the property der ORS 308.146 and shall be subject to tax

multiplied by the ratio, not greater than 1.00, on the assessed value so determined. The

of the average maximum assessed value over lien for the tax shall neither attach to, im-

the average real market value for the tax pair, nor be enforced against any interest of

year of property in the same area and prop- the United States in the real or personal

erty class. property. This section does not apply to real

(B) For each tax year after the first tax or personal property held and in immediate

year in which property is subject to the same use and occupation by this state or any

special assessment, shall equal 103 percent county, municipal corporation or political

of the property′s assessed value for the prior subdivision of this state, or to standing tim-

year or 100 percent of the property′s maxi- ber, prior to severance, of the United States

mum assessed value subject to special as- or any department or agency of the United

sessment from the prior year, whichever is States that is the subject of a contract of

greater. sale or other agreement. [Amended by 1953 c.698

§7; 1965 c.159 §1; 2001 c.509 §6]

(b) The assessed value of the property

shall equal the lesser of: 307.060 Property of the United States

held under lease or other interest less

(A) The specially assessed value of the than fee; deduction for restricted use.

property as determined under the law estab- Real and personal property of the United

lishing the special assessment; or States or any department or agency of the

(B) The property′s maximum assessed United States held by any person under a

value subject to special assessment as deter- lease or other interest or estate less than a

mined under paragraph (a) of this subsection. fee simple, other than under a contract of

sale, shall have a real market value deter-

(3) As used in this section, “area” and mined under ORS 308.232, subject only to

“property class” have the meanings given deduction for restricted use. The property

those terms in ORS 308.149. [2003 c.169 §6] shall have an assessed value determined un-

307.035 Publishing summary of certain der ORS 308.146 and shall be subject to tax

exempt real property. The assessor shall on the assessed value so determined. The lien

list and evaluate all real properties exempt for the tax shall attach to and be enforced

from taxation under ORS 307.090, 307.120, against only the leasehold, interest or estate

307.130, 307.140, 307.147, 307.150 and 307.160 in the real or personal property. This section

Title 29 Page 6 (2009 Edition)

PROPERTY SUBJECT TO TAXATION; EXEMPTIONS 307.095

does not apply to real property held or occu- all property of the city located in any such

pied primarily for agricultural purposes un- school district, and which is exempt from

der the authority of a federal wildlife taxation under subsection (1) of this section

conservation agency or held or occupied pri- when such property is outside the boundaries

marily for purposes of grazing livestock. This of the city and owned, used or operated for

section does not apply to real or personal the production, transmission, distribution or

property held by this state or any county, furnishing of electric power or energy or

municipal corporation or political subdivision electric service for or to the public. [Amended

of this state that is: by 1953 c.698 §7; 1957 c.649 §1; 1975 c.568 §1; 1977 c.673

§1; 1991 c.851 §2; 2005 c.832 §1; 2009 c.804 §1]

(1) In immediate use and occupation by

the political body; or 307.092 Property of housing authority;

exception. (1) As used in this section,

(2) Required, by the terms of the lease or “property of a housing authority” includes,

agreement, to be maintained and made avail- but is not limited to:

able to the federal government as a military

installation and facility. [Amended by 1953 c.698 (a) Property that is held under lease or

§7; 1959 c.298 §1; 1961 c.433 §1; 1969 c.241 §1; 1975 c.656 lease purchase agreement by the housing au-

§1; 1981 c.405 §2; 1991 c.459 §38; 1997 c.541 §99; 2001 c.509 thority; and

§7]

(b) Property of a partnership, nonprofit

307.065 Property of the United States corporation or limited liability company for

in possession of contractor under federal which the housing authority is a general

defense or space contract. Notwithstand- partner, limited partner, director, member,

ing the provisions of ORS 307.060, there shall manager or general manager, if the property

be exempt from ad valorem taxation all parts is leased or rented to persons of lower in-

and materials, all work in process and all come for housing purposes.

finished products, the title to which is vested

in the United States pursuant to clauses in (2) Except as provided in subsection (3)

a federal defense or space contract entered of this section, the property of a housing au-

into by a contractor and an Armed Forces thority is declared to be public property used

procurement agency, which have come into for essential public and governmental pur-

the possession of a contractor under a fed- poses and such property and an authority

eral defense or space contract for the assem- shall be exempt from all taxes and special

bly or manufacture of a product or products assessments of the city, the county, the state

pursuant to such contract. [1965 c.298 §2] or any political subdivision thereof. In lieu

of such taxes or special assessments, an au-

307.070 Settled or claimed government thority may agree to make payments to the

land; improvements. The assessor must as- city, county or any such political subdivision

sess all improvements on lands, the fee of for improvements, services and facilities fur-

which is still vested in the United States, as nished by such city, county or political sub-

personal property until the settler thereon division for the benefit of a housing project,

or claimant thereof has made final proof. Af- but in no event shall such payments exceed

ter final proof has been made, and a certif- the estimated cost to the city, county or pol-

icate issued therefor, the land itself must be itical subdivision of the improvements, ser-

assessed, notwithstanding the patent has not vices or facilities to be so furnished.

been issued. (3) The provisions of subsection (2) of

307.080 Mining claims. Except for the this section regarding exemption from taxes

improvements, machinery and buildings and special assessments shall not apply to

thereon, mining claims are exempt from tax- property of the housing authority that is

ation prior to obtaining a patent therefor commercial property leased to a taxable en-

from the United States. tity. [Formerly 456.225; 2007 c.606 §4]

307.090 Property of the state, counties 307.095 State property rented for

and other municipal corporations; pay- parking subject to ad valorem taxation;

ments in lieu of taxes on city-owned computation. (1) Any portion of state prop-

electric utility property. (1) Except as pro- erty that is used during the tax year for

vided by law, all property of the state and all parking on a rental or fee basis to private

public or corporate property used or intended individuals is subject to ad valorem taxation.

for corporate purposes of the several coun- (2) The real market value of such portion

ties, cities, towns, school districts, irrigation shall be computed by determining that per-

districts, drainage districts, ports, water dis- centage which the total of receipts from pri-

tricts, housing authorities and all other pub- vate use bears to the total of receipts from

lic or municipal corporations in this state, is all use of the property. The assessed value

exempt from taxation. of such portion shall be computed as pro-

(2) Any city may agree with any school vided in ORS 308.146. However, receipts from

district to make payments in lieu of taxes on any use by a state officer or employee in the

Title 29 Page 7 (2009 Edition)

307.100 REVENUE AND TAXATION

performance of the official duties of the state ORS chapter 307 or any series therein by legislative

officer or employee shall not be considered action. See Preface to Oregon Revised Statutes for fur-

ther explanation.

as receipts from private use in computing the

portion subject to ad valorem taxation. 307.110 Public property leased or

(3) This section and ORS 276.592 do not rented by taxable owner; exceptions. (1)

apply to state property that is used by the Except as provided in ORS 307.120, all real

Oregon University System or the Oregon and personal property of this state or any

Health and Science University solely to pro- institution or department thereof or of any

vide parking for employees, students or visi- county or city, town or other municipal cor-

tors. [1969 c.706 §60; 1989 c.659 §1; 1991 c.459 §39; 1993 poration or political subdivision of this state,

c.655 §1; 1995 c.162 §67a; 1995 c.748 §1; 1997 c.541 §100; held under a lease or other interest or estate

2001 c.67 §1] less than a fee simple, by any person whose

307.100 Public property held by taxa- real property, if any, is taxable, except em-

ble owner under contract of purchase. ployees of the state, municipality or political

Whenever real and personal property of the subdivision as an incident to such employ-

state or any institution or department ment, shall be subject to assessment and

thereof, or any county, municipal corporation taxation for the assessed or specially as-

or political subdivision of the state is the sessed value thereof uniformly with real

subject of a contract of sale or other agree- property of nonexempt ownerships.

ment whereby on certain payments being (2) Each leased or rented premises not

made the legal title is or may be acquired by exempt under ORS 307.120 and subject to as-

any person and such person uses and pos- sessment and taxation under this section

sesses such property or has the right of which is located on property used as an air-

present use and possession, then such prop- port and owned by and serving a municipal-

erty shall be considered, for all purposes of ity or port shall be separately assessed and

taxation, as the property of such person. No taxed.

deed or bill of sale to such property shall be (3) Nothing contained in this section

executed until all taxes and municipal shall be construed as subjecting to assess-

charges are fully paid thereon. This section ment and taxation any publicly owned prop-

shall not apply to standing timber, prior to erty described in subsection (1) of this

severance thereof, of the state or any poli- section that is:

tical entity referred to above which is the

subject of a contract of sale or other agree- (a) Leased for student housing by a

ment. [Amended by 1965 c.159 §2] school or college to students attending such

a school or college.

307.107 Property used for natural gas

pipeline extension project. (1) Property (b) Leased to or rented by persons, other

used for a natural gas pipeline extension than sublessees or subrenters, for agricul-

project is exempt from ad valorem property tural or grazing purposes and for other than

taxation if: a cash rental or a percentage of the crop.

(a) The project receives or has received (c) Utilized by persons under a land use

moneys from the Oregon Unified Interna- permit issued by the Department of Trans-

tional Trade Fund to pay any portion of the portation for which the department′s use re-

project; strictions are such that only an

(b) The length of the pipeline, including administrative processing fee is able to be

additions or improvements, does not exceed charged.

115 miles; and (d) County fairgrounds and the buildings

(c) The owner of the property is a local thereon, in a county holding annual county

government, as defined in ORS 174.116. fairs, managed by the county fair board un-

(2) The exemption under this section ap- der ORS 565.230, if utilized, in addition to

plies to all property used for the project, real county fair use, for any of the purposes de-

and personal, tangible and intangible. scribed in ORS 565.230 (2), or for horse stalls

or storage for recreational vehicles or farm

(3) Notwithstanding ORS 307.110 or

308.505 to 308.665 or any other provision of machinery or equipment.

state law, property that is exempt under this (e) The properties and grounds managed

section is not disqualified from exemption if and operated by the State Parks and Recre-

a person other than the owner: ation Director under ORS 565.080, if utilized,

(a) Holds a lease, sublease or other in- in addition to the purpose of holding the Or-

terest in the exempt property; or egon State Fair, for horse stalls or for stor-

age for recreational vehicles or farm

(b) Holds, manages or uses any portion

of the project. [2007 c.678 §1] machinery or equipment.

Note: 307.107 was enacted into law by the Legisla- (f) State property that is used by the Or-

tive Assembly but was not added to or made a part of egon University System or the Oregon

Title 29 Page 8 (2009 Edition)

PROPERTY SUBJECT TO TAXATION; EXEMPTIONS 307.112

Health and Science University to provide §4; 1981 c.381 §1; 1987 c.487 §1; 1989 c.659 §2; 1991 c.459

parking for employees, students or visitors. §40; 1991 c.851 §3; 1993 c.655 §2; 1993 c.737 §7; 1995 c.337

§1; 1995 c.376 §3; 1995 c.698 §9; 1995 c.748 §2; 1997 c.541

(g) Property of a housing authority cre- §101; 1997 c.819 §12; 1999 c.760 §1; 2001 c.67 §2; 2001 c.114

ated under ORS chapter 456 which is leased §8; 2003 c.662 §11a; 2005 c.777 §17]

or rented to persons of lower income for 307.111 Property of shipyard used for

housing pursuant to the public and govern- ship repair, layup, conversion or con-

mental purposes of the housing authority. struction. (1) Property within a shipyard

For purposes of this paragraph, “persons of capable of dry-docking oceangoing vessels of

lower income” has the meaning given the 200,000 deadweight tons or more and utilized

phrase under ORS 456.055. or leased by a sole contractor for the purpose

(h) Property of a health district if: of ship repair, layup, conversion or construc-

(A) The property is leased or rented for tion is exempt from ad valorem property tax-

the purpose of providing facilities for health ation.

care practitioners practicing within the (2) The public shipyard owner shall notify

county; and the county assessor of the date of the lease

(B) The county is a frontier rural prac- or other possessory interest agreement with

tice county under rules adopted by the Office the sole shipyard contractor.

of Rural Health. (3) Property subleased by the sole

(4) Property determined to be an eligible shipyard contractor, or utilized by another

project for tax exemption under ORS person pursuant to a possessory interest

285C.600 to 285C.626 and 307.123 that was agreement with the sole shipyard contractor,

acquired with revenue bonds issued under is not exempt under this section.

ORS 285B.320 to 285B.371 and that is leased (4) Persons having on January 1 of any

by this state, any institution or department year a lease, sublease, rent or preferential

thereof or any county, city, town or other assignment or other possessory interest in

municipal corporation or political subdivision property that is exempt from taxation under

of this state to an eligible applicant shall be this section are not required to make the

assessed and taxed in accordance with ORS payments in lieu of taxes described in ORS

307.123. The property′s continued eligibility 307.120 (2). [2001 c.114 §10]

for taxation and assessment under ORS Note: Section 3, chapter 337, Oregon Laws 1995,

307.123 is not affected: provides:

(a) If the eligible applicant retires the Sec. 3. Section 10 of this 2001 Act [307.111] applies

to property tax years beginning on or after July 1, 1995,

bonds prior to the original dates of maturity; and before July 1, 2010. [1995 c.337 §3; 2001 c.114 §11]

or

307.112 Property held under lease,

(b) If any applicable lease or financial sublease or lease-purchase by institution,

agreement is terminated prior to the original organization or public body other than

date of expiration. state. (1) Real or personal property of a tax-

(5) The provisions of law for liens and able owner held under lease, sublease or

the payment and collection of taxes levied lease-purchase agreement by an institution,

against real property of nonexempt owner- organization or public body, other than the

ships shall apply to all real property subject State of Oregon, granted exemption or the

to the provisions of this section. Taxes re- right to claim exemption for any of its prop-

maining unpaid upon the termination of a erty under ORS 307.090, 307.130, 307.136,

lease or other interest or estate less than a 307.140, 307.145 or 307.147, is exempt from

fee simple, shall remain a lien against the taxation if:

real or personal property. (a) The property is used by the lessee or,

(6) If the state enters into a lease of if the lessee is not in possession of the prop-

property with, or grants an interest or other erty, the entity in possession of the property

estate less than a fee simple in property to, in the manner, if any, required by law for the

a person whose real property, if any, is taxa- exemption of property owned, leased, sub-

ble, then within 30 days after the date of the leased or being purchased by it; and

lease, or within 30 days after the date the (b) It is expressly agreed within the

interest or estate less than a fee simple is lease, sublease or lease-purchase agreement

created, the state shall file a copy of the that the rent payable by the institution, or-

lease or other instrument creating or evi- ganization or public body has been estab-

dencing the interest or estate with the lished to reflect the savings below market

county assessor. This section applies not- rent resulting from the exemption from taxa-

withstanding that the property may other- tion.

wise be entitled to an exemption under this

section, ORS 307.120 or as otherwise pro- (2) To obtain the exemption under this

vided by law. [Amended by 1953 c.698 §7; 1961 c.449 section, the lessee or, if the lessee is not in

§1; 1969 c.675 §18; 1971 c.352 §1; 1971 c.431 §1; 1979 c.689 possession of the property, the entity in pos-

Title 29 Page 9 (2009 Edition)

307.115 REVENUE AND TAXATION

session of the property must file a claim for 1 of the same calendar year. [1977 c.673 §2; 1987

exemption with the county assessor, verified c.756 §20; 1991 c.459 §41; 1991 c.851 §4; 1993 c.19 §3; 1993

by the oath or affirmation of the president c.777 §4; 1995 c.513 §1; 1997 c.434 §1; 1997 c.541 §102; 1999

c.579 §18; 2003 c.117 §1; 2007 c.817 §1; 2009 c.626 §1]

or other proper officer of the institution or

Note: Section 4, chapter 626, Oregon Laws 2009,

organization, or head official of the public provides:

body or legally authorized delegate, showing:

Sec. 4. The amendments to ORS 307.112, 307.162

(a) A complete description of the prop- and 307.166 by sections 1 to 3 of this 2009 Act apply to

erty for which exemption is claimed. tax years beginning on or after July 1, 2009. [2009 c.626

§4]

(b) If applicable, all facts relating to the

use of the property by the lessee or, if the 307.115 Property of nonprofit corpo-

lessee is not in possession of the property, rations held for public parks or recre-

all facts relating to the use of the property ation purposes. (1) Subject to approval by

by the entity in possession of the property. the appropriate granting authority under

(c) A true copy of the lease, sublease or subsection (4) of this section, the following

lease-purchase agreement covering the prop- real or personal property owned or being

erty for which exemption is claimed. purchased under contract by any nonprofit

corporation meeting the requirements of

(d) Any other information required by the subsection (2) of this section shall be exempt

claim form. from taxation:

(3) If the assessor is not satisfied that the (a) The real or personal property, or pro-

rent stated in the lease, sublease or lease- portion thereof, as is actually and exclusively

purchase agreement has been established to occupied or used for public park or public

reflect the savings below market rent result- recreation purposes.

ing from the tax exemption, before the ex-

emption may be granted the lessor must (b) The real or personal property, or pro-

provide documentary proof, as specified by portion thereof, as is held for public parks

rule of the Department of Revenue, that the or public recreation purposes if the property

rent has been established to reflect the is not used for the production of income, for

savings below market rent resulting from the investment, or for any trade or business or

tax exemption. commercial purpose, or for the benefit or

enjoyment of any private stockholder or in-

(4)(a) The claim must be filed on or be- dividual, but only if the articles of incorpo-

fore April 1 preceding the tax year for which ration of the nonprofit corporation prohibit

the exemption is claimed, except: use of property owned or otherwise held by

(A) If the lease, sublease or lease-pur- the corporation, or of proceeds derived from

chase agreement is entered into after March the sale of that property, except for public

1 but not later than June 30, the claim must park or public recreation purposes.

be filed within 30 days after the date the (2) Any nonprofit corporation shall meet

lease, sublease or lease-purchase agreement the following requirements:

is entered into if exemption is claimed for

that year; or (a) The corporation shall be organized for

the principal purpose of maintaining and op-

(B) If a late filing fee is paid in the erating a public park and public recreation

manner provided in ORS 307.162 (2), as ap- facility or acquiring interest in land for de-

plicable and notwithstanding the limitation velopment for public parks or public recre-

of scope in ORS 307.162 (1), the claim may ation purposes;

be filed on or before December 31 of the tax

year for which exemption is first claimed. (b) No part of the net earnings of the

corporation shall inure to the benefit of any

(b) The exemption first applies for the tax private stockholder or individual; and

year beginning July 1 of the year for which

the claim is filed. The exemption continues (c) Upon liquidation, the assets of the

as long as the use of the property remains corporation shall be applied first in payment

unchanged and during the period of the of all outstanding obligations, and the bal-

lease, sublease or lease-purchase agreement. ance remaining, if any, in cash and in kind,

If the use changes, a new claim must be filed shall be distributed to the State of Oregon

as provided in this section. If the use or to one or more of its political subdivisions

changes due to sublease of the property or for public parks or public recreation pur-

any portion of the property from the tax ex- poses.

empt entity described in subsection (1) of this (3) If any property which is exempt under

section to another tax exempt entity, the en- this section subsequently becomes disquali-

tity in possession of the property must file a fied for such exemption or the exemption is

new claim for exemption as provided in this not renewed as provided in subsection (4) of

section. If the lease, sublease or lease-pur- this section, it shall be added to the next

chase agreement expires before July 1 of any general property tax roll for assessment and

year, the exemption terminates as of January taxation in the manner provided by law.

Title 29 Page 10 (2009 Edition)

PROPERTY SUBJECT TO TAXATION; EXEMPTIONS 307.118

(4)(a) Real or personal property shall not (d) The granting authority may approve

be exempt under this section except upon the application for exemption with respect to

approval of the appropriate granting author- only part of the property which is the subject

ity obtained in the manner provided under of the application. However, if any part of

this subsection. the application is denied, the applicant may

(b) Before any property shall be exempt withdraw the entire application.

under this section, on or before April 1 of (e) The exemption shall be granted for a

any year the corporation owning or purchas- 10-year period and may be renewed by the

ing such property shall file an application for granting authority for additional periods of

exemption with the county assessor. The 10 years each at the expiration of the pre-

provisions of ORS 307.162 shall apply as to ceding period, upon the filing of a new ap-

the form, time and manner of application. plication by the corporation with the county

Within 10 days of filing in the office of the assessor on or before April 1 of the year fol-

assessor, the assessor shall refer each appli- lowing the 10th year of exemption. The as-

cation for classification to the granting au- sessor shall refer the application to the

thority, which shall be the governing body governing body as provided in paragraph (b)

of a county for property located outside the of this subsection, and within 30 days there-

boundaries of a city and the governing body after, the governing body shall determine if

of the city for property located within the renewing the exemption will continue to

boundaries of the city. Within 60 days there- serve one of the purposes of paragraph (c) of

after, the application shall be granted or de- this subsection. Within 30 days after referral,

nied and written notice given to the written notice shall be given to the applicant

applicant and to the county assessor. In de- and to the county assessor of the determi-

termining whether an application made for nation made by the governing body.

exemption under this section should be ap- (5) Any nonprofit corporation aggrieved

proved or disapproved, the granting authority by the refusal of the granting authority to

shall weigh the benefits to the general wel- grant or renew an exemption under subsec-

fare of granting the proposed exemption to tion (4) of this section may, within 60 days

the property which is the subject of the ap- after written notice has been sent to the

plication against the potential loss in re- corporation, appeal from the determination

venue which may result from granting the of the granting authority to the Oregon Tax

application. Court. The appeal should be perfected in the

(c) The granting authority shall not deny manner provided in ORS 305.560. The pro-

the application solely because of the poten- visions of ORS 305.405 to 305.494 shall apply

tial loss in revenue if the granting authority to the appeals. [1971 c.584 §1; 1973 c.214 §1; 1979

determines that granting the exemption to c.689 §5; 1987 c.416 §1; 1995 c.79 §118; 1997 c.325 §18]

the property will: 307.118 Wastewater and sewage treat-

(A) Conserve or enhance natural or sce- ment facilities. Upon compliance with ORS

nic resources; 307.162, the wastewater treatment facilities,

(B) Protect air or streams or water sup- sewage treatment facilities and all other

plies; property used for the purpose of wastewater

treatment or sewage treatment, including the

(C) Promote conservation of soils, land underneath the facilities, shall be ex-

wetlands, beaches or tidal marshes; empt from taxation if:

(D) Conserve landscaped areas which en- (1) Owned by a nonprofit corporation

hance the value of abutting or neighboring that was in existence as of January 1, 1997;

property; and

(E) Enhance the value to the public of (2) The nonprofit corporation′s only ac-

abutting or neighboring parks, forests, wild- tivities consist of operating wastewater

life preserves, natural reservations, sanctu- treatment and sewage treatment facilities

aries or other open spaces;

that were constructed and in operation as of

(F) Enhance recreation opportunities; January 1, 1997. [1997 c.485 §2]

(G) Preserve historic sites; Note: Sections 1 to 4, chapter 256, Oregon Laws

2001, provide:

(H) Promote orderly urban or suburban

development; Sec. 1. (1) Upon compliance with section 3, chapter

256, Oregon Laws 2001, land that is used both as a golf

(I) Promote the reservation of land for course and for the discharge of wastewater or sewage

public parks, recreation or wildlife refuge effluent is exempt from the ad valorem property taxes

purposes; or of taxing districts authorizing the exemption under sec-

tion 4, chapter 256, Oregon Laws 2001, if:

(J) Affect any other factors relevant to (a) The land is owned by a municipality and leased

the general welfare of preserving the current by a nonprofit corporation that was in existence as of

use of the property. January 1, 1997; and

Title 29 Page 11 (2009 Edition)

307.120 REVENUE AND TAXATION

(b) The nonprofit corporation operates the golf berthing of ships, barges or other watercraft

course. (exclusive of property leased, subleased,

(2) Buildings or other improvements that are lo- rented or preferentially assigned primarily

cated on land that is exempt from ad valorem property for the purpose of the berthing of floating

taxes under subsection (1) of this section and that are

used in the operation of the golf course or the discharge homes, as defined in ORS 830.700), the dis-

of wastewater or sewage effluent are exempt from ad charging, loading or handling of cargo there-

valorem property taxes of the taxing districts that au- from or for storage of such cargo directly

thorized the exemption under section 4, chapter 256, incidental to transshipment, or the cleaning

Oregon Laws 2001. [2001 c.256 §1; 2003 c.771 §1]

or decontaminating of agricultural commod-

Sec. 2. (1) Section 1 (1), chapter 256, Oregon Laws ity cargo, to the extent the property does not

2001, applies to tax years beginning on or after July 1,

1998, and before July 1, 2021. further alter or process an agricultural com-

(2) Section 1 (2), chapter 256, Oregon Laws 2001,

modity;

applies to tax years beginning on or after July 1, 1999, (b) Held under lease or rental agreement

and before July 1, 2021. [2001 c.256 §2; 2003 c.771 §2] executed for any purpose prior to July 5,

Sec. 3. (1) In order for land to be exempt from ad 1947, except that this exemption shall con-

valorem property taxes under section 1 of this 2001 Act, tinue only during the term of the lease or

the nonprofit corporation described in section 1 of this

2001 Act must apply to the county assessor. The state- rental agreement in effect on that date; or

ment required under ORS 307.162 to claim an exemption (c) Used as an airport owned by and

listed in ORS 307.162 (1) shall serve as the application serving a municipality or port of less than

to be filed with the county assessor to claim the ex-

emption under section 1 of this 2001 Act. 300,000 inhabitants as determined by the lat-

(2) The application must be filed on or before July

est decennial census. Property owned or

1, 2002. The provisions for late filing described in ORS leased by the municipality, airport district or

307.162 do not apply to an application filed under this port that is located within or contiguous to

section. the airport is exempt from taxation under

(3) The application shall serve as the applicant′s this subsection if the proceeds of the lease,

claim for exemption for all tax years described in sec- sublease or rental are used by the munic-

tion 2 of this 2001 Act for which, as of each assessment ipality, airport district or port exclusively for

date, the applicant and property meet the criteria set

forth in section 1 of this 2001 Act. purposes of the maintenance and operation

of the airport.

(4) The assessor shall approve each timely filed

application in which the applicant and the land meet (2) Those persons having on January 1

the criteria to be exempt under section 1 of this 2001 of any year a lease, sublease, rent or prefer-

Act. ential assignment or other possessory inter-

(5) Any property taxes and interest that have been est in property exempt from taxation under

paid on behalf of property granted the exemption under subsection (1)(a) of this section, except dock

section 1 of this 2001 Act for a tax year beginning be-

fore January 1, 2002, shall be refunded in the manner area property, shall make payments in lieu

prescribed in subsection (6) of this section. If the taxes of taxes to any school district in which the

have not been paid, the taxes and any interest due exempt property is located as provided in

thereon are abated. subsection (3) of this section. The annual

(6) The tax collector shall notify the governing payment in lieu of taxes shall be one quarter

body of the county of any refund required under this of one percent (0.0025) of the real market

section and the governing body shall cause a refund of

the taxes and any interest paid to be made from the value of the exempt property and the pay-

unsegregated tax collections account described in ORS ment shall be made to the county treasurer

311.385. The refund under this subsection shall be made on or before May 1 of each year.

without interest. The county assessor and tax collector

shall make the necessary corrections in the records of (3)(a) On or before December 31 preced-

their offices. [2001 c.256 §3] ing any year for which a lease, sublease,

Sec. 4. The exemption provided in section 1 of this rental or preferential assignment or other

2001 Act applies only to the taxes of a taxing district possessory interest in property is to be held,

the governing body of which has adopted an ordinance or within 30 days after acquisition of such

or resolution authorizing the exemption under section an interest, whichever is later, any person

1 of this 2001 Act. [2001 c.256 §4]

described in subsection (2) of this section

307.120 Property owned or leased by shall file with the county assessor a request

municipalities, dock commissions, airport for computation of the payment in lieu of tax

districts or ports; exception; payments in for the exempt property in which the person

lieu of taxes to school districts. (1) Real has a possessory interest. The person shall

property owned or leased by any municipality also provide any information necessary to

and real and personal property owned or complete the computation that may be re-

leased by any dock commission of any city quested by the assessor. The request shall be

or by any airport district or port organized made on a form prescribed by the Depart-

under the laws of this state is exempt from ment of Revenue.

taxation to the extent to which such prop- (b) On or before April 1 of each assess-

erty is: ment year the county assessor shall compute

(a) Leased, subleased, rented or prefer- the in lieu tax for the property subject to

entially assigned for the purpose of the subsection (2) of this section for which a re-

Title 29 Page 12 (2009 Edition)

PROPERTY SUBJECT TO TAXATION; EXEMPTIONS 307.123

quest for computation has been filed under exempt property held, to the county treas-

paragraph (a) of this subsection and shall urer before May 1 following the date of the

notify each person who has filed such a re- request.

quest: (C) That, if the request is not made

(A) That the person is required to pay within the time prescribed, or if the in lieu

the amount in lieu of taxes to the county tax is not paid, or both, that the property

treasurer on behalf of the school district; shall not be exempt from taxation but shall

(B) Of the real market value of the prop- be assessed and taxed in the same manner

erty subject to the payment in lieu of taxes; as other property similarly situated is as-

and sessed and taxed.

(C) Of the amount due, the due date of (b) Failure of a municipality, dock com-

the payment in lieu of taxes and of the con- mission, airport district or port to give the

sequences of late payment or nonpayment. notice as prescribed under this subsection

does not relieve any person from the re-

(c) On or before July 15 of each tax year quirements of this section.

the county treasurer shall distribute to the

school districts the amounts received for the (7) As used in this section:

respective districts under subsection (2) of (a) “Dock” means a structure extended

this section. If the exempt property is located from the shore or area adjacent to deep wa-

in more than one school district, the amount ter for the purpose of permitting the mooring

received shall be apportioned to the school of ships, barges or other watercraft.

districts on the basis of the ratio that each

school district′s permanent limit on the rate (b) “Dock area” means that part of the

of ad valorem property taxes bears to the dock situated immediately adjacent to the

total permanent limit on the rate of ad mooring berth of ships, barges or other wa-

valorem property taxes applicable to all of tercraft which is used primarily for the load-

the school districts in which the property is ing and unloading of waterborne cargo, but

located. which shall not encompass any area other

than that area from which cargo is hoisted

(4) If a person described in subsection (2) or moved aboard a vessel, or to which cargo

of this section fails to request a computation is set down when unloaded from a vessel

or make a payment in lieu of taxes as pro- when utilizing shipboard or dockside ma-

vided in this section, the property shall not chinery.

be exempt for the tax year but shall be as-

sessed and taxed as other property similarly (c) “Dock area property” means all real

situated is assessed and taxed. property situated in the dock area, and in-

cludes all structures, machinery or equip-

(5) Upon granting of a lease, sublease, ment affixed to that property.

rental, preferential assignment or other

possessory interest in property described in (d) “School district” means a common or

subsection (1)(a) of this section, except dock union high school district, but does not in-

area property, the municipality, dock com- clude a county education bond district, an

mission, airport district or port shall provide education service district, a community col-

the county assessor with the name and ad- lege service district or a community college

dress of the lessee, sublessee, renter, prefer- district. [Amended by 1955 c.267 §1; 1973 c.234 §1; 1977

c.615 §1; 1979 c.705 §1; 1981 c.160 §1; 1983 c.740 §86; 1987

ential assignee or person granted the c.583 §5; 1987 c.756 §10; 1991 c.459 §42; 1995 c.337 §2; 1997

possessory interest. c.271 §4; 1997 c.541 §103; 1997 c.600 §5; 1999 c.570 §1; 2001

(6)(a) Not later than 15 days prior to the c.114 §9; 2003 c.119 §1; 2003 c.169 §1]

date that a request is required to be made 307.122 [1987 c.583 §§3,7; repealed by 1991 c.459 §81]

under subsection (3)(a) of this section, the 307.123 Property of strategic invest-

municipality, dock commission, airport dis- ment program eligible projects; rules. (1)

trict or port granting a lease, sublease, Except as provided in subsection (3) of this

rental, preferential assignment or other section, real or personal property that the

possessory interest in its exempt property for Oregon Business Development Commission,

which in lieu tax payments are imposed un- acting pursuant to ORS 285C.606, has deter-

der subsection (2) of this section, shall notify mined is an eligible project under ORS

the person granted the interest: 285C.600 to 285C.626 shall be subject to as-

(A) Of the obligation to file with the sessment and taxation as follows:

county assessor a request for appraisal and (a) That portion of the real market value

computation of in lieu tax no later than De- of the eligible project that equals the mini-

cember 31 or within 30 days after the inter- mum cost of the project under ORS 285C.606

est is granted, whichever is later. (1)(c), increased annually for growth at the

(B) Of the obligation to pay the in lieu rate of three percent, shall be taxable at the

tax, in the amount of one-quarter of one per- taxable portion′s assessed value under ORS

cent (0.0025) of the real market value of the 308.146. The taxable portion of real market

Title 29 Page 13 (2009 Edition)

307.125 REVENUE AND TAXATION

value, as adjusted, shall be allocated as fol- chapter 477 is exempt from taxation if such

lows until the entire amount is assigned: property is used exclusively for such pro-

first to land, second to buildings, third to tection and suppression. [1957 c.189 §1; 1965 c.253

real property machinery and equipment and §138]

last to personal property. 307.126 Federal Communications

(b) The remainder of the real market Commission licenses. Licenses granted by

value shall be exempt from taxation for a the Federal Communications Commission are

period of 15 years from the beginning of the exempt from ad valorem property taxation,

tax year after the earliest of the following and the value of the licenses may not be re-

dates: flected in the value of real or tangible per-

(A) The date the property is certified for sonal property. [2001 c.429 §2]

occupancy or, if no certificate of occupancy 307.127 [1977 c.478 §1; 1979 c.689 §6; repealed by 1995

c.79 §119]

is issued, the date the property is used to

produce a product for sale; or

(Institutional, Religious, Fraternal,

(B) The expiration of the exemption for Interment Properties)

commercial facilities under construction un-

der ORS 307.330. 307.130 Property of art museums, vol-

unteer fire departments or literary, be-

(2) If the real market value of the prop- nevolent, charitable and scientific

erty falls below the value determined under institutions. (1) As used in this section:

subsection (1)(a) of this section, the owner

or lessee shall pay taxes only on the assessed (a) “Art museum” means a nonprofit cor-

value of the property. poration organized to display works of art to

the public.

(3) Notwithstanding subsection (1) of this

section, real or personal property that has (b) “Internal Revenue Code” means the

received an exemption under ORS 285C.175 federal Internal Revenue Code as amended

may not be assessed under this section. and in effect on May 1, 2009.

(4) The Department of Revenue may (c) “Nonprofit corporation” means a cor-

adopt rules and prescribe forms that the de- poration that:

partment determines are necessary for ad- (A) Is organized not for profit, pursuant

ministration of this section. to ORS chapter 65 or any predecessor of ORS

(5) The determination by the Oregon chapter 65; or

Business Development Commission that a (B) Is organized and operated as de-

project is an eligible project that may receive scribed under section 501(c) of the Internal

a tax exemption under this section shall be Revenue Code.

conclusive, so long as the property included (d) “Volunteer fire department” means a

in the eligible project is constructed and in- nonprofit corporation organized to provide

stalled in accordance with the application fire protection services in a specific response

approved by the commission. area.

(6) Notwithstanding subsection (1) of this (2) Upon compliance with ORS 307.162,

section, if the owner or lessee of property the following property owned or being pur-

exempt under this section fails to pay the fee chased by art museums, volunteer fire de-

required under ORS 285C.609 (4)(b) by the partments, or incorporated literary,

end of the tax year in which it is due, the benevolent, charitable and scientific insti-

exemption shall be revoked and the property tutions shall be exempt from taxation:

shall be fully taxable for the following tax (a) Except as provided in ORS 748.414,

year and for each subsequent tax year for only such real or personal property, or pro-

which the fee remains unpaid. If an unpaid portion thereof, as is actually and exclusively

fee is paid after the exemption is revoked, occupied or used in the literary, benevolent,

the property shall again be eligible for the charitable or scientific work carried on by

exemption provided under this section, be- such institutions.

ginning with the tax year after the payment

is made. Reinstatement of the exemption (b) Parking lots used for parking or any

under this subsection shall not extend the other use as long as that parking or other

15-year exemption period provided for in use is permitted without charge for no fewer

subsection (1)(b) of this section. [1993 c.737 §5; than 355 days during the tax year.

1995 c.698 §8; 1997 c.325 §19; 1997 c.541 §412; 2003 c.662 (c) All real or personal property of a re-

§12]

habilitation facility or any retail outlet

307.125 Property of forest protection thereof, including inventory. As used in this

agencies. All the real and personal property subsection, “rehabilitation facility” means