Professional Documents

Culture Documents

Gokarn's Comments Come After FM Says There Is No Need To Restrict Tide of Foreign Capital

Gokarn's Comments Come After FM Says There Is No Need To Restrict Tide of Foreign Capital

Uploaded by

alivimmo0 ratings0% found this document useful (0 votes)

38 views1 pageRBI Deputy Governor Subir Gokarn said that the RBI may consider measures to deal with large inflows of foreign institutional investments, which are emerging as a potential threat. While the Finance Minister said there is no need to restrict foreign capital inflows, Gokarn noted that the large inflows could disrupt the economy by putting upward pressure on the rupee. The RBI has been taking steps since January to control inflation, which remains above its comfort zone, through interest rate hikes and other measures.

Original Description:

NEW ARTCLE OF RBI

Original Title

RBI

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentRBI Deputy Governor Subir Gokarn said that the RBI may consider measures to deal with large inflows of foreign institutional investments, which are emerging as a potential threat. While the Finance Minister said there is no need to restrict foreign capital inflows, Gokarn noted that the large inflows could disrupt the economy by putting upward pressure on the rupee. The RBI has been taking steps since January to control inflation, which remains above its comfort zone, through interest rate hikes and other measures.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

38 views1 pageGokarn's Comments Come After FM Says There Is No Need To Restrict Tide of Foreign Capital

Gokarn's Comments Come After FM Says There Is No Need To Restrict Tide of Foreign Capital

Uploaded by

alivimmoRBI Deputy Governor Subir Gokarn said that the RBI may consider measures to deal with large inflows of foreign institutional investments, which are emerging as a potential threat. While the Finance Minister said there is no need to restrict foreign capital inflows, Gokarn noted that the large inflows could disrupt the economy by putting upward pressure on the rupee. The RBI has been taking steps since January to control inflation, which remains above its comfort zone, through interest rate hikes and other measures.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

RBI LOOKING AT WAYS

TO MANAGE INFLOWS

Gokarn’s comments come after FM says there

is no need to restrict tide of foreign capital

BS REPORTER it could easily be financed and

Mumbai, 5 October is not a cause for concern. The

current account deficit has risen

he Reserve Bank of three times to $13.7 billion in

T India (RBI) may

consider measures

to deal with foreign

institutional investor

(FII) inflows, which are emerg-

ing as a potential threat, said

the central bank’s Deputy Gov-

the quarter to June, over the

corresponding period of the

previous year.

“As long as the capital flows

are in excess of the current ac-

count deficit, the pressure to

appreciate will continue and it

ernor, Subir Gokarn, in Mum- could potentially disrupt,”

bai today. His comments came ‘It is becoming a larger Gokarn said.

a day after Finance Minister global problem because of The senior central bank of-

Pranab Mukherjee said there the imbalance — there is so ficial also said policy-tighten-

was no need for restrictions on much of liquidity and the ing efforts by RBI since Janu-

foreign inflows, in an interview ary have moderated inflation,

with a television channel. returns are skewed towards but it still remains above the

FIIs have invested a record emerging markets’ comfort zone, and is a concern.

$19.9 billion in Indian equity SUBIR GOKARN “The sharp deceleration (in

this year, of which around a third RBI Deputy Governor inflation) in recent months may

has poured in since the start of reflect the impact of monetary

September, thereby exerting an actions and gives us confidence

upward pressure on the rupee. of liquidity and the returns are that the inflation rate will mod-

Overseas funds bought $9.9 bil- skewed towards emerging mar- erate significantly by the end

lion worth of Indian bonds in kets,” Gokarn said at a semi- of the fiscal year 2010-11,”

2010. On Monday, the domes- nar. “So, it is emerging as a po- said Gokarn.

tic currency strengthened to tential threat and we are clear- Since January, RBI has

a five-and-a-half-month high ly thinking of ways in which raised policy rates by 125-175

on sustained foreign portfolio we can deal with it.” basis points, and banks’ cash

investments and gains in other Planning Commission reserves by 100 bps to 6 per

regional peers. Deputy Chairman Montek cent. It expects headline infla-

“It is becoming a larger glob- Singh Ahluwalia on Monday tion to come down to 6 per cent

al problem because of the im- said though the current account by March end.

balance — there is so much deficit is wider than expected, Turn to Page 4

You might also like

- Equity Research Report HDFC BankDocument4 pagesEquity Research Report HDFC BankNikhil KumarNo ratings yet

- Financial StabilityDocument6 pagesFinancial Stabilitylucky4anshNo ratings yet

- Challenges of Shadow Banking: Behavioural Finance and Value InvestingDocument9 pagesChallenges of Shadow Banking: Behavioural Finance and Value InvestingArnnava SharmaNo ratings yet

- Caa Week 1 November, 2019.inddDocument6 pagesCaa Week 1 November, 2019.inddPraveen P. S. TomarNo ratings yet

- Economy Report August 2009Document14 pagesEconomy Report August 2009PriyankaNo ratings yet

- Insights IndiaDocument7 pagesInsights IndialifeNo ratings yet

- ANZ QR Indonesia Policy 19092019Document4 pagesANZ QR Indonesia Policy 19092019Handy HarisNo ratings yet

- Vol 45Document101 pagesVol 45Darshan ThummarNo ratings yet

- 1 PDFDocument7 pages1 PDFsamuelNo ratings yet

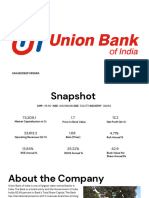

- Union BankDocument30 pagesUnion BankSanjeedeep Mishra , 315No ratings yet

- Indian Bonds in Global MarketsDocument1 pageIndian Bonds in Global Marketsptus nayakNo ratings yet

- Playing The Debt MarketDocument1 pagePlaying The Debt MarketChandan PreetNo ratings yet

- TOI - How RBI - Bring Dollars - Arrest Rupee's SlideDocument5 pagesTOI - How RBI - Bring Dollars - Arrest Rupee's Slidekarthik sNo ratings yet

- Ibps Po Pre Practice Set Vijay Tripathi PDFDocument131 pagesIbps Po Pre Practice Set Vijay Tripathi PDFDuvva VenkateshNo ratings yet

- Rbi Monetary Policy Review Further Cuts LikelyDocument6 pagesRbi Monetary Policy Review Further Cuts LikelyTaransh ANo ratings yet

- Subbarao's Policy Dilemma: FM Promises Action On Capital Inflows When It Is NeededDocument9 pagesSubbarao's Policy Dilemma: FM Promises Action On Capital Inflows When It Is Neededabhinavm84No ratings yet

- Banking Industry AnalysisDocument33 pagesBanking Industry Analysismjibran_1100% (1)

- Centre Issues First Zero-Coupon Recap Bonds of 5,500 CR: P&SB To Park Investment in HTM Category Raises ConcernDocument16 pagesCentre Issues First Zero-Coupon Recap Bonds of 5,500 CR: P&SB To Park Investment in HTM Category Raises ConcernGopalakrishnan SivasamyNo ratings yet

- Mutual Funds 2 0 Expanding Into New HorizonsDocument32 pagesMutual Funds 2 0 Expanding Into New HorizonsIrshadNo ratings yet

- Banks Have Ability To Withstand Stress: Also ReadDocument22 pagesBanks Have Ability To Withstand Stress: Also Readpriya2210No ratings yet

- U Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingDocument16 pagesU Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingAnjuRoseNo ratings yet

- ICICI Securities NBFC Sector UpdateDocument7 pagesICICI Securities NBFC Sector UpdateDivy JainNo ratings yet

- Performance of Debt Markt: An Article ReviewDocument11 pagesPerformance of Debt Markt: An Article ReviewNida SubhaniNo ratings yet

- Mutual Fund Review: Equity MarketDocument11 pagesMutual Fund Review: Equity MarketNadim ReghiwaleNo ratings yet

- LOW RATE OF SBI Moody'sDocument3 pagesLOW RATE OF SBI Moody'sVs RanaNo ratings yet

- EIIF Analysis of SBI Bank by Group 2Document21 pagesEIIF Analysis of SBI Bank by Group 2Shweta GuptaNo ratings yet

- Outlook For Banks 2010Document6 pagesOutlook For Banks 2010khabis007No ratings yet

- News Round Up: Month at GlanceDocument1 pageNews Round Up: Month at GlanceSwapnil ShethNo ratings yet

- Banking Outlook 2023 Navigating A Limited LandscapeDocument39 pagesBanking Outlook 2023 Navigating A Limited Landscapengu mahNo ratings yet

- Banking Sector Report 1Document14 pagesBanking Sector Report 1Pathanjali DiduguNo ratings yet

- Economic Brief Sept 2017Document20 pagesEconomic Brief Sept 2017Áron KerékgyártóNo ratings yet

- SA IV 13 300319 MB Intro Partha RayDocument2 pagesSA IV 13 300319 MB Intro Partha RayVenkyNo ratings yet

- SBI To Look Into Co-Lending IssueDocument1 pageSBI To Look Into Co-Lending IssueShubham TiwariNo ratings yet

- Yielding To Fundamentals? More of A Toss-Up: November 2, 2020Document4 pagesYielding To Fundamentals? More of A Toss-Up: November 2, 2020Gaurav ChopraNo ratings yet

- Macro-Economics Assignment: Npa of Indian Banks and The Future of BusinessDocument9 pagesMacro-Economics Assignment: Npa of Indian Banks and The Future of BusinessAnanditaKarNo ratings yet

- Directors Report To The Shareholders of Idlc Finance Limited 2019 944529Document9 pagesDirectors Report To The Shareholders of Idlc Finance Limited 2019 944529sajibarafatsiddiquiNo ratings yet

- 19th ANNUAL CEO TRACK RECORDDocument91 pages19th ANNUAL CEO TRACK RECORDChetan ChouguleNo ratings yet

- RBI Hikes Repo Rate For First Time in Four Years by Kapil KathpalDocument31 pagesRBI Hikes Repo Rate For First Time in Four Years by Kapil Kathpal32divyanshuNo ratings yet

- Wholesale Banking in India:: The Next FrontierDocument8 pagesWholesale Banking in India:: The Next Frontierprasad hegdeNo ratings yet

- WP 2022 009 PDFDocument23 pagesWP 2022 009 PDFNitu YadavNo ratings yet

- Fino KenDocument1 pageFino Kenhemanth pawaskarNo ratings yet

- Indian Banking Sector Credit Growth Has Grown at A Healthy PaceDocument1 pageIndian Banking Sector Credit Growth Has Grown at A Healthy PaceAkshay GonewarNo ratings yet

- Daily News Simplified - DNS: SL. NO. Topics The Hindu Page NoDocument11 pagesDaily News Simplified - DNS: SL. NO. Topics The Hindu Page NoVinayak ChaturvediNo ratings yet

- Economy Report Oct 2009Document17 pagesEconomy Report Oct 2009PriyankaNo ratings yet

- Financial Services-June 2022Document34 pagesFinancial Services-June 2022Sauvik RoyNo ratings yet

- Current Borrowing To Remain HighDocument1 pageCurrent Borrowing To Remain HighsharadkulloliNo ratings yet

- RbiDocument6 pagesRbiAnjali RaiNo ratings yet

- The Way Out of The Current Macroeconomic Mess - A Note by Sebastian MorrisDocument5 pagesThe Way Out of The Current Macroeconomic Mess - A Note by Sebastian MorrisKishore SeetharamNo ratings yet

- Vol. No. 7 Issue No. 9: March 2010Document32 pagesVol. No. 7 Issue No. 9: March 2010Dr. Sanjeev KumarNo ratings yet

- Monetary Policy Review 301007Document3 pagesMonetary Policy Review 301007pranjal92pandeyNo ratings yet

- Size of The Sector NBFCDocument14 pagesSize of The Sector NBFCniravthegreate999No ratings yet

- Project On Banking SectorDocument5 pagesProject On Banking SectorNikita BagulNo ratings yet

- Indian SF Market UpdateDocument8 pagesIndian SF Market UpdateVikasGargNo ratings yet

- CENTRAL BANK: Meaning, Functions and Monetary PolicyDocument30 pagesCENTRAL BANK: Meaning, Functions and Monetary PolicyARNESH KUMAR PALONo ratings yet

- Bhopal Branch of CIRC of ICAI: This Ediition SpecialDocument26 pagesBhopal Branch of CIRC of ICAI: This Ediition SpecialShrikrishna DwivediNo ratings yet

- Monetisation of Fiscal DeficitDocument2 pagesMonetisation of Fiscal DeficitGaurav GoyalNo ratings yet

- EY Report On Private Credit MarketDocument18 pagesEY Report On Private Credit MarketSaranNo ratings yet

- Ey Private Credit in India v1Document18 pagesEy Private Credit in India v1Naman JainNo ratings yet

- D - Salvatore Ch13 UneditedDocument49 pagesD - Salvatore Ch13 UneditedLihle SetiNo ratings yet

- Fixed Exchange Rate System - Under This System, All Countries Were Required To Set A SpecificDocument3 pagesFixed Exchange Rate System - Under This System, All Countries Were Required To Set A SpecificRemar22No ratings yet

- Certificate of Origin: Group IVDocument16 pagesCertificate of Origin: Group IVTravis OpizNo ratings yet

- Rickards The Global Elites' Secret Plan For The Next Financial CrisisDocument4 pagesRickards The Global Elites' Secret Plan For The Next Financial CrisisOCHETE AMNo ratings yet

- CBSE Class 12 Ecomonics - BOP and Foreign Exchange RateDocument7 pagesCBSE Class 12 Ecomonics - BOP and Foreign Exchange RateAshutosh GuptaNo ratings yet

- Chapter 1 PowerPoint SlidesDocument19 pagesChapter 1 PowerPoint SlidessamimiacademyNo ratings yet

- Political EconomyDocument16 pagesPolitical EconomyJane AlamNo ratings yet

- Balance of Payment of India For StudentsDocument4 pagesBalance of Payment of India For StudentskhushiYNo ratings yet

- Ghosh Current Account DeficitsDocument2 pagesGhosh Current Account DeficitsGogreen FieldsNo ratings yet

- List of DevelopingDocument1 pageList of DevelopingAna_Koridze_243No ratings yet

- API Is - Air.good - mt.k1 Ds2 en Excel v2 5997834Document68 pagesAPI Is - Air.good - mt.k1 Ds2 en Excel v2 5997834alireza.shadanpoorNo ratings yet

- International Business MCQ With Answers - IndiaclassDocument18 pagesInternational Business MCQ With Answers - Indiaclassmonalisha mishraNo ratings yet

- ECON 1269 Midterm 2 World Price Ratio Straight Line Knowledge SummaryDocument1 pageECON 1269 Midterm 2 World Price Ratio Straight Line Knowledge SummaryRetratssNo ratings yet

- Development Cooperation Report 2018 PDFDocument475 pagesDevelopment Cooperation Report 2018 PDFMaria BuenoNo ratings yet

- Why Is Indonesia Still A Developing CountryDocument2 pagesWhy Is Indonesia Still A Developing CountryDio AzzuriNo ratings yet

- MWV Web ServicesDocument48 pagesMWV Web ServicesRathna SubbuNo ratings yet

- BRICS - No Longer EmergingDocument3 pagesBRICS - No Longer EmergingEduardo RossiNo ratings yet

- Structure of Imports and Exports in EgyptDocument11 pagesStructure of Imports and Exports in EgyptChristine EdwarNo ratings yet

- Economics Paper 2 HL M14Document9 pagesEconomics Paper 2 HL M14BL 11100% (1)

- Exchange Rate Regimes: ITF220 Prof.J.FrankelDocument26 pagesExchange Rate Regimes: ITF220 Prof.J.FrankelsheetalNo ratings yet

- Global Economics: Prof. Anand VermaDocument13 pagesGlobal Economics: Prof. Anand VermaAlok PathakNo ratings yet

- L211 0242 S7G TopDocument9 pagesL211 0242 S7G TopGonzalo InnNo ratings yet

- Unit 2 (IB MBA)Document11 pagesUnit 2 (IB MBA)Megha PrajapatiNo ratings yet

- TT 03Document35 pagesTT 03AHMAD ALINo ratings yet

- BrexitDocument11 pagesBrexitapi-379339840No ratings yet

- China and The SDR-JRFM-Final-ProofDocument15 pagesChina and The SDR-JRFM-Final-ProofMik SerranoNo ratings yet

- Global FinanceDocument28 pagesGlobal FinanceRen Ren GutierrezNo ratings yet

- AnkiDocument14 pagesAnkiAnkita ChoksiNo ratings yet

- BricsDocument22 pagesBricsRadhaNo ratings yet

- IP - Chapter1 - Foreign Exchange and Currency Risk Management - StudentDocument22 pagesIP - Chapter1 - Foreign Exchange and Currency Risk Management - Studentđan thi nguyễnNo ratings yet