Professional Documents

Culture Documents

FIOF (April 2018) Leaflet WDP

FIOF (April 2018) Leaflet WDP

Uploaded by

vishalankitOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FIOF (April 2018) Leaflet WDP

FIOF (April 2018) Leaflet WDP

Uploaded by

vishalankitCopyright:

Available Formats

Live your

money to AXIS

FIXED INCOME

the fullest OPPORTUNITIES FUND

AN OPEN-ENDED DEBT SCHEME

March 2018

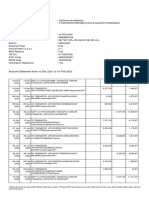

About the Fund Performance (NAV Movement)

28 March 2018

Axis Fixed Income Opportunities Fund - Growth

Positioned in the CRISIL Short Term Bond Fund Index (Benchmark)

` 13,647

short-term space

` 13,481

Controlled risk 15 July 2014

by maintaining duration

within 3 years `10,000

1 Year 3 Years 5 Years Since Inception

Point-to- Point-to- Point-to- Point-to-

CAGR Pointreturns CAGR Pointreturns CAGR Pointreturns CAGR Pointreturns

Stable (%) on Standard

Investment

of ` 10,000

(%) on Standard

Investment

of ` 10,000

(%) on Standard

Investment

of ` 10,000

(%) on Standard

Investment

of ` 10,000

returns with

High Accrual Axis Fixed Income Opportunities Fund - Growth

CRISIL Short-Term Bond Fund Index (Benchmark)

6.44%

6.11%

10,644

10,611

8.05%

7.90%

12,610

12,558

NA

NA

NA

NA

8.76%

8.40%

13,647

13,481

CRISIL 1 Year T-Bill (Additional Benchmark) 5.87% 10,587 6.91% 12,217 NA NA 7.30% 12,982

Diversified Past performance may or may not be sustained in future. Calculations are based on Growth Option NAV. Since inception (15 July 2014) returns are calculated on ` 10

invested at inception. The scheme is in existence for less than 5 years, hence performance for 5 year period is not provided. Different plans have different expense structure. Plan

of the scheme for which performance is given is indicated above. Devang Shah is managing the scheme since inception and he manages 43 schemes. Returns greater than 1 year

across

are Compounded Annual Growth Rates (CAGR).

ratings and

Risk Management

sectors

Risk Risk Management

Portfolio Characteristics

Controlled through diversification and stringent review of investable sectors;

Sector

Average Maturity Modified Duration Regulatory limits on sector exposure

Focus on high quality issuers

Credit

2.4 years

1.9 years Diversification

Investment Universe based on credit research

Exposure to each issuer limited by its rating

Tight position limits

Yield to Maturity * Investment Horizon Duration Strictly adhere to duration limits specified in offer documents & investment policy

8.54 6 months Liquidity

Liquidity/impact cost part of security selection/portfolio construction Optimize balance of

credit quality, returns and liquidity

% or

more Rating Allocation

*The yield to maturity given above is based on the portfolio of funds as on date given above. This

should not be taken as an indication of the returns that may be generated by the fund and the

securities bought by the fund may or may not be held till their respective maturities. The

Rating Mar-17 Feb-18 Target

calculations are based on the invested corpus.

Sovereign/ AAA & equivalent$ 53.7% 40.9% 30-40

Current strategy AA+/- 40.0% 48.0% 50-60

• The fund is positioned to benefit from its core A+/- 6.3% 11.1% 10-20

allocation in short term corporate bonds i.e. in

the 2-3-year space while monitoring risk by $AAA & Equivalent includes AAA/A1+-rated papers.

controlling the overall portfolio duration. The

current duration of the fund is 1.9 years. Investing facts

• The focus of the fund is to capture the

compression in the 1-4 year corporate bonds Options Inception Date Minimum Application Fund Manager

and also have a higher accrual.

• Given our market view on improved credit Devang Shah

environment, improving corporate profitability Growth & July 15 Lumpsum Work experience: 13 years

and looking at a favorable risk reward

perspective the fund has shifted from duration

Dividend

(Weekly & Monthly)

2014

` 5000

multiples of ` 1

He has been managing this fund since

inception.

and AAA corporate bonds to a majority

allocation in lower rated corporate bonds Entry Load : NA

(below AAA rating). Exit Load : If redeemed / switched-out within 12 months from the date of allotment :-

• For 10% of investment: Nil

• The portfolio stance is expected to benefit from

• For remaining investment: 1%

the compression in spreads in the short to If redeemed/switched out after 12 months from the date of allotment: Nil

medium term segment of the curve. (w.e.f November 10th, 2017)

Note: Portfolio allocation, maturity & duration is based on the current market conditions and is subject to changes depending on the fund manager’s view of the markets.

Top 3 & Bottom 3 schemes managed by Devang Shah (Total schemes managed 43 schemes) (As on March 28, 2018)

1 Year 3 Years@ 5 Years@@ Since Inception

Date of Point-to- Point-to- Point-to- Point-to-

Inception CAGR Point returns CAGR Point returns CAGR Point returns CAGR Point returns

(%) on Standard (%) on Standard (%) on Standard (%) on Standard

Investment Investment Investment Investment

of ` 10,000 of ` 10,000 of ` 10,000 of ` 10,000

DEVANG SHAH (Total schemes managed: 43)

Axis Fixed Income Opportunities Fund - Growth 15-Jul-14 6.44% 10,644 8.05% 12,610 NA NA 8.76% 13,647

CRISIL Short-Term Bond Fund Index (Benchmark) 6.11% 10,611 7.90% 12,558 NA NA 8.40% 13,481

CRISIL 1 Year T-Bill (Additional Benchmark) 5.87% 10,587 6.91% 12,217 NA NA 7.30% 12,982

Axis Fixed Income Opportunities Fund - Direct Plan - Growth 15-Jul-14 7.91% 10,791 9.39% 13,084 NA NA 10.00% 14,236

CRISIL Short-Term Bond Fund Index (Benchmark) 6.11% 10,611 7.90% 12,558 NA NA 8.40% 13,481

CRISIL 1 Year T-Bill (Additional Benchmark) 5.87% 10,587 6.91% 12,217 NA NA 7.30% 12,982

Top 3 schemes

Axis Hybrid Fund - Series 33 - Growth# 9/Sep/16 7.78% 10,778 - - - - 5.85% 10,919

Crisil Composite Bond Fund Index (80%) and 6.45% 10,645 - - - - 6.94% 11,094

Nifty 50 (20%) HY-33 (Benchmark)

CRISIL 1 Year T-Bill (Additional Benchmark) 5.87% 10,587 - - - - 6.21% 10,978

Axis Hybrid Fund - Series 35 - Growth# 1/Dec/16 7.75% 10,775 - - - - 10.38% 11,394

CRISIL Hybrid 85+15 - Conservative Index (Benchmark) 6.21% 10,621 - - - - 5.74% 10,765

CRISIL 1 Year T-Bill (Additional Benchmark) 5.87% 10,587 - - - - 5.85% 10,780

Axis Hybrid Fund - Series 31 - Growth# 19/Jul/16 7.73% 10,773 - - - - 6.69% 11,156

Crisil Composite Bond Fund Index (80%) and 6.45% 10,645 - - - - 8.18% 11,422

Nifty 50 (20%) HY-31 (Benchmark)

CRISIL 1 Year T-Bill (Additional Benchmark) 5.87% 10,587 - - - - 6.33% 11,094

Bottom 3 schemes

Axis Hybrid Fund - Series 5 - Growth# 25-Jul-13 3.36% 10,336 0.00% 10,001 - - 5.50% 12,846

CRISIL Hybrid 85+15 - Conservative Index (Benchmark) 6.21% 10,621 8.42% 12,739 - - 10.48% 15,935

CRISIL 1 Year T-Bill (Additional Benchmark) 5.87% 10,587 6.91% 12,217 - - 7.54% 14,051

Axis Constant Maturity 10 Year Fund - Growth 23/Jan/12 2.57% 10,257 6.41% 12,046 6.77% 13,876 6.83% 15,040

CRISIL 10 Year Gilt Index (Benchmark) -0.42% 9,958 6.36% 12,029 6.42% 13,649 6.82% 15,031

Axis Gold Fund 20/Oct/11 2.13% 10,213 2.01% 10,615 -2.74% 8,704 -0.65% 9,590

Domestic Price of Gold 8.34% 10,834 5.79% 11,835 0.02% 10,008 1.16% 10,772

Additional Benchmark - - - - - - - -

Only for distributors/advisors and their clients

#Scheme Performance may not be strictly comparable with that of its additional benchmark in view of hybrid nature of the scheme.

@@The performance data for 5 years period has not been provided for scheme/plan not in existence for 5 years. @The performance data for 3 years period has not been provided for scheme/plan not in existence for 3 years.

The performance of the scheme is benchmarked to the Total Return variant of the Benchmark Index (TRI) in terms of SEBI circular dated Jan. 4, 2018.

Data as on March 28, 2018.

Past performance may or may not be sustained in future. Calculations are based on Growth Option NAV. Since inception returns are calculated on Rs. 2026.8384/- for Gold ETF & Rs. 10/- for all other schemes. Different plans have different

expense structure. Plan of the scheme for which performance is given is indicated above.

The above data excludes performance of Fixed Maturity Plans and all the schemes which have not completed a year. Top 3 and Bottom 3 schemes (based on 1 year performance) managed by Devang Shah has been provided herein.

Devang Shah is managing Axis Liquid Fund, Axis Dynamic Bond Fund, Axis Constant Maturity 10 Year Fund , Axis Regular Savings Fund and Axis Short Term Fund and all Axis Hybrid Funds since 5th November 2012 (since inception date for Axis

Hybrid Funds launched after 5th November, 2012), Axis Fixed Income Opportunities Fund and Axis Enhanced Arbitrage Fund since inception and Axis Treasury Advantage Fund and Axis Income Saver (Debt portion), Axis Gold Fund, Axis Gold ETF ,

all Axis Fixed Term Plans since 7th June, 2016 (since inception date for Axis Fixed Term Plans launched after 7th June, 2016) and Axis Corporate Debt Opportunities Fund since July 13th, 2017.

Statutory Details: Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to ` 1 lakh). Trustee: Axis Mutual Fund Trustee Ltd. Investment Manager: Axis Asset

Management Co. Ltd. (the AMC). Risk Factors: Axis Bank Ltd. is not liable or responsible for any loss or shortfall resulting from the operation of the scheme.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Riskometer Distributed by

Axis Fixed Income Opportunities

ely Moderate Mod

Fund (an open-ended debt scheme) rat

de ow

e

Hig rate

This product is suitable for investors who are seeking*:

o

M L h ly

• Stable returns in the short to medium term

High

Low

• Investment in debt and money market instruments

across the yield curve and credit spectrum

*Investors should consult their financial advisers if in doubt LOW HIGH

about whether the product is suitable for them. Investors understand that their principal will be

at moderate risk

You might also like

- Traditional Mock ExamDocument5 pagesTraditional Mock ExamMicol Villaflor Ü83% (6)

- Chapter 14 InteractiveDocument8 pagesChapter 14 InteractiveAmita50% (2)

- Death-Claim-Forms FormateDocument7 pagesDeath-Claim-Forms FormateRushang PatelNo ratings yet

- Final Project Neft Rtgs PDFDocument82 pagesFinal Project Neft Rtgs PDFMehul Patel58% (12)

- 20171102006-FIOF (Nov17) - Leaflet - WDPDocument2 pages20171102006-FIOF (Nov17) - Leaflet - WDPRav RanjanNo ratings yet

- Small Cap Fund: Every Big Starts SmallDocument3 pagesSmall Cap Fund: Every Big Starts SmallManeesh YadavNo ratings yet

- Long Term Equity Fund Long Term Equity Fund: It Took Approximately 7 Years To Build The First FlightDocument3 pagesLong Term Equity Fund Long Term Equity Fund: It Took Approximately 7 Years To Build The First Flightashish ujjwalNo ratings yet

- 20180504001-F25F (May 2018) - Leaflet (WDP)Document2 pages20180504001-F25F (May 2018) - Leaflet (WDP)vishalankitNo ratings yet

- PGIM India Money Market FundDocument1 pagePGIM India Money Market FundYogi173No ratings yet

- OwnerAcknowledgement TraditionalDocument37 pagesOwnerAcknowledgement TraditionalJosephNo ratings yet

- Morning Star Report 20190916052814Document1 pageMorning Star Report 20190916052814ChankyaNo ratings yet

- Spice JetDocument21 pagesSpice JetSiddhartha Khemka100% (7)

- Morning Star Report 20190804013640Document1 pageMorning Star Report 20190804013640YumyumNo ratings yet

- Morning Star Report 20190804013715Document1 pageMorning Star Report 20190804013715YumyumNo ratings yet

- Morning Star Report 20190804013618Document1 pageMorning Star Report 20190804013618YumyumNo ratings yet

- Morning Star Report 20190804013543Document1 pageMorning Star Report 20190804013543YumyumNo ratings yet

- Morning Star Report 20190804013720Document1 pageMorning Star Report 20190804013720YumyumNo ratings yet

- Axis Overnight Fund Regular Growth: Interest Rate SensitivityDocument1 pageAxis Overnight Fund Regular Growth: Interest Rate SensitivitySunNo ratings yet

- Morning Star Report 20190804013615Document1 pageMorning Star Report 20190804013615YumyumNo ratings yet

- Edelweiss Overnight FundDocument1 pageEdelweiss Overnight FundYogi173No ratings yet

- Axis Overnight Fund Regular Daily Dividend Reinvestment: Interest Rate SensitivityDocument1 pageAxis Overnight Fund Regular Daily Dividend Reinvestment: Interest Rate SensitivityChankyaNo ratings yet

- Morning Star Report 20190725102748Document1 pageMorning Star Report 20190725102748SunNo ratings yet

- Morning Star Report 20190916052702Document1 pageMorning Star Report 20190916052702ChankyaNo ratings yet

- Morningstarreport20190906085207 PDFDocument1 pageMorningstarreport20190906085207 PDFChankyaNo ratings yet

- Axis Capital Builder Fund Series 4 (1582 Days) Direct Dividend PayoutDocument1 pageAxis Capital Builder Fund Series 4 (1582 Days) Direct Dividend PayoutChankyaNo ratings yet

- Morning Star Report 20190720091305Document1 pageMorning Star Report 20190720091305SunNo ratings yet

- Morning Star Report 20190804013718Document1 pageMorning Star Report 20190804013718YumyumNo ratings yet

- Morning Star Report 20190804013636Document1 pageMorning Star Report 20190804013636YumyumNo ratings yet

- Morning Star Report 20190916052827Document1 pageMorning Star Report 20190916052827ChankyaNo ratings yet

- Morning Star Report 20190720102601Document1 pageMorning Star Report 20190720102601Chaitanya VyasNo ratings yet

- Morning Star Report 20190720102659Document1 pageMorning Star Report 20190720102659Chaitanya VyasNo ratings yet

- Morning Star Report 20190720102610Document1 pageMorning Star Report 20190720102610Chaitanya VyasNo ratings yet

- Morning Star Report 20190720091258Document1 pageMorning Star Report 20190720091258SunNo ratings yet

- Morning Star Report 20190804013547Document1 pageMorning Star Report 20190804013547YumyumNo ratings yet

- Morning Star Report 20190720102413Document1 pageMorning Star Report 20190720102413Chaitanya VyasNo ratings yet

- Morning Star Report 20190720102524Document1 pageMorning Star Report 20190720102524Chaitanya VyasNo ratings yet

- Morning Star Report 20190720102542Document1 pageMorning Star Report 20190720102542Chaitanya VyasNo ratings yet

- Morning Star Report 20190916052840Document1 pageMorning Star Report 20190916052840ChankyaNo ratings yet

- Morning Star Report 20190720091304Document1 pageMorning Star Report 20190720091304SunNo ratings yet

- Morningstarreport20190720091252 PDFDocument1 pageMorningstarreport20190720091252 PDFSunNo ratings yet

- Morningstarreport20190720091252 PDFDocument1 pageMorningstarreport20190720091252 PDFSunNo ratings yet

- Morning Star Report 20191027111815Document1 pageMorning Star Report 20191027111815RaviTuduNo ratings yet

- ArbitrageDocument3 pagesArbitrageAmit SharmaNo ratings yet

- Morning Star Report 20190725102720Document1 pageMorning Star Report 20190725102720SunNo ratings yet

- Morning Star Report 20190916052801Document1 pageMorning Star Report 20190916052801ChankyaNo ratings yet

- Morningstarreport20190916052801 PDFDocument1 pageMorningstarreport20190916052801 PDFChankyaNo ratings yet

- Axis Overnight Fund Regular Weekly Dividend Reinvestment: Interest Rate SensitivityDocument1 pageAxis Overnight Fund Regular Weekly Dividend Reinvestment: Interest Rate SensitivityChankyaNo ratings yet

- Morningstarreport20190916052745 PDFDocument1 pageMorningstarreport20190916052745 PDFChankyaNo ratings yet

- Morning Star Report 20190916052733Document1 pageMorning Star Report 20190916052733ChankyaNo ratings yet

- Morning Star Report 20190916052745Document1 pageMorning Star Report 20190916052745ChankyaNo ratings yet

- Morning Star Report 20190916052706Document1 pageMorning Star Report 20190916052706ChankyaNo ratings yet

- Morning Star Report 20190916052813Document1 pageMorning Star Report 20190916052813ChankyaNo ratings yet

- Axis Overnight Fund Direct Weekly Dividend Payout: Interest Rate SensitivityDocument1 pageAxis Overnight Fund Direct Weekly Dividend Payout: Interest Rate SensitivityChankyaNo ratings yet

- Morning Star Report 20190916052735Document1 pageMorning Star Report 20190916052735ChankyaNo ratings yet

- Morning Star Report 20190916052747Document1 pageMorning Star Report 20190916052747ChankyaNo ratings yet

- Morningstarreport20190916052757 PDFDocument1 pageMorningstarreport20190916052757 PDFChankyaNo ratings yet

- Morningstarreport20190916052747 PDFDocument1 pageMorningstarreport20190916052747 PDFChankyaNo ratings yet

- Morningstarreport20190916052716 PDFDocument1 pageMorningstarreport20190916052716 PDFChankyaNo ratings yet

- Morning Star Report 20190916052649Document1 pageMorning Star Report 20190916052649ChankyaNo ratings yet

- Morning Star Report 20190906084504Document1 pageMorning Star Report 20190906084504YumyumNo ratings yet

- JK Cement: Key Financial Highlights (2018-19)Document1 pageJK Cement: Key Financial Highlights (2018-19)KpNo ratings yet

- Morningstarreport20190906084614 PDFDocument1 pageMorningstarreport20190906084614 PDFYumyumNo ratings yet

- Morning Star Report 20190906084738Document1 pageMorning Star Report 20190906084738YumyumNo ratings yet

- Problem 9Document5 pagesProblem 9Tk KimNo ratings yet

- ICICI Equity & DEBT Form With Auto Debit FormDocument2 pagesICICI Equity & DEBT Form With Auto Debit FormSaurabh JainNo ratings yet

- ICMarkets Funding InstructionsDocument1 pageICMarkets Funding Instructionscampur 90No ratings yet

- Advnced Excel Skills D2Document185 pagesAdvnced Excel Skills D2Monir HosenNo ratings yet

- Account Statement PDFDocument12 pagesAccount Statement PDFAjay GuptaNo ratings yet

- Deutsche Bank FinalDocument28 pagesDeutsche Bank FinalmonikNo ratings yet

- Glossary of Marine Insurance TermsDocument4 pagesGlossary of Marine Insurance Termspens13No ratings yet

- 3rd Annual Retail Deposit Design and OptimisationDocument4 pages3rd Annual Retail Deposit Design and OptimisationmuscdalifeNo ratings yet

- Accenture Driving The Future of Payments 10 Mega TrendsDocument16 pagesAccenture Driving The Future of Payments 10 Mega TrendsRaj BhatiNo ratings yet

- Swissindo World Trust International Orbit - Bullion Bank - SfagiDocument23 pagesSwissindo World Trust International Orbit - Bullion Bank - SfagisfagiNo ratings yet

- Digital Payment & TransactionsDocument91 pagesDigital Payment & Transactionschaliya00767% (3)

- Kethavath Shirisha BSDocument2 pagesKethavath Shirisha BSprakashNo ratings yet

- January-February 2013: 17. Metropolitan Bank & Trust Co. (MBT)Document2 pagesJanuary-February 2013: 17. Metropolitan Bank & Trust Co. (MBT)Nadine SantiagoNo ratings yet

- Export Credit AgencyDocument6 pagesExport Credit Agencyshiv161No ratings yet

- Solved Sean Nah The Bookkeeper For Revell Co Received A BankDocument1 pageSolved Sean Nah The Bookkeeper For Revell Co Received A BankAnbu jaromiaNo ratings yet

- Case StudyDocument3 pagesCase StudyMatthew ChangNo ratings yet

- Confirmation ReceiptDocument1 pageConfirmation ReceiptMani Rathinam RajamaniNo ratings yet

- Delegate Registration FormDocument2 pagesDelegate Registration FormNaveen LawrenceNo ratings yet

- PEXRDocument1 pagePEXRRavi JosanNo ratings yet

- Digital Modes. Send and Receive MoneyDocument7 pagesDigital Modes. Send and Receive MoneyJayanthikaa SekharNo ratings yet

- IDirect Motogaze Aug16Document16 pagesIDirect Motogaze Aug16umaganNo ratings yet

- 542 Supreme Court Reports Annotated Bank of The Philippine Islands vs. LaingoDocument11 pages542 Supreme Court Reports Annotated Bank of The Philippine Islands vs. LaingodanexrainierNo ratings yet

- Act 93 AgreementDocument9 pagesAct 93 AgreementprideandpromiseNo ratings yet

- Multiple Choice Taller 2 Favor de Indicar Su NombreDocument4 pagesMultiple Choice Taller 2 Favor de Indicar Su NombrerafnellieNo ratings yet

- Tutorial 3 Week 3 Chapter 2Document3 pagesTutorial 3 Week 3 Chapter 2drgaanNo ratings yet

- RBI Lender of Last ResortDocument18 pagesRBI Lender of Last ResortHemantVermaNo ratings yet