Professional Documents

Culture Documents

Investments Suggested Problems

Investments Suggested Problems

Uploaded by

chaitannya goelOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investments Suggested Problems

Investments Suggested Problems

Uploaded by

chaitannya goelCopyright:

Available Formats

1.1 & 1.

2 REAL VERSUS FINANCIAL ASSETS

MONEY MARKETS & CAPITAL MARKETS

PRIMARY & SECONDARY MARKETS

1.3 & 1.5 MARKETS AND THE ECONOMY

Technical analysis: study of charts, graphs as a proxy for supply

demand patterns in securities.

Fundamental analysis: study of company financial statements,

forecasts of earnings.

Market efficiency: Informational role of markets.

Rational action by some investors causes mispricing to disappear

relatively quickly so that rationality prevails in the aggregate.

Stated differently: prices do deviate from fundamental value, but

the deviations are random (slight difference from your text book!).

Behavioral paradigm:

Investors collectively exhibit several biases that may make prices

stay away from fundamental values for long periods of time:

(markets can stay irrational longer than you can remain solvent).

Overconfidence and optimism. 80% of all drivers feel their driving

is above average . Ever met an “average” money manager?

RISK – RETURN TRADEOFF (More in Chapter 5).

1.4 THE INVESTMENT PROCESS

Badrinath, Fin 327, 2013-1 Page 1 of 17

TOP-DOWN or BOTTOM-UP, macro-level, industry-level,

company-level. (CFA, mostly fundamental analysis).

Discuss the San Diego Chapter of the CFA Society. SDSU student

teams have won the local CFA Challenge Cup, 2 years in a row. I

will be picking a team later this Fall for a 3-peat!

1.4.1 ASSET ALLOCATION --divide money across different asset

classes-- stocks/bonds, industry/sector, domestic/international or

other. Asset allocation explains 90% of the variability in returns in

a fund over time. So how to divide among cash, bonds, stocks etc?

One approach is the life-cycle.

a) Accumulation: younger workers, higher risks

b) Consolidation mid-career, moderate risks

c) Spending post-retirement, less risk

Active portfolio management-finding undervalued securities, or

passive portfolio management (indexing). Vanguard S&P index

trust and Magellan fund, PIMCO’s bond fund.

Casual empiricism is 110- age = % in equities.

Brokerage house typically put out recommended blends (currently

about 65% stocks, 25% bonds)

US Stocks and Bonds make up about 60% of the world’stotal.

Diversification implies 40% of assets be invested abroad!!

ARE THEY?

SHOULD THEY?

IS FAMILIAR BETTER?

Is your human capital correlated with stocks? Pension plans

of Enron versus Microsoft.

Badrinath, Fin 327, 2013-1 Page 2 of 17

Buy mutual funds ?

Over 80% of mutual funds underperform the market.

Do you know your funds top holdings ?

Do you have control over when profits are taken ?

1.4.2 INDIVIDUALS VERSUS INSTITUTIONS

Funds are usually fully invested, do individuals have to be?

Buy and hold versus more frequent trading (market timing? )

Value (contrarian) vs. growth (momentum).

Individuals care about absolute performance, institutions tend to be

focus on relative performance.

Why pay someone when there are ETF’s? Describe them.

1.6 THE PLAYERS

Investment banks.

Mutual funds and hedge funds ($2.7 trillion now).

Pension funds: defined benefit,401KBanks and Insurance

Companies: Tend to be in high quality fixed assets, bonds,

mortgages and MBS (all mat).

Colleges and foundations

1.6.1 The Macro-environment

Europe out of recession ? US growth slowing? Growth in

emerging markets slowing, market performance weak?

US: Monetary policy: what is happening to interest rates ?

US: Fiscal policy: Tax changes are likely.

Badrinath, Fin 327, 2013-1 Page 3 of 17

State of financial system?

GDP growth of past years 1-2% driven by stimuli (Fed, tax

cuts, deficit spending, housing ATM, not organic.) Most recent

revision was around 1.5%!

Recession or depression? Prospects for economic growth? oil

prices ? employment statistics, wage growth (not good).

Implications of housing markets ? Are consumers tapped out?

Is business picking up the slack?

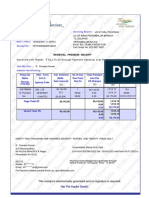

1.6.2 RECENT MARKET INDEX HISTORY (also See 5.3, 122-127)

S&P 500 Annual r NDX-100 Annual r

Dec-12

Dec-11 1261.12 0.3% 2277.83 2.7%

Dec-10 1257.75 12.8% 2217.86 19.3%

Dec-09 1115.10 23.5% 1860.30 53.5%

Dec-08 903.25 -38.5% 1211.65 -41.9%

Dec-07 1468.36 3.5% 2084.93 18.7%

Dec-06 1418.30 13.6% 1756.90 6.8%

Dec-05 1248.30 3.0% 1645.20 1.5%

Dec-04 1211.90 9.0% 1621.10 11.2%

Dec-03 1111.92 26.4% 1457.92 48.1%

Dec-02 879.82 -23.4% 984.37 -37.6%

Dec-01 1148.08 -13.0% 1577.10 -32.7%

Dec-00 1320.28 -10.1% 2341.70 -36.8%

Dec-99 1469.25 19.5% 3707.83 102.0%

Dec-98 1229.23 26.7% 1836.01 85.3%

Dec-97 970.43 31.0% 990.83 20.6%

Dec-96 740.74 20.3% 821.36 42.5%

Badrinath, Fin 327, 2013-1 Page 4 of 17

Dec-95 615.93 576.23

See long-term charts on website/Bloomberg.

1.6.2 Financial Analysts: (sell side and buy side)

a) issue research reports and recommendations (First Call). Assess

financial reports, statements, management teams, strength of

customer relationships, product markets. Used to be strong buy,

buy, hold, sell, strong sell. Now different gradations. Majority of

past recommendations were hold or above. Now a few more sells.

b) generate orders for sales force

c) guide institutional clients

d) listen to pitches from investor relations

Tend to have expertise in the industry, work experience, technical

knowledge, access to industry insiders.

Quality of analysis, conflicts with investment banking.

SEC and Regulation Fair Disclosure (is quality of info better?)

Companies cannot disclose earnings info selectively.

What if companies stop talking? Can make the case that it the

latter has actually made markets less efficient.Will it make an

analysts job easier or not?

How many companies are followed by analysts. Only 35% of 9000

listed companies have at least one analyst. The rest are not

followed.

How many analysts follow a company? GE has 15, Intel has

33, Cognos (that makes business intelligence software) has 36.

How do analysts pick companies to follow? Appears to be trading

volume and market cap.

Are analyst recommendations useful to investors?

Badrinath, Fin 327, 2013-1 Page 5 of 17

Big upgrades or downgrades affect prices short term (1-2 days)

New initiations affect prices longer term – 30 days

New initiations by major firms do not affect prices !!!

Monday announcements are rare, but upgrades impact prices

Badrinath, Fin 327, 2013-1 Page 6 of 17

CHAPTER 5: RATES OF RETURN (REVIEW AND MORE)

(REFER TO SECTION 5.1)

a) Single period (year)

0 1

100 120

HPR = (120-100)/100 = 20% (Tie to PV/FV)

0 1

b) with div.

100 120

Div 5

(End Price – Beg. Price + Cash Flow)

HPR = ---------------------------------------------

Beg. Price

HPR = (120 –100 + 5)/100 = 25%

= 20% (cap gain) + 5% (div yield)

Cash flow of dividends for stocks, and coupons for bonds.

c) APR (annualized percentage return) and EAR (effective annual rate)

APR = per period rate * periods/yr.

Say a T-bill pays $10,000 at maturity in 1 months. Its current price

is $9900.

HPR = (10000-9900)/9900 = 1.01%

APR = 1.01 * 12(months) = 12.12%

EAR = (1.01)12 – 1 = 12.82%

Badrinath, Fin 327, 2013-1 Page 7 of 17

d) MULTIPLE PERIODS (YEARS)

0 1 2

100 * (1+ X)2 = 121

X = 10% per year

0 1 2

100 108 121

8% 12.04%

Total Return = 21% for 2-periods (years)

e) TO AVERAGE 8% and 12.04% RETURNS ABOVE? (P 111)

Arithmetic Average = (8 + 12.04)/2 = 10%

Geometric Average = [(1.08) (1.1204)] (1/2) – 1] = 10%

When averaging returns over time, use Geometric.

0 1 2

100 50 100

-50% +100%

Arith. Avg = 25%

Geom Avg = 0% (which is correct).

PV/FV calculations implicitly use the geometric average.

f) DOLLAR WEIGHTED-RETURNS (Page 112)

When different amounts are being managed/invested, for different

periods of time, then this is just the INTERNAL RATE OF

RETURN (IRR).

Badrinath, Fin 327, 2013-1 Page 8 of 17

PRE-TAX & AFTER-TAX RETURNS

Assume a tax rate of 30%.

10% 1 10% 2

100 * ( 1.10) = 110 121

- tax = -3

After-tax = 107*(1.10) = 117.70

- tax = 3.21

After-tax = 114.49

Together

100 * (1.07 ) = 107 * (1.07) = 114.49

or 10 % pre-tax 10 * (1-tax rate) 7% after tax.

NOTE: Assumption implicit in this calculation is that taxes are paid as

you go, i.e, that gains are realized and taxed each year. With mutual

funds, the amount to be taxed is determined by the fund at distribution

time. For individuals, this may not be appropriate if you are holding

stocks long-term.

FULLY EQUIVALENT TAXABLE YIELD (FETY)

A CA bond has a yield of 6%, exempt from both federal

taxes (@30%) and state taxes @10%.

To compare this with a corporate bond on which both federal

and state taxes apply, calculate FETY as:

6%/(1-0.4) = 10%

Badrinath, Fin 327, 2013-1 Page 9 of 17

TAX LOSS CARRY FORWARDS

Individuals can carry losses forward beyond the $3000 deduction from

ordinary income. In addition, firms can also carry it back for 3-years

back.

TAX-LOSS SELLING

To sell a losing position in order to realize a loss for tax purposes. If you

like the security, you can always buy it back (wait 30 days, else IRS

decrees it a “wash” sale and the deduction is disallowed.

Chapter 5.4 NOMINAL AND REAL RATES OF RETURN

0 r = 9%(nominal) 1

|

100 nominal grows at 9% to 109

Cost of

“basket” =100 (with 7% inflation) = 107.

At time 1, the $109 purchases 109/107 = 1.0187 “baskets.” So in

terms of purchasing power, the 9% return translates into 1.87%

more “baskets” with 7% inflation.

1 + nominal rate

Or, real rate of return = ------------------------ - 1

1 + inflation rate

= (1 .09)/1.07) – 1 = 0.0187 or 1.87%

Common approximation:

Real rate = Nominal rate – Inflation rate

Badrinath, Fin 327, 2013-1 Page 10 of 17

TO INVESTORS, THE REAL, AFTER-TAX RATE OF RETURN

IS THE ONE TO CONSIDER.

Key issue pertaining to measuring inflation is components of the

Consumer Price Index (CPI). Now about 1-2% per year, different

estimates, periodically revised.

TIPS (Treasury Inflation-Protection Securities). (Also Pg 32).

Structured so that face value adjusts with the CPI and the coupon is a

fixed percentage of that “changing amount.” So as inflation increases,

you get a higher dollar periodic payment. Principal is protected from

declines, so it stays constant in a deflationary state.

YIELDS

T-bills sell at a discount from face value. A $10,000 face value bill may

be selling at $9,600 with maturity in 182 days (half-year). Or at a

discount of $400.

a) The effective 182-day return is 400/9600 = 4.17%

b) simple interest => an annual rate of 8.34% (bond equivalent yield)

c) With compound interest => an annual rate of (1.0417)2 –1=8.51%

BILLS ARE OFTEN QUOTED IN THE FINANCIAL PAGES AS

CARRYING A BANK DISCOUNT YIELD OF 7.91%

The $400 discount is annualized as 400 * 360/182 = 791.21

The yield is 791.21/10000 = 7.912%

THERE ARE THREE PROBLEMS WITH THIS.

(i) Annualized over 360 day year (bank calendar?).

(ii) Annualizing assumes simple, not compound interest.

(iii) Rate is calculated on face value not purchase price.

Badrinath, Fin 327, 2013-1 Page 11 of 17

IRA versus NON-IRA Returns (Not in Ch 5 but useful anyway)

Purpose is to illustrate time-value calculations. There are lots of

wrinkles and variations, Roths, Education IRAs and the like. Rules for

the tax-free amounts investable depend on income. For details, check out

any personal finance website.

Assume you have a single sum of $ 2000 to invest

Invest at 12% per year for 25 years until retirement

Tax rate is 30% now, 15% after 25 years

Under IRA: Principal and income are both taxed at retirement.

FV = 2000 * (1.12)25 = 34,000

Less: Tax = -5,100

After-tax value = 28,900

Outside the IRA: Both principal and income taxed each year.

FV = [2000 * (1-0.3)] * [1+ 0.12*(1-0.3)]25

= 1400 * (1+0.084)25 = 10516.23 (After-tax)

Q: What rate of return should be earned outside the IRA to make

the two after-tax values comparable?

1400 * (1+X)25 = 28,900, X = 12.87% after-tax

This implies 12.87/(1-0.3) = 18.39% pre-tax returns.

To be comparable to an IRA, an investment outside it should

earn 18.39% (as opposed to 12%)

Q: What type of investment vehicles should be in an IRA?

Stocks, bonds, municipal bonds?

A: Bonds throw off taxable income semi-annually.

Stocks have tax implications only if gains are realized.

Badrinath, Fin 327, 2013-1 Page 12 of 17

A SIMPLE RETIREMENT SCENARIO

30 WORK (r = 10%) 65 RETIRE (r=6%) 85

INCOME = $50,000/yr CONSUME=$40,000/yr

Q: How much to save each year ? Say S.

S * FV(ann) (35yrs, 10%) = 458797 = 40000 * PV(ann) (20yrs, 6%)

S = 1693/yr or 1693/50000 = 3.3% of income!

Q: TOO LITTLE?

Q: SAY, inflation is 3% per year over the next 55 years.

What does $40,000 in year 85 buy?

[40000 / {(1.03)55 }]= 7870 of things in today’s dollars.

Note that $40,000 is nominal and $7870 are REAL (or inflation-

adjusted) dollars.

ISSUES:

a) Life expectancy

b) Inflation Adjustment

c) Redo in real terms?

d) Other Savings

e) Fidelity/Vanguard Software, moneycentral.com,

quicken.com, Torrid-tech.com, esplanner.com,

wealthwhen.com

Badrinath, Fin 327, 2013-1 Page 13 of 17

Chapter 5.2: EXPECTED RETURNS = sum of (probabilities &

possible returns)

Prob. Possible Return (over next year)

0.5 50%

0.3 10%

0.4 –20%

Exp. Return = 0.5 * 50% + 0.3 * 10% + 0.2 * -20% = 24%

Standard deviation = 28%, link to Normal Distribution

RISK

Business Risk

Financial Risk

Exchange rate/Country risks

Systematic and unsystematic risks

RISK AND EXPECTED RETURN

STANDARD MODEL (CAPM)

E(return)

SML (CAPM)

Risk (beta)

E(Rj) = Rf + [E(Rm)-Rf] * j = 2 + 6 j

Slope of line = 6 reward per unit risk

Intercept of line = risk free rate = 2%

Badrinath, Fin 327, 2013-1 Page 14 of 17

WHERE DOES THIS COME FROM?

Asset Current Expected Beta Risk/reward

Price Return E(R ) [E(R )- Rf]/Beta

A 15 14% 1.5 6.67

B 50 12% 1.0 8.00

Rf 4% 0.0 0

For A, the expected return of 14% from current price levels implies

an expected future price of $17.1

For B, expected return of 12% => expected future price of $56

Case(i): Suppose B is priced correctly with a risk-reward of 8.

=> A is priced incorrectly. Investors will buy B, those owning A

will sell it and move to B until A’s risk-reward is same as B.

=> A’s price will fall and its expected return will rise.

=> For A therefore, [E(R ) – 4]/1.5 = 8, E(R ) = 16% (increases)

=> New Price (1.16) = 17.1, New Price for A = 14.74

Case (ii): Suppose instead that A is priced correctly. Then B is

undervalued and its price will increase to 50.601, its expected

return will drop to 10.67% and its risk-reward ratio will be 6.67.

Confirm it!

Often, both can happen especially if the market risk-reward is 7

(say). The example illustrates a process of how assets get priced

and repriced in markets.

Badrinath, Fin 327, 2013-1 Page 15 of 17

The message is that prices will (should) move this way to

equate risk/reward ratios across all assets. Or, prices should be

set so that the risk/reward ratio for all assets are equal.

Here the risk-reward ratio has a specific form and using it,

[E(Rj) – Rf]/j = [E(Rm) – Rf]/1.0 = 8, Rearranging:

E(Rj) = Rf + j [E(Rm) – Rf] or the CAPM.

In life, the risk-reward is probably more complicated than that

assumed for the CAPM and other models for valuing assets exist.

ISSUES: a) How is beta estimated? Is the slope from a regression

of returns to stock on returns to broad market index. Available

from multiple published sources and beta books.

b) What about a stock that plots above the CAPM line (actual

returns end up higher than expected => price was lower than

expected => undervalued => positive alpha).

c) Assumes that only market factor (index) matters and that other

risks are priced away. How good is such a model?

d) What does it mean to outperform the market?

Money managers think in terms of beating the S&P 500 (is this

risk-adjusted ? shouldn’t it be? )

e) Do higher risks imply higher expected returns

Do they? Over what time period? Only in January?

Is the relationship linear?

f) Think it terms of risk-premiums [E(Rj) – Rf]

What is an appropriate level for the market nowadays?

Badrinath, Fin 327, 2013-1 Page 16 of 17

FROM A PRACTICAL PERSPECTIVE, A VERSION OF THE 2nd

TERM IN THE CAPM is called the Sharpe ratio, as

= [E(Rj) – Rf ] / σj where j is any asset or portfolio and is used

(and much abused) as a reward-to-variability ratio.

IGNORE SECTIONS 5.5 and 5.6 FOR NOW.

Badrinath, Fin 327, 2013-1 Page 17 of 17

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Bayport Loan Schedule 2023Document2 pagesBayport Loan Schedule 2023mwalepersues50% (8)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Johnson Matthey Syngas Methanol Plant Capacity FinalDocument14 pagesJohnson Matthey Syngas Methanol Plant Capacity FinalRaquel Siñani ChavezNo ratings yet

- A Critique of The Social Security System Using Robert Nozick's Ideas of The Minimal State and Justice As EntitlementDocument64 pagesA Critique of The Social Security System Using Robert Nozick's Ideas of The Minimal State and Justice As EntitlementJj CastroNo ratings yet

- Proof of Cash MQM ComDocument5 pagesProof of Cash MQM ComCJ alandyNo ratings yet

- Carol Moerdyk Owner of Carol S Fashion Designs Inc Is PlanningDocument2 pagesCarol Moerdyk Owner of Carol S Fashion Designs Inc Is PlanningAmit PandeyNo ratings yet

- LIC ProofDocument1 pageLIC ProofkhumarpraveenNo ratings yet

- Chapter 11 Foreign ExchangeDocument17 pagesChapter 11 Foreign Exchangebuzov_dNo ratings yet

- CH 06Document40 pagesCH 06lalala010899No ratings yet

- Money MarketDocument8 pagesMoney MarketMAMTA WAGHNo ratings yet

- Bloomberg Businessweek Europe - April 23 2018Document76 pagesBloomberg Businessweek Europe - April 23 2018Anh ThànhNo ratings yet

- PEMBINAAN PURCON V ENTERTAINMENT VILLAGE (M)Document14 pagesPEMBINAAN PURCON V ENTERTAINMENT VILLAGE (M)Don NazarNo ratings yet

- La Logistique Verte, Par Dr. Said KAMMASDocument35 pagesLa Logistique Verte, Par Dr. Said KAMMASSaid KammasNo ratings yet

- Purchase Order 00005Document1 pagePurchase Order 00005Ginson Precast ConstructionNo ratings yet

- Business Today August 13 2017Document127 pagesBusiness Today August 13 2017nczadriennNo ratings yet

- NRI BankingDocument33 pagesNRI BankingKrinal Shah0% (1)

- Theories of DevelopmentDocument5 pagesTheories of DevelopmentJahedHossain100% (1)

- Fund Size TER (Inm ) in % P.ADocument69 pagesFund Size TER (Inm ) in % P.ASam UkiyoNo ratings yet

- Original For Buyer: Email Id-Corporatecare@timesinternet - inDocument1 pageOriginal For Buyer: Email Id-Corporatecare@timesinternet - inANKUR SARKARNo ratings yet

- Kirloskar Up Upl Uph UptDocument16 pagesKirloskar Up Upl Uph Uptedward baskaraNo ratings yet

- Philippine Banking Corporation vs. Lui SheDocument9 pagesPhilippine Banking Corporation vs. Lui SheAmanda ButtkissNo ratings yet

- BCK (Chapter 5)Document60 pagesBCK (Chapter 5)Isha BavdechaNo ratings yet

- Boston Matrix and Product Portfolios BCG MatrixDocument4 pagesBoston Matrix and Product Portfolios BCG MatrixColin Anderson100% (1)

- Management Case Analysis: The Coimbatore Bypass Road ProjectDocument11 pagesManagement Case Analysis: The Coimbatore Bypass Road ProjectSunny SanguineNo ratings yet

- Corrected Answer Set 2Document4 pagesCorrected Answer Set 2xamzaNo ratings yet

- GE-3 Activity 3 MIDTERMDocument2 pagesGE-3 Activity 3 MIDTERMArn Dela CruzNo ratings yet

- Stockholders of F. Guanzon vs. Register of DeedsDocument1 pageStockholders of F. Guanzon vs. Register of DeedsEdz Votefornoymar Del RosarioNo ratings yet

- Chapter 5-Dayag-TheorisDocument1 pageChapter 5-Dayag-TheorisMazikeen DeckerNo ratings yet

- Od327418991622128100 PDFDocument3 pagesOd327418991622128100 PDFSunny SundareNo ratings yet

- Althusser (Summary)Document1 pageAlthusser (Summary)Miriam MGNo ratings yet

- FSC Lobster Fisheries Management Plan FinalDocument7 pagesFSC Lobster Fisheries Management Plan FinalSipekne'katikNo ratings yet