Professional Documents

Culture Documents

Exam40610 Samplemidterm Answers

Exam40610 Samplemidterm Answers

Uploaded by

PRANAV BANSALOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exam40610 Samplemidterm Answers

Exam40610 Samplemidterm Answers

Uploaded by

PRANAV BANSALCopyright:

Available Formats

SAMPLE MIDTERM EXAM SOLUTIONS

Finance 40610 – Security Analysis

Mendoza College of Business

Professor Shane A. Corwin

INSTRUCTIONS:

1. You have 75 minutes to complete the exam.

2. The exam is worth a total of 100 points.

3. Allocate your time wisely. Use the number of points assigned to each problem as your guide.

4. In order to get full credit on the problems, you must show ALL your work!

5. You may use a calculator and a formula sheet. Please put your name on your formula sheet and hand

it in with your exam.

Multiple Choice (32 points)

Choose the best answer for each of the following questions. The questions are worth 4 points each.

1. Which of the following would NOT be a component of non-cash working capital?

a) Wages payable

b) Accounts receivable

c) Current portion of long-term debt

d) Inventory

2. You are valuing a U.S. manufacturing firm that generates 50% of its revenues in $US and 50% of its

revenues in Euros. To complete the valuation, you have decided to convert all of the cash flows to

either $U.S. or Euros. The yield on long-term U.S. Government Treasury Bonds is 4.9% and the

yield on long-term Euro-denominated Government Bonds issued by Germany is 4.7%. You assume

both rates are free of default risk. Which of the following statements is most accurate?

a) You cannot convert cash flows to a different currency in a valuation

b) You should use a risk-free rate of 4.7% regardless of what currency you use

c) You should use a risk-free rate of 4.9% regardless of what currency you use

d) Converting cash flows to Euros will give a higher valuation due to the lower risk-free rate

e) None of the above are accurate

3. Which of the following should NOT be excluded from past cash flow estimates when developing

forecasts of future cash flows?

a) Income from cash and marketable securities

b) Income from holdings in other firms

c) Non-recurring and one-time expenses

d) Expenses associated with executive compensation

e) All of the above items should be excluded

4. Which of the following would result in an increase Return on Equity (ROE), assuming all other

things are held constant?

a) An decrease in Return on Capital (ROC)

b) An decrease in leverage

c) A decrease in the interest expense associated with debt

d) A decrease in profit margin

e) None of the above

5. Which of the following is NOT an advantage of relative valuation as compared to discounted cash

flow valuation?

a) Relative valuation is unaffected by assumptions such as growth and ROE

b) Relative valuation can be used even when cash flows are negative

c) Relative valuation will incorporate current market perceptions

d) Relative valuation will always identify at least some securities as under and over-valued

relative to each other.

Finance 40610 – Midterm Exam 1

6. The Balance Sheet for Microsoft is shown on the next page. Based on this information, what is the

quick ratio for Microsoft?

a) 0.458

b) 0.299

c) 2.184

d) 1.885

e) 1.522 (this is the correct answer and was not provided on the original exam)

7. You are valuing several U.S. firms using discounted cash flow (DCF) analysis. Analysts at your firm

have provided you with the following historical data for the U.S. equity market during the period

from 1928-2006. If you use only this information to determine the market risk premium for use in

your valuation model, which estimate would be most appropriate?

Arithmetic Geometric

Average Risk Premium Average Average

Relative to 30-day T-Bills 7.87% 6.01%

Relative to 10-year T-Bonds 6.57% 4.91%

a) 7.87%

b) 6.57%

c) 6.01%

d) 4.91%

8. You are estimating the cost of equity for an emerging market firm incorporating country risk. You

are using a risk-free rate of 5.0% and the U.S. equity market risk premium of 4.5%. The equity Beta

for the firm is 1.6 and you estimate a country risk premium for the country of 2.5%. What is the cost

of equity for this firm after incorporating country risk, if you assume that all firms in the country

have equal sensitivity to country risk?

a) 12.2%

b) 14.7% 5% + 1.6(4.5%) + 1.0(2.5%)

c) 11.2%

d) 16.2%

Finance 40610 – Midterm Exam 2

Balance Sheet for Microsoft as of 6/30/2006

Finance 40610 – Midterm Exam 3

Problems (68 points)

Answer each of the questions below completely. You must show ALL your work to get full credit.

9. Industry Beta (8 points):

You are valuing an IPO firm using a discounted cash flow analysis. In order to calculate the cost of

capital for the firm, you have estimate the levered and unlevered Betas for the other firms in the same

industry. This information is provided below.

BetaL Debt/Equity BetaU

Firm 1 1.30 0.25 1.12

Firm 2 1.10 0.40 0.87

Firm 3 1.50 0.60 1.08

Firm 4 0.90 0.00 0.90

Average 1.20 0.31 0.99

Based on this information, calculate the Beta for your IPO firm. Assume that you firm has a debt to

equity ratio of 0.5 and a marginal tax rate of 35% (the same marginal tax rate as other industry firms).

L 0.991 .5(1 .35) 1.312

OR

1

u 1.20 0.999

1 0.31(1 .35)

L 0.999 1 0.5(1 .35) 1.323

10. Implied Equity Premium (8 points):

The current level of the Russell 3000 Index is 905.67 and the long-term Treasury yield is 5.0%. The

aggregate dividend yield (plus stock repurchases) on the Russell Index last year was 3.5% (of the

current index value) and this payout is expected to grow at a rate of 5% in perpetuity. Based on this

information, what is the implied equity risk premium for the U.S. market?

Div1 905.67(.035)(1.05)

Rg .05 8.675%

P 905.67

R R f 8.675% 5.0% 3.675%

Finance 40610 – Midterm Exam 4

11. Discounted Cash Flows (24 points):

You are performing a valuation of a retail firm based on free cash flow to the firm (FCFF). FCFF in

the most recent 12 months (year 0) was $365 million. The firm is in a declining industry. As a result,

you expect cash flows to grow at an annual rate of 4% for the next five years and then decrease at 1%

per year in perpetuity thereafter. The firm’s cost of equity is 10% and its weighted average cost of

capital is 8%. The firm also has debt with a book value of $700 million and a market value of $600

million.

a) (18 points) What is the value of this firm based on the discounted value of FCFF?

FCFF1 365(1.04) 379.60

1.04 5

1

1.08

PVHighGrowth 379.60 1631.96

.08 .04

FCFF6 365(1.04) 5 (.99) 439.638

439.638

TV5 4884.861

.08 (.01)

4884.861

PVTV 3324.554

(1.08) 5

FirmValue 1631.96 3324.554 $4956.514

b) (6 points) If the firm has 100 million shares outstanding, what is your estimate of the equity

value per share? If the current market price of $36 per share, should you buy or sell the stock?

EquityValue 4956.514 600

4956.514 600

P $43.57

100

BUY (because your estimated price is higher than the current market price, or 43.57 36)

Finance 40610 – Midterm Exam 5

12. Cost of Capital (28 points):

You are calculating the cost of capital for ABC corp. The firm’s equity has a book value of $600

million and a market value of $1 billion. The firm’s debt consists of operating leases with a debt

value of $500 million and two bonds. The first bond is a straight 30-year bond with book value equal

to $200 million and market value equal to $125 million. The second bond is a zero-coupon

convertible bond with 10-years to maturity, a face value of $500 million, and a market value of $400

million. The firm has a debt rating of BBB+ and has a marginal tax rate of 35%. You assume a

market risk premium of 4.5% and estimate the Beta of the firm to be 1.8.

a) (6 points) Based on the 10-year Treasury Bond yield, you assume a risk-free rate of 5.0%.

Using the default spreads described on the last page of the exam, calculate the cost of debt for

this firm.

Given the debt rating of BBB+, the table on the next page suggests that

the default spread is 1.341%.

K d R f DefaultSpr ead 5.0% 1.341 % 6.341 %

b) (8 points) Using the cost of debt you estimated above, estimate the value of the equity and

debt components of the convertible bond. (Note: if you can’t answer part (a), make an

assumption about the cost of debt in order to answer this question.)

500

DebtValue 270.373

(1.06341)10

EquityValue 400 270.373 129.627

c) (14 points) Using your answers to parts (a) and (b) along with the other information provided,

estimate the weighted average cost of capital (WACC) for this firm. (Note: if you can’t answer

parts (a) or (b), make any assumptions necessary in order to answer this question.)

Debt 500 125 270.373 895.373

Equity 1000 129.627 1129.627

Debt Equity 895.373 1129.627 2025

K e 5.0% 1.8(4.5%) 13.1%

1129.627 895.373

WACC 13.1% (6.341%)(1 .35) 9.13%

2025 2025

Finance 40610 – Midterm Exam 6

10-year Yield

Debt Rating Spread

AAA 0.866%

AA 0.893%

A+ 0.953%

A 1.044%

A- 1.183%

BBB+ 1.341%

BBB 1.472%

BBB- 1.838%

BB+ 2.716%

BB 3.508%

BB- 3.533%

B+ 3.775%

B 4.418%

B- 4.953%

Finance 40610 – Midterm Exam 7

You might also like

- Corporate Finance FinalsDocument66 pagesCorporate Finance FinalsRahul Patel50% (2)

- Why Moats Matter: The Morningstar Approach to Stock InvestingFrom EverandWhy Moats Matter: The Morningstar Approach to Stock InvestingRating: 4 out of 5 stars4/5 (3)

- Detailed Lesson Plan in English IV - COMPOUND SENTENCEDocument12 pagesDetailed Lesson Plan in English IV - COMPOUND SENTENCEMadhie Gre Dela Provi94% (16)

- Final Exam: Fall 1997 This Exam Is Worth 30% and You Have 2 HoursDocument84 pagesFinal Exam: Fall 1997 This Exam Is Worth 30% and You Have 2 HoursJatin PanchiNo ratings yet

- Ss11 646 Corporate FinanceDocument343 pagesSs11 646 Corporate Financed-fbuser-32825803100% (12)

- Environmental Impact Assessment ModuleDocument39 pagesEnvironmental Impact Assessment ModuleJoshua Landoy100% (2)

- Sample Exam Questions (FINC3015, S1, 2012)Document5 pagesSample Exam Questions (FINC3015, S1, 2012)Tecwyn LimNo ratings yet

- BUS 497a - Homework 1 - Solution GuideDocument5 pagesBUS 497a - Homework 1 - Solution GuidesaltyaxelNo ratings yet

- Exam1 Solutions 40610 2008Document7 pagesExam1 Solutions 40610 2008JordanNo ratings yet

- Sample Online Test 2020-2021Document7 pagesSample Online Test 2020-2021Tiago TagueroNo ratings yet

- Compre BAV Sol 2019-20 1Document9 pagesCompre BAV Sol 2019-20 1f20211062No ratings yet

- 2007 Spring VoldDocument25 pages2007 Spring VoldMark LeviyNo ratings yet

- CV Midterm Exam 1 - Solution GuideDocument11 pagesCV Midterm Exam 1 - Solution GuideKala Paul100% (1)

- Discounted Cashflow Valuation Problems and SolutionDocument54 pagesDiscounted Cashflow Valuation Problems and SolutionJang haewonNo ratings yet

- MAN 321 Corporate Finance Final Examination: Fall 2001Document8 pagesMAN 321 Corporate Finance Final Examination: Fall 2001Suzette Faith LandinginNo ratings yet

- Ficha 2Document4 pagesFicha 2Elsa MachadoNo ratings yet

- Tutorial 6 FAT SolutionDocument11 pagesTutorial 6 FAT SolutionAhmad FarisNo ratings yet

- Practice Final Exam Questions399Document17 pagesPractice Final Exam Questions399MrDorakonNo ratings yet

- Problems and Questions - 3Document6 pagesProblems and Questions - 3mashta04No ratings yet

- MBA507Document10 pagesMBA507pheeyonaNo ratings yet

- Quiz 2: Spring 1996Document40 pagesQuiz 2: Spring 1996Vivek AnandanNo ratings yet

- Compre BAV QP 2019-20 1Document3 pagesCompre BAV QP 2019-20 1f20211062No ratings yet

- Fin 4342 Midterm2 Practice Questions 000Document2 pagesFin 4342 Midterm2 Practice Questions 000Mahedi HasanNo ratings yet

- Exam Focus - May 2010 Strategic Level Exams and The New Pre-Seen Case StudyDocument4 pagesExam Focus - May 2010 Strategic Level Exams and The New Pre-Seen Case StudynirudafatNo ratings yet

- End Term ExamDocument4 pagesEnd Term ExamKeshav Sehgal0% (2)

- Financial Management: Friday 9 December 2011Document8 pagesFinancial Management: Friday 9 December 2011Hussain MeskinzadaNo ratings yet

- BUS 635 Quiz3 Sum15 AnswersDocument5 pagesBUS 635 Quiz3 Sum15 AnswershnoamanNo ratings yet

- Quiz 2Document40 pagesQuiz 2MAYANK JAINNo ratings yet

- FINA 410 - Exercises (NOV)Document7 pagesFINA 410 - Exercises (NOV)said100% (1)

- BBA07Final09 Marking SchemeDocument4 pagesBBA07Final09 Marking SchemeKamal AkzNo ratings yet

- EF343.FSM (AL-I) Question CMA January-2023 Exam.Document4 pagesEF343.FSM (AL-I) Question CMA January-2023 Exam.GT Moringa LimitedNo ratings yet

- EF343.CFS (AL-I) Question CMA May-2023 Exam.Document4 pagesEF343.CFS (AL-I) Question CMA May-2023 Exam.GT Moringa LimitedNo ratings yet

- Corporate Finance - Mock ExamDocument8 pagesCorporate Finance - Mock ExamLưu Quỳnh MaiNo ratings yet

- D23 FM Examiner's ReportDocument20 pagesD23 FM Examiner's ReportEshal KhanNo ratings yet

- FNCE623 Solution To Final Exam 2021 WinterDocument4 pagesFNCE623 Solution To Final Exam 2021 Winteralka murarkaNo ratings yet

- Year CF To Equity Int (1-t) CF To Firm: Variant 1 A-MDocument5 pagesYear CF To Equity Int (1-t) CF To Firm: Variant 1 A-MNastya MedlyarskayaNo ratings yet

- QUIZDocument5 pagesQUIZNastya MedlyarskayaNo ratings yet

- Finance FinalDocument15 pagesFinance Finaldingdong ditchNo ratings yet

- Final Review Session SPR12RปDocument10 pagesFinal Review Session SPR12RปFight FionaNo ratings yet

- Mock Exam - Section ADocument4 pagesMock Exam - Section AHAHAHANo ratings yet

- Final Exam PFIN 3Document5 pagesFinal Exam PFIN 310622006No ratings yet

- Financial, Treasury and Forex ManagementDocument8 pagesFinancial, Treasury and Forex ManagementnikhilNo ratings yet

- Finance 510 Graded Final - AaronDocument14 pagesFinance 510 Graded Final - Aaronbusinessdoctor23No ratings yet

- Shapiro CHAPTER 6 SolutionsDocument10 pagesShapiro CHAPTER 6 SolutionsjzdoogNo ratings yet

- 2009T2 Fins1613 FinalExamDocument24 pages2009T2 Fins1613 FinalExamchoiyokbao100% (1)

- Exam 2 PracticeDocument4 pagesExam 2 PracticeRaunak KoiralaNo ratings yet

- Financial CasesDocument64 pagesFinancial CasesMarwan MikdadyNo ratings yet

- PAK Mock Exam-QFIC-QUESTIONS-TOTAL-76Document79 pagesPAK Mock Exam-QFIC-QUESTIONS-TOTAL-76cnmouldplasticNo ratings yet

- Bus 306 Exam 2 - Fall 2012 (A) - SolutionDocument15 pagesBus 306 Exam 2 - Fall 2012 (A) - SolutionCyn SyjucoNo ratings yet

- Cost of Capital Question SetDocument8 pagesCost of Capital Question SethbyhNo ratings yet

- Assignment - 4 Jul 31Document5 pagesAssignment - 4 Jul 31spectrum_48No ratings yet

- Edu 2008 11 Fete ExamDocument22 pagesEdu 2008 11 Fete ExamcalvinkaiNo ratings yet

- Key Assignment Draft: in ThousandsDocument2 pagesKey Assignment Draft: in ThousandsDavid RiveraNo ratings yet

- Practice Questions Before The Final Fall 2014Document4 pagesPractice Questions Before The Final Fall 2014rheg3070No ratings yet

- Mock Exam Reviewer QuestionnaireDocument8 pagesMock Exam Reviewer QuestionnaireJerome BadilloNo ratings yet

- Assignment Business Finance Fina 321 Fall 2016Document4 pagesAssignment Business Finance Fina 321 Fall 2016Aboubakr SoultanNo ratings yet

- Strategic Corporate Finance Exam 3 Hours Is GivenDocument5 pagesStrategic Corporate Finance Exam 3 Hours Is GivenicaNo ratings yet

- Unit 6 QuizDocument12 pagesUnit 6 QuizMichael JohnsonNo ratings yet

- 2006 FinalDocument30 pages2006 Finalriders29No ratings yet

- Portfolio and Investment Analysis with SAS: Financial Modeling Techniques for OptimizationFrom EverandPortfolio and Investment Analysis with SAS: Financial Modeling Techniques for OptimizationRating: 3 out of 5 stars3/5 (1)

- Creating a Balanced Scorecard for a Financial Services OrganizationFrom EverandCreating a Balanced Scorecard for a Financial Services OrganizationNo ratings yet

- SPE 163723 Pressure Transient Analysis of Data From Permanent Downhole GaugesDocument24 pagesSPE 163723 Pressure Transient Analysis of Data From Permanent Downhole GaugesLulut Fitra FalaNo ratings yet

- Miller PreviewDocument252 pagesMiller PreviewcqpresscustomNo ratings yet

- Azosprilum 2Document24 pagesAzosprilum 2Dipti PriyaNo ratings yet

- StatementOfAccount 6316692309 21072023 222045Document17 pagesStatementOfAccount 6316692309 21072023 222045Asekar AlagarsamyNo ratings yet

- EEET423L Final ProjectDocument7 pagesEEET423L Final ProjectAlan ReyesNo ratings yet

- GDPR ReportDocument84 pagesGDPR ReportKingPlaysNo ratings yet

- 11 Earthing and Lightning Protection PDFDocument37 pages11 Earthing and Lightning Protection PDFThomas Gilchrist100% (1)

- Elrc 4507 Unit PlanDocument4 pagesElrc 4507 Unit Planapi-284973023No ratings yet

- Dungeon 190Document77 pagesDungeon 190Helmous100% (4)

- Peptides and Proteins: M.Prasad Naidu MSC Medical Biochemistry, PH.DDocument30 pagesPeptides and Proteins: M.Prasad Naidu MSC Medical Biochemistry, PH.DDr. M. Prasad NaiduNo ratings yet

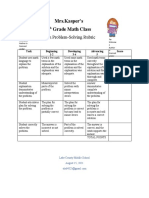

- Problemsolving RubricDocument1 pageProblemsolving Rubricapi-560491685No ratings yet

- The Holy Spirit: A New LifeDocument2 pagesThe Holy Spirit: A New LifeKatu2010No ratings yet

- PAYROLLMANAGEMENTDocument5 pagesPAYROLLMANAGEMENTSai Prabhav (Sai Prabhav)No ratings yet

- September 23, Infer The Purpose of The Poem Listened ToDocument4 pagesSeptember 23, Infer The Purpose of The Poem Listened ToLouelle GonzalesNo ratings yet

- C C P S: Lalit KumarDocument3 pagesC C P S: Lalit KumarAbhishek aby5No ratings yet

- Teachers' Interview PDFDocument38 pagesTeachers' Interview PDFlalitNo ratings yet

- CaneToadsKakadu 2Document3 pagesCaneToadsKakadu 2Matheesha RajapakseNo ratings yet

- Jon FosseDocument4 pagesJon FosseNoe CarNo ratings yet

- Tivoli Storage Manager Operational Reporting Installation, Configuration and CustomizationDocument53 pagesTivoli Storage Manager Operational Reporting Installation, Configuration and CustomizationSABRINE KHNo ratings yet

- Form 137Document2 pagesForm 137Raymund BondeNo ratings yet

- St. Thomas' School Session 2021-22: Goyalavihar, Near Sec-19, DwarkaDocument3 pagesSt. Thomas' School Session 2021-22: Goyalavihar, Near Sec-19, DwarkaHarshit PalNo ratings yet

- Manual Tecnico Jblgo PDFDocument2 pagesManual Tecnico Jblgo PDFMarcosDanielSoaresNo ratings yet

- Nursing Care PlanDocument4 pagesNursing Care PlanPutra AginaNo ratings yet

- 501-453 Universal Cable GalndsDocument1 page501-453 Universal Cable Galndsmeribout adelNo ratings yet

- The Price of SilenceDocument9 pagesThe Price of Silencewamu885100% (1)

- Common Prospectus EnglishDocument293 pagesCommon Prospectus Englishven23No ratings yet

- Measurement of Thermal Conductivity: Engineering Properties of Biological Materials and Food Quality 3 (2+1)Document17 pagesMeasurement of Thermal Conductivity: Engineering Properties of Biological Materials and Food Quality 3 (2+1)Mel CapalunganNo ratings yet

- IWA City Stories SingaporeDocument2 pagesIWA City Stories SingaporeThang LongNo ratings yet