Professional Documents

Culture Documents

61 - 2004 Winter-Spring PDF

61 - 2004 Winter-Spring PDF

Uploaded by

Garo OhanogluCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Big Banks Strategy PDFDocument18 pagesBig Banks Strategy PDFGaro Ohanoglu100% (1)

- 21 Candlesticks Every Trader Should KnowDocument83 pages21 Candlesticks Every Trader Should KnowArmtin GhahremaniNo ratings yet

- Cognitive Biases in Technical AnalysisDocument143 pagesCognitive Biases in Technical AnalysisAmir TabchNo ratings yet

- Country Asset Allocation Quantitative Country Selection Strategies in Global Factor InvestingDocument270 pagesCountry Asset Allocation Quantitative Country Selection Strategies in Global Factor Investingtachyon007_mechNo ratings yet

- موجات اليوت الدرس الأولDocument13 pagesموجات اليوت الدرس الأولcadecortxNo ratings yet

- CANDLESTICKS WicksDocument8 pagesCANDLESTICKS WicksAnshuman GuptaNo ratings yet

- SNP 101619Document36 pagesSNP 101619Garo Ohanoglu100% (1)

- Super Trader Tactics For TRIPLE-DIGIT RETURNSDocument22 pagesSuper Trader Tactics For TRIPLE-DIGIT RETURNSjdalvaran85% (20)

- HarfordDocument13 pagesHarfordGaro OhanogluNo ratings yet

- Weekly Options Digital Guide PDFDocument48 pagesWeekly Options Digital Guide PDFGaro Ohanoglu100% (4)

- Performance Analysis of CBOE S&P 500 Options Selling IndicesDocument23 pagesPerformance Analysis of CBOE S&P 500 Options Selling IndicesGaro OhanogluNo ratings yet

- DT Ebook Futures-OptionsStrategyGuide PDFDocument69 pagesDT Ebook Futures-OptionsStrategyGuide PDFGaro OhanogluNo ratings yet

- FSC From Paper To Virtual and Symposium Series Enhanced FullDocument46 pagesFSC From Paper To Virtual and Symposium Series Enhanced FullGaro OhanogluNo ratings yet

- 10 Commandments of Option Trading For Income PDFDocument31 pages10 Commandments of Option Trading For Income PDFGaro OhanogluNo ratings yet

- HowSIPCProtectsYou English WebDocument5 pagesHowSIPCProtectsYou English WebGaro OhanogluNo ratings yet

- Trading System Design - The Options Selling ModelDocument44 pagesTrading System Design - The Options Selling ModelGaro OhanogluNo ratings yet

- The Efficient Markets Hypothesis: Mohammad Ali SaeedDocument21 pagesThe Efficient Markets Hypothesis: Mohammad Ali SaeedBalach MalikNo ratings yet

- Thom Hartle - Active Trader Magazine - Trading Strategies Analysis Collection Vol1Document74 pagesThom Hartle - Active Trader Magazine - Trading Strategies Analysis Collection Vol1Miroslav ZaporozhanovNo ratings yet

- Trading Terms @AllCandleSticksPatternDocument3 pagesTrading Terms @AllCandleSticksPatternLOVEPREET PURINo ratings yet

- Daily Digest From BDO Securities 2Document64 pagesDaily Digest From BDO Securities 2Glenford “Glen” EbroNo ratings yet

- Summary - Pivot PointsDocument3 pagesSummary - Pivot PointsTermureAronNo ratings yet

- TradeFoxx Automated Trading Guide SystemDocument12 pagesTradeFoxx Automated Trading Guide SystemtonyNo ratings yet

- A Price Action Traders Guide To Supply and DemandDocument17 pagesA Price Action Traders Guide To Supply and Demandmohamed100% (6)

- ESIGNAL BrochureDocument11 pagesESIGNAL Brochuretamiyanvarada0% (1)

- Literature Review of Technical AnalysisDocument7 pagesLiterature Review of Technical Analysistulasinad12350% (4)

- Bryce Gilmore - An Introduction To The Methods of WD GannDocument11 pagesBryce Gilmore - An Introduction To The Methods of WD Gannenvieme100% (4)

- Importance of Technical and Fundamental Analysis in The European Foreign Exchange Market 0Document13 pagesImportance of Technical and Fundamental Analysis in The European Foreign Exchange Market 0Mohana Sundaram100% (1)

- Portfolio Management Tutorial 3: Prepared By: Ang Win Sun Pong Chong Bin Chin Chen Hong Jashvin Kaur Diong Seng LongDocument10 pagesPortfolio Management Tutorial 3: Prepared By: Ang Win Sun Pong Chong Bin Chin Chen Hong Jashvin Kaur Diong Seng LongchziNo ratings yet

- Chartered Market Technician (CMT) Program Level 2 - Spring 2010Document4 pagesChartered Market Technician (CMT) Program Level 2 - Spring 2010Foru FormeNo ratings yet

- The Modern Portfolio Theory As An Investment Decision Tool: ReviewDocument10 pagesThe Modern Portfolio Theory As An Investment Decision Tool: Reviewjulius muthiniNo ratings yet

- Double Top Double BottomDocument9 pagesDouble Top Double BottomAmit KumarNo ratings yet

- Investments Global Edition 10th Edition Bodie Test BankDocument61 pagesInvestments Global Edition 10th Edition Bodie Test Bankcomplinofficialjasms100% (34)

- Bollinger BandsDocument27 pagesBollinger Bandsspmltechnologies67% (6)

- Candlesticks For Support and Resistance PDF (PDFDrive)Document40 pagesCandlesticks For Support and Resistance PDF (PDFDrive)Raja100% (2)

- Reading ListDocument6 pagesReading Listgnanda1987100% (5)

- Wiley, American Finance Association The Journal of FinanceDocument5 pagesWiley, American Finance Association The Journal of FinanceAmanuel TesfayeNo ratings yet

- Fundamental Analysis - WikipediaDocument21 pagesFundamental Analysis - WikipediaNaman JindalNo ratings yet

- Portfolio Management'Document99 pagesPortfolio Management'sumesh894No ratings yet

- Study Material of Agrawal Corporate - 2349Document246 pagesStudy Material of Agrawal Corporate - 2349Rohan Raikwar100% (2)

- The Ultimate Bootcamp Guide To Trading Forex PDFDocument124 pagesThe Ultimate Bootcamp Guide To Trading Forex PDFpaolo100% (1)

- Unit 2Document48 pagesUnit 2Noddy SinghNo ratings yet

61 - 2004 Winter-Spring PDF

61 - 2004 Winter-Spring PDF

Uploaded by

Garo OhanogluOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

61 - 2004 Winter-Spring PDF

61 - 2004 Winter-Spring PDF

Uploaded by

Garo OhanogluCopyright:

Available Formats

JOURNAL

of

Technical

Analysis

Issue 61

Winter-Spring 2004

SM

Market Technicians Association, Inc.

A Not-For-Profit Professional Organization ■ Incorporated 1973

JOURNAL of Technical Analysis Winter-Spring 2004 Issue 61

● ●

Table of Contents

The postponement of the Dow Award this spring had its repercussion with our Journal of Technical Analysis. We

normally publish the winning paper in this issue. However, it has turned out for the better. Not only are more excellent

papers being submitted for the award, but also this Journal is enlivened with some wonderful practical as well as

theoretical articles for your enjoyment and education.

As technicians, we like to believe that somewhere out there is a theoretical base that can explain what we have long

observed through our own experience and learned from the experience of others about open market behavior. In this

issue Dr. Henry Pruden, long time past editor of the Journal, and two French professors, Dr. Bernard Paranque and Dr.

Walter Baets, continue to investigate the connection between investor behavior and our technical principles utilizing

catastrophe theory and an experiment at Cal-Tech on irrational exuberance.

We also have two excellent articles of more practical nature: one on using a new configuration of an old, well-

known oscillator by Saleh Nasser from Egypt and the other on using the classic relative strength model on selecting

foreign stock markets and sectors for investment by Tim Hayes. Both of these gentlemen are CMTs.

Charles D. Kirkpatrick II, CMT, Editor

Journal Editor & Reviewers 3

The Organization of the Market Technicians Association, Inc. 4

Behavioral Finance and Technical Analysis 5

Interpreting Data From an Experiment on Irrational Exuberance, Part A:

Applying a Cusp Catastrophe Model and Technical Analysis Rules

1 Henry O. Pruden, Ph.D.; Dr. Bernard Paranque; Dr. Walter Baets

The Deviation Oscillator (DO) 13

2 Saleh Nasser, CMT

Momentum Leads Price: A Universal Concept With Global Applications 19

3 Timothy W. Hayes, CMT

notes

JOURNAL of Technical Analysis • Winter-Spring 2004 1

2 JOURNAL of Technical Analysis • Winter-Spring 2004

Journal Editor & Reviewers

Editor

Charles D. Kirkpatrick II, CMT

Kirkpatrick & Company, Inc.

Bayfield, Colorado

Associate Editor

Michael Carr, CMT

Cheyenne, Wyoming

Manuscript Reviewers

Connie Brown, CMT J. Ronald Davis, CMT Kenneth G. Tower, CMT

Aerodynamic Investments Inc. Golum Investors, Inc. CyberTrader, Inc.

Pawley’s Island, South Carolina Portland, Oregon Princeton, New Jersey

Matthew Claassen, CMT Cynthia Kase, CMT Avner Wolf, Ph.D.

The Technical View Kase and Company Bernard M. Baruch College of the

Vienna, Virginia Albuquerque, New Mexico City University of New York

New York, New York

Julie Dahlquist, Ph.D. Michael J. Moody, CMT

University of Texas Dorsey, Wright & Associates

San Antonio, Texas Pasadena, California

Production Coordinator Publisher

Barbara I. Gomperts Market Technicians Association, Inc.

Manager, Marketing Services, MTA 74 Main Street, 3rd Floor

Marblehead, Massachusetts Woodbridge, New Jersey 07095

JOURNAL of Technical Analysis is published by the Market Technicians Association, Inc., (MTA) 74 Main Street, 3rd Floor, Woodbridge, NJ 07095. Its purpose

is to promote the investigation and analysis of the price and volume activities of the world’s financial markets. JOURNAL of Technical Analysis is distributed to

individuals (both academic and practitioner) and libraries in the United States, Canada and several other countries in Europe and Asia. JOURNAL of Technical

Analysis is copyrighted by the Market Technicians Association and registered with the Library of Congress. All rights are reserved.

JOURNAL of Technical Analysis • Winter-Spring 2004 3

The Organization of the

Market Technicians Association, Inc.

Member and Affiliate Information Journal Submission Guidelines

MTA MEMBER We want your article to be published and to be read. In the latter regard, we

Member category is available to those “whose professional efforts are spent ask for active simple rather than passive sentences, minimal syllables per word,

practicing financial technical analysis that is either made available to the in- and brevity. Charts and graphs must be cited in the text, clearly marked, and

vesting public or becomes a primary input into an active portfolio management limited in number. All equations should be explained in simple English, and

process or for whom technical analysis is a primary basis of their investment introductions and summaries should be concise and informative.

decision-making process.” Applicants for Membership must be engaged in the 1. Authors should submit, with a cover letter, their manuscript and supporting

above capacity for five years and must be sponsored by three MTA Members material on a 1.44mb diskette or through email. The cover letter should

familiar with the applicant’s work. include the authors’ names, addresses, telephone numbers, email addresses,

MTA AFFILIATE the article title, format of the manuscript and charts, and a brief description

of the files submitted. We prefer Word for documents and *.jpg for charts,

MTA Affiliate status is available to individuals who are interested in tech-

nical analysis and the benefits of the MTA listed below. Most importantly, graphs or illustrations.

Affiliates are included in the vast network of MTA Members and Affiliates 2. As well as the manuscript, references, endnotes, tables, charts, figures, or

across the nation and the world providing you with common ground among illustrations, each in separate files on the diskette, we request that the

fellow technicians. authorsÕ submit a non-technical abstract of the paper as well as a short

DUES biography of each author, including educational background and special

designations such as Ph.D., CFA or CMT.

Dues for Members and Affiliates are $300 per year and are payable when

joining the MTA and annually on July 1st. College students may join at a 3. References should be limited to works cited in the text and should follow

reduced rate of $50 with the endorsement of a professor. Applicants for Mem- the format standard to the Journal of Finance.

ber status will be charged a one-time application fee of $25. 4. Upon acceptance of the article, to conform to the above style conventions,

we maintain the right to make revisions or to return the manuscript to the

author for revisions.

Members and Affiliates

Please submit your non-CMT paper to:

■ have access to the Placement Committee (career placement)

Charles D. Kirkpatrick II, CMT

■ can register for the CMT Program 7669 CR 502

■ may attend regional and national meetings with featured speakers Bayfield, CO 81122

■ receive a reduced rate for the annual seminar journal@mta.org

■ receive the monthly newsletter, Technically Speaking

■ receive the Journal of Technical Analysis, bi-annually

■ have access to the MTA website and their own personal page

■ have access to the MTA lending library

■ become a Colleague of the International Federation of Technical Analysts

(IFTA)

4 JOURNAL of Technical Analysis • Winter-Spring 2004

Behavioral Finance and Technical Analysis

Interpreting Data from an Experiment on Irrational Exuberance, Part A:

Applying a Cusp Catastrophe Model and Technical Analysis Rules

Henry O. Pruden, Ph.D.

Visiting Scholar

Dr. Bernard Paranque

Head, Finance and

Dr. Walter Baets

Professor of Complexity and

1

Information Department Knowledge Management

A Cusp Catastrophe Model from the behavioral sciences provides a posi- Technical market analysis and “behavioral finance” are similar in their roots.

tive scientific theory as to the “why” of behavior in a stock market. Technical Both are rooted in the assumption that man acts for behavioral reasons in ways

market analysis furnishes a nominal theory of rules and principles about “how” that, by the standards of classical economics, may seem irrational. Both ap-

a trader or investor may profit from the behavior observed in a stock market. proach the study of markets to identify patterns of human behavior that un-

Introduction cover opportunities for profits.

While watching the 1997 McNeil-Lehr Newshour Video depicting the Cali- “Technical market analysis” has existed as a practice in real world financial

fornia Institute of Technology Experiment on Irrational Exuberance in securi- markets for over a century. It, too, has theoretical roots in psychology and soci-

ties trading, we became intrigued by the apparent strong parallels between the ology which are often overlooked by the practical men and women of action

trading behavior exhibited in the video film and the idealized graphical model who practice investing, trading and analysis. If we envision a theory-application

of the Cusp Catastrophe Model presented in Christopher Zeeman’s 1977 book spectrum, we can see “behavioral finance” occupying the theoretical pole while

Catastrophe Theory Selected Papers, 1972-1997 (See Figure 1). Investigative technical market analysis occupies the practical applications end of the spec-

attention was focused upon the fold or cusp in the model which captures the trum.

transition from bullish behavior to panic conditions. As outside observers, we Arguably practitioners and students of technical market analysis champi-

agreed with all of the comments made by Professor Charles Plott (McNeil Lehrer, oned the center stage of behavioral finance long before the arrival of what re-

1997) of Cal Tech during the experiment, except for one critical exception. cently has become known as “behavioral finance.” In his 1969 book, Stock

Professor Plott claimed that there was no way that a participant or observer Market Behavior: The Technical Approach to Understanding Wall Street, Dr.

could have predicted the break in prices and, hence, no way for any of the Harvey Krow defined technical analysis as synonymous with “behavioral fi-

players who were in the experiment to have capitalized upon the bubble’s burst. nance.” In his preface to that book, Dr. Krow identified three competing schools

We disagreed with Professor Plott’s conclusion. Instead, we hypothesized that of thought in finance: fundamental analysis, the random walk, and the behav-

according to Cusp Catastrophe Theory a “dissipative gradient” occurs in the iorist. Technical analysis fell within the behaviorist or behavioral school, con-

behavior pattern of the trades in the experiment just before the catastrophic cluded Dr. Krow.

plunge in price. Hence, the break in price action could have been anticipated. The prominence of behavioral finance grafted to technical analysis was

Furthermore, we anticipated that close examination of the price behavior within boosted by October 9, 1993 issue of the Economist magazine. In that article,

the zone of the Cusp, or threshold, would reveal behavior patterns that could be the author Matt Ridley observed the linkage between technical analysis and

profitably analyzed and interpreted according to the rules and indicators of “behavioral finance.” Mr. Ridley stated that a combination of computer horse-

technical market analysis. power and mathematical brainpower had made it possible to find new sources

Figure 1. A Cusp Catastrophe Model of a Stock Exchange of profit in the forecasting of financial markets. As the author stated:

What the new mathematicians are mining for is not inefficiencies in the

flow of information but something entirely different. They have found new

meat in the familiar fact that traders are a diverse bunch; by unearthing

some of its previously unrecognized effects...the most popular idea for ex-

plaining it has to do with the heterogeneity of traders in particular, the fact

that people reason differently about the information they receive, that they

have different time horizons...and that they have different attitudes to risk...

The efficient-market theory is...right that efficiency will delete time-arbi-

trage opportunities based on who does not have information, but wrong to

conclude that therefore the market cannot be beaten.

Ridley emphasized, “Prices do contain hints of what they will do next. Com-

puters have resuscitated chartism.”

As the Ridley article emphasized an appreciation that technical analysis

was evolving through the attempt to predict prices using computers to study

market behavior. For example, moving average timing and break out signals

produced profits by more than by chance.

As Ridley concluded, “Chartists – who prefer to be called technical analysts

– justify their techniques with quite reasonable arguments about the behavior of

investors. They do not claim to predict the behavior of the index so much as the

behavior of the people who trade in the market...a rising price is a band wagon.”

And there are models from behavioral science that capture band wagons. Tech-

nicians were studying the behavior of people who make markets run.

JOURNAL of Technical Analysis • Winter-Spring 2004 5

Behavioral Finance: Cusp Catastrophe Model Figure 2. Dissipative Gradient

“Catastrophe theory is a new mathematical method for describing the

evolution of forms in nature. It was created by Rene Thom who wrote a

revolutionary book Structural Stability and Morphogenesis in 1972,

expanding the philosophy behind the ideas. It is particularly applicable

where gradually changing forces produce sudden effects. We often call

such effects catastrophes, because the lack of intuition about the underlying

continuity of the forces makes the very discontinuity of the effects so

unexpected. The remarkable thing about the results is that, although the

proofs are sophisticated, the elementary catastrophes themselves are both

surprising and relatively easy to understand, and can be profitably used

by scientists who are not expert mathematicians” (Zeeman, 1977).

A Catastrophe Theory Model modified for the explanation of the evolution/

revolution of behavior in the securities market can be classified in the realm of CUSP MODEL IN OPERATION

behavioral finance. (See Thaler, 1993; Statman, 1998 and Pruden, 1989). An

early model of the Cusp Catastrophe Model modified to explain speculative Now let us imagine Figure 1 in operation. The flow of the market index

crashes appeared in Zeeman (1976, 1977). Later, Pruden (1979) expanded upon takes place over a smooth surface composed of equilibrium points. Changes in

Zeeman’s use of the Cusp Model version of Catastrophe Theory to allow for the control variables, fear and greed, have unique responses on the behavior

“buying stampedes” as well as “selling panics.” Pruden (1980) also established surface. The dynamic process of the model causes the index to seek out local

connections between the Cusp Catastrophe Model and technical market analy- points of stable, albeit temporary, equilibrium.

sis. Whereas the Catastrophe Theory Model, like other models from the behav- Starting at a bear market low, where the market index is on the lower attractor

ioral sciences, provides a positive scientific theory as to the “why” of behavior sheet, the level of greed (demand) is suppressed by the level of fear (supply).

in the stock market, technical market analysis furnishes a nominal theory of Mounting greed (e.g., expectation of higher prices) gradually overcomes fear

rules and principles about “how” a trader or investor may profit from the behav- until the edge of the sheet is reached, at which point the market breaks out of an

ior observed in the stock market. Hence, the presupposition is that behavioral upside reversal pattern via a catastrophe jump to the top sheet as the mood of

science models that explain the stock market behavior provide solid scientific the market becomes decidedly bullish. The index then flows along a rising chan-

foundations upon which to base the principles and practices of technical market nel on the top sheet until the bullish potential is exhausted. At that point, both

analysis. greed and fear are high. Finally, as fear overcomes greed the market index is

The Cusp Catastrophe shown in Figure 1 offers a unique three-dimensional pushed to a threshold on the top sheet, then the price index plunges to the bot-

graphic model for structuring two independent and one dependant variable. It tom sheet via a bearish catastrophe jump.

furnishes a basis for classifying and interrelating price trends and sentiment Catastrophe Theory analyzes equilibrium and its breakdown. As such, it is

variables, thereby enhancing logical clarity and empirical predictability. Im- ideally suited for understanding the stock market where price movements re-

plicit in the model is a fourth temporal dimension. sult from the balances and imbalances between buying power and selling pres-

sure, which in turn are animated by the forces of greed and fear.

EQUILIBRIUM SURFACE

Applications of Catastrophe Theory can be qualitative in nature. Catastro-

The Cusp Catastrophe model posits two parallel surfaces. The upper behav- phe Theory does not pretend to render pinpoint or unalterable predictions far in

ior or equilibrium surface is represented by a price index such as the Dow- advance. The theory does not negate the art of interpretation.

Jones Industrial Average. This behavior surface is further subdivided into a top In Catastrophe Theory the prior history of behavior states of the market is

sheet representing bullish behavior and a bottom sheet reflecting the domi- required to predict the future. This undercuts the assumptions of the “random

nance of bearish behavior. Each point on the behavior surface is an equilibrium walk” or efficient market hypothesis. Catastrophe Theory underscores the rel-

juncture between supply and demand, even though incremental and transitory. evance of the historical, chart approach to analyzing the market.

Near the center of the behavior surface of the model lies the Cusp The Cusp model encompasses duality and opposition. There is room for a

Catastrophe’s most interesting feature – a fold curve or cusp. What this sug- greed axis and a fear axis. It brings the opposition between bullish versus bear-

gests is that there is no equilibrium (horizontal range) available until the top ish sentiments into clear relief.

sheet is reached after a buying stampede or the bottom sheet is reached after a

selling panic. Notice that the abstract model shows the behavior surface curv- The Cal Tech Experiment on Irrational Exuberance

ing over to a threshold point, after which comes the panic sell-off. In the Cusp

Catastrophe model this all-important juncture along the top sheet is known as INTRODUCTION

the “dissipative gradient.” When the internet bubble burst there was a massive opportunity to make

CONTROL SURFACE serious money through short selling or at least avoiding losing money already

The market price or the equilibrium behavior surface is the dependent vari- earned. A predictive theory that would have alerted a trader to the potential

able. The independent, predictor or control variable, which accounts for the collapse would have been extremely valuable.

index or to which the index may be ascribed, lies on the control surface below. The Cusp Catastrophe Model could have been that predictive theory. The

In Figure 2, the independent, predictors are shown as the emotional forces of Cusp-Catastrophe Model is based upon behavioral science/behavioral finance

fear and greed. to explain types of non-linear, discontinuous behavior. It is especially models

The model featured in Figure 1 presents fear and greed as opposing factors. behavior of rapid change, such as a stock market bubble bursting. Catastrophe

The relative power of these two opposing forces is what animates market be- theory has revealed that sudden change and behavior extremes are not only

havior. The gradual changing relationship between fear and greed gives rise to natural and interrelated but, if one were to see the early warning signs, a col-

sudden discontinuations in price behavior when thresholds are reached and pan- lapse would be predictable.

ics or stampedes ensue. The Cusp Catastrophe Model posits that behavior is driven by fear and greed.

In the case of a stock bubble, price climbs along the top layer of the Cusp

6 JOURNAL of Technical Analysis • Winter-Spring 2004

Model. Eventually the speculative excess reflects increasing nervousness and Figure 3. The Overall Results of the Experiment

starts to de-escalate, moving toward the drop-off at the cusp. Within the cusp

itself there exists the small, incremental change downward, the “dissipative

gradient,” that marks the beginning of the collapse. Afterward behavior then

suddenly drops off the cusp and falls vertically in rapid collapse (See Figure 4).

Market behavior explainable by the Cusp Catastrophe Model was evident

after the U.S. stock market run up in late 1999 and early 2000. The market had

become extremely overpriced and signs of nervousness started to appear. There

was one market session in which the NASDAQ dropped over 500 points only

to make a surprising and outstanding recovery back before the end of the ses-

sion. The nervousness depicted by this sudden and dramatic price drop was a

sign of the impending collapse. The dot.com bubble having reached the cusp,

it was period for a catastrophic decline.

THE EXPERIMENT

Using the Cusp Catastrophe as a framework, we interpreted the research

data from a Cal-Tech Experiment on Irrational Exuberance that was produced Figure 4 depicts the overall results of the experiment. It shows the average

by WGBH television and shown on PBS (McNeil Lehrer, 1997). The Cal Tech value of the company as it depletes the oil (line A) and the absolute maximum

experiment furnished empirical data to “test” propositions derivable from the value of the company with oil at its maximum potential market value (line B).

Cusp Catastrophe Model. The experiment likewise offered an opportunity to Line A should represent the average stock price and line B should be the maxi-

extract and highlight several nominal rules/indicators of technical analysis that mum price over achieved. Stock prices beyond line B were not rational because

fit with the logic of the Cusp Model. The indicators of technical analysis that fit everyone in the game knew that the value above line B was beyond any under-

with the Cusp Model were then also applied to the data of the experiment in an lying asset value. At set intervals, the dividends were paid. These dividend

effort to anticipate and profit from the catastrophic decline in price that fol- payment intervals are shown in Figure 4 by the dashed vertical lines. All par-

lowed the bursting of the speculative bubble created during the experiment. ticipants in the experiment knew this information before the game was played.

To further our research efforts, we stopped the video of the Cal Tech Ex- The prices established by the buyers and sellers in the experiment did not

periment at key junctures in order to photograph the charts that had recorded drop as would have been expected from the logic of rational economic analysis

the behavior of the traders during the experiment (See Figure 3 and Figure 4). of the situation even though all players were rational and had the same informa-

We blew up the pictures from the video that showed the transition from a bull tion. The traders in the Cal Tech experiment persistently traded at a prices that

market to a bear market. Our interpretation of the expanded photos of behavior were greater than the fundamental value indicated the company was worth. As

led us to conclude that the Cusp Catastrophe Model coupled with technical the experiment progressed, the traders in the experiment ignored the average

analysis principles and indicators could have explained the experimental data value line and then, surprisingly, crossed the maximum value line. The students

and exploited the trading action generated by this laboratory experiment on in the experiment paid for the stock in the experiment well beyond what even

irrational exuberance. The data indicated that, as anticipated, a dissipative gra- the most optimistic investor should have paid. Apparently, chasing dividend dis-

dient precedes a catastrophic collapse in price. tribution dates, they continued to trade was based upon the greater fool theory. It

Professor Charles Plott, California Institute of Technology, conducted his was rational to buy overvalued stock so long as someone else would buy their

experiment with well trained, knowledgeable Cal Tech students. The students overvalued stock later on, after the dividend had been collected, thus allowing

had experience with similar experiments but they had not been exposed to the the trader to continue to profit from dividends with little risk.

exact parameters of irrational exuberance experiment. All the students were by Eventually, as the oil well neared depletion, the market began to show signs

definition very bright, very rational individuals who were oriented toward mak- of nervousness. This nervousness by players in the experiment was very evi-

ing the most profit available within the context of the risk they perceived. dent on the videotape since Professor Plott had tied price bids to purchase the

Trading was done on a closed network of computers and students were al- stock to lower sounds on the musical scale. The high notes on the chart re-

lowed to buy or sell one stock. The better they traded, the more money they flected sell offers while the low notes were bid orders (See Figure 5). As the

could make up to several hundred dollars. The students who held the stock at market neared extreme upside valuations, there arose heightened nervousness

the periodic divided payment junctures were the ones who would win the game. evidenced by a striking increase in the intensity of the lower notes. Both sellers

The stock being traded was a fictitious oil company and to make things simple and buyers were shifting their expectations downwards apace with lowering

it had only one oil well. As oil was pumped from the well, the stockholder- tones and the sound volume level increased rapidly. Such a change in the sound

student was paid dividends at pre-set intervals. When the oil ran out, the com- of the market, the sentiment, has been often noted by traders on the floor of the

pany was basically worthless. exchange as a harbinger of a reversal of price trend. As the experiment pro-

gressed the buy offers that were well below the existing price began to in-

crease, although the price level itself stabilized into a horizontal trend channel.

Ultimately there occurred a sudden, sharp drop – the catastrophic jump – in the

transaction price in the experiment. The market changed suddenly and swiftly;

sentiment flipped from bullish to bearish as the price plunged to its underlying

economic asset value.

It should be mentioned that this experiment was conducted without exog-

enous factors. There were no news or media reports, no external noise, and no

one was allowed to voluntarily enter or leave the game. These restrictions may

have contributed to the stability of the price data along a horizontal trend chan-

nel rather than prompting price to oscillate upward and downward as time pro-

gressed.

JOURNAL of Technical Analysis • Winter-Spring 2004 7

Figure 4. Applying Technical Analysis sentiment played on key. Additionally, the picturing of the fear and greed vari-

ables sentiment as opposing forces in the Cusp Model was brought into dra-

matic display by two high notes versus the low notes in the Cal Tech experi-

ment. The Cusp Model revealed a new and powerful way for practicing techni-

cians to display and interpret indications of sentiment.

A tight trading range of channel of price behavior, predicted by the Cusp

Model, was created by the student investors in the Cal Tech experiment (Figure

6). That the price behavior adhered so closely to a linear trend channel was

surprising to the author, who expected to see broader and more jagged up and

down swings in price. The linear trend channel of price behavior occurring

during the experiment upheld the technical analysis practice of drawing linear

trend lines of support and resistance. The breaking of a “support line” drawn

along the horizontal price bottoms of the price channel created during the ex-

periment constituted the crossing of the Cusp and the onset of the catastrophic

downward plunge in price.

FIGURE 5. FEAR VS. GREED JUXTAPOSED

Even though Professor Plott asserted that the sudden and dramatic shift that

was not predictable, looking at the data with the aid of the Cusp Catastrophe

Theory reveals that there was a tip-off before the tumble. This tip-off was to be

expected by the curve of the “dissipative gradient” at the cusp of the model.

Applying the Cusp-Catastrophe Model

What occurred in the Cal Tech exercise was ipso facto an experiment dem-

onstrating the elements and efficacy of the Cusp-Catastrophe Model. The mar-

ket moved along an elevated course until it met with a bifurcation point. That

point was the maximum expected value or line B on Figure 3. The group of

students participating, motivated by greed, collectively decided to continue buy-

ing despite shrinking oil well resources. This build up of a speculative bubble

can be seen as taking place along the top sheet of prices on the Cusp Catastro-

phe model. The price moved smoothly along the upper level of the sheet until

the cusp. Then as fear started to play a stronger role while buying intentions

were becoming exhausted (fear was overcoming greed as a collective motive)

the threshold of the cusp was reached. Thereafter, the price plunge in the ex-

periment can be explained as the dropping off from the upper level of the cusp FIGURE 6. TRADING RANGE

in a dramatic swoon to lower level as the selling panic, the downward catastro-

phe jump erupted.

APPLYING TECHNICAL ANALYSIS

The Cusp Catastrophe Model itself and the application of the Cusp Catas-

trophe Model to the Cal Tech Experiment on Irrational Exuberance spotlighted

the efficacy of six principles of technical analysis and trading that are well

known but often overlooked or under-appreciated by technicians and traders.

These principles of technical market analysis and trading are:

■ Fear vs. Greed Juxtaposed

■ Trading Range Channels Along Tops and Bottoms

■ Descending Price Peaks: Dissipative Gradient

■ Catastrophic Panics Causing Price Gaps

■ Mental Discipline Needed to Win the “Greater Fool” Game

These six principles could play an analytical role alerting a trader, a partici-

pant in the Cal Tech Experiment, when to abandon playing the “greater fool

theory” game. These principles of technical analysis and trading were instru-

mental in the diagnosis of the “dissipative gradient” and thus the prognosis of

the decline (See Figure 4).

FEAR VS. GREED JUXTAPOSED

The Cal Tech experiment vividly revealed the classical role of sentiment as

the musical notes depicting bids and offers reflecting sentiment shifted down-

ward before the downward slide in price (Figure 5). The anticipatory role of

8 JOURNAL of Technical Analysis • Winter-Spring 2004

Descending Price Peaks: Dissipative Gradient tend to overlook and underappreciate the pattern of descending peaks as a tip

Our expectation of a pattern of “descending price peaks” within the trend off of weakness and harbinger of panic.

channel but before the price break was a key reason why we had disagreed with Once the panic decline gets underway, the scramble of offers to sell coupled

Professor Plott’s assertion that the break in price was unpredictable and un- with the withdrawal of bids to purchase, leads to repeated “air pockets” or gaps

beatable. As he opined, there was simply no way to get out on the way down. in price on the way down in price Data from the experiment revealed a gapping

However, technical analysis with aid of the Cusp Model’s, “dissipative gradi- phenomenon more pronounced and prevalent than the time honored “break away,”

ent” of descending price peaks led us to expect a window of opportunity that “measuring” and “exhaustion” gap trio of technical analysis (Figure 8). The

would alert a few astute traders to exit before the crash. The evidence from the “breakaway gap” corresponds to the catastrophe jump across the threshold.

Cal Tech Experiment on Irrational Exuberance confirmed that expectation: the Figure 9. Mental Discipline Needed to Win

downward plunge in price at the end of the Cal Tech experiment was predict- the “Greater Fool” Game

able (Figure 7).

Descending price peaks were long ago recognized by such technical ana-

lysts as Richard D. Wyckoff as a reliable pattern for prognosticating of behav-

ior for lower prices to come. The repeated attempts to rally which failed to

reach previous price levels (i.e., lower price peaks) showed that demand was

reaching exhausting. Greed/bullish sentiment was no longer supporting the el-

evated price, hence a price drop was about to occur.

Figure 7. Descending Prices Peaks

The sixth technical analysis principle enumerated above, “mental discipline

needed to win the ‘Greater Fool’ game” has more to do with trading discipline

than with chart reading (Figure 9). When commenting on the rational versus

irrational behavior of the student-investors in the experiment, Professor Plott

observed that each person who was playing the game to win was acting ratio-

nally. One is tempted to amend Professor Plott’s statements with the words

“individually rational but collectively irrational.” To win the game, the student

Figure 8. Catastrophe Panic Causing Price Gaps trader had to engage in the risky behavior of buying. Those who did not partici-

pate in the game could not earn the all-important dividend reward available to

those who did play. The optimal winning mental discipline would have been to

play the game in order to have a chance to win and “continue to play with

confidence until the sentiment-mood started to shift. Then the trader-student-

game participant had to depart from the game as price behavior as evidenced

by the descending price peaks that follow after the early warning signals of

sentiment.” With the empowerment given to an active-aggressive trader by un-

derlying behavioral finance theory like the Cusp Catastrophe Model, and the

five technical analysis principles explained above, the participant in the game

could have played the game with confidence until the end of the opportunity

for profit.

Summary and Discussion

Catastrophe Theory began with the ideas of Rene Thom in the early 1960s.

Both the mathematics and the applications were present from the beginning,

each stimulating the other, as can be seen in Thom’s classic book on Structural

Stability and Morphogenesis. The concept was then popularized by the various

The pattern of descending price peaks occurred in the experiment it was works of Christopher Zeeman, most notably in his 1977 book, Catastrophe

reminiscent of the right-hand side of the classic price-reversal patterns analysis Theory: Selected Papers 1972-77. Then in 1979 Pruden described the logical

employed by technical analysts. For example, within the classic head-and-shoul- linkages between Catastrophe Theory, a dimension within behavioral finance

ders top formation, the technical-analyst-trader is counseled to enter a short and technical market analysis. The Cusp Model of Catastrophe Theory pre-

position on the third rally or pullback to the neckline of price support. Prior sents a behavior path flowing along the top sheet until a threshold, a cusp, is

rallies to higher prices would have been to the right shoulder and to the head of reached as the underlying emotions shift toward fear overcoming greed, then

that formation. In sum, the Cusp Catastrophe Model reveals the “triple descend- suddenly the market price will jump downward. The clues given by the shift

ing peaks” pattern as a powerful technical tool. In our judgment, technicians toward dominance by supply over demand during the latter stages of a trading

JOURNAL of Technical Analysis • Winter-Spring 2004 9

range will presage the development of a bearish trend in stock prices. But up References

until that transition phase threshold point, the market would remain high and

delay its descent until remaining pockets of demand were exhausted. ■ Krow, H. (1969), Stock Market Behavior: The Technical Approach to

Let us fast forward to the stock market shown in the Cal Tech Experiment Understanding Wall Street, Random House

and then zoom in on the behavior brought about by bullish emotions vs. bearish ■ Pruden, Henry O., (1999), “Life Cycle Model of Crowd Behavior,” Technical

emotions during the latter phases in a trading range market. The moral of the Analysis of Stocks and Commodities.

jump story applies directly. During the trading range the alternating price swings ■ Pruden, Henry O., (1979), “Catastrophe Theory: A Model for Stock Market

up and down reflect the struggle between greed and fear, so the analyst - trader Behavior,” Market Technicians Association Journal.

must respect the fact that the market could jump either way...its behavior is bi-

■ Pruden, Henry O., (1980). “Catastrophe Theory: A Practical Application,”

modal. So to be effective the trader must remain neutral until the testing phase

Market Technicians Association Journal.

on the right hand side of a stock market trading range. Before we reach a

conclusion regarding future trend direction, the market should be allowed to ■ Pruden, Henry O. (1995), “Behavioral finance: What is it?” Market

define the line of least resistance and then and only then should a position, long Technicians Association Newsletter and MTA Journal, September.

or short, be entered. The breakdown was anticipated by the descending price ■ Pruden, Henry O., (2003), “Catastrophe Theory and Technical Analysis

peaks, “the dissipative gradient,” as shown on the Cusp Catastrophe Model. Applied to a Cal Tech Experiment on Irrational Exuberance,” Managerial

Behavior changes gradually before the breakdown. On the top sheet of the Finance Journal.

cusp catastrophe model one can see a slight curling over of the behavior path. ■ Ridley, M., “Survey: Frontiers of Finance,” The Economist, (October 9,

Stock market behavior would likely show, for example, a series of descending 1993).

peaks in price. Similarly on the bottom sheet of the cusp model one can see a ■ Rogers, Everett M., and F. Floyd Shoemaker (1971). Communications of

gradual curling upward of the bottom behavior sheet before the upward jump Innovations, Free Press.

(breakout) by a series of ascending bottoms during the ending stages or the ■ Schwager, Jack D., (1996). Schwager On Futures: Technical Analysis, John

right hand side of a trading range. These descending price peaks and ascending Wiley & Sons.

price bottoms are powerful, but under-appreciated, technical tools.

■ Shiller, Robert J., “Stock Prices and Social Dynamics” in Thaler, Richard

H. ed, (1993) Advances in Behavioral Finance, Russell Sage Foundation

■ Statman, Meir., (1998), “Behavioral Finance,” Contemporary Finance

Digest, Financial Management Association.

■ Thaler, Richard H., ed. (1993). Advances In Behavioral Finance, Russell

Sage Foundation.

■ Thom, Rene., (1972), Stabilite Structurelle et Morphogenese, New York:

Benjamin Press

■ Wyckoff, Richard D. in Charting The Market: The Wyckoff Method, Jack

Hutson, Ed. Technical Analysis of Stocks and Commodities.

■ Zeeman, E.C., (1977), Catastrophe Theory: Selected Papers, 1972-1977,

Reading, Mass: Addison-Wesley Publishing Company (1977), p. 1.

■ Zeeman, E.C., (1976), “Catastrophe Theory,” Scientific American, pp. 65-

83.

■ Zeeman, E.C., (1974), “On the Unstable Behavior of Stock Exchanges,”

Journal of Mathematical Economics, pp. 39-49.

10 JOURNAL of Technical Analysis • Winter-Spring 2004

About the Authors DR. WALTER BAETS

Walter R. J. Baets is Director Graduate Programs at Euromed Marseille

DR. HENRY O. PRUDEN - Ecole de Management and Distinguished Professor in Information, Inno-

Hank Pruden is a professor in the School of Business at Golden Gate vation and Knowledge at Universiteit Nyenrode, The Netherlands Business

University in San Francisco, California where he has been teaching for 20 School. He is also director of Notion, the Nyenrode Institute for Knowl-

years. Hank is more than a theoretician, he has actively traded his own edge Management and Virtual Education. Previously he was Dean of Re-

account for the past 20 years. His personal involvement in the market en- search at the Euro-Arab Management School in Granada, Spain. He gradu-

sures that what he teaches is practical for the trader, and not just abstract ated in Econometrics and Operations Research at the University of Antwerp

academic theory. (Belgium) and did postgraduate studies in Business Administration at

He is the Executive Director of the Institute of Technical Market Analy- Warwick Business School (UK). He was awarded a Ph.D. from the Univer-

sis (ITMA). At Golden Gate he developed the accredited courses in techni- sity of Warwick in Industrial and Business Studies.

cal market analysis in 1976. Since then the curriculum has expanded to He pursued a career in strategic planning, decision support and IS

include advanced topics in technical analysis and trading. In his courses consultancy for more than ten years, before joining the academic world,

Hank emphasizes the psychology of trading and as well as the use of tech- first as managing director of the management development centre of the

nical analysis methods. He has published extensively in both areas. Louvain Universities (Belgium) and later as Associate Professor at Nijenrode

Hank has mentored individual and institutional traders in the field of University, The Netherlands Business School. He has been a Visiting Pro-

technical analysis for many years. He is presently on the Board of Directors fessor at the University of Aix-Marseille (IAE), GRASCE (Complexity

of the Technical Securities Analysts Association of San Francisco and is Research Centre) Aix-en-Provence, ESC Rouen, KU Leuven, RU Gent,

past president of that association. Hank was also on the Board of Directors Moscow, St Petersburg, Tyumen and Purdue University. Most of his pro-

of the Market Technicians Association (MTA). Hank has served as vice fessional experience was acquired in the telecommunications and banking

chair, Americas IFTA (International Federation of Technical Analysts): IFTA sector. He has substantial experience in management development activi-

educates and certifies analysts worldwide. For eleven years Hank was the ties in Russia and the Arab world.

editor of The Market Technicians Association Journal, the premier publica- His research interests include: Innovation and knowledge; Complexity,

tion of technical analysts. From 1982 to 1993 he was a member of the Board chaos and change; The impact of (new information) technologies on

of Trustees of Golden Gate University. organisations; Knowledge, learning, artificial intelligence and neural net-

Professor Pruden is a visiting scholar at Euromed Marseille Ecole de works; On-line learning and work-place learning.

Management, Marseille, France during 2004-2005. He is a member of the International Editorial Board of the Journal of

Strategic Information Systems, Information & Management and Syst mes

DR. BERNARD PARANQUE

d’Information et Management. He has acted as a reviewer/evaluator for a

Bernard Paranque is a doctor of economics ( University of Lyon Lumi re number of International Conferences (e.g. ECIS an ICIS) and for the EU

- 1984) and holds the “Habilitation ˆ diriger les recherches” (1995). He RACE programme. He has published in several journals including the Jour-

began his career as an associate economist in an accountancy firm in 1984. nal of Strategic Information Systems, The European Journal of Operations

In 1990, he joined the “Banque de France” (French Central Bank) busi- Research, Knowledge and Process Management, Marketing Intelligence and

ness department. From 1990 to 2000 he produced papers on the financial Planning, The Journal of Systems Management, Information & Manage-

structure of non-financial companies (www.ssrn.com). He was a represen- ment, The Learning Organization and Accounting, Management and Infor-

tative of the Banque de France in the European Committee of Central Bal- mation Technologies. He has organised international conferences in the

ance Sheet Offices between 1993 and 2002. area of IT and organizational change.

In 1999, he was on secondment from the Banque de France to the Sec- Walter Baets is the author of “Organizational Learning and Knowledge

retary of State to SMEs’ where he was in charge of the “business financing” Technologies in a Dynamic Environment” published in 1998 by Kluwer

department. He was also a member of the French delegation to the SMEs’ Academic Publishers, and co-author with Gert Van der Linden of “The

working party of the Business and Environment Committee of the OECD. Hybrid Business School: Developing knowledge management through man-

His research refer to the “ conomie des conventions” and are focused agement learning,” published by Prentice-Hall in 2000. Along with Bob

on the financial behavior of the non-financial organization and the promo- Galliers he co-edited “Information Technology and Organizational Trans-

tion of specific tools and assessment procedures designed to enhance SMEs’ formation: Innovation for the 21st Century Organization” also published in

access to financing. 1998 by Wiley. In 1999, he edited “Complexity and Management: A col-

He is co-author with Bernard Belletante and Nadine Levratto of “Diversit lection of essays,” published by World Scientific Publishing. Recently he

conomique et mode de financement des PME” published in 2001. He is co-authored “Virtual Corporate Universities,” published 2003 by Kluwer

also the co-author of “Structures of Corporate Finance in Germany and Academic.

France” with Hans Friderichs in” JahrbŸcher fŸr National konomie und

Statistik,” 2001.

He is associate researcher of the CNRS team IDHE-ENS Cachan in

Paris and member of the New York Academy of Science.

He joins Euromed Marseille Ecole de Management as Professor of Fi-

nance and Head of the “Information and finance” department.

JOURNAL of Technical Analysis • Winter-Spring 2004 11

12 JOURNAL of Technical Analysis • Winter-Spring 2004

2

The Deviation Oscillator (DO)

Saleh Nasser, CMT

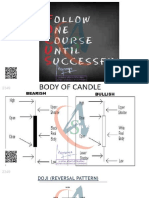

Introduction Figure 1

The major aim of the Deviation Oscillator, or DO, is to track minor changes

in the strength of a trend. It usually does not track major reversals; however, it

can be very suitable with countertrend corrections. The DO moves in an un-

bounded range above and below a zero level and it can be used alone and/or

with other indicators. Its objective is to detect weakening bulls or bears as soon

as possible. Sometimes sellers begin to weaken, while the price is still declin-

ing; the DO will recognize this weakness and will begin showing some bullish

tendencies, even before prices begin to rise.

This indicator is derived from a chart with three moving averages; a mov-

ing average of the close, a moving average of the high, and another one of the

low. It can be observed that the MA of the close deviates between the MA of the

high and the one of the low. When prices rise the MA (close) approaches the

one of the high, when prices decline, it approaches the moving average of the

low. This confirms the notion that during a rise the price usually closes near the

high of the day, and vice versa. Based on this observation, the DO was created.

Thus, the DO calculates the deviation of the moving average of the close of a Now, to extract the Deviation Oscillator, line 2 is subtracted from line 1:

certain issue from the moving average of the high and from that of the low. Deviation Oscillator (DO) = [MA (high) - MA (close)] - [MA (close) - MA (low)]

Whenever the moving average of the close of a certain period deviates from the

low towards the high it indicates strength. When it deviates from the high to- This oscillator deviates above and below a zero line. Breaking the zero line

wards the low it indicates weakness. The DO is very useful when used with to the upside means that prices are getting closer to the lows and vice versa.

other indicators like MACD, momentum, and the stochastic oscillator. This To make visual inspection easier, the scale is inverted. Thus rises and de-

paper explains its calculation, its basic interpretation, how it can be used in clines of the DO will accompany rises and declines in prices.

combination with other indicators. Figure 2

The most important aspect of this indicator is divergences. When a diver-

gence occurs it means that a countertrend move should occur. The DO can be

used along with momentum as a confirming indicator, and to filter some of its

bad signals since at times DO diverges with momentum. It can also be used

with MACD as a setup. A MACD buy signal will be triggered when accompa-

nied by a positive divergence between DO and the price. This gives superior

results as opposed to using MACD crossovers alone.

Another oscillator that was extracted from DO is the “RCDO”. It is the

Rate of Change of the Cumulative function of DO. This oscillator is mainly

used for overbought and oversold conditions. This oscillator and its uses are

also explained in this paper.

The Calculation

1. Calculate a moving average of the close, a moving average of the high and

a moving average of the low. These calculations use simple moving averages Microsoft chart with DO, after inverting the y-axis. Note that trading on

and a time span of 20 days. zero crossovers is not recommended as it suffers from whipsaws. Now a break

2. Calculate the distance between the moving average of the high and the of the zero line to the upside (after the scale is inverted) means that the moving

moving average of the close (MA(high)- MA (close)). The greater the average of the close is closer to MA high than MA low and vice versa.

difference, the closer MA (close) goes towards MA (low). A short cut for the calculation: to avoid inverting the scale, a simpler

3. Calculate the distance between the moving average of the close and the calculation can be used. (MA close - MA low) - (MA high - MA close). We

moving average of the low (MA (close) - MA (low)). will not have to invert the scale by using this calculation.

Figure 1 shows two lines that intersect with each other. When line 1 (MA

high-MA close) crosses line 2 (MA close-MA low) to the upside, then the mov- Use of the Deviation Oscillator

ing average of the close is closer to the moving average of the low than that of

the high. When line 1 crosses line 2 to the downside, the moving average of the BASIC INTERPRETATION

close is nearer to the moving average of the high. Zero Crossover

Buying when DO crosses above the zero line and selling when it crosses

below it proved to be a losing technique, resulting in a total loss of 27.05% for

the 30 Dow stocks from 1999-2003. Results improved when a buffer zone was

JOURNAL of Technical Analysis • Winter-Spring 2004 13

placed at 0.2 and -0.2. Thus the buy signal was not triggered until the upper Using the Deviation Oscillator with Other Indicators

buffer zone was broken to the upside and the position was closed when a viola-

tion of the lower boundary occurred. The loss was reduced to 20%. The results USING THE DEVIATION OSCILLATOR WITH MOMENTUM

were worst when shorts were added; covering shorts and buying longs above The Deviation Oscillator can be used as a confirming indicator for momen-

zero and closing longs and building shorts below zero with a loss of 35.5% tum divergences. Usually, when momentum witnesses a positive divergence,

which was reduced to a loss of 24% by using a buffer zone. this divergence will be more meaningful if it is confirmed by a similar diver-

Divergences gence in DO. A divergence triggered by both momentum and DO is a strong

This is the most important aspect of the Deviation Oscillator. Even when signal. A positive divergence in this case means that the decline is decelerating;

using DO with other oscillators, divergence analysis is employed. Divergence and the MA of the close is getting closer to the MA of the high.

is very important as it shows that there is hidden weakness or strength in the Another way to use DO along with momentum is to track divergences be-

market that is not apparent in the price action. tween both indicators. Sometimes the price makes a lower low, confirmed by

■ First type of divergence occurs when DO is rising and the price is still

momentum, which also triggers a lower low formation. This action might not

declining (positive divergence) or the DO curve is declining while the price be confirmed by DO, which follows a higher low formation, thus diverging

is rising (negative divergence). This means (in the case of a positive with momentum. Such divergences are very useful as they are usually followed

divergence) that despite that prices are still declining; the closing price is by a minor reversal in the trend. The same can occur at a market peak, when

getting closer to the high. The 20-day MA of the close is moving away from momentum continues making a higher high, while DO follows a lower high

the MA of the low and approaching that of the high. The decline is losing its formation. It was found, however, that positive divergences give better results

strength, as buyers are able to bring the closing price away from its lows. than negative divergences.

Testing was done on the 30 Dow stocks to see how positive divergences

If the price is declining and DO rising, buy at a breakout of a minor top,

between DO and momentum affected the price:

with a stop loss below this top or below the nearest minor bottom, depending

■ 75.8% of the time a positive divergence between DO and momentum led to

on risk tolerance. Use this divergence as a setup and buy at a breakout.

Usually such a breakout will not be false because it was preceded by some a rise in price of more than 5%.

strength. If another indicator confirms this positive divergence, the signal ■ 12.9% led to movements less than 5%, either positive or negative. The

will be stronger. The same holds true when DO declines while the price is divergence had no effect.

still rising. It means that the bears are getting stronger as they are able to ■ 11.29% of the time, momentum was a better indicator and a decline exceeded

bring the closing price away from the highs. 5% occurred after a positive divergence.

One of the most bullish signals appears when DO rises vertically, while the A positive divergence here means that momentum was triggering a lower

price is still in a trading range or slightly declining. low, while DO was showing a higher low formation. The buy signal should be

■ Second type of divergence appears more often: it occurs when the price

triggered the day after the divergence occurs, or after an up day with high vol-

makes a lower low while the DO follows a higher low (in the case of a umes for more confirmation. A stop loss could be placed below the latest minor

positive divergence), or when the price forms a higher high, while the DO bottom. Using candlesticks patterns for buying can also be useful.

triggers a lower high (in the case of negative divergence). A positive The logic behind such a divergence is as follows: the price is declining, and

divergence in this case means that during the second bottom the MA of the still accelerating to the downside, however, MA (close), which is already very

close was nearer to the MA of the high than during the first bottom. The near to MA (low), begins to move towards MA (high). In other words, buyers

price violated support but with weaker sellers. are getting stronger as they are able to close the market away from its lows.

Figure 3 Figure 4

The chart of Newmont Gold (NEM) shows a positive divergence between

DO and Momentum during July 2002. As the price was making a lower low,

Philip Morris (MO) shows a very interesting story. During March 2003, the momentum confirmed this weakness, while DO triggered a higher low forma-

DO witnessed a positive divergence with the price. During April and May, the tion. Prices rose afterwards from around 24.5 to 30. During October and early

stock’s price began to form a higher low, confirming the previous divergence. December 2002, both DO and Momentum diverged with the price action, thus

In May, while the price was trading sideways, the DO moved sharply upwards, confirming each other’s strength. As the price was trying to find support near

hinting of a continuation of the rise. At the end of the stock’s rise, from 18 June, its first bottom, both indicators witnessed a higher low formation. A healthy

to early July, the DO began to move downwards, while the stock was still ris- rise followed afterwards. In the beginning of April 2003, as price was slightly

ing, signaling potential weakness that came later. rising from 25, DO witnessed a sharp rise to the upside, indicating that prices

are moving rapidly to their highs. Momentum was rising but at a slower pace.

Usually a sudden rise in DO is considered as a very bullish action as it means

that the closing price is moving quickly towards the highs.

14 JOURNAL of Technical Analysis • Winter-Spring 2004

USING THE DEVIATION OSCILLATOR WITH MACD Thus, the buy signal will be triggered at the second MACD bullish cross-

One very useful technique is to use DO as a setup for buying and use MACD over after a positive divergence between the DO and the price. Exit will take

crossovers for actual buying and selling signals. The MACD crossover method place at the first bearish MACD crossover.

generates buy and sell signals when the MACD line crosses above or below its The rationale of the “two cross” system is that more strength appeared be-

signal line. The MACD is one of the indicators that give early signals when a fore the actual buy signal. A bullish MACD crossover during the first DO bot-

new trend is underway. This is a very good merit of the MACD, but obviously tom tells us that there was more strength in the market than the first “one cross”

a merit that often suffers from whipsaws. Eliminating bad MACD signals by system. Obviously, as the market makes a lower low, the MACD will trigger a

using another indicator enhances our trading results. Using D.O. along with bearish crossover, which will be followed by a new bullish crossover while the

MACD reduces whipsaws. DO diverges with prices.

The tactic used is to buy when the MACD line crosses above its signal line Figure 6

only after a positive divergence occurred between the DO and the price. Exit

on the first bearish MACD crossover. The main drawback of this system is that

it exits early. Traders and technicians can find better exits by additional re-

search.

Main Rule for combining D.O. and MACD: Buy when the DO creates a

positive divergence with prices and the MACD triggers a bullish crossover.

Exit after the first MACD bearish crossover.

This tactic can also be used with other indicators. The reason why the DO

can be used as a setup when it triggers divergences with prices is that its diver-

gences are even more meaningful than momentum divergences.

To increase objectivity, three distinct buy signals can be defined, dependent

on the behavior of MACD.

“One cross” system is a positive divergence occurs between the DO and

the price, and then MACD triggers a buy signal after or during the second DO The S&P 500 chart shows an example of the “two cross” system. During

bottom. The MACD thus gives only one bullish crossover after the divergence February and March 2003, DO witnessed a positive divergence with price ac-

between the DO and the price. The buy is executed when the MACD signals a tion. In February, during the first bottom, MACD triggered a bullish crossover.

bullish crossover after the DO positive divergence and exit at the first bearish As the price declined during March, MACD witnessed a bearish crossover,

crossover. followed by a new bullish crossover, which coincided with a higher DO bot-

Figure 5 tom. This is a positive divergence between DO and the price action, followed

by a MACD buy signal. The only difference here is that the MACD witnessed

two bullish crossovers instead of one. The letters “A” and “B” on the chart

show the two MACD crossovers. The two vertical lines show the buy and exit

signal. This trade was profitable, however, prices continued moving to the up-

side after the exit was triggered. As was mentioned previously, the main draw-

back of this system is that it gives a premature exit signal.

“Cross and a test” system should be expected to give the best results as

the MACD witnesses a bullish crossover during the first bottom, but does not

witness a bearish crossover afterwards. During the second bottom, and while

the DO is positively diverging with prices, the MACD line declines slightly to

test its signal line, before rising again. The buy signal is triggered as soon as a

positive divergence between the DO and the price is identified and the MACD

line moves upwards after testing its signal line. The logic of this system is that

there was strength from the beginning (bullish MACD crossover during the

first bottom) but the temporary weakness was much less than that of the “two

The chart of JP Morgan Chase shows the “One cross” buy signal. During cross” system, as the MACD line did not witness a bearish crossover. It only

February 2002, a positive divergence occurred between DO and the price ac- tested its signal line and moved upwards again. The buy will be triggered the

tion. Following this divergence, a bullish MACD crossover occurred (see the second day as the MACD line begins moving upwards once again.

vertical line). Only one MACD buy signal occurred after the DO divergence. Figure 7

The two vertical lines show the buy and sell signal. As stated, the exit signal is

triggered with the first MACD bearish crossover after a buy is signaled.

“Two cross” system occurs when MACD triggers two buy signals. The

first crossover coincides with the first DO bottom, while the second MACD

crossover coincides with the second DO bottom. During this time, the DO trig-

gers a higher bottom, while the price follows a lower bottom formation (posi-

tive divergence). What really happens is that during the first DO bottom the

MACD gives a buy signal. During the second DO bottom, an MACD bearish

crossover, followed by a new bullish crossover occurs. The trick of this tactic is

that it gives us a false bearish crossover; however, using DO in conjunction

with MACD will eliminate such a whipsaw. Even if the trader is whipsawed by

selling at the MACD bearish crossover, he will quickly re-enter with the new

buy signal as it coincides with a positive divergence in the DO.

JOURNAL of Technical Analysis • Winter-Spring 2004 15

During February and March 2003, McDonald’s chart shows the DO wit- tive. The result is an oscillator that moves slower than the normal Deviation

nessed a positive divergence with price. MACD triggered a bullish crossover Oscillator but can show overbought and oversold conditions when used in com-

during the first bottom, and a test between the MACD line and its signal line bination with other oscillators.

took place during the second bottom. No bearish crossovers occurred. The buy The ROC of the Cumulative Deviation Oscillator moves faster and when

was triggered at point B and the exit signal took place with the first bearish used with the stochastic oscillator it serves as a confirming indicator for over-

crossover afterwards. This system is very profitable and it has the merit of bought and oversold conditions. Obviously, the indicator can be used in many

being objective. Its drawback is the premature exit signals that often occur. ways and with other indicators; here it used as a confirming indicator for the

The DO and MACD system was tested across the 30 Dow stocks from 1999 stochastic and Bollinger Bands. When all three indicators confirmed each other,

through 2003 with relatively good results. The “two cross” and “cross and a a buy was triggered. The upper boundary of the Bollinger Bands was used as an

test” gave a superior results compared to the “one cross” in terms of % profit exit signal. Obviously, exit signals were not perfect, but the important thing is

per trade. On the other hand, the “one cross” was better in terms of % of prof- that nice profitable moves followed buy signals. The technician should find

itable trades than the “two cross”. Most of the buy signals fell in the category of other exit tactics than the ones used here, especially when profitable moves

“one cross” and “two cross.” A small percentage triggered the “cross and a occur.

test” system. Usually when the MACD gives a buy signal and begins to decline A buy signal is triggered when the stochastic reaches oversold, the RCDO

again, it will witness a temporary bearish crossover before witnessing a new reaches oversold, and the price tests the lower boundary of the Bollinger Bands.

buy signal. There is a small problem here. The RCDO is unbounded, unlike the stochastic,

Overall, 41.4% of the buy signals were triggered by the “one cross” system; so oversold can be identified after a certain area is touched at least two times.

48.7% were triggered by the “two cross”; while only 9.7% were “cross and a test.” There are no pre-defined levels to be used as oversold and overbought.

Figure 8

Testing results of the DO versus MACD

OVERALL RESULT

% of positive trades % of negative trades % of even trades

(profits above 5%) (losses above 5%) (less than 5% trades)

73.17% 6.5% 20.33%

% Profit/ trade % loss/ trade

17% 7%

73% of the trades were profitable with an average profit of 17% per trade. On the

other hand, 6.5% of the trades were negative, with an average loss of 7% per trade.

The rest, 20.33%, were even trades with almost no profit or loss. Some of these even

trades witnessed sharp rises afterwards, but only after the MACD gave an exit signal.

No. of days No. of days No. of days Novellus (NVLS) shows the price, the DO, the RCDO, and the stochastic.