Professional Documents

Culture Documents

Quiz 01 Financial Management Total Marks 30

Quiz 01 Financial Management Total Marks 30

Uploaded by

Repunzel RaajCopyright:

Available Formats

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- East Coast Yachts KeyDocument8 pagesEast Coast Yachts Keyreddevil911100% (2)

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Practice Problem Set #1: Time Value of Money I Theoretical and Conceptual Questions: (See Notes or Textbook For Solutions)Document15 pagesPractice Problem Set #1: Time Value of Money I Theoretical and Conceptual Questions: (See Notes or Textbook For Solutions)raymondNo ratings yet

- Time Value of MoneTIME VALUE OF MONEY SOLVEDy SolvedDocument4 pagesTime Value of MoneTIME VALUE OF MONEY SOLVEDy SolvedFaiz Ahmed0% (1)

- Exercise - Time Value of MoneyDocument2 pagesExercise - Time Value of MoneyMina Zahari100% (1)

- Time Value of MoneyDocument6 pagesTime Value of MoneyRezzan Joy Camara MejiaNo ratings yet

- Data Transmission Modes and FormsDocument3 pagesData Transmission Modes and FormsRepunzel Raaj0% (1)

- QuizDocument2 pagesQuizRepunzel RaajNo ratings yet

- Economic and Development Planning (MCQS)Document5 pagesEconomic and Development Planning (MCQS)Repunzel Raaj67% (3)

- Tax AljamiaDocument22 pagesTax AljamiaFlash Light100% (2)

- Project Report On Credit Risk ManagementDocument56 pagesProject Report On Credit Risk ManagementGayatriThotakura80% (30)

- Business Finance Time Value of Money Assignment 2 Solve Following ProblemsDocument2 pagesBusiness Finance Time Value of Money Assignment 2 Solve Following ProblemsAlex Asher100% (1)

- Nanyang Business School AB1201 Financial Management Tutorial 2: Time Value of Money (Common Questions)Document7 pagesNanyang Business School AB1201 Financial Management Tutorial 2: Time Value of Money (Common Questions)asdsadsaNo ratings yet

- Nanyang Business School AB1201 Financial Management Seminar Questions Set 2: Time Value of Money (Common Questions)Document7 pagesNanyang Business School AB1201 Financial Management Seminar Questions Set 2: Time Value of Money (Common Questions)cccqNo ratings yet

- Assignment of Business MathsDocument2 pagesAssignment of Business MathsIrfanNo ratings yet

- RTPBDocument87 pagesRTPBKr PrajapatNo ratings yet

- Answer: (A) Payment of Beginning of Year 2 535.96, Year 3 576.16, Year 4 619.37, Year 5 665.82 (B) CPM 648.03 (C) Effective Yield 9.07%Document3 pagesAnswer: (A) Payment of Beginning of Year 2 535.96, Year 3 576.16, Year 4 619.37, Year 5 665.82 (B) CPM 648.03 (C) Effective Yield 9.07%Irfan AzmanNo ratings yet

- Lecture 3 QuestionsDocument9 pagesLecture 3 QuestionsPubg KrNo ratings yet

- Tutorial TVMDocument5 pagesTutorial TVMMi ThưNo ratings yet

- Assignment 1Document4 pagesAssignment 1Ahmad Ullah KhanNo ratings yet

- Calculate The Each Question, Show All Your Calculation. On Each Question Draw The Time Line, Identify The Problem, Use The Relevant FormulaDocument1 pageCalculate The Each Question, Show All Your Calculation. On Each Question Draw The Time Line, Identify The Problem, Use The Relevant FormulaAydin GaniyevNo ratings yet

- Faculty of Economics and Business Universiti Malaysia Sarawak Business Mathematics EBQ1043 Tutorial 8Document2 pagesFaculty of Economics and Business Universiti Malaysia Sarawak Business Mathematics EBQ1043 Tutorial 8Li YuNo ratings yet

- Time Value of MoneyDocument9 pagesTime Value of Moneyelarabel abellareNo ratings yet

- Tutorial 5 TVM Application - SVDocument5 pagesTutorial 5 TVM Application - SVHiền NguyễnNo ratings yet

- Tutorial TVM - S2 - 2021.22Document5 pagesTutorial TVM - S2 - 2021.22Ngoc HuynhNo ratings yet

- Tutorial Time Value of MoneyDocument5 pagesTutorial Time Value of MoneyNgọc Ngô Minh TuyếtNo ratings yet

- Tutorial 4 TVM ApplicationDocument4 pagesTutorial 4 TVM ApplicationTrần ThảoNo ratings yet

- Tutorial TVM - S1 - 2020.21Document4 pagesTutorial TVM - S1 - 2020.21Bảo NhiNo ratings yet

- Sec - C - TVM 2019 - PW, FW, AW, GR, Nom-EffDocument4 pagesSec - C - TVM 2019 - PW, FW, AW, GR, Nom-EffNaveen KumarNo ratings yet

- FM Tutorial TVM 2023.24Document5 pagesFM Tutorial TVM 2023.24Đức ThọNo ratings yet

- Unit 2 Time and Money D PDFDocument2 pagesUnit 2 Time and Money D PDFCarmelo Janiza LavareyNo ratings yet

- TMV 1Document3 pagesTMV 1Alpana RastogiNo ratings yet

- Class Discussion - TVMDocument2 pagesClass Discussion - TVMyingrou.upacNo ratings yet

- Problems For Topic 3Document4 pagesProblems For Topic 3Quỳnh Anh TrầnNo ratings yet

- Tutorial TVMDocument5 pagesTutorial TVMNguyễn Quốc HưngNo ratings yet

- 0ecd7tvm AssignDocument1 page0ecd7tvm AssignAman WadhwaNo ratings yet

- Business Finance 2-2 PDFDocument4 pagesBusiness Finance 2-2 PDFThomas nyadeNo ratings yet

- Annuities QuestionsDocument3 pagesAnnuities Questionsyoussef elshrityNo ratings yet

- TUTORIAL TVM Feb17Document5 pagesTUTORIAL TVM Feb17Thu Uyên Trần ThiNo ratings yet

- Practice Problem Set #2: Time Value of Money Theoretical and Conceptual Questions: (See Notes or Textbook For Solutions)Document3 pagesPractice Problem Set #2: Time Value of Money Theoretical and Conceptual Questions: (See Notes or Textbook For Solutions)raymondNo ratings yet

- Chapter Four ExampleDocument2 pagesChapter Four ExampleyomifNo ratings yet

- FOF Assgt 2 30102022 070850pmDocument4 pagesFOF Assgt 2 30102022 070850pmMughal777No ratings yet

- Assignment 1 TVM, Bonds StockDocument2 pagesAssignment 1 TVM, Bonds StockMuhammad Ali SamarNo ratings yet

- Tutorial 1Document4 pagesTutorial 1Thuận Nguyễn Thị KimNo ratings yet

- Time Value of Money AssignmentDocument1 pageTime Value of Money AssignmentawaischeemaNo ratings yet

- Tutorial TVM - S1 - 2020.21Document4 pagesTutorial TVM - S1 - 2020.21anon_355962815No ratings yet

- Assignment Problems of Financial Management PDFDocument39 pagesAssignment Problems of Financial Management PDFprashanth1911820% (2)

- Compilation For Final Exam 1 Converted 1Document7 pagesCompilation For Final Exam 1 Converted 1Trending News and TechnologyNo ratings yet

- Problem Set 04 - More Problems Using Financial FunctionsDocument2 pagesProblem Set 04 - More Problems Using Financial FunctionsShashwatNo ratings yet

- FM A Assignment 19-40659-1Document11 pagesFM A Assignment 19-40659-1Pacific Hunter JohnnyNo ratings yet

- RE 410: Real Estate Finance: Spring 2017Document2 pagesRE 410: Real Estate Finance: Spring 2017Mohammed Al-YagoobNo ratings yet

- Time Value of Money (Sample Questions) (1) 2Document2 pagesTime Value of Money (Sample Questions) (1) 2mintakhtsNo ratings yet

- Chapter 4 - Time Value of MoneyDocument4 pagesChapter 4 - Time Value of MoneyTruc Khanh Pham NgocNo ratings yet

- Exercises 1Document4 pagesExercises 1Dilina De SilvaNo ratings yet

- Time Value (Financial Management)Document9 pagesTime Value (Financial Management)Keyur BhojakNo ratings yet

- Erxerise 1 Valuation Summer 2023Document2 pagesErxerise 1 Valuation Summer 2023Pamela Abegail MonsantoNo ratings yet

- Exam Financial Mathematics 15122023Document2 pagesExam Financial Mathematics 15122023nguyen16023No ratings yet

- Quizz 1Document4 pagesQuizz 1thuylinhdo6624No ratings yet

- FINA 6274 Time Value of Money Practice ProblemsDocument1 pageFINA 6274 Time Value of Money Practice ProblemsFaran KhanNo ratings yet

- Workbook1 TimevalueofMoneyDocument2 pagesWorkbook1 TimevalueofMoneyDe BuNo ratings yet

- Assignment Time Value and MoneyDocument2 pagesAssignment Time Value and MoneySaqib Mirza0% (1)

- Assignemt - Chapter 2 - Time Value of MoneyDocument3 pagesAssignemt - Chapter 2 - Time Value of Money721d0042No ratings yet

- Basic Excel Functions - ProblemsDocument31 pagesBasic Excel Functions - ProblemsSushma Jeswani TalrejaNo ratings yet

- Advanced NPV ProblemsDocument3 pagesAdvanced NPV ProblemsjimjoneNo ratings yet

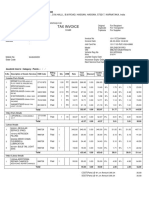

- Ms AllowanceDocument1 pageMs AllowanceRepunzel RaajNo ratings yet

- Accounting QuizDocument1 pageAccounting QuizRepunzel Raaj0% (1)

- PPSC 2019 Old PapersDocument39 pagesPPSC 2019 Old PapersRepunzel Raaj100% (1)

- PPSC Exam NotesDocument3 pagesPPSC Exam NotesRepunzel RaajNo ratings yet

- Weekly Breakkup of Course Contentsof 1 - Year, Computer Operator Course, Level-Giii (1St, Semester)Document26 pagesWeekly Breakkup of Course Contentsof 1 - Year, Computer Operator Course, Level-Giii (1St, Semester)Repunzel RaajNo ratings yet

- Assignment 1Document3 pagesAssignment 1Repunzel RaajNo ratings yet

- Chapter 4, Part 6 Filing and Fining MethodDocument5 pagesChapter 4, Part 6 Filing and Fining MethodRepunzel RaajNo ratings yet

- Communication ProtocolDocument4 pagesCommunication ProtocolRepunzel RaajNo ratings yet

- Assignment 2Document4 pagesAssignment 2Repunzel RaajNo ratings yet

- Access Designing Databases Manual PDFDocument29 pagesAccess Designing Databases Manual PDFRepunzel RaajNo ratings yet

- Juanita Salas Vs CA Et AlDocument2 pagesJuanita Salas Vs CA Et AlMary Joyce Lacambra Aquino100% (1)

- AffidavitDocument6 pagesAffidavitGopalakrishna GorleNo ratings yet

- Hero 10117CC24V8991Document2 pagesHero 10117CC24V8991punithupcharNo ratings yet

- For Examiner's UseDocument13 pagesFor Examiner's UseAung Zaw HtweNo ratings yet

- Northern Beef Packers 20 Largest CreditorsDocument3 pagesNorthern Beef Packers 20 Largest CreditorsChapter 11 DocketsNo ratings yet

- Yes Bank CaseDocument3 pagesYes Bank Caseudaya priya.b100% (1)

- BudgetCommentary - 2020-21 ICMAPDocument122 pagesBudgetCommentary - 2020-21 ICMAPDaud ShahNo ratings yet

- Stock Valuation ProblemsDocument1 pageStock Valuation Problemstdavis1234No ratings yet

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document11 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali100% (1)

- A Financial Statement Analysis of SBS Philippines Corporation For The Years 2014-2016Document11 pagesA Financial Statement Analysis of SBS Philippines Corporation For The Years 2014-2016sephNo ratings yet

- Single (Copy To Be Sent The ZAO)Document1 pageSingle (Copy To Be Sent The ZAO)James GonzalezNo ratings yet

- Yuson vs. VitanDocument15 pagesYuson vs. VitanKrissaNo ratings yet

- Private Equity and Venture Capital: by Professor Stefano CaselliDocument69 pagesPrivate Equity and Venture Capital: by Professor Stefano CaselliYash ModiNo ratings yet

- Tax XXXXDocument60 pagesTax XXXXGerald Bowe ResuelloNo ratings yet

- Insurance Note Taking GuideDocument2 pagesInsurance Note Taking Guideapi-252390333100% (1)

- Question Paper-S4 - Set 4Document2 pagesQuestion Paper-S4 - Set 4Titus ClementNo ratings yet

- Credit Risk ManagementDocument4 pagesCredit Risk ManagementinspectorsufiNo ratings yet

- All Above 1 CroreDocument1 pageAll Above 1 CrorebteuNo ratings yet

- SS15 Fixed-Income: Basic Concepts SS15 Fixed-Income: Analysis of RiskDocument39 pagesSS15 Fixed-Income: Basic Concepts SS15 Fixed-Income: Analysis of RiskAydin GaniyevNo ratings yet

- KFH Oasis Card CatalougeDocument4 pagesKFH Oasis Card Catalougejayaworld2002No ratings yet

- Investments: Learning ObjectivesDocument52 pagesInvestments: Learning ObjectivesElaine LingxNo ratings yet

- Goods and Services Tax (Question Bank For Internal)Document14 pagesGoods and Services Tax (Question Bank For Internal)rupalNo ratings yet

- Confirmation PDFDocument2 pagesConfirmation PDFrashiNo ratings yet

- Problems and Prospects of Bangladesh Stock MarketDocument21 pagesProblems and Prospects of Bangladesh Stock Markettamjid100% (11)

- Meghna Life InsuranceDocument20 pagesMeghna Life InsuranceSadman Shariar Biswas100% (1)

- CITATION Ste15 /L 1033Document5 pagesCITATION Ste15 /L 1033GR PandeyNo ratings yet

- 41 Toh v. Solid Bank CorporationDocument2 pages41 Toh v. Solid Bank CorporationIldefonso HernaezNo ratings yet

Quiz 01 Financial Management Total Marks 30

Quiz 01 Financial Management Total Marks 30

Uploaded by

Repunzel RaajOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quiz 01 Financial Management Total Marks 30

Quiz 01 Financial Management Total Marks 30

Uploaded by

Repunzel RaajCopyright:

Available Formats

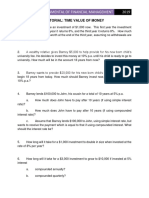

Quiz 01

Financial Management

Total Marks 30

Question 01: Financial manager Mr. Amir is considering two different savings plans. The first plan would have her deposit $500

every six months, and she would receive interest at a 7 percent annual rate, compounded semiannually. Under the second plan she

would deposit $1,000 every year with a rate of interest of 7.5 percent, compounded annually. The initial deposit with Plan 1 would be

made six months from now and, with Plan 2, one year hence.

a. What is the future (terminal) value of the first plan at the end of 10 years?

b. What is the future (terminal) value of the second plan at the end of 10 years?

c. Which plan should Mr. Amir use, assuming that her only concern is with the value of her savings at the end of 10

years?

d. Would your answer change if the rate of interest on the second plan were 7 percent?

Question 02: Nasir has decided to start saving for his retirement. Beginning on his twenty-first birthday, Nasir plans to invest

$2,000 each birthday into a savings investment earning a 7 percent compound annual rate of interest. He will continue this savings

program for a total of 10 years and then stop making payments. But his savings will continue to compound at 7 percent for 35 more

years, until he retires at age 65. Asma also plans to invest $2,000 a year, on each birthday, at 7 percent, and will do so for a total of 35

years. However, she will not begin her contributions until her thirty-first birthday. How much will Nasir’s and Asma’s savings

programs be worth at the retirement age of 65? Who is better off financially at retirement, and by how much?

Question 03: Write a brief note on: Future Value of Annuity, Scope of Financial Management

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- East Coast Yachts KeyDocument8 pagesEast Coast Yachts Keyreddevil911100% (2)

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Practice Problem Set #1: Time Value of Money I Theoretical and Conceptual Questions: (See Notes or Textbook For Solutions)Document15 pagesPractice Problem Set #1: Time Value of Money I Theoretical and Conceptual Questions: (See Notes or Textbook For Solutions)raymondNo ratings yet

- Time Value of MoneTIME VALUE OF MONEY SOLVEDy SolvedDocument4 pagesTime Value of MoneTIME VALUE OF MONEY SOLVEDy SolvedFaiz Ahmed0% (1)

- Exercise - Time Value of MoneyDocument2 pagesExercise - Time Value of MoneyMina Zahari100% (1)

- Time Value of MoneyDocument6 pagesTime Value of MoneyRezzan Joy Camara MejiaNo ratings yet

- Data Transmission Modes and FormsDocument3 pagesData Transmission Modes and FormsRepunzel Raaj0% (1)

- QuizDocument2 pagesQuizRepunzel RaajNo ratings yet

- Economic and Development Planning (MCQS)Document5 pagesEconomic and Development Planning (MCQS)Repunzel Raaj67% (3)

- Tax AljamiaDocument22 pagesTax AljamiaFlash Light100% (2)

- Project Report On Credit Risk ManagementDocument56 pagesProject Report On Credit Risk ManagementGayatriThotakura80% (30)

- Business Finance Time Value of Money Assignment 2 Solve Following ProblemsDocument2 pagesBusiness Finance Time Value of Money Assignment 2 Solve Following ProblemsAlex Asher100% (1)

- Nanyang Business School AB1201 Financial Management Tutorial 2: Time Value of Money (Common Questions)Document7 pagesNanyang Business School AB1201 Financial Management Tutorial 2: Time Value of Money (Common Questions)asdsadsaNo ratings yet

- Nanyang Business School AB1201 Financial Management Seminar Questions Set 2: Time Value of Money (Common Questions)Document7 pagesNanyang Business School AB1201 Financial Management Seminar Questions Set 2: Time Value of Money (Common Questions)cccqNo ratings yet

- Assignment of Business MathsDocument2 pagesAssignment of Business MathsIrfanNo ratings yet

- RTPBDocument87 pagesRTPBKr PrajapatNo ratings yet

- Answer: (A) Payment of Beginning of Year 2 535.96, Year 3 576.16, Year 4 619.37, Year 5 665.82 (B) CPM 648.03 (C) Effective Yield 9.07%Document3 pagesAnswer: (A) Payment of Beginning of Year 2 535.96, Year 3 576.16, Year 4 619.37, Year 5 665.82 (B) CPM 648.03 (C) Effective Yield 9.07%Irfan AzmanNo ratings yet

- Lecture 3 QuestionsDocument9 pagesLecture 3 QuestionsPubg KrNo ratings yet

- Tutorial TVMDocument5 pagesTutorial TVMMi ThưNo ratings yet

- Assignment 1Document4 pagesAssignment 1Ahmad Ullah KhanNo ratings yet

- Calculate The Each Question, Show All Your Calculation. On Each Question Draw The Time Line, Identify The Problem, Use The Relevant FormulaDocument1 pageCalculate The Each Question, Show All Your Calculation. On Each Question Draw The Time Line, Identify The Problem, Use The Relevant FormulaAydin GaniyevNo ratings yet

- Faculty of Economics and Business Universiti Malaysia Sarawak Business Mathematics EBQ1043 Tutorial 8Document2 pagesFaculty of Economics and Business Universiti Malaysia Sarawak Business Mathematics EBQ1043 Tutorial 8Li YuNo ratings yet

- Time Value of MoneyDocument9 pagesTime Value of Moneyelarabel abellareNo ratings yet

- Tutorial 5 TVM Application - SVDocument5 pagesTutorial 5 TVM Application - SVHiền NguyễnNo ratings yet

- Tutorial TVM - S2 - 2021.22Document5 pagesTutorial TVM - S2 - 2021.22Ngoc HuynhNo ratings yet

- Tutorial Time Value of MoneyDocument5 pagesTutorial Time Value of MoneyNgọc Ngô Minh TuyếtNo ratings yet

- Tutorial 4 TVM ApplicationDocument4 pagesTutorial 4 TVM ApplicationTrần ThảoNo ratings yet

- Tutorial TVM - S1 - 2020.21Document4 pagesTutorial TVM - S1 - 2020.21Bảo NhiNo ratings yet

- Sec - C - TVM 2019 - PW, FW, AW, GR, Nom-EffDocument4 pagesSec - C - TVM 2019 - PW, FW, AW, GR, Nom-EffNaveen KumarNo ratings yet

- FM Tutorial TVM 2023.24Document5 pagesFM Tutorial TVM 2023.24Đức ThọNo ratings yet

- Unit 2 Time and Money D PDFDocument2 pagesUnit 2 Time and Money D PDFCarmelo Janiza LavareyNo ratings yet

- TMV 1Document3 pagesTMV 1Alpana RastogiNo ratings yet

- Class Discussion - TVMDocument2 pagesClass Discussion - TVMyingrou.upacNo ratings yet

- Problems For Topic 3Document4 pagesProblems For Topic 3Quỳnh Anh TrầnNo ratings yet

- Tutorial TVMDocument5 pagesTutorial TVMNguyễn Quốc HưngNo ratings yet

- 0ecd7tvm AssignDocument1 page0ecd7tvm AssignAman WadhwaNo ratings yet

- Business Finance 2-2 PDFDocument4 pagesBusiness Finance 2-2 PDFThomas nyadeNo ratings yet

- Annuities QuestionsDocument3 pagesAnnuities Questionsyoussef elshrityNo ratings yet

- TUTORIAL TVM Feb17Document5 pagesTUTORIAL TVM Feb17Thu Uyên Trần ThiNo ratings yet

- Practice Problem Set #2: Time Value of Money Theoretical and Conceptual Questions: (See Notes or Textbook For Solutions)Document3 pagesPractice Problem Set #2: Time Value of Money Theoretical and Conceptual Questions: (See Notes or Textbook For Solutions)raymondNo ratings yet

- Chapter Four ExampleDocument2 pagesChapter Four ExampleyomifNo ratings yet

- FOF Assgt 2 30102022 070850pmDocument4 pagesFOF Assgt 2 30102022 070850pmMughal777No ratings yet

- Assignment 1 TVM, Bonds StockDocument2 pagesAssignment 1 TVM, Bonds StockMuhammad Ali SamarNo ratings yet

- Tutorial 1Document4 pagesTutorial 1Thuận Nguyễn Thị KimNo ratings yet

- Time Value of Money AssignmentDocument1 pageTime Value of Money AssignmentawaischeemaNo ratings yet

- Tutorial TVM - S1 - 2020.21Document4 pagesTutorial TVM - S1 - 2020.21anon_355962815No ratings yet

- Assignment Problems of Financial Management PDFDocument39 pagesAssignment Problems of Financial Management PDFprashanth1911820% (2)

- Compilation For Final Exam 1 Converted 1Document7 pagesCompilation For Final Exam 1 Converted 1Trending News and TechnologyNo ratings yet

- Problem Set 04 - More Problems Using Financial FunctionsDocument2 pagesProblem Set 04 - More Problems Using Financial FunctionsShashwatNo ratings yet

- FM A Assignment 19-40659-1Document11 pagesFM A Assignment 19-40659-1Pacific Hunter JohnnyNo ratings yet

- RE 410: Real Estate Finance: Spring 2017Document2 pagesRE 410: Real Estate Finance: Spring 2017Mohammed Al-YagoobNo ratings yet

- Time Value of Money (Sample Questions) (1) 2Document2 pagesTime Value of Money (Sample Questions) (1) 2mintakhtsNo ratings yet

- Chapter 4 - Time Value of MoneyDocument4 pagesChapter 4 - Time Value of MoneyTruc Khanh Pham NgocNo ratings yet

- Exercises 1Document4 pagesExercises 1Dilina De SilvaNo ratings yet

- Time Value (Financial Management)Document9 pagesTime Value (Financial Management)Keyur BhojakNo ratings yet

- Erxerise 1 Valuation Summer 2023Document2 pagesErxerise 1 Valuation Summer 2023Pamela Abegail MonsantoNo ratings yet

- Exam Financial Mathematics 15122023Document2 pagesExam Financial Mathematics 15122023nguyen16023No ratings yet

- Quizz 1Document4 pagesQuizz 1thuylinhdo6624No ratings yet

- FINA 6274 Time Value of Money Practice ProblemsDocument1 pageFINA 6274 Time Value of Money Practice ProblemsFaran KhanNo ratings yet

- Workbook1 TimevalueofMoneyDocument2 pagesWorkbook1 TimevalueofMoneyDe BuNo ratings yet

- Assignment Time Value and MoneyDocument2 pagesAssignment Time Value and MoneySaqib Mirza0% (1)

- Assignemt - Chapter 2 - Time Value of MoneyDocument3 pagesAssignemt - Chapter 2 - Time Value of Money721d0042No ratings yet

- Basic Excel Functions - ProblemsDocument31 pagesBasic Excel Functions - ProblemsSushma Jeswani TalrejaNo ratings yet

- Advanced NPV ProblemsDocument3 pagesAdvanced NPV ProblemsjimjoneNo ratings yet

- Ms AllowanceDocument1 pageMs AllowanceRepunzel RaajNo ratings yet

- Accounting QuizDocument1 pageAccounting QuizRepunzel Raaj0% (1)

- PPSC 2019 Old PapersDocument39 pagesPPSC 2019 Old PapersRepunzel Raaj100% (1)

- PPSC Exam NotesDocument3 pagesPPSC Exam NotesRepunzel RaajNo ratings yet

- Weekly Breakkup of Course Contentsof 1 - Year, Computer Operator Course, Level-Giii (1St, Semester)Document26 pagesWeekly Breakkup of Course Contentsof 1 - Year, Computer Operator Course, Level-Giii (1St, Semester)Repunzel RaajNo ratings yet

- Assignment 1Document3 pagesAssignment 1Repunzel RaajNo ratings yet

- Chapter 4, Part 6 Filing and Fining MethodDocument5 pagesChapter 4, Part 6 Filing and Fining MethodRepunzel RaajNo ratings yet

- Communication ProtocolDocument4 pagesCommunication ProtocolRepunzel RaajNo ratings yet

- Assignment 2Document4 pagesAssignment 2Repunzel RaajNo ratings yet

- Access Designing Databases Manual PDFDocument29 pagesAccess Designing Databases Manual PDFRepunzel RaajNo ratings yet

- Juanita Salas Vs CA Et AlDocument2 pagesJuanita Salas Vs CA Et AlMary Joyce Lacambra Aquino100% (1)

- AffidavitDocument6 pagesAffidavitGopalakrishna GorleNo ratings yet

- Hero 10117CC24V8991Document2 pagesHero 10117CC24V8991punithupcharNo ratings yet

- For Examiner's UseDocument13 pagesFor Examiner's UseAung Zaw HtweNo ratings yet

- Northern Beef Packers 20 Largest CreditorsDocument3 pagesNorthern Beef Packers 20 Largest CreditorsChapter 11 DocketsNo ratings yet

- Yes Bank CaseDocument3 pagesYes Bank Caseudaya priya.b100% (1)

- BudgetCommentary - 2020-21 ICMAPDocument122 pagesBudgetCommentary - 2020-21 ICMAPDaud ShahNo ratings yet

- Stock Valuation ProblemsDocument1 pageStock Valuation Problemstdavis1234No ratings yet

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document11 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali100% (1)

- A Financial Statement Analysis of SBS Philippines Corporation For The Years 2014-2016Document11 pagesA Financial Statement Analysis of SBS Philippines Corporation For The Years 2014-2016sephNo ratings yet

- Single (Copy To Be Sent The ZAO)Document1 pageSingle (Copy To Be Sent The ZAO)James GonzalezNo ratings yet

- Yuson vs. VitanDocument15 pagesYuson vs. VitanKrissaNo ratings yet

- Private Equity and Venture Capital: by Professor Stefano CaselliDocument69 pagesPrivate Equity and Venture Capital: by Professor Stefano CaselliYash ModiNo ratings yet

- Tax XXXXDocument60 pagesTax XXXXGerald Bowe ResuelloNo ratings yet

- Insurance Note Taking GuideDocument2 pagesInsurance Note Taking Guideapi-252390333100% (1)

- Question Paper-S4 - Set 4Document2 pagesQuestion Paper-S4 - Set 4Titus ClementNo ratings yet

- Credit Risk ManagementDocument4 pagesCredit Risk ManagementinspectorsufiNo ratings yet

- All Above 1 CroreDocument1 pageAll Above 1 CrorebteuNo ratings yet

- SS15 Fixed-Income: Basic Concepts SS15 Fixed-Income: Analysis of RiskDocument39 pagesSS15 Fixed-Income: Basic Concepts SS15 Fixed-Income: Analysis of RiskAydin GaniyevNo ratings yet

- KFH Oasis Card CatalougeDocument4 pagesKFH Oasis Card Catalougejayaworld2002No ratings yet

- Investments: Learning ObjectivesDocument52 pagesInvestments: Learning ObjectivesElaine LingxNo ratings yet

- Goods and Services Tax (Question Bank For Internal)Document14 pagesGoods and Services Tax (Question Bank For Internal)rupalNo ratings yet

- Confirmation PDFDocument2 pagesConfirmation PDFrashiNo ratings yet

- Problems and Prospects of Bangladesh Stock MarketDocument21 pagesProblems and Prospects of Bangladesh Stock Markettamjid100% (11)

- Meghna Life InsuranceDocument20 pagesMeghna Life InsuranceSadman Shariar Biswas100% (1)

- CITATION Ste15 /L 1033Document5 pagesCITATION Ste15 /L 1033GR PandeyNo ratings yet

- 41 Toh v. Solid Bank CorporationDocument2 pages41 Toh v. Solid Bank CorporationIldefonso HernaezNo ratings yet