Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

13 viewsDocuments List For GST Registration

Documents List For GST Registration

Uploaded by

Vidya MishraThe document lists the documents required for GST registration for different business entity types: proprietorship (single owner), partnership firm, and private limited company/LLP/OPC. For proprietorships, requirements include the proprietor's PAN card, ID proof, bank details, and business premises documents. Partnership firms must provide similar documents for the firm as well as details for all partners. Private companies/LLPs/OPCs need to submit documents like PAN, bank details, incorporation certificate, director details, and board resolution. All documents should be scanned and emailed to the provided contact for registration assistance.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Application For Registered PV Service ProviderDocument4 pagesApplication For Registered PV Service ProviderLahiru MadurangaNo ratings yet

- Employment Claims without a Lawyer: A Handbook for Litigants in Person, Revised 2nd editionFrom EverandEmployment Claims without a Lawyer: A Handbook for Litigants in Person, Revised 2nd editionNo ratings yet

- Note Brokering for Profit: Your Complete Work At Home Success ManualFrom EverandNote Brokering for Profit: Your Complete Work At Home Success ManualNo ratings yet

- Digging Into The WordPress by CustomizerDocument58 pagesDigging Into The WordPress by CustomizerVidya Mishra100% (1)

- Documents List For GST RegistrationDocument2 pagesDocuments List For GST RegistrationPrakash AryaNo ratings yet

- Ptec Registration Checklist PDFDocument2 pagesPtec Registration Checklist PDFNetaji BhosaleNo ratings yet

- Wanting Doc For Food Licence ManufacturingDocument1 pageWanting Doc For Food Licence ManufacturingPROJECT POINTNo ratings yet

- Documents Required RegistrationDocument8 pagesDocuments Required RegistrationFinance & Health ExpressNo ratings yet

- GST RegistrationDocument2 pagesGST RegistrationCA Prayash SundasNo ratings yet

- Document Required For Sales Tax RegistrationDocument2 pagesDocument Required For Sales Tax RegistrationAlok JhaNo ratings yet

- For Auto Bricks IndustryDocument7 pagesFor Auto Bricks IndustryRana MasudNo ratings yet

- Cif Opg Form ENTITY Full Kyc Annexure 3Document1 pageCif Opg Form ENTITY Full Kyc Annexure 3Vibhu Sharma JoshiNo ratings yet

- 3i Infotech CompanyDocument3 pages3i Infotech Companygiri xdaNo ratings yet

- Vendor Registration FormDocument2 pagesVendor Registration FormRobin Robinson50% (2)

- Check List of Private Limited CompanyDocument3 pagesCheck List of Private Limited Companypaaliwal23No ratings yet

- Requirement For Registration of Tnvat & CSTDocument2 pagesRequirement For Registration of Tnvat & CSTLawrence GeorgeMannanNo ratings yet

- Bhavsar & Patadia: Documents Required For GST RegistrationDocument1 pageBhavsar & Patadia: Documents Required For GST RegistrationLalit MaheshwariNo ratings yet

- Checklist For VAT Registration & FSSAIDocument1 pageChecklist For VAT Registration & FSSAIRaju & AssociatesNo ratings yet

- E-Mudhra AppForm OrganizationDocument4 pagesE-Mudhra AppForm Organizationajaykumar1549No ratings yet

- Format For Docs. CollectedDocument1 pageFormat For Docs. CollectedRathan MatNo ratings yet

- Import Export Code or IE Code Is Required For Every Person or Firm or Company or Entity Engaged in Export Business in IndiaDocument7 pagesImport Export Code or IE Code Is Required For Every Person or Firm or Company or Entity Engaged in Export Business in IndiamanishaNo ratings yet

- 1546 Battula Vijaya Rani PDFDocument8 pages1546 Battula Vijaya Rani PDFSneha AdepuNo ratings yet

- 3-5 Dec, 2022Document34 pages3-5 Dec, 2022Faiq MurtazaNo ratings yet

- Modified Vendor Registration Form PDFDocument3 pagesModified Vendor Registration Form PDFAnonymous cKGCdi100% (1)

- Transaction Details: Product Type Loan Amount/Premium (RS.) Downpayment (RS.) EMI Amount (RS.)Document3 pagesTransaction Details: Product Type Loan Amount/Premium (RS.) Downpayment (RS.) EMI Amount (RS.)Seela VaraprasadNo ratings yet

- TES Lite Registration Requirement AnnouncementDocument1 pageTES Lite Registration Requirement AnnouncementGlenda TaylanNo ratings yet

- Commoditites Account Opening FormDocument22 pagesCommoditites Account Opening Formabdulrehman akhtarNo ratings yet

- RERA Agents Individual Check ListDocument2 pagesRERA Agents Individual Check ListG N Harish Kumar YadavNo ratings yet

- Vendor Registration Form Municipal Corporation of Greater MumbaiDocument3 pagesVendor Registration Form Municipal Corporation of Greater Mumbaiaman3327No ratings yet

- 5pmf0508205pmf121a1c41881bbe494c Fpesig0508205ptplkf8xg4u3jsfDocument11 pages5pmf0508205pmf121a1c41881bbe494c Fpesig0508205ptplkf8xg4u3jsfmanoj mannaiNo ratings yet

- Cherry Application FormDocument1 pageCherry Application FormklynnesstaycationNo ratings yet

- Vendor Registration Form SDFPLDocument3 pagesVendor Registration Form SDFPLpet.shrinksleevesNo ratings yet

- Main Application Form1Document2 pagesMain Application Form1ericsondav245No ratings yet

- Supplier Accreditation Form - CorporationDocument2 pagesSupplier Accreditation Form - CorporationTerence Jhon TabonNo ratings yet

- Vendor Registration FormDocument15 pagesVendor Registration FormJTO-IT Manipur SSANo ratings yet

- Guidelines and Registration Form Local Vendor Post Contract Award Products or Services L2Document5 pagesGuidelines and Registration Form Local Vendor Post Contract Award Products or Services L2anitalee0705No ratings yet

- Must Know For FamiliesDocument14 pagesMust Know For FamiliesAbhikalpKulshresthaNo ratings yet

- Guidelines For RemisiersDocument15 pagesGuidelines For Remisierssantosh.pw4230No ratings yet

- Audio Conferencing Form - Final V2Document2 pagesAudio Conferencing Form - Final V2Mostafizur RahmanNo ratings yet

- INDCOSERVE TEA - Vendors Reg - FormDocument9 pagesINDCOSERVE TEA - Vendors Reg - FormsubragmNo ratings yet

- Web Address Contact No Email-Id BSE NSEDocument16 pagesWeb Address Contact No Email-Id BSE NSENasar KelotNo ratings yet

- E-Mudhra AppForm Individual 070213 PDFDocument1 pageE-Mudhra AppForm Individual 070213 PDFRama PrajapatiNo ratings yet

- New Application (Category e Trade)Document1 pageNew Application (Category e Trade)angelica ponceNo ratings yet

- Section 8 Check ListDocument1 pageSection 8 Check ListG N Harish Kumar YadavNo ratings yet

- Loan DocumentsDocument7 pagesLoan DocumentsRajeev kumar AgarwalNo ratings yet

- Agency Enrollment FormDocument2 pagesAgency Enrollment FormJap KhambholiyaNo ratings yet

- Documents ListDocument1 pageDocuments Listmanoj.sharma110045No ratings yet

- Trading & Depository ApplicationDocument21 pagesTrading & Depository ApplicationMUTHYALA NEERAJANo ratings yet

- Templete For AllDocument18 pagesTemplete For AllCommerce Adda ConsultancyNo ratings yet

- Company Incorporation ChecklistDocument1 pageCompany Incorporation ChecklistRAGHAVNo ratings yet

- Vendor Registration FormDocument3 pagesVendor Registration FormDanish Naeem LambeNo ratings yet

- Application For Certificate of Evidence' Under Section 131 of The Home Building ActDocument2 pagesApplication For Certificate of Evidence' Under Section 131 of The Home Building Actapi-3751980No ratings yet

- UFlex Mandotry KYC LetterDocument7 pagesUFlex Mandotry KYC Letterabhikumarchoudhary85No ratings yet

- SmartPay Application & KYC Form - 2022 v1.1Document7 pagesSmartPay Application & KYC Form - 2022 v1.1STEWARD KIDING ANAK ENTILYNo ratings yet

- Details For Digital Signature CertificateDocument1 pageDetails For Digital Signature Certificatesharma.shireesh264808No ratings yet

- Business Permit ApplicationDocument2 pagesBusiness Permit Applicationtine delos santosNo ratings yet

- Anf 2A: Office Address Is Required in Case of Companies/ Head Office Address Is Required For All Other Categories)Document4 pagesAnf 2A: Office Address Is Required in Case of Companies/ Head Office Address Is Required For All Other Categories)Dalu ChockiNo ratings yet

- 0 - Dealer Application Form NewDocument5 pages0 - Dealer Application Form NewRamesh TagoorNo ratings yet

- KYC FormDocument3 pagesKYC FormAkash BansalNo ratings yet

- Transaction Details: Product Type Loan Amount/Premium (RS.) Downpayment (RS.) EMI Amount (RS.)Document3 pagesTransaction Details: Product Type Loan Amount/Premium (RS.) Downpayment (RS.) EMI Amount (RS.)Mahtab KhanNo ratings yet

- Raghrsha Raghu Raj Sharma: Index of DocumentsDocument17 pagesRaghrsha Raghu Raj Sharma: Index of Documentsshobha sharmaNo ratings yet

- Reading Financial Statement by CFIDocument66 pagesReading Financial Statement by CFIVidya MishraNo ratings yet

- Bentley Installation Guide PDFDocument14 pagesBentley Installation Guide PDFVidya MishraNo ratings yet

- Application For Student MembershipDocument1 pageApplication For Student MembershipVidya MishraNo ratings yet

- Strengthofmateri00smitrich PDFDocument190 pagesStrengthofmateri00smitrich PDFVidya MishraNo ratings yet

Documents List For GST Registration

Documents List For GST Registration

Uploaded by

Vidya Mishra0 ratings0% found this document useful (0 votes)

13 views2 pagesThe document lists the documents required for GST registration for different business entity types: proprietorship (single owner), partnership firm, and private limited company/LLP/OPC. For proprietorships, requirements include the proprietor's PAN card, ID proof, bank details, and business premises documents. Partnership firms must provide similar documents for the firm as well as details for all partners. Private companies/LLPs/OPCs need to submit documents like PAN, bank details, incorporation certificate, director details, and board resolution. All documents should be scanned and emailed to the provided contact for registration assistance.

Original Description:

Read it once

Original Title

GST Procedure

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document lists the documents required for GST registration for different business entity types: proprietorship (single owner), partnership firm, and private limited company/LLP/OPC. For proprietorships, requirements include the proprietor's PAN card, ID proof, bank details, and business premises documents. Partnership firms must provide similar documents for the firm as well as details for all partners. Private companies/LLPs/OPCs need to submit documents like PAN, bank details, incorporation certificate, director details, and board resolution. All documents should be scanned and emailed to the provided contact for registration assistance.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

13 views2 pagesDocuments List For GST Registration

Documents List For GST Registration

Uploaded by

Vidya MishraThe document lists the documents required for GST registration for different business entity types: proprietorship (single owner), partnership firm, and private limited company/LLP/OPC. For proprietorships, requirements include the proprietor's PAN card, ID proof, bank details, and business premises documents. Partnership firms must provide similar documents for the firm as well as details for all partners. Private companies/LLPs/OPCs need to submit documents like PAN, bank details, incorporation certificate, director details, and board resolution. All documents should be scanned and emailed to the provided contact for registration assistance.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

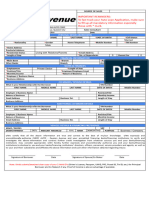

DOCUMENTS LIST FOR GST REGISTRATION

A. PROPRIETORSHIP (SINGLE OWNER)

1. PAN CARD OF PROPRIETOR.

2. AADHAAR CARD(OPTINAL)

3. CANCELLED SAVING ACCOUNT / BANK STATEMENT

OR COMPANY CHEQUE.

4. RENTAL AGREEMENT/ELECTICITY BILL/PROPERTY

TAX OF BUSINESS PREMISES.

5. FIRM NAME, MOB NUMBER AND EMAIL ID/ONE

PHOTO OF PROPRIETOR.

6. PRODUCTS /SERVICES.

B. PARTNERSHIP FIRM

1. PAN CARD OF THE FIRM.

2. CANCELLED CHEQUE/ BANK STATEMENT OF THE

FIRM.

3. PARTNERSHIP DEED.

4. RENTAL AGREEMENT/ELECTRICITY BILL/PROPERTY

TAX OF BUSINESS PREMISES.

5. PAN CARD, PHOTO AND ADDRESS PROOF OF ALL

PARTNERS.

6. ALL PARTNERS’S MOBILE NO AND EMAIL ID.

7. PRODUCTS/SERVICES

C. PVT LTD COMPANY / LLP / OPC

1. PAN CARD OF THE COMPANY.

2. CANCELLED CHEQUE /BANK STATEMENT OF THE

COMPANY.

3. COMPANY INCORPORATION CERTIFICATE.

4. RENTAL AGREEMENT/ELECTRICITY BILL/PROPERTY

TAX OF BUSINESS PREMISES.

5. PAN CARD, PHOTO AND ADDRESS PROOF OF ALL

DIRECTORS.

6. DIN (DIRECTORS IDENTIFICATION NUMBER) OF

DIRECTORS.

7. ALL DIRECTOR’S CONTACT NO, EMAIL ID.

8. BOARD RESOLUTION LETTER.

9. ONE DIRCTOR DIGITAL SIGNATURE.

10. PRODUCTS/SERVICES.

Note:

• SCAN COPY OF ALL DOCUMENTS TO BE SEND TO BELOW

MENTIONED MAIL ID.

www.filingbazaar.com

info@filingbazaar.com

+91-999913234

You might also like

- Application For Registered PV Service ProviderDocument4 pagesApplication For Registered PV Service ProviderLahiru MadurangaNo ratings yet

- Employment Claims without a Lawyer: A Handbook for Litigants in Person, Revised 2nd editionFrom EverandEmployment Claims without a Lawyer: A Handbook for Litigants in Person, Revised 2nd editionNo ratings yet

- Note Brokering for Profit: Your Complete Work At Home Success ManualFrom EverandNote Brokering for Profit: Your Complete Work At Home Success ManualNo ratings yet

- Digging Into The WordPress by CustomizerDocument58 pagesDigging Into The WordPress by CustomizerVidya Mishra100% (1)

- Documents List For GST RegistrationDocument2 pagesDocuments List For GST RegistrationPrakash AryaNo ratings yet

- Ptec Registration Checklist PDFDocument2 pagesPtec Registration Checklist PDFNetaji BhosaleNo ratings yet

- Wanting Doc For Food Licence ManufacturingDocument1 pageWanting Doc For Food Licence ManufacturingPROJECT POINTNo ratings yet

- Documents Required RegistrationDocument8 pagesDocuments Required RegistrationFinance & Health ExpressNo ratings yet

- GST RegistrationDocument2 pagesGST RegistrationCA Prayash SundasNo ratings yet

- Document Required For Sales Tax RegistrationDocument2 pagesDocument Required For Sales Tax RegistrationAlok JhaNo ratings yet

- For Auto Bricks IndustryDocument7 pagesFor Auto Bricks IndustryRana MasudNo ratings yet

- Cif Opg Form ENTITY Full Kyc Annexure 3Document1 pageCif Opg Form ENTITY Full Kyc Annexure 3Vibhu Sharma JoshiNo ratings yet

- 3i Infotech CompanyDocument3 pages3i Infotech Companygiri xdaNo ratings yet

- Vendor Registration FormDocument2 pagesVendor Registration FormRobin Robinson50% (2)

- Check List of Private Limited CompanyDocument3 pagesCheck List of Private Limited Companypaaliwal23No ratings yet

- Requirement For Registration of Tnvat & CSTDocument2 pagesRequirement For Registration of Tnvat & CSTLawrence GeorgeMannanNo ratings yet

- Bhavsar & Patadia: Documents Required For GST RegistrationDocument1 pageBhavsar & Patadia: Documents Required For GST RegistrationLalit MaheshwariNo ratings yet

- Checklist For VAT Registration & FSSAIDocument1 pageChecklist For VAT Registration & FSSAIRaju & AssociatesNo ratings yet

- E-Mudhra AppForm OrganizationDocument4 pagesE-Mudhra AppForm Organizationajaykumar1549No ratings yet

- Format For Docs. CollectedDocument1 pageFormat For Docs. CollectedRathan MatNo ratings yet

- Import Export Code or IE Code Is Required For Every Person or Firm or Company or Entity Engaged in Export Business in IndiaDocument7 pagesImport Export Code or IE Code Is Required For Every Person or Firm or Company or Entity Engaged in Export Business in IndiamanishaNo ratings yet

- 1546 Battula Vijaya Rani PDFDocument8 pages1546 Battula Vijaya Rani PDFSneha AdepuNo ratings yet

- 3-5 Dec, 2022Document34 pages3-5 Dec, 2022Faiq MurtazaNo ratings yet

- Modified Vendor Registration Form PDFDocument3 pagesModified Vendor Registration Form PDFAnonymous cKGCdi100% (1)

- Transaction Details: Product Type Loan Amount/Premium (RS.) Downpayment (RS.) EMI Amount (RS.)Document3 pagesTransaction Details: Product Type Loan Amount/Premium (RS.) Downpayment (RS.) EMI Amount (RS.)Seela VaraprasadNo ratings yet

- TES Lite Registration Requirement AnnouncementDocument1 pageTES Lite Registration Requirement AnnouncementGlenda TaylanNo ratings yet

- Commoditites Account Opening FormDocument22 pagesCommoditites Account Opening Formabdulrehman akhtarNo ratings yet

- RERA Agents Individual Check ListDocument2 pagesRERA Agents Individual Check ListG N Harish Kumar YadavNo ratings yet

- Vendor Registration Form Municipal Corporation of Greater MumbaiDocument3 pagesVendor Registration Form Municipal Corporation of Greater Mumbaiaman3327No ratings yet

- 5pmf0508205pmf121a1c41881bbe494c Fpesig0508205ptplkf8xg4u3jsfDocument11 pages5pmf0508205pmf121a1c41881bbe494c Fpesig0508205ptplkf8xg4u3jsfmanoj mannaiNo ratings yet

- Cherry Application FormDocument1 pageCherry Application FormklynnesstaycationNo ratings yet

- Vendor Registration Form SDFPLDocument3 pagesVendor Registration Form SDFPLpet.shrinksleevesNo ratings yet

- Main Application Form1Document2 pagesMain Application Form1ericsondav245No ratings yet

- Supplier Accreditation Form - CorporationDocument2 pagesSupplier Accreditation Form - CorporationTerence Jhon TabonNo ratings yet

- Vendor Registration FormDocument15 pagesVendor Registration FormJTO-IT Manipur SSANo ratings yet

- Guidelines and Registration Form Local Vendor Post Contract Award Products or Services L2Document5 pagesGuidelines and Registration Form Local Vendor Post Contract Award Products or Services L2anitalee0705No ratings yet

- Must Know For FamiliesDocument14 pagesMust Know For FamiliesAbhikalpKulshresthaNo ratings yet

- Guidelines For RemisiersDocument15 pagesGuidelines For Remisierssantosh.pw4230No ratings yet

- Audio Conferencing Form - Final V2Document2 pagesAudio Conferencing Form - Final V2Mostafizur RahmanNo ratings yet

- INDCOSERVE TEA - Vendors Reg - FormDocument9 pagesINDCOSERVE TEA - Vendors Reg - FormsubragmNo ratings yet

- Web Address Contact No Email-Id BSE NSEDocument16 pagesWeb Address Contact No Email-Id BSE NSENasar KelotNo ratings yet

- E-Mudhra AppForm Individual 070213 PDFDocument1 pageE-Mudhra AppForm Individual 070213 PDFRama PrajapatiNo ratings yet

- New Application (Category e Trade)Document1 pageNew Application (Category e Trade)angelica ponceNo ratings yet

- Section 8 Check ListDocument1 pageSection 8 Check ListG N Harish Kumar YadavNo ratings yet

- Loan DocumentsDocument7 pagesLoan DocumentsRajeev kumar AgarwalNo ratings yet

- Agency Enrollment FormDocument2 pagesAgency Enrollment FormJap KhambholiyaNo ratings yet

- Documents ListDocument1 pageDocuments Listmanoj.sharma110045No ratings yet

- Trading & Depository ApplicationDocument21 pagesTrading & Depository ApplicationMUTHYALA NEERAJANo ratings yet

- Templete For AllDocument18 pagesTemplete For AllCommerce Adda ConsultancyNo ratings yet

- Company Incorporation ChecklistDocument1 pageCompany Incorporation ChecklistRAGHAVNo ratings yet

- Vendor Registration FormDocument3 pagesVendor Registration FormDanish Naeem LambeNo ratings yet

- Application For Certificate of Evidence' Under Section 131 of The Home Building ActDocument2 pagesApplication For Certificate of Evidence' Under Section 131 of The Home Building Actapi-3751980No ratings yet

- UFlex Mandotry KYC LetterDocument7 pagesUFlex Mandotry KYC Letterabhikumarchoudhary85No ratings yet

- SmartPay Application & KYC Form - 2022 v1.1Document7 pagesSmartPay Application & KYC Form - 2022 v1.1STEWARD KIDING ANAK ENTILYNo ratings yet

- Details For Digital Signature CertificateDocument1 pageDetails For Digital Signature Certificatesharma.shireesh264808No ratings yet

- Business Permit ApplicationDocument2 pagesBusiness Permit Applicationtine delos santosNo ratings yet

- Anf 2A: Office Address Is Required in Case of Companies/ Head Office Address Is Required For All Other Categories)Document4 pagesAnf 2A: Office Address Is Required in Case of Companies/ Head Office Address Is Required For All Other Categories)Dalu ChockiNo ratings yet

- 0 - Dealer Application Form NewDocument5 pages0 - Dealer Application Form NewRamesh TagoorNo ratings yet

- KYC FormDocument3 pagesKYC FormAkash BansalNo ratings yet

- Transaction Details: Product Type Loan Amount/Premium (RS.) Downpayment (RS.) EMI Amount (RS.)Document3 pagesTransaction Details: Product Type Loan Amount/Premium (RS.) Downpayment (RS.) EMI Amount (RS.)Mahtab KhanNo ratings yet

- Raghrsha Raghu Raj Sharma: Index of DocumentsDocument17 pagesRaghrsha Raghu Raj Sharma: Index of Documentsshobha sharmaNo ratings yet

- Reading Financial Statement by CFIDocument66 pagesReading Financial Statement by CFIVidya MishraNo ratings yet

- Bentley Installation Guide PDFDocument14 pagesBentley Installation Guide PDFVidya MishraNo ratings yet

- Application For Student MembershipDocument1 pageApplication For Student MembershipVidya MishraNo ratings yet

- Strengthofmateri00smitrich PDFDocument190 pagesStrengthofmateri00smitrich PDFVidya MishraNo ratings yet