Professional Documents

Culture Documents

44608bos34430smipages Mod1 PDF

44608bos34430smipages Mod1 PDF

Uploaded by

Navin Man Singh ShresthaCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Prodigal Son - Veronica LancetDocument555 pagesThe Prodigal Son - Veronica LancettashirabavaNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Securities Contracts (Regulation) Act, 1956: © The Institute of Chartered Accountants of IndiaDocument38 pagesSecurities Contracts (Regulation) Act, 1956: © The Institute of Chartered Accountants of IndiaNavin Man Singh ShresthaNo ratings yet

- Concept of Insolvency and BankruptcyDocument68 pagesConcept of Insolvency and BankruptcyNavin Man Singh ShresthaNo ratings yet

- Appointment and Remuneration of Managerial Personnel: © The Institute of Chartered Accountants of IndiaDocument29 pagesAppointment and Remuneration of Managerial Personnel: © The Institute of Chartered Accountants of IndiaNavin Man Singh ShresthaNo ratings yet

- 169final New Syllabus PDFDocument15 pages169final New Syllabus PDFNavin Man Singh ShresthaNo ratings yet

- Revised Scheme of Education and Training For Ca Course, Faqs and Implementation ScheduleDocument2 pagesRevised Scheme of Education and Training For Ca Course, Faqs and Implementation ScheduleNavin Man Singh ShresthaNo ratings yet

- Lec. Intro Lec. Basic Lec.1 Lec.6: CA Final Custom Module Lecture DetailsDocument2 pagesLec. Intro Lec. Basic Lec.1 Lec.6: CA Final Custom Module Lecture DetailsNavin Man Singh ShresthaNo ratings yet

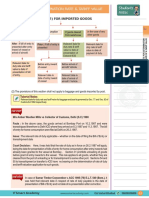

- Section 15 (1) For Imported Goods: Date For Determination Rate & Tariff ValueDocument6 pagesSection 15 (1) For Imported Goods: Date For Determination Rate & Tariff ValueNavin Man Singh ShresthaNo ratings yet

- Students Notes: Person-In-Charge of A Vessel or An Aircraft Entering IndiaDocument20 pagesStudents Notes: Person-In-Charge of A Vessel or An Aircraft Entering IndiaNavin Man Singh ShresthaNo ratings yet

- Me6301 Engineering Thermodynamics Lecture Notes PDFDocument139 pagesMe6301 Engineering Thermodynamics Lecture Notes PDFvenkat_mie1080100% (2)

- Analisis Akuntabilitas Transparansi Dan EfektivitaDocument15 pagesAnalisis Akuntabilitas Transparansi Dan EfektivitanurulNo ratings yet

- Grid Analysis: Making A Decision by Weighing Up Different FactorsDocument2 pagesGrid Analysis: Making A Decision by Weighing Up Different FactorsFebby LienNo ratings yet

- 7.09 Review Maths Algebra 2Document19 pages7.09 Review Maths Algebra 2dekoes0% (1)

- UD11T4107 English Maritime History Human FactorDocument4 pagesUD11T4107 English Maritime History Human FactorParminder singh parmarNo ratings yet

- Master Radiology Notes GIT PDFDocument115 pagesMaster Radiology Notes GIT PDFuroshkgNo ratings yet

- Health Lesson 2Document13 pagesHealth Lesson 2rosemarie guimbaolibotNo ratings yet

- 07 Local Search AlgorithmsDocument32 pages07 Local Search AlgorithmsQuynh Nhu Tran ThiNo ratings yet

- GenChem - Acetylsalicylic AcidDocument4 pagesGenChem - Acetylsalicylic Acidelnini salaNo ratings yet

- Introduction To The PoemDocument260 pagesIntroduction To The PoemDavid Andrés Villagrán Ruz100% (3)

- Advantages and Disadvantages of Federalism Federalism's AdvantagesDocument1 pageAdvantages and Disadvantages of Federalism Federalism's AdvantagesjoyfandialanNo ratings yet

- DNA Rules On EvidenceDocument4 pagesDNA Rules On EvidenceZoe Gacod Takumii UsuiiNo ratings yet

- 3 - PRobabilityDocument17 pages3 - PRobabilityAnonymous UP5RC6JpGNo ratings yet

- MidtermDocument1 pageMidtermDarex Arcega BiaganNo ratings yet

- Surgical Site Infection: Dr. Maryam. Surgical Unit 3Document22 pagesSurgical Site Infection: Dr. Maryam. Surgical Unit 3med stuNo ratings yet

- The Child As ReaderDocument7 pagesThe Child As ReaderDeepa AgarwalNo ratings yet

- ARTS10 q1 Mod3 The Modern Filipino Artists FINAL CONTENTDocument21 pagesARTS10 q1 Mod3 The Modern Filipino Artists FINAL CONTENTMarites t. TabijeNo ratings yet

- Aisha Ra AgeDocument11 pagesAisha Ra Agepoco X3No ratings yet

- Full CalculationDocument8 pagesFull CalculationkprabishNo ratings yet

- International Econ Salvatore CH 1 4 Practice QuestionsDocument17 pagesInternational Econ Salvatore CH 1 4 Practice QuestionsalliNo ratings yet

- Lea 4Document53 pagesLea 4Anna Marie Ventayen Miranda100% (1)

- Aristotelian and Galilean Views On MotionDocument26 pagesAristotelian and Galilean Views On MotionMARIA BELENDA GALLEGANo ratings yet

- Arabic Subject PronounsDocument2 pagesArabic Subject Pronounsainabalqis roslyNo ratings yet

- Alexa Gomez Analysis of The RavenDocument3 pagesAlexa Gomez Analysis of The RavenAlexa GomezNo ratings yet

- Eugenics, The Science of Improving The Human Species by Selectively Mating People With SpecificDocument3 pagesEugenics, The Science of Improving The Human Species by Selectively Mating People With SpecificIrwan M. Iskober100% (1)

- OAuth Echo - Identity Veri Cation Delegation (DraftDocument2 pagesOAuth Echo - Identity Veri Cation Delegation (Draftapi-25885864No ratings yet

- OptoelectronicsDocument23 pagesOptoelectronicsChristian Dave TamparongNo ratings yet

- The Following Text Is For Questions 8-9: Announcement English Conversation Club (ECC)Document2 pagesThe Following Text Is For Questions 8-9: Announcement English Conversation Club (ECC)Dian SaputriNo ratings yet

- Critical Analysis of Medical Negligence in IndiaDocument33 pagesCritical Analysis of Medical Negligence in IndiapiyuNo ratings yet

44608bos34430smipages Mod1 PDF

44608bos34430smipages Mod1 PDF

Uploaded by

Navin Man Singh ShresthaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

44608bos34430smipages Mod1 PDF

44608bos34430smipages Mod1 PDF

Uploaded by

Navin Man Singh ShresthaCopyright:

Available Formats

FINAL COURSE STUDY MATERIAL

PAPER 3

Advanced Auditing and

Professional Ethics

MODULE – 1

BOARD OF STUDIES

THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA

© The Institute of Chartered Accountants of India

This Study Material has been prepared by the faculty of the Board of Studies. The objective of

the Study Material is to provide teaching material to the students to enable them to obtain

knowledge and skills in the subject. In case students need any clarifications or have any

suggestions to make for further improvement of the material contained herein, they may write

to the Director of Studies.

All care has been taken to provide interpretations and discussions in a manner useful for the

students. However, the Study Material has not been specifically discussed by the Council of

the Institute or any of its Committees and the views expressed herein may not be taken to

necessarily represent the views of the Council or any of its Committees.

Permission of the Institute is essential for reproduction of any portion of this material.

THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA

All rights reserved. No part of this book may be reproduced, stored in retrieval system, or

transmitted, in any form, or by any means, Electronic, Mechanical, photocopying, recording, or

otherwise, without prior permission in writing from the publisher.

Revised Edition : January, 2017

Website : www.icai.org

Department/ : Board of Studies

Committee

E-mail : bos@icai.in

ISBN No. :

Price : `

Published by : The Publication Department on behalf of The Institute of Chartered

Accountants of India, ICAI Bhawan, Post Box No. 7100, Indraprastha

Marg, New Delhi-110 002, India.

Typeset and designed at Board of Studies.

Printed by : Sahitya Bhawan Publications, Hospital Road, Agra 282 003

ii

© The Institute of Chartered Accountants of India

SYLLABUS

PAPER 3: ADVANCED AUDITING AND PROFESSIONAL ETHICS

(One Paper- Three hours - 100 marks)

Level of Knowledge: Advanced knowledge

Objectives:

(a) To gain expert knowledge of current auditing practices and procedures and apply them in

auditing engagements,

(b) To develop ability to solve cases relating to audit engagements.

Contents:

1. Auditing Standards, Statements and Guidance Notes

Auditing and Assurance Standards (AASs); Statements and Guidance Notes on Auditing

issued by the ICAI; Significant differences between Auditing and Assurance Standards

and International Standards on Auditing.

2. Audit strategy, planning and programming

Planning the flow of audit work; audit strategy, planning programme and importance of

supervision: review of audit notes and working papers; drafting of reports; principal’s

ultimate responsibility; extent of delegation; control over quality of audit work; reliance on

the work of other auditor, internal auditor or an expert.

3. Risk Assessment and Internal Control

Evaluation of internal control procedures; techniques including questionnaire, flowchart;

internal audit and external audit, coordination between the two.

4. Audit under computerized information system (CIS) environment

Special aspects of CIS Audit Environment, need for review of internal control especially

procedure controls and facility controls. Approach to audit in CIS Environment, use of

computers for internal and management audit purposes: audit tools, test packs,

computerized audit programmes; Special Aspects in Audit of E-Commerce Transaction.

5. Special audit techniques

(a) Selective verification; statistical sampling: Special audit procedures; physical

verification of assets, direct confirmation of debtors and creditors

(b) Analytical review procedures

(c) Risk-based auditing.

6. Audit of limited companies

Relevant provisions under the Companies Act, 2013 relating to Audit and Auditors and

Rules made thereunder; Audit of branches; joint audits; Dividends and divisible profits-

financial, legal, and policy considerations.

iii

© The Institute of Chartered Accountants of India

7. Rights, duties, and liabilities of auditors; third party liability.

8. Audit reports; Qualifications, notes on accounts, distinction between notes and

qualifications, detailed observations by the statutory auditor to the management vis-a-vis

obligations of reporting to the members.

9. Audit Committee and Corporate Governance

10. Provisions under the Companies Act, 2013 in respect of Accounts of Companies and

Rules made thereunder. Audit of Consolidated Financial Statements, Audit Reports and

Certificates for Special Purpose engagements; Certificates under the Payment of Bonus

Act, import/export control authorities, etc.; Specific services to non-audit clients;

Certificate on Corporate Governance.

11. Special features of audit of banks, insurance companies, co-operative societies and non-

banking financial companies.

12. Audit under Fiscal Laws, viz, Direct and Indirect Tax Laws.

13. Cost audit

14. Special audit assignments like audit of bank borrowers, audit of stock and commodity

exchange intermediaries and depositories; inspection of special entities like banks,

financial institutions, mutual funds, stock brokers.

15. Special features in audit of public sector companies. Directions of Comptroller and

Auditor General of India to statutory auditors; Concepts of propriety and efficiency audit.

16. Internal audit, management and operational audit. Nature and purpose, organisation,

audit programme, behavioural problems; Internal Audit Standards issued by the ICAI;

Specific areas of management and operational audit involving review of internal control,

purchasing operations, manufacturing operations, selling and distribution, personnel

policies, systems and procedures. Aspects relating to concurrent audit.

17. Investigation and Due Diligence.

18. Concept of peer review

19. Salient features of Sarbanes – Oxley Act, 2002 with special reference to reporting on

internal control.

20. Professional Ethics

Code of Ethics with special reference to the relevant provisions of The Chartered

Accountants Act, 1949 and the Regulations thereunder.

Note:

(i) The provisions of the Companies Act, 1956 which are still in force would form part

of the syllabus till the time their corresponding or new provisions of the

Companies Act, 2013 are enforced.

(ii) If new legislations are enacted in place of the existing legislations, the syllabus

would include the corresponding provisions of such new legislations with effect

from a date notified by the Institute.

iv

© The Institute of Chartered Accountants of India

A WORD ABOUT STUDY MATERIAL

Auditing is, perhaps, one of the most practical-oriented subjects in the C.A. curriculum. This

paper aims to provide working knowledge of generally accepted auditing procedures and of

techniques and skills needed to apply them in audit engagements. A good knowledge of the

subject would provide a strong foundation to students while pursuing the Chartered

Accountancy course. A good understanding of the theoretical concepts, particularly, in the

context of auditing standards would make practical training an enriching and enjoying

experience. While studying this paper, students are advised to integrate the knowledge

acquired in other subjects, specifically, accounting and corporate laws in a meaningful

manner. Such learning would only help a student to become a better professional.

The study material deals with the conceptual theoretical framework in detail. Its main features

are as under:

• The entire syllabus has been divided into twenty two chapters.

• In each chapter, the topic has been covered in a step by step approach. The text has

been explained, where appropriate, through illustrations and practical problems. You

should go through the chapter carefully ensuring that you understand the topic and then

can tackle the exercises.

Handbook on Auditing Pronouncements comprises of Standards on Auditing and Guidance

Notes.

The Practice Manual aims to provide guidance as to the manner of writing an answer in the

examination. Main features of Practice Manual are as under:

• After completing the Chapters of Study Material, Students are expected to attempt the

questions and then compare it with the actual answers.

• Compilation of questions appearing during last twenty examinations.

• Exercises have been given at the end of each topic for independent practice.

This study material has been revised in view of Companies Act, 2013, Reporting under CARO,

2016, Notification/Circulars issued by MCA, CBDT, SEBI, RBI, ICAI including Listing Order

Disclosure Requirements, Consolidated Financial Statements, Internal Controls, ICDS, Tax

Audit Form 3CD, New and Revised Standards on Auditing etc. This revised study material

contains the ‘highlights of changes’ in the tabular form to aid the students to know what and

where the updates are made in the module. It may also be noted that Chapter 8, 9 and 10 are

majorly revised therefore relevant page numbers are not given in table. The changes have

been inserted in the bold italics for convenience of the students.

It is important to note that till the time Statements, Engagement and Quality Control Standards,

© The Institute of Chartered Accountants of India

Guidance Notes, Code of Ethics etc. bare documents get updated from Auditing and Assurance

Standard Board, Ethical Standard Board of ICAI and other Competent Authority in pursuance of the

Companies Act, 2013, students are required to understand the basic nature of the provision and quote

the same along with the new corresponding provisions.

• Attention is invited to the Significant Additions/Modifications made in this edition of

the study material which are given on the next page.

• Please note that the changes over the previous edition have been indicated in bold

and italics in the chapters.

• New case studies and Examples have been added to explain the application of the

existing concepts in and these have been indicated in grey background.

• Diagrammatic Presentation has been made in most of Chapters for quick revision of

described concept.

• Feedback form is given at the end of this study material wherein students are

encouraged to give their feedback/suggestions.

In case you need any further clarification/guidance, please send your queries at

karuna.bhansali@icai.in and Rajeev.sachdeva@icai.in.

vi

© The Institute of Chartered Accountants of India

SIGNIFICANT ADDITIONS IN THE REVISED EDITION

Chapter Chapter Name Section / Sub-Section wherein Page

No. Additions / updation have been done Number

1.5 Quality Control and Engagement 1.6

Standards

1.6.2 Guidance Note on Audit Reports 1.9

and Certificates for Special Purposes

1.6.15 Guidance Note on Audit of 1.15

Consolidated Financial

Statements(CFS)

Auditing Standards,

1 Statements and Guidance 1.6.16 Guidance Note on CARO 2016 1.16

Notes – An Overview 1.6.17 Guidance Notes on Audit of 1.16

Internal Financial Controls over

Financial Reporting

1.6.18 Guidance Note on Reporting on 1.16

Fraud under section 143(12) of the

Companies Act, 2013

1.8.5 Ind AS (Indian Accounting 1.21

Standards)

3.2 Internal Control System - Nature, 3.2

Scope, Objectives and Structure

Risk Assessment and

3 Internal Control 3.3 Components of Internal Controls 3.7

3.4 Review of the System of Internal 3.13

Controls

Insertion of Example on Section 144 6.7

Insertion of Example on Auditor 6.13

Rotation

Clarification on Auditor’s Rotation 6.14

6 The Company Audit Provision

6.6.1 Removal of Auditor before 6.19

Expiry of Term

6.6.2 Appointment of Auditor other than 6.20

retiring Auditor

vii

© The Institute of Chartered Accountants of India

6.9 Duties of Auditors 6.29

6.14 Cost Audit 6.43

6.16.1 Financial Statements 6.47

6.16.2 Consolidated Financial 6.48

Statement

6.16.5 Form of the Balance Sheet 6.51

Appendix- General Instructions for 6.71

preparation of Balance Sheet

7 Liabilities of Auditor 7.5 Criminal Liability under the 7.20

Companies Act

8 Audit Report Almost Complete Chapter

9 Audit Committee and Almost Complete Chapter

Corporate Governance

10 Audit of Consolidated Almost Complete Chapter

Financial Statements

11.1 Introduction 11.1

11.3 Form and Content of Financial 11.2

Statements

11.4 Audit of Accounts 11.4

11 Audit of Banks Announcement on Demonetisation 11.10

11.5.11 Compliance with CRR and 11.16

SLR requirements

11.6 Verification of Assets and 11.21

Balances

14 Audit of Non-Banking 14.5.2 Compliance with CARO 2016: 14.16

Financial Companies

15 Audit under Fiscal Laws 15.3.2 Income Computation and 15.11

Disclosure Standards (ICDS)

15.3.4 Clause 13 (d), (e), (f) of Form 15.26

3CD

16 Cost Audit 16.6 Cost Audit under the Companies 16.10

Act

17 Special Audit 17.9.2 Audit Report 17.23

Assignments

viii

© The Institute of Chartered Accountants of India

18 Audit of Public Sector 18.9.3 Propriety elements under 18.23

Undertakings CARO,2016

19 Internal Audit, 19.6 Relationship between Internal and 19.12

Management and External Auditors

Operational Audit

20 Investigation and Due Reporting of Fraud under section 143(12) 20.3

Diligence

22.4.5 MEMBER IN PRACTICE 22.11

PROHIBITED FROM USING A

DESIGNATION OTHER THAN

CHARTERED ACCOUNTANT

22.8 Schedules to the Act:

22 Professional Ethics (i) The First Schedule-Part 1: Insertion

of Proviso in Clause 6 22.22

(ii) Website Guidelines in Clause 6 22.24

(iii) Regulation 192. Restriction on

fees 22.46

(iv) Insertion in General Resolution in

Clause 11 22.48

ix

© The Institute of Chartered Accountants of India

STUDY PLAN – KEY TO EFFECTIVE LEARNING

As Benjamin Franklin said, “By failing to prepare, you are preparing to fail.”

Preparation is first and very important step towards success. For doing preparation of

CA. Final Paper 3 - Advanced Auditing and Professional Ethics Examination, one has

to be very careful as preparation consists of Study as well as Revision.

When you are starting for studies you must have all relevant material for subject and

strategy to study. Study includes all relevant and reference material whereas strategy

tells us how to effectively use the same. In absence of any of both it will be difficult to

get through.

Study

Relevant Strategy to

Materials Study

Study Material Practice Manual Auditing Reference Concentration

Pronouncements Materials and focus

Notified Sections of the

Engagement and Companies Act, 2013 Preparation of

Quality Control and Legislative Flow Charts for

Standards Amendments issued by Quick Revision

Regulating Authorities

till 31st October, 2016

Guidance Notes Collection of

questions

covering major

Forms 3CA, 3CB, 3CD; provisins for

LODR;CFS; Reporting revision before

Statements under CARO, 2016 etc. Examination

Attempt Mock

Test Papers to

check knowledge

RTP, Compiler, and preparation

Suggested Answers etc level

.

Analysis of

weakness and

then imporving

the same

Refer the diagram given above it is important to note that Latest Study Material and

Practice Manual which is further divided in into twenty two chapters in our study

material covering in detail, principles of Auditing, Standards on Auditing issued by the

ICAI, reporting on internal control as a part of Risk Assessment and Internal Control,

© The Institute of Chartered Accountants of India

specific audit issues classified by organizations like Company Audit, Audit of Banks,

Audit of General Insurance Business, Audit of Co-Operative Societies, NBFCs and Audit of

Public Sector Undertakings, special audit issues like audit under Fiscal Laws, role of

auditor as per Listing Order and Disclosure Requirements, Audit of Consolidated Financial

Statements, Investigation and Due Diligence and Salient features of Sarbanes Oxley Act,

2002. In addition to above, Peer Review is considered as an important step towards

maintenance and improvement of audit quality. Similarly, Professional Ethics are regarded

as a foundation to the audit function, which is essentially developed on the foundation of

ethical norms, which has so far brought name and fame to the profession. All students of

Final course should read these chapters with sincerity and imbibe the norms explained.

These Chapters are comprehensively covered in our Latest Study Material incorporating

all relevant changes.

Students may also note that relevant notified Sections of the Companies Act, 2013 and

other legislative amendments i.e. Rules, significant notifications and circulars issued

by SEBI, RBI, NBFC, MCA etc up to 31st October, 2016 are applicable for May, 2017

and up to 30th April, 2017 are applicable for November, 2017 & onward Examination.

Students must go through the Study Material along with other reference materials. It is

important to note that auditing is largely a practical and application discipline. Students

should learn the Auditing concepts and techniques as also their intricacies purely for

purposes of applying them in practice in their audit work.

For the purpose of its full coverage syllabus of this paper may be segregated

into following seven parts for preparation:

Part I Engagements and Quality Control Standards on Auditing

(SA/SRS/SRE/SAE) and Guidance Notes

Part II Audit strategy, planning and programming, Risk Assessment and Internal

Control, Audit under computerized information system (CIS) environment,

Special audit techniques

Part III Audit of limited companies, Rights, duties, and liabilities of auditors; third

party liability, Audit Committee and Corporate Governance

Part IV Audit Reports, Audit of Consolidated Financial Statements, Certificate on

Corporate Governance

Part V Special features of audit of banks, insurance companies, co-operative

societies and non-banking financial companies, Audit under Fiscal Laws, viz,

Direct and Indirect Tax Laws, Cost audit, Special audit assignments like

audit of bank borrowers, audit of stock and commodity exchange

intermediaries and depositories; inspection of special entities like banks,

xi

© The Institute of Chartered Accountants of India

financial institutions, mutual funds, stock brokers.

Part VI Special features in audit of public sector companies, Internal Audit,

Management and Operational Audit, Investigation and Due Diligence,

Concept of Peer Review.

Part VII Professional Ethics

In first part you may prepare Engagements and Quality Control Standards on Auditing

(SA/SRS/SRE/SAE) and Guidance Notes for which list of applicable standards are

published by ICAI from time to time. For doing preparation for Part First, read the bare

standard along with its application and other explanatory material. After reading this

you are advised to draw a flow chart or some diagrammatic presentation for your better

understanding and revision purpose. You are also expected to focus on the application

aspects of each of the Auditing Standards and guidance notes. As it is important to

have the basic understanding, the objective is to the gain the ability to practice the

same in the working scenario.

In part two, you may prepare audit strategy, planning and programming, risk

assessment and internal control evaluation, audit under computerized information

system (CIS) environment, special audit techniques like selective verification;

statistical sampling; special audit procedures; physical verification of assets, direct

confirmation of debtors and creditors, analytical review procedures, risk-based auditing

etc. While doing preparation for this part, you may interlink it with Auditing Standards,

specially the series of SA 300 – 499 i.e. Risk Assessment and Response to Assessed

Risks and series of SA 500 – 599 Audit Evidence.

For the preparation of Audit Strategy, Planning and Programming, you should practice

developing an “Engagement Approach Document”. The Approach document should

primarily outline the activity based scoping of an engagement and planning of the

procedures for each of the activity. An Approach Document should treat each engagement

as a project which would highlight the resource requirements in each activity area and

scheduling as well. Similarly for the Risk Assessment and Internal Control Evaluation you

should gain understanding of the Risk Management Framework, relevance of control

procedures, control assessment questionnaires and the complementary role that the

internal and external audit plays. Further you should apply the accounting knowledge; and

business intelligence framework along with the ratio analysis and trend reviews for any

un-reasonable gaps in inputs provided / made available.

In part three, you may incorporate audit of limited companies, rights, duties and

liabilities of auditors, third party liability and Audit Committee and corporate

governance. For better understanding, you must have good knowledge of the

Companies Act which is pre-requisite. Not only knowledge but updation of knowledge

is also required on time to time basis.

xii

© The Institute of Chartered Accountants of India

In part four, you may include Audit Reports, Reporting under CARO, 2016 and Audit of

Consolidated Financial Statements. While doing study of Audit Reports, you may

interlink this with series of SA 700-799 i.e. Audit Conclusion and Reporting and

sections 143 of the Companies Act, 2013. You are also required to practice the

drafting of qualifications. You may also scan through the Annual Financial Statements

of Companies to analyse the notes and qualifications, if any, incorporated by the

Auditors in their Audit Report.

In part five, you may include miscellaneous audits like audit of banks, insurance

companies, co-operative societies, NBFCs, audit under fiscal laws, cost audit and

special audit assignments. For the preparation of part five, deep knowledge of

statutory requirements is a pre-requisite for validation to adherence of the business

with applicable laws. For this you should follow a check-list approach ensuring

completeness of compliance validations. Further, you should update yourself with

latest notification, circulars etc. You may also interlink the above part with guidance

notes already covered in part one.

In part six, you should prepare special features in audit of public sector companies,

internal audit, management and operational audit, investigation and due diligence and

concept of peer review. For the preparation of this part, you are again required to have

sound knowledge of statutory requirements.

Last but not the least; in the seventh part you may prepare Professional Ethics.

Generally it has been observed that there is one question i.e. case studies based

question of 16 marks in the examination paper. For better preparation of this part you

are advised to read the 22 Chapter of the Study Material in detail which elaborates this

topic along with examples. Further, you may write down all the clauses in notes form

for the revision purpose.

While answering the case studies based question, answer should be split in to two

parts, first one is Facts of the case and second one is the relevant concept and finally

give your own conclusion. In this way the case study and application oriented theory

questions can be answered.

Fact of the Case Provisions and Explanation Conclusion

Diagram showing Steps for Answering of Case Study

As in all other subjects of CA course, to excel in Audit proper preparation and planning

is very much required to avoid failure. Further Audit is a paper which requires a

xiii

© The Institute of Chartered Accountants of India

practical approach towards actual Audit work. You should in the first instance focus on

studying Auditing concepts, procedures and techniques from the study material. The

knowledge being so derived may be related by the students to the practical work in the

field of Auditing which they do as part of their Articles training.

Part three, five and six are based on statutory requirements. Therefore, you must be

cautious about the amendments and updates happened at least six months before the

exam and also go through the other amendments. Further, you should also take a

keen interest in updating yourself on contemporary developments in the field of

auditing by regularly referring to articles on Auditing in CA Journal, Students' monthly

Journal and other relevant professional journals, publications and books. It is also

advisable to mention applicable Engagement Quality Control Standards or Accounting

Standards or Sections in audit paper wherever required. Answers should be crisp,

precise and to the point to secure good marks.

Audit is a subject that requires a lot of quick and logical application of mind to answer

practical problems. Hence, give a reading to ICAI audit study material and Practice

Manual to understand the depth and figure out the efforts and time required for

preparation. In addition to study material suggested answers of past examination,

Revisionary Test Papers, Standard books should also be read.

Study Revision Preparation

Your study and preparation should be in such manner that you are able to revise the same in

one day time span. Finally don't forget to revise as already shown in diagram Study and

Revision both are essential for Preparation for Examination.

“Give me six hours to chop down a tree and I will spend the first four sharpening the

axe.” ―Abraham Lincoln

Happy Reading and Best Wishes!

xiv

© The Institute of Chartered Accountants of India

CONTENTS

MODULE – 1

Chapter 1 – Auditing Standards, Statements and Guidance Notes – An Overview

Chapter 2 – Audit Strategy, Planning and Programming

Chapter 3 – Risk Assessment and Internal Control

Chapter 4 – Audit under Computerised Information System (CIS) Environment

Chapter 5 – Special Audit Techniques

Chapter 6 – The Company Audit

Chapter 7 – Liabilities of Auditors

Chapter 8 – Audit Report

Chapter 9 – Audit Committee and Corporate Governance

Chapter 10 – Audit of Consolidated Financial Statements

MODULE – 2

Chapter 11 – Audit of Banks

Chapter 12 – Audit of General Insurance Companies

Chapter 13 – Audit of Co-Operative Societies

Chapter 14 – Audit of Non Banking Financial Companies

Chapter 15 – Audit under Fiscal Laws

Chapter 16 – Cost Audit

MODULE – 3

Chapter 17 – Special Audit Assignments

Chapter 18 – Audit of Public Sector Undertakings

Chapter 19 – Internal Audit, Management and Operational Audit

Chapter 20 – Investigation and Due Diligence

Chapter 21 – Peer Review

Chapter 22 – Professional Ethics

xvii

© The Institute of Chartered Accountants of India

DETAILED CONTENTS: MODULE – 1

CHAPTER 1 : AUDITING STANDARDS, STATEMENTS AND GUIDANCE NOTES - AN

OVERVIEW

1.1 Introduction ..................................................................................................... 1.1

1.2 Historical Retrospect ........................................................................................ 1.1

1.3 Auditing and Assurance Standards Board – Scope and Functions ..................... 1.2

1.4 Framework of Standards and Guidance Notes on Related Services .................. 1.5

1.5 Quality Control and Engagement Standards ................ ……………………..........1.6

1.6 Guidance Notes ............................................................................................... 1.8

1.7 Guidance Note(s) on Related Services ........................................................... 1.17

1.8 Authority Attached to the Documents issued by the Institute ........................... 1.17

CHAPTER 2: AUDIT STRATERGY, PLANNING AND PROGRAMMING

2.1 Commencing an Audit ...................................................................................... 2.1

2.2 Overall Audit Strategy ...................................................................................... 2.4

2.3 Audit Programme ............................................................................................. 2.8

CHAPTER 3: RISK ASSESSMENT AND INTERNAL CONTROL

3.1 Introduction ..................................................................................................... 3.1

3.2 Internal Control System - Nature, Scope, Objective and Structure ..................... 3.2

3.3 Components of Internal Control ........................................................................ 3.7

3.4 Review of the System of Internal Controls ...................................................... 3.13

3.5 Methods of Recording .................................................................................... 3.15

3.6 Internal Control and Risk Assessment ............................................................ 3.26

3.7 Internal control in Small Business Enterprises ................................................ 3.34

3.8 Reporting to clients on Internal Control Weaknesses ...................................... 3.34

Annexure -The Sarbanes – Oxley Act of 2002 ......................... ………………………………3.37

xviii

© The Institute of Chartered Accountants of India

CHAPTER 4: AUDIT UNDER COMPUTERISED INFORMATION SYSTEM (CIS)

ENVIRONMENT

4.1 Introduction ..................................................................................................... 4.1

4.2 Scope of Audit in a CIS Environment ................................................................ 4.2

4.3 Impact of changes on Business Processes (for shifting from manual to

electronic medium) ........................................................................................... 4.3

4.4 Audit Approach in a CIS environment ............................................................... 4.5

4.5 Effect of Computers on Internal Controls .......................................................... 4.7

4.6 Effects of Computers on Auditing ..................................................................... 4.9

4.7 Internal controls in a CIS environment ............................................................ 4.10

4.8 Consideration of Control Attributes by the Auditors ......................................... 4.11

4.9 Internal control requirement under CIS Environment ....................................... 4.12

4.10 Auditing in a CIS Environment ........................................................................ 4.13

4.11 Review of Checks and Controls in a CIS Environment .................................... 4.16

4.12 Computer assisted audit techniques (CAATs) ................................................. 4.22

CHAPTER 5: SPECIAL AUDIT TECHNIQUES

5.1 Introduction ..................................................................................................... 5.1

5.2 Statistical Sampling in Auditing ...................................................................... 5.11

5.3 Risk-Based Audit ........................................................................................... 5.23

CHAPTER 6: THE COMPANY AUDIT

6.1 Eligibility, Qualifications and Disqualifications of an Auditor ...................................... 6.1

6.2 Appointment of auditor ............................................................................................ 6.8

6.3 Rotation of Auditor................................................................................................. 6.12

6.4 Provisions relating to Audit Committee ................................................................... 6.17

6.5 Auditor's Remuneration ......................................................................................... 6.19

6.6 Removal of Auditors .............................................................................................. 6.19

6.7 Ceiling on number of audits ................................................................................... 6.20

6.8 Powers/Rights of Auditors...................................................................................... 6.23

xix

© The Institute of Chartered Accountants of India

6.9 Duties of Auditors .................................................................................................. 6.27

6.10 Audit Report .......................................................................................................... 6.38

6.11 Disclosure in the Auditor Report ............................................................................ 6.38

6.12 Joint Audit ............................................................................................................. 6.39

6.13 Audit of Branch Office Accounts............................................................................. 6.41

6.14 Cost Audit ............................................................................................................. 6.43

6.15 Punishment for non-compliance ....................................................................... 6.46

6.16 Financial Accounts Preparation and Presentation ............................................. 6.46

6.17 Significance of True and Fair ........................................................................... 6.51

6.18 Divisible Profits, Dividends and Reserves ........................................................ 6.54

6.19 Depreciation .................................................................................................... 6.69

Appendix- Schedule III to the Companies Act, 2013 ................................................... 6. 71

CHAPTER 7: LIABILITIES OF AUDITORS

7.1 Nature of Auditor’s Liability .............................................................................. 7.1

7.2 Professional Negligence ................................................................................... 7.3

7.3 Cases Concerning the Civil Liability of Auditors for Negligence ....................... 7.12

7.4 Civil Liabilities under the Companies Act ........................................................ 7.14

7.5 Criminal Liability under the Companies Act ..................................................... 7.19

7.6 Cases Concerning the Misconduct of Auditors under the

Chartered Accountants Act ............................................................................. 7.22

7.7 Liabilities under Income Tax Act, 1961 ........................................................... 7.25

CHAPTER 8: AUDIT REPORT

8.1 Auditor’s opinion .............................................................................................. 8.1

8.2 The Auditor’s Report on Financial Statements .................................................. 8.1

8.3 Reporting Under CARO, 2016 ........................................................................ 8.27

8.4 Distinction between Audit Report and Certificate ............................................ 8.32

8.5 Audit Reports and Certificates for Special Purposes ....................................... 8.34

8.6 Reporting Requirements in case of Comparative Information .......................... 8.37

xx

© The Institute of Chartered Accountants of India

Appendix 1: Comprehensive Format on the Audit Report........................................................ 8.41

Appendix 2: Comprehensive Case Studies on CARO 2016 ................................................... 8.49

Appendix 3: Key Aspects discussed in Guidance Note on Reporting of Fraud under

section143(12) of the Companies Act 2013 ......................................................... 8.58

Appendix 4: Key Aspects Discussed in Guidance Note on Reporting Under

Section 143(3) (F) and (H) of the Companies Act, 2013 ...................................... 8.60

Appendix 5: Key Aspects discussed in Guidance Note on Internal Financial Control over

Financial Reporting ............................................................................................. 8.63

CHAPTER 9: AUDIT COMMITTEE AND CORPORATE GOVERNANCE

9.1 Introduction ..................................................................................................... 9.1

9.2 Corporate Governance ..................................................................................... 9.1

9.3 The Legal Framework ...................................................................................... 9.1

9.4 Audit Committee under LODR Regulations ....................................................... 9.3

9.5 Audit Committee under Section 177 of the Companies Act, 2013 ...................... 9.6

9.6 Functions of the Audit Committee ..................................................................... 9.6

9.7 Review of Information by Audit Committee ....................................................... 9.8

9.8 Role of Auditor in Audit Committee and Certification of Compliance

of Conditions of Corporate Governance ............................................................ 9.8

9.9 Remuneration of Directors [Part C of Schedule V] .......................................... 9.11

9.10 Obligations of Director and Senior Management [Regulations 17(2)

to 17(4), 25(5) to 25(6), 26(1) to 26 (2), 26(4) to 26(5)] .................................. 9.13

9.11 Code of Conduct [Regulations 17(5), 26(3), 46(2) and Part D of Schedule V] ....... 9.15

9.12 Vigil Mechanism [Regulations 22 and 46 and Part C of Schedule V] ................ 9.15

9.13 Subsidiary of Listed Entity [Regulations 16(c), 24 and 46

and Part C of Schedule V] ............................................................................. 9.15

9.14 Statement of Deviation(s) or Variation(s) [Regulation 32 and

Part C of Schedule II] ..................................................................................... 9.17

9.15 Disclosures - Management Discussion and Analysis [Schedule V] .................. 9.17

9.16 Information to Shareholders [Regulation 36] ................................................... 9.18

9.17 Stakeholders Relationship Committee [Regulation 20 and

Part D of Schedule II] ..................................................................................... 9.18

9.18 Transfer or Transmission or Transposition of Securities [Regulation 40] ......... 9.19

xxi

© The Institute of Chartered Accountants of India

9.19 Compliance Certificate [Part B of Schedule II] ................................................ 9.19

9.20 Disclosures .................................................................................................... 9.21

9.21 Risk Management Committee [ Regulation 21] ................................................ 9.21

9.22 Nomination and Remuneration Committee [Regulation 19 and

Part D of Schedule II] .................................................................................... 9.22

9.23 Report on Corporate Governance [Regulation 27 and Schedule II] ................. 9.23

9.24 Auditors’ Certificate ...................................................................................... 9.23

Appendix: Corporate Governance – Schedule II to the SEBI (LODR) Regulations, 2015 .... 9.26

CHAPTER 10: AUDIT OF CONSOLIDATED FINANCIAL STATEMENTS

10.1 Introduction ................................................................................................... 10.1

10.2 Definitions ..................................................................................................... 10.3

10.3 Responsibility of Parent ................................................................................. 10.4

10.4 Responsibility of the Auditor of the Consolidated Financial Statements ........... 10.5

10.5 Audit Considerations ...................................................................................... 10.6

10.6 Auditing the Consolidation.............................................................................. 10.8

10.7 Special Considerations ................................................................................ 10.11

10.8 Management Representations ...................................................................... 10.17

10.9 Reporting ..................................................................................................... 10.17

xxii

© The Institute of Chartered Accountants of India

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Prodigal Son - Veronica LancetDocument555 pagesThe Prodigal Son - Veronica LancettashirabavaNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Securities Contracts (Regulation) Act, 1956: © The Institute of Chartered Accountants of IndiaDocument38 pagesSecurities Contracts (Regulation) Act, 1956: © The Institute of Chartered Accountants of IndiaNavin Man Singh ShresthaNo ratings yet

- Concept of Insolvency and BankruptcyDocument68 pagesConcept of Insolvency and BankruptcyNavin Man Singh ShresthaNo ratings yet

- Appointment and Remuneration of Managerial Personnel: © The Institute of Chartered Accountants of IndiaDocument29 pagesAppointment and Remuneration of Managerial Personnel: © The Institute of Chartered Accountants of IndiaNavin Man Singh ShresthaNo ratings yet

- 169final New Syllabus PDFDocument15 pages169final New Syllabus PDFNavin Man Singh ShresthaNo ratings yet

- Revised Scheme of Education and Training For Ca Course, Faqs and Implementation ScheduleDocument2 pagesRevised Scheme of Education and Training For Ca Course, Faqs and Implementation ScheduleNavin Man Singh ShresthaNo ratings yet

- Lec. Intro Lec. Basic Lec.1 Lec.6: CA Final Custom Module Lecture DetailsDocument2 pagesLec. Intro Lec. Basic Lec.1 Lec.6: CA Final Custom Module Lecture DetailsNavin Man Singh ShresthaNo ratings yet

- Section 15 (1) For Imported Goods: Date For Determination Rate & Tariff ValueDocument6 pagesSection 15 (1) For Imported Goods: Date For Determination Rate & Tariff ValueNavin Man Singh ShresthaNo ratings yet

- Students Notes: Person-In-Charge of A Vessel or An Aircraft Entering IndiaDocument20 pagesStudents Notes: Person-In-Charge of A Vessel or An Aircraft Entering IndiaNavin Man Singh ShresthaNo ratings yet

- Me6301 Engineering Thermodynamics Lecture Notes PDFDocument139 pagesMe6301 Engineering Thermodynamics Lecture Notes PDFvenkat_mie1080100% (2)

- Analisis Akuntabilitas Transparansi Dan EfektivitaDocument15 pagesAnalisis Akuntabilitas Transparansi Dan EfektivitanurulNo ratings yet

- Grid Analysis: Making A Decision by Weighing Up Different FactorsDocument2 pagesGrid Analysis: Making A Decision by Weighing Up Different FactorsFebby LienNo ratings yet

- 7.09 Review Maths Algebra 2Document19 pages7.09 Review Maths Algebra 2dekoes0% (1)

- UD11T4107 English Maritime History Human FactorDocument4 pagesUD11T4107 English Maritime History Human FactorParminder singh parmarNo ratings yet

- Master Radiology Notes GIT PDFDocument115 pagesMaster Radiology Notes GIT PDFuroshkgNo ratings yet

- Health Lesson 2Document13 pagesHealth Lesson 2rosemarie guimbaolibotNo ratings yet

- 07 Local Search AlgorithmsDocument32 pages07 Local Search AlgorithmsQuynh Nhu Tran ThiNo ratings yet

- GenChem - Acetylsalicylic AcidDocument4 pagesGenChem - Acetylsalicylic Acidelnini salaNo ratings yet

- Introduction To The PoemDocument260 pagesIntroduction To The PoemDavid Andrés Villagrán Ruz100% (3)

- Advantages and Disadvantages of Federalism Federalism's AdvantagesDocument1 pageAdvantages and Disadvantages of Federalism Federalism's AdvantagesjoyfandialanNo ratings yet

- DNA Rules On EvidenceDocument4 pagesDNA Rules On EvidenceZoe Gacod Takumii UsuiiNo ratings yet

- 3 - PRobabilityDocument17 pages3 - PRobabilityAnonymous UP5RC6JpGNo ratings yet

- MidtermDocument1 pageMidtermDarex Arcega BiaganNo ratings yet

- Surgical Site Infection: Dr. Maryam. Surgical Unit 3Document22 pagesSurgical Site Infection: Dr. Maryam. Surgical Unit 3med stuNo ratings yet

- The Child As ReaderDocument7 pagesThe Child As ReaderDeepa AgarwalNo ratings yet

- ARTS10 q1 Mod3 The Modern Filipino Artists FINAL CONTENTDocument21 pagesARTS10 q1 Mod3 The Modern Filipino Artists FINAL CONTENTMarites t. TabijeNo ratings yet

- Aisha Ra AgeDocument11 pagesAisha Ra Agepoco X3No ratings yet

- Full CalculationDocument8 pagesFull CalculationkprabishNo ratings yet

- International Econ Salvatore CH 1 4 Practice QuestionsDocument17 pagesInternational Econ Salvatore CH 1 4 Practice QuestionsalliNo ratings yet

- Lea 4Document53 pagesLea 4Anna Marie Ventayen Miranda100% (1)

- Aristotelian and Galilean Views On MotionDocument26 pagesAristotelian and Galilean Views On MotionMARIA BELENDA GALLEGANo ratings yet

- Arabic Subject PronounsDocument2 pagesArabic Subject Pronounsainabalqis roslyNo ratings yet

- Alexa Gomez Analysis of The RavenDocument3 pagesAlexa Gomez Analysis of The RavenAlexa GomezNo ratings yet

- Eugenics, The Science of Improving The Human Species by Selectively Mating People With SpecificDocument3 pagesEugenics, The Science of Improving The Human Species by Selectively Mating People With SpecificIrwan M. Iskober100% (1)

- OAuth Echo - Identity Veri Cation Delegation (DraftDocument2 pagesOAuth Echo - Identity Veri Cation Delegation (Draftapi-25885864No ratings yet

- OptoelectronicsDocument23 pagesOptoelectronicsChristian Dave TamparongNo ratings yet

- The Following Text Is For Questions 8-9: Announcement English Conversation Club (ECC)Document2 pagesThe Following Text Is For Questions 8-9: Announcement English Conversation Club (ECC)Dian SaputriNo ratings yet

- Critical Analysis of Medical Negligence in IndiaDocument33 pagesCritical Analysis of Medical Negligence in IndiapiyuNo ratings yet