Professional Documents

Culture Documents

Inspired Sisters LTD Online) AU

Inspired Sisters LTD Online) AU

Uploaded by

thankksCopyright:

Available Formats

You might also like

- Manual Vibro SanyDocument241 pagesManual Vibro SanyGabby Bautista100% (1)

- P60 End of Year Certificate 10 05 19 16 14 16 5273Document1 pageP60 End of Year Certificate 10 05 19 16 14 16 527313KARATNo ratings yet

- P45 Part 1A Details of Employee Leaving WorkDocument3 pagesP45 Part 1A Details of Employee Leaving WorkCaleb PriceNo ratings yet

- Amontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20Document1 pageAmontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20shamiaNo ratings yet

- Copy For Employee: Complete Only If Tax Code Is Cumulative. If There Is AnDocument3 pagesCopy For Employee: Complete Only If Tax Code Is Cumulative. If There Is AnZavache DanaNo ratings yet

- 5184 P45 (Online) PDFDocument3 pages5184 P45 (Online) PDFAlejandroe AuditoreNo ratings yet

- Sociosexual BehaviorDocument10 pagesSociosexual Behaviornegurii hearteuNo ratings yet

- Starter Checklist: Instructions For EmployersDocument2 pagesStarter Checklist: Instructions For EmployersTareqNo ratings yet

- Print VAT Registration - GOV - UkDocument11 pagesPrint VAT Registration - GOV - Uksiva kumarNo ratings yet

- PrintP45 PDFDocument3 pagesPrintP45 PDFIstoc AngelaNo ratings yet

- P45 68148Document4 pagesP45 68148Эдварт АнтонNo ratings yet

- P 85Document5 pagesP 85bhavik24No ratings yet

- View Tax Return 2018 PDFDocument16 pagesView Tax Return 2018 PDFRobert GyetwayNo ratings yet

- Staff - p45Document4 pagesStaff - p45velorutionNo ratings yet

- P45 Part 1A Details of Employee Leaving WorkDocument6 pagesP45 Part 1A Details of Employee Leaving WorkCatalin FandaracNo ratings yet

- P45 Part 1A Details of Employee Leaving WorkDocument3 pagesP45 Part 1A Details of Employee Leaving WorkDan NolanNo ratings yet

- Ion Onl Y: Copy For HM Revenue & CustomsDocument4 pagesIon Onl Y: Copy For HM Revenue & CustomsM Muneeb SaeedNo ratings yet

- UK Legal Entity: Assets TransferredDocument3 pagesUK Legal Entity: Assets Transferredshu1706No ratings yet

- p45 Tomasz Jureczko Diamonds Digital LTDDocument3 pagesp45 Tomasz Jureczko Diamonds Digital LTDTomasz JureczkoNo ratings yet

- Ep60 2016-17 PDFDocument1 pageEp60 2016-17 PDFAnonymous ZoN0SOKzVNo ratings yet

- Copy For Employee: P45 Part 1A Details of Employee Leaving WorkDocument3 pagesCopy For Employee: P45 Part 1A Details of Employee Leaving WorkSteve OrtonNo ratings yet

- Copy For Employee: P45 Part 1A Details of Employee Leaving WorkDocument3 pagesCopy For Employee: P45 Part 1A Details of Employee Leaving WorkDenis VitalieviciNo ratings yet

- Tax Return 2018-19Document18 pagesTax Return 2018-19Kasam ANo ratings yet

- Avis 2018 Revenus 2017Document15 pagesAvis 2018 Revenus 2017Arnaud CalisteNo ratings yet

- R43 2019 PDFDocument4 pagesR43 2019 PDFDavid Mark AldridgeNo ratings yet

- P 50Document2 pagesP 50Emily DeerNo ratings yet

- Claim For Repayment of Tax Deducted From Savings and InvestmentsDocument4 pagesClaim For Repayment of Tax Deducted From Savings and InvestmentsxzmangeshNo ratings yet

- Statement 25-NOV-22 AC 43388212 27104301Document4 pagesStatement 25-NOV-22 AC 43388212 27104301cecilia mwangiNo ratings yet

- 64-8 Form (Másolat)Document2 pages64-8 Form (Másolat)Molnar FerencneNo ratings yet

- Payslip Month Ending 30 November 2022Document1 pagePayslip Month Ending 30 November 2022zeppo1234No ratings yet

- Inbound Paper SA1 Form With Instruction - SignedDocument3 pagesInbound Paper SA1 Form With Instruction - SignedKushal SharmaNo ratings yet

- Tax Year To 5 April 2020 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsDocument1 pageTax Year To 5 April 2020 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsNatalino GuterresNo ratings yet

- LicenseDocument6 pagesLicenseRazvannusNo ratings yet

- Your National Insurance Number: About This FormDocument4 pagesYour National Insurance Number: About This FormTatyana TerziyskaNo ratings yet

- Agent Appointment FormDocument2 pagesAgent Appointment FormSatyen ChikhliaNo ratings yet

- Leaving The UK - Getting Your Tax Right: About This FormDocument4 pagesLeaving The UK - Getting Your Tax Right: About This Form_Cristi_No ratings yet

- HMRC Leaving The UK Getting Your Tax Right UIY IBG4 OYADocument4 pagesHMRC Leaving The UK Getting Your Tax Right UIY IBG4 OYAAbhay PatodiNo ratings yet

- Confirming Your Eligibility For Tax ReliefDocument4 pagesConfirming Your Eligibility For Tax ReliefNurullah GuzelNo ratings yet

- Tax Return 2016Document18 pagesTax Return 2016kezia dugdale0% (1)

- P60single 2Document1 pageP60single 2Claira JervisNo ratings yet

- 2021 FullDocument14 pages2021 FullDamian MikaNo ratings yet

- ПЭЙСЛИП OutputDocument1 pageПЭЙСЛИП Output13KARATNo ratings yet

- 620 Iova M SA100 11-12Document16 pages620 Iova M SA100 11-12Natalia Ciocirlan100% (1)

- View Tax Return PDFDocument14 pagesView Tax Return PDFEmil AndriesNo ratings yet

- HM Revenue & Customs: Tax Return For The Year Ended 5 April 2021Document15 pagesHM Revenue & Customs: Tax Return For The Year Ended 5 April 2021Toni Mirosanu100% (1)

- Sa150-Notes 2018 PDFDocument15 pagesSa150-Notes 2018 PDFNechifor Laurenţiu-CătălinNo ratings yet

- BoothPeterDarren 2022 1Document14 pagesBoothPeterDarren 2022 1Αριστείδης ΜέγαςNo ratings yet

- NinoDocument1 pageNinoSavage GuyNo ratings yet

- Private & Confidential: Dept: PADDB Paddington BarDocument1 pagePrivate & Confidential: Dept: PADDB Paddington BarCarlos Freitas0% (1)

- Amended Tax Credit Certificate 2022: 9371000KA Pps NoDocument2 pagesAmended Tax Credit Certificate 2022: 9371000KA Pps NoJose ArevaloNo ratings yet

- 6.110907 29424343Document10 pages6.110907 29424343Christy JosephNo ratings yet

- What Is Aadhaar KYC Know e KYC For Aadhaar CardDocument3 pagesWhat Is Aadhaar KYC Know e KYC For Aadhaar CardHARSHNo ratings yet

- Basic Pay Income Tax National Insurance: 8344788 Carlos Ariza 16-FEB-2020 ZR 57 69 94 UDocument3 pagesBasic Pay Income Tax National Insurance: 8344788 Carlos Ariza 16-FEB-2020 ZR 57 69 94 UCamilo NietoNo ratings yet

- HMRC NRL1e Non Resident Landlord Application For An Individual 83G 62UW SOFDocument3 pagesHMRC NRL1e Non Resident Landlord Application For An Individual 83G 62UW SOFDavid Gatt100% (1)

- A Guide To Our HMRC Tax Calculation & Tax Year Overview RequirementsDocument7 pagesA Guide To Our HMRC Tax Calculation & Tax Year Overview RequirementsbswaminaNo ratings yet

- Mrs M Altman 2019-20 Tax ReturnDocument22 pagesMrs M Altman 2019-20 Tax Returnyochanan altman100% (1)

- P21 Balancing Statement 2019 1196241200004Document2 pagesP21 Balancing Statement 2019 1196241200004Viorica Zaporojan IascerinschiNo ratings yet

- Tax Credit Claim Form 2018: For Donation Claims OnlyDocument2 pagesTax Credit Claim Form 2018: For Donation Claims OnlyasdfNo ratings yet

- BERAYDocument3 pagesBERAYberaylyatif2No ratings yet

- P45 (Online) - LJDocument3 pagesP45 (Online) - LJGreat EmmanuelNo ratings yet

- P45 Part 1A Details of Employee Leaving WorkDocument3 pagesP45 Part 1A Details of Employee Leaving WorkPapa JP JohnNo ratings yet

- Tugas PKL J.W MarriotDocument32 pagesTugas PKL J.W MarriotDini WulansariNo ratings yet

- Uhv Unit 4Document25 pagesUhv Unit 4Radha KrishnaNo ratings yet

- Visitors GuideDocument16 pagesVisitors GuideisraelvaiNo ratings yet

- 871 BookDocument4 pages871 Bookmurty99No ratings yet

- Fall Arrest SystemDocument16 pagesFall Arrest SystemDragos VerdesNo ratings yet

- Final Health 1-10 01.09.2014Document66 pagesFinal Health 1-10 01.09.2014Jinsen Paul Martin100% (1)

- Hira WalravenDocument219 pagesHira WalravennunnaraoNo ratings yet

- 08 MTE 271 Point DefectsDocument11 pages08 MTE 271 Point DefectsNIKHIL TOPNO100% (1)

- Spindle Motor Troubleshooting GuideDocument7 pagesSpindle Motor Troubleshooting GuideIsrael Martinez AlonsoNo ratings yet

- Drug StudyDocument8 pagesDrug StudyRuel LoriaNo ratings yet

- Pakistan Tobacco Company LimitedDocument10 pagesPakistan Tobacco Company LimitedMinhas KhanNo ratings yet

- First Floor: No. Location Area (M ) Cooling (Btu/h) Model (Daikin) Cap. (Btu/h) Type OtherDocument3 pagesFirst Floor: No. Location Area (M ) Cooling (Btu/h) Model (Daikin) Cap. (Btu/h) Type OtherIm ChinithNo ratings yet

- Autotrophic Nutrition Heterotrophic NutritionDocument1 pageAutotrophic Nutrition Heterotrophic NutritionAditya KediaNo ratings yet

- Endotracheal IntubationDocument28 pagesEndotracheal Intubationsyukur_odeNo ratings yet

- Ped 10Document17 pagesPed 10Tufail AhmadNo ratings yet

- Scpa Presentation December 15, 2014: Presented By: Chandra Brown, Internal Audit Monya Wyatt, SCPA Budget ManagerDocument20 pagesScpa Presentation December 15, 2014: Presented By: Chandra Brown, Internal Audit Monya Wyatt, SCPA Budget ManagerCincinnatiEnquirerNo ratings yet

- Rate AnalysisDocument14 pagesRate Analysispsycin0% (1)

- BSC Thesis - Eva Lind FellsDocument18 pagesBSC Thesis - Eva Lind FellsHanna Kate EnriquezNo ratings yet

- Design and Fabrication of Pesticide Solar SprayerDocument6 pagesDesign and Fabrication of Pesticide Solar SprayerK IsmailNo ratings yet

- Watts Zone Controls and Valves - 2Document16 pagesWatts Zone Controls and Valves - 2Sid KherNo ratings yet

- Sound Isolation 2017Document81 pagesSound Isolation 2017vartika guptaNo ratings yet

- File Download AjaDocument3 pagesFile Download AjaIdaNurNo ratings yet

- Page 1 of 17Document17 pagesPage 1 of 17RamBabuMeenaNo ratings yet

- by The Radisson Hotel Group, Managed by Sarovar Hotels: Park Plaza, LudhianaDocument14 pagesby The Radisson Hotel Group, Managed by Sarovar Hotels: Park Plaza, Ludhianasaurabh kumarNo ratings yet

- HSE PlanDocument196 pagesHSE PlanSyed Shiraz AliNo ratings yet

- Rojek Advance Solutions Employee HandbookDocument32 pagesRojek Advance Solutions Employee HandbookJämes ScarlétteNo ratings yet

- Hazard ManagementDocument18 pagesHazard Managementsthiyagu0% (1)

- Type 441 - Standard & High Pressure SeriesDocument16 pagesType 441 - Standard & High Pressure SeriesnagarajhebbarNo ratings yet

Inspired Sisters LTD Online) AU

Inspired Sisters LTD Online) AU

Uploaded by

thankksOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Inspired Sisters LTD Online) AU

Inspired Sisters LTD Online) AU

Uploaded by

thankksCopyright:

Available Formats

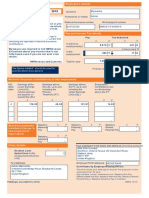

P45 Part 1A

Details of employee leaving work

Copy for employee

1 Employer PAYE reference 5 Student Loan deductions

Office number Reference number

Student Loan deductions to continue

080 / LZ50696

6 Tax Code at leaving date

2 Employee's National Insurance number

647L

If week 1 or month 1 applies, enter 'X' in the box below.

JJ 78 95 26 C

3 Title – enter MR, MRS, MISS, MS or other title

Week 1/Month 1

7 Last entries on P11 Deductions Working Sheet.

MRS

Surname or family name Complete only if Tax Code is cumulative. If there is an ‘X’

at box 6 there will be no entries here.

Week number Month number

UDDIN

8

First or given name(s)

Total pay to date

AMIRUN

£ 3872.68 p

4 Leaving date DD MM YYYY Total tax to date

06 11 2009 £ 0.00 p

8 This employment pay and tax. If no entry here, the amounts 12 Employee’s private address

are those shown at box 7.

Total pay in this employment

59 BRYNTON RD

LONGSIGHT

£ p MANCHESTER

Total tax in this employment

Postcode

£ p

M13 0VQ

9 Works number/Payroll number and Department or branch

(if any) 13 I certify that the details entered in items 1 to 11 on

this form are correct.

Employer name and address

5042

INSPIRED SISTERS LTD

10 Gender. Enter ‘X’ in the appropriate box

STUDIO 17

LONGSIGHT BUSINESS PARK

Male Female

X HAMILTON RD

MANCHESTER

11 Date of birth DD MM YYYY Postcode

10 12 1977 M13 0PD

Date DD MM YYYY

22 03 2010

To the employee Tax credits

The P45 is in three parts. Please keep this part (Part 1A) safe. Tax credits are flexible. They adapt to changes in your life, such

Copies are not available. You might need the information in as leaving a job. If you need to let us know about a change in

Part 1A to fill in a Tax Return if you are sent one. your income, phone 0845 300 3900.

Please read the notes in Part 2 that accompany Part 1A.

To the new employer

The notes give some important information about what you

should do next and what you should do with Parts 2 and 3 of If your new employee gives you this Part 1A, please return

this form. it to them. Deal with Parts 2 and 3 as normal.

P45(Online) Part 1 A HMRC 04/08

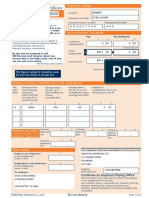

P45 Part 2

Details of employee leaving work

Copy for new employer

1 Employer PAYE reference 5 Student Loan deductions

Office number Reference number

Student Loan deductions to continue

080 / LZ50696

6 Tax Code at leaving date

2 Employee's National Insurance number

647L

If week 1 or month 1 applies, enter 'X' in the box below.

JJ 78 95 26 C

3 Title – enter MR, MRS, MISS, MS or other title

Week 1/Month 1

7 Last entries on P11 Deductions Working Sheet.

MRS

Surname or family name Complete only if Tax Code is cumulative. If there is an ‘X’

at box 6 there will be no entries here.

Week number Month number

UDDIN

8

First or given name(s)

Total pay to date

AMIRUN

£ 3872.68 p

4 Leaving date DD MM YYYY Total tax to date

06 11 2009 £ 0.00 p

To the employee

This form is important to you. Take good care of it and Claiming Jobseeker's Allowance or

keep it safe. Copies are not available. Please keep Employment and Support Allowance (ESA)

Parts 2 and 3 of the form together and do not alter them Take this form to your Jobcentre Plus Office. They will pay you

in any way. any tax refund you may be entitled to when your claim ends,

Going to a new job or at 5 April if this is earlier.

Give Parts 2 and 3 of this form to your new employer, Not working and not claiming Jobseeker's Allowance or

or you will have tax deducted using the emergency Employment and Support Allowance (ESA)

code and may pay too much tax. If you do not want If you have paid tax and wish to claim a refund ask for

your new employer to know the details on this form, form P50 Claiming tax back when you have stopped working

send it to your HM Revenue & Customs (HMRC) office from any HMRC office or Enquiry Centre.

immediately with a letter saying so and giving the Help

name and address of your new employer. HMRC can If you need further help you can contact any HMRC office

make special arrangements, but you may pay too or Enquiry Centre. You can find us in The Phone Book under

much tax for a while as a result of this. HM Revenue & Customs or go to www.hmrc.gov.uk

Going abroad

To the new employer

If you are going abroad or returning to a country

Check this form and complete boxes 8 to 18 in Part 3

outside the UK ask for form P85 Leaving the United Kingdom

and prepare a form P11 Deductions Working Sheet.

from any HMRC office or Enquiry Centre.

Follow the instructions in the Employer Helpbook

Becoming self-employed E13 Day-to-day payroll, for how to prepare a P11 Deductions

You must register with HMRC within three months of Working Sheet. Send Part 3 of this form to your HMRC

becoming self-employed or you could incur a penalty. office immediately. Keep Part 2.

To register as newly self-employed see The Phone Book

under HM Revenue & Customs or go to www.hmrc.gov.uk

to get a copy of the booklet SE1 Are you thinking of working

for yourself?

P45(Online) Part 2 HMRC04/08

P45 Part 3

New employee details

For completion by new employer

File your employee's P45 online at www.hmrc.gov.uk Use capital letters when completing this form

1 Employer PAYE reference 5 Student Loan deductions

Office number Reference number

Student Loan deductions to continue

080 / LZ50696

6 Tax Code at leaving date

2 Employee's National Insurance number

647L

If week 1 or month 1 applies, enter 'X' in the box below.

JJ 78 95 26 C

3 Title – enter MR, MRS, MISS, MS or other title

Week 1/Month 1

7 Last entries on P11 Deductions Working Sheet.

MRS

Surname or family name Complete only if Tax Code is cumulative. If there is an ‘X’

at box 6 there will be no entries here.

Week number Month number

UDDIN

8

First or given name(s)

Total pay to date

AMIRUN

£ 3872.68 p

4 Leaving date DD MM YYYY Total tax to date

06 11 2009 £ 0.00 p

To the new employer Complete boxes 8 to 18 and send P45 Part 3 only to your HMRC office immediately.

8 New employer PAYE reference 15 Employee's private address

Office number Reference number

/

9 Date new employment started DD MM YYYY

Postcode

10 Works number/Payroll number and Department or branch

(if any) 16 Gender. Enter ‘X’ in the appropriate box

Male Female

17 Date of birth DD MM YYYY

11 Enter 'P' here if employee will not be paid by you

between the date employment began and the

next 5 April.

Declaration

12 Enter Tax Code in use if different to the Tax Code at box 6. 18 I have prepared a P11 Deductions Working Sheet in

accordance with the details above.

Employer name and address

If week 1 or month 1 applies, enter 'X' in the box below.

Week 1/Month 1

13 If the tax figure you are entering on P11 Deductions

Working Sheet differs from box 7 (see the E13 Employer

Helpbook Day-to-day payroll) please enter the

figure here. Postcode

£ p

14 New employee's job title or job description Date DD MM YYYY

P45(Online) Part 3 HMRC 04/08

You might also like

- Manual Vibro SanyDocument241 pagesManual Vibro SanyGabby Bautista100% (1)

- P60 End of Year Certificate 10 05 19 16 14 16 5273Document1 pageP60 End of Year Certificate 10 05 19 16 14 16 527313KARATNo ratings yet

- P45 Part 1A Details of Employee Leaving WorkDocument3 pagesP45 Part 1A Details of Employee Leaving WorkCaleb PriceNo ratings yet

- Amontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20Document1 pageAmontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20shamiaNo ratings yet

- Copy For Employee: Complete Only If Tax Code Is Cumulative. If There Is AnDocument3 pagesCopy For Employee: Complete Only If Tax Code Is Cumulative. If There Is AnZavache DanaNo ratings yet

- 5184 P45 (Online) PDFDocument3 pages5184 P45 (Online) PDFAlejandroe AuditoreNo ratings yet

- Sociosexual BehaviorDocument10 pagesSociosexual Behaviornegurii hearteuNo ratings yet

- Starter Checklist: Instructions For EmployersDocument2 pagesStarter Checklist: Instructions For EmployersTareqNo ratings yet

- Print VAT Registration - GOV - UkDocument11 pagesPrint VAT Registration - GOV - Uksiva kumarNo ratings yet

- PrintP45 PDFDocument3 pagesPrintP45 PDFIstoc AngelaNo ratings yet

- P45 68148Document4 pagesP45 68148Эдварт АнтонNo ratings yet

- P 85Document5 pagesP 85bhavik24No ratings yet

- View Tax Return 2018 PDFDocument16 pagesView Tax Return 2018 PDFRobert GyetwayNo ratings yet

- Staff - p45Document4 pagesStaff - p45velorutionNo ratings yet

- P45 Part 1A Details of Employee Leaving WorkDocument6 pagesP45 Part 1A Details of Employee Leaving WorkCatalin FandaracNo ratings yet

- P45 Part 1A Details of Employee Leaving WorkDocument3 pagesP45 Part 1A Details of Employee Leaving WorkDan NolanNo ratings yet

- Ion Onl Y: Copy For HM Revenue & CustomsDocument4 pagesIon Onl Y: Copy For HM Revenue & CustomsM Muneeb SaeedNo ratings yet

- UK Legal Entity: Assets TransferredDocument3 pagesUK Legal Entity: Assets Transferredshu1706No ratings yet

- p45 Tomasz Jureczko Diamonds Digital LTDDocument3 pagesp45 Tomasz Jureczko Diamonds Digital LTDTomasz JureczkoNo ratings yet

- Ep60 2016-17 PDFDocument1 pageEp60 2016-17 PDFAnonymous ZoN0SOKzVNo ratings yet

- Copy For Employee: P45 Part 1A Details of Employee Leaving WorkDocument3 pagesCopy For Employee: P45 Part 1A Details of Employee Leaving WorkSteve OrtonNo ratings yet

- Copy For Employee: P45 Part 1A Details of Employee Leaving WorkDocument3 pagesCopy For Employee: P45 Part 1A Details of Employee Leaving WorkDenis VitalieviciNo ratings yet

- Tax Return 2018-19Document18 pagesTax Return 2018-19Kasam ANo ratings yet

- Avis 2018 Revenus 2017Document15 pagesAvis 2018 Revenus 2017Arnaud CalisteNo ratings yet

- R43 2019 PDFDocument4 pagesR43 2019 PDFDavid Mark AldridgeNo ratings yet

- P 50Document2 pagesP 50Emily DeerNo ratings yet

- Claim For Repayment of Tax Deducted From Savings and InvestmentsDocument4 pagesClaim For Repayment of Tax Deducted From Savings and InvestmentsxzmangeshNo ratings yet

- Statement 25-NOV-22 AC 43388212 27104301Document4 pagesStatement 25-NOV-22 AC 43388212 27104301cecilia mwangiNo ratings yet

- 64-8 Form (Másolat)Document2 pages64-8 Form (Másolat)Molnar FerencneNo ratings yet

- Payslip Month Ending 30 November 2022Document1 pagePayslip Month Ending 30 November 2022zeppo1234No ratings yet

- Inbound Paper SA1 Form With Instruction - SignedDocument3 pagesInbound Paper SA1 Form With Instruction - SignedKushal SharmaNo ratings yet

- Tax Year To 5 April 2020 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsDocument1 pageTax Year To 5 April 2020 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsNatalino GuterresNo ratings yet

- LicenseDocument6 pagesLicenseRazvannusNo ratings yet

- Your National Insurance Number: About This FormDocument4 pagesYour National Insurance Number: About This FormTatyana TerziyskaNo ratings yet

- Agent Appointment FormDocument2 pagesAgent Appointment FormSatyen ChikhliaNo ratings yet

- Leaving The UK - Getting Your Tax Right: About This FormDocument4 pagesLeaving The UK - Getting Your Tax Right: About This Form_Cristi_No ratings yet

- HMRC Leaving The UK Getting Your Tax Right UIY IBG4 OYADocument4 pagesHMRC Leaving The UK Getting Your Tax Right UIY IBG4 OYAAbhay PatodiNo ratings yet

- Confirming Your Eligibility For Tax ReliefDocument4 pagesConfirming Your Eligibility For Tax ReliefNurullah GuzelNo ratings yet

- Tax Return 2016Document18 pagesTax Return 2016kezia dugdale0% (1)

- P60single 2Document1 pageP60single 2Claira JervisNo ratings yet

- 2021 FullDocument14 pages2021 FullDamian MikaNo ratings yet

- ПЭЙСЛИП OutputDocument1 pageПЭЙСЛИП Output13KARATNo ratings yet

- 620 Iova M SA100 11-12Document16 pages620 Iova M SA100 11-12Natalia Ciocirlan100% (1)

- View Tax Return PDFDocument14 pagesView Tax Return PDFEmil AndriesNo ratings yet

- HM Revenue & Customs: Tax Return For The Year Ended 5 April 2021Document15 pagesHM Revenue & Customs: Tax Return For The Year Ended 5 April 2021Toni Mirosanu100% (1)

- Sa150-Notes 2018 PDFDocument15 pagesSa150-Notes 2018 PDFNechifor Laurenţiu-CătălinNo ratings yet

- BoothPeterDarren 2022 1Document14 pagesBoothPeterDarren 2022 1Αριστείδης ΜέγαςNo ratings yet

- NinoDocument1 pageNinoSavage GuyNo ratings yet

- Private & Confidential: Dept: PADDB Paddington BarDocument1 pagePrivate & Confidential: Dept: PADDB Paddington BarCarlos Freitas0% (1)

- Amended Tax Credit Certificate 2022: 9371000KA Pps NoDocument2 pagesAmended Tax Credit Certificate 2022: 9371000KA Pps NoJose ArevaloNo ratings yet

- 6.110907 29424343Document10 pages6.110907 29424343Christy JosephNo ratings yet

- What Is Aadhaar KYC Know e KYC For Aadhaar CardDocument3 pagesWhat Is Aadhaar KYC Know e KYC For Aadhaar CardHARSHNo ratings yet

- Basic Pay Income Tax National Insurance: 8344788 Carlos Ariza 16-FEB-2020 ZR 57 69 94 UDocument3 pagesBasic Pay Income Tax National Insurance: 8344788 Carlos Ariza 16-FEB-2020 ZR 57 69 94 UCamilo NietoNo ratings yet

- HMRC NRL1e Non Resident Landlord Application For An Individual 83G 62UW SOFDocument3 pagesHMRC NRL1e Non Resident Landlord Application For An Individual 83G 62UW SOFDavid Gatt100% (1)

- A Guide To Our HMRC Tax Calculation & Tax Year Overview RequirementsDocument7 pagesA Guide To Our HMRC Tax Calculation & Tax Year Overview RequirementsbswaminaNo ratings yet

- Mrs M Altman 2019-20 Tax ReturnDocument22 pagesMrs M Altman 2019-20 Tax Returnyochanan altman100% (1)

- P21 Balancing Statement 2019 1196241200004Document2 pagesP21 Balancing Statement 2019 1196241200004Viorica Zaporojan IascerinschiNo ratings yet

- Tax Credit Claim Form 2018: For Donation Claims OnlyDocument2 pagesTax Credit Claim Form 2018: For Donation Claims OnlyasdfNo ratings yet

- BERAYDocument3 pagesBERAYberaylyatif2No ratings yet

- P45 (Online) - LJDocument3 pagesP45 (Online) - LJGreat EmmanuelNo ratings yet

- P45 Part 1A Details of Employee Leaving WorkDocument3 pagesP45 Part 1A Details of Employee Leaving WorkPapa JP JohnNo ratings yet

- Tugas PKL J.W MarriotDocument32 pagesTugas PKL J.W MarriotDini WulansariNo ratings yet

- Uhv Unit 4Document25 pagesUhv Unit 4Radha KrishnaNo ratings yet

- Visitors GuideDocument16 pagesVisitors GuideisraelvaiNo ratings yet

- 871 BookDocument4 pages871 Bookmurty99No ratings yet

- Fall Arrest SystemDocument16 pagesFall Arrest SystemDragos VerdesNo ratings yet

- Final Health 1-10 01.09.2014Document66 pagesFinal Health 1-10 01.09.2014Jinsen Paul Martin100% (1)

- Hira WalravenDocument219 pagesHira WalravennunnaraoNo ratings yet

- 08 MTE 271 Point DefectsDocument11 pages08 MTE 271 Point DefectsNIKHIL TOPNO100% (1)

- Spindle Motor Troubleshooting GuideDocument7 pagesSpindle Motor Troubleshooting GuideIsrael Martinez AlonsoNo ratings yet

- Drug StudyDocument8 pagesDrug StudyRuel LoriaNo ratings yet

- Pakistan Tobacco Company LimitedDocument10 pagesPakistan Tobacco Company LimitedMinhas KhanNo ratings yet

- First Floor: No. Location Area (M ) Cooling (Btu/h) Model (Daikin) Cap. (Btu/h) Type OtherDocument3 pagesFirst Floor: No. Location Area (M ) Cooling (Btu/h) Model (Daikin) Cap. (Btu/h) Type OtherIm ChinithNo ratings yet

- Autotrophic Nutrition Heterotrophic NutritionDocument1 pageAutotrophic Nutrition Heterotrophic NutritionAditya KediaNo ratings yet

- Endotracheal IntubationDocument28 pagesEndotracheal Intubationsyukur_odeNo ratings yet

- Ped 10Document17 pagesPed 10Tufail AhmadNo ratings yet

- Scpa Presentation December 15, 2014: Presented By: Chandra Brown, Internal Audit Monya Wyatt, SCPA Budget ManagerDocument20 pagesScpa Presentation December 15, 2014: Presented By: Chandra Brown, Internal Audit Monya Wyatt, SCPA Budget ManagerCincinnatiEnquirerNo ratings yet

- Rate AnalysisDocument14 pagesRate Analysispsycin0% (1)

- BSC Thesis - Eva Lind FellsDocument18 pagesBSC Thesis - Eva Lind FellsHanna Kate EnriquezNo ratings yet

- Design and Fabrication of Pesticide Solar SprayerDocument6 pagesDesign and Fabrication of Pesticide Solar SprayerK IsmailNo ratings yet

- Watts Zone Controls and Valves - 2Document16 pagesWatts Zone Controls and Valves - 2Sid KherNo ratings yet

- Sound Isolation 2017Document81 pagesSound Isolation 2017vartika guptaNo ratings yet

- File Download AjaDocument3 pagesFile Download AjaIdaNurNo ratings yet

- Page 1 of 17Document17 pagesPage 1 of 17RamBabuMeenaNo ratings yet

- by The Radisson Hotel Group, Managed by Sarovar Hotels: Park Plaza, LudhianaDocument14 pagesby The Radisson Hotel Group, Managed by Sarovar Hotels: Park Plaza, Ludhianasaurabh kumarNo ratings yet

- HSE PlanDocument196 pagesHSE PlanSyed Shiraz AliNo ratings yet

- Rojek Advance Solutions Employee HandbookDocument32 pagesRojek Advance Solutions Employee HandbookJämes ScarlétteNo ratings yet

- Hazard ManagementDocument18 pagesHazard Managementsthiyagu0% (1)

- Type 441 - Standard & High Pressure SeriesDocument16 pagesType 441 - Standard & High Pressure SeriesnagarajhebbarNo ratings yet