Professional Documents

Culture Documents

Slides08 01 PDF

Slides08 01 PDF

Uploaded by

Saddy ButtOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Slides08 01 PDF

Slides08 01 PDF

Uploaded by

Saddy ButtCopyright:

Available Formats

Tax Reporting vs.

Financial Reporting

• Income Tax Expense on the • Income Tax Payable (or paid in

income statement is based on cash) is based on Taxable Income

pre-tax income computed using using tax code rules

GAAP (or IFRS)

Financial Statements (“Books”): Tax Return:

Pre-tax income (per GAAP rules) Taxable income (per IRS rules)

x Effective tax rate . x Statutory tax rate .

= Income Tax Expense = Income Tax Payable

• The two tax amounts can be DIFFERENT!

– Permanent differences

– Temporary differences

KNOWLEDGE FOR ACTION

Tax Reporting vs. Financial Reporting

Examples GAAP Tax Code

Interest income from Interest revenue increases Does not affect taxable

municipal bonds pre-tax income income (tax-exempt)

Cash advances Revenue recognized when Revenue recognized when

from customers earned (in future) cash collected (now)

(unearned revenue)

Bad debt expense Expense recognized when Expense when account is

sale is made (now) written-off (in future)

Depreciation Depreciation method Depreciation schedule

chosen by firm from tax authority

KNOWLEDGE FOR ACTION

Example

Books Tax Return

2011 2012 2011 2012

EBITDA 50,000 50,000 EBITDA 50,000 50,000

• EBITDA in this example is Earnings before depreciation, municipal

bond interest revenue, and taxes

KNOWLEDGE FOR ACTION

Example: Permanent Differences

Books Tax Return

2011 2012 2011 2012

EBITDA 50,000 50,000 EBITDA 50,000 50,000

Muni Interest Revenue 1,000 1,000 Muni Interest Revenue 0 0

• Permanent Differences

– Revenues that are never included in taxable income and expenses that are never

deductible for tax purposes

• Examples: Interest on tax-exempt municipal bonds, tax penalties and tax credits, state

and foreign taxes

– Do not reverse over time

– Cause the Effective Tax Rate to not equal the Statutory Tax Rate

KNOWLEDGE FOR ACTION

Example: Temporary Differences

Books Tax Return

2011 2012 2011 2012

EBITDA 50,000 50,000 EBITDA 50,000 50,000

Muni Interest Revenue 1,000 1,000 Muni Interest Revenue 0 0

Depreciation (10,000) (10,000) Depreciation (15,000) (5,000)

• Temporary Differences

– Revenues or expenses recognized in a different period for tax purposes than for

financial reporting purposes

• Examples: book vs. tax depreciation, bad debt expense, unearned revenue

– Reverse over time

– Stored up in Deferred Tax Assets and Liabilities

KNOWLEDGE FOR ACTION

Example: Pre-tax Income vs. Taxable Income

Books Tax Return

2011 2012 2011 2012

EBITDA 50,000 50,000 EBITDA 50,000 50,000

Muni Interest Revenue 1,000 1,000 Muni Interest Revenue 0 0

Depreciation (10,000) (10,000) Depreciation (15,000) (5,000)

Pre-tax Income 41,000 41,000 Taxable income 35,000 45,000

• Pre-Tax Income: Earnings before taxes under GAAP

• Taxable Income: Earnings before taxes under tax rules

– Differences between pre-tax income and taxable income arise from permanent

and temporary differences

KNOWLEDGE FOR ACTION

Example: Income Tax Payable

Books Tax Return

2011 2012 2011 2012

EBITDA 50,000 50,000 EBITDA 50,000 50,000

Muni Interest Revenue 1,000 1,000 Muni Interest Revenue 0 0

Depreciation (10,000) (10,000) Depreciation (15,000) (5,000)

Pre-tax Income 41,000 41,000 Taxable income 35,000 45,000

X Statutory rate 0.35 0.35

Income Tax Payable 12,250 15,750

• Statutory rate: Tax rate set by the government

• Income Tax Payable: Taxes owed to the government

– Taxable income x statutory rate

KNOWLEDGE FOR ACTION

Example: Adjusted Pre-Tax Income

Books Tax Return

2011 2012 2011 2012

EBITDA 50,000 50,000 EBITDA 50,000 50,000

Muni Interest Revenue 1,000 1,000 Muni Interest Revenue 0 0

Depreciation (10,000) (10,000) Depreciation (15,000) (5,000)

Pre-tax Income 41,000 41,000 Taxable income 35,000 45,000

Remove Perm Diff (1,000) (1,000) X Statutory rate 0.35 0.35

Adj. Pre-tax Income 40,000 40,000 Income Tax Payable 12,250 15,750

• Adjusted Pre-Tax Income

– Used to compute Income Tax Expense for financial reporting purposes

– Pre-tax income adjusted for permanent tax differences

KNOWLEDGE FOR ACTION

Example: Income Tax Expense

Books Tax Return

2011 2012 2011 2012

EBITDA 50,000 50,000 EBITDA 50,000 50,000

Muni Interest Revenue 1,000 1,000 Muni Interest Revenue 0 0

Depreciation (10,000) (10,000) Depreciation (15,000) (5,000)

Pre-tax Income 41,000 41,000 Taxable income 35,000 45,000

Remove Perm Diff (1,000) (1,000) X Statutory rate 0.35 0.35

Adj. Pre-tax Income 40,000 40,000 Income Tax Payable 12,250 15,750

X Statutory rate 0.35 0.35

Income Tax Expense 14,000 14,000

• Income Tax Expense

– Number reported on the income statement

– Adjusted Pre-Tax Income x Statutory rate

– Differs from Income Tax Payable due to Temporary Differences

KNOWLEDGE FOR ACTION

Example: Income Tax Expense vs. Income Tax Payable

Books Tax Return

2011 2012 2011 2012

EBITDA 50,000 50,000 EBITDA 50,000 50,000

Muni Interest Revenue 1,000 1,000 Muni Interest Revenue 0 0

Depreciation (10,000) (10,000) Depreciation (15,000) (5,000)

Pre-tax Income 41,000 41,000 Taxable income 35,000 45,000

Remove Perm Diff (1,000) (1,000) X Statutory rate 0.35 0.35

Adj. Pre-tax Income 40,000 40,000 Income Tax Payable 12,250 15,750

X Statutory rate 0.35 0.35

Income Tax Expense 14,000 14,000

IncTaxExp–IncTaxPay 1,750 (1,750)

KNOWLEDGE FOR ACTION

Example: Income Tax Expense vs. Income Tax Payable

Books Tax Return

2011 2012 2011 2012

EBITDA 50,000 50,000 EBITDA 50,000 50,000

Muni Interest Revenue 1,000 1,000 Muni Interest Revenue 0 0

Depreciation (10,000) (10,000) Depreciation (15,000) (5,000)

Pre-tax Income 41,000 41,000 Taxable income 35,000 45,000

Remove Perm Diff (1,000) (1,000) X Statutory rate 0.35 0.35

Adj. Pre-tax Income 40,000 40,000 Income Tax Payable 12,250 15,750

X Statutory rate 0.35 0.35

Income Tax Expense 14,000 14,000

Book Depr-Tax Depr 5000 (5000)

IncTaxExp – IncTaxPay 1,750 (1,750)

KNOWLEDGE FOR ACTION

Example: Income Tax Expense vs. Income Tax Payable

Books Tax Return

2011 2012 2011 2012

EBITDA 50,000 50,000 EBITDA 50,000 50,000

Muni Interest Revenue 1,000 1,000 Muni Interest Revenue 0 0

Depreciation (10,000) (10,000) Depreciation (15,000) (5,000)

Pre-tax Income 41,000 41,000 Taxable income 35,000 45,000

Remove Perm Diff (1,000) (1,000) X Statutory rate 0.35 0.35

Adj. Pre-tax Income 40,000 40,000 Income Tax Payable 12,250 15,750

X Statutory rate 0.35 0.35

Income Tax Expense 14,000 14,000

Book Depr-Tax Depr 5000 (5000)

IncTaxExp – IncTaxPay 1,750 (1,750) Tax Effect @ 35% 1,750 (1,750)

• Temporary Differences reverse over time!

KNOWLEDGE FOR ACTION

Example: Effective Tax Rate

Books Tax Return

2011 2012 2011 2012

EBITDA 50,000 50,000 EBITDA 50,000 50,000

Muni Interest Revenue 1,000 1,000 Muni Interest Revenue 0 0

Depreciation (10,000) (10,000) Depreciation (15,000) (5,000)

Pre-tax Income 41,000 41,000 Taxable income 35,000 45,000

Remove Perm Diff (1,000) (1,000) X Statutory rate 0.35 0.35

Adj. Pre-tax Income 40,000 40,000 Income Tax Payable 12,250 15,750

X Statutory rate 0.35 0.35

Income Tax Expense 14,000 14,000

Effective Tax Rate 34.1% 34.1%

• Effective Tax Rate = Income Tax Expense / Pre-Tax Income

– Does not equal 35% (Statutory Rate) because of Permanent Differences

– Does not reverse

KNOWLEDGE FOR ACTION

Tax Expense Calculation: Summary

Books Tax Return

2011 2012 2011 2012

EBITDA 50,000 50,000 EBITDA 50,000 50,000

Muni Interest Revenue 1,000 1,000 Muni Interest Revenue 0 0

Depreciation (10,000) (10,000) Depreciation (15,000) (5,000)

Pre-tax Income 41,000 41,000 Taxable income 35,000 45,000

Income Tax Expense 14,000 14,000 Income Tax Payable 12,250 15,750

Pre-Tax Income 41,000 2011

+/- Permanent Diff - 1,000

Adjusted Pre-Tax Inc X Statutory rate = Income Tax Expense 40,000 X 0.35 = 14,000

+/- Temporary Diff -5,000

Taxable Income X Statutory rate = Income Tax Payable 35,000 X 0.35 = 12,250

KNOWLEDGE FOR ACTION

Tax Expense Calculation: Summary

Books Tax Return

2011 2012 2011 2012

EBITDA 50,000 50,000 EBITDA 50,000 50,000

Muni Interest Revenue 1,000 1,000 Muni Interest Revenue 0 0

Depreciation (10,000) (10,000) Depreciation (15,000) (5,000)

Pre-tax Income 41,000 41,000 Taxable income 35,000 45,000

Income Tax Expense 14,000 14,000 Income Tax Payable 12,250 15,750

Pre-Tax Income 41,000 2012

+/- Permanent Diff - 1,000

Adjusted Pre-Tax Inc X Statutory rate = Income Tax Expense 40,000 X 0.35 = 14,000

+/- Temporary Diff +5,000

Taxable Income X Statutory rate = Income Tax Payable 45,000 X 0.35 = 15,750

KNOWLEDGE FOR ACTION

You might also like

- Cash Flow Statement StudentDocument60 pagesCash Flow Statement StudentJanine MosatallaNo ratings yet

- Accounting QBDocument661 pagesAccounting QBTrang VũNo ratings yet

- Tutorial Letter 102/3/2020: Question BankDocument303 pagesTutorial Letter 102/3/2020: Question Bankdivyesh mehtaNo ratings yet

- Sample Problems With AnswerDocument7 pagesSample Problems With AnswerCatherine OrdoNo ratings yet

- Assignment 1 MENG 6502Document6 pagesAssignment 1 MENG 6502russ jhingoorieNo ratings yet

- Supplementory Lease Deed!!!Document2 pagesSupplementory Lease Deed!!!Saddy Butt67% (3)

- Group 1 - TransDigm CaseDocument2 pagesGroup 1 - TransDigm CaseIshan BhatiaNo ratings yet

- Tax Reporting vs. Financial Reporting: - Income Tax Expense On The - Income Tax Payable (Or Paid inDocument15 pagesTax Reporting vs. Financial Reporting: - Income Tax Expense On The - Income Tax Payable (Or Paid inVen KatNo ratings yet

- Income Taxes GtstatDocument32 pagesIncome Taxes Gtstatgaurav tiwariNo ratings yet

- Deferred Tax Assets: - Arise From Temporary Differences Where, Initially, Tax Rules RequireDocument14 pagesDeferred Tax Assets: - Arise From Temporary Differences Where, Initially, Tax Rules RequireSaddy ButtNo ratings yet

- Ias 12Document33 pagesIas 12samrawithagos2002No ratings yet

- Asset-V1 MITx+15.516x+1T2024+type@asset+block@module 6b Lecture SlidesDocument40 pagesAsset-V1 MITx+15.516x+1T2024+type@asset+block@module 6b Lecture SlidesMarkus_MardenNo ratings yet

- Ias 12Document33 pagesIas 12bisrattesfayeNo ratings yet

- Pas 12Document27 pagesPas 12Princess Jullyn ClaudioNo ratings yet

- Income-Taxes HandoutDocument22 pagesIncome-Taxes HandoutAhMed MahMoudNo ratings yet

- Meet 11-Accounting For Income Taxes-DYP PDFDocument19 pagesMeet 11-Accounting For Income Taxes-DYP PDFRENDY FILIANGNo ratings yet

- Chapter One Accounting For Income TaxesDocument55 pagesChapter One Accounting For Income TaxestalilaNo ratings yet

- ACC2001 Lecture 4Document53 pagesACC2001 Lecture 4michael krueseiNo ratings yet

- IncomeTax IAS 12 Revised Edited GD 2020Document46 pagesIncomeTax IAS 12 Revised Edited GD 2020yonas alemuNo ratings yet

- Accounting For Deferred TaxDocument14 pagesAccounting For Deferred TaxDeepan MarxNo ratings yet

- Pertemuan 12 Chapter 19 KiesoDocument90 pagesPertemuan 12 Chapter 19 KiesoJordan SiahaanNo ratings yet

- The Ice DragonDocument26 pagesThe Ice DragonRobertNo ratings yet

- FR16 Taxation (Stud) .Document45 pagesFR16 Taxation (Stud) .duong duongNo ratings yet

- CH 19Document101 pagesCH 19Miranti NurulNo ratings yet

- Intermediate Accounting IFRS 2nd Edition Kieso, Weygandt, and WarfieldDocument59 pagesIntermediate Accounting IFRS 2nd Edition Kieso, Weygandt, and WarfieldSumon iqbalNo ratings yet

- Financial Statements xAYwDocument21 pagesFinancial Statements xAYwKinNo ratings yet

- Ias 12Document28 pagesIas 12Hagere EthiopiaNo ratings yet

- IAS#12Document31 pagesIAS#12Shah KamalNo ratings yet

- PAS 12 Accounting For Income TaxDocument17 pagesPAS 12 Accounting For Income TaxReynaldNo ratings yet

- Lecture Three 2024Document20 pagesLecture Three 2024Khulekani SbonokuhleNo ratings yet

- Accounting For Income TaxesDocument16 pagesAccounting For Income TaxesMUNAWAR ALI100% (5)

- LMT School of Management, Thapar University Masters of Business AdministrationDocument9 pagesLMT School of Management, Thapar University Masters of Business Administrationtechnical sNo ratings yet

- IASSS16e Ch16.Ab - AzDocument33 pagesIASSS16e Ch16.Ab - AzLovely DungcaNo ratings yet

- ch19 Accounting Income TaxesDocument102 pagesch19 Accounting Income TaxesIndah SariwatiNo ratings yet

- F7.1 Chap 15 - TaxationDocument33 pagesF7.1 Chap 15 - TaxationLê Đăng Cát NhậtNo ratings yet

- Chapter 10: Income TaxDocument32 pagesChapter 10: Income TaxNgô Thành DanhNo ratings yet

- LM09 Analysis of Income Taxes IFT NotesDocument12 pagesLM09 Analysis of Income Taxes IFT NotesjagjitbhaimbbsNo ratings yet

- ASC 740 Income Tax Accounting Challenges in 2013: Presenting A Live 110-Minute Teleconference With Interactive Q&ADocument96 pagesASC 740 Income Tax Accounting Challenges in 2013: Presenting A Live 110-Minute Teleconference With Interactive Q&Agir botNo ratings yet

- Maksi Perbanas IAS 19 Income Taxes-1Document102 pagesMaksi Perbanas IAS 19 Income Taxes-1Vi Trio100% (1)

- Ind As 12Document74 pagesInd As 12Akhil AkhyNo ratings yet

- Ind As 12Document92 pagesInd As 12stutisinha.chandraNo ratings yet

- 14Document106 pages14Alex liaoNo ratings yet

- FormulasDocument9 pagesFormulasYajZaragozaNo ratings yet

- IAS 12 - Deferred-2Document66 pagesIAS 12 - Deferred-2Keyshall PofadderNo ratings yet

- Ind As On Items Impacting The Financial Statements: Unit 1: Indian Accounting Standard 12: Income TaxesDocument61 pagesInd As On Items Impacting The Financial Statements: Unit 1: Indian Accounting Standard 12: Income Taxesjigar BrahmbhattNo ratings yet

- CH 18Document53 pagesCH 18petitmar1No ratings yet

- Difference Between Accounting Rules and Tax RulesDocument18 pagesDifference Between Accounting Rules and Tax RulesCezar Rishane Mae SaligueNo ratings yet

- As 22.deffered - TaxDocument7 pagesAs 22.deffered - TaxabrastogiNo ratings yet

- Taxation in Financial Statements (IAS12)Document30 pagesTaxation in Financial Statements (IAS12)Mo HachimNo ratings yet

- IAS 12 Income TaxDocument62 pagesIAS 12 Income TaxValerie Verity MarondedzeNo ratings yet

- Analysis of FSDocument28 pagesAnalysis of FSHaseeb TariqNo ratings yet

- Special Allowable Itemized DeductionsDocument13 pagesSpecial Allowable Itemized DeductionsSandia EspejoNo ratings yet

- Deferred Tax Lecture SlidesDocument38 pagesDeferred Tax Lecture Slidesmd salehinNo ratings yet

- Income Tax - Corporations Sample Problems: SolutionsDocument12 pagesIncome Tax - Corporations Sample Problems: SolutionsYellow BelleNo ratings yet

- Task 2 Financial Statement AnalysisDocument10 pagesTask 2 Financial Statement AnalysisUzma SiddiquiNo ratings yet

- Ninja Sparring - FAR (Income Taxes)Document19 pagesNinja Sparring - FAR (Income Taxes)David BrawleyNo ratings yet

- CH 5 SolutionDocument36 pagesCH 5 SolutionSen Ho Ng0% (1)

- IAS (7) Cashflow-6-3-2020Document32 pagesIAS (7) Cashflow-6-3-2020Dana HasanNo ratings yet

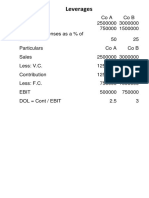

- AFM IBSB Leverages WordDocument16 pagesAFM IBSB Leverages WordSangeetha K SNo ratings yet

- Intermediate Accounting: Assignment 4: Exercise 4-6: Multiple-Step and Extraordinary ItemsDocument13 pagesIntermediate Accounting: Assignment 4: Exercise 4-6: Multiple-Step and Extraordinary ItemsMuhammad MalikNo ratings yet

- Accounting For Income TaxDocument14 pagesAccounting For Income TaxJasmin Gubalane100% (1)

- Ethiopia D3S4 Income TaxesDocument19 pagesEthiopia D3S4 Income TaxesEshetie Mekonene AmareNo ratings yet

- Taxnz221 WS1 Actsols 02Document16 pagesTaxnz221 WS1 Actsols 02Joshua EbarleNo ratings yet

- Dropshipping Hunting SheetDocument488 pagesDropshipping Hunting SheetSaddy ButtNo ratings yet

- Partnership Deed-Zarqa PharmaDocument3 pagesPartnership Deed-Zarqa PharmaSaddy ButtNo ratings yet

- Writ Petition (Contempt Criminal Matter) Mst. Asia Nabeela (ADV Mian Muhammad Yasin)Document6 pagesWrit Petition (Contempt Criminal Matter) Mst. Asia Nabeela (ADV Mian Muhammad Yasin)Saddy ButtNo ratings yet

- In The Lahore High Court, Lahore: Ghani Distirct Mohammad AgencyDocument3 pagesIn The Lahore High Court, Lahore: Ghani Distirct Mohammad AgencySaddy ButtNo ratings yet

- Declaration by Banking CourtDocument28 pagesDeclaration by Banking CourtSaddy ButtNo ratings yet

- Auction ProclamationDocument81 pagesAuction ProclamationSaddy ButtNo ratings yet

- SEc 9 (3) FIODocument14 pagesSEc 9 (3) FIOSaddy ButtNo ratings yet

- Nestle Income Statement & Balance SheetDocument10 pagesNestle Income Statement & Balance SheetDristi SinghNo ratings yet

- Measuring Investment ReturnsDocument8 pagesMeasuring Investment ReturnsErrah Jenn CajesNo ratings yet

- Daily Report 192 27-08-2021Document176 pagesDaily Report 192 27-08-2021jay ResearchNo ratings yet

- 2024 Financial Derivatives Practice QuestionsDocument9 pages2024 Financial Derivatives Practice Questions24a4013096No ratings yet

- Bankrupty Liquidation and ReorDocument31 pagesBankrupty Liquidation and ReorKale MessayNo ratings yet

- Capital Gain Tax-CGT System: NCCPLDocument49 pagesCapital Gain Tax-CGT System: NCCPLNaveed KhanNo ratings yet

- Statement of Cash Flows 4Document6 pagesStatement of Cash Flows 4Rashid W QureshiNo ratings yet

- Finance - Financial Planning ProcessDocument9 pagesFinance - Financial Planning ProcessTrishia Lynn MartinezNo ratings yet

- Assignment 1 - Financial Statement AnalysisDocument2 pagesAssignment 1 - Financial Statement AnalysisNabilla RahmadhiyaNo ratings yet

- Lecture7 Ratio AnalysisDocument31 pagesLecture7 Ratio AnalysisAeris StrongNo ratings yet

- Strategic Financial ManagementDocument96 pagesStrategic Financial Managementansary75No ratings yet

- Corporate Financing and Planning Course1Document24 pagesCorporate Financing and Planning Course1edoardozanetta99No ratings yet

- Salient Differences Between IAS 39 and IFRS 9Document3 pagesSalient Differences Between IAS 39 and IFRS 9Dennis Velasquez50% (2)

- DEPOSITORY RECEIPT-A NoteDocument1 pageDEPOSITORY RECEIPT-A NoteFathimaNo ratings yet

- Kotak Mahindra INC FY23Document22 pagesKotak Mahindra INC FY23Kaneez FatimaNo ratings yet

- Chap002 PPTDocument25 pagesChap002 PPTUmaid FaisalNo ratings yet

- Corporations: Organization and Capital Stock Transactions: Weygandt - Kieso - KimmelDocument54 pagesCorporations: Organization and Capital Stock Transactions: Weygandt - Kieso - Kimmelkey aidanNo ratings yet

- Analisis Laporan Keuangan PT Blue BirdDocument4 pagesAnalisis Laporan Keuangan PT Blue BirdSedih BerasaNo ratings yet

- Assignment 4 - Contemporary Engineering BookDocument9 pagesAssignment 4 - Contemporary Engineering BookDhiraj NayakNo ratings yet

- Paco Company: A. Accounting For Corporate LiquidationDocument3 pagesPaco Company: A. Accounting For Corporate LiquidationTine Griego100% (1)

- Jurnal Seeti RevisiDocument11 pagesJurnal Seeti RevisiAlexiz HoldingNo ratings yet

- Public Announcement - SEPL 25.11.2022Document1 pagePublic Announcement - SEPL 25.11.2022VishalNo ratings yet

- SMU Company Law Consolidated Notes FinalsDocument26 pagesSMU Company Law Consolidated Notes FinalsOng LayLiNo ratings yet

- An Introduction To Financial ManagementDocument17 pagesAn Introduction To Financial Managementariel mahardikaNo ratings yet

- 7 Audit of Shareholders Equity and Related Accounts Dlsau Integ t31920Document5 pages7 Audit of Shareholders Equity and Related Accounts Dlsau Integ t31920Heidee ManliclicNo ratings yet

- Est Time: 01-05 Financial Statements: Solutions To Chapter 3 Accounting and FinanceDocument16 pagesEst Time: 01-05 Financial Statements: Solutions To Chapter 3 Accounting and FinanceAEM EntertainmentNo ratings yet