Professional Documents

Culture Documents

Courier C102348 R6 TDK0 CA

Courier C102348 R6 TDK0 CA

Uploaded by

Oscar Gabriel FernándezOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Courier C102348 R6 TDK0 CA

Courier C102348 R6 TDK0 CA

Uploaded by

Oscar Gabriel FernándezCopyright:

Available Formats

Round: 6

Dec. 31, C102348

2024

Andrews Salary Baldwin Salary Chester Salary

GRETZEL ALCON $500 CARLOS ARCANI $0 EVELYN CANO $0

JACQUELINE FERNANDE $0 EDGAR CUENTAS $0 RUBEN GUTIERREZ $500

DANIELA LIMACHI $0 MARCO LINARES $0 ALVARO MARCA $0

CARLA MACHICADO $0 KATZUO QUISBERT $0 CLAUDIA POMA $0

KEVIN RAMOS $0 YOMARA VELASCO $1,000 KEILA TORREZ $0

Digby Salary Erie Salary Ferris

WILMER ALANOCA $0 MARIANNY ARIAS $3,500

OSCAR FERNANDEZ $500 VALERIA ARTEAGA $0

HEIDY ORDOEZ $0 YOSSY CORDOVA $0

FANNY POCOACA $0 ESTEFANY DORADO $0

ROSELVY EGGERS $0

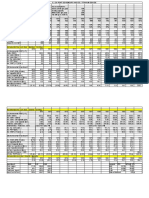

Selected Financial Statistics

Andrews Baldwin Chester Digby Erie Ferris

ROS 15.6% 1.9% 3.3% 9.4% -25.2% 1.2%

Asset Turnover 1.25 1.32 1.56 1.72 0.46 0.92

ROA 19.5% 2.5% 5.2% 16.1% -11.6% 1.1%

Leverage 1.3 1.7 1.8 1.3 8.5 2.2

ROE 25.7% 4.3% 9.4% 21.3% -98.9% 2.3%

Emergency Loan $0 $0 $0 $0 $105,673,165 $0

Sales $269,012,803 $179,256,140 $221,185,948 $309,471,657 $68,736,931 $217,245,169

EBIT $70,574,174 $10,400,773 $17,676,013 $48,517,771 ($3,728,735) $18,968,145

Profits $41,907,753 $3,392,364 $7,337,162 $28,977,197 ($17,344,500) $2,505,974

Cumulative Profit $121,050,908 $20,733,719 $34,168,443 $94,225,717 ($38,207,394) $40,483,183

SG&A / Sales 9.3% 12.9% 8.9% 9.0% 12.5% 10.5%

Contrib. Margin % 46.0% 31.0% 27.5% 33.3% 14.5% 28.9%

CAPSTONE ® COURIER Page 1

Round: 6

Stock & Bonds C102348 Dec. 31, 2024

Stock Market Summary

MarketCap

Company Close Change Shares Book Value EPS Dividend Yield P/E

($M)

Andrews $177.18 $46.03 2,014,597 $357 $80.80 $20.80 $0.75 0.4% 8.5

Baldwin $40.13 $1.88 2,392,130 $96 $33.23 $1.42 $0.00 0.0% 28.3

Chester $57.61 $6.66 2,000,000 $115 $38.96 $3.67 $0.00 0.0% 15.7

Digby $135.44 $35.30 1,990,014 $270 $68.27 $14.56 $0.56 0.4% 9.3

Erie $1.00 $0.00 2,350,327 $2 $7.47 ($7.38) $0.00 0.0% -0.1

Ferris $43.96 ($4.33) 2,651,552 $117 $40.66 $0.95 $0.00 0.0% 46.5

Bond Market Summary

Company Series# Face Yield Close$ S&P Company Series# Face Yield Close$ S&P

Andrews Digby

12.2S2031 $13,997,508 12.0% 101.84 AAA 11.3S2029 $6,500,000 11.6% 97.83 AA

11.6S2034 $25,368,000 11.7% 98.86 AAA 12.0S2033 $1,000,000 11.9% 100.53 AA

Baldwin Erie

12.5S2034 $22,000,000 13.1% 95.71 BBB Ferris

Chester 12.2S2031 $6,405,209 13.6% 89.50 CCC

11.7S2030 $14,000,000 12.7% 92.16 BB 13.0S2032 $17,300,589 14.1% 92.30 CCC

12.6S2031 $9,000,000 13.2% 95.24 BB 13.4S2033 $13,840,868 14.3% 93.73 CCC

13.5S2033 $3,000,000 13.6% 99.00 BB 14.0S2034 $30,264,972 14.5% 96.45 CCC

Next Year's Prime Rate10.00%

CAPSTONE ® COURIER Page 2

Round: 6

Financial Summary C102348 Dec. 31, 2024

Cash Flow Statement Survey Andrews Baldwin Chester Digby Erie Ferris

CashFlows from operating activities

Net Income(Loss) $41,908 $3,392 $7,337 $28,977 ($17,344) $2,506

Adjustment for non-cash items:

Depreciation $18,345 $12,267 $12,426 $13,043 $7,627 $14,220

Extraordinary gains/losses/writeoffs $448 $0 $0 $0 $0 $0

Changes in current assets and liablilities

Accounts payable $1,491 $5,989 $4,397 $2,053 $393 $517

Inventory ($11,542) ($4,130) ($2,093) ($6,682) ($25,931) ($899)

Accounts Receivable ($2,089) $178 ($3,464) ($2,383) $1,360 ($2,516)

Net cash from operations $48,561 $17,695 $18,603 $35,008 ($33,896) $13,827

Cash flows from investing activities

Plant improvements(net) ($57,580) ($29,400) ($10,536) ($35,840) $0 ($26,900)

Cash flows from financing activities

Dividends paid ($1,511) $0 $0 ($1,114) $0 $0

Sales of common stock $0 $15,000 $0 $0 $0 $12,111

Purchase of common stock $0 $0 $0 ($1,000) $0 $0

Cash from long term debt issued $25,368 $22,000 $0 $0 $0 $30,265

Early retirement of long term debt ($21,300) $0 $0 $0 $0 $0

Retirement of current debt ($4,000) ($10,000) ($4,000) $0 ($71,777) ($32,951)

Cash from current debt borrowing $0 $0 $4,000 $0 $0 $26,037

Cash from emergency loan $0 $0 $0 $0 $105,673 $0

Net cash from financing activities ($1,443) $27,000 $0 ($2,114) $33,896 $35,462

Net change in cash position ($10,462) $15,295 $8,067 ($2,946) $0 $22,389

Balance Sheet Survey Andrews Baldwin Chester Digby Erie Ferris

Cash $9,216 $22,302 $18,774 $49,565 $0 $50,901

Accounts Receivable $22,111 $12,278 $17,574 $24,588 $5,650 $17,856

Inventory $18,771 $11,906 $22,782 $6,969 $113,554 $23,532

Total Current Assets $50,098 $46,486 $59,130 $81,123 $119,204 $92,289

Plant and equipment $275,180 $184,000 $186,384 $195,640 $114,400 $213,300

Accumulated Depreciation ($110,412) ($94,299) ($103,611) ($96,267) ($83,693) ($70,540)

Total Fixed Assets $164,768 $89,701 $82,773 $99,373 $30,707 $142,760

Total Assets $214,866 $136,187 $141,903 $180,496 $149,910 $235,049

Accounts Payable $12,714 $13,850 $13,131 $16,282 $5,841 $12,535

Current Debt $0 $20,850 $24,850 $20,850 $126,523 $46,887

Long Term Debt $39,366 $22,000 $26,000 $7,500 $0 $67,812

Total Liabilities $52,080 $56,700 $63,981 $44,632 $132,364 $127,234

Common Stock $18,860 $33,360 $18,360 $18,191 $30,360 $52,917

Retained Earnings $143,926 $46,127 $59,562 $117,673 ($12,814) $54,898

Total Equity $162,786 $79,487 $77,922 $135,865 $17,546 $107,815

Total Liabilities & Owners Equity $214,866 $136,187 $141,903 $180,496 $149,910 $235,049

Income Statement Survey Andrews Baldwin Chester Digby Erie Ferris

Sales $269,013 $179,256 $221,186 $309,472 $68,737 $217,245

Variable Costs(Labor,Material,Carry) $145,400 $123,677 $160,407 $206,396 $58,765 $154,431

Depreciation $18,345 $12,267 $12,426 $13,043 $7,627 $14,220

SGA(R&D,Promo,Sales,Admin) $24,952 $23,061 $19,678 $28,000 $8,574 $22,757

Other(Fees,Writeoffs,TQM,Bonuses) $9,741 $9,850 $11,000 $13,515 ($2,500) $6,869

EBIT $70,574 $10,401 $17,676 $48,518 ($3,729) $18,968

Interest(Short term,Long term) $4,650 $5,064 $6,134 $2,981 $22,955 $15,030

Taxes $23,073 $1,868 $4,040 $15,938 ($9,339) $1,378

Profit Sharing $943 $76 $165 $622 $0 $54

Net Profit $41,908 $3,392 $7,337 $28,977 ($17,344) $2,506

CAPSTONE ® COURIER Page 3

Round: 6

Production Analysis C102348 Dec. 31, 2024

2nd

Shift Auto

Unit & mation Capacity

Primary Units Inven Revision Age Pfmn Size Material Labor Contr. Over- Next Next Plant

Name Segment Sold tory Date Dec.31 MTBF Coord Coord Price

Cost

Cost Marg. time Round Round Utiliz.

Able Trad 2,007 1,193 3/25/2024 1.7 14000 7.9 12.2 $26.40 $6.97 $6.61 44% 80% 7.3 2,350 178%

Acre Low 3,868 0 7/15/2023 6.0 12000 3.6 16.5 $19.40 $3.72 $2.96 65% 95% 8.8 2,550 193%

Adam Trad 911 0 4/29/2024 1.8 25000 10.4 9.6 $27.00 $11.49 $5.46 36% 0% 6.5 900 99%

Aft Pfmn 1,201 54 6/6/2024 1.5 27000 15.4 11.8 $32.25 $13.34 $8.54 32% 33% 4.0 950 131%

Agape Size 1,291 59 6/6/2024 1.5 18500 8.2 4.6 $32.50 $11.09 $9.01 38% 60% 4.0 950 159%

Acacia High 965 0 5/10/2024 1.4 25000 14.4 5.6 $37.00 $14.02 $7.55 41% 15% 4.5 700 114%

Baker Trad 2,049 393 6/13/2024 1.4 14000 9.2 10.8 $26.00 $8.69 $10.26 25% 32% 5.5 2,000 129%

Bead Low 3,028 0 5/17/2024 1.9 12000 4.5 15.6 $19.50 $4.76 $6.97 39% 94% 7.0 2,000 189%

Bid High 340 70 11/24/2024 1.2 14000 11.2 8.8 $37.50 $10.09 $11.33 32% 0% 4.5 900 46%

Bold Pfmn 600 75 1/5/2025 2.3 27000 13.1 13.4 $32.50 $13.46 $9.92 26% 0% 4.0 700 73%

Buddy Size 693 40 9/25/2024 1.3 21000 7.8 5.5 $33.00 $12.57 $10.96 29% 7% 3.5 700 105%

Beer High 316 0 7/5/2025 1.4 22000 12.5 7.5 $37.50 $13.36 $11.33 27% 0% 3.0 500 39%

Cake Trad 2,484 210 5/23/2024 1.6 17000 9.2 10.8 $26.10 $9.37 $8.74 29% 26% 5.1 2,160 125%

Cedar Low 3,826 0 8/7/2024 1.7 12500 4.7 15.3 $18.40 $4.98 $7.74 30% 69% 7.0 2,280 168%

Cid Trad 949 326 10/31/2024 1.4 17000 9.9 10.5 $27.00 $9.72 $9.44 17% 0% 4.0 900 97%

Coat Pfmn 954 133 9/20/2024 1.4 27000 15.4 11.8 $31.80 $14.52 $10.53 21% 72% 4.5 600 170%

Cure Size 909 407 6/30/2024 1.5 17500 8.2 4.6 $33.00 $11.78 $10.00 32% 42% 4.8 700 140%

Daze Trad 2,298 400 5/13/2024 1.6 14000 9.2 10.8 $27.05 $7.82 $9.30 35% 51% 5.0 1,900 150%

Dell Low 2,778 0 11/5/2023 5.9 12000 4.2 15.8 $20.05 $4.13 $8.13 38% 100% 6.5 1,610 198%

Dixie High 982 0 6/16/2024 1.4 25000 14.3 5.7 $37.45 $13.97 $9.38 38% 10% 4.0 900 109%

Dot Pfmn 999 0 8/23/2024 1.4 27000 15.4 11.1 $32.25 $13.48 $10.65 26% 66% 3.6 650 165%

Dune Size 942 0 6/13/2024 1.5 17500 8.2 4.6 $32.10 $10.83 $10.53 34% 58% 3.6 650 157%

Derek High 888 0 7/6/2024 1.2 25000 14.5 5.5 $37.20 $14.09 $10.17 35% 28% 4.0 800 127%

Deyhi Trad 2,177 5 5/26/2023 2.2 17000 8.5 11.5 $27.25 $8.17 $11.42 27% 69% 4.0 1,400 168%

Eat Low 1,188 0 11/21/2015 9.1 17500 5.5 14.5 $26.00 $7.26 $9.52 35% 0% 4.0 1,800 66%

Ebb Low 1,802 0 5/4/2019 8.1 14000 3.5 17.0 $21.00 $4.63 $9.05 34% 30% 5.0 1,400 129%

Echo 0 1,854 4/19/2017 7.7 23000 8.0 12.0 $36.00 $10.70 $10.75 NA 0% 3.1 900 45%

Edge 0 1,760 6/29/2016 8.5 25000 9.4 15.5 $33.00 $11.02 $10.88 0% 0% 3.0 600 73%

Egg 0 1,529 2/23/2019 7.2 19000 4.2 11.0 $33.00 $8.99 $10.75 NA 0% 3.1 600 63%

Fast Low 792 0 1/28/2022 6.1 12000 5.5 14.5 $20.50 $5.60 $12.01 13% 100% 4.0 900 198%

Feat Pfmn 848 261 8/28/2024 3.2 27000 15.0 12.3 $32.00 $14.82 $6.92 33% 0% 6.0 1,600 59%

Fist High 1,214 0 8/4/2024 1.3 25000 14.7 5.4 $37.00 $16.05 $10.62 28% 25% 4.5 800 124%

Foam Pfmn 1,060 172 8/29/2024 1.3 27000 15.8 11.1 $32.00 $15.43 $7.62 26% 0% 6.0 1,100 95%

Fume Size 953 629 8/6/2024 1.3 17000 8.2 3.8 $32.00 $12.48 $8.47 30% 30% 6.0 1,250 129%

Fox High 1,182 0 7/12/2024 1.2 25000 14.7 5.3 $37.00 $16.09 $7.62 36% 0% 6.0 1,150 77%

Fuel Size 649 44 5/6/2024 0.6 25000 8.0 4.5 $32.00 $14.51 $8.39 27% 80% 6.0 750 116%

CAPSTONE ® COURIER Page 4

Traditional Segment Analysis C102348 Round: 6

Dec. 31, 2024

Traditional Statistics

Total Industry Unit Demand 12,526

Actual Industry Unit Sales |12,526

Segment % of Total Industry |26.5%

Next Year's Segment Growth Rate |9.2%

Traditional Customer Buying Criteria

Expectations Importance

1. Age Ideal Age = 2.0 47%

2. Price $17.00 - 27.00 23%

3. Ideal Position Pfmn 9.2 Size 10.8 21%

4. Reliability MTBF 14000-19000 9%

Top Products in Traditional Segment

Units Cust. Cust. Dec.

Market Sold to Revision Stock Pfmn Size List Age Promo A

ware- Sales A

ccess-

Cust

Name Share Seg Date Out Coord Coord Price MTBF Dec.31 Budget n

ess Budget ibility

Survey

Cake 20% 2,484 5/23/2024 9.2 10.8 $26.10 17000 1.60 $1,040 69% $1,585 82% 44

Daze 18% 2,298 5/13/2024 9.2 10.8 $27.05 14000 1.59 $1,400 75% $1,576 88% 41

Deyhi 17% 2,177 5/26/2023 8.5 11.5 $27.25 17000 2.16 $1,330 59% $2,254 88% 41

Baker 16% 2,049 6/13/2024 9.2 10.8 $26.00 14000 1.41 $1,830 76% $2,360 71% 35

Able 15% 1,885 3/25/2024 7.9 12.2 $26.40 14000 1.75 $1,590 78% $2,190 86% 33

Cid 7% 873 10/31/2024 9.9 10.5 $27.00 17000 1.44 $860 48% $2,238 82% 32

Adam 6% 760 4/29/2024 YES 10.4 9.6 $27.00 25000 1.80 $1,590 57% $1,844 86% 38

CAPSTONE ® COURIER Page 5

Low End Segment Analysis C102348 Round: 6

Dec. 31, 2024

Low End Statistics

Total Industry Unit Demand 17,404

Actual Industry Unit Sales |17,404

Segment % of Total Industry |36.8%

Next Year's Segment Growth Rate |11.7%

Low End Customer Buying Criteria

Expectations Importance

1. Price $12.00 - 22.00 53%

2. Age Ideal Age = 7.0 24%

3. Ideal Position Pfmn 4.7 Size 15.3 16%

4. Reliability MTBF 12000-17000 7%

Top Products in Low End Segment

Units Cust. Cust. Dec.

Market Sold to Revision Stock Pfmn Size List Age Promo A

ware- Sales A

ccess-

Cust

Name Share Seg Date Out Coord Coord Price MTBF Dec.31 Budget n

ess Budget ibility

Survey

Acre 22% 3,868 7/15/2023 YES 3.6 16.5 $19.40 12000 6.03 $1,520 77% $2,190 85% 17

Cedar 22% 3,826 8/7/2024 YES 4.7 15.3 $18.40 12500 1.66 $1,000 58% $1,585 87% 15

Bead 17% 3,028 5/17/2024 YES 4.5 15.6 $19.50 12000 1.86 $1,830 70% $2,178 77% 12

Dell 16% 2,778 11/5/2023 YES 4.2 15.8 $20.05 12000 5.87 $1,315 66% $2,024 100% 24

Ebb 10% 1,802 5/4/2019 YES 3.5 17.0 $21.00 14000 8.13 $900 43% $858 37% 4

Eat 7% 1,188 11/21/2015 YES 5.5 14.5 $26.00 17500 9.10 $1,000 25% $936 37% 1

Fast 5% 792 1/28/2022 YES 5.5 14.5 $20.50 12000 6.08 $200 40% $695 47% 10

Able 1% 123 3/25/2024 7.9 12.2 $26.40 14000 1.75 $1,590 39% $2,190 85% 0

CAPSTONE ® COURIER Page 6

High End Segment Analysis C102348 Round: 6

Dec. 31, 2024

High End Statistics

Total Industry Unit Demand 6,286

Actual Industry Unit Sales |6,115

Segment % of Total Industry |13.3%

Next Year's Segment Growth Rate |16.2%

High End Customer Buying Criteria

Expectations Importance

1. Ideal Position Pfmn 14.3 Size 5.7 43%

2. Age Ideal Age = 0.0 29%

3. Reliability MTBF 20000-25000 19%

4. Price $27.00 - 37.00 9%

Top Products in High End Segment

Units Cust. Cust. Dec.

Market Sold to Revision Stock Pfmn Size List Age Promo A

ware- Sales A

ccess-

Cust

Name Share Seg Date Out Coord Coord Price MTBF Dec.31 Budget n

ess Budget ibility

Survey

Fist 20% 1,214 8/4/2024 YES 14.7 5.4 $37.00 25000 1.26 $1,600 70% $1,042 91% 53

Fox 19% 1,182 7/12/2024 YES 14.7 5.3 $37.00 25000 1.25 $1,600 64% $1,042 91% 49

Dixie 16% 982 6/16/2024 YES 14.3 5.7 $37.45 25000 1.37 $1,340 71% $1,691 90% 55

Acacia 16% 965 5/10/2024 YES 14.4 5.6 $37.00 25000 1.41 $1,360 66% $1,844 86% 57

Derek 15% 888 7/6/2024 YES 14.5 5.5 $37.20 25000 1.24 $1,390 69% $1,461 90% 58

Bid 6% 340 11/24/2024 11.2 8.8 $37.50 14000 1.18 $650 59% $908 59% 0

Beer 5% 316 7/5/2025 YES 12.5 7.5 $37.50 22000 1.37 $700 51% $908 59% 11

Adam 2% 150 4/29/2024 YES 10.4 9.6 $27.00 25000 1.80 $1,590 48% $1,844 86% 5

Cid 1% 77 10/31/2024 9.9 10.5 $27.00 17000 1.44 $860 30% $2,238 56% 0

CAPSTONE ® COURIER Page 7

Performance Segment Analysis C102348 Round: 6

Dec. 31, 2024

Performance Statistics

Total Industry Unit Demand 5,662

Actual Industry Unit Sales |5,662

Segment % of Total Industry |12.0%

Next Year's Segment Growth Rate |19.8%

Performance Customer Buying Criteria

Expectations Importance

1. Reliability MTBF 22000-27000 43%

2. Ideal Position Pfmn 15.4 Size 11.8 29%

3. Price $22.00 - 32.00 19%

4. Age Ideal Age = 1.0 9%

Top Products in Performance Segment

Units Cust. Cust. Dec.

Market Sold to Revision Stock Pfmn Size List Age Promo A

ware- Sales A

ccess-

Cust

Name Share Seg Date Out Coord Coord Price MTBF Dec.31 Budget n

ess Budget ibility

Survey

Aft 21% 1,201 6/6/2024 15.4 11.8 $32.25 27000 1.53 $1,370 76% $1,844 74% 56

Foam 19% 1,060 8/29/2024 15.8 11.1 $32.00 27000 1.33 $1,600 76% $1,042 77% 50

Dot 18% 999 8/23/2024 YES 15.4 11.1 $32.25 27000 1.37 $1,310 69% $1,242 67% 48

Coat 17% 954 9/20/2024 15.4 11.8 $31.80 27000 1.42 $1,000 61% $1,865 70% 50

Feat 15% 848 8/28/2024 15.0 12.3 $32.00 27000 3.17 $1,600 75% $1,042 77% 43

Bold 11% 600 1/5/2025 13.1 13.4 $32.50 27000 2.33 $1,280 65% $1,361 61% 23

CAPSTONE ® COURIER Page 8

Size Segment Analysis C102348 Round: 6

Dec. 31, 2024

Size Statistics

Total Industry Unit Demand 5,437

Actual Industry Unit Sales |5,437

Segment % of Total Industry |11.5%

Next Year's Segment Growth Rate |18.3%

Size Customer Buying Criteria

Expectations Importance

1. Ideal Position Pfmn 8.2 Size 4.6 43%

2. Age Ideal Age = 1.5 29%

3. Reliability MTBF 16000-21000 19%

4. Price $22.00 - 32.00 9%

Top Products in Size Segment

Units Cust. Cust. Dec.

Market Sold to Revision Stock Pfmn Size List Age Promo A

ware- Sales A

ccess-

Cust

Name Share Seg Date Out Coord Coord Price MTBF Dec.31 Budget n

ess Budget ibility

Survey

Agape 24% 1,291 6/6/2024 8.2 4.6 $32.50 18500 1.54 $1,450 77% $1,614 73% 54

Fume 18% 953 8/6/2024 8.2 3.8 $32.00 17000 1.31 $1,600 73% $1,042 69% 33

Dune 17% 942 6/13/2024 YES 8.2 4.6 $32.10 17500 1.47 $1,380 66% $1,242 62% 47

Cure 17% 909 6/30/2024 8.2 4.6 $33.00 17500 1.52 $1,000 58% $2,052 64% 35

Buddy 13% 693 9/25/2024 7.8 5.5 $33.00 21000 1.29 $1,500 67% $1,361 60% 34

Fuel 12% 649 5/6/2024 8.0 4.5 $32.00 25000 0.65 $1,600 52% $1,042 69% 46

CAPSTONE ® COURIER Page 9

Round: 6

Market Share C102348 Dec. 31, 2024

Actual Market Share in Units Potential Market Share in Units

Trad Low High Pfmn Size Total Trad Low High Pfmn Size Total

Industry Unit Sales 12,526 17,404 6,115 5,662 5,437 47,144 Units Demanded 12,526 17,404 6,286 5,662 5,437 47,315

% of Market 26.6% 36.9% 13.0% 12.0% 11.5% 100.0% % of Market 26.5% 36.8% 13.3% 12.0% 11.5% 100.0%

Able 15.0% 0.7% 4.3% Able 13.5% 3.6%

Acre 22.2% 8.2% Acre 23.2% 8.5%

Adam 6.1% 2.5% 1.9% Adam 11.8% 4.2% 3.7%

Aft 21.2% 2.5% Aft 21.1% 2.5%

Agape 23.7% 2.7% Agape 24.3% 2.8%

Acacia 15.8% 2.1% Acacia 18.1% 2.4%

Total 21.1% 22.9% 18.2% 21.2% 23.7% 21.7% Total 25.3% 23.3% 22.2% 21.1% 24.3% 23.5%

Baker 16.4% 4.3% Baker 14.7% 3.9%

Bead 17.4% 6.4% Bead 14.3% 5.2%

Bid 5.6% 0.7% Bid 4.4% 0.6%

Bold 10.6% 1.3% Bold 10.5% 1.3%

Buddy 12.7% 1.5% Buddy 12.2% 1.4%

Beer 5.2% 0.7% Beer 5.9% 0.8%

Total 16.4% 17.4% 10.7% 10.6% 12.7% 14.9% Total 14.7% 14.2% 10.4% 10.5% 12.2% 13.2%

Cake 19.8% 5.3% Cake 18.3% 4.8%

Cedar 22.0% 8.1% Cedar 16.8% 6.2%

Cid 7.0% 1.3% 2.0% Cid 6.2% 1.0% 1.8%

Coat 16.9% 2.0% Coat 16.8% 2.0%

Cure 16.7% 1.9% Cure 15.3% 1.8%

Total 26.8% 22.0% 1.3% 16.9% 16.7% 19.4% Total 24.5% 16.8% 0.9% 16.8% 15.3% 16.5%

Daze 18.4% 4.9% Daze 16.6% 4.4%

Dell 16.0% 5.9% Dell 27.7% 10.2%

Dixie 16.1% 2.1% Dixie 17.8% 2.4%

Dot 17.6% 2.1% Dot 18.1% 2.2%

Dune 17.3% 2.0% Dune 20.6% 2.4%

Derek 14.5% 1.9% Derek 18.2% 2.4%

Deyhi 17.4% 4.6% Deyhi 18.9% 5.0%

Total 35.7% 16.0% 30.6% 17.6% 17.3% 23.5% Total 35.5% 27.7% 36.0% 18.1% 20.6% 28.9%

Eat 6.8% 2.5% Eat 1.4% 0.5%

Ebb 10.3% 3.8% Ebb 6.9% 2.5%

Echo Echo

Egg Egg

Total 17.2% 6.3% Total 8.3% 3.1%

Fast 4.5% 1.7% Fast 9.7% 3.6%

Feat 15.0% 1.8% Feat 14.9% 1.8%

Fist 19.9% 2.6% Fist 15.9% 2.1%

Foam 18.7% 2.3% Foam 18.6% 2.2%

Fume 17.5% 2.0% Fume 16.0% 1.8%

Fox 19.3% 2.5% Fox 14.5% 1.9%

Fuel 11.9% 1.4% Fuel 11.7% 1.3%

Total 4.5% 39.2% 33.7% 29.5% 14.2% Total 9.7% 30.4% 33.5% 27.6% 14.8%

CAPSTONE ® COURIER Page 10

Round: 6

Perceptual Map C102348 Dec. 31, 2024

Andrews Baldwin Chester

Name Pfmn Size Revised Name Pfmn Size Revised Name Pfmn Size Revised

Able 7.9 12.2 3/25/2024 Baker 9.2 10.8 6/13/2024 Cake 9.2 10.8 5/23/2024

Acre 3.6 16.5 7/15/2023 Bead 4.5 15.6 5/17/2024 Cedar 4.7 15.3 8/7/2024

Adam 10.4 9.6 4/29/2024 Bid 11.2 8.8 11/24/2024 Cid 9.9 10.5 10/31/2024

Aft 15.4 11.8 6/6/2024 Bold 13.1 13.4 1/5/2025 Coat 15.4 11.8 9/20/2024

Agape 8.2 4.6 6/6/2024 Buddy 7.8 5.5 9/25/2024 Cure 8.2 4.6 6/30/2024

Acacia 14.4 5.6 5/10/2024 Beer 12.5 7.5 7/5/2025

Digby Erie Ferris

Name Pfmn Size Revised Name Pfmn Size Revised Name Pfmn Size Revised

Daze 9.2 10.8 5/13/2024 Eat 5.5 14.5 11/21/2015 Fast 5.5 14.5 1/28/2022

Dell 4.2 15.8 11/5/2023 Ebb 3.5 17.0 5/4/2019 Feat 15.0 12.3 8/28/2024

Dixie 14.3 5.7 6/16/2024 Echo 8.0 12.0 4/19/2017 Fist 14.7 5.4 8/4/2024

Dot 15.4 11.1 8/23/2024 Edge 9.4 15.5 6/29/2016 Foam 15.8 11.1 8/29/2024

Dune 8.2 4.6 6/13/2024 Egg 4.2 11.0 2/23/2019 Fume 8.2 3.8 8/6/2024

Derek 14.5 5.5 7/6/2024 Fox 14.7 5.3 7/12/2024

Deyhi 8.5 11.5 5/26/2023 Fuel 8.0 4.5 5/6/2024

CAPSTONE ® COURIER Page 11

Round: 6

HR/TQM Report C102348 Dec. 31, 2024

HUMAN RESOURCES SUMMARY

Andrews Baldwin Chester Digby Erie Ferris

Needed Complement 967 1,006 1,173 1,672 699 907

Complement 967 1,006 1,172 1,505 701 907

1st Shift Complement 640 765 833 1,070 640 732

2nd Shift Complement 327 241 339 435 61 175

Overtime Percent 0.0% 0.0% 0.1% 15.6% 0.0% 0.0%

Turnover Rate 7.2% 11.0% 9.2% 10.0% 13.2% 9.2%

New Employees 97 330 333 358 93 83

Separated Employees 0 0 0 0 0 66

Recruiting Spend $2,500 $1,000 $2,400 $2,650 $0 $2,500

Training Hours 80 2 26 80 0 30

Productivity Index 118.9% 100.0% 104.4% 107.1% 100.0% 108.5%

Recruiting Cost $340 $661 $1,132 $1,307 $93 $291

Separation Cost $0 $0 $0 $0 $0 $332

Training Cost $1,547 $40 $609 $2,408 $0 $544

Total HR Admin Cost $1,888 $701 $1,742 $3,714 $93 $1,167

Labor Contract Next Year

Wages $29.16 $28.54 $29.62 $28.64 $26.96 $29.58

Benefits 2,700 2,750 2,650 2,640 2,625 2,625

Profit Sharing 2.2% 2.2% 2.2% 2.1% 2.1% 2.1%

Annual Raise 5.4% 5.5% 5.4% 5.3% 5.3% 5.3%

Starting Negotiation Position

Wages

Benefits

Profit Sharing

Annual Raise

Ceiling Negotiation Position

Wages

Benefits

Profit Sharing

Annual Raise

Adjusted Labor Demands

Wages

Benefits

Profit Sharing

Annual Raise

Strike Days

TQM SUMMARY

Andrews Baldwin Chester Digby Erie Ferris

Process Mgt Budgets Last Year

CPI Systems $720 $1,000 $1,500 $1,500 $0 $0

VendorJIT $720 $1,000 $1,500 $1,500 $0 $0

Quality Initiative Training $720 $1,000 $1,500 $1,500 $0 $0

Channel Support Systems $700 $0 $0 $1,500 $0 $750

Concurrent Engineering $725 $1,000 $0 $0 $0 $750

UNEP Green Programs $725 $0 $0 $1,500 $0 $0

TQM Budgets Last Year

Benchmarking $725 $1,000 $1,500 $1,500 $0 $750

Quality Function Deployment Effort $720 $1,000 $1,500 $1,500 $0 $750

CCE/6 Sigma Training $725 $1,000 $1,500 $1,000 $0 $750

GEMI TQEM Sustainability Initiatives $725 $1,000 $1,500 $1,500 $0 $0

Total Expenditures $7,205 $8,000 $10,500 $13,000 $0 $3,750

Cumulative Impacts

Material Cost Reduction 11.77% 1.98% 3.99% 11.74% 0.00% 0.14%

Labor Cost Reduction 14.00% 2.47% 6.21% 13.62% 0.00% 0.58%

Reduction R&D Cycle Time 40.01% 26.37% 40.01% 37.23% 0.00% 32.16%

Reduction Admin Costs 54.43% 20.50% 59.74% 60.02% 0.00% 28.68%

Demand Increase 14.40% 11.42% 6.00% 14.39% 0.00% 4.28%

CAPSTONE ® COURIER Page 12

Round: 6

Ethics Report C102348 Dec. 31, 2024

ETHICS SUMMARY

Other (Fees, Writeoffs, etc.) The actual dollar impact. Example, $120 means Other increased by $120.

Demand Factor The % of normal. 98% means demand fell 2%.

Material Cost Impact The % of normal. 104% means matieral costs rose 4%.

Admin Cost Impact The % of normal. 103% means admin costs rose 3%.

Productivity Impact The % of normal. 104% means productivity increased by 4%.

Awareness Impact The % of normal. 105% means normal awareness was multiplied by 1.05.

Accessibility Impact The % of normal. 98% means normal accessiblity was multiplied by 0.98.

Normal means the value that would have been produced if the problem had not been presented.

No Impact Andrews Baldwin Chester Digby Erie Ferris

To Speak Or Not To Speak

Other (Fees, Writeoffs, etc.) $0 $-1000 $-1000 $-1000 $-1000 $-1000 $-1000

Demand Factor 100% 99% 99% 99% 99% 99% 98%

Material Cost Impact 100% 100% 100% 100% 100% 100% 100%

Admin Cost Impact 100% 100% 100% 100% 100% 100% 130%

Productivity Impact 100% 100% 100% 100% 100% 100% 100%

Awareness Impact 100% 100% 100% 100% 100% 100% 100%

Accessibility Impact 100% 100% 100% 100% 100% 100% 100%

Total

Other (Fees, Writeoffs, etc.) $0 $-1000 $-1000 $-1000 $-1000 $-1000 $-1000

Demand Factor 100% 99% 99% 99% 99% 99% 98%

Material Cost Impact 100% 100% 100% 100% 100% 100% 100%

Admin Cost Impact 100% 100% 100% 100% 100% 100% 130%

Productivity Impact 100% 100% 100% 100% 100% 100% 100%

Awareness Impact 100% 100% 100% 100% 100% 100% 100%

Accessibility Impact 100% 100% 100% 100% 100% 100% 100%

CAPSTONE ® COURIER Page 13

Annual Report

Round: 6

Annual Report Digby C102348

Dec. 31, 2024

Balance Sheet

DEFINITIONS: Common Size: The common size column

simply represents each item as a percentage of total ASSETS 2024 2023

assets for that year. Cash: Your end-of-year cash Common

position. Accounts Receivable: Reflects the lag between

Size

delivery and payment of your products. Inventories: The Cash $49,565 27.5% $52,512

current value of your inventory across all products. A zero

Account Receivable $24,588 13.6% $22,206

indicates your company stocked out. Unmet demand

would, of course, fall to your competitors. Plant & Inventory $6,969 3.9% $288

Equipment: The current value of your plant. Accum Total Current Assets $81,122 44.9% $75,006

Deprec: The total accumulated depreciation from your

plant. Accts Payable: What the company currently owes

Plant & Equipment $195,640 108.0% $159,800

suppliers for materials and services. Current Debt: The

debt the company is obligated to pay during the next year Accumulated Depreciation ($96,267) -53.3% ($83,224)

of operations. It includes emergency loans used to keep Total Fixed Assets $99,373 55.1% $76,576

your company solvent should you run out of cash during Total Assets $180,496 100.0% $151,581

the year. Long Term Debt: The companys long term debt

is in the form of bonds, and this represents the total value LIABILITIES & OWNERS

of your bonds. Common Stock: The amount of capital

EQUITY

invested by shareholders in the company. Retained

Earnings: The profits that the company chose to keep Accounts Payable $16,282 9.0% $14,229

instead of paying to shareholders as dividends.

Current Debt $20,850 11.6% $0

Long Term Debt $7,500 4.2% $28,350

Total Liabilities $44,632 24.7% $42,579

Common Stock $18,191 10.1% $18,360

Retained Earnings $117,673 65.2% $90,642

Total Equity $135,864 75.3% $109,002

Total Liab. & O. Equity $180,496 100.0% $151,581

Cash Flow Statement

The Cash Flow Statement examines what happened in the Cash Account Cash Flows from Operating Activities 2024 2023

during the year. Cash injections appear as positive numbers and cash Net Income(Loss) $28,977 $22,923

withdrawals as negative numbers. The Cash Flow Statement is an excellent Depreciation $13,043 $10,653

tool for diagnosing emergency loans. When negative cash flows exceed Extraordinary gains/losses/writeoffs $0 $0

positives, you are forced to seek emergency funding. For example, if sales Accounts Payable $2,053 $1,761

are bad and you find yourself carrying an abundance of excess inventory,

Inventory ($6,682) $4,076

the report would show the increase in inventory as a huge negative cash

Accounts Receivable ($2,383) ($2,935)

flow. Too much unexpected inventory could outstrip your inflows, exhaust

your starting cash and force you to beg for money to keep your company Net cash from operation $35,008 $36,479

afloat. Cash Flows from Investing Activities

Plant Improvements ($35,840) ($7,400)

Cash Flows from Financing Activities

Dividends paid ($1,114) $0

Sales of common stock $0 $0

Purchase of common stock ($1,000) $0

Cash from long term debt $0 $1,000

Retirement of long term debt ($20,850) $0

Change in current debt(net) $20,850 ($13,900)

Net cash from financing activities ($2,114) ($12,900)

Net change in cash position ($2,946) $16,179

Closing cash position $49,565 $52,512

Annual Report Page 14

Round: 6

Annual Report Digby C102348

Dec. 31, 2024

2024 Income Statement

2024 Common

(Product Name) Daze Dell Dixie Dot Dune Derek Deyhi

Total

Size

Sales $62,171 $55,691 $36,779 $32,218 $30,251 $33,028 $59,334 $0 $309,472 100.0%

Variable Costs:

Direct Labor $21,371 $22,577 $9,208 $10,637 $9,928 $9,030 $24,862 $0 $107,613 34.8%

Direct Material $18,120 $11,917 $13,734 $13,311 $10,160 $12,459 $18,246 $0 $97,946 31.7%

Inventory Carry $824 $0 $0 $0 $0 $0 $12 $0 $836 0.3%

Total Variable $40,316 $34,494 $22,942 $23,947 $20,088 $21,488 $43,120 $0 $206,396 66.7%

Contribution Margin $21,855 $21,197 $13,837 $8,270 $10,163 $11,539 $16,214 $0 $103,076 33.3%

Period Costs:

Depreciation $3,293 $3,435 $1,320 $884 $884 $1,173 $2,053 $0 $13,043 4.2%

SG&A: R&D $371 $0 $465 $654 $456 $521 $0 $0 $2,467 0.8%

Promotions $1,400 $1,315 $1,340 $1,310 $1,380 $1,390 $1,330 $0 $9,465 3.1%

Sales $1,576 $2,024 $1,691 $1,242 $1,242 $1,461 $2,254 $0 $11,489 3.7%

Admin $920 $824 $544 $477 $448 $489 $878 $0 $4,580 1.5%

Total Period $7,560 $7,598 $5,360 $4,567 $4,410 $5,033 $6,516 $0 $41,043 13.3%

Net Margin $14,295 $13,599 $8,477 $3,704 $5,753 $6,506 $9,699 $0 $62,033 20.0%

Definitions: Sales: Unit Sales times list price. Direct Labor: Labor costs incurred to produce the product Other $13,515 4.4%

that was sold. Inventory Carry Cost: the cost unsold goods in inventory. Depreciation: Calculated on EBIT $48,518 15.7%

straight-line. 15-year depreciation of plant value. R&D Costs: R&D department expenditures for each Short Term Interest $2,127 0.7%

product. Admin: Administration overhead is estimated at 1.5% of sales. Promotions: The promotion budget Long Term Interest $855 0.3%

for each product. Sales: The sales force budget for each product. Other: Chargs not included in other Taxes $15,938 5.2%

categories such as Fees, Write offs, and TQM. The fees include money paid to investment bankers and Profit Sharing $622 0.2%

brokerage firms to issue new stocks or bonds plus consulting fees your instructor might assess. Write-offs Net Profit $28,977 9.4%

include the loss you might experience when you sell capacity or liquidate inventory as the result of

eliminating a production line. If the amount appears as a negative amount, then you actually made money

on the liquidation of capacity or inventory. EBIT: Earnings Before Interest and Taxes. Short Term Interest:

Interest expense based on last years current debt, including short term debt, long term notes that have

become due, and emergency loans, Long Term Interest: Interest paid on outstanding bonds. Taxes:

Income tax based upon a 35% tax rate. Profit Sharing: Profits shared with employees under the labor

contract. Net Profit: EBIT minus interest, taxes, and profit sharing.

Annual Report Page 15

You might also like

- Financial AccountingDocument2 pagesFinancial AccountingRakesh Sharma0% (2)

- This Study Resource Was: Andrea Jasmin D. Nazario October 29, 2020 BSA191A Intermediate Accounting 2Document5 pagesThis Study Resource Was: Andrea Jasmin D. Nazario October 29, 2020 BSA191A Intermediate Accounting 2Nah Hamza67% (3)

- Capstone Courier Round 5Document13 pagesCapstone Courier Round 5AkashNo ratings yet

- ZipCar SolutionDocument15 pagesZipCar SolutionAshwinKumarNo ratings yet

- Innocents Abroad - Currencies and International Stock ReturnsDocument112 pagesInnocents Abroad - Currencies and International Stock ReturnsGragnor PrideNo ratings yet

- Capstone Courier Round 5 ResultsDocument15 pagesCapstone Courier Round 5 ResultsSanyam GulatiNo ratings yet

- Masters of Business Administration-Intelligent Data Science Academic Year: 2019-20Document21 pagesMasters of Business Administration-Intelligent Data Science Academic Year: 2019-20Tania PoddarNo ratings yet

- GSRTC Presentation BY RAHESH - BKMIBA-HLBBADocument49 pagesGSRTC Presentation BY RAHESH - BKMIBA-HLBBArahesh sutariyaNo ratings yet

- Tata Motors and FIAT Auto FinalDocument37 pagesTata Motors and FIAT Auto FinalbalwanideepaNo ratings yet

- Toon Eneco PDFDocument4 pagesToon Eneco PDFDHEEPIKANo ratings yet

- Saito Solar - Discounted Cash Flow ValuationDocument8 pagesSaito Solar - Discounted Cash Flow ValuationSana BatoolNo ratings yet

- Citibank Group7Document30 pagesCitibank Group7Muhammad Mazhar YounusNo ratings yet

- Mustika RatuDocument17 pagesMustika Raturadhi_hirziNo ratings yet

- CVP Analysis QsDocument2 pagesCVP Analysis QsLaila Hozli33% (3)

- SFM Question Bank 2019Document32 pagesSFM Question Bank 2019Oyeleye Tofunmi100% (1)

- Capst Courier 7 RoundDocument15 pagesCapst Courier 7 Roundkuala singhNo ratings yet

- Courier 4Document14 pagesCourier 4vivek singhNo ratings yet

- Courier Round 7 (2028)Document15 pagesCourier Round 7 (2028)G H O S TNo ratings yet

- Problems-Finance Fall, 2014Document22 pagesProblems-Finance Fall, 2014jyoon2140% (1)

- Capsim Simulation: Team Eerie (Group 5)Document4 pagesCapsim Simulation: Team Eerie (Group 5)Dhruv KumbhareNo ratings yet

- Courier C58866 Rounds 1-6 (With Scores)Document78 pagesCourier C58866 Rounds 1-6 (With Scores)jackmooreausNo ratings yet

- Caterpillar Case StudyDocument6 pagesCaterpillar Case StudykhanNo ratings yet

- ZomatoDocument56 pagesZomatopreethishNo ratings yet

- Titanium Dioxide and Super Project Prof. Joshy JacobDocument3 pagesTitanium Dioxide and Super Project Prof. Joshy JacobSIDDHARTH SINGHNo ratings yet

- Indian UnicornsDocument8 pagesIndian UnicornsPrasaad TayadeNo ratings yet

- Electric Vehicle "Solution For Future Ecofriendly Autotech": Presented By: Ratna Wulan Charisma NurfitriDocument4 pagesElectric Vehicle "Solution For Future Ecofriendly Autotech": Presented By: Ratna Wulan Charisma NurfitriNovriyanto RianNo ratings yet

- PrakashaDocument12 pagesPrakashaSharan GowdaNo ratings yet

- Nerolac - Solution PDFDocument5 pagesNerolac - Solution PDFricha krishnaNo ratings yet

- Strategy: Strategy and Tactics Differ Mainly Around Time ScaleDocument18 pagesStrategy: Strategy and Tactics Differ Mainly Around Time Scalemash68No ratings yet

- Case Example - Delhi Metro - SolutionDocument14 pagesCase Example - Delhi Metro - Solutionlakshya jainNo ratings yet

- Automobile IndustryDocument7 pagesAutomobile IndustryAniket VermaNo ratings yet

- Ferrari Project CompleteDocument15 pagesFerrari Project CompleteAdrian CrutanNo ratings yet

- Hero MotoCorp DCF Solution 20200512 V2Document37 pagesHero MotoCorp DCF Solution 20200512 V2vijayNo ratings yet

- Case Study Application For Optimizing The Product Mix Problem of Linear Programming in The Apparel IndustryDocument8 pagesCase Study Application For Optimizing The Product Mix Problem of Linear Programming in The Apparel IndustrySmriti GoelNo ratings yet

- On Nirma CaseDocument36 pagesOn Nirma CaseMuskaan ChaudharyNo ratings yet

- ACC Cement Research Report and Equity ValuationDocument12 pagesACC Cement Research Report and Equity ValuationSougata RoyNo ratings yet

- P5 2maruti Suzuki Ssales PlanDocument17 pagesP5 2maruti Suzuki Ssales PlanAditya SakpalNo ratings yet

- Financial Modeling of Automobile Industry (Maruti Suzuki)Document26 pagesFinancial Modeling of Automobile Industry (Maruti Suzuki)Harshit PoddarNo ratings yet

- Marriot Corporation: The Cost of Capital: 1.598 Re-Levered BDocument1 pageMarriot Corporation: The Cost of Capital: 1.598 Re-Levered BAhmad AliNo ratings yet

- Kansai Nerolac QuestionDocument6 pagesKansai Nerolac Questionricha krishnaNo ratings yet

- Balance Sheet of Tata MotorsDocument6 pagesBalance Sheet of Tata Motorsnehanayaka25No ratings yet

- Ipucet Result 2020 PDFDocument294 pagesIpucet Result 2020 PDFparakram SinghNo ratings yet

- Case 1Document18 pagesCase 1Amit Kanti RoyNo ratings yet

- SimsimDocument3 pagesSimsimSid RoyNo ratings yet

- State Wise SDP 02 08 2021 11aug21Document6 pagesState Wise SDP 02 08 2021 11aug21Jahangir Seema NizamiNo ratings yet

- Mindtree Model ReferenceDocument66 pagesMindtree Model Referencesaidutt sharma100% (1)

- Sneaker Excel Sheet For Risk AnalysisDocument11 pagesSneaker Excel Sheet For Risk AnalysisSuperGuyNo ratings yet

- FBE 529 Lecture 1 PDFDocument26 pagesFBE 529 Lecture 1 PDFJIAYUN SHENNo ratings yet

- Case Study Cross Badging PDFDocument5 pagesCase Study Cross Badging PDFJithesh Kumar KNo ratings yet

- Solutions Balancing Process Capacity Simulation Challenge 1 and Challange 2Document29 pagesSolutions Balancing Process Capacity Simulation Challenge 1 and Challange 2Mariam AlraeesiNo ratings yet

- Capxm Final RoundDocument21 pagesCapxm Final RoundManoj KuchipudiNo ratings yet

- Business Intelligence AutomotiveDocument32 pagesBusiness Intelligence AutomotiveElsaNo ratings yet

- Commercial VehicleDocument12 pagesCommercial VehicleAsif ShaikhNo ratings yet

- Management LessonsDocument7 pagesManagement LessonsAnkush NayarNo ratings yet

- Tire City Case AnalysisDocument10 pagesTire City Case AnalysisVASANTADA SRIKANTH (PGP 2016-18)No ratings yet

- Berkshire Hathaway IncDocument2 pagesBerkshire Hathaway IncZerohedgeNo ratings yet

- Devyani International LTD - IPO Note-1Document4 pagesDevyani International LTD - IPO Note-1chinna rao100% (1)

- ATHERDocument4 pagesATHERSubham Arya, 11No ratings yet

- Eadr Project On Infosys CompanyDocument5 pagesEadr Project On Infosys CompanyDivyavadan MateNo ratings yet

- BIOCON Ratio AnalysisDocument3 pagesBIOCON Ratio AnalysisVinuNo ratings yet

- Total 621 1749 2544 3300Document6 pagesTotal 621 1749 2544 3300Anupam ChaplotNo ratings yet

- 256 Inquirer1Document41 pages256 Inquirer1sgoyal89No ratings yet

- Round: 4 Dec. 31, 2024: Selected Financial StatisticsDocument15 pagesRound: 4 Dec. 31, 2024: Selected Financial StatisticsCRNo ratings yet

- Round: 2 Dec. 31, 2022: Selected Financial StatisticsDocument15 pagesRound: 2 Dec. 31, 2022: Selected Financial StatisticsAshesh DasNo ratings yet

- Profe03 - Chapter 1 Business Combinations Recognition and MeasurementDocument19 pagesProfe03 - Chapter 1 Business Combinations Recognition and MeasurementSteffany Roque100% (1)

- Kertas Kerja KosongDocument19 pagesKertas Kerja KosongSyifa AlliaaNo ratings yet

- Interim Financial Reporting and Operating Segment Discussion Problems and Answer KeyDocument4 pagesInterim Financial Reporting and Operating Segment Discussion Problems and Answer Keyprincess QNo ratings yet

- Shilpa Medicare Initiating Coverage Mar 2014Document14 pagesShilpa Medicare Initiating Coverage Mar 2014bhavan123No ratings yet

- SMB2F2 2Document183 pagesSMB2F2 2Bajaj BhagyashreeNo ratings yet

- Analyzing Financial Statements: Before You Go On Questions and AnswersDocument52 pagesAnalyzing Financial Statements: Before You Go On Questions and AnswersNguyen Ngoc Minh Chau (K15 HL)No ratings yet

- Chapter6 - Trial balance and Preparation of Final Accounts яDocument13 pagesChapter6 - Trial balance and Preparation of Final Accounts яshreya taluja100% (1)

- Inventories Cost ApproachDocument56 pagesInventories Cost ApproachJD DLNo ratings yet

- Tarea Semana 3 Excel FBDocument14 pagesTarea Semana 3 Excel FBNoely EspinalNo ratings yet

- Hebron Arts - BSDocument9 pagesHebron Arts - BSMangsuan mungcheshamNo ratings yet

- Grennell FarmDocument1,270 pagesGrennell FarmPradeep Elavarasan50% (4)

- Exercise Financial Model IndividualDocument5 pagesExercise Financial Model IndividualHaziq SuhairiNo ratings yet

- Class Xi AccountancyDocument3 pagesClass Xi AccountancySWASTIKNo ratings yet

- CH 04Document4 pagesCH 04Nusirwan Mz50% (2)

- Chapter 1 - Income TaxDocument30 pagesChapter 1 - Income TaxKhanh LinhNo ratings yet

- FAC 310 TEST 1 2023 Final With SolutionDocument10 pagesFAC 310 TEST 1 2023 Final With SolutionGrechen UdigengNo ratings yet

- Accounting Interview Questions: What Is Minority Interest?Document16 pagesAccounting Interview Questions: What Is Minority Interest?vemula_ramakoti94840% (1)

- Cost Accounting Unit 1Document16 pagesCost Accounting Unit 1archana_anuragiNo ratings yet

- Abo Royce Stephen Cfas Activities AnswersDocument37 pagesAbo Royce Stephen Cfas Activities Answerscj gamingNo ratings yet

- Group 3 Case 04Document5 pagesGroup 3 Case 04Nelia Putri AnggrainiNo ratings yet

- Common Size Balance Sheet (Final) 3Document2 pagesCommon Size Balance Sheet (Final) 3varun rajNo ratings yet

- PERHITUNGANDocument4 pagesPERHITUNGANBeertyavrillianNo ratings yet

- Partnership LiquidationDocument6 pagesPartnership LiquidationJayhan PalmonesNo ratings yet

- SM Ch3-6Document14 pagesSM Ch3-6Danka PredolacNo ratings yet

- Fish RUsDocument11 pagesFish RUseia aieNo ratings yet

- Principles of Accountancy MCQDocument10 pagesPrinciples of Accountancy MCQlindakutty67% (3)