Professional Documents

Culture Documents

Scorecard and Assessment Report For Startups: Concept

Scorecard and Assessment Report For Startups: Concept

Uploaded by

Prahlad ThakurCopyright:

Available Formats

You might also like

- Mobile App Business PlanDocument12 pagesMobile App Business PlanMuhammad Hidayah0% (1)

- Investment Journey and Key Learnings Kumar SaurabhDocument7 pagesInvestment Journey and Key Learnings Kumar SaurabhAASHAV PATELNo ratings yet

- Lab 5 Thermo FluidsDocument13 pagesLab 5 Thermo FluidsAimiWaniNo ratings yet

- BiZCrateDocument6 pagesBiZCrateShubhayu BasuNo ratings yet

- New Venture - EntryDocument2 pagesNew Venture - EntryGlennWoltersNo ratings yet

- The Economics & Key Decisions of Platforms: © National University of Singapore. All Rights ReservedDocument35 pagesThe Economics & Key Decisions of Platforms: © National University of Singapore. All Rights Reservedkeeweikuang123No ratings yet

- How To Pitch An IdeaDocument30 pagesHow To Pitch An IdeaJ. MbogoNo ratings yet

- MBA Marketing 2Document23 pagesMBA Marketing 2Bianca Leyva100% (1)

- 10INV PYOE Business Plan AssessmentDocument5 pages10INV PYOE Business Plan AssessmentAndrew DaviesNo ratings yet

- Strategy Last TutorialDocument4 pagesStrategy Last Tutorialcangelo.kluskaNo ratings yet

- Part-A, Question 2: Internal Factors External FactorsDocument6 pagesPart-A, Question 2: Internal Factors External FactorsShovan ChowdhuryNo ratings yet

- Feasib RubricDocument2 pagesFeasib RubricArveeh AvilesNo ratings yet

- Hewlett-Packard (HP) Business Strategy ReportDocument33 pagesHewlett-Packard (HP) Business Strategy Reportjessica_liemNo ratings yet

- Zyta6azz4 Tool PodcaststrategytemplateDocument7 pagesZyta6azz4 Tool PodcaststrategytemplateOmar mobasherNo ratings yet

- Module Week 6 EntrepDocument6 pagesModule Week 6 Entrepゔ違でStrawberry milkNo ratings yet

- IRubric - Business Plan Grading Rubric (Written) - W523C3 - RCampusDocument1 pageIRubric - Business Plan Grading Rubric (Written) - W523C3 - RCampusRecks MateoNo ratings yet

- SWOT Analysis QuestionsDocument19 pagesSWOT Analysis QuestionsSteven Bonacorsi100% (12)

- Prioritize Your Cost Optimization Efforts: A Decision Framework ForDocument5 pagesPrioritize Your Cost Optimization Efforts: A Decision Framework FornikNo ratings yet

- Date Session On Learning From ModuleDocument34 pagesDate Session On Learning From ModuleKishore KintaliNo ratings yet

- Blue Sheet - CS PuneDocument11 pagesBlue Sheet - CS PuneShipra SinghNo ratings yet

- Mobile App Business PlanDocument12 pagesMobile App Business PlanFitzmaurice SimaanyaNo ratings yet

- Strategy and ConsultingDocument75 pagesStrategy and ConsultingRitu MendirattaNo ratings yet

- External & Internal AnalysisDocument19 pagesExternal & Internal AnalysisSumon iqbalNo ratings yet

- Full Download Solution Manual For Managing Operations Across The Supply Chain 3rd Edition PDF Full ChapterDocument36 pagesFull Download Solution Manual For Managing Operations Across The Supply Chain 3rd Edition PDF Full Chapterscrotalfilietyhakbc100% (23)

- Strategic Management II - Portfolio Analysis and Strategic ChoiceDocument32 pagesStrategic Management II - Portfolio Analysis and Strategic ChoiceArup BaksiNo ratings yet

- Group 1 The Entrepreneurial MindsetDocument15 pagesGroup 1 The Entrepreneurial MindsetBri CorpuzNo ratings yet

- Idea2PoC - Elevate - Pitch Deck Template - FinalDocument12 pagesIdea2PoC - Elevate - Pitch Deck Template - FinalBTechMag comNo ratings yet

- Applied Eco Module 6Document7 pagesApplied Eco Module 6Madelyn ArimadoNo ratings yet

- Reviewer For GR 12 STEM StudentDocument5 pagesReviewer For GR 12 STEM Studentm97998668No ratings yet

- Whetting The E-Business ConceptDocument18 pagesWhetting The E-Business ConceptNishanth KannaNo ratings yet

- Segment Standard CriteriaDocument11 pagesSegment Standard CriteriaTimothy SkibaNo ratings yet

- SWOT Analysis TemplateDocument3 pagesSWOT Analysis TemplatesamrinNo ratings yet

- F0400-03 SWOT Analysis TemplateDocument3 pagesF0400-03 SWOT Analysis TemplateRito BaloyiNo ratings yet

- Blue Sheet - BNY PuneDocument11 pagesBlue Sheet - BNY PuneShipra SinghNo ratings yet

- New Client OutreachDocument2 pagesNew Client Outreachalex KNo ratings yet

- SPPT 5 - Competitive Advantage, Firm Performance & Business ModelsDocument27 pagesSPPT 5 - Competitive Advantage, Firm Performance & Business ModelsBaaba EsselNo ratings yet

- SYLLABUS IN TLE 10 (Entrepreneurship) First QuarterDocument25 pagesSYLLABUS IN TLE 10 (Entrepreneurship) First QuarterMaricel sinfuegoNo ratings yet

- Dividend Decision Class NotesDocument18 pagesDividend Decision Class NotesSphamandla MakalimaNo ratings yet

- 3 - IB Exam DCF DamodaranDocument5 pages3 - IB Exam DCF Damodaranmatthew erNo ratings yet

- 5fe7507d6abf1 KPMG Ideation Challenge - How To Prepare Your Next RoundDocument15 pages5fe7507d6abf1 KPMG Ideation Challenge - How To Prepare Your Next Roundqhimtjbjw7No ratings yet

- Options Grids (Og) : Page. Make Sure There Is Serious Content To Go Over One PageDocument2 pagesOptions Grids (Og) : Page. Make Sure There Is Serious Content To Go Over One PageJosé Mario PeñaNo ratings yet

- Blue Sheet - Barclays PuneDocument11 pagesBlue Sheet - Barclays PuneShipra SinghNo ratings yet

- ROI Framework by GTM Partners (1)Document10 pagesROI Framework by GTM Partners (1)feisalNo ratings yet

- Business Plan TemplateDocument23 pagesBusiness Plan TemplateTshering DemaNo ratings yet

- Corporate Strategy: A.A.Mohamed FaisalDocument17 pagesCorporate Strategy: A.A.Mohamed FaisalfaisNo ratings yet

- SM Core Comp and PLCDocument36 pagesSM Core Comp and PLCGaming Guruji HeatNo ratings yet

- BLUE - Business Case Template (Auto-Saved)Document10 pagesBLUE - Business Case Template (Auto-Saved)JananiRajamanickamNo ratings yet

- B Plan WorkshopDocument39 pagesB Plan WorkshopChirag GargNo ratings yet

- Imp FrameworkDocument20 pagesImp Frameworksrinivas250No ratings yet

- Learning Objectives: at The End of The Lesson, Students Will Be Able To: ENGLISH - Collaboration, and CommunicationDocument3 pagesLearning Objectives: at The End of The Lesson, Students Will Be Able To: ENGLISH - Collaboration, and CommunicationTeacher AnaNo ratings yet

- Frameworks - FMSDocument6 pagesFrameworks - FMSParth SOODANNo ratings yet

- SWOT Analysis TemplateDocument12 pagesSWOT Analysis TemplateSteven Bonacorsi100% (10)

- How To Buy, Sell and Value Shares in Stock ExchangesDocument85 pagesHow To Buy, Sell and Value Shares in Stock Exchangesagrawal.minNo ratings yet

- Relative ValuationDocument96 pagesRelative ValuationParvesh AghiNo ratings yet

- Business Plan Rubric - FinalDocument3 pagesBusiness Plan Rubric - FinalAHMAD 1999100% (1)

- Stock Investing Mastermind - Zebra Learn-100Document2 pagesStock Investing Mastermind - Zebra Learn-100RGNitinDevaNo ratings yet

- FY13 Business Plan Presentation RubricDocument5 pagesFY13 Business Plan Presentation RubricXtine Rivera - ParungaoNo ratings yet

- Any B2B Sales StrategyDocument3 pagesAny B2B Sales StrategyAvin ShanbhagNo ratings yet

- Relative ValuationDocument90 pagesRelative ValuationParvesh AghiNo ratings yet

- Transactional Analysis: Greeshma. T S4 MSWDocument42 pagesTransactional Analysis: Greeshma. T S4 MSWSridhar KodaliNo ratings yet

- CO 126 F FRESDENLEN 410358301910485666 Candy 126 F Optima Wash SystemDocument41 pagesCO 126 F FRESDENLEN 410358301910485666 Candy 126 F Optima Wash SystemSweetOfSerbiaNo ratings yet

- Jsu PT3 ENGLISHDocument2 pagesJsu PT3 ENGLISHDineswari SelvamNo ratings yet

- Bangalore University: "Student Attendance Management"Document10 pagesBangalore University: "Student Attendance Management"Rohit VilliersNo ratings yet

- QM.J2 Doc Ref MatrixDocument2 pagesQM.J2 Doc Ref MatrixProsenjit DasNo ratings yet

- Cttplus HandbookDocument36 pagesCttplus HandbookgcarreongNo ratings yet

- 3 ReviewDocument5 pages3 ReviewJNo ratings yet

- Personality DevelopmentDocument28 pagesPersonality Developmentmaverick-riouNo ratings yet

- Английский язык 2Document9 pagesАнглийский язык 2Mariam ChubabriaNo ratings yet

- 501a 17 PDFDocument28 pages501a 17 PDFhikary2.032100% (1)

- RefsDocument38 pagesRefsLê TrungNo ratings yet

- Ada358766 (1) (2021 - 06 - 28 00 - 45 - 34 Utc)Document370 pagesAda358766 (1) (2021 - 06 - 28 00 - 45 - 34 Utc)Nicodemos de JesusNo ratings yet

- S B Mallur - C VDocument12 pagesS B Mallur - C VsbmallurNo ratings yet

- SECOND Periodic Test in AP 4 With TOS SY 2022 2023Document6 pagesSECOND Periodic Test in AP 4 With TOS SY 2022 2023MICHAEL VERINANo ratings yet

- 8 y 9 Sem MATERIAL de ESTUDIO INGLES V Unit V Do You Know Where It Is Unit VI Since WhenDocument12 pages8 y 9 Sem MATERIAL de ESTUDIO INGLES V Unit V Do You Know Where It Is Unit VI Since WhenJoseph MartinezNo ratings yet

- CDA ResumewithFolioDocument25 pagesCDA ResumewithFoliocdabandoNo ratings yet

- PDF Psychotherapy Relationships That Work Volume 1 Evidence Based Therapist Contributions John C Norcross Ebook Full ChapterDocument47 pagesPDF Psychotherapy Relationships That Work Volume 1 Evidence Based Therapist Contributions John C Norcross Ebook Full Chapterdavid.muterspaw637100% (2)

- Transformer ProtectionDocument10 pagesTransformer ProtectionmachokotolainhardoceanNo ratings yet

- Corrosión Manual NalcoDocument126 pagesCorrosión Manual NalcotinovelazquezNo ratings yet

- Time Response AnalysisDocument43 pagesTime Response AnalysisAkmal IsnaeniNo ratings yet

- MKT306 - May Assignment 2014Document6 pagesMKT306 - May Assignment 2014Rajib AhmedNo ratings yet

- Chafi2009Document7 pagesChafi2009radhakrishnanNo ratings yet

- Ks2 NC Reading Progress ReportDocument5 pagesKs2 NC Reading Progress ReportCyndee PamintuanNo ratings yet

- Okok Projects 2023Document45 pagesOkok Projects 202319BMR016 Disha MahzoozaNo ratings yet

- Better Graphics r10 PDFDocument45 pagesBetter Graphics r10 PDFdocsmsNo ratings yet

- JJRM PPT Marxism PSM1Document20 pagesJJRM PPT Marxism PSM1Jeff Rey ColumnaNo ratings yet

- Atlas 3CR12 DatasheetDocument3 pagesAtlas 3CR12 DatasheettridatylNo ratings yet

- 2019 (Gatsov-Nedelcheva) Pietrele 2 Lithic-Industry (Small)Document177 pages2019 (Gatsov-Nedelcheva) Pietrele 2 Lithic-Industry (Small)Clive BonsallNo ratings yet

- Lien 2020Document11 pagesLien 2020Puraghan cahya herawanNo ratings yet

Scorecard and Assessment Report For Startups: Concept

Scorecard and Assessment Report For Startups: Concept

Uploaded by

Prahlad ThakurOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Scorecard and Assessment Report For Startups: Concept

Scorecard and Assessment Report For Startups: Concept

Uploaded by

Prahlad ThakurCopyright:

Available Formats

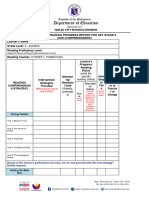

Scorecard and assessment report for startups

Team/Venture Name | E-mail id SunEmison Solar Energy Pvt. Ltd. | info@sunemison.com

Code 963

Report created on 2018-09-16

Out of a total possible score of

Your score 54

250

POC/Beta / Pilot/

Current status Yet to Start Growth

Early Growth

May be of interest to

Is this venture in an area of interest to investors? No Yes

some investors

Note: This is an interim report, based on inferences from the material received and the website/app (if relevant). The scorecard and assessment

report may change based on more detailed interactions.

Concept 0 out of 36

Market opportunity: Does the concept/solution No or need already Perhaps a latent need,

address a real, felt need or an obvious need gap that is being well serviced by but may not be an YES

currently un-addressed? others expressed need

Does the venture have a clear value proposition that is

NO YES

meaningful to its target customers?

Differentiated from

Value proposition others, but Consumers/Clients likely to prefer

Does the product / service have a differentiator /

same/similar as other differentiator may not this brand based on this

uniqueness?

options/brands. be a key decision point differentiator.

for customers.

May be (e.g.

processes, scale,

Is the differentiator / uniqueness defensible? No brand… things that Yes (e.g. IP)

can give a competitive

distinctiveness)

Can it disrupt the industry? Unlikely May be Yes

Overall potential Weak Scope for improvement Strong

Product 2 out of 19

Technology Not indicated / Cannot infer from information provided in pitch deck

UI Weak Scope for improvement Strong

UX (Online as well as offline, if relevant) Not indicated / Cannot infer from information provided in pitch deck

Is the value proposition articulated in a way that is

No Scope for improvement Yes

compelling for the target audience?

Overall product Weak Scope for improvement Strong

Business model and business case 10 out of 29

Revenue streams Weak or impractical Basic Strong/Practical/Innovative

Practical / in line with strategy &

Pricing Impractical Basic

positioning

Business Model Weak or impractical Basic Strong/Practical/Innovative

Business case / Unit Economics Not indicated / Cannot infer from information provided in pitch deck

When can the business be profitable? Not indicated / Cannot infer from information provided in pitch deck

Can this be a meaningful business? Not indicated / Cannot infer from information provided in pitch deck

Market size and competition 0 out of 16

Potential - Size of the market opportunity USD 1bn - USD 5bn > USD 5 bn

Is the market local or global Local Global

Not first mover, but

Competitive environment Crowded / Challenging winners yet to be Low/No Competition currently

declared in the segment

Does the team's product and plan have a reasonable

No May be Yes

chance to succeed in the market?

Traction and Product-Market Fit 0 out of 26

Traction Not indicated / Cannot infer from information provided in pitch deck

Customers / users satisfaction Not indicated / Cannot infer from information provided in pitch deck

Customer coversion metrics Not indicated / Cannot infer from information provided in pitch deck

Has the product-market fit been established? Not indicated / Cannot infer from information provided in pitch deck

Is the progress impressive? Not indicated / Cannot infer from information provided in pitch deck

Team 40 out of 66

Number of founders Not indicated / Cannot infer from information provided in pitch deck

Does the team have the diversity of skills required to

No Yes

make the venture successful?

Less than 3 years or

More than 3 years of industry

Does the team have Industry Experience? No some members have

experience

industry experience

Some members have

Strong team with relevant

Does the team have subject-matter expertise? No relevant subject-matter

experience / expertise

expertise

Are all founders full-time on this venture? Not indicated / Cannot infer from information provided in pitch deck

Tech team in-house, Founder(s) with strong tech

How strong is the team on technology? Weak / outsourced but none of the background, and strong in-house

founders is a techie tech team

How strong is the team on marketing & sales? Not indicated / Cannot infer from information provided in pitch deck

Is the equity fairly distributed among founders? Not indicated / Cannot infer from information provided in pitch deck

Is this a strong team? Not indicated / Cannot infer from information provided in pitch deck

Go-to-market plans and milestones 2 out of 9

Possible to scale, but

Challenges for scaling up - Can this scale without

Difficult to scale with operational High possibility of scale

operational scaling up of operations

challenges

Does the team have a strong implementation plan? Not indicated / Cannot infer from information provided in pitch deck

Is the venture targeting a sharply defined audience, and

No Yes

with a focused business model?

Does the company have a reasonable chance to be

dominant player in the market based on the current No May be Yes

plans?

Readiness for fund raising 0 out of 26

Will the pace of growth, implementation plan and

Not indicated / Cannot infer from information provided in pitch deck

milestones projected appeal to investors?

Valuation sought by the team Not indicated / Cannot infer from information provided in pitch deck

Exit options for early-investors if the venture

Weak Moderate Strong

progresses well

If the business does not go as plan, can it get to self-

Not indicated / Cannot infer from information provided in pitch deck

sustainability with this round of funding?

Is the quantum of capital sought adequate and practical? Not indicated / Cannot infer from information provided in pitch deck

Does the investor pitch deck communicate the story

No Yes

powerfully to exite investors?

Does the investor pitch deck cover all aspects that

No Yes

investors seek information on?

Is the venture likely to excite investors in its current

No May be Yes

form?

Out of a total

Your total score 54

possible score of 250

Note: Scores on 'Not indicated' columns are taken at '2' (Or '5' in case of Percentage and

important parameters). However, they may be revised upwards of lower based chances of getting 22%

on further information. investor interest

What the score and colour codes indicate

Note: The scorecard is prepared by the Q-Rate review team. It is subjective. Different people will have different perspectives on a business. The

intention is to provide entrepreneurs one experienced perspective on how investors are likely to view their venture.

Above 85% - Strong chances Between 70 - 85% - Modest Between 50 and 70% - Will Below 50% - unlikely to get

of getting investor interest chances of getting investor need significant changes in investor interest

interest - can be improved strategy to attract investor

interest

This model has been developed by Applyifi. All rights reserved.

Write to us at helpdesk.istart@rajasthan.gov.in for inputs to improve your score and

increase your odds of getting funded.

You might also like

- Mobile App Business PlanDocument12 pagesMobile App Business PlanMuhammad Hidayah0% (1)

- Investment Journey and Key Learnings Kumar SaurabhDocument7 pagesInvestment Journey and Key Learnings Kumar SaurabhAASHAV PATELNo ratings yet

- Lab 5 Thermo FluidsDocument13 pagesLab 5 Thermo FluidsAimiWaniNo ratings yet

- BiZCrateDocument6 pagesBiZCrateShubhayu BasuNo ratings yet

- New Venture - EntryDocument2 pagesNew Venture - EntryGlennWoltersNo ratings yet

- The Economics & Key Decisions of Platforms: © National University of Singapore. All Rights ReservedDocument35 pagesThe Economics & Key Decisions of Platforms: © National University of Singapore. All Rights Reservedkeeweikuang123No ratings yet

- How To Pitch An IdeaDocument30 pagesHow To Pitch An IdeaJ. MbogoNo ratings yet

- MBA Marketing 2Document23 pagesMBA Marketing 2Bianca Leyva100% (1)

- 10INV PYOE Business Plan AssessmentDocument5 pages10INV PYOE Business Plan AssessmentAndrew DaviesNo ratings yet

- Strategy Last TutorialDocument4 pagesStrategy Last Tutorialcangelo.kluskaNo ratings yet

- Part-A, Question 2: Internal Factors External FactorsDocument6 pagesPart-A, Question 2: Internal Factors External FactorsShovan ChowdhuryNo ratings yet

- Feasib RubricDocument2 pagesFeasib RubricArveeh AvilesNo ratings yet

- Hewlett-Packard (HP) Business Strategy ReportDocument33 pagesHewlett-Packard (HP) Business Strategy Reportjessica_liemNo ratings yet

- Zyta6azz4 Tool PodcaststrategytemplateDocument7 pagesZyta6azz4 Tool PodcaststrategytemplateOmar mobasherNo ratings yet

- Module Week 6 EntrepDocument6 pagesModule Week 6 Entrepゔ違でStrawberry milkNo ratings yet

- IRubric - Business Plan Grading Rubric (Written) - W523C3 - RCampusDocument1 pageIRubric - Business Plan Grading Rubric (Written) - W523C3 - RCampusRecks MateoNo ratings yet

- SWOT Analysis QuestionsDocument19 pagesSWOT Analysis QuestionsSteven Bonacorsi100% (12)

- Prioritize Your Cost Optimization Efforts: A Decision Framework ForDocument5 pagesPrioritize Your Cost Optimization Efforts: A Decision Framework FornikNo ratings yet

- Date Session On Learning From ModuleDocument34 pagesDate Session On Learning From ModuleKishore KintaliNo ratings yet

- Blue Sheet - CS PuneDocument11 pagesBlue Sheet - CS PuneShipra SinghNo ratings yet

- Mobile App Business PlanDocument12 pagesMobile App Business PlanFitzmaurice SimaanyaNo ratings yet

- Strategy and ConsultingDocument75 pagesStrategy and ConsultingRitu MendirattaNo ratings yet

- External & Internal AnalysisDocument19 pagesExternal & Internal AnalysisSumon iqbalNo ratings yet

- Full Download Solution Manual For Managing Operations Across The Supply Chain 3rd Edition PDF Full ChapterDocument36 pagesFull Download Solution Manual For Managing Operations Across The Supply Chain 3rd Edition PDF Full Chapterscrotalfilietyhakbc100% (23)

- Strategic Management II - Portfolio Analysis and Strategic ChoiceDocument32 pagesStrategic Management II - Portfolio Analysis and Strategic ChoiceArup BaksiNo ratings yet

- Group 1 The Entrepreneurial MindsetDocument15 pagesGroup 1 The Entrepreneurial MindsetBri CorpuzNo ratings yet

- Idea2PoC - Elevate - Pitch Deck Template - FinalDocument12 pagesIdea2PoC - Elevate - Pitch Deck Template - FinalBTechMag comNo ratings yet

- Applied Eco Module 6Document7 pagesApplied Eco Module 6Madelyn ArimadoNo ratings yet

- Reviewer For GR 12 STEM StudentDocument5 pagesReviewer For GR 12 STEM Studentm97998668No ratings yet

- Whetting The E-Business ConceptDocument18 pagesWhetting The E-Business ConceptNishanth KannaNo ratings yet

- Segment Standard CriteriaDocument11 pagesSegment Standard CriteriaTimothy SkibaNo ratings yet

- SWOT Analysis TemplateDocument3 pagesSWOT Analysis TemplatesamrinNo ratings yet

- F0400-03 SWOT Analysis TemplateDocument3 pagesF0400-03 SWOT Analysis TemplateRito BaloyiNo ratings yet

- Blue Sheet - BNY PuneDocument11 pagesBlue Sheet - BNY PuneShipra SinghNo ratings yet

- New Client OutreachDocument2 pagesNew Client Outreachalex KNo ratings yet

- SPPT 5 - Competitive Advantage, Firm Performance & Business ModelsDocument27 pagesSPPT 5 - Competitive Advantage, Firm Performance & Business ModelsBaaba EsselNo ratings yet

- SYLLABUS IN TLE 10 (Entrepreneurship) First QuarterDocument25 pagesSYLLABUS IN TLE 10 (Entrepreneurship) First QuarterMaricel sinfuegoNo ratings yet

- Dividend Decision Class NotesDocument18 pagesDividend Decision Class NotesSphamandla MakalimaNo ratings yet

- 3 - IB Exam DCF DamodaranDocument5 pages3 - IB Exam DCF Damodaranmatthew erNo ratings yet

- 5fe7507d6abf1 KPMG Ideation Challenge - How To Prepare Your Next RoundDocument15 pages5fe7507d6abf1 KPMG Ideation Challenge - How To Prepare Your Next Roundqhimtjbjw7No ratings yet

- Options Grids (Og) : Page. Make Sure There Is Serious Content To Go Over One PageDocument2 pagesOptions Grids (Og) : Page. Make Sure There Is Serious Content To Go Over One PageJosé Mario PeñaNo ratings yet

- Blue Sheet - Barclays PuneDocument11 pagesBlue Sheet - Barclays PuneShipra SinghNo ratings yet

- ROI Framework by GTM Partners (1)Document10 pagesROI Framework by GTM Partners (1)feisalNo ratings yet

- Business Plan TemplateDocument23 pagesBusiness Plan TemplateTshering DemaNo ratings yet

- Corporate Strategy: A.A.Mohamed FaisalDocument17 pagesCorporate Strategy: A.A.Mohamed FaisalfaisNo ratings yet

- SM Core Comp and PLCDocument36 pagesSM Core Comp and PLCGaming Guruji HeatNo ratings yet

- BLUE - Business Case Template (Auto-Saved)Document10 pagesBLUE - Business Case Template (Auto-Saved)JananiRajamanickamNo ratings yet

- B Plan WorkshopDocument39 pagesB Plan WorkshopChirag GargNo ratings yet

- Imp FrameworkDocument20 pagesImp Frameworksrinivas250No ratings yet

- Learning Objectives: at The End of The Lesson, Students Will Be Able To: ENGLISH - Collaboration, and CommunicationDocument3 pagesLearning Objectives: at The End of The Lesson, Students Will Be Able To: ENGLISH - Collaboration, and CommunicationTeacher AnaNo ratings yet

- Frameworks - FMSDocument6 pagesFrameworks - FMSParth SOODANNo ratings yet

- SWOT Analysis TemplateDocument12 pagesSWOT Analysis TemplateSteven Bonacorsi100% (10)

- How To Buy, Sell and Value Shares in Stock ExchangesDocument85 pagesHow To Buy, Sell and Value Shares in Stock Exchangesagrawal.minNo ratings yet

- Relative ValuationDocument96 pagesRelative ValuationParvesh AghiNo ratings yet

- Business Plan Rubric - FinalDocument3 pagesBusiness Plan Rubric - FinalAHMAD 1999100% (1)

- Stock Investing Mastermind - Zebra Learn-100Document2 pagesStock Investing Mastermind - Zebra Learn-100RGNitinDevaNo ratings yet

- FY13 Business Plan Presentation RubricDocument5 pagesFY13 Business Plan Presentation RubricXtine Rivera - ParungaoNo ratings yet

- Any B2B Sales StrategyDocument3 pagesAny B2B Sales StrategyAvin ShanbhagNo ratings yet

- Relative ValuationDocument90 pagesRelative ValuationParvesh AghiNo ratings yet

- Transactional Analysis: Greeshma. T S4 MSWDocument42 pagesTransactional Analysis: Greeshma. T S4 MSWSridhar KodaliNo ratings yet

- CO 126 F FRESDENLEN 410358301910485666 Candy 126 F Optima Wash SystemDocument41 pagesCO 126 F FRESDENLEN 410358301910485666 Candy 126 F Optima Wash SystemSweetOfSerbiaNo ratings yet

- Jsu PT3 ENGLISHDocument2 pagesJsu PT3 ENGLISHDineswari SelvamNo ratings yet

- Bangalore University: "Student Attendance Management"Document10 pagesBangalore University: "Student Attendance Management"Rohit VilliersNo ratings yet

- QM.J2 Doc Ref MatrixDocument2 pagesQM.J2 Doc Ref MatrixProsenjit DasNo ratings yet

- Cttplus HandbookDocument36 pagesCttplus HandbookgcarreongNo ratings yet

- 3 ReviewDocument5 pages3 ReviewJNo ratings yet

- Personality DevelopmentDocument28 pagesPersonality Developmentmaverick-riouNo ratings yet

- Английский язык 2Document9 pagesАнглийский язык 2Mariam ChubabriaNo ratings yet

- 501a 17 PDFDocument28 pages501a 17 PDFhikary2.032100% (1)

- RefsDocument38 pagesRefsLê TrungNo ratings yet

- Ada358766 (1) (2021 - 06 - 28 00 - 45 - 34 Utc)Document370 pagesAda358766 (1) (2021 - 06 - 28 00 - 45 - 34 Utc)Nicodemos de JesusNo ratings yet

- S B Mallur - C VDocument12 pagesS B Mallur - C VsbmallurNo ratings yet

- SECOND Periodic Test in AP 4 With TOS SY 2022 2023Document6 pagesSECOND Periodic Test in AP 4 With TOS SY 2022 2023MICHAEL VERINANo ratings yet

- 8 y 9 Sem MATERIAL de ESTUDIO INGLES V Unit V Do You Know Where It Is Unit VI Since WhenDocument12 pages8 y 9 Sem MATERIAL de ESTUDIO INGLES V Unit V Do You Know Where It Is Unit VI Since WhenJoseph MartinezNo ratings yet

- CDA ResumewithFolioDocument25 pagesCDA ResumewithFoliocdabandoNo ratings yet

- PDF Psychotherapy Relationships That Work Volume 1 Evidence Based Therapist Contributions John C Norcross Ebook Full ChapterDocument47 pagesPDF Psychotherapy Relationships That Work Volume 1 Evidence Based Therapist Contributions John C Norcross Ebook Full Chapterdavid.muterspaw637100% (2)

- Transformer ProtectionDocument10 pagesTransformer ProtectionmachokotolainhardoceanNo ratings yet

- Corrosión Manual NalcoDocument126 pagesCorrosión Manual NalcotinovelazquezNo ratings yet

- Time Response AnalysisDocument43 pagesTime Response AnalysisAkmal IsnaeniNo ratings yet

- MKT306 - May Assignment 2014Document6 pagesMKT306 - May Assignment 2014Rajib AhmedNo ratings yet

- Chafi2009Document7 pagesChafi2009radhakrishnanNo ratings yet

- Ks2 NC Reading Progress ReportDocument5 pagesKs2 NC Reading Progress ReportCyndee PamintuanNo ratings yet

- Okok Projects 2023Document45 pagesOkok Projects 202319BMR016 Disha MahzoozaNo ratings yet

- Better Graphics r10 PDFDocument45 pagesBetter Graphics r10 PDFdocsmsNo ratings yet

- JJRM PPT Marxism PSM1Document20 pagesJJRM PPT Marxism PSM1Jeff Rey ColumnaNo ratings yet

- Atlas 3CR12 DatasheetDocument3 pagesAtlas 3CR12 DatasheettridatylNo ratings yet

- 2019 (Gatsov-Nedelcheva) Pietrele 2 Lithic-Industry (Small)Document177 pages2019 (Gatsov-Nedelcheva) Pietrele 2 Lithic-Industry (Small)Clive BonsallNo ratings yet

- Lien 2020Document11 pagesLien 2020Puraghan cahya herawanNo ratings yet