Professional Documents

Culture Documents

Chapter2 Article7 ProfessionalTax PDF

Chapter2 Article7 ProfessionalTax PDF

Uploaded by

Wilmer urbanoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter2 Article7 ProfessionalTax PDF

Chapter2 Article7 ProfessionalTax PDF

Uploaded by

Wilmer urbanoCopyright:

Available Formats

Article Seven.

- Professional Tax

Section 58. Professional Tax. - There is hereby imposed an annual professional

tax on each person engaged in the exercise or practice of his profession requiring

government examination at the rate of Three Hundred Pesos (P300.00)

Section 59. Coverage. - Professionals who passed the bar examinations

conducted by the Supreme Court, or any board or other examinations conducted by the

Professional Regulation Commission (PRC) shall be subject to the professional tax.

Section 60. Exemption. - Professionals exclusively employed in the government

shall be exempt from the payment of this tax.

Section 61. Payment of the Tax. - The professional tax shall be paid before any

profession herein specified can be lawfully pursued. A line of profession does not become

exempt even if conducted with some other profession for which the tax has been paid.

Section 62. Time and Place of Payment. - The professional tax shall be payable

annually, on or before the thirty-first (31st) day of January of each year to the City Treasurer.

Any person first beginning to practice a profession after the month of January must,

however, pay the full tax before engaging therein.

Every person legally authorized to practice his profession in this city shall pay to the

city where he maintains his principal office in case he practices his profession in several

places.

Section 63. Administrative Provisions.

(a) A person who paid the professional tax shall be entitled to practice his

profession in any part of the Philippines without being subjected to any other national or

local tax or fee for the practice of such profession.

(b) The City Treasurer or his duly authorized representative shall require from

professionals their unexpired professional licensed card or Profession Identification Card

issued by PRC or a certification from PRC that the professional ID/license card is still on

process before accepting payment of their professional tax for the current year. In case of

a lawyer, he/she must present his/her latest official receipt in payment of his/her Integrated

Bar of the Philippines (IBP) membership fee issued by the latter.

(c) Any individual or corporation employing a person subject to the professional

tax shall require payment by that person of the tax on his profession before employment

and annually thereafter.

(d) Any person subject to the professional tax shall write in deeds, receipts,

prescriptions, reports, books of account, plans and designs, survey's and maps, as the

case may be, the number of the official receipt issued to him.

You might also like

- Local Government TaxationDocument5 pagesLocal Government TaxationDiane UyNo ratings yet

- The County Government of Kiambu Finance Bill.Document71 pagesThe County Government of Kiambu Finance Bill.Kiambu County Government -Kenya.No ratings yet

- Section 90. Practice of Profession.Document2 pagesSection 90. Practice of Profession.Sallen DaisonNo ratings yet

- Chapter Vii - Community Tax Sec. 285. Community Tax The City Hereby Levy's Community Tax in Lieu of Former Residence Tax Levied andDocument12 pagesChapter Vii - Community Tax Sec. 285. Community Tax The City Hereby Levy's Community Tax in Lieu of Former Residence Tax Levied andJascinth Sabanal - LumahangNo ratings yet

- The Companies (Profits) Surtax Act, 1964Document16 pagesThe Companies (Profits) Surtax Act, 1964Mrigendra MishraNo ratings yet

- Basis For Newly Started BusinessDocument3 pagesBasis For Newly Started BusinessmarmiedyanNo ratings yet

- Conditions For Purposes of Appearance. - (1) No Person Shall Be Eligible To AttendDocument7 pagesConditions For Purposes of Appearance. - (1) No Person Shall Be Eligible To AttendLITTO GEORGENo ratings yet

- BIR TAX CODE Other Percentage TaxesDocument7 pagesBIR TAX CODE Other Percentage TaxesGenie Mae LopezNo ratings yet

- Commonwealth Act No. 465Document3 pagesCommonwealth Act No. 465Carlos RabagoNo ratings yet

- 3.2.1 Procedure For Voluntary Winding Up: Step 7. Register For Sales TaxDocument3 pages3.2.1 Procedure For Voluntary Winding Up: Step 7. Register For Sales TaxAhsan LakhaniNo ratings yet

- RR 30-03Document8 pagesRR 30-03matinikkiNo ratings yet

- Makati Revenue CodeDocument12 pagesMakati Revenue CodeMica de GuzmanNo ratings yet

- Tax 1.1Document13 pagesTax 1.1Mheryza De Castro PabustanNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument3 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledBlue GreenNo ratings yet

- Quarterly Corporate Income Tax Annual Declaration and Quarterly Payments of Income TaxesDocument2 pagesQuarterly Corporate Income Tax Annual Declaration and Quarterly Payments of Income TaxesshakiraNo ratings yet

- Professional Tax RulesDocument8 pagesProfessional Tax RulesSundasNo ratings yet

- Republic Act No. 6511Document3 pagesRepublic Act No. 6511Jay-arr ValdezNo ratings yet

- Kalakalan 20Document2 pagesKalakalan 20Benitez GheroldNo ratings yet

- Taxation: 4. Other Percentage TaxDocument6 pagesTaxation: 4. Other Percentage TaxMarkuNo ratings yet

- Ilovepdf MergedDocument10 pagesIlovepdf Mergedpiyushshukla9642No ratings yet

- DRAFT RR-Implementing EOPT - For Public ConsultationDocument4 pagesDRAFT RR-Implementing EOPT - For Public ConsultationGennelyn OdulioNo ratings yet

- Barangay Taxing PowersDocument27 pagesBarangay Taxing PowersNichelle De RamaNo ratings yet

- Expenses Regarding Service Tax Return Submited by Babai in The Month of June - 09Document13 pagesExpenses Regarding Service Tax Return Submited by Babai in The Month of June - 09mdbalajeeNo ratings yet

- Img 202402Document1 pageImg 202402Cirilone BalagaNo ratings yet

- Withholding On Wages SEC. 78. Definitions. - As Used in This ChapterDocument5 pagesWithholding On Wages SEC. 78. Definitions. - As Used in This ChaptershakiraNo ratings yet

- RR 2-98 (As Amended)Document74 pagesRR 2-98 (As Amended)Mariano RentomesNo ratings yet

- The PEZA IssueDocument29 pagesThe PEZA IssueArne TanNo ratings yet

- Ra 9294 Offshore Banking Units FcduDocument6 pagesRa 9294 Offshore Banking Units Fcduapi-247793055No ratings yet

- CTC Legal BasisDocument1 pageCTC Legal Basisromeo abacaNo ratings yet

- Cedula / Community Tax CertificateDocument1 pageCedula / Community Tax Certificateromeo abacaNo ratings yet

- RA 9335 Attrition Act of 2005Document5 pagesRA 9335 Attrition Act of 2005Sj EclipseNo ratings yet

- Percentage TaxDocument22 pagesPercentage TaxMa.annNo ratings yet

- After The Previous Year ExpiryDocument4 pagesAfter The Previous Year ExpiryRaj JamadarNo ratings yet

- Tax RateDocument10 pagesTax RateErwin Dave M. DahaoNo ratings yet

- DOF Local Finance Circular 03-93Document4 pagesDOF Local Finance Circular 03-93Peggy SalazarNo ratings yet

- Model Agreement - KBM & KBMDocument7 pagesModel Agreement - KBM & KBMkanishk.basuNo ratings yet

- R.A. 6511Document3 pagesR.A. 6511Qu RaNo ratings yet

- Other Percentage TaxDocument5 pagesOther Percentage TaxMGVMonNo ratings yet

- Other Percentage TaxesreportDocument40 pagesOther Percentage TaxesreportZhee BillarinaNo ratings yet

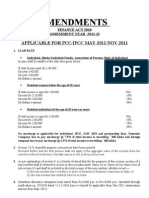

- Amendments: Applicable For Pcc/Ipcc May-2011/Nov-2011Document28 pagesAmendments: Applicable For Pcc/Ipcc May-2011/Nov-2011kavs234No ratings yet

- Karnataka Profession Tax: ST ST TH TH THDocument3 pagesKarnataka Profession Tax: ST ST TH TH THSHRINIDHINo ratings yet

- Payment of Bonus Act1965Document5 pagesPayment of Bonus Act1965kumar_2089No ratings yet

- Professional Tax ReceiptDocument1 pageProfessional Tax ReceiptLizabeth PeñaNo ratings yet

- RR 12-01Document6 pagesRR 12-01matinikkiNo ratings yet

- Administrative Provisions SEC. 236. Registration Requirements.Document6 pagesAdministrative Provisions SEC. 236. Registration Requirements.Blanca Louise Vali ValledorNo ratings yet

- Ordinance No 1 TaxationDocument5 pagesOrdinance No 1 TaxationMiguel BravoNo ratings yet

- Tax Deducted at SourceDocument29 pagesTax Deducted at SourceAmbar Pratik MishraNo ratings yet

- ST THDocument3 pagesST THDhananjaya MnNo ratings yet

- Philippine Laws Statutes and Codes - Chan Robles Virtual Law LibraryDocument4 pagesPhilippine Laws Statutes and Codes - Chan Robles Virtual Law LibraryVicente SalanapNo ratings yet

- RA - 6810.pdf Filename - UTF-8''RA 6810 PDFDocument27 pagesRA - 6810.pdf Filename - UTF-8''RA 6810 PDFRio AborkaNo ratings yet

- Section 194LB Section 194LC Section 194LDDocument2 pagesSection 194LB Section 194LC Section 194LDSid MehtaNo ratings yet

- RA 9294 - Restoring Tax Exemption of OBus and FCDusDocument6 pagesRA 9294 - Restoring Tax Exemption of OBus and FCDusRocky MarcianoNo ratings yet

- Revenue Etc For Income TaxationDocument286 pagesRevenue Etc For Income TaxationpurplebasketNo ratings yet

- Tds Amendements Via Finance Bill 2020Document12 pagesTds Amendements Via Finance Bill 2020ABHISHEKNo ratings yet

- City Gov't of San Pablo vs. ReyesDocument9 pagesCity Gov't of San Pablo vs. ReyesonryouyukiNo ratings yet

- CIR v. Amex (Inc)Document3 pagesCIR v. Amex (Inc)Eva TrinidadNo ratings yet

- Codal Estate Tax: CralawDocument2 pagesCodal Estate Tax: CralawKitem Kadatuan Jr.No ratings yet

- RMC No. 13-2020 Annex A - 1600-VT 2018 GuidelinesDocument1 pageRMC No. 13-2020 Annex A - 1600-VT 2018 GuidelinesGodfrey Tejada100% (1)

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Practical Research 2 2021Document36 pagesPractical Research 2 2021Allen Paul Gamazon0% (1)

- Toba Tek Singh-Mo-Banner Preliminary List of Interested Candidates 14fhdDocument5 pagesToba Tek Singh-Mo-Banner Preliminary List of Interested Candidates 14fhdAli TasaramNo ratings yet

- Unit 2 Contemporary Filipino ArtistsDocument49 pagesUnit 2 Contemporary Filipino Artistsyel kirstenNo ratings yet

- A Cognitive Model of Posttraumatic Stress Disorder: Behaviour Research and Therapy April 2000Document28 pagesA Cognitive Model of Posttraumatic Stress Disorder: Behaviour Research and Therapy April 2000Fenrrir BritoNo ratings yet

- New GAP Algorithm Draft 4-7-19Document1 pageNew GAP Algorithm Draft 4-7-19Umber AgarwalNo ratings yet

- Final Exam Form 1Document12 pagesFinal Exam Form 1ILANGGO KANANNo ratings yet

- Kebf Prelim ReviewerDocument10 pagesKebf Prelim ReviewerJamaica EstorninosNo ratings yet

- EiE Competency Framework CPHA Annex enDocument25 pagesEiE Competency Framework CPHA Annex enCumar Cadaani100% (1)

- Striking Out Pleadings and IndorsmentsDocument19 pagesStriking Out Pleadings and IndorsmentsNur Amirah SyahirahNo ratings yet

- Footing Design Calculations: DefinitionsDocument31 pagesFooting Design Calculations: DefinitionsMark Roger Huberit IINo ratings yet

- Impact of Online Shopping of FMCG Sector On Working Women: Amity School of Business Amity University Uttar PradeshDocument34 pagesImpact of Online Shopping of FMCG Sector On Working Women: Amity School of Business Amity University Uttar PradeshYash MittalNo ratings yet

- Shri Mahakali Khadagmala Stotram & Ma Kali Beej Mantra Kreem Sadhna Vidhi in HindiDocument34 pagesShri Mahakali Khadagmala Stotram & Ma Kali Beej Mantra Kreem Sadhna Vidhi in Hindisumit girdharwal87% (23)

- Εγχειρίδιο Χρήσης WiFi - EVA - II - Pro - Wifi - 0 PDFDocument16 pagesΕγχειρίδιο Χρήσης WiFi - EVA - II - Pro - Wifi - 0 PDFZaital GilNo ratings yet

- Case 580n 580sn 580snwt 590sn Service ManualDocument20 pagesCase 580n 580sn 580snwt 590sn Service Manualwilliam100% (39)

- Republic vs. Castelvi, 58 SCRA 336 (1974)Document4 pagesRepublic vs. Castelvi, 58 SCRA 336 (1974)Gabriel HernandezNo ratings yet

- Astro A50 Headset ManualDocument14 pagesAstro A50 Headset ManualkanesmallNo ratings yet

- Populorum ProgressioDocument4 pagesPopulorum ProgressioSugar JumuadNo ratings yet

- Apoorv Geology Paper 2 Section ADocument235 pagesApoorv Geology Paper 2 Section Agarvit.msmesitarganjNo ratings yet

- Set 3Document4 pagesSet 3Sharan SNo ratings yet

- 3M ManualDocument12 pages3M ManualpanikeeNo ratings yet

- My Consignment Agreement PDFDocument3 pagesMy Consignment Agreement PDFtamara_arifNo ratings yet

- 04 Rodrigo Roa Duterte, Fifth State of The Nation Address, July 27, 2020 - Official Gazette of The Republic of The PhilippinesDocument23 pages04 Rodrigo Roa Duterte, Fifth State of The Nation Address, July 27, 2020 - Official Gazette of The Republic of The PhilippinesJoseph SalazarNo ratings yet

- Lesson 7Document20 pagesLesson 7rj libayNo ratings yet

- Compania de Naveira Nedelka Sa V Tradex Internacional SaDocument3 pagesCompania de Naveira Nedelka Sa V Tradex Internacional SaAbhishek RaiNo ratings yet

- Greeshma Vasu: Receptionist/Cashier/Edp Clerk/Customer ServiceDocument2 pagesGreeshma Vasu: Receptionist/Cashier/Edp Clerk/Customer Serviceoday abuassaliNo ratings yet

- Sepak TakrawDocument39 pagesSepak TakrawRandy Gasalao100% (2)

- Department of Education: Unpacked Most Essential Learning Competencies (MELC)Document8 pagesDepartment of Education: Unpacked Most Essential Learning Competencies (MELC)Rubina Pontillas100% (1)

- Codirectores y ActasDocument6 pagesCodirectores y ActasmarcelaNo ratings yet

- Quaid e AzamDocument7 pagesQuaid e AzamFM statusNo ratings yet

- Oppositional Inference: Northwesternuniversity, IncDocument3 pagesOppositional Inference: Northwesternuniversity, IncDanica CumlatNo ratings yet