Professional Documents

Culture Documents

Bonds and FX Strategy Approaching Rubicon Levels': Global Yield Curve

Bonds and FX Strategy Approaching Rubicon Levels': Global Yield Curve

Uploaded by

fasdOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bonds and FX Strategy Approaching Rubicon Levels': Global Yield Curve

Bonds and FX Strategy Approaching Rubicon Levels': Global Yield Curve

Uploaded by

fasdCopyright:

Available Formats

STRATEGY NOTE:

BONDS AND FX STRATEGY

APPROACHING ‘RUBICON LEVELS’

MEHUL DAYA NEELS HEYNEKE

Strategist Senior Strategist

MehulD@Nedbank.co.za Nheyneke@Nedbank.co.za

GLOBAL BOND YIELDS ON THE MOVE AMID TIGHTER GLOBAL FINANCIAL CONDITIONS

• The first half of 2018 was dominated by tighter global

financial conditions amid the contraction in Global $-

Liquidity, which resulted in the stronger US dollar

weighing heavily on the performance of risks assets,

particularly EM assets and, of course locally, on our

currency (-15% YTD vs USD), bonds (+60bps YTD, R186)

and equity market (-8% YTD, Top40).

• Global bond yields are on the rise again, led by the US

Treasury yields, which as we have highlighted in

numerous reports, is the world’s risk-free rate.

• The JPM Global Bond yield, after being in a tight

channel, has now begun to accelerate higher. There is

scope for the JPM Global Bond yield to rise another 20-

30bps, close to 2.70%, which is the ‘Rubicon level’ for

global financial markets, in our view.

• If the JPM Global Bond yield rises above 2.70%, the cost

of global capital would rise further, unleashing another

risk-off phase. Our view is that 2.70% will hold, for the

time being.

• We believe the global bond yield will eventually break

above 2.70%, amid the contraction in Global $-Liquidity.

Source: BBG, Nedbank CIB

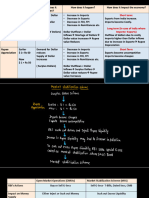

GLOBAL LIQUIDITY CRUNCH NEARING AS GLOBAL YIELD CURVE FLATTENS/INVERTS

• A stronger US dollar and the global cost of capital rising

is the perfect cocktail, in our opinion, for a liquidity

2.5 Global yield curve crunch.

%

• Major liquidity crunches often occur when yield curves

2 Greenspan CB stimulus around the world flatten or invert. Currently, the global

rate cuts Commodity yield curve is inverted; this is an ominous sign for the

1.5 cycle global economy and financial markets, especially over-

valued stocks markets like the US.

1 • The US economy remains robust, but we believe a

global liquidity crunch will weigh on the economy.

Taper Hence, we believe a US downturn is closer than most

0.5 market participants are predicting.

Fragile 5

0

Mexico/ GFC ?

-0.5 Russia crisis EM carry-trade

S&L EM $-debt

Asian

-1 Share buyback-fuelled US

crisis

stock market

US recession

-1.5

1990 1993 1996 1999 2002 2005 2008 2011 2014 2017 2020

Source: Spread between 1-5yr to 5-10yr maturity buckets of JPM Global Bond index, Nedbank CIB

4 OCTOBER 2018 | PAGE 1

STRATEGY NOTE:

BONDS AND FX STRATEGY

APPROACHING ‘RUBICON LEVELS’

GLOBAL VELOCITY OF MONEY WOULD LOSE MOMENTUM

• The traditional velocity of money indicator can be

Velocity of Money Indicator calculated only on a quarterly basis (lagged). Hence,

8 we have developed our own velocity of money

35

BRICS term indicator that can be calculated on a monthly basis.

coined

6

• Our Velocity of Money Indicator (VoM)is a

proprietary indicator that we monitor closely. It is a

25 ECB QE

China M2 modernised version of Irving Fisher’s work on the

30%yoy Abenomics

$-liquidity 4 Quantity Theory of Money, MV=PQ.

15 QE 2/

LTRO

squeeze • We believe it is a useful indicator to understand the

'animal spirits' of the global economy and a leading

QE 1 2

5 indicator when compared to PMIs, stock prices and

business cycle indicators, at times.

-5

Taper 0 • The cost of capital and Global $-Liquidity tend to lead

EZ debt crisis Tantrum

the credit cycle (cobweb theory), which in turn filters

CNY devalue

through to prospects for the real economy.

-2

-15 G20

"Shanghai • Prospects for global growth and risk assets are likely

Accord" to be dented over the next 6-12 months, as the rising

-25 -4 cost of capital globally will likely weigh on the global

economy’s ability to generate liquidity – this is

Subprime

Tech bubble Metldown already being indicated by our Global VoM indicator

-35 -6

2000 2002 2004 2006 2008 2010 2012 2014 2016 2018

VoM indicator (RHS, yoy%) OECD Global Leading Indicator (LHS,yoy%)

Source: Nedbank CIB, VoM indicator = Changes in global yield curves, bank stock prices, corporate

spreads, money multiplier and commodity prices;

SUPPORTS TO HOLD, FOR NOW…

• As the JPM Global yield targets 2.70%, we believe local

bonds will remain under pressure, targeting close to the

9.40% level. We, however, believe 9.35% will not be

breached.

• We expect the rand to consolidate around 14.70,

potentially targeting 15.00 in the short term, but we do

not expect weakness above 15.00 to be sustained.

• In the next phase of Global $-Liquidity shortage, we

expect local bonds to climb above 10%, targeting

10.50%, and the currency to breach 15.00, targeting

15.80.

Source: BBG, Nedbank CIB

Link to Nedbank CIB Disclaimer

4 OCTOBER 2018 | PAGE 2

You might also like

- JPM CDO Research 12-Feb-2008Document20 pagesJPM CDO Research 12-Feb-2008Gunes KulaligilNo ratings yet

- KornFerry and Peoplescout JobsDocument994 pagesKornFerry and Peoplescout JobsDeepak PasupuletiNo ratings yet

- MisUse of MonteCarlo Simulation in NPV Analysis-DavisDocument5 pagesMisUse of MonteCarlo Simulation in NPV Analysis-Davisminerito2211No ratings yet

- pdf2 - JephteN - On Economic Issues - FbnBank - Feb12 - 2024 - V12Feb2024Document22 pagespdf2 - JephteN - On Economic Issues - FbnBank - Feb12 - 2024 - V12Feb2024choralesengamariaNo ratings yet

- Breakfast With Dave: David A. RosenbergDocument14 pagesBreakfast With Dave: David A. Rosenbergrichardck61No ratings yet

- Global Investment OutlookDocument82 pagesGlobal Investment OutlookAnte MaricNo ratings yet

- CLO PrimerDocument31 pagesCLO PrimerdgnyNo ratings yet

- FX Insight eDocument15 pagesFX Insight eBoris BonkoungouNo ratings yet

- Bond PortfolioDocument36 pagesBond PortfoliomarcchamiehNo ratings yet

- Indian Financial Sector and The Global Financial Crisis: Jayanth R VarmaDocument10 pagesIndian Financial Sector and The Global Financial Crisis: Jayanth R VarmaDeepayan BasakNo ratings yet

- Unmask The Veil of ChinaDocument18 pagesUnmask The Veil of ChinaGinNo ratings yet

- Booze Report - Meltdown, Recovery and Strategic ResponseDocument23 pagesBooze Report - Meltdown, Recovery and Strategic ResponsecoolhunkdelhiNo ratings yet

- Global Fixed IncomeDocument5 pagesGlobal Fixed IncomeSpeculation OnlyNo ratings yet

- E D Exter Dome Rnal A Estic and Debt T: Chapte Er No. 9Document26 pagesE D Exter Dome Rnal A Estic and Debt T: Chapte Er No. 9BilalNumanNo ratings yet

- Global Financial Stability ReportDocument5 pagesGlobal Financial Stability ReportGustavo SilvaNo ratings yet

- Case CompetitionDocument12 pagesCase CompetitionPark Ji EunNo ratings yet

- Mi InvestmentDocument22 pagesMi Investmentalpha.square.betaNo ratings yet

- Japanese Economy B Lecture Note 4-5Document40 pagesJapanese Economy B Lecture Note 4-5vraimentinutileemailNo ratings yet

- The Flattening Yield Curve: We Care, But Are Not Worried: Point of ViewDocument4 pagesThe Flattening Yield Curve: We Care, But Are Not Worried: Point of ViewThea LandichoNo ratings yet

- Perspective On Real Interest Rates ImfDocument32 pagesPerspective On Real Interest Rates ImfsuksesNo ratings yet

- (9781589061620 - International Monetary Fund Annual Report 2002) International Monetary Fund Annual Report 2002Document233 pages(9781589061620 - International Monetary Fund Annual Report 2002) International Monetary Fund Annual Report 2002Juasadf IesafNo ratings yet

- Global Macro Outlook Mim q1 2022Document31 pagesGlobal Macro Outlook Mim q1 2022fatimaezzahra el farsiNo ratings yet

- Citi Middle Year OutlookDocument71 pagesCiti Middle Year OutlookAnonymous gDTyrCzoNo ratings yet

- Global Macro Outlook 2023 q3Document10 pagesGlobal Macro Outlook 2023 q3Henry J AlvarezNo ratings yet

- The Great Unwind and Its Impact, by Jim ZukinDocument21 pagesThe Great Unwind and Its Impact, by Jim Zukinpfuhrman100% (3)

- 2021OUTLOOK SUMMARY - Views From The Street PDFDocument15 pages2021OUTLOOK SUMMARY - Views From The Street PDFShazin ShahabudeenNo ratings yet

- Global Credit OutlookDocument37 pagesGlobal Credit Outlookjateel.t13No ratings yet

- Kemenkeu - BCA - Indonesia Macroeconomic Update - Drawing A Silver Lining On Post-Covid 19 EraDocument26 pagesKemenkeu - BCA - Indonesia Macroeconomic Update - Drawing A Silver Lining On Post-Covid 19 EraAryttNo ratings yet

- Financial Risk Management: Martien Lamers // 7-12-2020Document93 pagesFinancial Risk Management: Martien Lamers // 7-12-2020DaanNo ratings yet

- Indonesia Strategy: Assessing Debt Monetization ImpactDocument8 pagesIndonesia Strategy: Assessing Debt Monetization ImpactEnggar Shafira AgriskaNo ratings yet

- Breakfast With Dave 051010Document10 pagesBreakfast With Dave 051010Tikhon BernstamNo ratings yet

- Fitzgerald Global Financial Crisis EditDocument29 pagesFitzgerald Global Financial Crisis EditkrkrtNo ratings yet

- 2019-7-31 Inaugural EditionDocument6 pages2019-7-31 Inaugural Editionsvejed123No ratings yet

- Currency Crisis: Causes, Impacts and ImplicationsDocument40 pagesCurrency Crisis: Causes, Impacts and ImplicationsMohammad Tahmid HassanNo ratings yet

- TD Economics: Special ReportDocument6 pagesTD Economics: Special ReportInternational Business TimesNo ratings yet

- Sbi Optimal Equity Aif Factsheet-oct-2022-FinalDocument6 pagesSbi Optimal Equity Aif Factsheet-oct-2022-Finalritvik singh rautelaNo ratings yet

- Introduction To Oil and Gas Industry - Oil Economics: Management and Humanities DepartmentDocument27 pagesIntroduction To Oil and Gas Industry - Oil Economics: Management and Humanities DepartmentAbu-Ayman Alameen MohamedNo ratings yet

- Economic Report May 2022Document15 pagesEconomic Report May 2022Pietro PrevattoNo ratings yet

- RIL IR2022 FinancialPerformanceDocument10 pagesRIL IR2022 FinancialPerformanceMansiNo ratings yet

- Quantitative Easing - IIDocument36 pagesQuantitative Easing - IICijil DiclauseNo ratings yet

- JPMorgan Chase PresentationDocument11 pagesJPMorgan Chase PresentationZerohedgeNo ratings yet

- Class Lecture - 11Document21 pagesClass Lecture - 11Tanay BansalNo ratings yet

- Global Financial Crisis: Dr. V. N. BrimsDocument81 pagesGlobal Financial Crisis: Dr. V. N. Brimsborngenius1231019No ratings yet

- Presented by Amir KhanDocument17 pagesPresented by Amir KhanHassaan BillahNo ratings yet

- Financial Meltdown - Crisis of Governance?Document6 pagesFinancial Meltdown - Crisis of Governance?Atif RehmanNo ratings yet

- Chapter 09 - Exchange Rate Crises - How Pegs Work and How They BreakDocument103 pagesChapter 09 - Exchange Rate Crises - How Pegs Work and How They BreakcountofsurdanNo ratings yet

- International Monetary Fund Global Financial Stability Report January 2010Document6 pagesInternational Monetary Fund Global Financial Stability Report January 2010http://besthedgefund.blogspot.comNo ratings yet

- A Test of Resilience Banking Through The Crisis and Beyond VFDocument53 pagesA Test of Resilience Banking Through The Crisis and Beyond VFJózsef PataiNo ratings yet

- Understanding Sovereign RiskDocument7 pagesUnderstanding Sovereign Risk1234567899525No ratings yet

- Euro Credit Risk Feb2010Document32 pagesEuro Credit Risk Feb2010melvineNo ratings yet

- McKinsey The Future of Wealth and Growth Hangs in The BalanceDocument46 pagesMcKinsey The Future of Wealth and Growth Hangs in The BalanceDaví José Nardy AntunesNo ratings yet

- Global Debt Monitor - April2020 IIF PDFDocument5 pagesGlobal Debt Monitor - April2020 IIF PDFAndyNo ratings yet

- Global Debt Monitor - Sept2023 - VFDocument7 pagesGlobal Debt Monitor - Sept2023 - VFlimsixNo ratings yet

- Us Yield CurveDocument6 pagesUs Yield Curvealiimrandar6939No ratings yet

- Apollo Academy Private Credit Primetime White Paper Retail Version 3 PDFDocument12 pagesApollo Academy Private Credit Primetime White Paper Retail Version 3 PDFFrancis LewahNo ratings yet

- Overview Kebijakan Fiskal Pasca Pandemi Covid-19 Dan Kondisi Ketidak Pastian Perekonomian Global Dampak Perang Rusia-Ukraina 2022Document39 pagesOverview Kebijakan Fiskal Pasca Pandemi Covid-19 Dan Kondisi Ketidak Pastian Perekonomian Global Dampak Perang Rusia-Ukraina 2022RM DeboniNo ratings yet

- Farragut Newsletter August 2009Document2 pagesFarragut Newsletter August 2009FruffingNo ratings yet

- FinQuiz - Curriculum Note, Study Session 4, Reading 14Document16 pagesFinQuiz - Curriculum Note, Study Session 4, Reading 14Pom Jung100% (1)

- 2022 Preqin Global Sample Pages: Private EquityDocument9 pages2022 Preqin Global Sample Pages: Private EquityIsabelle ZhuNo ratings yet

- Market Snapshot - Sept 2023Document18 pagesMarket Snapshot - Sept 2023wqtg5kkm29No ratings yet

- Coinbase Monthly Outlook - Cyclical Not StructuralDocument6 pagesCoinbase Monthly Outlook - Cyclical Not StructuralAndres SimoneNo ratings yet

- Navigating the Global Storm: A Policy Brief on the Global Financial CrisisFrom EverandNavigating the Global Storm: A Policy Brief on the Global Financial CrisisNo ratings yet

- Recycling Saves The EcosystemDocument3 pagesRecycling Saves The EcosystemAbdulrahman AlhammadiNo ratings yet

- Marx To Engels, April 30, 1968Document6 pagesMarx To Engels, April 30, 1968giliad.souzaNo ratings yet

- ACC707 Auditing Assurance Services AssignmentDocument2 pagesACC707 Auditing Assurance Services AssignmentHaris AliNo ratings yet

- Love 07Document11 pagesLove 07Diwaker PandeyNo ratings yet

- Executive SummaryDocument23 pagesExecutive SummaryLois RazonNo ratings yet

- Documentary Analysis For "Magtanim Ay Di Biro" by Kara DavidDocument1 pageDocumentary Analysis For "Magtanim Ay Di Biro" by Kara DavidEishley Gwen Espiritu CabatbatNo ratings yet

- Tda ProfileDocument8 pagesTda ProfileZubair MohammedNo ratings yet

- Request 3. CoreLogic Annual ReportDocument140 pagesRequest 3. CoreLogic Annual ReportkirantailurNo ratings yet

- Federal Reserve Issues FOMC Statement: ShareDocument1 pageFederal Reserve Issues FOMC Statement: ShareTREND_7425No ratings yet

- Ultimate Mini Guide Property Development Investing V1Document42 pagesUltimate Mini Guide Property Development Investing V1zviviNo ratings yet

- Sophia Antipolis Case Study Balan Felicia TabitaDocument3 pagesSophia Antipolis Case Study Balan Felicia TabitaTabitha BălanNo ratings yet

- The Position of Distribution LogisticsDocument5 pagesThe Position of Distribution LogisticsAlfira RestyNo ratings yet

- Fabozzi BMAS8 CH03 IM GE VersionDocument29 pagesFabozzi BMAS8 CH03 IM GE VersionsophiaNo ratings yet

- Considerations For Entrepreneurs Entering The Recreational Marijuana IndustryDocument15 pagesConsiderations For Entrepreneurs Entering The Recreational Marijuana IndustryRay RodriguezNo ratings yet

- Tender No: 03230119 Closing Date/Time: 08/08/2023 14:15: 2. Item DetailsDocument10 pagesTender No: 03230119 Closing Date/Time: 08/08/2023 14:15: 2. Item DetailsSwaraj AgarwalNo ratings yet

- Microeconomics Module 1Document11 pagesMicroeconomics Module 1Jemar RomeroNo ratings yet

- Functions of State Bank of IndiaDocument7 pagesFunctions of State Bank of IndiaMitali Pardhiye64% (11)

- GGCSR Lesson 2 Strategic Management of Stakeholder RelationshipDocument6 pagesGGCSR Lesson 2 Strategic Management of Stakeholder RelationshipSkyler FaithNo ratings yet

- DLL - BRM - Ecommerce AnalyticsDocument4 pagesDLL - BRM - Ecommerce AnalyticsamanNo ratings yet

- 133 Week2Document18 pages133 Week2E_dienNo ratings yet

- General Agreement On Tariffs and TradeDocument15 pagesGeneral Agreement On Tariffs and TradeCrbaseraNo ratings yet

- Sales PPT - GRP 3Document14 pagesSales PPT - GRP 321324jesikaNo ratings yet

- Risk Assessment For Capital Construction ProjectsDocument27 pagesRisk Assessment For Capital Construction ProjectsM.TauqeerNo ratings yet

- Methods of Credit Control Employed by The Central BankDocument4 pagesMethods of Credit Control Employed by The Central BankMD. IBRAHIM KHOLILULLAHNo ratings yet

- Chapter12 - Ethics in The Global EnvironmentDocument27 pagesChapter12 - Ethics in The Global Environmenttsy0703100% (1)

- Objectives:: Tourism Industry in BangladeshDocument39 pagesObjectives:: Tourism Industry in BangladeshAshiqur RahmanNo ratings yet

- HR - OBIA - 11.1.1.10.x - Product - GuidesDocument146 pagesHR - OBIA - 11.1.1.10.x - Product - GuidesMaheshBirajdarNo ratings yet