Professional Documents

Culture Documents

Sample First Quiz 1

Sample First Quiz 1

Uploaded by

PG93Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sample First Quiz 1

Sample First Quiz 1

Uploaded by

PG93Copyright:

Available Formats

NAME:

DERIVATIVES AND FINANCIAL RISK MANAGEMENT

QUIZ-1, Spring 2004

1. Option prices on Amgen Inc are provided below. The stock closed at $ 66.25.

CALLS PUTS

Strike Mar’04 Apr’04 Mar ’04 Apr’

04

65 2.80 3.60 1.50 2.10

70 0.75 1.30 4.40 4.90

a) What would be the minimum value, the maximum value and the break-even stock

price (at expiration) for the Amgen April 65 put options?

Min value = zero

Max value = Strike price = 65 (when/if the stock goes to zero)

Break-even => 0 = 1 * [Max (0, 65- S) – 2.10], S = 62.90

b) If the risk-free interest rate until April is 1% (0.01) then use put-call parity to

check whether the April 70 options are fairly priced. If they are not, suggest what

strategy you would undertake to exploit the resulting arbitrage opportunity.

Put-call parity implies that C + PV(X) = P + S

Compare: 1.30 + [70/1.01] vs 4.90 + 66.25 OR 70.61 vs 71.15.

No the options are not fairly priced. So, short the expensive side and long the

cheaper side, i.e. Short puts and stock, buy call and T-bills

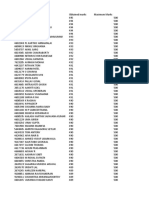

You might also like

- Power of Numbers TheoryDocument28 pagesPower of Numbers TheorysureshNo ratings yet

- Decisions Analysis: Presented By: Afzal Waseem Presented To: Dr. Arnold YuanDocument34 pagesDecisions Analysis: Presented By: Afzal Waseem Presented To: Dr. Arnold YuanAfzal WaseemNo ratings yet

- Midwest Ice Cream CompanyDocument5 pagesMidwest Ice Cream CompanyPG93No ratings yet

- COMM 308 OptionsDocument8 pagesCOMM 308 Optionsadcyechicon123No ratings yet

- Rayner Teo - Best Move Avg Trade Strategy 22.12.21Document5 pagesRayner Teo - Best Move Avg Trade Strategy 22.12.21Joy CheungNo ratings yet

- Chapter 17. Tool Kit For Financial Options and Real Options With The TAB Labeled "Real Options."Document30 pagesChapter 17. Tool Kit For Financial Options and Real Options With The TAB Labeled "Real Options."Nidhi KaushikNo ratings yet

- Kase Handout On StopsDocument10 pagesKase Handout On StopsCynthia Ann KaseNo ratings yet

- This Study Resource Was: Problem Set 2: Call and Put Option ContractDocument3 pagesThis Study Resource Was: Problem Set 2: Call and Put Option Contractdummy tommyNo ratings yet

- Put-Call Parity: By: Shruti Agrawal-201 Suhas Anjaria-202 Kankana Dutta-205 Aabhas Garg-207Document24 pagesPut-Call Parity: By: Shruti Agrawal-201 Suhas Anjaria-202 Kankana Dutta-205 Aabhas Garg-207Aabbhas GargNo ratings yet

- Basic Option Strategies: Ron Shonkwiler (Shonkwiler@math - Gatech.edu) WWW - Math.gatech - Edu/ ShenkDocument67 pagesBasic Option Strategies: Ron Shonkwiler (Shonkwiler@math - Gatech.edu) WWW - Math.gatech - Edu/ ShenkthiruvilanNo ratings yet

- Basic Option Strategies: Ron Shonkwiler (Shonkwiler@math - Gatech.edu) WWW - Math.gatech - Edu/ ShenkDocument67 pagesBasic Option Strategies: Ron Shonkwiler (Shonkwiler@math - Gatech.edu) WWW - Math.gatech - Edu/ ShenkthiruvilanNo ratings yet

- Short Butterfly Spread With Calls - FidelityDocument8 pagesShort Butterfly Spread With Calls - FidelityanalystbankNo ratings yet

- Option Chain AnalysisDocument2 pagesOption Chain AnalysisCosmetic surgery A Plus ClinicNo ratings yet

- Short VolatilityDocument37 pagesShort VolatilityGautam PraveenNo ratings yet

- Modified Put Butterfly - FidelityDocument6 pagesModified Put Butterfly - FidelityNarendra BholeNo ratings yet

- 2011 - Drawdown-At-Risk Monte CarloDocument12 pages2011 - Drawdown-At-Risk Monte CarloCarlosNo ratings yet

- Operations ResearchDocument31 pagesOperations ResearchPriya PatilNo ratings yet

- Decision Theory and Decision TreeDocument48 pagesDecision Theory and Decision Treekeerthana gopiNo ratings yet

- Webinar6 - OptionsDocument21 pagesWebinar6 - OptionsTheTickerDistrictNo ratings yet

- Short Butterfly Spread With Puts - FidelityDocument7 pagesShort Butterfly Spread With Puts - FidelityanalystbankNo ratings yet

- The Covered CallDocument8 pagesThe Covered CallpilluNo ratings yet

- Corporate Finance: Class Notes 13Document36 pagesCorporate Finance: Class Notes 13Sakshi VermaNo ratings yet

- Investing Like Warren Buffett: Nicola BorriDocument36 pagesInvesting Like Warren Buffett: Nicola BorriZoe RossiNo ratings yet

- Decision AnalysisDocument39 pagesDecision AnalysisRehan MemonNo ratings yet

- Nism 8 - Test-1 - Equity Derivatives - PracticeDocument29 pagesNism 8 - Test-1 - Equity Derivatives - PracticeAbhijeet Kumar0% (2)

- Course Name Ism515 Financial Markets and Institutions Homework Title Homework Assessment Scale Essay Part 15 Points Problem Part 15 PointsDocument4 pagesCourse Name Ism515 Financial Markets and Institutions Homework Title Homework Assessment Scale Essay Part 15 Points Problem Part 15 PointsEzatullah SiddiqiNo ratings yet

- Kertas Tugasan A02-01-01-LE2-AS1: Institut Latihan Jabatan Tenaga Manusia Kementerian Sumber Manusia MalaysiaDocument4 pagesKertas Tugasan A02-01-01-LE2-AS1: Institut Latihan Jabatan Tenaga Manusia Kementerian Sumber Manusia MalaysiaAhmad Abu Naim AwangNo ratings yet

- Chapter 9 Executive OwnershipDocument19 pagesChapter 9 Executive OwnershipMohammad TayyabNo ratings yet

- Long Butterfly Spread With Puts - FidelityDocument7 pagesLong Butterfly Spread With Puts - FidelityanalystbankNo ratings yet

- Practice Test 1Document19 pagesPractice Test 1KAYOMARZ ICHHAPORIANo ratings yet

- Decision TheoryDocument30 pagesDecision TheoryJuhi SiddiquiNo ratings yet

- AnovaDocument3 pagesAnovaHananaNo ratings yet

- Long Iron Butterfly Spread - FidelityDocument8 pagesLong Iron Butterfly Spread - FidelityanalystbankNo ratings yet

- 1x2 Ratio Volatility Spread With Puts - FidelityDocument8 pages1x2 Ratio Volatility Spread With Puts - FidelityanalystbankNo ratings yet

- Risk MetricsDocument32 pagesRisk Metricscas67No ratings yet

- EContent 1 2023 06 24 10 20 29 QTDM Studymaterialfeb23pdf 2023 03 15 11 44 02Document23 pagesEContent 1 2023 06 24 10 20 29 QTDM Studymaterialfeb23pdf 2023 03 15 11 44 02Tom CruiseNo ratings yet

- What Is Double Diagonal Spread - FidelityDocument8 pagesWhat Is Double Diagonal Spread - FidelityanalystbankNo ratings yet

- Trailing Stop PercentDocument3 pagesTrailing Stop Percentchristophermrequinto100% (2)

- 10.books Not Yet Received Volume 5 Options-For Only Running BatchDocument4 pages10.books Not Yet Received Volume 5 Options-For Only Running BatchRajkumar SharmaNo ratings yet

- S&P - Up Trend, Lower Volatility (ATR)Document3 pagesS&P - Up Trend, Lower Volatility (ATR)Joy CheungNo ratings yet

- Derivatives Assignment: Futures Vs SpotDocument2 pagesDerivatives Assignment: Futures Vs SpotBhargesh PatelNo ratings yet

- Spread Worksheet LockedDocument8 pagesSpread Worksheet LockedJack ToutNo ratings yet

- MCR DemoDocument64 pagesMCR Demopramod78No ratings yet

- Should We Care? Psychological Barriers in Stock MarketsDocument6 pagesShould We Care? Psychological Barriers in Stock MarketsTahir SajjadNo ratings yet

- INR - Technicals Talking Technicals 14-Oct-16: Questions? E-Mail UsDocument8 pagesINR - Technicals Talking Technicals 14-Oct-16: Questions? E-Mail UsAakash RungtaNo ratings yet

- Var Margin: With 99% Confidence, What Is The Maximum Value That An Asset or Portfolio May Loose Over The Next Day"?Document11 pagesVar Margin: With 99% Confidence, What Is The Maximum Value That An Asset or Portfolio May Loose Over The Next Day"?Utkrisht SethiNo ratings yet

- Financial Derivative (90 M Session)Document33 pagesFinancial Derivative (90 M Session)nicero555No ratings yet

- Pairs Trading: A Statistical Arbitrage StrategyDocument21 pagesPairs Trading: A Statistical Arbitrage StrategyKeshav SehgalNo ratings yet

- Chap3 Introduction To Options (Derivatives)Document30 pagesChap3 Introduction To Options (Derivatives)Jihen MejriNo ratings yet

- Simplified AFM Concept Book by Finance Acharya Jatin NagpalDocument233 pagesSimplified AFM Concept Book by Finance Acharya Jatin NagpalpranaviNo ratings yet

- Price Action - NotesDocument37 pagesPrice Action - NotesArun Kumar100% (3)

- Technical Analysis of Commonditie. (Gold, Silver, Zinc & Crude Oil) at Motilal Oswal Securities LTDDocument58 pagesTechnical Analysis of Commonditie. (Gold, Silver, Zinc & Crude Oil) at Motilal Oswal Securities LTDKirankumar AriNo ratings yet

- International Finance Management Case Study-5 The Options SpeculatorDocument4 pagesInternational Finance Management Case Study-5 The Options SpeculatorSachin D Salankey100% (1)

- Assignment 1 Complete Markets Questions. Valeria Ruiz Mollinedo.Document4 pagesAssignment 1 Complete Markets Questions. Valeria Ruiz Mollinedo.Valeria MollinedoNo ratings yet

- II. Threats-Opportunities-Weaknesses-Strengths (TOWS) Matrix. Strengths-S Weaknesses - W 1. 2. 1. 2Document6 pagesII. Threats-Opportunities-Weaknesses-Strengths (TOWS) Matrix. Strengths-S Weaknesses - W 1. 2. 1. 2Gwy HipolitoNo ratings yet

- An Improved Approach To Computing Implied Volatility: FinancialDocument11 pagesAn Improved Approach To Computing Implied Volatility: Financialharsh guptaNo ratings yet

- Reasons For Market Risk MeasurementDocument13 pagesReasons For Market Risk MeasurementTran LongNo ratings yet

- CH8: Behavioral Finance and The Psychology of InvestingDocument5 pagesCH8: Behavioral Finance and The Psychology of Investingali marhoonNo ratings yet

- 4 Rules To Time The Market Using The TRINDocument4 pages4 Rules To Time The Market Using The TRINbolinjkarvinit0% (1)

- Basics of EquityDocument30 pagesBasics of Equityswatisingh01No ratings yet

- JF PMMDocument1 pageJF PMMPG93No ratings yet

- Chirag - Jul'23-1Document2 pagesChirag - Jul'23-1PG93No ratings yet

- Annual Report 2017 PDFDocument264 pagesAnnual Report 2017 PDFPG93No ratings yet

- Wills QuestionsDocument2 pagesWills QuestionsPG93No ratings yet

- API IND DS2 en Excel v2Document446 pagesAPI IND DS2 en Excel v2PG93No ratings yet

- Annual Report 2017Document2 pagesAnnual Report 2017PG93No ratings yet

- Sparsh DS2 NotesDocument22 pagesSparsh DS2 NotesPG93No ratings yet

- CBSC Board Data 2013 For DSTDocument228 pagesCBSC Board Data 2013 For DSTPG93No ratings yet

- BGSDocument5 pagesBGSPG93No ratings yet

- Question Solution Solution Solution 1 A 1 D 1 B 2 D 2 A 2 C 3 A 3 B 3 B 4 D 4 A 4 C 5 A 5 C 5 D 6 A 6 D 6 B 7 D 8 B 9 ADocument2 pagesQuestion Solution Solution Solution 1 A 1 D 1 B 2 D 2 A 2 C 3 A 3 B 3 B 4 D 4 A 4 C 5 A 5 C 5 D 6 A 6 D 6 B 7 D 8 B 9 APG93No ratings yet

- BH PGP 2018Document21 pagesBH PGP 2018PG93No ratings yet

- Air Emissions CalculatorDocument5 pagesAir Emissions CalculatorPG93No ratings yet

- Problem Statement 2017Document5 pagesProblem Statement 2017PG93No ratings yet

- Quiz 3032Document4 pagesQuiz 3032PG93No ratings yet

- Iimb Eximius Invites Your CollegeDocument11 pagesIimb Eximius Invites Your CollegePG93No ratings yet