Professional Documents

Culture Documents

Intercompany Sale of Fixed Assets

Intercompany Sale of Fixed Assets

Uploaded by

Calvin Joseph TinoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Intercompany Sale of Fixed Assets

Intercompany Sale of Fixed Assets

Uploaded by

Calvin Joseph TinoCopyright:

Available Formats

INTERCOMPANY SALE OF FIXED ASSETS_2

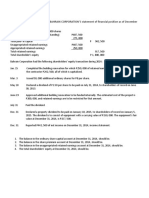

During 2014 HULI Company sold Land with a cost of P150, 000 to its 80% owned subsidiary, NATO

Company, for P200, 000. The subsidiary sold the land in 2016 to an outsider for P280, 000. The

subsidiary and the parent reported net income as follows:

Parent Subsidiary

2014 P351, 000 P154, 000

2015 P335, 000 P149, 000

2016 P315, 000 P165, 000

The reported income of the parent includes P51, 00 of dividend income each year.

Compute for the investment income of HULI Co. from NATO Co. each year and consolidated net income,

controlling interest in net income, and minority interest in net income each year.

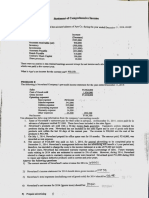

On January 1, 2014, DEPART Company a 90% owned subsidiary of MENTAL Company transferred

equipment to its parent in exchange for P75, 000 cash. At the date of transfer, the subsidiary’s record

carried the equipment at a cost of P106, 000 less accumulated depreciation of P45, 000. The equipment

has an estimated remaining life of 7 years. The subsidiary reported net income for 2014 and 2015 of

P132, 000 and P197, 000 respectively. The parent company reported income of P220, 000 (including

dividend income of P45, 000) and P295, 000(including dividend income of P45, 000) for 2014 and 2015,

respectively.

Compute for the investment income of HULI Co. from NATO Co. each year and consolidated net income,

controlling interest in net income, and minority interest in net income each year.

You might also like

- PROBLEM 1: P Company Had 90% Ownership Interest Acquired Several Years Ago in S Company. TheDocument4 pagesPROBLEM 1: P Company Had 90% Ownership Interest Acquired Several Years Ago in S Company. TheMargaveth P. Balbin75% (4)

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Problem 11 AFARDocument4 pagesProblem 11 AFARNorman Delirio0% (1)

- Consolidated Problems TestbankDocument6 pagesConsolidated Problems TestbankIvy Salise0% (1)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- MODADV2 - Lecture Cases Consolidation Problem 1Document3 pagesMODADV2 - Lecture Cases Consolidation Problem 1Marcus ReyesNo ratings yet

- Investments Part1Document4 pagesInvestments Part1SUBA, Michagail D.No ratings yet

- Quizzer With Answer PDFDocument6 pagesQuizzer With Answer PDFGamers HubNo ratings yet

- Module 5Document1 pageModule 5Margaveth P. BalbinNo ratings yet

- Advac 2Document3 pagesAdvac 2acadsbreakNo ratings yet

- Practice Problems (Business Combination - Intercompany Sales Transactions) PDFDocument1 pagePractice Problems (Business Combination - Intercompany Sales Transactions) PDFJefferson ArayNo ratings yet

- Final Examination in Business Combi 2021Document7 pagesFinal Examination in Business Combi 2021Michael BongalontaNo ratings yet

- AC11 Chapter 4 CompilationDocument35 pagesAC11 Chapter 4 Compilationanon_467190796No ratings yet

- Intercompany Sale of InventoryDocument2 pagesIntercompany Sale of InventoryJon Dumagil Inocentes, CPANo ratings yet

- FAR - RQ - Investment in AssociatesDocument2 pagesFAR - RQ - Investment in AssociatesKriane Kei50% (2)

- DocxDocument4 pagesDocxMingNo ratings yet

- Acctng 7 Partnership Review ProblemsDocument5 pagesAcctng 7 Partnership Review ProblemssarahbeeNo ratings yet

- Statement of Comprehensive IncomeDocument3 pagesStatement of Comprehensive IncomeMitzi CatemprateNo ratings yet

- Business Combination Problem SetDocument6 pagesBusiness Combination Problem SetbigbaekNo ratings yet

- Earning Per ShareDocument6 pagesEarning Per ShareArianne LlorenteNo ratings yet

- P1 1.3CashBasisAccrualBasisSingleEntryZETADocument3 pagesP1 1.3CashBasisAccrualBasisSingleEntryZETASophia AprilNo ratings yet

- Cash Basis Accrual Basis Single Entry Error Correction ASSIGNMENT 1Document3 pagesCash Basis Accrual Basis Single Entry Error Correction ASSIGNMENT 1Christine BNo ratings yet

- Department of Accountancy: Investment in AssociateDocument2 pagesDepartment of Accountancy: Investment in AssociateAiza S. Maca-umbosNo ratings yet

- Stockholders' Equity by J. GonzalesDocument7 pagesStockholders' Equity by J. GonzalesGonzales JhayVeeNo ratings yet

- CE On Intercompany Transactions PDFDocument3 pagesCE On Intercompany Transactions PDFMarcus ReyesNo ratings yet

- AFARDocument12 pagesAFARsino akoNo ratings yet

- BS & Is (Questions)Document7 pagesBS & Is (Questions)Dale JimenoNo ratings yet

- NCAHS & Discontinued OperationsDocument2 pagesNCAHS & Discontinued Operations夜晨曦No ratings yet

- Act131-Prelim Examination: Book Value Fair ValueDocument2 pagesAct131-Prelim Examination: Book Value Fair ValueSittie Ainna Acmed UnteNo ratings yet

- AFAR - BC TwoDocument3 pagesAFAR - BC TwoJoanna Rose DeciarNo ratings yet

- Removal JulyDocument8 pagesRemoval JulyRosanna RomancaNo ratings yet

- Quiz No. 2Document2 pagesQuiz No. 2Nayra DizonNo ratings yet

- Assignment Business CombinationDocument4 pagesAssignment Business CombinationLeisleiRagoNo ratings yet

- BADNEWS!Document4 pagesBADNEWS!Janella CastroNo ratings yet

- Practical Accounting QuizzesDocument3 pagesPractical Accounting QuizzesMichelle ValeNo ratings yet

- Compre Prac Problem FAFVPL and FAFVOCIDocument1 pageCompre Prac Problem FAFVPL and FAFVOCIDzulija TalipanNo ratings yet

- Partnership and Corporation Comprehensive ProblemDocument2 pagesPartnership and Corporation Comprehensive ProblemJustin Mae BagaNo ratings yet

- Bcacctg2 - Accounting For Partnership and Corporation: Exercise 4 Shareholders' EquityDocument4 pagesBcacctg2 - Accounting For Partnership and Corporation: Exercise 4 Shareholders' EquityNimfa SantiagoNo ratings yet

- Quiz On L2 and L3: 60,000 Loss Not GAIN 1,500,000Document2 pagesQuiz On L2 and L3: 60,000 Loss Not GAIN 1,500,000Unknown WandererNo ratings yet

- Test - Financial PlanningDocument3 pagesTest - Financial PlanningMasTer PanDaNo ratings yet

- Takehome Quiz On Cash Basis Accrual Basis Single Entry Error CorrectionDocument3 pagesTakehome Quiz On Cash Basis Accrual Basis Single Entry Error CorrectionYour MaterialsNo ratings yet

- Ce P1 13-14Document16 pagesCe P1 13-14shudayeNo ratings yet

- Rev 1Document1 pageRev 1Jessa BeloyNo ratings yet

- Rev 1Document1 pageRev 1Jessa BeloyNo ratings yet

- P2 06Document9 pagesP2 06Darrel100% (1)

- ASSIGNMENT (3points Each)Document5 pagesASSIGNMENT (3points Each)sammie helsonNo ratings yet

- Toaz.info Intercompany Sale of Inventory Pr 6a732103dc5147b991707ba0a8d9adeaDocument3 pagesToaz.info Intercompany Sale of Inventory Pr 6a732103dc5147b991707ba0a8d9adeagerald anthony salasNo ratings yet

- Quiz Audit of Shareholders Equity-2Document10 pagesQuiz Audit of Shareholders Equity-2Moi Escalante100% (1)

- Final Exam Adv Acctg2 - 1st Sem Sy2012-2013Document19 pagesFinal Exam Adv Acctg2 - 1st Sem Sy2012-2013John Paul LappayNo ratings yet

- Rev 1Document1 pageRev 1Jessa BeloyNo ratings yet

- The Shareholder's Equity Section BAHRAIN CORPORATION'S Statement of Financial Position As of December 31, 2013, Is As FollowsDocument4 pagesThe Shareholder's Equity Section BAHRAIN CORPORATION'S Statement of Financial Position As of December 31, 2013, Is As FollowsCyril John ReyesNo ratings yet

- Handout 3 SCI Special Topics PDFDocument1 pageHandout 3 SCI Special Topics PDFGenesis Del Castillo RazaNo ratings yet

- Business Combi - SubsequentDocument5 pagesBusiness Combi - Subsequentnaser100% (2)

- Quizzer 6Document2 pagesQuizzer 6Midas PhiNo ratings yet

- Father Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #2)Document11 pagesFather Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #2)marygraceomacNo ratings yet

- Name: Section: Date: Score: Long Exam On Non-Profit Organization and Business CombinationDocument2 pagesName: Section: Date: Score: Long Exam On Non-Profit Organization and Business CombinationLiezelNo ratings yet

- Exercise 1 - Balancing The Acctg Equation - v2Document1 pageExercise 1 - Balancing The Acctg Equation - v2Ai MelNo ratings yet

- Intercompany TransactionDocument3 pagesIntercompany TransactionHanna ValerosoNo ratings yet

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesFrom EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNo ratings yet