Professional Documents

Culture Documents

CRS Self Certification Form Individual

CRS Self Certification Form Individual

Uploaded by

Salman ArshadOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CRS Self Certification Form Individual

CRS Self Certification Form Individual

Uploaded by

Salman ArshadCopyright:

Available Formats

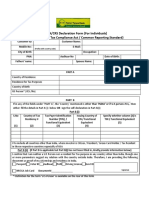

CRS Form for Tax Residency Self Certification

For Individuals, Joint Accounts (CRS–I)

Please read these instructions carefully before completing the form

Chapter XIIA of Income Tax Rules, 2002 and Regulations based on the OECD Common Reporting Standard (CRS) require

Al Meezan Investment Management Limited to collect and report certain information about each person’s tax

residency. If your tax residence is located outside Pakistan and/or United States of America (USA), we may be legally

obliged to pass on the information in this form and other financial information with respect to your financial accounts

to Federal Board of Revenue (FBR) and they may exchange this information with tax authorities of another jurisdiction

or jurisdictions pursuant to intergovernmental agreements to exchange financial account information.

You can find summaries of defined terms in the Glossary of Terms provided at page 3 of this form.

Please complete this form if you are an individual, a sole trader or sole proprietor. Please use a separate form for each

individual of a Joint Account. In case of Minor Account, guardian should complete this form on behalf of account holder

i.e. minor.

This form will remain valid unless there is a change in circumstances relating to information, such as the account

holder’s tax status or other information that makes this form incorrect or incomplete. In that case you must notify us

and provide an updated self-certification.

PART 1 ACCOUNT HOLDER INFORMATION Customer ID

Name of Investor Date of Birth

Place of Birth City: Country:

Current Residence Address Mailing Address (Complete only if different from current address)

Address Line 1: Address Line 1:

Address Line 2: Address Line 2:

City: City:

Province/State: Province/State:

Country: Country:

PART 2 CRS – DECLARATION OF TAX RESIDENCY (Please refer to Appendix – I for your tax residency status)

I am tax resident of Pakistan or/and USA ONLY.

Yes (Proceed to Part 4)

No (Proceed to Part 3)

CRS Self Certification Form (16-02-2018) Page 1 of 2

CRS Form for Tax Residency Self Certification

For Individuals, Joint Accounts (CRS–I)

PART 3 COUNTRY OF RESIDENCE FOR TAX PURPOSE

Please complete the following table indicating (i) the country where the Account Holder is resident for tax purposes and (ii)

the Account Holder’s Taxpayer Identification Number (TIN) or functional equivalent for each country indicated. . Please refer

to the OECD website for more information on tax residency http://www.oecd.org/tax/automatic-exchange/crs-

implementation-and-assistance/tax-residency/

If Tax Identification Number (TIN) is not available, please tick () the appropriate box with reason A, B or C as defined

below and provide Supporting Evidence:

Reason A - The country/jurisdiction where the Account Holder is resident does not issue TINs to its residents

Reason B - The Account Holder is otherwise unable to obtain a TIN or equivalent number (Please provide reasons if this is

selected)

Reason C - No TIN is required. (Note: Only select this reason, along-with evidence, if the domestic law of the relevant country

does not require the collection of the TIN issued by such country)

Tick () ONE only (If TIN is not available)

Country(ies) of Tax Residence TIN or Equivalent

Reason A Reason B Reason C

1

If Reason B selected, please explain in the following box(es) why you are unable to obtain a TIN or Functional Equivalent

1

PART 4 DECLARATION AND SIGNATURE

I understand that the information supplied by me is covered by the full provisions of the terms and conditions governing the

Account Holder’s relationship with Al Meezan Investment Management Limited setting out how Al Meezan Investment

Management Limited may use and share the information supplied by me. I acknowledge that the information contained in

this form and information regarding the Account Holder and any Reportable Account(s) may be provided to the tax

authorities of the country/jurisdiction in which this account(s) is/are maintained and exchanged with tax authorities of

another country/jurisdiction or countries/jurisdictions in which the Account Holder may be tax resident pursuant to

intergovernmental agreements to exchange financial account information.

I declare that all statements made in this declaration are, to the best of my knowledge and belief, correct and complete. I

undertake to submit a suitably updated Form within 30 days of any change in circumstances which affects the tax residency

status or where any information contained herein to become incorrect.

Investor’s Signature______________________________ Date___________________________

CRS Self Certification Form (16-02-2018) Page 2 of 2

CRS Form for Tax Residency Self Certification

For Individuals, Joint Accounts (CRS–I) - Guidelines

TERMS & CONDITIONS AND GLOSSARY OF TERMS

In case Investor has the following Indicia/indication pertaining to a foreign country and yet declares self to be non-tax

resident in the respective country, he/she is required to provide relevant Curing Documents as mentioned below:

CRS Indicia/indication Observed Documentation required for Cure of CRS Indicia

Residence/mailing address in a Obtain reasonable written explanation along-with relevant documentary

country other than Pakistan or/and evidence(s).

USA

Telephone number in a country other Examples of reasonable explanation may include a statement by the individual

than Pakistan or/and USA that he/she:

Mandate Holder of account having (1) is a student or teacher or trainee with a foreign address/contact number and

residence/ mailing address in a holds the appropriate visa;

country other than Pakistan or/and (2) is assigned to a diplomatic post or a position in a consulate or embassy with a

USA foreign address/contact number;

“Hold mail” or “in care of” address in a (3) is a seafarer or frontier worker or employee working on a truck or train

country other than Pakistan or/and travelling between countries/jurisdictions.

USA (4) visited, for example, United Kingdom for leisure/holidays for less than 6

months; therefore, his/her NICOP shows the Current Address/Country of Stay of

the United Kingdom.

Examples of documentary evidence(s) are as follows:

Copy of Passport, Visa and/or other documentary evidence establishing the non-

tax resident status of relevant foreign country.

Note: These are selected summaries of defined terms provided to assist you with the completion of this form. Further details

can be found within the OECD Common Reporting Standard and the associated Commentary to the CRS at the

http://www.oecd.org/tax/transparency/automaticexchangeofinformation.htm

CRS

CRS is the Common Reporting Standard under which member states of the European Union and countries that have

concluded Competent Authority Agreements exchange financial account information.

Participating Country/Jurisdiction

Participating country/jurisdiction means a jurisdiction/country (i) with which an agreement is in place pursuant to which

there is an obligation in place to provide the certain information, and (ii) which is identified in a published list to be made

available on FBR’s web portal.

Reportable Account

The term “Reportable Account” means an account held by one or more Reportable Persons.

Reportable Jurisdiction

Reportable Jurisdiction means all jurisdictions other than Pakistan and the United States of America;

Reportable Person

A Reportable Person is defined as an individual who is tax resident in a Reportable Jurisdiction/country under the tax laws of

that jurisdiction.

TIN (including Functional Equivalent)

TIN means Taxpayer Identification Number or any other functional equivalent. A TIN is a unique combination of letters or

numbers assigned by a country/jurisdiction to an individual or an Entity and used to identify the individual or Entity for the

purposes of administering the tax laws of such country/jurisdiction.

CRS Self Certification Form (07-2017) Page 1 of 3

CRS Form for Tax Residency Self Certification

For Individuals, Joint Accounts (CRS–I) - Guidelines

Appendix – I

A. You are TAX resident, If you have stayed for more than:

3 Month (≈ 91 Days) in the any of following country(ies)

Guernsey, South Africa

6 Month (≈ 183 Days) in the any of following country(ies)

Andorra, Australia, Austria, Belize, Brazil, Bulgaria, Canada, Colombia, Croatia, Cyprus, Czech Republic,

Chile, Costa Rica, Denmark, Estonia, Faroe Islands, Finland, Gibraltar, Greece, Germany, Greenland, Hong

Kong (China), Hungary, India, Iceland, Ireland, Isle of Man, Israel, Jersey, Korea, Latvia, Liechtenstein,

Lithuania, Malaysia, Malta, Mauritius, Montserrat, New Zealand, Norway, Poland, Portugal, Romania,

Russian Federation, Saint Lucia, Saint Vincent & the Grenadines, Saudi Arabia, Singapore, Slovak Republic,

Slovenia, Spain, Switzerland, Uruguay, Sweden, Turkey, UK

1 Year (≈ 12 Months) in the any of following country(ies)

Argentina, China, Japan

B. Following Jurisdictions have stated rules for the classification of an Individual as Tax Resident

Jurisdiction(s) Conditions for being Tax Residents

"Resident Person" in the United Arab Emirates means:

a) Any United Arab Emirates National; or

UAE b) An individual who is a resident in United Arab Emirates with:

a valid Emirates ID

a valid Residency Visa.

According Italian income tax code, an individual is considered resident in Italy for tax

purposes if at least one of the following conditions are met for a period of time that is

greater than half of the tax period (183 Days):

Italy Registration of the individual in the Municipal population registers

Presence of a domicile in Italy related to the individual according to the civil code

definition.

Residence of the individual in Italy

Are liable to income tax: Resident taxpayers, i.e. physical persons who have their tax

Luxembourg domicile or normal place of residence in Luxembourg on their domestic and foreign taxable

income.

All individuals who establish their permanent home in Mexico are deemed to be residents in

Mexico. If they have their centre of vital interest in national territory; this is, when more

Mexico than 50% of the total revenue obtained by the individual within a calendar year arises from

sources within the country or when the main centre of their professional activities is located

in Mexico

The main facts and circumstances that determine tax residence are:

you spend most of your time at a Dutch address;

your partner and/or family lives in the Netherlands;

you work in the Netherlands;

Netherlands

you have insurance in the Netherlands;

your (family) physician is resident in the Netherlands;

you are a member of one or more clubs / societies in the Netherlands;

your kids receive an education in the Netherlands.

CRS Self Certification Form (07-2017) Page 2 of 3

CRS Form for Tax Residency Self Certification

For Individuals, Joint Accounts (CRS–I) - Guidelines

The notion of tax residency for natural persons is provided for by Article 10 of Law no. 166 of

16 December 2013.

Under said Article, natural persons shall be deemed to be resident in San Marino for tax

purposes if, in the tax period of reference, at least one of the following conditions is met:

Republic of San

they have their registered residency in San Marino for most of the tax period;

Marino

they live in the territory of San Marino for most of the tax period;

they have their centre of vital interests in the territory of San Marino.

Under Article 4 B of the CGI, regardless of their nationality, individuals are deemed to be

domiciled in France for tax purposes if:

their home is in France; or

France their main place of abode is in France;

they carry on a professional activity in France, salaried or not, unless they can prove

that it is a secondary activity;

they have the centre of their economic interests in France

When an individual generates income from Macao, either through employment or self-

employment, he or she would be taxable, and therefore a unique TIN will be given to him or

Macao

her.

“Professional Tax (salaries tax)” is the type of tax that is attributable to such income

C. Tax Exempted Jurisdictions

Tax Exempted Jurisdictions (There is no Income Tax applicable on Individuals)

Bermuda, Cayman Islands, Kuwait, Seychelles, Turks and Caicos Islands

List of Jurisdictions may be updated w.r.t. OECD website. For complete details about tax residency, kindly visit

http://www.oecd.org/tax/automatic-exchange/crs-implementation-and-assistance/tax-residency/

CRS Self Certification Form (07-2017) Page 3 of 3

You might also like

- Form W-8BEN Rev 920Document2 pagesForm W-8BEN Rev 920alejandroguitierrazxxx100% (3)

- CRS Individual Self Certification Form: InstructionsDocument2 pagesCRS Individual Self Certification Form: InstructionsCyrus FungNo ratings yet

- Identification of Account Holder: PARTDocument2 pagesIdentification of Account Holder: PARTMuhammad HarisNo ratings yet

- CRS Entity (Organization)Document7 pagesCRS Entity (Organization)Muhammad HarisNo ratings yet

- CVL Kra Kyc Change Individual FormDocument2 pagesCVL Kra Kyc Change Individual FormM. Sadiq. A. PachapuriNo ratings yet

- MCQ FimDocument13 pagesMCQ FimVIVEK SHARMA100% (3)

- CRS Individual Account Self-Cert Form v2015-12 CBI RBI AsiaDocument6 pagesCRS Individual Account Self-Cert Form v2015-12 CBI RBI AsiaJoris RectoNo ratings yet

- CRS Tax Residency Self Certification Form For Controlling Persons (CRS-CP)Document2 pagesCRS Tax Residency Self Certification Form For Controlling Persons (CRS-CP)Salman ArshadNo ratings yet

- CRS Individual Self-Certification FormDocument6 pagesCRS Individual Self-Certification FormsamNo ratings yet

- CRS - 2022Document13 pagesCRS - 2022johny SahaNo ratings yet

- Fatca Crs Self Certification FormDocument6 pagesFatca Crs Self Certification FormMohammed FaisalNo ratings yet

- CRS Self Certification Form For IndividualsDocument6 pagesCRS Self Certification Form For IndividualsSergeyNo ratings yet

- CRS Form For Tax Residency Self CertificationDocument2 pagesCRS Form For Tax Residency Self Certificationcoldbrizze2No ratings yet

- New Self Certification FormDocument3 pagesNew Self Certification Formtimstark004No ratings yet

- Crs-I Individual Self Cert Form-AustraliaDocument2 pagesCrs-I Individual Self Cert Form-AustraliaminemecryptoNo ratings yet

- Fatca/Crs Self Certification / Declaration For Individuals: Documents As Mentioned BelowDocument2 pagesFatca/Crs Self Certification / Declaration For Individuals: Documents As Mentioned BelowRaviJhaNo ratings yet

- Individual Tax Residency Self-Certification FormDocument2 pagesIndividual Tax Residency Self-Certification FormEmadNo ratings yet

- Bank AL Habib Limited: CRS Individual / Proprietorship Tax ResidencyDocument2 pagesBank AL Habib Limited: CRS Individual / Proprietorship Tax ResidencyMitti da PalwaanNo ratings yet

- Franklin Templeton Investments: Investor DetailsDocument5 pagesFranklin Templeton Investments: Investor Detailspiper_No ratings yet

- Individual Tax Residency Self Certification FormDocument5 pagesIndividual Tax Residency Self Certification FormYaacov KotlickiNo ratings yet

- Self CertificationDocument6 pagesSelf CertificationGuocheng MaNo ratings yet

- CRS 421019577252Document5 pagesCRS 421019577252Saad KhanNo ratings yet

- Fatca Declaration Active Trade Channel IslandsDocument6 pagesFatca Declaration Active Trade Channel IslandsLosaNo ratings yet

- NCB Self Certification of ResidencyDocument2 pagesNCB Self Certification of Residencygeeman9787No ratings yet

- 141121120000amiop CRS IndivisualDocument5 pages141121120000amiop CRS Indivisualdesignify101No ratings yet

- CRS-I FormDocument2 pagesCRS-I Formmramzan9820No ratings yet

- FM105W - SLR - CRS - SELFCERT - IND - JUL20 - 002 (Writable)Document3 pagesFM105W - SLR - CRS - SELFCERT - IND - JUL20 - 002 (Writable)HKRRL HKRRLNo ratings yet

- CRS Self-Certification Form For Individual CustomersDocument2 pagesCRS Self-Certification Form For Individual CustomersBenNo ratings yet

- 4.fatca Self Declaraton Form Individuals PDFDocument2 pages4.fatca Self Declaraton Form Individuals PDFbala krishnanNo ratings yet

- FATCADocument2 pagesFATCAORIENNo ratings yet

- CRS Self Certification Form EntityDocument4 pagesCRS Self Certification Form EntitySalman ArshadNo ratings yet

- 68-CRS - Controlling PersonDocument4 pages68-CRS - Controlling PersonDeedar AhmedNo ratings yet

- Account Holder: AEOI Self-Certification For An Individual/Controlling PersonDocument3 pagesAccount Holder: AEOI Self-Certification For An Individual/Controlling PersonNigil josephNo ratings yet

- Individual Tax Residency Self Certification FormDocument5 pagesIndividual Tax Residency Self Certification FormJennifer LeetNo ratings yet

- FATCA Declaration For Individual Investors FormDocument2 pagesFATCA Declaration For Individual Investors FormnithiyNo ratings yet

- Jamaica FATCA Individual Self Certification - 2022Document2 pagesJamaica FATCA Individual Self Certification - 2022FandENo ratings yet

- W-8BEN Form - Frequently Asked QuestionsDocument2 pagesW-8BEN Form - Frequently Asked QuestionsAnkit ChhabraNo ratings yet

- FATCA-CRS Annexure For Individual Accounts (Including Sole Proprietor) Details Under FATCA and CRSDocument2 pagesFATCA-CRS Annexure For Individual Accounts (Including Sole Proprietor) Details Under FATCA and CRSOws AnishNo ratings yet

- FATCA CORP English - Bank Muscat 1Document17 pagesFATCA CORP English - Bank Muscat 1reema-algheshyanNo ratings yet

- Edoc Profile Apr092021Document2 pagesEdoc Profile Apr092021Ryan ReidNo ratings yet

- Fillable W-8BEN 2023Document2 pagesFillable W-8BEN 2023marioNo ratings yet

- Business Banking Sole Trader Residency FormDocument2 pagesBusiness Banking Sole Trader Residency FormbtcturkdestekinfoNo ratings yet

- FATCA Individual PDFDocument2 pagesFATCA Individual PDFPrathik NamakalNo ratings yet

- CAN Declaration Tax Residence Rc518 Fill 18eDocument2 pagesCAN Declaration Tax Residence Rc518 Fill 18eMax PowerNo ratings yet

- Fatca Crs Declaration Individuals PDFDocument2 pagesFatca Crs Declaration Individuals PDFfujstructuralNo ratings yet

- FATCA-CRS-DECLARATION-FORM-IndividualDocument2 pagesFATCA-CRS-DECLARATION-FORM-Individualdhruv KhandelwalNo ratings yet

- Document Pack 9ST99MJR PDFDocument6 pagesDocument Pack 9ST99MJR PDFMohamed Diaa Mortada100% (1)

- FATCA Form Individual 061015 V1Document2 pagesFATCA Form Individual 061015 V1sanjay901No ratings yet

- Crs FormDocument6 pagesCrs Form- EmslieNo ratings yet

- FATCA and CRS Annexure For Individual Accounts-V-2Document2 pagesFATCA and CRS Annexure For Individual Accounts-V-2Maksim MikhailNo ratings yet

- FATCA-CRS Individual Self Certification - TradeZero - Dec 2018Document2 pagesFATCA-CRS Individual Self Certification - TradeZero - Dec 2018Kahchoon ChinNo ratings yet

- FATCA Individuals PDFDocument2 pagesFATCA Individuals PDFfordd greenNo ratings yet

- Benfitsform Starbucks BeanstockDocument1 pageBenfitsform Starbucks BeanstockAndrew Christopher CaseNo ratings yet

- FRM W8DM HRDocument2 pagesFRM W8DM HRmiscribeNo ratings yet

- Know Your Client (KYC) Application Form (For Individuals Only)Document26 pagesKnow Your Client (KYC) Application Form (For Individuals Only)Abin ThomasNo ratings yet

- Extended KYC Annexure IndividualsDocument2 pagesExtended KYC Annexure IndividualsNarendra Reddy BhumaNo ratings yet

- AEOI FormDocument2 pagesAEOI Formgheorgheadrianonea100% (1)

- New ITRs 2014Document72 pagesNew ITRs 2014miles1280No ratings yet

- CRS-I Individual Self Cert Form LlenaDocument5 pagesCRS-I Individual Self Cert Form LlenaZaskya BenitezNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Foreign Exchange Rate Sheet: 129 Sheet No Date 17-Jul-19Document1 pageForeign Exchange Rate Sheet: 129 Sheet No Date 17-Jul-19Salman ArshadNo ratings yet

- RemittanceMBL 17JUL PDFDocument1 pageRemittanceMBL 17JUL PDFSalman ArshadNo ratings yet

- FX MBL 30octDocument1 pageFX MBL 30octSalman ArshadNo ratings yet

- Currency Buying: Treasury DepartmentDocument1 pageCurrency Buying: Treasury DepartmentSalman ArshadNo ratings yet

- FX MBL 29octDocument1 pageFX MBL 29octSalman ArshadNo ratings yet

- RemittanceMBL 30OCTDocument1 pageRemittanceMBL 30OCTSalman ArshadNo ratings yet

- RemittanceMBL 11DECDocument1 pageRemittanceMBL 11DECSalman ArshadNo ratings yet

- RMBL13NOVDocument1 pageRMBL13NOVSalman ArshadNo ratings yet

- RemittanceMBL 29OCTDocument1 pageRemittanceMBL 29OCTSalman ArshadNo ratings yet

- Engagement Letter MSF HollandDocument4 pagesEngagement Letter MSF HollandDevendra VermaNo ratings yet

- Modification or Discharge of Debt in A Chapter 9 CaseDocument13 pagesModification or Discharge of Debt in A Chapter 9 CaseSnowdenKonanNo ratings yet

- Step by Step - Transfer of TitleDocument4 pagesStep by Step - Transfer of TitleRommyr P. Caballero100% (2)

- Course OutlineDocument217 pagesCourse OutlineAðnan YasinNo ratings yet

- FinMan PaperDocument4 pagesFinMan PaperMara TuasonNo ratings yet

- LR 2433Document2 pagesLR 2433mnitoo193No ratings yet

- New Straits Times - Interview The Expert With Kathlyn Toh - Benefit of Trading The U.S. Stock MarketDocument1 pageNew Straits Times - Interview The Expert With Kathlyn Toh - Benefit of Trading The U.S. Stock MarketBeyond InsightsNo ratings yet

- Financial Management I Ch3Document8 pagesFinancial Management I Ch3bikilahussenNo ratings yet

- ERM - Experience From Japanese CompanyDocument38 pagesERM - Experience From Japanese CompanyNguyen Quoc HuyNo ratings yet

- Delta Spinners 2009Document40 pagesDelta Spinners 2009bari.sarkarNo ratings yet

- Assignment 3B: Financial Report and Analysis: Course: Accounting in Organisation and SocietyDocument22 pagesAssignment 3B: Financial Report and Analysis: Course: Accounting in Organisation and SocietyAn NguyenthenamNo ratings yet

- Accounting RemedialDocument40 pagesAccounting Remedialwhyme_bNo ratings yet

- Derivatives and OptionsDocument23 pagesDerivatives and OptionsSathya Keerthy KNo ratings yet

- 2012 Annual Report AcerinoxDocument142 pages2012 Annual Report Acerinoxaniket_ghoseNo ratings yet

- G.R. No. 168078 Fabio Cahayag and Conrado RIVERA, Petitioners, Commercial Credit CorporationDocument26 pagesG.R. No. 168078 Fabio Cahayag and Conrado RIVERA, Petitioners, Commercial Credit CorporationRobelen CallantaNo ratings yet

- Course Delivery ScheduleDocument7 pagesCourse Delivery ScheduleNaThaliaNo ratings yet

- E006 - Exp PF-1Document4 pagesE006 - Exp PF-1Evhellsing StudioNo ratings yet

- DepreciationDocument11 pagesDepreciationSuman LaskarNo ratings yet

- Subject: Financial Management: Indira Institute of Management, PuneDocument23 pagesSubject: Financial Management: Indira Institute of Management, PunePrasad RandheNo ratings yet

- Investor PitchDocument65 pagesInvestor PitchDamonSirScootLawrenceNo ratings yet

- Qureshi Debt Collection AgencyDocument14 pagesQureshi Debt Collection AgencyHammad SaeedNo ratings yet

- Universal Paralal LedgerDocument46 pagesUniversal Paralal LedgersundargowdaNo ratings yet

- Form Expense ClaimDocument2 pagesForm Expense Claimviedelamonde_3868443No ratings yet

- Determinants of Bank Performance Evidence From Commercial Banks in Sri LankaDocument10 pagesDeterminants of Bank Performance Evidence From Commercial Banks in Sri LankaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Statutory Construction Digest 8 14Document7 pagesStatutory Construction Digest 8 14Justine Stefan GaverzaNo ratings yet

- Social ResponsibilityDocument24 pagesSocial ResponsibilityAnuj DubeyNo ratings yet

- Fama-French Factors and Business CyclesDocument19 pagesFama-French Factors and Business CyclesJoanna_01No ratings yet

- Current Affairs 2017 PDF Capsule by AffairscloudDocument392 pagesCurrent Affairs 2017 PDF Capsule by Affairscloudkewal259No ratings yet

- Credit CardsDocument21 pagesCredit Cardsdixita_chotalia3829100% (1)