Professional Documents

Culture Documents

13-9 Ines Checked

13-9 Ines Checked

Uploaded by

SulistyonoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

13-9 Ines Checked

13-9 Ines Checked

Uploaded by

SulistyonoCopyright:

Available Formats

13-9

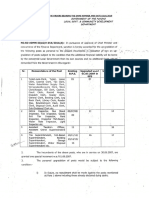

NEW PROJECT ANALYSIS

You must evaluate a proposal to buy a new milling machine. The base price is $108.000,

and shipping and installation costs would add another $12.500. The machine falls into the

MACRS 3-year class, and it would be sold after 3 years for $65.000. The applicable

depreciation rates are 33%, 45%, 15%, and 7% as discussed in Appendix 13A. The machine

would require a $5.500 increase in net operating working capital (increased inventory less

increased accounts payable). There would be no effect on revenues, but pretax labor costs

would decline by $44.000 per year. The marginal tax rate is 35%, and the WACC is 12%.

Also, the firm spent $5.000 last year investigating the feasibility of using the machine.

a. How should the $5.000 spent last year be handled?

b. What is the initial investment outlay for the machine for capital budgeting purposes,

that is, what is the Year 0 project cash flow?

c. What are the project’s annual cash flows during Years 1,2, and 3?

d. Should the machine be purchased? Explain your answer.

Jawab

a. $5.000 digunakan untuk menginvestigasi feasibility dari penggunaan mesin, maka

dana tersebut dianggap sunk cost dan tidak seharusnya diikutsertakan dalam

analisis karena dianggap tidak relevan.

b. The initial investment outlay for the machine :

Base price $108.000

Shipping+installation $12.500

Increase in NOWC $5.500

$126.000

c. Project’s annual cash flows :

- After tax savings : $44.000(1-T)

= $44.000(1-0,35)

= $28.600

- Depreciation cost

Basis price : price + Installment & shipping : $108.000+ $12.500 = $120.500

Tahun 1 : 33% x $120.500 = $39.765

Tahun 2 : 45% x $120.500 = $54.225

Tahun 3 : 15% x $120.500 = $18.075

Depreciation tax saving :

Tahun 1 : 35% x $39.765 = $13.918

Tahun 2 : 35% x $54.225 = $18.979

Tahun 3 : 35% x $18.075 = $6.327

Depreciation cost tahun 4 : 7% x $120.500 = $8.435

Tax on SV : ($65.000-$8.435)(35%) = $19.798

Tahun 1 Tahun 2 Tahun 3

After-tax savings $28.600 $28.600 $28.600

Depreciation tax $13.918 $18.979 $6.327

savings

Salvage value $65.000

Tax on SV ($19.798)

Return of NWC $5.500

Project cash flow $42.518 $47.579 $85.629

d. WACC = 12%

0 1 2 3

Project $126.000 $42.518 $47.579 $85.629

NPV = -126.000 + 42.518/(1,121) + 47.579/(1,122) + 85.629/(1,123)

= $10.842

Karena nilai NPV positif maka project ini bisa diterima, perusahaan bisa membeli

mesin baru tersebut.

NOTE: No Findings for 13-9

You might also like

- Matheson ElectronicsDocument2 pagesMatheson ElectronicsReg Lagarteja80% (5)

- More Sample Exam Questions-Midterm2Document6 pagesMore Sample Exam Questions-Midterm2mehdiNo ratings yet

- PNP Payslip Portal - Print PDFDocument1 pagePNP Payslip Portal - Print PDFEric libatonNo ratings yet

- Tugas GSLC Corp Finance Session 16Document6 pagesTugas GSLC Corp Finance Session 16Javier Noel ClaudioNo ratings yet

- 3 - Capital Budgeting ImplementationDocument9 pages3 - Capital Budgeting ImplementationoryzanoviaNo ratings yet

- Quiz 3Document14 pagesQuiz 3K L YEONo ratings yet

- Brealey 5CE Ch09 SolutionsDocument27 pagesBrealey 5CE Ch09 SolutionsToby Tobes TobezNo ratings yet

- Chapter 6 Answer Key (1 15)Document15 pagesChapter 6 Answer Key (1 15)Desrifta FaheraNo ratings yet

- Fundamentals of Corporate Finance Canadian 6th Edition Brealey Solutions ManualDocument26 pagesFundamentals of Corporate Finance Canadian 6th Edition Brealey Solutions Manualmisentrynotal6ip1lp100% (19)

- Corporate Finance Canadian 7th Edition Jaffe Solutions ManualDocument16 pagesCorporate Finance Canadian 7th Edition Jaffe Solutions Manualtaylorhughesrfnaebgxyk100% (31)

- FM II Assignment 3 Solution W22Document3 pagesFM II Assignment 3 Solution W22Farah ImamiNo ratings yet

- CFM Session 8Document7 pagesCFM Session 8khanhnguyenfgoNo ratings yet

- Problem Set4 Ch09 and Ch10-SolutionsDocument6 pagesProblem Set4 Ch09 and Ch10-SolutionszainebkhanNo ratings yet

- GSLC Session 16: Javier Noel Claudio 2301949040 Accounting Technology Corporate Financial Management LB90Document6 pagesGSLC Session 16: Javier Noel Claudio 2301949040 Accounting Technology Corporate Financial Management LB90salsabilla rpNo ratings yet

- GSLC Session 16: Javier Noel Claudio 2301949040 Accounting Technology Corporate Financial Management LB90Document6 pagesGSLC Session 16: Javier Noel Claudio 2301949040 Accounting Technology Corporate Financial Management LB90Javier Noel ClaudioNo ratings yet

- Ch11 ShowDocument63 pagesCh11 ShowMahmoud AbdullahNo ratings yet

- CH 11Document35 pagesCH 11তি মিNo ratings yet

- More On Capital BudgetingDocument56 pagesMore On Capital BudgetingnewaznahianNo ratings yet

- F7 SolutionsDocument15 pagesF7 Solutionsnoor ul anum100% (1)

- Fundamentals of Corporate Finance Canadian 6th Edition Brealey Solutions Manual 1Document36 pagesFundamentals of Corporate Finance Canadian 6th Edition Brealey Solutions Manual 1jillhernandezqortfpmndz100% (32)

- Week 13and14 Assignment FINALSDocument10 pagesWeek 13and14 Assignment FINALSkristelle0marisseNo ratings yet

- Chapter 6 - Answer KeyDocument8 pagesChapter 6 - Answer KeyĐặng Thanh ThuỷNo ratings yet

- Financial Management Assignment NotesDocument3 pagesFinancial Management Assignment NotesDaniyal AliNo ratings yet

- Chapter 11Document10 pagesChapter 11Syed Sheraz AliNo ratings yet

- Solutions PracProblems Visit 4Document19 pagesSolutions PracProblems Visit 4Falak HanifNo ratings yet

- Chapter 11 Exercises and Problems Exercise 11-2: 1. Straight-LineDocument23 pagesChapter 11 Exercises and Problems Exercise 11-2: 1. Straight-LineHazel Rose CabezasNo ratings yet

- Chapter 10 - Capital Budgeting - SolutionsDocument10 pagesChapter 10 - Capital Budgeting - Solutionsbraydenfr05No ratings yet

- 9 - Chapter-7-Discounted-Cashflow-Techniques-with-AnswerDocument15 pages9 - Chapter-7-Discounted-Cashflow-Techniques-with-AnswerMd SaifulNo ratings yet

- Tugas Af Chapter 13Document5 pagesTugas Af Chapter 13Nana NurhayatiNo ratings yet

- Answer Chapter11 Cash Flow EstimationDocument3 pagesAnswer Chapter11 Cash Flow EstimationIsmah ParkNo ratings yet

- Resume MK CHapter 10 - Cyrillus Ekana - 6032231237Document24 pagesResume MK CHapter 10 - Cyrillus Ekana - 6032231237Cyrillus EkanaNo ratings yet

- Brigham Chap 11 Practice Questions Solution For Chap 11Document11 pagesBrigham Chap 11 Practice Questions Solution For Chap 11robin.asterNo ratings yet

- Manajemen Keuangan: Chapter 6: Making Capital Investment DecisionDocument9 pagesManajemen Keuangan: Chapter 6: Making Capital Investment Decision21. Syafira Indi KhoirunisaNo ratings yet

- Chapter 9 Check Figures and Complete SolutionsDocument6 pagesChapter 9 Check Figures and Complete SolutionsAmrita AroraNo ratings yet

- Developing Financial InsightsDocument3 pagesDeveloping Financial InsightsRahma Putri HapsariNo ratings yet

- Cash Flow Estimation and Risk Analysis: by Dr. Yi ZhangDocument35 pagesCash Flow Estimation and Risk Analysis: by Dr. Yi ZhangBibi KathNo ratings yet

- Managerial Economics (Chapter 14)Document28 pagesManagerial Economics (Chapter 14)api-3703724100% (1)

- Year Project A Project B: Total PV NPVDocument19 pagesYear Project A Project B: Total PV NPVChin EENo ratings yet

- Managerial Project (Akanksha Shahi) FINALDocument5 pagesManagerial Project (Akanksha Shahi) FINALakankshashahi1986No ratings yet

- F9 - IPRO - Mock 1 - AnswersDocument12 pagesF9 - IPRO - Mock 1 - AnswersOlivier MNo ratings yet

- Solution: Year Cash Inflows Present Value Factor Present Value $ @10% $Document10 pagesSolution: Year Cash Inflows Present Value Factor Present Value $ @10% $Waylee CheroNo ratings yet

- FIN Home Assigment AnswersDocument5 pagesFIN Home Assigment AnswersIkra MemonNo ratings yet

- Corporate Finance Tutorial 4 - SolutionsDocument22 pagesCorporate Finance Tutorial 4 - Solutionsandy033003No ratings yet

- Fundamentals of Corporate Finance 9th Edition Brealey Solutions ManualDocument16 pagesFundamentals of Corporate Finance 9th Edition Brealey Solutions Manualmisentrynotal6ip1lp100% (24)

- Chapter 13 Capital Budgeting Estimating Cash Flow and Analyzing Risk Answers To End of Chapter Questions 13 3 Since The Cost of Capital Includes A Premium For Expected Inflation Failure 1Document8 pagesChapter 13 Capital Budgeting Estimating Cash Flow and Analyzing Risk Answers To End of Chapter Questions 13 3 Since The Cost of Capital Includes A Premium For Expected Inflation Failure 1ghzNo ratings yet

- PDF Document 8Document42 pagesPDF Document 8nancymijaresalgosoNo ratings yet

- FM FinalDocument7 pagesFM FinalStoryKingNo ratings yet

- CH 11 - CF Estimation Mini Case Sols Excel 14edDocument36 pagesCH 11 - CF Estimation Mini Case Sols Excel 14edأثير مخوNo ratings yet

- Module 4 - Home Work SolutionDocument3 pagesModule 4 - Home Work Solutionntkt0408No ratings yet

- Chapter 12Document14 pagesChapter 12Naimmul FahimNo ratings yet

- Afm AssignmentDocument17 pagesAfm AssignmentHabtamuNo ratings yet

- Sinclair Company Group Case StudyDocument20 pagesSinclair Company Group Case StudyNida AmriNo ratings yet

- Polenar Budgeting-AssignmentDocument4 pagesPolenar Budgeting-AssignmentRyhanna Lou ReyesNo ratings yet

- CH09Document26 pagesCH09devinaNo ratings yet

- Chapter 3 PDFDocument15 pagesChapter 3 PDFJay BrockNo ratings yet

- Valuation and Capital Budgeting For Levered Firm (Chaper 18)Document26 pagesValuation and Capital Budgeting For Levered Firm (Chaper 18)Yogi Dwi Jaya PerkasaNo ratings yet

- Capital BudgetingDocument21 pagesCapital BudgetingRalph Clarence NicodemusNo ratings yet

- CapbudprobsolDocument8 pagesCapbudprobsolAlicia May Castro LapuzNo ratings yet

- Document 1Document5 pagesDocument 1Yohannes AlemuNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- CVP ThesisDocument84 pagesCVP ThesisSulistyonoNo ratings yet

- Toyota Problem Solving MethodDocument1 pageToyota Problem Solving MethodSulistyonoNo ratings yet

- Probability SamDocument98 pagesProbability SamSulistyonoNo ratings yet

- Thirteen: Mcgraw-Hill/Irwin © 2005 The Mcgraw-Hill Companies, Inc., All Rights ReservedDocument36 pagesThirteen: Mcgraw-Hill/Irwin © 2005 The Mcgraw-Hill Companies, Inc., All Rights ReservedSulistyonoNo ratings yet

- Chapter15 LengkapDocument7 pagesChapter15 LengkapSulistyonoNo ratings yet

- 13.3 Unequal Lives. Haley's Graphic Designs Inc. Is Considering Two Mutually Exclusive Projects. BothDocument3 pages13.3 Unequal Lives. Haley's Graphic Designs Inc. Is Considering Two Mutually Exclusive Projects. BothSulistyonoNo ratings yet

- PF, ESIC Compliance: ContributionDocument1 pagePF, ESIC Compliance: ContributionAnand DiveNo ratings yet

- Sales Tax Collection MatrixDocument2 pagesSales Tax Collection MatrixbeckerjeNo ratings yet

- Demands ListDocument90 pagesDemands Listjohn rukorioNo ratings yet

- RMC 47-2019Document2 pagesRMC 47-2019RichardNo ratings yet

- Indian-Cab Corporation: Price ListDocument1 pageIndian-Cab Corporation: Price ListAnonymous SDeSP1No ratings yet

- What About?: Questions Ordained Ministers Ask About TaxesDocument4 pagesWhat About?: Questions Ordained Ministers Ask About TaxesRa ElNo ratings yet

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocument8 pagesIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaGeetanjali BarejaNo ratings yet

- Tax Rate and Double Taxation - PPTDocument15 pagesTax Rate and Double Taxation - PPTAlex CruzNo ratings yet

- ITAD BIR RULING NO. 026-18, March 5, 2018Document10 pagesITAD BIR RULING NO. 026-18, March 5, 2018Kriszan ManiponNo ratings yet

- Chapter - Ii Rate Structure of Personal and Corporate Income Tax in IndiaDocument51 pagesChapter - Ii Rate Structure of Personal and Corporate Income Tax in IndiaJai VermaNo ratings yet

- Tax ChallanDocument1 pageTax ChallanShishir YadavNo ratings yet

- Composition Scheme and Registration Unit 2Document9 pagesComposition Scheme and Registration Unit 2Cupid FriendNo ratings yet

- Revised PPT On Income Tax Batch 2023 March 11 2022Document155 pagesRevised PPT On Income Tax Batch 2023 March 11 2022Anushka SinghNo ratings yet

- Tax 1 Midterm Exam 2019Document4 pagesTax 1 Midterm Exam 2019Lindbergh SyNo ratings yet

- SEZ PresentationDocument18 pagesSEZ Presentationvinunair79No ratings yet

- Recent Post: List of Ust Law Applicants Qualified For Enrollment (For April & MAY 2019 Entrance Exams)Document4 pagesRecent Post: List of Ust Law Applicants Qualified For Enrollment (For April & MAY 2019 Entrance Exams)Nikki Manuel Tionko GutierrezNo ratings yet

- 2016 Bar Exam Suggested Answers in Taxation by The UP Law ComplexDocument20 pages2016 Bar Exam Suggested Answers in Taxation by The UP Law ComplexSamuel LuptakNo ratings yet

- Excitel Broadband BillDocument1 pageExcitel Broadband Billpritemp.23No ratings yet

- Indian ComplianceDocument29 pagesIndian Compliancekundhavai nambiNo ratings yet

- US Tax ReturnDocument13 pagesUS Tax Returnjamo christineNo ratings yet

- Multiple ChoiceDocument4 pagesMultiple ChoiceSophia KeratinNo ratings yet

- Flight Invoice A240216601850Document2 pagesFlight Invoice A240216601850entry.mazinNo ratings yet

- Upgradation of PostsDocument2 pagesUpgradation of PostsihtishamulhussanNo ratings yet

- FoA2 Week 2 Lesson and HW 3Document8 pagesFoA2 Week 2 Lesson and HW 3Christine Joyce MagoteNo ratings yet

- Utah Form TC-20 Tax Return and InstructionsDocument26 pagesUtah Form TC-20 Tax Return and InstructionsBrandonNo ratings yet

- Tax On Corporation MaterialsDocument18 pagesTax On Corporation Materialsjdy managbanagNo ratings yet

- CA Final Direct Tax Flow Charts May 2017 2SDMBZA2Document92 pagesCA Final Direct Tax Flow Charts May 2017 2SDMBZA2Meet Mehta100% (1)

- Flipkart InvoiceDocument1 pageFlipkart InvoiceApplication PurposeNo ratings yet

- National Development Co Vs Cebu CityDocument3 pagesNational Development Co Vs Cebu CityRaymond RoqueNo ratings yet