Professional Documents

Culture Documents

Individual Mandate Tax Penalty - 2016

Individual Mandate Tax Penalty - 2016

Uploaded by

Jason PyeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Individual Mandate Tax Penalty - 2016

Individual Mandate Tax Penalty - 2016

Uploaded by

Jason PyeCopyright:

Available Formats

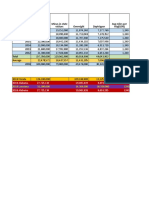

OBAMACARE’S POVERTY TAX: AMERICANS PAYING INDIVIDUAL MANDATE TAX PENALTY (2016, By State)

Percentage of Percentage of

Penalty Payers Penalty Payers Penalty Payers

Number of Penalty Penalty Payers

State Total Amount Paid with Incomes with Incomes with Incomes $0-

Payers (Returns*) with Incomes

$0- $25,000 under $25,000 $50,000

under $50,000

United States 4,953,490 $3,628,017,000 1,666,310 33.63% 3,807,530 76.86%

Alabama 48,260 $33,374,000 19,170 39.72% 38,030 78.80%

Alaska 15,270 $13,307,000 4,030 26.39% 10,210 66.86%

Arizona 113,850 $83,874,000 41,480 36.43% 90,770 79.72%

Arkansas 44,130 $30,947,000 16,720 37.88% 34,970 79.24%

California 598,750 $445,692,000 193,850 32.37% 385,070 64.31%

Colorado 97,810 $71,973,000 28,940 29,58% 71,630 73.23%

Connecticut 44,310 $31,087,000 14,410 32.52% 33,990 76.70%

Delaware 11,550 $8,113,000 4,140 35.84% 9,050 78.35%

District of

5,350 $3,762,000 1,670 31.21% 3,910 73.08%

Colombia

Florida 375,930 $282,473,000 127,700 33.96% 293,250 78.00%

Georgia 154,760 $116,177,000 54,310 35.09% 121,290 78.37%

Hawaii 11,200 $7,459,000 4,450 39.73% 8,770 78.30%

Idaho 31,490 $24,078,000 8,810 27.97% 23,400 74.30%

Illinois 176,290 $121,720,000 63,380 35.95% 139,650 79.21%

Indiana 113,060 $76,669,000 44,830 39.65% 92,340 81.67%

Iowa 39,670 $25,010,000 14,090 35.51% 32,010 80.69%

Kansas 41,020 $28,270,000 13,460 32.81% 32,190 78.47%

Kentucky 59,010 $38,232,000 22,510 38.14% 47,890 81.15%

Louisiana 69,020 $50,604,000 21,730 31.48% 51,330 74.36%

Maine 25,610 $18,876,000 8,280 32.33% 20,000 78.09%

Maryland 68,160 $50,952,000 29,330 43.03% 58,250 85.46%

Massachusetts 79,730 $52,100,000 23,520 29.94% 59,560 74.70%

Michigan 147,340 $95,392,000 59,510 40.38% 121,280 82.31%

Minnesota 68,060 $45,197,000 21,890 32.16% 52,880 77.69%

Mississippi 39,260 $29,652,000 14,440 36.78% 30,860 78.60%

Compiled by the Office of Senator Steve Daines (MT)

Source: Internal Revenue Service: https://www.irs.gov/statistics/soi-tax-stats-historic-table-2, See rows 126 & 127.

*“Returns” means the number of returns that have data reported on the 1040 for the related line.

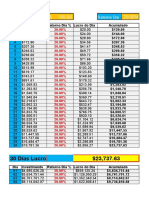

OBAMACARE’S POVERTY TAX: AMERICANS PAYING INDIVIDUAL MANDATE TAX PENALTY (2016, By State)

Percentage of Percentage of

Penalty Payers Penalty Payers Penalty Payers

Number of Penalty Penalty Payers

State Total Amount Paid with Incomes with Incomes $0-

Payers (Returns*) with Incomes with Incomes

$0- $25,000 under $25,000 $50,000

under $50,000

Missouri 84,810 $59,020,000 28,960 34.14% 67,150 79.17%

Montana 20,810 $15,444,000 7,170 34.45% 15,900 76.40%

Nebraska 32,110 $22,209,000 10,410 32.41% 25,700 80.03%

Nevada 54,850 $39,699,000 19,500 35.55% 42,500 77.48%

New Hampshire 24,350 $17,392,000 8,020 32.93% 18,670 76.67%

New Jersey 142,800 $111,600,000 48,510 33.97% 108,380 75.89%

New Mexico 26,780 $19,729,000 9,480 35.39% 20,950 78.23%

New York 280,750 $201,568,000 94,550 33.67% 214,780 76.50%

North Carolina 153,310 $111,275,000 49,990 32.60% 118,130 77.05%

North Dakota 12,830 $8,970,000 4,300 33.51% 9,830 76.61%

Ohio 139,290 $93,190,000 57,280 41.12% 116,860 84.50%

Oklahoma 56,750 $42,454,000 16,570 29.19% 41,960 73.93%

Oregon 66,410 $44,760,000 26,630 35.58% 54,250 81.68%

Pennsylvania 166,680 $108,842,000 65,920 39.54% 136,070 81.63%

Rhode Island 16,320 $10,676,000 5,820 35.66% 13,250 81.11%

South Carolina 68,700 $50,884,000 24,420 35.54% 54,320 70.06%

South Dakota 11,880 $8,217,000 3,800 31.98% 9,400 79.12%

Tennessee 87,780 $62,863,000 29,830 33.98% 69,120 78.74%

Texas 620,830 $520,290,000 182,350 29.37% 451,460 72.71%

Utah 49,590 $37,303,000 14,310 28.85% 33,860 74.32%

Vermont 10,590 $7,346,000 3,190 30.12% 8,260 77.99%

Virginia 114,690 $86,774,000 36,920 32.19% 87,310 76.12%

Washington 108,850 $78,884,000 30,950 28.43% 76,740 70.50%

West Virginia 25,140 $17,402,000 9,880 39.29% 20,110 79.99%

Wisconsin 82,060 $52,602,000 27,420 33.41% 65,880 80.28%

Wyoming 11,420 $9,524,000 3,030 26.53% 7,840 68.65%

Other Areas 4,260 $3,750,000 1,760 41.31% 3,010 70.65%

Compiled by the Office of Senator Steve Daines (MT)

Source: Internal Revenue Service: https://www.irs.gov/statistics/soi-tax-stats-historic-table-2, See rows 126 & 127.

*“Returns” means the number of returns that have data reported on the 1040 for the related line.

You might also like

- Wakeland Community Hospital Statement of Operations For The Years Ended December 31, 20X1 and 20X0 (In Thousands) Particulars RevenuesDocument10 pagesWakeland Community Hospital Statement of Operations For The Years Ended December 31, 20X1 and 20X0 (In Thousands) Particulars Revenuesmohitgaba19100% (1)

- Fortune 1000 US List 2019 - Someka V1Document8 pagesFortune 1000 US List 2019 - Someka V1Brajesh Kumar SinghNo ratings yet

- Civil Asset Forfeiture: Grading The StatesDocument17 pagesCivil Asset Forfeiture: Grading The StatesJason Pye100% (2)

- Pestle Analysis United Arab EmiratesDocument16 pagesPestle Analysis United Arab EmiratesSamer Abu Rashed0% (2)

- Ra 386 Civil Code of The Philippines AnnotatedDocument16 pagesRa 386 Civil Code of The Philippines AnnotatedMarie Mariñas-delos Reyes100% (1)

- IB Extended Essay: Male Gender Roles in Cold War BalletDocument22 pagesIB Extended Essay: Male Gender Roles in Cold War BalletBen GrimmNo ratings yet

- Woke Gaming: Digital Challenges To Oppression and Social InjusticeDocument38 pagesWoke Gaming: Digital Challenges To Oppression and Social InjusticeUniversity of Washington Press40% (5)

- Description: Tags: DLB0318ADocument1 pageDescription: Tags: DLB0318Aanon-402749No ratings yet

- Time MI Principal FV AmountDocument20 pagesTime MI Principal FV AmountArrow NagNo ratings yet

- Family Remittances 2023 Dialogue FormatDocument43 pagesFamily Remittances 2023 Dialogue FormatddelaflorNo ratings yet

- Time MI Principal FV AmountDocument20 pagesTime MI Principal FV AmountArrow NagNo ratings yet

- Vuksinick Excel1Document4 pagesVuksinick Excel1api-418450750No ratings yet

- Roberts Excel1Document3 pagesRoberts Excel1api-384482953No ratings yet

- Hubbard County Payable 2024 Preliminary Levy ChartDocument2 pagesHubbard County Payable 2024 Preliminary Levy ChartShannon GeisenNo ratings yet

- Courtyard by Marriott at The Prudential Center - DemographicsDocument1 pageCourtyard by Marriott at The Prudential Center - Demographicsdavid rockNo ratings yet

- UVA-S-F-1210.XLS Version 2.0: StudentDocument5 pagesUVA-S-F-1210.XLS Version 2.0: StudentwhatNo ratings yet

- Year Inflation Rate (%) GDP (Billions) Nominal GDPDocument14 pagesYear Inflation Rate (%) GDP (Billions) Nominal GDPHaris FayyazNo ratings yet

- Year Inflation Rate (%) GDP (Billions) Nominal GDPDocument14 pagesYear Inflation Rate (%) GDP (Billions) Nominal GDPHaris FayyazNo ratings yet

- 2015 IRS Refunds by StateDocument1 page2015 IRS Refunds by StateKelly Phillips ErbNo ratings yet

- Main Compounding PlanDocument12 pagesMain Compounding PlanShafieqNo ratings yet

- U.S. R&D Spending by State, 2006-11 (In USD Millions)Document2 pagesU.S. R&D Spending by State, 2006-11 (In USD Millions)Sunil KumarNo ratings yet

- Flat Tax RateDocument2 pagesFlat Tax RateirfanNo ratings yet

- 01560-Designated Statestable7-7-06-JT 4Document5 pages01560-Designated Statestable7-7-06-JT 4losangelesNo ratings yet

- Family YMCA Financial Assistance 2023 - Annual IncomeDocument1 pageFamily YMCA Financial Assistance 2023 - Annual IncomeCynthiaNo ratings yet

- ESA Estimated Fiscal ImpactDocument1 pageESA Estimated Fiscal ImpactDan LehrNo ratings yet

- Residuales Flahs MobileDocument1 pageResiduales Flahs MobileJaime CucaitaNo ratings yet

- 14 Year Board DVD 0 1 700 1500 2 550 1050 3 130 450 NPV Discount $238.58 $469.50 Irr 27.51% 25.09%Document8 pages14 Year Board DVD 0 1 700 1500 2 550 1050 3 130 450 NPV Discount $238.58 $469.50 Irr 27.51% 25.09%Arif JamaliNo ratings yet

- Home Buying CalculatorDocument7 pagesHome Buying CalculatorDan CliffeNo ratings yet

- Cost Breakdown YTD OctDocument1 pageCost Breakdown YTD OctBreckenridge Grand Real EstateNo ratings yet

- Evaluación Financiera Real BessDocument21 pagesEvaluación Financiera Real BessrolandogaraysalazarNo ratings yet

- Datos para Abc CervDocument2 pagesDatos para Abc CervCESAR EDUARDO RIOS VASQUEZNo ratings yet

- Tourism Gas Tax RevenueDocument3 pagesTourism Gas Tax RevenueSteve WilsonNo ratings yet

- Mortgage Interest Rates and Home Prices Median Home PriceDocument11 pagesMortgage Interest Rates and Home Prices Median Home PriceI'm a red antNo ratings yet

- Best States To Practice 2010Document2 pagesBest States To Practice 2010kaustin718No ratings yet

- Planilha de Risco - 1Document12 pagesPlanilha de Risco - 1TCG RURALNo ratings yet

- Money ManagementDocument8 pagesMoney ManagementHemed AllyNo ratings yet

- 2009 Major NYC AgenciesDocument1 page2009 Major NYC AgenciesElizabeth BenjaminNo ratings yet

- Lista de PreciosDocument6 pagesLista de PreciossonnetickNo ratings yet

- Financial Independence CalculatorDocument22 pagesFinancial Independence CalculatorRyukyu Dojo PTYNo ratings yet

- P10 - 04 Pizza CorrelationDocument10 pagesP10 - 04 Pizza CorrelationKamakshi GuptaNo ratings yet

- Colombia BrasilDocument3 pagesColombia BrasilBryanCamiloChiquizaNo ratings yet

- Property Taxes On Owner-Occupied Housing, by State 2008Document10 pagesProperty Taxes On Owner-Occupied Housing, by State 20082391136No ratings yet

- Task 1: Prepare Budgets Part 1 A (Refer To Spreadsheet) Profit BudgetDocument15 pagesTask 1: Prepare Budgets Part 1 A (Refer To Spreadsheet) Profit BudgetUurka LucyNo ratings yet

- HB 3739 DatasheetDocument2 pagesHB 3739 DatasheetvincemperezNo ratings yet

- Year GDP (Billions) Nominal GDP Quantity of MoneyDocument17 pagesYear GDP (Billions) Nominal GDP Quantity of MoneyHaris FayyazNo ratings yet

- Menahga ISD821 Estimated Tax Impact Pay 2023Document1 pageMenahga ISD821 Estimated Tax Impact Pay 2023Shannon GeisenNo ratings yet

- Economic Impact of Tribal GamingDocument2 pagesEconomic Impact of Tribal GamingKJZZ PhoenixNo ratings yet

- TALLER PRÁCTICO EN CLASgvcgbvbCDocument20 pagesTALLER PRÁCTICO EN CLASgvcgbvbCJuan sebastian Muñoz QuintanaNo ratings yet

- Proyecto MoocDocument3 pagesProyecto MoocHector GodoyNo ratings yet

- LAM DCF ModelDocument1 pageLAM DCF ModelAzureSilhouetteNo ratings yet

- Informatica ActividadesDocument74 pagesInformatica ActividadesEmily AnguayaNo ratings yet

- FbricadeSalarios Gerenciamento1Document12 pagesFbricadeSalarios Gerenciamento1Vitor BrasilNo ratings yet

- e02p1AutoSales M Noorbi PatelDocument1 pagee02p1AutoSales M Noorbi Patelnoorbipatel145No ratings yet

- e02p1AutoSales + Patel NoorbiDocument1 pagee02p1AutoSales + Patel Noorbinoorbipatel145No ratings yet

- Content: Chapter I - What Is and What Does An Ecologist?Document7 pagesContent: Chapter I - What Is and What Does An Ecologist?Andre AndreeaNo ratings yet

- Cuota Facturacion Cuota: Seguimiento de DOMICILIOS Y ASISTIDADocument4 pagesCuota Facturacion Cuota: Seguimiento de DOMICILIOS Y ASISTIDADiana Camargo MurciaNo ratings yet

- Planilha de GerenciamentoDocument10 pagesPlanilha de Gerenciamentobetoloko89.bsNo ratings yet

- Sales Data Customer Percent Gross Profitgross Sales Gross Profit Industry Code Competitive RatingDocument4 pagesSales Data Customer Percent Gross Profitgross Sales Gross Profit Industry Code Competitive RatingnorshaheeraNo ratings yet

- Tabla 1 Documento Base Forecast 2023Document1 pageTabla 1 Documento Base Forecast 2023marioralvarezNo ratings yet

- Instapdf - In-Fortune-500-Companies-List GL 1 CMGFHC Ga T1J4UWpwSHNCOXZweFRMY0hUTzFiVWVwSm1VR1d5WEZSXzlQcjF3SWxxSy11eEwtQXV0NmJZUFNpMzROQWxQbw..-662Document79 pagesInstapdf - In-Fortune-500-Companies-List GL 1 CMGFHC Ga T1J4UWpwSHNCOXZweFRMY0hUTzFiVWVwSm1VR1d5WEZSXzlQcjF3SWxxSy11eEwtQXV0NmJZUFNpMzROQWxQbw..-662Darlene BlayaNo ratings yet

- S.No Name Income IT Net IncomeDocument4 pagesS.No Name Income IT Net Incomerangoli maheshwariNo ratings yet

- Sales DataDocument6 pagesSales DataSandeep Rao VenepalliNo ratings yet

- Ejercicios Guia ExcelDocument47 pagesEjercicios Guia ExcelNehesly BonillaNo ratings yet

- PAA10 G5 Avila Castillo Fahad Lasala Navarete ValizadoDocument2 pagesPAA10 G5 Avila Castillo Fahad Lasala Navarete ValizadoMariah ValizadoNo ratings yet

- Biden's Dis-Unity Task ForceDocument14 pagesBiden's Dis-Unity Task ForceJason PyeNo ratings yet

- FW-WhitePaper - Overcrim - HoggDocument11 pagesFW-WhitePaper - Overcrim - HoggJason PyeNo ratings yet

- Wage Subsidies: A Multi-Trillion Dollar Market Distortion That America Cannot AffordDocument13 pagesWage Subsidies: A Multi-Trillion Dollar Market Distortion That America Cannot AffordJason PyeNo ratings yet

- The Congressional Review Act: What To Know Before The New Congress BeginsDocument13 pagesThe Congressional Review Act: What To Know Before The New Congress BeginsJason PyeNo ratings yet

- Restoring Internet Freedom - The Net Neutrality DebateDocument12 pagesRestoring Internet Freedom - The Net Neutrality DebateJason PyeNo ratings yet

- 2018 CFPB Payday Loan Coalition LetterDocument3 pages2018 CFPB Payday Loan Coalition LetterJason PyeNo ratings yet

- Expansion of The Federal Safety Valve For Mandatory Minimum SentencesDocument5 pagesExpansion of The Federal Safety Valve For Mandatory Minimum SentencesJason PyeNo ratings yet

- "Unjust, Cruel, and Even Irrational": The Stacking of Charges Under 924 (C)Document4 pages"Unjust, Cruel, and Even Irrational": The Stacking of Charges Under 924 (C)Jason PyeNo ratings yet

- CJR Coalition LetterDocument4 pagesCJR Coalition LetterJason PyeNo ratings yet

- The Over-Criminalization Epidemic: The Need For A Guilty Mind Requirement in Federal Criminal LawDocument11 pagesThe Over-Criminalization Epidemic: The Need For A Guilty Mind Requirement in Federal Criminal LawJason Pye100% (2)

- Coalition Letter of Opposition To SB 127Document2 pagesCoalition Letter of Opposition To SB 127Jason PyeNo ratings yet

- From High Seas To Highway Robbery: How Civil Asset Forfeiture Became One of The Worst Forms of Government OverreachDocument15 pagesFrom High Seas To Highway Robbery: How Civil Asset Forfeiture Became One of The Worst Forms of Government OverreachJason PyeNo ratings yet

- O Level History NotesDocument59 pagesO Level History Notesoalevels91% (350)

- United States Court of Appeals, Third CircuitDocument14 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- Ebralinag v. Division Superintendent - Case DigestDocument1 pageEbralinag v. Division Superintendent - Case DigestRobeh AtudNo ratings yet

- A Blank Nafta CooDocument2 pagesA Blank Nafta CooAna Patricia Castro MendozaNo ratings yet

- Ma. Vilma F. Maniquiz vs. Atty. Danilo C. Emelo A.C. No. 8968, September 26, 2017 FactsDocument2 pagesMa. Vilma F. Maniquiz vs. Atty. Danilo C. Emelo A.C. No. 8968, September 26, 2017 FactsEduardNo ratings yet

- Segal and Cover - Ideological Values and The Votes of US Supreme Court JusticesDocument10 pagesSegal and Cover - Ideological Values and The Votes of US Supreme Court JusticesSofia Caniggia NaranjoNo ratings yet

- An Act Establishing A National Policy On Population, Creating The Commission On Population and For Other PurposesDocument3 pagesAn Act Establishing A National Policy On Population, Creating The Commission On Population and For Other PurposesNynn Juliana GumbaoNo ratings yet

- Pakistan Studies: Course GuideDocument101 pagesPakistan Studies: Course GuideAliNo ratings yet

- Open Society Barometer Can Democracy Deliver 20230911Document48 pagesOpen Society Barometer Can Democracy Deliver 20230911yosue7dNo ratings yet

- 8.tétel British MediaDocument2 pages8.tétel British MediaAranypofiNo ratings yet

- 031-2013 - MR (Mtop)Document9 pages031-2013 - MR (Mtop)SbGuinobatanNo ratings yet

- Language Curriculum Design - (2. Environment Analysis)Document2 pagesLanguage Curriculum Design - (2. Environment Analysis)Sumbal ChohanNo ratings yet

- Diplomatic Alignments and Appeasement (3.2.3) - IB History - TutorChaseDocument10 pagesDiplomatic Alignments and Appeasement (3.2.3) - IB History - TutorChaseMartina ColeNo ratings yet

- 18 - Trade Unions of The PH Vs NHCDocument2 pages18 - Trade Unions of The PH Vs NHCGia Dimayuga50% (2)

- Comprehensive Evaluation For SPG FormDocument1 pageComprehensive Evaluation For SPG FormJessica MarcelinoNo ratings yet

- Breakout No. 3 Garin vs. City of Muntinlupa Bayocboc Cano VelascoDocument5 pagesBreakout No. 3 Garin vs. City of Muntinlupa Bayocboc Cano VelascoJoanne Louise BayocbocNo ratings yet

- SCA NotesDocument3 pagesSCA NoteskdescallarNo ratings yet

- Migration and Discrimination - Non-Discrimination As Guardian Against Arbitrariness or Driver of Integration - Wouter VandenholeDocument23 pagesMigration and Discrimination - Non-Discrimination As Guardian Against Arbitrariness or Driver of Integration - Wouter VandenholeJuan Jose Garzon CamposNo ratings yet

- Stamford Water Distribution Replacement ProjectDocument81 pagesStamford Water Distribution Replacement ProjectChris BrazellNo ratings yet

- Gitlow v. New York, 268 U.S. 652 (1925)Document16 pagesGitlow v. New York, 268 U.S. 652 (1925)Scribd Government DocsNo ratings yet

- American ImperialismDocument20 pagesAmerican ImperialismAnonymous 3Y1ZnENo ratings yet

- Summary Module 2 TCW Presentation - PDF Market GlobalismDocument25 pagesSummary Module 2 TCW Presentation - PDF Market GlobalismDan Czar T. JuanNo ratings yet

- Charles Mosley v. Town of Pennington Gap John C. Marion Fred Ely, 995 F.2d 1063, 4th Cir. (1993)Document4 pagesCharles Mosley v. Town of Pennington Gap John C. Marion Fred Ely, 995 F.2d 1063, 4th Cir. (1993)Scribd Government DocsNo ratings yet

- Charter Act 1833Document3 pagesCharter Act 1833Ayush Manihar100% (1)

- Cover & Table of Contents - Public Sector Accounting (6th Edition)Document11 pagesCover & Table of Contents - Public Sector Accounting (6th Edition)gsete0000No ratings yet

- An Assignment On: Submitted by Submitted ToDocument6 pagesAn Assignment On: Submitted by Submitted ToMahabur RahmanNo ratings yet