Professional Documents

Culture Documents

Notes: 6311 Accounting I Summer 2010, Version 2

Notes: 6311 Accounting I Summer 2010, Version 2

Uploaded by

api-262218593Copyright:

Available Formats

You might also like

- Accounting Principles 12th Edition Weygandt Solutions Manual Full Chapter PDFDocument37 pagesAccounting Principles 12th Edition Weygandt Solutions Manual Full Chapter PDFEdwardBishopacsy100% (13)

- Exercises On RFBT (Law On Obligations) With AnswersDocument8 pagesExercises On RFBT (Law On Obligations) With Answersjimmy repuelaNo ratings yet

- Landlord Tenant OutlineDocument36 pagesLandlord Tenant OutlineMeaghan Caltabiano100% (1)

- Chapter-Six Accounting For Receivable: Page 1 of 1Document12 pagesChapter-Six Accounting For Receivable: Page 1 of 1Abrha636No ratings yet

- CH 1 Final Copy ADD Theory and Examples 2020-2021Document16 pagesCH 1 Final Copy ADD Theory and Examples 2020-2021Utkarsh SharmaNo ratings yet

- Accounting Fundamentals II: Lesson 5Document8 pagesAccounting Fundamentals II: Lesson 5gretatamaraNo ratings yet

- Account CurrentDocument29 pagesAccount CurrentRicky ManchandaNo ratings yet

- Notes ReceivableDocument4 pagesNotes ReceivableVincent CaesarNo ratings yet

- Learning Guide Learning Guide: Unit of Competence Module Title LG Code: TTLM CodeDocument17 pagesLearning Guide Learning Guide: Unit of Competence Module Title LG Code: TTLM CodeNigussie BerhanuNo ratings yet

- CH 1Document11 pagesCH 1alemayehuNo ratings yet

- Week OnedDocument33 pagesWeek OneddaweiliNo ratings yet

- Chapter 3 Principles II Final FinallDocument16 pagesChapter 3 Principles II Final FinallMathewos Woldemariam BirruNo ratings yet

- Module 6 Notes ReceivablesDocument7 pagesModule 6 Notes ReceivablesMa Leobelle BiongNo ratings yet

- Accounting For Notes Payable: Key Terms and Concepts To KnowDocument16 pagesAccounting For Notes Payable: Key Terms and Concepts To KnowEMBA KUBSNo ratings yet

- 01-Average-Due-Date (Accounts) - Hdiojiu9dcvyqqqpit7gDocument9 pages01-Average-Due-Date (Accounts) - Hdiojiu9dcvyqqqpit7gAsur SkaalNo ratings yet

- A. Super Visor B. Manager C. Employees D. AllDocument2 pagesA. Super Visor B. Manager C. Employees D. Allnahu a dinNo ratings yet

- Accounting 3Document20 pagesAccounting 3Nigussie BerhanuNo ratings yet

- Unit 8. Accounting For ReceivablesDocument20 pagesUnit 8. Accounting For ReceivablesHussen AbdulkadirNo ratings yet

- Unit 8. Accounting For ReceivablesDocument20 pagesUnit 8. Accounting For ReceivablesYonasNo ratings yet

- MA170 Chapter 1Document8 pagesMA170 Chapter 1ishanissantaNo ratings yet

- Prepare, Match and Process ReceiptsDocument15 pagesPrepare, Match and Process Receiptsfishfiya1No ratings yet

- Chapter 6 ReceivablesDocument8 pagesChapter 6 ReceivablesHaileluel WondimnehNo ratings yet

- Learning Guide: Accounts and Budget Support Level IiiDocument19 pagesLearning Guide: Accounts and Budget Support Level IiiNigussie BerhanuNo ratings yet

- Learning Guide: Accounts and Budget Support Level IiiDocument21 pagesLearning Guide: Accounts and Budget Support Level IiirameNo ratings yet

- Average Due Date and Account CurrentDocument80 pagesAverage Due Date and Account CurrentShynaNo ratings yet

- Accounting MidtermDocument13 pagesAccounting MidtermAlaiza Maas LanonNo ratings yet

- Notes ReceivableDocument5 pagesNotes ReceivableallysaallysaNo ratings yet

- Accounting For RecievableDocument13 pagesAccounting For RecievablemikiyastedyNo ratings yet

- M7B Adjusting Process Overview and Accrued IncomeDocument3 pagesM7B Adjusting Process Overview and Accrued IncomeCharles Eli AlejandroNo ratings yet

- Accounting For Notes Receivable: Weygandt - Kieso - KimmelDocument17 pagesAccounting For Notes Receivable: Weygandt - Kieso - KimmelHaftom YitbarekNo ratings yet

- Test Bank Notes ReceivableDocument5 pagesTest Bank Notes ReceivableErrold john DulatreNo ratings yet

- Prepare and Match ReciptsDocument15 pagesPrepare and Match Reciptstafese kuracheNo ratings yet

- Accounting Principles 12th Edition Weygandt Solutions ManualDocument16 pagesAccounting Principles 12th Edition Weygandt Solutions Manualmalabarhumane088100% (32)

- Ac101 ch7Document15 pagesAc101 ch7infinite_dreamsNo ratings yet

- ReceivableDocument24 pagesReceivableMaria MushtaqueNo ratings yet

- Payroll AccountingDocument44 pagesPayroll AccountingYohanes TolasaNo ratings yet

- Pamela Peterson Drake, James Madison UniversityDocument4 pagesPamela Peterson Drake, James Madison Universityveda20No ratings yet

- Cash DiscountsDocument13 pagesCash DiscountsDonquixote MingoNo ratings yet

- Chapter 3 Current Liability PayrollDocument39 pagesChapter 3 Current Liability PayrollAbdi Mucee Tube100% (1)

- Practie Homework CH 9 (25ed) Updated NovDocument3 pagesPractie Homework CH 9 (25ed) Updated NovThomas TermoteNo ratings yet

- Definition of ReceivableDocument9 pagesDefinition of Receivableegram2022No ratings yet

- Process Customer ACCtDocument21 pagesProcess Customer ACCtGemeda AdinewNo ratings yet

- Chapter 2: Accounting For ReceivablesDocument12 pagesChapter 2: Accounting For ReceivablesHabtamu BelachewNo ratings yet

- Fabm 1 - Q2 - Week 1 - Module 1 - Preparing Adjusting Entries of A Service Business - For ReproductionDocument16 pagesFabm 1 - Q2 - Week 1 - Module 1 - Preparing Adjusting Entries of A Service Business - For ReproductionJosephine C QuibidoNo ratings yet

- Notes ReceivableDocument5 pagesNotes ReceivableEllaine Pearl AlmillaNo ratings yet

- Accounts ReceivableDocument21 pagesAccounts ReceivableMurtaza Hussain SyedNo ratings yet

- Chapter-10 Account CurrentDocument5 pagesChapter-10 Account Currentlenovo lenovoNo ratings yet

- 55 Chapter 7 PracticeDocument1 page55 Chapter 7 Practicegio gioNo ratings yet

- Unit 6: Average Due Date: Learning OutcomesDocument21 pagesUnit 6: Average Due Date: Learning OutcomesAshish SultaniaNo ratings yet

- Chapter 2 Non Current LiablitesDocument11 pagesChapter 2 Non Current LiablitesabelNo ratings yet

- Unit 6: Average Due Date: Learning OutcomesDocument21 pagesUnit 6: Average Due Date: Learning OutcomesSreelakshmiMinnalaNo ratings yet

- Clean and Dirty PriceDocument4 pagesClean and Dirty PriceAnkur GargNo ratings yet

- What Are Notes ReceivableDocument2 pagesWhat Are Notes ReceivableDarlene SarcinoNo ratings yet

- 61807bos50279 cp6 U4Document23 pages61807bos50279 cp6 U4Vishvanath VishvanathNo ratings yet

- Average Due DateDocument19 pagesAverage Due DatePriyanshuNo ratings yet

- Notes Payable Test Bank PDFDocument5 pagesNotes Payable Test Bank PDFAB CloydNo ratings yet

- FoA CH 5Document15 pagesFoA CH 5Mekonnen TarikuNo ratings yet

- Learning Guide Learning Guide: Accounts and Budget Support Level IiiDocument26 pagesLearning Guide Learning Guide: Accounts and Budget Support Level IiiAgatNo ratings yet

- CommerceDocument66 pagesCommercemultiverseofkpop25No ratings yet

- Cambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersFrom EverandCambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersRating: 2 out of 5 stars2/5 (4)

- Employment RubricDocument1 pageEmployment Rubricapi-262218593No ratings yet

- Restaurant Entrepreneur Project-Student RequirementsDocument1 pageRestaurant Entrepreneur Project-Student Requirementsapi-262218593No ratings yet

- Entrepreneur Research ActivityDocument1 pageEntrepreneur Research Activityapi-262218593No ratings yet

- 5.03 - NOTES: 6311 Accounting I Summer 2010, Version 2Document15 pages5.03 - NOTES: 6311 Accounting I Summer 2010, Version 2api-262218593No ratings yet

- 3.03 - Resources For Career Information: WWW - Bls.gov/oohDocument1 page3.03 - Resources For Career Information: WWW - Bls.gov/oohapi-262218593No ratings yet

- AccountingDocument1 pageAccountingapi-262218593No ratings yet

- Creating Your Cover LetterDocument4 pagesCreating Your Cover Letterapi-262218593No ratings yet

- 3.02 Key Terms: Sold by A CompanyDocument12 pages3.02 Key Terms: Sold by A Companyapi-262218593No ratings yet

- Activity - Interview MethodsDocument1 pageActivity - Interview Methodsapi-262218593No ratings yet

- 1.01 - NOTES: Generally Accepted Accounting Principles (GAAP) Is Defined As The Set ofDocument27 pages1.01 - NOTES: Generally Accepted Accounting Principles (GAAP) Is Defined As The Set ofapi-262218593No ratings yet

- 1.02 NOTES: 6312 Accounting II Summer 2011 Version 2Document17 pages1.02 NOTES: 6312 Accounting II Summer 2011 Version 2api-262218593No ratings yet

- 3.03 Key Terms: Fiscal PeriodDocument18 pages3.03 Key Terms: Fiscal Periodapi-262218593No ratings yet

- 3.01 Key Terms - Page 1: Departmental Accounting SystemDocument28 pages3.01 Key Terms - Page 1: Departmental Accounting Systemapi-262218593No ratings yet

- 3.03 Key TermsDocument95 pages3.03 Key Termsapi-262218593No ratings yet

- 4.03 Key Terms For Preparing PayrollDocument21 pages4.03 Key Terms For Preparing Payrollapi-262218593No ratings yet

- 2.01 - CONTENT: 6312 Accounting II Summer 2011 Version 2Document11 pages2.01 - CONTENT: 6312 Accounting II Summer 2011 Version 2api-262218593No ratings yet

- Accounting For A Merchandising Business Organized As A Partnership Chapter 12 &13 Preparing Payroll RecordsDocument20 pagesAccounting For A Merchandising Business Organized As A Partnership Chapter 12 &13 Preparing Payroll Recordsapi-262218593No ratings yet

- 3.01 Key TermsDocument17 pages3.01 Key Termsapi-262218593No ratings yet

- 4.02 Steps For Recording Petty Cash EntriesDocument2 pages4.02 Steps For Recording Petty Cash Entriesapi-262218593No ratings yet

- 5.02 - NotesDocument14 pages5.02 - Notesapi-262218593No ratings yet

- 3.02 Key TermsDocument25 pages3.02 Key Termsapi-262218593No ratings yet

- I.03 Content Notes: Key Terms Ethics TermsDocument9 pagesI.03 Content Notes: Key Terms Ethics Termsapi-262218593No ratings yet

- 4.01 Steps For Reconciling A Bank StatementDocument2 pages4.01 Steps For Reconciling A Bank Statementapi-262218593No ratings yet

- 2.02 - NOTES: 6311 Accounting I Summer 2010, Version 2Document18 pages2.02 - NOTES: 6311 Accounting I Summer 2010, Version 2api-262218593No ratings yet

- 1.02 Content Notes: 6311 Accounting I Summer 2010, Version 2Document4 pages1.02 Content Notes: 6311 Accounting I Summer 2010, Version 2api-262218593No ratings yet

- 2.03 - Notes: Trial Balance Is Prepared. Only The Accounts That Have A Balance, Which IncludeDocument8 pages2.03 - Notes: Trial Balance Is Prepared. Only The Accounts That Have A Balance, Which Includeapi-262218593No ratings yet

- Notes: 6311 Accounting I Summer 2010, Version 2Document8 pagesNotes: 6311 Accounting I Summer 2010, Version 2api-262218593No ratings yet

- Conflict Resolution ProcessDocument1 pageConflict Resolution Processapi-262218593No ratings yet

- 1.01 - Content NotesDocument8 pages1.01 - Content Notesapi-262218593No ratings yet

- I MessageDocument1 pageI Messageapi-262218593No ratings yet

- Development in Banking SectorDocument1 pageDevelopment in Banking Sectorhafiz1979No ratings yet

- Consumer Forum JudgmentDocument19 pagesConsumer Forum JudgmentLatest Laws TeamNo ratings yet

- Nego SalaoDocument23 pagesNego SalaoJohn Robert BautistaNo ratings yet

- Worksheet Adi JayaDocument4 pagesWorksheet Adi JayaMarda LenaNo ratings yet

- Cash Flow StatementDocument35 pagesCash Flow StatementShiv Shankar Kumar100% (1)

- TBLDocument14 pagesTBLAsiri KasunjithNo ratings yet

- LAW 107 - Advocates For Truth in Lending, Inc. & Olaguer v. Bangko Sentral Monetary BoardDocument3 pagesLAW 107 - Advocates For Truth in Lending, Inc. & Olaguer v. Bangko Sentral Monetary BoardDanielle AbuelNo ratings yet

- Ireland Financial CrisisDocument15 pagesIreland Financial Crisissantaukura2No ratings yet

- Pnoc Vs KeppelDocument6 pagesPnoc Vs KeppeljessapuerinNo ratings yet

- Risk Management Presentation January 14 2013Document206 pagesRisk Management Presentation January 14 2013George LekatisNo ratings yet

- SKS Microfinance Cse ReportDocument10 pagesSKS Microfinance Cse ReportKomal JainNo ratings yet

- Working Capital ManagementDocument17 pagesWorking Capital ManagementThilaga SenthilmuruganNo ratings yet

- AUD610 Advanced Auditing (Handouts March 2016)Document202 pagesAUD610 Advanced Auditing (Handouts March 2016)ewinze100% (1)

- COA C2012 001 SupportingDocument58 pagesCOA C2012 001 Supportingvocks_200096% (28)

- Canara BankDocument15 pagesCanara BankSanthosh SomaNo ratings yet

- Long-Term Social Impacts and Financial Costs of Foreclosure On Families and Communities of ColorDocument49 pagesLong-Term Social Impacts and Financial Costs of Foreclosure On Families and Communities of ColorJH_CarrNo ratings yet

- BPI v. de Coster, 47 Phil. 594, March 16, 1925Document2 pagesBPI v. de Coster, 47 Phil. 594, March 16, 1925catrina lobatonNo ratings yet

- Commercial Bank Management Midsem NotesDocument12 pagesCommercial Bank Management Midsem NotesWinston WongNo ratings yet

- DMI Housing Finance - Commitment To CustomersDocument5 pagesDMI Housing Finance - Commitment To CustomersDMI HousingNo ratings yet

- SME Finance - Diagnostic ChecklistDocument2 pagesSME Finance - Diagnostic ChecklistcizarNo ratings yet

- MM-FI Integration in PO For Handling Down PaymentsDocument8 pagesMM-FI Integration in PO For Handling Down PaymentsAgastya Pavan KumarNo ratings yet

- Basics of Commercial BankingDocument59 pagesBasics of Commercial BankingRhea PaboralinanNo ratings yet

- Project I04Document2 pagesProject I04DavidHCNo ratings yet

- OkayDocument20 pagesOkayShibly FaroqueNo ratings yet

- Money, Lending, and Interest: Chapter OverviewDocument18 pagesMoney, Lending, and Interest: Chapter OverviewUzair ZulkiflyNo ratings yet

- Tesla Inc. ReportDocument28 pagesTesla Inc. ReportJoel FernandesNo ratings yet

- Everett V Asia BankDocument2 pagesEverett V Asia BankEM RGNo ratings yet

- Manual DFD For Cashiering System Figure 1.1: 1.1 Inquiries of Services and Customer Info 1.3Document1 pageManual DFD For Cashiering System Figure 1.1: 1.1 Inquiries of Services and Customer Info 1.3api-19728830No ratings yet

Notes: 6311 Accounting I Summer 2010, Version 2

Notes: 6311 Accounting I Summer 2010, Version 2

Uploaded by

api-262218593Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Notes: 6311 Accounting I Summer 2010, Version 2

Notes: 6311 Accounting I Summer 2010, Version 2

Uploaded by

api-262218593Copyright:

Available Formats

NOTES

Students must understand the concepts about promissory notes that are listed below to

be able to apply the procedures to prepare journal entries related to notes payable

and notes receivable.

A promissory note is a written and signed promise to pay a sum of money on a

specific date.

Promissory notes are used when a business borrows money from a bank or other

lending agency for a period of time. These are called Notes Payable.

Businesses may request a note from a customer who wants credit beyond the

usual time given for sales on account. These are called Notes Receivable.

Notes can be useful in a court of law as written evidence of a debt.

The time of a note issued for less than one year is usually stated in days. The

time used in calculating interest is usually stated as a fraction of 360 days.

The time between the date a note is signed and the date a note is due (maturity

date) is typically expressed in days. The maturity date is calculated by counting

the exact number of days. The date on which the note is written is not counted,

but the maturity date is counted.

Students may have difficulty knowing or remembering the number of days in each

month. Teachers may teach students the nursery rhyme (Thirty Days Hath

September) or the knuckles and valleys method to determine the number of days

in each month. These ideas can be found by following these links:

http://www.jetcityorange.com/days-of-the-month/ (includes a You-Tube video)

http://www.eudesign.com/mnems/dayspcm.htm

http://www.instructables.com/id/Easy-way-to-remember-the-days-in-each-month/

6311 Accounting I Summer 2010, Version 2 Page 123

CONTENT

I. Calculating Interest, Maturity Date, and Maturity Value on a Note

A. Interest = Principal X Interest Rate X Time in Years

B. Maturity Date

Example: 90-day Note, signed May 18, Maturity Date is August 16

1. Calculate the number of days remaining in May (13) by subtracting the date

of the note (18) from the number of days in May (31): 31 – 18 = 13.

2. Calculate the number of days remaining in the term of the note (77) by

subtracting the number of days in the previous month (13) from the term of

the note (90). Because 77 is greater than the number of days in June (30),

add all of the days in June (30).

3. Calculate the number of days remaining in the term of the note (47) by

subtracting the number of days in the previous months, 43 (13+30), from

the term of the note, 90. Because 43 is greater than the number of days in

July (31), add all of the days in July (31).

4. Calculate the number of days remaining in the term of the note (16) by

subtracting the number of days in the previous months, 74 (13+30+31),

from the term of the note, 90: 90 – 74 = 16. Because 16 is less than the

number of days in August (31), add only 16 days in August. The Maturity

Date is August 16.

C. Maturity Value = Principal + Interest

II. Procedures for Journalizing Notes Payable Transactions

A. Issuance of a note payable

1. Write the date in the Date column of the Cash Receipts Journal.

2. Write the receipt number in the Doc. No. column.

3. Debit Cash for the principal amount of the note.

4. Credit Notes Payable for the principal amount of the note.

B. Payment of principal and interest on a note payable

1. Write the date in the Date column of the Cash Payments Journal.

2. Write the check number in the Doc. No. column.

3. Debit Notes Payable for the principal amount of the note.

4. Debit Interest Expense for the amount of the interest paid.

5. Credit Cash for the total amount paid (maturity value of the note).

C. A note payable issued for an extension of time

1. Write the date in the Date column of the General Journal.

2. Debit Accounts Payable (referencing the appropriate vendor account) for

the principal amount of the note.

3. Credit Notes Payable for the principal amount of the note.

D. Payment on a note payable for an extension of time

1. Write the date in the Date column of the Cash Payments Journal.

2. Write the check number in the Doc. No. column.

3. Debit Notes Payable for the principal amount of the note.

4. Debit Interest Expense for the interest paid.

5. Credit Cash for the total amount paid.

6311 Accounting I Summer 2010, Version 2 Page 124

III. Procedures for Journalizing Notes Receivable Transactions

A. Acceptance of a note receivable from a customer

1. Write the date in the Date column of the General Journal.

2. Write the note number in the Doc. No. column.

3. Debit Notes Receivable for the principal amount of the note.

4. Credit Accounts Receivable (referencing the appropriate customer) for the

principal amount of the note.

B. Collection of principal and interest on a note receivable

1. Write the date in the Date column of the Cash Receipts Journal.

2. Write the receipt number in the Doc. No. column.

3. Debit Cash for the total amount received (maturity value of the note

receivable).

4. Credit Interest Income for the amount of the interest received.

5. Credit Notes Receivable for the principal amount of the note.

C. A dishonored note receivable

1. Write the date in the Date column of the General Journal.

2. Debit Accounts Receivable (referencing the appropriate customer account)

for the total amount of the note, including interest due.

3. Credit Notes Receivable for the principal amount of the note.

4. Credit Interest Income for the interest due on the note.

KEY TERMS

Promissory note Current liabilities

Creditor Long-term liabilities

Note payable Interest-bearing note

Principal (face value Non-interest-bearing note

Term (time Bank discount

Issue date Proceeds

Payee Interest Expense

Maturity date Note receivable

Maker Interest income

Maturity value Dishonored note

6311 Accounting I Summer 2010, Version 2 Page 125

5.01 Calculating Interest, Maturity Date, and Maturity Value

Fill in the blanks with the correct information.

Calculating Interest

The amount paid for the use of money for a period of time is called .

X X = Interest for One Year

Example: $20,000.00 X 6% X 1 = $

X X = Interest for Fraction of Year

Example: $20,000.00 X 6% X 90/360 =

Calculating Maturity Date

The maturity date is calculated by counting the . The

date on which the note is is not counted, but the

date is counted.

Example: Date of 90-day Note – May 18th

May 18-May 31 = 13 days

June = 30 days

July = 31 days

August 1-August 16 = 16 days

Total = 90 days

Calculating Maturity Value

The amount that is due on the maturity date of a note is called the

.

+ =

Example: $20,000.00 + $300.00 = $

6311 Accounting I Summer 2010, Version 2 Page 126

5.01 Calculating Interest, Maturity Date, and Maturity Value –

Calculating Interest

The amount paid for the use of money for a period of time is called interest.

Principal X Interest Rate X Time in Years = Interest for One Year

Example: $20,000.00 X 6% X 1 = $1,200.00

Principal X Interest Rate X Time as Fraction of Year = Interest for Fraction of Year

Example: $20,000.00 X 6% X 90/360 = $300.00

Calculating Maturity Date

The maturity date is calculated by counting the exact number of days.

The date on which the note is written is not counted, but the maturity date

is counted.

Example: Date of 90-day Note – May 18th

May 18-May 31 = 13 days

June = 30 days

July = 31 days

August 1-August 16 = 16 days

Total = 90 days

Calculating Maturity Value

The amount that is due on the maturity date of a note is called the maturity

value.

Principal + Interest = Maturity Value

Example: $20,000.00 + $300.00 = $20,300.00

6311 Accounting I Summer 2010, Version 2 Page 127

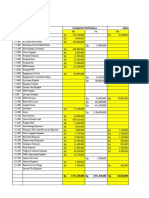

5.01 Journalizing Notes Payable and Notes Receivable

Transactions

Fill in the accounts to complete the entries.

1. Journalizing the Issuance of a Note Payable

Debit

Credit

2. Journalizing the Payment of Principal and Interest on a Note Payable

Debit

Debit

Credit

3. Journalizing a Note Payable for an Extension of Time

Debit

Credit

4. Journalizing Payment on a Note Payable for an Extension of Time

Debit

Debit

Credit

5. Journalizing the Acceptance of a Note Receivable from a Customer

Debit

Credit

6. Journalizing the Collection of Principal and Interest on a Note Receivable

Debit

Credit

Credit

7. Journalizing a Dishonored Note Receivable

Debit

Credit

Credit

6311 Accounting I Summer 2010, Version 2 Page 128

5.01 Journalizing Notes Payable and Notes Receivable

Transactions

Fill in the accounts to complete the entries.

1. Journalizing the Issuance of a Note Payable

Debit Cash

Credit Notes Payable

2. Journalizing the Payment of Principal and Interest on a Note Payable

Debit Notes Payable

Debit Interest Expense

Credit Cash

3. Journalizing a Note Payable for an Extension of Time

Debit Accounts Payable (using the appropriate vendor account)

Credit Notes Payable

4. Journalizing Payment on a Note Payable for an Extension of Time

Debit Notes Payable

Debit Interest Expense

Credit Cash

5. Journalizing the Acceptance of a Note Receivable from a Customer

Debit Notes Receivable

Credit Accounts Receivable (referencing the appropriate customer)

6. Journalizing the Collection of Principal and Interest on a Note Receivable

Debit Cash

Credit Notes Receivable

Credit Interest Income

7. Journalizing a Dishonored Note Receivable

Debit Accounts Receivable (referencing the appropriate customer)

Credit Notes Receivable

Credit Interest Income

6311 Accounting I Summer 2010, Version 2 Page 129

5.01 KEY TERMS

TERM DEFINITION

Promissory note A written promise to pay a certain amount of money at

a specific time

Creditor A person or organization to whom a liability is owed

Note payable A promissory note that a business issues to a creditor

when it borrows or buys on credit

Principal (face value) Amount being borrowed

Term (time) Amount of time ( stated in days, months, or years) the

borrower has to repay the note

Issue date Date on which the note is written and signed

Payee The person or business to whom the amount of a note

is payable

Interest rate Fee charged for use of money; a percentage of the

principal

Maturity date Date a note is due

Maker The person or business borrowing money by note and

promising to repay the principal and interest

Maturity value The amount due at the due date

Current liabilities Liabilities due within a short time, usually within a year

Long-term liabilities Liabilities that are due after one year

Interest-bearing note A note that requires payment of the principal plus

interest on the maturity date

Non-interest-bearing note A note that requires the interest to be paid in advance;

interest is deducted from the face value of the note

Bank discount Interest on a note that is deducted in advance

Proceeds The cash received by the borrower; equals face value

less any bank discount

Interest Expense General ledger account used to record interest paid on

a note; classified as an Other Expense

Note receivable Promissory note that a business accepts from a

customer

Interest income Interest earned on a note receivable; general ledger

account classified as Other Income

Dishonored note A note that is not paid when due

6311 Accounting I Summer 2010, Version 2 Page 130

Notes Payable and Notes Receivable

6311 Accounting I Summer 2010, Version 2 Page 131

You might also like

- Accounting Principles 12th Edition Weygandt Solutions Manual Full Chapter PDFDocument37 pagesAccounting Principles 12th Edition Weygandt Solutions Manual Full Chapter PDFEdwardBishopacsy100% (13)

- Exercises On RFBT (Law On Obligations) With AnswersDocument8 pagesExercises On RFBT (Law On Obligations) With Answersjimmy repuelaNo ratings yet

- Landlord Tenant OutlineDocument36 pagesLandlord Tenant OutlineMeaghan Caltabiano100% (1)

- Chapter-Six Accounting For Receivable: Page 1 of 1Document12 pagesChapter-Six Accounting For Receivable: Page 1 of 1Abrha636No ratings yet

- CH 1 Final Copy ADD Theory and Examples 2020-2021Document16 pagesCH 1 Final Copy ADD Theory and Examples 2020-2021Utkarsh SharmaNo ratings yet

- Accounting Fundamentals II: Lesson 5Document8 pagesAccounting Fundamentals II: Lesson 5gretatamaraNo ratings yet

- Account CurrentDocument29 pagesAccount CurrentRicky ManchandaNo ratings yet

- Notes ReceivableDocument4 pagesNotes ReceivableVincent CaesarNo ratings yet

- Learning Guide Learning Guide: Unit of Competence Module Title LG Code: TTLM CodeDocument17 pagesLearning Guide Learning Guide: Unit of Competence Module Title LG Code: TTLM CodeNigussie BerhanuNo ratings yet

- CH 1Document11 pagesCH 1alemayehuNo ratings yet

- Week OnedDocument33 pagesWeek OneddaweiliNo ratings yet

- Chapter 3 Principles II Final FinallDocument16 pagesChapter 3 Principles II Final FinallMathewos Woldemariam BirruNo ratings yet

- Module 6 Notes ReceivablesDocument7 pagesModule 6 Notes ReceivablesMa Leobelle BiongNo ratings yet

- Accounting For Notes Payable: Key Terms and Concepts To KnowDocument16 pagesAccounting For Notes Payable: Key Terms and Concepts To KnowEMBA KUBSNo ratings yet

- 01-Average-Due-Date (Accounts) - Hdiojiu9dcvyqqqpit7gDocument9 pages01-Average-Due-Date (Accounts) - Hdiojiu9dcvyqqqpit7gAsur SkaalNo ratings yet

- A. Super Visor B. Manager C. Employees D. AllDocument2 pagesA. Super Visor B. Manager C. Employees D. Allnahu a dinNo ratings yet

- Accounting 3Document20 pagesAccounting 3Nigussie BerhanuNo ratings yet

- Unit 8. Accounting For ReceivablesDocument20 pagesUnit 8. Accounting For ReceivablesHussen AbdulkadirNo ratings yet

- Unit 8. Accounting For ReceivablesDocument20 pagesUnit 8. Accounting For ReceivablesYonasNo ratings yet

- MA170 Chapter 1Document8 pagesMA170 Chapter 1ishanissantaNo ratings yet

- Prepare, Match and Process ReceiptsDocument15 pagesPrepare, Match and Process Receiptsfishfiya1No ratings yet

- Chapter 6 ReceivablesDocument8 pagesChapter 6 ReceivablesHaileluel WondimnehNo ratings yet

- Learning Guide: Accounts and Budget Support Level IiiDocument19 pagesLearning Guide: Accounts and Budget Support Level IiiNigussie BerhanuNo ratings yet

- Learning Guide: Accounts and Budget Support Level IiiDocument21 pagesLearning Guide: Accounts and Budget Support Level IiirameNo ratings yet

- Average Due Date and Account CurrentDocument80 pagesAverage Due Date and Account CurrentShynaNo ratings yet

- Accounting MidtermDocument13 pagesAccounting MidtermAlaiza Maas LanonNo ratings yet

- Notes ReceivableDocument5 pagesNotes ReceivableallysaallysaNo ratings yet

- Accounting For RecievableDocument13 pagesAccounting For RecievablemikiyastedyNo ratings yet

- M7B Adjusting Process Overview and Accrued IncomeDocument3 pagesM7B Adjusting Process Overview and Accrued IncomeCharles Eli AlejandroNo ratings yet

- Accounting For Notes Receivable: Weygandt - Kieso - KimmelDocument17 pagesAccounting For Notes Receivable: Weygandt - Kieso - KimmelHaftom YitbarekNo ratings yet

- Test Bank Notes ReceivableDocument5 pagesTest Bank Notes ReceivableErrold john DulatreNo ratings yet

- Prepare and Match ReciptsDocument15 pagesPrepare and Match Reciptstafese kuracheNo ratings yet

- Accounting Principles 12th Edition Weygandt Solutions ManualDocument16 pagesAccounting Principles 12th Edition Weygandt Solutions Manualmalabarhumane088100% (32)

- Ac101 ch7Document15 pagesAc101 ch7infinite_dreamsNo ratings yet

- ReceivableDocument24 pagesReceivableMaria MushtaqueNo ratings yet

- Payroll AccountingDocument44 pagesPayroll AccountingYohanes TolasaNo ratings yet

- Pamela Peterson Drake, James Madison UniversityDocument4 pagesPamela Peterson Drake, James Madison Universityveda20No ratings yet

- Cash DiscountsDocument13 pagesCash DiscountsDonquixote MingoNo ratings yet

- Chapter 3 Current Liability PayrollDocument39 pagesChapter 3 Current Liability PayrollAbdi Mucee Tube100% (1)

- Practie Homework CH 9 (25ed) Updated NovDocument3 pagesPractie Homework CH 9 (25ed) Updated NovThomas TermoteNo ratings yet

- Definition of ReceivableDocument9 pagesDefinition of Receivableegram2022No ratings yet

- Process Customer ACCtDocument21 pagesProcess Customer ACCtGemeda AdinewNo ratings yet

- Chapter 2: Accounting For ReceivablesDocument12 pagesChapter 2: Accounting For ReceivablesHabtamu BelachewNo ratings yet

- Fabm 1 - Q2 - Week 1 - Module 1 - Preparing Adjusting Entries of A Service Business - For ReproductionDocument16 pagesFabm 1 - Q2 - Week 1 - Module 1 - Preparing Adjusting Entries of A Service Business - For ReproductionJosephine C QuibidoNo ratings yet

- Notes ReceivableDocument5 pagesNotes ReceivableEllaine Pearl AlmillaNo ratings yet

- Accounts ReceivableDocument21 pagesAccounts ReceivableMurtaza Hussain SyedNo ratings yet

- Chapter-10 Account CurrentDocument5 pagesChapter-10 Account Currentlenovo lenovoNo ratings yet

- 55 Chapter 7 PracticeDocument1 page55 Chapter 7 Practicegio gioNo ratings yet

- Unit 6: Average Due Date: Learning OutcomesDocument21 pagesUnit 6: Average Due Date: Learning OutcomesAshish SultaniaNo ratings yet

- Chapter 2 Non Current LiablitesDocument11 pagesChapter 2 Non Current LiablitesabelNo ratings yet

- Unit 6: Average Due Date: Learning OutcomesDocument21 pagesUnit 6: Average Due Date: Learning OutcomesSreelakshmiMinnalaNo ratings yet

- Clean and Dirty PriceDocument4 pagesClean and Dirty PriceAnkur GargNo ratings yet

- What Are Notes ReceivableDocument2 pagesWhat Are Notes ReceivableDarlene SarcinoNo ratings yet

- 61807bos50279 cp6 U4Document23 pages61807bos50279 cp6 U4Vishvanath VishvanathNo ratings yet

- Average Due DateDocument19 pagesAverage Due DatePriyanshuNo ratings yet

- Notes Payable Test Bank PDFDocument5 pagesNotes Payable Test Bank PDFAB CloydNo ratings yet

- FoA CH 5Document15 pagesFoA CH 5Mekonnen TarikuNo ratings yet

- Learning Guide Learning Guide: Accounts and Budget Support Level IiiDocument26 pagesLearning Guide Learning Guide: Accounts and Budget Support Level IiiAgatNo ratings yet

- CommerceDocument66 pagesCommercemultiverseofkpop25No ratings yet

- Cambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersFrom EverandCambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersRating: 2 out of 5 stars2/5 (4)

- Employment RubricDocument1 pageEmployment Rubricapi-262218593No ratings yet

- Restaurant Entrepreneur Project-Student RequirementsDocument1 pageRestaurant Entrepreneur Project-Student Requirementsapi-262218593No ratings yet

- Entrepreneur Research ActivityDocument1 pageEntrepreneur Research Activityapi-262218593No ratings yet

- 5.03 - NOTES: 6311 Accounting I Summer 2010, Version 2Document15 pages5.03 - NOTES: 6311 Accounting I Summer 2010, Version 2api-262218593No ratings yet

- 3.03 - Resources For Career Information: WWW - Bls.gov/oohDocument1 page3.03 - Resources For Career Information: WWW - Bls.gov/oohapi-262218593No ratings yet

- AccountingDocument1 pageAccountingapi-262218593No ratings yet

- Creating Your Cover LetterDocument4 pagesCreating Your Cover Letterapi-262218593No ratings yet

- 3.02 Key Terms: Sold by A CompanyDocument12 pages3.02 Key Terms: Sold by A Companyapi-262218593No ratings yet

- Activity - Interview MethodsDocument1 pageActivity - Interview Methodsapi-262218593No ratings yet

- 1.01 - NOTES: Generally Accepted Accounting Principles (GAAP) Is Defined As The Set ofDocument27 pages1.01 - NOTES: Generally Accepted Accounting Principles (GAAP) Is Defined As The Set ofapi-262218593No ratings yet

- 1.02 NOTES: 6312 Accounting II Summer 2011 Version 2Document17 pages1.02 NOTES: 6312 Accounting II Summer 2011 Version 2api-262218593No ratings yet

- 3.03 Key Terms: Fiscal PeriodDocument18 pages3.03 Key Terms: Fiscal Periodapi-262218593No ratings yet

- 3.01 Key Terms - Page 1: Departmental Accounting SystemDocument28 pages3.01 Key Terms - Page 1: Departmental Accounting Systemapi-262218593No ratings yet

- 3.03 Key TermsDocument95 pages3.03 Key Termsapi-262218593No ratings yet

- 4.03 Key Terms For Preparing PayrollDocument21 pages4.03 Key Terms For Preparing Payrollapi-262218593No ratings yet

- 2.01 - CONTENT: 6312 Accounting II Summer 2011 Version 2Document11 pages2.01 - CONTENT: 6312 Accounting II Summer 2011 Version 2api-262218593No ratings yet

- Accounting For A Merchandising Business Organized As A Partnership Chapter 12 &13 Preparing Payroll RecordsDocument20 pagesAccounting For A Merchandising Business Organized As A Partnership Chapter 12 &13 Preparing Payroll Recordsapi-262218593No ratings yet

- 3.01 Key TermsDocument17 pages3.01 Key Termsapi-262218593No ratings yet

- 4.02 Steps For Recording Petty Cash EntriesDocument2 pages4.02 Steps For Recording Petty Cash Entriesapi-262218593No ratings yet

- 5.02 - NotesDocument14 pages5.02 - Notesapi-262218593No ratings yet

- 3.02 Key TermsDocument25 pages3.02 Key Termsapi-262218593No ratings yet

- I.03 Content Notes: Key Terms Ethics TermsDocument9 pagesI.03 Content Notes: Key Terms Ethics Termsapi-262218593No ratings yet

- 4.01 Steps For Reconciling A Bank StatementDocument2 pages4.01 Steps For Reconciling A Bank Statementapi-262218593No ratings yet

- 2.02 - NOTES: 6311 Accounting I Summer 2010, Version 2Document18 pages2.02 - NOTES: 6311 Accounting I Summer 2010, Version 2api-262218593No ratings yet

- 1.02 Content Notes: 6311 Accounting I Summer 2010, Version 2Document4 pages1.02 Content Notes: 6311 Accounting I Summer 2010, Version 2api-262218593No ratings yet

- 2.03 - Notes: Trial Balance Is Prepared. Only The Accounts That Have A Balance, Which IncludeDocument8 pages2.03 - Notes: Trial Balance Is Prepared. Only The Accounts That Have A Balance, Which Includeapi-262218593No ratings yet

- Notes: 6311 Accounting I Summer 2010, Version 2Document8 pagesNotes: 6311 Accounting I Summer 2010, Version 2api-262218593No ratings yet

- Conflict Resolution ProcessDocument1 pageConflict Resolution Processapi-262218593No ratings yet

- 1.01 - Content NotesDocument8 pages1.01 - Content Notesapi-262218593No ratings yet

- I MessageDocument1 pageI Messageapi-262218593No ratings yet

- Development in Banking SectorDocument1 pageDevelopment in Banking Sectorhafiz1979No ratings yet

- Consumer Forum JudgmentDocument19 pagesConsumer Forum JudgmentLatest Laws TeamNo ratings yet

- Nego SalaoDocument23 pagesNego SalaoJohn Robert BautistaNo ratings yet

- Worksheet Adi JayaDocument4 pagesWorksheet Adi JayaMarda LenaNo ratings yet

- Cash Flow StatementDocument35 pagesCash Flow StatementShiv Shankar Kumar100% (1)

- TBLDocument14 pagesTBLAsiri KasunjithNo ratings yet

- LAW 107 - Advocates For Truth in Lending, Inc. & Olaguer v. Bangko Sentral Monetary BoardDocument3 pagesLAW 107 - Advocates For Truth in Lending, Inc. & Olaguer v. Bangko Sentral Monetary BoardDanielle AbuelNo ratings yet

- Ireland Financial CrisisDocument15 pagesIreland Financial Crisissantaukura2No ratings yet

- Pnoc Vs KeppelDocument6 pagesPnoc Vs KeppeljessapuerinNo ratings yet

- Risk Management Presentation January 14 2013Document206 pagesRisk Management Presentation January 14 2013George LekatisNo ratings yet

- SKS Microfinance Cse ReportDocument10 pagesSKS Microfinance Cse ReportKomal JainNo ratings yet

- Working Capital ManagementDocument17 pagesWorking Capital ManagementThilaga SenthilmuruganNo ratings yet

- AUD610 Advanced Auditing (Handouts March 2016)Document202 pagesAUD610 Advanced Auditing (Handouts March 2016)ewinze100% (1)

- COA C2012 001 SupportingDocument58 pagesCOA C2012 001 Supportingvocks_200096% (28)

- Canara BankDocument15 pagesCanara BankSanthosh SomaNo ratings yet

- Long-Term Social Impacts and Financial Costs of Foreclosure On Families and Communities of ColorDocument49 pagesLong-Term Social Impacts and Financial Costs of Foreclosure On Families and Communities of ColorJH_CarrNo ratings yet

- BPI v. de Coster, 47 Phil. 594, March 16, 1925Document2 pagesBPI v. de Coster, 47 Phil. 594, March 16, 1925catrina lobatonNo ratings yet

- Commercial Bank Management Midsem NotesDocument12 pagesCommercial Bank Management Midsem NotesWinston WongNo ratings yet

- DMI Housing Finance - Commitment To CustomersDocument5 pagesDMI Housing Finance - Commitment To CustomersDMI HousingNo ratings yet

- SME Finance - Diagnostic ChecklistDocument2 pagesSME Finance - Diagnostic ChecklistcizarNo ratings yet

- MM-FI Integration in PO For Handling Down PaymentsDocument8 pagesMM-FI Integration in PO For Handling Down PaymentsAgastya Pavan KumarNo ratings yet

- Basics of Commercial BankingDocument59 pagesBasics of Commercial BankingRhea PaboralinanNo ratings yet

- Project I04Document2 pagesProject I04DavidHCNo ratings yet

- OkayDocument20 pagesOkayShibly FaroqueNo ratings yet

- Money, Lending, and Interest: Chapter OverviewDocument18 pagesMoney, Lending, and Interest: Chapter OverviewUzair ZulkiflyNo ratings yet

- Tesla Inc. ReportDocument28 pagesTesla Inc. ReportJoel FernandesNo ratings yet

- Everett V Asia BankDocument2 pagesEverett V Asia BankEM RGNo ratings yet

- Manual DFD For Cashiering System Figure 1.1: 1.1 Inquiries of Services and Customer Info 1.3Document1 pageManual DFD For Cashiering System Figure 1.1: 1.1 Inquiries of Services and Customer Info 1.3api-19728830No ratings yet