Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

5 viewsCost of Debt Yield To Maturity X (1 - Tax Rate) Cost of Debt 12% X (1 - 0.35) Cost of Debt 7.80%

Cost of Debt Yield To Maturity X (1 - Tax Rate) Cost of Debt 12% X (1 - 0.35) Cost of Debt 7.80%

Uploaded by

Drey MartinezThe Heuser Company currently has outstanding bonds with a 10% coupon and 12% yield to maturity. If it issued new bonds at par that provided a similar 12% yield, its after-tax cost of debt would be 7.8% given its 35% marginal tax rate. This is calculated by taking the yield to maturity and multiplying it by 1 minus the tax rate.

Tunney Industries can issue perpetual preferred stock at $47.50 per share. The document provides the formula to calculate the after-tax cost of debt but does not show the calculation for the cost of preferred stock.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Cheatsheet MTDocument3 pagesCheatsheet MT01dynamic0% (1)

- Chapter 12 HW SolutionDocument5 pagesChapter 12 HW SolutionZarifah Fasihah67% (3)

- Solution Manual CH 12 Multinational Financial ManagementDocument1 pageSolution Manual CH 12 Multinational Financial Managementariftanur0% (1)

- Mini Case - Chapter 10Document6 pagesMini Case - Chapter 10mfitani75% (4)

- Chapter 20Document24 pagesChapter 20Huzefa ShabbirNo ratings yet

- Davidson Corporationcost of Equity With and Without FlotationDocument6 pagesDavidson Corporationcost of Equity With and Without FlotationMashaal FasihNo ratings yet

- Bonus Assignment 1Document4 pagesBonus Assignment 1Zain Zulfiqar100% (2)

- Tutorial 8Document4 pagesTutorial 8dinhhoaithu22112004No ratings yet

- Quiz 9Document3 pagesQuiz 9朱潇妤100% (1)

- Selected Tutorial Solutions - Week 8Document4 pagesSelected Tutorial Solutions - Week 8qhayyumNo ratings yet

- Topic: Government Bonds: Not To Be Copied or Distributed in Any WayDocument28 pagesTopic: Government Bonds: Not To Be Copied or Distributed in Any WayL SNo ratings yet

- Cost of Capital (Updated)Document21 pagesCost of Capital (Updated)Asmaa AlsabaaNo ratings yet

- 2.1 Cost of CapitalDocument47 pages2.1 Cost of CapitalScotty ScottNo ratings yet

- Overview of The Cost of CapitalDocument43 pagesOverview of The Cost of Capitalnavier funtabulousNo ratings yet

- Cost of CapitalDocument23 pagesCost of CapitalAsad AliNo ratings yet

- Cost CapitalDocument28 pagesCost Capitalaliashour123No ratings yet

- Outcome. 5 and 6Document3 pagesOutcome. 5 and 6Sohel MemonNo ratings yet

- Tutorial 8 Cost of CapitalDocument3 pagesTutorial 8 Cost of CapitalHiền NguyễnNo ratings yet

- Cost of CapitalDocument25 pagesCost of Capital190189No ratings yet

- The Cost of Capital: All Rights ReservedDocument29 pagesThe Cost of Capital: All Rights ReservedsadNo ratings yet

- Homework 10Document4 pagesHomework 10Gia Hân TrầnNo ratings yet

- Financial Management - Cost of CapitalDocument23 pagesFinancial Management - Cost of CapitalSoledad Perez33% (3)

- International Financial Fin Man The FINAL WorksDocument5 pagesInternational Financial Fin Man The FINAL WorksCBM0% (1)

- Bond Prices and Interest Rates: Example 1: A One-Year BondDocument4 pagesBond Prices and Interest Rates: Example 1: A One-Year BondshailNo ratings yet

- Cost of Capital Reviewer For Financial Management IDocument56 pagesCost of Capital Reviewer For Financial Management Ikimjoonmyeon22No ratings yet

- Cost of Capital 2Document29 pagesCost of Capital 2BSA 1A100% (2)

- Chapter 12 - : Cost of CapitalDocument32 pagesChapter 12 - : Cost of CapitalRobinvarshney100% (1)

- Chapter 13 16Document7 pagesChapter 13 16labonno35No ratings yet

- Cost of Capital Interest Rate at Zero Level Risk + Premium For Business Risk + Premium For Financial RiskDocument6 pagesCost of Capital Interest Rate at Zero Level Risk + Premium For Business Risk + Premium For Financial RiskAjay GuptaNo ratings yet

- Topic 10 Tutorial Solutions v2-1Document4 pagesTopic 10 Tutorial Solutions v2-1Nguyễn Mạnh HùngNo ratings yet

- Cost of Capital ExcercisesDocument3 pagesCost of Capital ExcercisesLinh Ha Nguyen Khanh100% (1)

- PS04 MainDocument8 pagesPS04 MainBenjamin Ford100% (1)

- Main Exam 2014-Sol-1Document7 pagesMain Exam 2014-Sol-1Diego AguirreNo ratings yet

- Miki Niki SolutionCenterDocument4 pagesMiki Niki SolutionCenterteraz2810No ratings yet

- MockExamSolutions 2019 PDFDocument11 pagesMockExamSolutions 2019 PDFkovacsmathieu87No ratings yet

- Cost of Capital PDFDocument34 pagesCost of Capital PDFMera SamirNo ratings yet

- Valuation of Fixed Income Securities Aims and ObjectivesDocument20 pagesValuation of Fixed Income Securities Aims and ObjectivesAyalew Taye100% (2)

- The Cost of Capital: All Rights ReservedDocument35 pagesThe Cost of Capital: All Rights ReservedSajjad RavinNo ratings yet

- Practice Questions - Cost of Capital - 2Document11 pagesPractice Questions - Cost of Capital - 2arun babuNo ratings yet

- Assignment Postmid 1Document3 pagesAssignment Postmid 1abulhassanabbasNo ratings yet

- 2.6. Cost of CapitalDocument34 pages2.6. Cost of Capitalaprilia wahyu perdaniNo ratings yet

- Busn 233 CH 4Document27 pagesBusn 233 CH 4Abreham SolomonNo ratings yet

- Santa Cruz Institute (Marinduque) IncDocument3 pagesSanta Cruz Institute (Marinduque) IncRichard Kate RicohermosoNo ratings yet

- Pset Capital Structure SolDocument6 pagesPset Capital Structure SolDivyesh DixitNo ratings yet

- The Cost of Capital: All Rights ReservedDocument56 pagesThe Cost of Capital: All Rights ReservedANISA RABANIANo ratings yet

- CDO Modelling 1 PostDocument14 pagesCDO Modelling 1 PostddwadawdwadNo ratings yet

- Example:: Online Live Tutor Indifferent Point - Debt, Equity FundingDocument1 pageExample:: Online Live Tutor Indifferent Point - Debt, Equity FundingIvy BaguindocNo ratings yet

- Cost of CapitalDocument28 pagesCost of CapitalSari ika nugrahaNo ratings yet

- Answer On Question #50988, Economics, FinanceDocument2 pagesAnswer On Question #50988, Economics, FinanceFatima ZehraNo ratings yet

- Lecture 20Document5 pagesLecture 20laxmikushwah7272No ratings yet

- Hybrid Financing:: Preferred Stock, Leasing, Warrants, and ConvertiblesDocument36 pagesHybrid Financing:: Preferred Stock, Leasing, Warrants, and ConvertiblesAhsanNo ratings yet

- Cost of CapitalFM 1.1Document54 pagesCost of CapitalFM 1.1KALAI ARASANNo ratings yet

- Financial ManagementDocument6 pagesFinancial ManagementRon BoostNo ratings yet

- Group 6 - Business Finance Boy BandDocument27 pagesGroup 6 - Business Finance Boy Bandace mabutiNo ratings yet

- Quantitative Problems Chapter 10Document5 pagesQuantitative Problems Chapter 10Nurainey Maraya100% (1)

- 6 Cost of CapitalDocument19 pages6 Cost of Capitaladib nassarNo ratings yet

- CH-4 Cost of CapitalDocument18 pagesCH-4 Cost of CapitalRahul KukrejaNo ratings yet

- 1 Assignment-7Document8 pages1 Assignment-7Mar'atul IslamiyahNo ratings yet

- Point of IndifferenceDocument3 pagesPoint of IndifferenceSandhyaNo ratings yet

- Scheduling/ Registration Financial Counseling: Hahahahaha Nice Naksss Adult Well How Can Sge KK ByeDocument1 pageScheduling/ Registration Financial Counseling: Hahahahaha Nice Naksss Adult Well How Can Sge KK ByeDrey MartinezNo ratings yet

- Odysseus JourneyDocument8 pagesOdysseus JourneyDrey MartinezNo ratings yet

- Odysseus JourneyDocument8 pagesOdysseus JourneyDrey MartinezNo ratings yet

- Scheduling/ Registration Financial Counseling: Hahahahaha NiceDocument1 pageScheduling/ Registration Financial Counseling: Hahahahaha NiceDrey MartinezNo ratings yet

- Law Exam PaperDocument14 pagesLaw Exam PaperDrey MartinezNo ratings yet

- Revenue Cycle: Scheduling/ RegistrationDocument2 pagesRevenue Cycle: Scheduling/ RegistrationDrey MartinezNo ratings yet

- Scheduling/ Registration Financial Counseling: Hahahahaha Nice Naksss AdultDocument1 pageScheduling/ Registration Financial Counseling: Hahahahaha Nice Naksss AdultDrey MartinezNo ratings yet

- Scheduling/ Registration Financial Counseling: Hahahahaha Nice Naksss Adult Well How Can SgeDocument1 pageScheduling/ Registration Financial Counseling: Hahahahaha Nice Naksss Adult Well How Can SgeDrey MartinezNo ratings yet

- Scheduling/ Registration Financial Counseling: Hahahahaha Nice NaksssDocument1 pageScheduling/ Registration Financial Counseling: Hahahahaha Nice NaksssDrey MartinezNo ratings yet

- Cost of Debt Yield To Maturity X (1 - Tax Rate) Cost of Debt 12% X (1 - 0.35) Cost of Debt 7.80%Document1 pageCost of Debt Yield To Maturity X (1 - Tax Rate) Cost of Debt 12% X (1 - 0.35) Cost of Debt 7.80%Drey MartinezNo ratings yet

- Scheduling/ Registration Financial Counseling: AppealsDocument1 pageScheduling/ Registration Financial Counseling: AppealsDrey MartinezNo ratings yet

- Scheduling/ Registration Financial Counseling: AppealsDocument1 pageScheduling/ Registration Financial Counseling: AppealsDrey MartinezNo ratings yet

- Revenue Cycle: Scheduling/ Registration Financial CounselingDocument2 pagesRevenue Cycle: Scheduling/ Registration Financial CounselingDrey MartinezNo ratings yet

- FlowchartDocument1 pageFlowchartDrey MartinezNo ratings yet

- AisDocument1 pageAisDrey MartinezNo ratings yet

- Slow Processing of Orders Low Quality of ProductsDocument2 pagesSlow Processing of Orders Low Quality of ProductsDrey MartinezNo ratings yet

- CDR KingDocument2 pagesCDR KingDrey MartinezNo ratings yet

Cost of Debt Yield To Maturity X (1 - Tax Rate) Cost of Debt 12% X (1 - 0.35) Cost of Debt 7.80%

Cost of Debt Yield To Maturity X (1 - Tax Rate) Cost of Debt 12% X (1 - 0.35) Cost of Debt 7.80%

Uploaded by

Drey Martinez0 ratings0% found this document useful (0 votes)

5 views1 pageThe Heuser Company currently has outstanding bonds with a 10% coupon and 12% yield to maturity. If it issued new bonds at par that provided a similar 12% yield, its after-tax cost of debt would be 7.8% given its 35% marginal tax rate. This is calculated by taking the yield to maturity and multiplying it by 1 minus the tax rate.

Tunney Industries can issue perpetual preferred stock at $47.50 per share. The document provides the formula to calculate the after-tax cost of debt but does not show the calculation for the cost of preferred stock.

Original Description:

before after

Original Title

After

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Heuser Company currently has outstanding bonds with a 10% coupon and 12% yield to maturity. If it issued new bonds at par that provided a similar 12% yield, its after-tax cost of debt would be 7.8% given its 35% marginal tax rate. This is calculated by taking the yield to maturity and multiplying it by 1 minus the tax rate.

Tunney Industries can issue perpetual preferred stock at $47.50 per share. The document provides the formula to calculate the after-tax cost of debt but does not show the calculation for the cost of preferred stock.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

5 views1 pageCost of Debt Yield To Maturity X (1 - Tax Rate) Cost of Debt 12% X (1 - 0.35) Cost of Debt 7.80%

Cost of Debt Yield To Maturity X (1 - Tax Rate) Cost of Debt 12% X (1 - 0.35) Cost of Debt 7.80%

Uploaded by

Drey MartinezThe Heuser Company currently has outstanding bonds with a 10% coupon and 12% yield to maturity. If it issued new bonds at par that provided a similar 12% yield, its after-tax cost of debt would be 7.8% given its 35% marginal tax rate. This is calculated by taking the yield to maturity and multiplying it by 1 minus the tax rate.

Tunney Industries can issue perpetual preferred stock at $47.50 per share. The document provides the formula to calculate the after-tax cost of debt but does not show the calculation for the cost of preferred stock.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

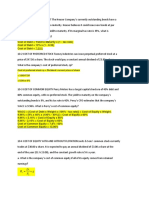

1 AFTER-TAX COST OF DEBT The Heuser Company’s currently outstanding bonds have a

10% coupon and a 12% yield to maturity. Heuser believes it could issue new bonds at par

that would provide a similar yield to maturity. If its marginal tax rate is 35%, what is

Heuser’s after-tax cost of debt?

Cost of Debt = Yield to Maturity x (1 - tax rate)

Cost of Debt = 12% x (1 - 0.35)

Cost of Debt = 7.80%

10-2 COST OF PREFERRED STOCK Tunney Industries can issue perpetual preferred stock at a

price of $47.50 a share. The stock would

cost pf capital

You might also like

- Cheatsheet MTDocument3 pagesCheatsheet MT01dynamic0% (1)

- Chapter 12 HW SolutionDocument5 pagesChapter 12 HW SolutionZarifah Fasihah67% (3)

- Solution Manual CH 12 Multinational Financial ManagementDocument1 pageSolution Manual CH 12 Multinational Financial Managementariftanur0% (1)

- Mini Case - Chapter 10Document6 pagesMini Case - Chapter 10mfitani75% (4)

- Chapter 20Document24 pagesChapter 20Huzefa ShabbirNo ratings yet

- Davidson Corporationcost of Equity With and Without FlotationDocument6 pagesDavidson Corporationcost of Equity With and Without FlotationMashaal FasihNo ratings yet

- Bonus Assignment 1Document4 pagesBonus Assignment 1Zain Zulfiqar100% (2)

- Tutorial 8Document4 pagesTutorial 8dinhhoaithu22112004No ratings yet

- Quiz 9Document3 pagesQuiz 9朱潇妤100% (1)

- Selected Tutorial Solutions - Week 8Document4 pagesSelected Tutorial Solutions - Week 8qhayyumNo ratings yet

- Topic: Government Bonds: Not To Be Copied or Distributed in Any WayDocument28 pagesTopic: Government Bonds: Not To Be Copied or Distributed in Any WayL SNo ratings yet

- Cost of Capital (Updated)Document21 pagesCost of Capital (Updated)Asmaa AlsabaaNo ratings yet

- 2.1 Cost of CapitalDocument47 pages2.1 Cost of CapitalScotty ScottNo ratings yet

- Overview of The Cost of CapitalDocument43 pagesOverview of The Cost of Capitalnavier funtabulousNo ratings yet

- Cost of CapitalDocument23 pagesCost of CapitalAsad AliNo ratings yet

- Cost CapitalDocument28 pagesCost Capitalaliashour123No ratings yet

- Outcome. 5 and 6Document3 pagesOutcome. 5 and 6Sohel MemonNo ratings yet

- Tutorial 8 Cost of CapitalDocument3 pagesTutorial 8 Cost of CapitalHiền NguyễnNo ratings yet

- Cost of CapitalDocument25 pagesCost of Capital190189No ratings yet

- The Cost of Capital: All Rights ReservedDocument29 pagesThe Cost of Capital: All Rights ReservedsadNo ratings yet

- Homework 10Document4 pagesHomework 10Gia Hân TrầnNo ratings yet

- Financial Management - Cost of CapitalDocument23 pagesFinancial Management - Cost of CapitalSoledad Perez33% (3)

- International Financial Fin Man The FINAL WorksDocument5 pagesInternational Financial Fin Man The FINAL WorksCBM0% (1)

- Bond Prices and Interest Rates: Example 1: A One-Year BondDocument4 pagesBond Prices and Interest Rates: Example 1: A One-Year BondshailNo ratings yet

- Cost of Capital Reviewer For Financial Management IDocument56 pagesCost of Capital Reviewer For Financial Management Ikimjoonmyeon22No ratings yet

- Cost of Capital 2Document29 pagesCost of Capital 2BSA 1A100% (2)

- Chapter 12 - : Cost of CapitalDocument32 pagesChapter 12 - : Cost of CapitalRobinvarshney100% (1)

- Chapter 13 16Document7 pagesChapter 13 16labonno35No ratings yet

- Cost of Capital Interest Rate at Zero Level Risk + Premium For Business Risk + Premium For Financial RiskDocument6 pagesCost of Capital Interest Rate at Zero Level Risk + Premium For Business Risk + Premium For Financial RiskAjay GuptaNo ratings yet

- Topic 10 Tutorial Solutions v2-1Document4 pagesTopic 10 Tutorial Solutions v2-1Nguyễn Mạnh HùngNo ratings yet

- Cost of Capital ExcercisesDocument3 pagesCost of Capital ExcercisesLinh Ha Nguyen Khanh100% (1)

- PS04 MainDocument8 pagesPS04 MainBenjamin Ford100% (1)

- Main Exam 2014-Sol-1Document7 pagesMain Exam 2014-Sol-1Diego AguirreNo ratings yet

- Miki Niki SolutionCenterDocument4 pagesMiki Niki SolutionCenterteraz2810No ratings yet

- MockExamSolutions 2019 PDFDocument11 pagesMockExamSolutions 2019 PDFkovacsmathieu87No ratings yet

- Cost of Capital PDFDocument34 pagesCost of Capital PDFMera SamirNo ratings yet

- Valuation of Fixed Income Securities Aims and ObjectivesDocument20 pagesValuation of Fixed Income Securities Aims and ObjectivesAyalew Taye100% (2)

- The Cost of Capital: All Rights ReservedDocument35 pagesThe Cost of Capital: All Rights ReservedSajjad RavinNo ratings yet

- Practice Questions - Cost of Capital - 2Document11 pagesPractice Questions - Cost of Capital - 2arun babuNo ratings yet

- Assignment Postmid 1Document3 pagesAssignment Postmid 1abulhassanabbasNo ratings yet

- 2.6. Cost of CapitalDocument34 pages2.6. Cost of Capitalaprilia wahyu perdaniNo ratings yet

- Busn 233 CH 4Document27 pagesBusn 233 CH 4Abreham SolomonNo ratings yet

- Santa Cruz Institute (Marinduque) IncDocument3 pagesSanta Cruz Institute (Marinduque) IncRichard Kate RicohermosoNo ratings yet

- Pset Capital Structure SolDocument6 pagesPset Capital Structure SolDivyesh DixitNo ratings yet

- The Cost of Capital: All Rights ReservedDocument56 pagesThe Cost of Capital: All Rights ReservedANISA RABANIANo ratings yet

- CDO Modelling 1 PostDocument14 pagesCDO Modelling 1 PostddwadawdwadNo ratings yet

- Example:: Online Live Tutor Indifferent Point - Debt, Equity FundingDocument1 pageExample:: Online Live Tutor Indifferent Point - Debt, Equity FundingIvy BaguindocNo ratings yet

- Cost of CapitalDocument28 pagesCost of CapitalSari ika nugrahaNo ratings yet

- Answer On Question #50988, Economics, FinanceDocument2 pagesAnswer On Question #50988, Economics, FinanceFatima ZehraNo ratings yet

- Lecture 20Document5 pagesLecture 20laxmikushwah7272No ratings yet

- Hybrid Financing:: Preferred Stock, Leasing, Warrants, and ConvertiblesDocument36 pagesHybrid Financing:: Preferred Stock, Leasing, Warrants, and ConvertiblesAhsanNo ratings yet

- Cost of CapitalFM 1.1Document54 pagesCost of CapitalFM 1.1KALAI ARASANNo ratings yet

- Financial ManagementDocument6 pagesFinancial ManagementRon BoostNo ratings yet

- Group 6 - Business Finance Boy BandDocument27 pagesGroup 6 - Business Finance Boy Bandace mabutiNo ratings yet

- Quantitative Problems Chapter 10Document5 pagesQuantitative Problems Chapter 10Nurainey Maraya100% (1)

- 6 Cost of CapitalDocument19 pages6 Cost of Capitaladib nassarNo ratings yet

- CH-4 Cost of CapitalDocument18 pagesCH-4 Cost of CapitalRahul KukrejaNo ratings yet

- 1 Assignment-7Document8 pages1 Assignment-7Mar'atul IslamiyahNo ratings yet

- Point of IndifferenceDocument3 pagesPoint of IndifferenceSandhyaNo ratings yet

- Scheduling/ Registration Financial Counseling: Hahahahaha Nice Naksss Adult Well How Can Sge KK ByeDocument1 pageScheduling/ Registration Financial Counseling: Hahahahaha Nice Naksss Adult Well How Can Sge KK ByeDrey MartinezNo ratings yet

- Odysseus JourneyDocument8 pagesOdysseus JourneyDrey MartinezNo ratings yet

- Odysseus JourneyDocument8 pagesOdysseus JourneyDrey MartinezNo ratings yet

- Scheduling/ Registration Financial Counseling: Hahahahaha NiceDocument1 pageScheduling/ Registration Financial Counseling: Hahahahaha NiceDrey MartinezNo ratings yet

- Law Exam PaperDocument14 pagesLaw Exam PaperDrey MartinezNo ratings yet

- Revenue Cycle: Scheduling/ RegistrationDocument2 pagesRevenue Cycle: Scheduling/ RegistrationDrey MartinezNo ratings yet

- Scheduling/ Registration Financial Counseling: Hahahahaha Nice Naksss AdultDocument1 pageScheduling/ Registration Financial Counseling: Hahahahaha Nice Naksss AdultDrey MartinezNo ratings yet

- Scheduling/ Registration Financial Counseling: Hahahahaha Nice Naksss Adult Well How Can SgeDocument1 pageScheduling/ Registration Financial Counseling: Hahahahaha Nice Naksss Adult Well How Can SgeDrey MartinezNo ratings yet

- Scheduling/ Registration Financial Counseling: Hahahahaha Nice NaksssDocument1 pageScheduling/ Registration Financial Counseling: Hahahahaha Nice NaksssDrey MartinezNo ratings yet

- Cost of Debt Yield To Maturity X (1 - Tax Rate) Cost of Debt 12% X (1 - 0.35) Cost of Debt 7.80%Document1 pageCost of Debt Yield To Maturity X (1 - Tax Rate) Cost of Debt 12% X (1 - 0.35) Cost of Debt 7.80%Drey MartinezNo ratings yet

- Scheduling/ Registration Financial Counseling: AppealsDocument1 pageScheduling/ Registration Financial Counseling: AppealsDrey MartinezNo ratings yet

- Scheduling/ Registration Financial Counseling: AppealsDocument1 pageScheduling/ Registration Financial Counseling: AppealsDrey MartinezNo ratings yet

- Revenue Cycle: Scheduling/ Registration Financial CounselingDocument2 pagesRevenue Cycle: Scheduling/ Registration Financial CounselingDrey MartinezNo ratings yet

- FlowchartDocument1 pageFlowchartDrey MartinezNo ratings yet

- AisDocument1 pageAisDrey MartinezNo ratings yet

- Slow Processing of Orders Low Quality of ProductsDocument2 pagesSlow Processing of Orders Low Quality of ProductsDrey MartinezNo ratings yet

- CDR KingDocument2 pagesCDR KingDrey MartinezNo ratings yet