Professional Documents

Culture Documents

Assign 2 M

Assign 2 M

Uploaded by

senzo scholarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assign 2 M

Assign 2 M

Uploaded by

senzo scholarCopyright:

Available Formats

Assignment: 2014-05-22 Solution

Problem 1 [0]

Borrow or not?

Solution:

(a) 100% Equity financing

The MARR = 8,5% is known.

=> Determine PW at the MARR.

PW = −R250 000 + R15 000 × (P/A; 8,5%; 15) 3

= −R250 000 + R15 000 × 8,304 2

= −R−125 437 33

Conclusion: 100% equity does not meet the MARR requirement 3

(b) 60%-40% D-E financing

Loan principal = R250 000 × 0.60

= R150 000

Loan payment = R150 000(A/P ; 9%; 15)

= R150 000 × 0,124 1%

= R18 615/year

Cost of 60% debt capital is 9% for the loan.

WACC = 0,40 × 8,5% + 0,40 × 9%

= 8,8% 3

MARR = 8,8%

Annual NCF = project NCF − loan payment

= R−3 615

Amount of equity invested = R250 000 − R150 000

= R100 000

P W = −R100 000 + R−3 615(P/A; 8,8%; 15) 3

= −R100 000 + R−3 615 × 8,156 7

= −R100 000 + R−29 486

= −R129 486 3

Conclusion: 60% debt-40% equity mix does not meet the MARR requirement 3 .

(c) The 100% Equity mix is bad, but better than the 60% debt-40% Equity mix. 33

Problem 2 [8]

The committee on the scale

1. Flexibility[f] The most important factor

2. Safety[s] 50% as important as uptime

3. Uptime[u] One-half as important as flexibility

4. Speed[v] As important as uptime

5. Rate of Return[r] Twice as important as safety

Use these statements to determine the normalised weights if scores are assigned between 0 and 10.

Adv. Eng. Economics Page 1 of 5

Assignment: 2014-05-22 Solution

Solution:

Normalised:

10 ≥ f, s, u, v, r ≥ 0

10

f > s, u, v, r fn = = 0,363 6 3

27.5

2×s=u 5

un , vn , sn = = 0,181 8 333

2×u=f 27.5

2.5

u=v sn = = 0,090 9 3

27.5

r =2×s

Choose Test:

f = 10 3 X 10 + 3 × 5 + 2.5

fn , sn , un , vn , rn = =1

then 27.5

10 10 ≥ fn = [0,363 6]

u, v = =5

2 = 2 × {un , vn , rn }

u

s = = 2.5 = [0,181 8]

2

r =2×s=5 = 2 × sn = [0,090 9] ≥ 0

X

f, s, u, v, r = 10 + 5 + 5 + 2.5 + 5 33

= 27.5

Problem 3 [8]

Economic service life

Solution:

(a) (4 marks) Determining the ESL:

For n = 1 :

AW1 = −100 000(A/P ; 18%; 1) − 75 000 + 100 000(0.85)1 (A/F ; 18%; 1)

= −100 000 × 1,180 0 − 75 000 + 85 000 × 1,000 0

= −108 000

For n = 2 :

AW2 = −100 000(A/P ; 18%; 2) − 75 000 − 10 000(A/G; 18%; 2) + 100 000(0.85)2 (A/F ; 18%; 2)

= −100 000 × 0,638 7 − 75 000 − 10 000 × 0,458 7 + 72 250 × 0,458 7

= −110 316

=>ESL is 1 year with AW1 = −108 000.

(b) (4 marks) Determining a rough better price:

Set the AW6 equal to AW1 = −108 000 and solve for P, the required lower first cost.

AW6 = −108 000 3

= −P (A/P ; 18%; 6) − 75 000 − 10 000(A/G; 18%; 6) + P (0.85)6 (A/F ; 18%; 6) 3

−108 000 = −P × 0,285 9 − 75 000 − 10 000 × 2,025 2 + P × 0,377 1 × 0,105 9

0,246 0P = −95 252 − (−108 000)

=> P = 51 821 33

The first cost would have to be reduced from R100 000 to R51 821. This is a quite large reduction.

Adv. Eng. Economics Page 2 of 5 See next …

Assignment: 2014-05-22 Solution

Problem 4 [8]

When is the price right?

Fixed cost, R’000 Variable cost, R/Unit

Administrative 30 Materials 2 500

Salaries and benefits: 20% of 350 Labour 200

Equipment 100 Indirect Labour 2 000

Space,etc. 55 Subcontractors 600

Computers: 13 of 100 Misc cost 200

Solution:

FC = R288 333

v = R5 500/unit

(a) (4 marks) Calculate revenue per unit to break-even

Profit = (r − v)Q − F C

0 = (r − 5 500)5 000 − 288 333 3

288 333

r − 5 500 = 3

5 000

r = R5 558/unit 33

(b) (4 marks) Calculate revenue per unit to achieve turnover

Profit = (r − v)Q − F C

500 000 = (r − 5 500)(5 000 + 3 000) − 288 333 3

500 000 = (r − 5 500)8 000 − 288 333

(r − 5 500) = (500 000 + 288 333)/8 000 3

r = R5 599/unit 33

Problem 5 [8]

Buy or make?

Indirect Costs

Direct

Basis Allocated Material

Department Rate/h Labour

Hours Hours Cost

Cost

A Labour 10 25 000 200 000 200 000

B Machine 5 25 000 50 000 200 000

C Labour 15 10 000 50 000 100 000

300 000 500 000

Solution: For making the components in-house, the AOC is comprised of direct labour, direct material, and

indirect costs. Use the data of the table to calculate the indirect cost allocation.

Adv. Eng. Economics Page 3 of 5 See next …

Assignment: 2014-05-22 Solution

Department A: 25 000 × 10 = 250 000

Department B: 25 000 × 5 = 125 000

Department C: 10 000 × 15 = 150 000

Total = 525 000 3

AOC = 525 000 + 300 000 + 500 000 3

= 1 325 000 3

The make alternative annual worth is the total of capital recovery and AOC

AWmake = −FC(A/P, i, n) + salvage(A/F, i, n) − AOC 3

= −2 000 000(A/P, 15%, 10) + 50 000(A/F, 15%, 10) − 1 325 000

= −2 000 000 × 0,199 3 + 50 000 × 0,049 3 − 1 325 000

= −1 726 065 33

Currently, the carafes are purchased with an AW of:

AWbuy = −1 500 000

It is cheaper to purchase, because the AW of costs is less. 33

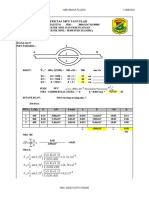

Problem 6 [18]

What percentage?

Solution: Given information:

Value Units Value Units

Phase I (PCap) 1,8 Mega ton Fixed Cost I 40 Rm

Phase IIA 3,6 Mega ton Fixed Cost II 80 Rm

Phase IIB 5,4 Mega ton First Cost I 800 Rm

Production Cost (PC) 150 R/ton First Cost II 700 Rm

Production Revenue (PR) 500 R/ton Remediation Cost 90 Rm

gR (Revenues) −3% per year Investment Rate (r) 15% per year

gC (Costs) 3% per year Borrowing Rate (k) 16% per year

Periods 12 years

Adv. Eng. Economics Page 4 of 5 See next …

Assignment: 2014-05-22 Solution

Calculations: (without formula)

n Year Invest Revenue Cost Profit CF FW+ PW- Mark

2012 -266 -266,667 -266,667 3

1 2013 -266 -266,667 -229,885 3

2 2014 -266 -266,667 -198,177 3

3 2015 900,000 310,000 590,000 590,000 1804,823 3

4 2016 873,000 318,100 554,900 554,900 1476,045 3

5 2017 846,810 326,443 520,367 520,367 1203,640 3

6 2018 -700 821,406 335,036 486,369 -213,631 -87,683 3

7 2019 -700 796,764 343,887 452,876 -247,124 -87,440 3

8 2020 1545,721 706,008 839,713 839,713 1277,099 3

9 2021 2249,024 1047,182 1201,842 1201,842 1589,436 3

10 2022 2181,554 1076,198 1105,356 1105,356 1271,159 3

11 2023 -90 2116,107 1106,084 1010,023 920,023 920,023 3

P

9542,227 -869,851 33

FW+

−P W − 10,970 33

ERR= 24,33% 33

0-End of Assignment-0

0-0-0

Adv. Eng. Economics Page 5 of 5 End of assignment and info

You might also like

- Friendly Introduction To Numerical Analysis 1st Edition Bradie Solutions Manual PDFDocument13 pagesFriendly Introduction To Numerical Analysis 1st Edition Bradie Solutions Manual PDFChesterine Copperfield33% (3)

- Power Electronics Circuits Devices and Applications 4th Edition Rashid 9332584583 9789332584587 Solution ManualDocument11 pagesPower Electronics Circuits Devices and Applications 4th Edition Rashid 9332584583 9789332584587 Solution Manualrebeccaterrelljefxwgzyod100% (31)

- Exercises Problems Answers Chapter 5Document5 pagesExercises Problems Answers Chapter 5A Sibiescu100% (1)

- The Freelance Content Marketing Writer Find Your Perfect Clients, Make Tons of Money and Build A Business You Love (Gregory Jennifer Goforth) (Z-Library)Document219 pagesThe Freelance Content Marketing Writer Find Your Perfect Clients, Make Tons of Money and Build A Business You Love (Gregory Jennifer Goforth) (Z-Library)Mara Relunia-Ayen100% (1)

- MMW Activity 5 - SENDINDocument4 pagesMMW Activity 5 - SENDINJolly S. Sendin100% (1)

- Exercises Problems Answers Chapter 8: Problem 8.1Document9 pagesExercises Problems Answers Chapter 8: Problem 8.1A SibiescuNo ratings yet

- Microelectronic Circuits Analysis and Design 3rd Edition Rashid Solutions ManualDocument50 pagesMicroelectronic Circuits Analysis and Design 3rd Edition Rashid Solutions Manuala851945412100% (1)

- Chapter - II Review of Literature Review of LiteratureDocument24 pagesChapter - II Review of Literature Review of LiteratureeshuNo ratings yet

- STAT6015TestAns2023 1Document3 pagesSTAT6015TestAns2023 1Wing Kin CHANNo ratings yet

- Assn10 SolDocument8 pagesAssn10 SolHadi MoshayediNo ratings yet

- Dwnload Full Microelectronic Circuits Analysis and Design 3rd Edition Rashid Solutions Manual PDFDocument36 pagesDwnload Full Microelectronic Circuits Analysis and Design 3rd Edition Rashid Solutions Manual PDFpardonstopping.q54x100% (15)

- Microelectronic Circuits Analysis and Design 3rd Edition Rashid Solutions ManualDocument25 pagesMicroelectronic Circuits Analysis and Design 3rd Edition Rashid Solutions ManualMichaelMeyerfisp100% (47)

- QM Solutions April 23 by Permal SajjadDocument14 pagesQM Solutions April 23 by Permal Sajjadfasihullah1500No ratings yet

- ACST202/ACST851: Mathematics of Finance Tutorial Solutions 7: Project AppraisalDocument10 pagesACST202/ACST851: Mathematics of Finance Tutorial Solutions 7: Project AppraisalAbhishekMaranNo ratings yet

- Microelectronic Circuits Analysis and Design 3rd Edition Rashid Solutions ManualDocument15 pagesMicroelectronic Circuits Analysis and Design 3rd Edition Rashid Solutions Manualstibinesimousc6bgx100% (37)

- BM PracticeDocument25 pagesBM PracticeShagufta ParveenNo ratings yet

- MonedasDocument2 pagesMonedasNono Amigón AlvaradoNo ratings yet

- KertasModelUPSA 3Document5 pagesKertasModelUPSA 3Atiqa ShafiqaNo ratings yet

- Print: Sin Sin Sin (+) /2 60 40 Sin /2 60 Sin 50 Sin 30 0.766 0.54Document4 pagesPrint: Sin Sin Sin (+) /2 60 40 Sin /2 60 Sin 50 Sin 30 0.766 0.5411.vega.tos2No ratings yet

- Statistics For Business and Economics Revised 12th Edition Anderson Solutions ManualDocument27 pagesStatistics For Business and Economics Revised 12th Edition Anderson Solutions Manualchieverespectsew100% (28)

- Business Statistics in Practice 8th Edition Bowerman Solutions Manual DownloadDocument10 pagesBusiness Statistics in Practice 8th Edition Bowerman Solutions Manual DownloadSteven Campbell100% (25)

- Statistical Techniques in Business and EconomicsDocument15 pagesStatistical Techniques in Business and EconomicsJesslyn Emmanuela Njoto PrawiroNo ratings yet

- Statistics For Business and Economics Revised 12th Edition Anderson Solutions Manual 1Document26 pagesStatistics For Business and Economics Revised 12th Edition Anderson Solutions Manual 1eldora100% (47)

- Mfin514 3 1Document18 pagesMfin514 3 1judbavNo ratings yet

- MS8 IGNOU MBA Assignment 2009Document6 pagesMS8 IGNOU MBA Assignment 2009rakeshpipadaNo ratings yet

- April 2014 MLC Multiple Choice Solutions: L L L L L L D Q L L LDocument9 pagesApril 2014 MLC Multiple Choice Solutions: L L L L L L D Q L L LHông HoaNo ratings yet

- Lesson 9: Test of Correlation and Simple Linear RegressionDocument7 pagesLesson 9: Test of Correlation and Simple Linear RegressionAntonio ArienzaNo ratings yet

- W2 II C12 Systematic Risk and Equity Risk PremiumDocument12 pagesW2 II C12 Systematic Risk and Equity Risk PremiumSophie LimNo ratings yet

- QM Assignment July 22 by Permal Sajjad - SolutionDocument7 pagesQM Assignment July 22 by Permal Sajjad - SolutionZeeshan Bakali100% (1)

- Lahore School of Economics Financial Management II Review of FM I - 1Document3 pagesLahore School of Economics Financial Management II Review of FM I - 1Daniyal AliNo ratings yet

- Exp 4Document7 pagesExp 4PHUI LUAN YAPNo ratings yet

- Fractions, Decimals, ApproximationsDocument4 pagesFractions, Decimals, ApproximationsEbube KennethNo ratings yet

- ISOM2500 Spring 2019 Assignment 4 Suggested Solution: Regression StatisticsDocument4 pagesISOM2500 Spring 2019 Assignment 4 Suggested Solution: Regression StatisticsChing Yin HoNo ratings yet

- STM Problems 2003Document24 pagesSTM Problems 2003ManchariNo ratings yet

- ACST202/ACST851: Mathematics of Finance Tutorial Solutions 13: Bond StatisticsDocument11 pagesACST202/ACST851: Mathematics of Finance Tutorial Solutions 13: Bond StatisticsAbhishekMaranNo ratings yet

- Jawaban Fismat Bab.1 - Bab.3Document155 pagesJawaban Fismat Bab.1 - Bab.3nurul kartika100% (2)

- Mekflu TugasDocument13 pagesMekflu Tugasbakti20No ratings yet

- Tutorial 7 Questions - Model - Answers-21Document5 pagesTutorial 7 Questions - Model - Answers-21Munna ChoudharyNo ratings yet

- DPP-3 Geo Solution p65Document4 pagesDPP-3 Geo Solution p65Maddala NagendrakumarNo ratings yet

- Investments Canadian Canadian 8th Edition Bodie Solutions Manual 1Document14 pagesInvestments Canadian Canadian 8th Edition Bodie Solutions Manual 1theresa100% (51)

- Measures of Location (Solutions) : I I I I J J I I I I I I IDocument3 pagesMeasures of Location (Solutions) : I I I I J J I I I I I I IAvast FreeNo ratings yet

- HW3 Solutions - Stats 500: Problem 1Document4 pagesHW3 Solutions - Stats 500: Problem 1Souleymane CoulibalyNo ratings yet

- Decision ScienceDocument8 pagesDecision ScienceHimanshi YadavNo ratings yet

- This Study Resource Was: Statistics 355 Homework 15Document3 pagesThis Study Resource Was: Statistics 355 Homework 15LC JayNo ratings yet

- Second Course in Statistics Regression Analysis 7th Edition Mendenhall Solutions ManualDocument11 pagesSecond Course in Statistics Regression Analysis 7th Edition Mendenhall Solutions Manualdulcitetutsanz9u100% (21)

- FIE400E 2016 Spring SolutionsDocument4 pagesFIE400E 2016 Spring SolutionsSander Von Porat BaugeNo ratings yet

- PrinciplesDocument6 pagesPrinciplesburievaasal14No ratings yet

- Tutorial 4 SolutionsDocument6 pagesTutorial 4 SolutionsNokubongaNo ratings yet

- Power Electronics Circuits Devices and Applications 4th Edition Rashid Solution ManualDocument28 pagesPower Electronics Circuits Devices and Applications 4th Edition Rashid Solution ManualstevenNo ratings yet

- Time Value of MoneyDocument5 pagesTime Value of MoneyTennya Kua Yen Fong100% (1)

- S2 - Chapter Review 6Document3 pagesS2 - Chapter Review 6ameen jayahNo ratings yet

- 1.3 Floating Point Number Systems: Full DownloadDocument13 pages1.3 Floating Point Number Systems: Full DownloadArlette MendezNo ratings yet

- A.) Graphical Method: EQ. (1) EQ.Document4 pagesA.) Graphical Method: EQ. (1) EQ.Rosita LanderoNo ratings yet

- N5 Applications of Maths With Solutions 4 PDFDocument59 pagesN5 Applications of Maths With Solutions 4 PDFThe Unique Game ChangerNo ratings yet

- De La Salle University - Dasmariñas: Mathematics and Statistics DepartmentDocument4 pagesDe La Salle University - Dasmariñas: Mathematics and Statistics DepartmentPran piyaNo ratings yet

- Tugas Distribusi Probabilitas Ivonella 1Document8 pagesTugas Distribusi Probabilitas Ivonella 1Ivonella maraniNo ratings yet

- Calculos de Las 6 Laboratori de EymDocument1 pageCalculos de Las 6 Laboratori de EymLAZARONo ratings yet

- Chap-17 - Current Electricity - SolutionsDocument6 pagesChap-17 - Current Electricity - Solutionsagamkapoor0135No ratings yet

- Sample Applied Statistics and Probability For EngineersDocument7 pagesSample Applied Statistics and Probability For EngineersALBERT DAODANo ratings yet

- Statistika Minggu 3Document9 pagesStatistika Minggu 3Kintan ImayasariNo ratings yet

- Statistics For Business and Economics 12Th Edition Anderson Solutions Manual Full Chapter PDFDocument36 pagesStatistics For Business and Economics 12Th Edition Anderson Solutions Manual Full Chapter PDFmelvina.burger100100% (19)

- Monrovia Casablanca and Addis Abeba - THDocument10 pagesMonrovia Casablanca and Addis Abeba - THsenzo scholarNo ratings yet

- COVID-19 Corona Virus Vaccine - WHO Is Misleading The World (2020, White Supremacy)Document2 pagesCOVID-19 Corona Virus Vaccine - WHO Is Misleading The World (2020, White Supremacy)senzo scholarNo ratings yet

- Black Lives Matter, Covid-19 and The Scene of PoliticsDocument8 pagesBlack Lives Matter, Covid-19 and The Scene of Politicssenzo scholarNo ratings yet

- Leadership in Colonial Africa - Disruption of Traditional Frameworks and Patterns (2014, Palgrave Macmillan US)Document196 pagesLeadership in Colonial Africa - Disruption of Traditional Frameworks and Patterns (2014, Palgrave Macmillan US)senzo scholarNo ratings yet

- Advertisement For Tender Roads Marking20112020Document4 pagesAdvertisement For Tender Roads Marking20112020senzo scholarNo ratings yet

- You Are Hereby Invited To Submit Quotation For The Requirements of National Health Laboratory ServiceDocument41 pagesYou Are Hereby Invited To Submit Quotation For The Requirements of National Health Laboratory Servicesenzo scholarNo ratings yet

- VSO Photovoice Facilitators GuideDocument20 pagesVSO Photovoice Facilitators GuideVSO50% (2)

- ONGC Cash FlowDocument4 pagesONGC Cash FlowSreehari K.SNo ratings yet

- First Benchmark PublishingDocument17 pagesFirst Benchmark PublishingChan Mark AyapanaNo ratings yet

- Vortex Bladeless Wind TurbineDocument3 pagesVortex Bladeless Wind TurbineLokesh Kumar GuptaNo ratings yet

- RCC Details Design of Bridge No. 422 of N F RailwayDocument26 pagesRCC Details Design of Bridge No. 422 of N F Railwayshashibhushan singhNo ratings yet

- Design To PDFDocument78 pagesDesign To PDFMark John PeñaNo ratings yet

- AirportsDocument12 pagesAirportsfairus100% (2)

- Art 332 of Revised Penal CodeDocument3 pagesArt 332 of Revised Penal CodeImmanuel Cris PalasigueNo ratings yet

- Liminal Business and Entity Verification Market and Buyers Guide - 12122023Document53 pagesLiminal Business and Entity Verification Market and Buyers Guide - 12122023rand808No ratings yet

- Foreign: JUCHE 110Document20 pagesForeign: JUCHE 110mike johnNo ratings yet

- Accessibility - Delfont Mackintosh TheatresDocument5 pagesAccessibility - Delfont Mackintosh TheatresLomon SamNo ratings yet

- Visible Surface Detection AlgorithmsDocument21 pagesVisible Surface Detection AlgorithmsTara ElanNo ratings yet

- S02 Rock Drill, Flushing HeadDocument28 pagesS02 Rock Drill, Flushing HeadrolandNo ratings yet

- New IdeaDocument14 pagesNew Ideaarun447No ratings yet

- Lamp Driver Modules: GeneralDocument2 pagesLamp Driver Modules: GeneralDeepanshu ShishodiaNo ratings yet

- Dr. M. Syed Jamil Asghar: Paper Published: 80Document6 pagesDr. M. Syed Jamil Asghar: Paper Published: 80Awaiz NoorNo ratings yet

- 6469 4 Sun-Protection DigitalDocument2 pages6469 4 Sun-Protection DigitalMohammed sabatinNo ratings yet

- PAASCU Accredited: GS Level III / HS Level III: La Consolacion College - CaloocanDocument2 pagesPAASCU Accredited: GS Level III / HS Level III: La Consolacion College - CaloocanCarpiceKatherineNo ratings yet

- Day Bang by Roosh V by Gene - PDF ArchiveDocument8 pagesDay Bang by Roosh V by Gene - PDF ArchivemohammaderfandardashtiNo ratings yet

- Sbi Life EshieldDocument6 pagesSbi Life EshieldAnkit VyasNo ratings yet

- MSDS of Asi-CalphosDocument4 pagesMSDS of Asi-Calphosthiensuty74No ratings yet

- Pile Cap DesignDocument95 pagesPile Cap Designpravin100% (1)

- CCJ Issue 49 PDFDocument132 pagesCCJ Issue 49 PDFsleepanon4362No ratings yet

- Munier Hossain - Making Sense of Medical Statistics (2021, Cambridge University Press) - Libgen - LiDocument199 pagesMunier Hossain - Making Sense of Medical Statistics (2021, Cambridge University Press) - Libgen - LijonahiNo ratings yet

- R Janardhana Rao Vs G Lingappa 12011999 SC1220s990785COM978453Document3 pagesR Janardhana Rao Vs G Lingappa 12011999 SC1220s990785COM978453A. L. JainNo ratings yet

- Yahoo Business StrategyDocument9 pagesYahoo Business Strategytanvir7650% (2)

- Ecs 1azDocument21 pagesEcs 1azjamesNo ratings yet

- CS Datasheet BiHiKu6 - CS6W MB AG - v2.1 - EN (Canadise)Document2 pagesCS Datasheet BiHiKu6 - CS6W MB AG - v2.1 - EN (Canadise)AlejandraNo ratings yet