Professional Documents

Culture Documents

Business Registration and Certification For Individuals Contracting With Public Agencies and For Unincorporated Construction Contractors

Business Registration and Certification For Individuals Contracting With Public Agencies and For Unincorporated Construction Contractors

Uploaded by

highland bandOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Registration and Certification For Individuals Contracting With Public Agencies and For Unincorporated Construction Contractors

Business Registration and Certification For Individuals Contracting With Public Agencies and For Unincorporated Construction Contractors

Uploaded by

highland bandCopyright:

Available Formats

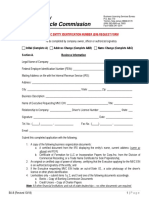

NJ-REG-A

(Rev 12/06)

Business Registration and Certification for Individuals Contracting with Public Agencies

and for Unincorporated Construction Contractors

OFFICIAL USE ONLY

DLN#:

Ch. 57, P.L. 2004: State law requires all contractors and subcontractors with the State or other

public sector entities to provide proof of registration with the Department of Treasury.

Chapter 85, P.L. 2006, defined under N.J.S.A. 54A:7-1.2: You must use this form to comply with the law if you are an

unincorporated construction contractor performing services in NJ and need proof of registration from the Division of Revenue.

You may use this form to comply with the above-referenced laws if you are an individual with no business tax or employer

obligations with the State of New Jersey and are not yet registered.

Fill out the registration section and certification below and send the completed form to:

NJ Division of Revenue

Client Registration Bureau

PO Box 252

Trenton, NJ 08646-0252

Please note that the registrant's name listed in Section A must be the same as shown in the Certification, Section B. Type,

machine print or hand print all information, except your signature. If you have or will have business tax or employer

obligations, file form NJ-REG. Call (609) 292-9292 for more information. If you currently are registered, please enter your

NJ Taxpayer Identification Number in the space provided below.

SECTION A. REGISTRATION DETAIL

Social Security Number

Registrant's Name

Physical Address:

Street, City, State, Zip

Do not use P.O Box

County

Mailing Address:

Street, City, State, Zip

Contact Information:

Telephone Number

E-mail Address

SECTION B. CERTIFICATION

I __________________________________________ hereby certify that I am an individual having no business tax

or employer obligations with the State of New Jersey. Further, I certify that any income that I derive from business activities

with the State of New Jersey will be reported on my personal income tax return. I understand that pursuant to State law, if I

knowingly report inaccurate of misleading information, I maybe subject to penalties.

Signed: ________________________________ Date: _______________

Signature

Title: ______________________________________________________

You might also like

- FleischerDocument10 pagesFleischerMert BekarNo ratings yet

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- Barack Obama Foundation Tax-Exempt Application June 21 2014Document51 pagesBarack Obama Foundation Tax-Exempt Application June 21 2014Jerome Corsi100% (1)

- Barack Obama Foundation Form 1023 June 21 2014Document51 pagesBarack Obama Foundation Form 1023 June 21 2014Jerome CorsiNo ratings yet

- Ba 8Document2 pagesBa 8issrihari_629088783No ratings yet

- The United States Is Still A British ColonyDocument33 pagesThe United States Is Still A British Colonyfamousafguy100% (5)

- TransportationDocument557 pagesTransportationArmil Busico Puspus100% (2)

- Deviations and Non Conformances SOP PDFDocument1 pageDeviations and Non Conformances SOP PDFAlinaNo ratings yet

- A Nine-Digit Number That Is Assigned by The IRS and Used To Identify Taxpayers in A Business EntityDocument3 pagesA Nine-Digit Number That Is Assigned by The IRS and Used To Identify Taxpayers in A Business EntityJeff ArthurNo ratings yet

- Unified FormDocument1 pageUnified FormRobert V. AbrasaldoNo ratings yet

- NM Substitute W9Document2 pagesNM Substitute W9marcelNo ratings yet

- Change of Address or Responsible Party - BusinessDocument2 pagesChange of Address or Responsible Party - BusinessDwayne YoungNo ratings yet

- BARACK OBAMA FOUNDATION IRS Form 1023 June 21 2014 PDFDocument51 pagesBARACK OBAMA FOUNDATION IRS Form 1023 June 21 2014 PDFJerome Corsi100% (1)

- Vendor Authorization Form Businesses B1Document1 pageVendor Authorization Form Businesses B1David GuerraNo ratings yet

- Jaleica Coding and Billing LLC.: 437 Melissa Circle Romeoville IL.60446Document8 pagesJaleica Coding and Billing LLC.: 437 Melissa Circle Romeoville IL.60446Julius Masigan100% (1)

- LicsurrenderDocument2 pagesLicsurrenderCentrē TechNo ratings yet

- JNB Enterprises of Palm Beach LLC Company LLCDocument2 pagesJNB Enterprises of Palm Beach LLC Company LLCQuân NguyễnNo ratings yet

- Trustee Address Change IRSDocument2 pagesTrustee Address Change IRS25sparrow100% (6)

- Cra (2) DddaDocument14 pagesCra (2) DddadulmasterNo ratings yet

- 20992NAP Payment Form ReDocument1 page20992NAP Payment Form ReTzuyu TchaikovskyNo ratings yet

- Kyc Updation Cum Customer Service Request Form (Non Individuals)Document4 pagesKyc Updation Cum Customer Service Request Form (Non Individuals)Dheeraj AcharyaNo ratings yet

- NSDLDocument13 pagesNSDLSrini VasanNo ratings yet

- Remington & Vernick Engineers II, Inc.-2020 - BE - FormDocument140 pagesRemington & Vernick Engineers II, Inc.-2020 - BE - FormRise Up Ocean CountyNo ratings yet

- It 000135879998 2023 00Document1 pageIt 000135879998 2023 00Qavi UddinNo ratings yet

- Annexure - 1 Organisation and Tax Related Details: Sr. No Description Vendor ResponseDocument13 pagesAnnexure - 1 Organisation and Tax Related Details: Sr. No Description Vendor ResponseMirza FaisalNo ratings yet

- Accreditation FormDocument2 pagesAccreditation Formrowena balaguerNo ratings yet

- CP575Notice 1645023110303Document2 pagesCP575Notice 1645023110303MannatechESNo ratings yet

- Form BN 1: Registration of Business Names ActDocument3 pagesForm BN 1: Registration of Business Names ActJasmine JacksonNo ratings yet

- FORM (Rev. January 1993)Document2 pagesFORM (Rev. January 1993)eye_precious100% (2)

- Declaration by Salaried Persons To Be Submitted To The Employer by The EmployeeDocument4 pagesDeclaration by Salaried Persons To Be Submitted To The Employer by The EmployeeM. AamirNo ratings yet

- Business Permit FormDocument2 pagesBusiness Permit FormNicole De VillaNo ratings yet

- Canada EngDocument3 pagesCanada Engpaolomarabella8No ratings yet

- Application Form For Business Permit: Amendment: AmendmentDocument2 pagesApplication Form For Business Permit: Amendment: AmendmentJdavidNo ratings yet

- 2019 CorporateDocument32 pages2019 Corporateapi-167637329No ratings yet

- Substitute Form W-9Document2 pagesSubstitute Form W-9gopaljiiNo ratings yet

- Florio Perrucci Steinhardt & Cappelli Pay To PlayDocument66 pagesFlorio Perrucci Steinhardt & Cappelli Pay To PlayRise Up Ocean CountyNo ratings yet

- Form - Application For Business PermitDocument2 pagesForm - Application For Business Permitcamilo martalNo ratings yet

- New Life Capital LLC in EinDocument2 pagesNew Life Capital LLC in EinRichard GreenNo ratings yet

- David J StiansenDocument2 pagesDavid J StiansengaryNo ratings yet

- Employee Leasing Company Initial Registration of Client CompaniesDocument2 pagesEmployee Leasing Company Initial Registration of Client CompaniesHirenSitaparaNo ratings yet

- Type or Print Information Neatly. Please Refer To Instructions For More InformationDocument3 pagesType or Print Information Neatly. Please Refer To Instructions For More InformationЛена КиселеваNo ratings yet

- MCSBG@co - Monterey.ca - Us: County of Monterey Workforce Development Board EmailDocument2 pagesMCSBG@co - Monterey.ca - Us: County of Monterey Workforce Development Board EmailIliana RamosNo ratings yet

- NYS Resale CertificateDocument1 pageNYS Resale CertificateVanessa HernandezNo ratings yet

- FATCA CRS Individual Declaration FormDocument2 pagesFATCA CRS Individual Declaration FormSrigandh's WealthNo ratings yet

- Jaime SerranoDocument3 pagesJaime SerranoMichelle Chris100% (1)

- E595E 4-2022 WebFill - 1Document3 pagesE595E 4-2022 WebFill - 1justinNo ratings yet

- PDFDocument4 pagesPDFTeresa Falardeau100% (1)

- Application Form For Business Permit New Renewal and Retirement 1Document4 pagesApplication Form For Business Permit New Renewal and Retirement 1Amiel GuintoNo ratings yet

- Occupational Limited License (Oll) Petition: (Type or Print Information)Document6 pagesOccupational Limited License (Oll) Petition: (Type or Print Information)Howard ShowersNo ratings yet

- North Carolina Articles of IncorporationDocument3 pagesNorth Carolina Articles of IncorporationRocketLawyer50% (2)

- Honorarium PacketDocument4 pagesHonorarium Packetseptian90.kwNo ratings yet

- Project Veritas Tax Exemption ApplicationDocument22 pagesProject Veritas Tax Exemption ApplicationLachlan MarkayNo ratings yet

- Form W9Document4 pagesForm W9Mary MilaniNo ratings yet

- Customer Information SheetDocument8 pagesCustomer Information SheetAthena PaulaNo ratings yet

- Revised VMD Form With Classification (LFILLING UP)Document11 pagesRevised VMD Form With Classification (LFILLING UP)Daniel CookNo ratings yet

- Barbyq Dire IrsDocument2 pagesBarbyq Dire IrsrolfNo ratings yet

- Sav 5396Document1 pageSav 5396Jeff LouisNo ratings yet

- How To Structure Your Business For Success: Everything You Need To Know To Get Started Building Business CreditFrom EverandHow To Structure Your Business For Success: Everything You Need To Know To Get Started Building Business CreditNo ratings yet

- Provincial Facilitation for Investment and Trade Index: Measuring Economic Governance for Business Development in the Lao People’s Democratic Republic-Second EditionFrom EverandProvincial Facilitation for Investment and Trade Index: Measuring Economic Governance for Business Development in the Lao People’s Democratic Republic-Second EditionNo ratings yet

- The Destruction of Records Act, 1917 - Arrangement of SectionsDocument3 pagesThe Destruction of Records Act, 1917 - Arrangement of SectionsKashishNo ratings yet

- Term Paper - Philippine GovernmentDocument8 pagesTerm Paper - Philippine GovernmentRan RanNo ratings yet

- North Korea, Sanity On The BrinkDocument4 pagesNorth Korea, Sanity On The BrinkrazahamdaniNo ratings yet

- Murder in Baldurs Gate Events SupplementDocument8 pagesMurder in Baldurs Gate Events SupplementDavid L Kriegel100% (3)

- Something DifferentDocument20 pagesSomething DifferentRupanjali BishtNo ratings yet

- Nec 2006Document59 pagesNec 2006loots69No ratings yet

- Eti Base Code EnglishDocument4 pagesEti Base Code EnglishJohn RajeshNo ratings yet

- Thanks For Your Order!: Billing Information Payment Details Receipt DetailsDocument1 pageThanks For Your Order!: Billing Information Payment Details Receipt Detailschalapathi psNo ratings yet

- Barangay Sangalang Vs Barangay MaguihanDocument2 pagesBarangay Sangalang Vs Barangay MaguihanVim MalicayNo ratings yet

- CREW: Environmental Protection Agency: Regarding Mary Gade: CREW Appeal Dow - List by Number Batch 1 - PDF-RDocument328 pagesCREW: Environmental Protection Agency: Regarding Mary Gade: CREW Appeal Dow - List by Number Batch 1 - PDF-RCREWNo ratings yet

- Hotel Lux: Early HistoryDocument5 pagesHotel Lux: Early HistoryNikola_kuzelovNo ratings yet

- I. Police Power CasesDocument127 pagesI. Police Power CasesAlvinson DayritNo ratings yet

- GRIHA Pre-Certification A5 HDDocument2 pagesGRIHA Pre-Certification A5 HDUp VickyNo ratings yet

- Safety and Health Protection On The JobDocument1 pageSafety and Health Protection On The JobCPSSTNo ratings yet

- BT Chap 6Document4 pagesBT Chap 6Hang NguyenNo ratings yet

- 2023 Regulations Release Version 1 22042022Document64 pages2023 Regulations Release Version 1 22042022Dwi PutriwatiNo ratings yet

- BWV45 - Es Ist Dir Gesagt, Mensch, Was Gut IstDocument54 pagesBWV45 - Es Ist Dir Gesagt, Mensch, Was Gut IstLegalSheetsNo ratings yet

- Affidavit of Romy BuymaxxDocument2 pagesAffidavit of Romy BuymaxxanonNo ratings yet

- Test Bank For Business Ethics Case Studies and Selected Readings 7th EditionDocument13 pagesTest Bank For Business Ethics Case Studies and Selected Readings 7th Editionuntradedfantan3wg75100% (28)

- Financial Accounting (International) : Fundamentals Pilot Paper - Knowledge ModuleDocument19 pagesFinancial Accounting (International) : Fundamentals Pilot Paper - Knowledge ModuleNguyen Thi Phuong ThuyNo ratings yet

- Terms of Reference of Pta Organization Position Terms of ReferencesDocument3 pagesTerms of Reference of Pta Organization Position Terms of ReferencesCastor Jr JavierNo ratings yet

- Doctrine of Residuary PowersDocument11 pagesDoctrine of Residuary PowersKishan PatelNo ratings yet

- 8689-2018 Sixco Chain SlingDocument2 pages8689-2018 Sixco Chain SlingAnonymous wuugFvOBjZNo ratings yet

- Unit II Electron BallisticsDocument18 pagesUnit II Electron BallisticsDr. Shafiulla Basha ShaikNo ratings yet

- April SBIDocument5 pagesApril SBIRahul kumarNo ratings yet