Professional Documents

Culture Documents

Application 2. Composition of The Board

Application 2. Composition of The Board

Uploaded by

Joyce CagayatOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Application 2. Composition of The Board

Application 2. Composition of The Board

Uploaded by

Joyce CagayatCopyright:

Available Formats

2009 Circular (Revised Code of Corporate 2016 Circular (Code of Corporate

Governance) Governance for Publicly-Listed

Companies) – applied if silent

1. Application PALS (Public, Assets more than 50 M, Publicly-listed companies only

Listed, Secondary Licenses)

2. Composition of the Board 5-15 members (except for mergers) Majority of non-executive directors

At least 2 independent directors/20% of At least 3 independent directors, or such

the members of the board, whichever is number that constitutes at least 1/3 of

lesser, in no case be less than 2 the members of the Board, whichever is

higher (always round up)

The Board’s independent directors should

serve for a maximum cumulative term of

nine years. After which, the independent

director should be perpetually barred

from re-election as such in the same

company, but may continue to qualify for

nomination and election as a non-

independent director (may be retained

as independent director by meritorious

justification and shareholder’s approval

during annual shareholders’ meeting)

3. Composition of the Audit At least 3 directors, who shall preferably At least 3 NON-EXECUTIVE DIRECTORS,

Committee have accounting and finance majority of whom, including the

backgrounds, one is an independent chairman, must be independent

director and 1 with audit experience.

ALL of the members of the Audit

Chairman of the Audit Committee must Committee must have relevant

be an independent director knowledge, skills, and/or experience in

the areas of accounting, auditing and

finance

Chairman of the Audit Committee should

not be the Chairman of the Board/any

other committee

4. Functions of the Audit Committee In case the company does not have a

Board Risk Oversight Committee and/or

Related Party Transactions Committee,

performs the functions of such

committees

(not sure if difference, but inemphasize ni

sir during the discussion for publicly-listed

companies) The Audit Committee meets

with the board at least every quarter

without the presence of the CEO or other

management team members, and

periodically meets with the head of the

internal audit.

5. Fostering Commitment/Duties The directors should attend and actively

and Responsibilities participate in all meetings of the Board,

Committees, and Shareholders in person

or through tele-/videoconferencing,

except when justifiable causes such as

illness, death in the immediate family and

serious accidents, prevent them from

doing so.

The absence of a director in more than

50% of all regular and special meetings of

the Board during his/her incumbency is a

ground for disqualification in the

succeeding election, unless the absence is

due to justifiable causes.

The non-executive directors of the Board

should concurrently serve as directors to

a maximum of five publicly-listed

companies.

6. Positions of the Chairman and the As much as practicable, be separate to Must be separate and each individual

CEO foster an appropriate balance of power. should have clearly defined

May be unified but proper checks and responsibilities.

balances should be laid down.

7. NEDs separate periodic meetings The NEDs should have separate periodic

meetings with the external auditor and

heads of the internal audit, compliance

and risk functions, without any executive

directors present to ensure that proper

checks and balances are in place within

the corporation

You might also like

- QUIZ 2.with AnswerDocument20 pagesQUIZ 2.with AnswerJoyce Cagayat33% (3)

- PR Ambac Motion PDFDocument17 pagesPR Ambac Motion PDFDebtwire Municipals100% (1)

- Dilemma 1 MemoDocument2 pagesDilemma 1 MemoQiang ChenNo ratings yet

- Corporate GovernanceDocument36 pagesCorporate GovernanceMai ChiNo ratings yet

- Charter of The Board of Directors by Professor R Balakrishnan 5Document5 pagesCharter of The Board of Directors by Professor R Balakrishnan 5routraykhushbooNo ratings yet

- Corporate Governance: Presented To MSOP Participants, Ahmedabad Chapter of Icsi by Jaladhi Shukla, FCS AhmedabadDocument43 pagesCorporate Governance: Presented To MSOP Participants, Ahmedabad Chapter of Icsi by Jaladhi Shukla, FCS AhmedabadFajri MekkaNo ratings yet

- Y.S.P. Southeast Asia Holding Bhd. (Company No. 552781 X) Board CharterDocument11 pagesY.S.P. Southeast Asia Holding Bhd. (Company No. 552781 X) Board CharterNinerMike MysNo ratings yet

- Chapter 5 Board Structure - CanvasDocument27 pagesChapter 5 Board Structure - Canvassariyah vlogsNo ratings yet

- Board of DirectoreDocument9 pagesBoard of DirectoreHassan TariqNo ratings yet

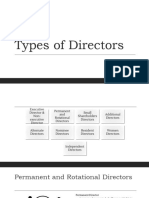

- Types of DirectorsDocument21 pagesTypes of Directors21010125396No ratings yet

- CCG 2019 What Does Research Indicate: Independent Director. - (1) It Is Mandatory That Each Listed Company ShallDocument5 pagesCCG 2019 What Does Research Indicate: Independent Director. - (1) It Is Mandatory That Each Listed Company ShallShoaibNo ratings yet

- SEC Memorandum Circular No. 6 Series of 2009: Revised Code of Corporate GovernanceDocument13 pagesSEC Memorandum Circular No. 6 Series of 2009: Revised Code of Corporate GovernanceJames FigueroaNo ratings yet

- GMI Rating For ONGCDocument15 pagesGMI Rating For ONGCcuckppNo ratings yet

- Chapter 15 - Company DirectorsDocument19 pagesChapter 15 - Company DirectorsK59 Vo Doan Hoang AnhNo ratings yet

- ZA BoardCommittees 24032014Document9 pagesZA BoardCommittees 24032014MH PHOTO CREATIVENo ratings yet

- Degree of Bachelor of Commerce - Bachelor of Business Administration - Business Analytics of CHRIST (Deemed To Be University)Document16 pagesDegree of Bachelor of Commerce - Bachelor of Business Administration - Business Analytics of CHRIST (Deemed To Be University)Harshada JadhavNo ratings yet

- Group 3 PresentationDocument50 pagesGroup 3 PresentationBENILDA CAMASONo ratings yet

- Corpo Notes MidtermsDocument5 pagesCorpo Notes MidtermsKean Fernand BocaboNo ratings yet

- Corporate Governance AnalysisDocument10 pagesCorporate Governance AnalysisGreggina TalumewoNo ratings yet

- Summary Corporation Law Pages 147 - 149Document3 pagesSummary Corporation Law Pages 147 - 149blackmail1No ratings yet

- Committees of The Boar: PresentatorDocument11 pagesCommittees of The Boar: PresentatorTaha SaleemNo ratings yet

- Analysis of Uday Kotak Committee Report 2019Document14 pagesAnalysis of Uday Kotak Committee Report 2019Harshada JadhavNo ratings yet

- Revision NotesDocument93 pagesRevision NotesPragati DixitNo ratings yet

- Company Name: Ultratech Cements Limited Entity Type: Public LimitedDocument6 pagesCompany Name: Ultratech Cements Limited Entity Type: Public LimitedBaalNo ratings yet

- Principle 5 Reinforcing Board IndependenceDocument2 pagesPrinciple 5 Reinforcing Board IndependenceJoshua EgeronNo ratings yet

- Board of Directors - A Powerful Instrument in Governance Corporate Management StructureDocument3 pagesBoard of Directors - A Powerful Instrument in Governance Corporate Management StructureReazulNo ratings yet

- Managerial Personnel: Presented By:-Neelima Thakur Pallavi Suri Neha Kapoor Nitin ChaudharyDocument23 pagesManagerial Personnel: Presented By:-Neelima Thakur Pallavi Suri Neha Kapoor Nitin ChaudharyGagan BhallaNo ratings yet

- WYN - Board of Directors Corporate Governance GuidelinesDocument6 pagesWYN - Board of Directors Corporate Governance GuidelinesVerlie FajardoNo ratings yet

- Corporate Governance AnswerDocument2 pagesCorporate Governance Answernurmaisarahnurazim1No ratings yet

- Ali Baba CG Guide 1Document7 pagesAli Baba CG Guide 1Arinah RamleNo ratings yet

- Title III Sec 22Document10 pagesTitle III Sec 22Eloise Coleen Sulla PerezNo ratings yet

- General Board Charter 022813Document18 pagesGeneral Board Charter 022813Aleli Manimtim-CorderoNo ratings yet

- Corporate Governance GuidelinesDocument8 pagesCorporate Governance GuidelinesNguyễn VươngNo ratings yet

- GUIDELINES - Corporate Governance 2023-04-11Document19 pagesGUIDELINES - Corporate Governance 2023-04-11Munna Kumar YadavNo ratings yet

- Preparing Boards Paper 1Document30 pagesPreparing Boards Paper 1Shaikh ShahzadaliNo ratings yet

- Audit CommiteeDocument17 pagesAudit CommiteeAadi saklechaNo ratings yet

- AADocument18 pagesAAMohanrajNo ratings yet

- Board of DirectorsDocument42 pagesBoard of Directorsharshitamehson63No ratings yet

- Cadbury Committee: The Recommendation Made by The Cadbury Committee Are As FollowsDocument17 pagesCadbury Committee: The Recommendation Made by The Cadbury Committee Are As FollowsSaiprasad Nitin LolekarNo ratings yet

- AuditDocument5 pagesAuditKyanna Mae LecarosNo ratings yet

- Sasbadi AR 2023Document149 pagesSasbadi AR 2023steven yapNo ratings yet

- Lesson 9 Code of Corporate GovernanceDocument9 pagesLesson 9 Code of Corporate GovernanceNazia SyedNo ratings yet

- Types of Directors: Ayan Choksi Rakib Merchant Mahesh Sindha Sandeep PandeyDocument15 pagesTypes of Directors: Ayan Choksi Rakib Merchant Mahesh Sindha Sandeep PandeyAyan ChoksiNo ratings yet

- Corporate Governance SDocument12 pagesCorporate Governance SMariam AlraeesiNo ratings yet

- Aud330 CompilationDocument15 pagesAud330 CompilationCamie YoungNo ratings yet

- Selection of Board MembersDocument9 pagesSelection of Board MembersaliferyalNo ratings yet

- Corporate Governance, Current State, Challenges and Way ForwardDocument52 pagesCorporate Governance, Current State, Challenges and Way Forwardnaushad73No ratings yet

- Role of Independent Directors in CompaniesDocument15 pagesRole of Independent Directors in CompaniesSiddharthaChowdaryNo ratings yet

- Kumar Managalam Birla COMMITTEE, 1999Document13 pagesKumar Managalam Birla COMMITTEE, 1999singla_stcNo ratings yet

- Integrated Report 2019e 23Document5 pagesIntegrated Report 2019e 23saxobobNo ratings yet

- Corporate Governance Guidelines PDFDocument8 pagesCorporate Governance Guidelines PDFpradeep jayaNo ratings yet

- LU 4 - Theme1 - Directors - Slides For ClassDocument29 pagesLU 4 - Theme1 - Directors - Slides For ClassTk NarshaiNo ratings yet

- 7 Types of Boards of DirectorsDocument6 pages7 Types of Boards of Directors36. Lê Minh Phương 12A3No ratings yet

- Lesson 5 Board of DirectorsDocument13 pagesLesson 5 Board of DirectorsSaif Ullah KhanNo ratings yet

- Amended Manual OnCorporate Governance - June162014Document27 pagesAmended Manual OnCorporate Governance - June162014Karl LabagalaNo ratings yet

- Stanley Black & Decker, Inc. Corporate Governance Guidelines As Adopted by The Board of Directors Effective July 2020 1. Director QualificationsDocument6 pagesStanley Black & Decker, Inc. Corporate Governance Guidelines As Adopted by The Board of Directors Effective July 2020 1. Director QualificationsHemanth KumarNo ratings yet

- Bcorp Board Charter 2019 PDFDocument13 pagesBcorp Board Charter 2019 PDFAverion MANo ratings yet

- Auditing and Corporate Governance AssignmentDocument32 pagesAuditing and Corporate Governance AssignmentSiddhi GargNo ratings yet

- Corporate-Governance IPJDocument5 pagesCorporate-Governance IPJreeshemah45No ratings yet

- Role of DirectorsDocument29 pagesRole of DirectorsREHANRAJNo ratings yet

- Appointment, Nomination and Remuneration of Directors, KMP and Senior ManagementDocument2 pagesAppointment, Nomination and Remuneration of Directors, KMP and Senior ManagementAnkit SabhayaNo ratings yet

- Corporate Governance - Effective Performance Evaluation of the BoardFrom EverandCorporate Governance - Effective Performance Evaluation of the BoardNo ratings yet

- The Certified Executive Board SecretaryFrom EverandThe Certified Executive Board SecretaryRating: 5 out of 5 stars5/5 (2)

- Resa Tax 1 Final Preboard May 2018Document11 pagesResa Tax 1 Final Preboard May 2018Joyce CagayatNo ratings yet

- Resa Tax 1 Final Preboard May 2018 PDFDocument5 pagesResa Tax 1 Final Preboard May 2018 PDFJoyce CagayatNo ratings yet

- Resa Afar 1 Final Preboard May 2018 PDFDocument6 pagesResa Afar 1 Final Preboard May 2018 PDFJoyce CagayatNo ratings yet

- Code of Corporate Governance For Publicly Listed CompaniesDocument7 pagesCode of Corporate Governance For Publicly Listed CompaniesJoyce Cagayat100% (1)

- IAC PPE and Intangible Students FinalDocument4 pagesIAC PPE and Intangible Students FinalJoyce Cagayat100% (1)

- 9-2 Directors Resolution Adopting AmendmentDocument1 page9-2 Directors Resolution Adopting AmendmentDaniel100% (2)

- Steve Ellis - Ted Klein - Edward MacKenzie - 02-27-2015 PDFDocument86 pagesSteve Ellis - Ted Klein - Edward MacKenzie - 02-27-2015 PDFfrancis battNo ratings yet

- Governance Midterms PDFDocument71 pagesGovernance Midterms PDFRyan Canatuan100% (2)

- We Are OFW Foundation, Inc.: International GrantmakingDocument10 pagesWe Are OFW Foundation, Inc.: International GrantmakingrieNo ratings yet

- The University of Cagayan Valley Administrators' Code of EthicsDocument8 pagesThe University of Cagayan Valley Administrators' Code of EthicsMei Dabalos CuntapayNo ratings yet

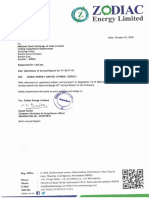

- zodAR 2017 2018Document69 pageszodAR 2017 2018enucnNo ratings yet

- COSO FrameworkDocument0 pagesCOSO FrameworkCynthia StoneNo ratings yet

- Independent Director and Their Evolution PDFDocument45 pagesIndependent Director and Their Evolution PDFviral bhanushali100% (1)

- Cimpor 2009 Annual ReportDocument296 pagesCimpor 2009 Annual Reportrlshipgx1314No ratings yet

- Pukehāmoamoa School Complaints ProcedureDocument2 pagesPukehāmoamoa School Complaints ProcedureJoshua WoodhamNo ratings yet

- Ethics Book Chapter 1Document71 pagesEthics Book Chapter 1Anonymous pY48IoDR4JNo ratings yet

- 1609138054.25831 - OLYMPIC 2019-2020 Annual - 2Document152 pages1609138054.25831 - OLYMPIC 2019-2020 Annual - 2A BNo ratings yet

- Mendoza Vs Officers of Manila Water Employees Union (MWEU), FactsDocument19 pagesMendoza Vs Officers of Manila Water Employees Union (MWEU), Factsmichellouise17No ratings yet

- Indonesia: A. Types of OrganizationsDocument15 pagesIndonesia: A. Types of OrganizationsStevenNo ratings yet

- 6 Skin Pharmaceuticals Private Limited: Directors' ReportDocument12 pages6 Skin Pharmaceuticals Private Limited: Directors' ReportvineminaiNo ratings yet

- ECS Holdings 2010 Annual ReportDocument95 pagesECS Holdings 2010 Annual ReportWeR1 Consultants Pte LtdNo ratings yet

- Good Corporate GovernanceDocument3 pagesGood Corporate Governancekaye kayeNo ratings yet

- BAHR213 SIMaDocument122 pagesBAHR213 SIMaJeliemay VergaraNo ratings yet

- Duties of An AuditorDocument3 pagesDuties of An AuditorAtul GuptaNo ratings yet

- Journalizing CorporationsDocument61 pagesJournalizing CorporationsBridgett Florence CaldaNo ratings yet

- Accountability and Responsibility in Corporate GovernanceDocument65 pagesAccountability and Responsibility in Corporate Governanceapril rose dinampoNo ratings yet

- Tourism MasterplanDocument53 pagesTourism MasterplanwatyapalaNo ratings yet

- 2007-6-26 SEC SpeechDocument158 pages2007-6-26 SEC SpeechDiane SternNo ratings yet

- Review of ScamsDocument19 pagesReview of ScamsKanika JainNo ratings yet

- JSW Steel Ar Full Report 2018-19!12!35Document350 pagesJSW Steel Ar Full Report 2018-19!12!35mallik vNo ratings yet

- BR1 - Board Resolution For Account Level Access - With Minutes of MeetingDocument2 pagesBR1 - Board Resolution For Account Level Access - With Minutes of Meetingmy trainingNo ratings yet

- Central Bank Vs CADocument9 pagesCentral Bank Vs CAMaria TracyNo ratings yet

- ASML 2012 Annual AccountsDocument150 pagesASML 2012 Annual Accountsjasper laarmansNo ratings yet