Professional Documents

Culture Documents

Important Tax Reforms Are Under Way in The Euro Area

Important Tax Reforms Are Under Way in The Euro Area

Uploaded by

aldhibahOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Important Tax Reforms Are Under Way in The Euro Area

Important Tax Reforms Are Under Way in The Euro Area

Uploaded by

aldhibahCopyright:

Available Formats

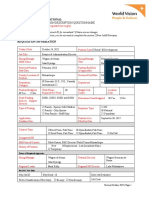

Box 5

Tax reforms in the euro area

Important tax reforms are under way in the euro area

Most euro area countries are currently implementing or planning significant reductions in labour and corporate

income taxation and social security contributions. The objectives, which are broadly shared by all countries,

are (i) to promote employment and investment via lower marginal taxation and contribution rates, (ii) to

increase tax neutrality with respect to savings and financing instruments, (iii) to improve the efficiency of

tax administration, and (iv) to simplify tax codes. This is expected to raise aggregate supply and the

non-inflationary growth potential in the euro area.

Tax reforms are also needed from an international perspective. Most euro area countries have an average tax

burden far in excess of the main industrialised countries outside the euro area. Relative to the tax plans

announced at the beginning of 2000, tax reforms have gained momentum in all euro area countries: future

plans have been brought forward and, in some cases, the announced measures have been frontloaded. The

quantitative effect of tax and social security cuts is quite significant, reflecting the large scale of reforms in

many of these countries. At the same time, some increases in indirect taxes, the widening of tax bases and

efficiency gains in tax collection will compensate for a small share of the revenue loss. In the euro area, the

cumulative total of tax cuts in 2000 and 2001 will average some 1 percentage point of GDP. Further tax cuts

are planned in a number of countries in 2002 and beyond.

Reforms are following a common pattern and are moving in the right direction

The tax reforms are following a common pattern, although they differ across countries in terms of their size

and composition. About half of the euro area countries are expected to cut taxes by more than 1 percentage

point of GDP over 2000-01, whereas one country is expected to raise taxes. In most countries, tax cuts will

benefit the household sector more than the corporate sector.

Most euro area countries have introduced or plan to introduce significant corporate and personal income tax

cuts. The latter will typically benefit all income groups, although many countries favour low-income earners.

A number of countries explicitly state the objectives of alleviating poverty and unemployment traps, promoting

“fairness” in the tax system and stimulating labour demand and supply. The objective of promoting employment

is also behind the social security contribution cuts pursued in roughly half of the euro area countries.

Most countries have also implemented or are planning corporate tax rate reductions. The related costs are

partly being offset by broadening the tax base via less generous tax allowances for depreciation. A number of

countries have reorganised and rationalised capital income taxation, aiming at a more neutral taxation of

income from various sources (i.e. dividends, interest income and capital gains) in order to reduce distortions in

investment and financing decisions. Some countries have also implemented tax measures to promote corporate

reorganisation and restructuring. A number of countries have passed legislation or reinforced existing legislation

favouring small and medium-sized firms.

Tax and social security contribution cuts are being partly compensated for by increases in indirect and

environmental taxes in a minority of countries. All countries expect a positive fiscal contribution from more

efficient tax systems and tax fraud prevention, and three of them have set explicit targets in this direction. A

number of countries are also seeking to simplify different parts of their tax systems.

ECB Monthly Bulletin • December 2000 47

You might also like

- Template For Feasibility Study Project ProposalDocument13 pagesTemplate For Feasibility Study Project ProposalArnold Steven100% (2)

- Cost AccountingDocument6 pagesCost AccountingCarl Angelo100% (5)

- Administration PlanDocument6 pagesAdministration PlanSHah LeLabah100% (3)

- Tax NotesDocument254 pagesTax NotesJane100% (1)

- Financial Policy and Procedures ManualDocument41 pagesFinancial Policy and Procedures ManualDanica NixNo ratings yet

- Lecture 2 - Income TaxDocument13 pagesLecture 2 - Income TaxMasitala PhiriNo ratings yet

- Probable RRLDocument3 pagesProbable RRLCharrey Leigh T. FORMARANNo ratings yet

- Tax and Economic Growth: Summary and Main FindingsDocument7 pagesTax and Economic Growth: Summary and Main FindingsSanjeev BorgohainNo ratings yet

- Value Added Tax Withholding in Ethiopia: Implications For Revenue Performance and Refund (Preliminary Findings)Document34 pagesValue Added Tax Withholding in Ethiopia: Implications For Revenue Performance and Refund (Preliminary Findings)fre mcNo ratings yet

- Revenue Productivity of The Tax System in Lesotho Nthabiseng J. Koatsa and Mamello A. NchakeDocument18 pagesRevenue Productivity of The Tax System in Lesotho Nthabiseng J. Koatsa and Mamello A. NchakeTseneza RaselimoNo ratings yet

- Taxation Trends in The European Union - 2011 - Booklet 27Document1 pageTaxation Trends in The European Union - 2011 - Booklet 27Dimitris ArgyriouNo ratings yet

- Cap 1.2.5Document45 pagesCap 1.2.5DavidNo ratings yet

- Income Tax Self Assessment Scheme Effectiveness andDocument4 pagesIncome Tax Self Assessment Scheme Effectiveness andIrfan AbbasiNo ratings yet

- Fiscal Policy of The Philippine GovernmentDocument55 pagesFiscal Policy of The Philippine GovernmentJervin Paul ManzanoNo ratings yet

- Beps 2014 Deliverables Explanatory StatementDocument12 pagesBeps 2014 Deliverables Explanatory StatementLenin FernándezNo ratings yet

- Adv PF & TXN Chapter IVDocument55 pagesAdv PF & TXN Chapter IVSamrawit AndualemNo ratings yet

- The Economic Impacts of Taxation: The Effects of Direct Taxation, The Effects of Indirect TaxationDocument8 pagesThe Economic Impacts of Taxation: The Effects of Direct Taxation, The Effects of Indirect TaxationBiniamNo ratings yet

- ECO209 Present OutlineDocument3 pagesECO209 Present OutlineManda ChungNo ratings yet

- Taxation in Sri LankaDocument11 pagesTaxation in Sri LankaThiluneluNo ratings yet

- ReadingDocument12 pagesReadinglaraghorbani12No ratings yet

- 18bco6el U3Document11 pages18bco6el U3Teguade ChekolNo ratings yet

- PWC. Paying Taxes 2012Document318 pagesPWC. Paying Taxes 2012Carlos Santillán DelgadoNo ratings yet

- 201902-Govinda Rao - GSTDocument39 pages201902-Govinda Rao - GSTbest videosNo ratings yet

- Next Generation Tax Reform in The PhilippinesDocument18 pagesNext Generation Tax Reform in The PhilippinesJonas MedinaNo ratings yet

- Project Report GSTDocument36 pagesProject Report GSTshilpi_suresh70% (50)

- JufridaDocument6 pagesJufridaMCINo ratings yet

- Taxation IssuesDocument23 pagesTaxation IssuesBianca Jane GaayonNo ratings yet

- LEGAL Topic 2Document8 pagesLEGAL Topic 2Inf1nitr0nNo ratings yet

- Corporate Tax Harmonization in The EU: Fiftieth Panel Meeting Hosted by The Universiteit Van TilburgDocument67 pagesCorporate Tax Harmonization in The EU: Fiftieth Panel Meeting Hosted by The Universiteit Van TilburgJonisa HoxhaNo ratings yet

- Addressing Tax Evasion and AvoidanceDocument43 pagesAddressing Tax Evasion and Avoidancek2a2m2No ratings yet

- Taxation of MncsDocument47 pagesTaxation of MncsUdayabhanu SwainNo ratings yet

- Tema 6-BEPS Project-ENGDocument15 pagesTema 6-BEPS Project-ENGkiana mitreNo ratings yet

- Bac Iv Law Course Taxation IiDocument168 pagesBac Iv Law Course Taxation IiGilbert SanoNo ratings yet

- Business Taxation: Rachel Griffith, Helen Miller and Martin O'Connell (IFS)Document12 pagesBusiness Taxation: Rachel Griffith, Helen Miller and Martin O'Connell (IFS)anon_241413889No ratings yet

- Project Report GST PDFDocument36 pagesProject Report GST PDFhaz008100% (1)

- Project Report GSTDocument36 pagesProject Report GSThaz002No ratings yet

- Dit Project PDFDocument30 pagesDit Project PDFSanthosh MJNo ratings yet

- Tax Awarness SessionsDocument23 pagesTax Awarness Sessionsyara aliNo ratings yet

- CH 1Document20 pagesCH 1tomas PenuelaNo ratings yet

- Tax Revenue Mobilization Episodes in Developing Countries: Policy Design and PracticeDocument30 pagesTax Revenue Mobilization Episodes in Developing Countries: Policy Design and PracticeKatia ToledoNo ratings yet

- ATR 3 - 1 - 82-92 - WordDocument11 pagesATR 3 - 1 - 82-92 - WordAkingbesote VictoriaNo ratings yet

- Ministerial MeetingDocument7 pagesMinisterial MeetingaghaandmazaNo ratings yet

- Tax System Reform in Ethiopian Revenue ADocument5 pagesTax System Reform in Ethiopian Revenue AGoogle jkNo ratings yet

- Economics of TaxationDocument2 pagesEconomics of Taxationmitchgb100% (1)

- Final Project SunitaDocument37 pagesFinal Project SunitaAtul LabdiNo ratings yet

- Identify The Problem On The Tax Assessment and Collection Activities of The Tabor Sub - City in Southern Ethiopia of Hawassa.Document35 pagesIdentify The Problem On The Tax Assessment and Collection Activities of The Tabor Sub - City in Southern Ethiopia of Hawassa.abceritreaNo ratings yet

- Personal Tax in The European UnionDocument27 pagesPersonal Tax in The European Unionmunchlax27No ratings yet

- Demirew Getachew - Tax Reform in Eth and Progress To DateDocument23 pagesDemirew Getachew - Tax Reform in Eth and Progress To Datewondimg100% (5)

- TAD CH.2 PritDocument76 pagesTAD CH.2 PritYitera SisayNo ratings yet

- Income Inequality and Growth: The Role of Taxes and TransfersDocument14 pagesIncome Inequality and Growth: The Role of Taxes and TransfersDorel NorocNo ratings yet

- Consumption Taxes The Way of The FutureDocument8 pagesConsumption Taxes The Way of The FutureStacey JohnsonNo ratings yet

- Consumption Taxes in Developing Countries - The Case of The Bangladesh VATDocument36 pagesConsumption Taxes in Developing Countries - The Case of The Bangladesh VATtj_hunkNo ratings yet

- Taxation: Témakör 2 Téma 3 1Document2 pagesTaxation: Témakör 2 Téma 3 1Mark MatyasNo ratings yet

- Comparison of Tax Amnesty Implementation in Developing CountriesDocument10 pagesComparison of Tax Amnesty Implementation in Developing Countriesiftinanda SalmaNo ratings yet

- 2022-CRS - Global Minimum Tax Could Lead To Higher Multinational Taxes - Tax NotesDocument16 pages2022-CRS - Global Minimum Tax Could Lead To Higher Multinational Taxes - Tax Noteswedsrvn599No ratings yet

- Public Finance Reporting. 1.2Document44 pagesPublic Finance Reporting. 1.2Axel Jhon FabayosNo ratings yet

- VAT of CommoditiesDocument108 pagesVAT of CommoditiessnsgmNo ratings yet

- Paying Taxes 2010Document116 pagesPaying Taxes 2010Christian JoneliukstisNo ratings yet

- Goods and Services TaxDocument6 pagesGoods and Services TaxHARSHULNo ratings yet

- Calculate Taxes Fees and Charges For 2015 EntryDocument45 pagesCalculate Taxes Fees and Charges For 2015 Entrywashoelias5No ratings yet

- Impact of Indirect TaxationDocument64 pagesImpact of Indirect TaxationShaguolo O. JosephNo ratings yet

- Tax Evasion, Tax Avoidance and Tax Expenditures in Developing CountriesDocument76 pagesTax Evasion, Tax Avoidance and Tax Expenditures in Developing CountriesMaz Here100% (3)

- Slides 09 PublicFinance Part1Document30 pagesSlides 09 PublicFinance Part1Ashish PandeyNo ratings yet

- Ecb - rb220621 F8769cf5a8.enDocument7 pagesEcb - rb220621 F8769cf5a8.enaldhibahNo ratings yet

- Ecb - rb210728 224099ec93.enDocument4 pagesEcb - rb210728 224099ec93.enaldhibahNo ratings yet

- Ecb - Mepletter200629 Pedicini 5413f962ab - enDocument2 pagesEcb - Mepletter200629 Pedicini 5413f962ab - enaldhibahNo ratings yet

- Ecb - wp2305 F2c93ab1af - enDocument31 pagesEcb - wp2305 F2c93ab1af - enaldhibahNo ratings yet

- Ecb-Public: Christine LAGARDEDocument3 pagesEcb-Public: Christine LAGARDEaldhibahNo ratings yet

- Ecb-Public: Christine LAGARDEDocument3 pagesEcb-Public: Christine LAGARDEaldhibahNo ratings yet

- Ecb - rb221031 A05030021c.enDocument7 pagesEcb - rb221031 A05030021c.enaldhibahNo ratings yet

- Ecb - Wgeurorfr Impacttransitioneoniaeurostrcashderivativesproducts D917dffb84.enDocument72 pagesEcb - Wgeurorfr Impacttransitioneoniaeurostrcashderivativesproducts D917dffb84.enaldhibahNo ratings yet

- 161129letter Fernandez - en enDocument2 pages161129letter Fernandez - en enaldhibahNo ratings yet

- Ethereum Development With Go PDFDocument154 pagesEthereum Development With Go PDFaldhibahNo ratings yet

- Ecb - Op229 4c5ec8f02a.enDocument54 pagesEcb - Op229 4c5ec8f02a.enaldhibahNo ratings yet

- Working Paper Series: Much Ado About Nothing? The Shale Oil Revolution and The Global Supply CurveDocument27 pagesWorking Paper Series: Much Ado About Nothing? The Shale Oil Revolution and The Global Supply CurvealdhibahNo ratings yet

- Casper The Friendly Ghost: A "Correct-by-Construction" Blockchain Consensus ProtocolDocument16 pagesCasper The Friendly Ghost: A "Correct-by-Construction" Blockchain Consensus ProtocolaldhibahNo ratings yet

- Questions Related To The European Economic Strategy Regarding China's Monetary PolicyDocument1 pageQuestions Related To The European Economic Strategy Regarding China's Monetary PolicyaldhibahNo ratings yet

- Ecb Tibereu enDocument23 pagesEcb Tibereu enaldhibahNo ratings yet

- Political Commitments and The Stability and Growth Pact: ECB December 2007Document2 pagesPolitical Commitments and The Stability and Growth Pact: ECB December 2007aldhibahNo ratings yet

- Technical Assumptions: Economic and Monetary DevelopmentsDocument1 pageTechnical Assumptions: Economic and Monetary DevelopmentsaldhibahNo ratings yet

- Economic and Monetary Developments: Forecasts by Other InstitutionsDocument2 pagesEconomic and Monetary Developments: Forecasts by Other InstitutionsaldhibahNo ratings yet

- Ecb wp2212 enDocument36 pagesEcb wp2212 enaldhibahNo ratings yet

- Technical Assumptions About Interest Rates, Exchange Rates, Commodity Prices and Fiscal PoliciesDocument1 pageTechnical Assumptions About Interest Rates, Exchange Rates, Commodity Prices and Fiscal PoliciesaldhibahNo ratings yet

- Ecb - Mepletter181128 Chountis - enDocument3 pagesEcb - Mepletter181128 Chountis - enaldhibahNo ratings yet

- Inflation in NepalDocument25 pagesInflation in NepalAvay ShresthaNo ratings yet

- Budgeting For Planning and ControlDocument31 pagesBudgeting For Planning and ControlLeo CerenoNo ratings yet

- Final RPT of Cavinkare PK - DocxDocument71 pagesFinal RPT of Cavinkare PK - DocxPooja KukrejaNo ratings yet

- Budget Policy PDFDocument3 pagesBudget Policy PDFQueenNo ratings yet

- Clovis Thorn ResumeDocument2 pagesClovis Thorn ResumeclthornNo ratings yet

- Cash and Liquidity ManagementDocument21 pagesCash and Liquidity ManagementDivyajyoti SinghNo ratings yet

- BEC Demo CompanionDocument23 pagesBEC Demo Companionalik711698100% (1)

- Present Economic Condition of IndiaDocument9 pagesPresent Economic Condition of Indiasaptarshi80023550No ratings yet

- Economics of Plant Design (Report)Document10 pagesEconomics of Plant Design (Report)Hamizah Mieza100% (1)

- Budgeting and Profit PlanningDocument28 pagesBudgeting and Profit PlanningNagarjuna AppuNo ratings yet

- Poll: Large Majority of Illinois Voters Think State Is On The Wrong TrackDocument19 pagesPoll: Large Majority of Illinois Voters Think State Is On The Wrong TrackIllinois PolicyNo ratings yet

- JDPDQ Finance & Admin Director-Moz 26 Oct 2022Document13 pagesJDPDQ Finance & Admin Director-Moz 26 Oct 2022Chico Manuel Dias JamoNo ratings yet

- Book3: Updated Local Treasury Operations Manual (Ltom)Document176 pagesBook3: Updated Local Treasury Operations Manual (Ltom)Ah MhiNo ratings yet

- Economics Handout Public Debt: The Debt Stock Net Budget DeficitDocument6 pagesEconomics Handout Public Debt: The Debt Stock Net Budget DeficitOnella GrantNo ratings yet

- MS1-Final Exams For StudentsDocument6 pagesMS1-Final Exams For StudentsNikki Estores GonzalesNo ratings yet

- Describe How and Why Managers Use BudgetsDocument4 pagesDescribe How and Why Managers Use BudgetsSanJana NahataNo ratings yet

- WSA Organizational Chart 10-13Document1 pageWSA Organizational Chart 10-13BeckyWSANo ratings yet

- Direct and Indirect Speech RulesDocument25 pagesDirect and Indirect Speech Rulesroshan soniNo ratings yet

- Vertex42 Money Manager 2.0: INSTRUCTIONS - For Excel 2010 or LaterDocument26 pagesVertex42 Money Manager 2.0: INSTRUCTIONS - For Excel 2010 or LaterNikkiNo ratings yet

- My BudgetDocument6 pagesMy Budgetapi-458902916No ratings yet

- ResumeCharlieL HernanDocument3 pagesResumeCharlieL HernanAimee EstrelladoNo ratings yet

- Earmark RequestDocument1 pageEarmark RequestdjsunlightNo ratings yet

- Project Policy: AIESEC in Universitas Andalas 2017/2018Document7 pagesProject Policy: AIESEC in Universitas Andalas 2017/2018deyNo ratings yet

- Solutions (Chapter10)Document16 pagesSolutions (Chapter10)Nguyễn Hữu HoàngNo ratings yet

- Corporate Finance Valuation ModelsDocument16 pagesCorporate Finance Valuation Modelsottowms1No ratings yet