Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

24 viewsCapital Structure Decision

Capital Structure Decision

Uploaded by

sushantscalperThis document discusses a case study of capital structure decisions in small and medium enterprises (SMEs) in the road freight industry. It analyzes how management in these firms reason about their capital structure choices. The study found that most companies prefer internal financing through retained earnings and see bank loans as a secondary option. Management's desire for independence, past experiences, and risk tolerance influence this preferred financing order. The capital structure strategy is shaped by beliefs about debt and perceived needs for debt. While growth is usually debt-financed, these SMEs have a restrictive view of debt that limits their desire to grow rapidly. All companies used some debt financing despite a preference for retained earnings.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Training Manual For DFS Production For The Salt ProcessorsDocument115 pagesTraining Manual For DFS Production For The Salt ProcessorsSyed AhamedNo ratings yet

- Comunicaciones Digitales Avanzadas DEBER 1 (Select Max. 10 Problems and Answer The Two Questions)Document3 pagesComunicaciones Digitales Avanzadas DEBER 1 (Select Max. 10 Problems and Answer The Two Questions)Cristian Sancho LopezNo ratings yet

- Final Report of SIPDocument56 pagesFinal Report of SIPRahul Parashar100% (1)

- Dubai's Golden SandsDocument17 pagesDubai's Golden SandsscrbdfanNo ratings yet

- Capital Structure Decisions: Research in Estonian Non-Financial CompaniesDocument3 pagesCapital Structure Decisions: Research in Estonian Non-Financial CompaniesMridul LuthraNo ratings yet

- The Impact of Capital StructureDocument27 pagesThe Impact of Capital StructureJoy JepchirchirNo ratings yet

- Capital Structure On Bank Performance Report.Document25 pagesCapital Structure On Bank Performance Report.Aniba ButtNo ratings yet

- Post - Mid Assignment 2: Zahra Faiz June 2020Document5 pagesPost - Mid Assignment 2: Zahra Faiz June 2020Laiba ManzoorNo ratings yet

- Literature Review Capital StructureDocument4 pagesLiterature Review Capital Structureea793wsz100% (1)

- Thesis Capital Structure and Firm PerformanceDocument8 pagesThesis Capital Structure and Firm Performancelaurasmithkansascity100% (2)

- Capital Structure and Firm Performance EDocument12 pagesCapital Structure and Firm Performance EBasilio MaliwangaNo ratings yet

- Dividend Policy of Everest Bank Limited: A Thesis Proposal byDocument9 pagesDividend Policy of Everest Bank Limited: A Thesis Proposal byRam khadkaNo ratings yet

- The Impact of Debt Financing On CompanyDocument25 pagesThe Impact of Debt Financing On CompanykasmshahabNo ratings yet

- How Do CFOs mak-WPS OfficeDocument12 pagesHow Do CFOs mak-WPS OfficeLaiqaNo ratings yet

- Financing Decision - SMEs Data - V1Document17 pagesFinancing Decision - SMEs Data - V1Trịnh Hồng HàNo ratings yet

- Proposal ThesisDocument8 pagesProposal ThesisFahad Ali 3516-FBAS/BSSE/F17No ratings yet

- Summary Graham and HarveyDocument2 pagesSummary Graham and HarveyJingwen WangNo ratings yet

- Capital Structure Dessertation FinalDocument29 pagesCapital Structure Dessertation FinalBasavaraj MtNo ratings yet

- Research Paper Capital Structure PDFDocument7 pagesResearch Paper Capital Structure PDFfvfmxb2y100% (1)

- Research Paper in Finance ManagementDocument8 pagesResearch Paper in Finance Managementggsmsyqif100% (1)

- Dissertation On Access To FinanceDocument6 pagesDissertation On Access To FinancePayToDoPaperCanada100% (1)

- The Effect of Financial Constraints On Corporate Investment DecisionsDocument5 pagesThe Effect of Financial Constraints On Corporate Investment DecisionsJames ShamaunNo ratings yet

- Dissertation On Impact of Capital Structure On ProfitabilityDocument5 pagesDissertation On Impact of Capital Structure On ProfitabilityWriteMyPaperForMeUKNo ratings yet

- GROUP 1 Article Review FM 8 The Relationship Between The Cash Flow and InvestmentsDocument5 pagesGROUP 1 Article Review FM 8 The Relationship Between The Cash Flow and InvestmentsJUDIL BANASTAONo ratings yet

- Term Paper New SeniDocument7 pagesTerm Paper New SeniBiniyam YitbarekNo ratings yet

- Back GroundDocument8 pagesBack GroundAli ShahanNo ratings yet

- Analytical Study of Capital Structure of Icici BankDocument22 pagesAnalytical Study of Capital Structure of Icici BankKuldeep Ban100% (2)

- The Speed of Adjustment Towards Optimal Capital Structure A Test of Dynamic Trade-Off ModelDocument12 pagesThe Speed of Adjustment Towards Optimal Capital Structure A Test of Dynamic Trade-Off ModelaliefNo ratings yet

- Finance Dissertation StructureDocument5 pagesFinance Dissertation StructurePayToDoPaperNewHaven100% (1)

- Synphosis On Project FinanceDocument3 pagesSynphosis On Project FinanceSatya KumarNo ratings yet

- Corporate Finance Term PaperDocument19 pagesCorporate Finance Term Paperabirhossain20031No ratings yet

- Article Review MohammedDocument13 pagesArticle Review MohammedG.A.A.P PRO ACCTNo ratings yet

- Literature Review On Optimal Capital StructureDocument6 pagesLiterature Review On Optimal Capital Structureafmzaoahmicfxg100% (2)

- Literature Review On Capital Budgeting PDFDocument7 pagesLiterature Review On Capital Budgeting PDFc5g10bt2100% (1)

- Capital Budgeting JobelleDocument5 pagesCapital Budgeting JobelleSheena PretestoNo ratings yet

- Term Paper Seni2Document6 pagesTerm Paper Seni2Biniyam YitbarekNo ratings yet

- Credit Banking Romanian Eco Joural June 2016Document15 pagesCredit Banking Romanian Eco Joural June 2016noor ul hqNo ratings yet

- Zuhuur 1Document15 pagesZuhuur 1Khader MohamedNo ratings yet

- Term Paper of Financial ManagementDocument6 pagesTerm Paper of Financial Managementafmzmxkayjyoso100% (1)

- MSCTHESISDocument84 pagesMSCTHESISPtomsa KemuelNo ratings yet

- An Evaluation of Capital Structure and Profitability of Business OrganizationDocument16 pagesAn Evaluation of Capital Structure and Profitability of Business OrganizationPushpa Barua0% (1)

- Finance Dissertation SampleDocument8 pagesFinance Dissertation SampleSomeoneToWriteMyPaperForMeEvansville100% (1)

- The Small Medium-Free Trade Zone That Able To Acquire DebtDocument10 pagesThe Small Medium-Free Trade Zone That Able To Acquire DebtTest AccountNo ratings yet

- The Capital Budgeting Decisions of Small BusinessesDocument21 pagesThe Capital Budgeting Decisions of Small BusinessesKumar KrisshNo ratings yet

- CF SummaryDocument1 pageCF SummaryVikram RatneNo ratings yet

- Literature Review On Sme FinancingDocument5 pagesLiterature Review On Sme Financingaflsimgfs100% (1)

- Strategic Financial ManagementDocument19 pagesStrategic Financial Managementsai krishnaNo ratings yet

- Research Final - AccountingDocument45 pagesResearch Final - Accountingamith chathurangaNo ratings yet

- Published Version Impact of Banking Sector Development On Capital Structure of Non-Financial Sector Firms in PakistanDocument12 pagesPublished Version Impact of Banking Sector Development On Capital Structure of Non-Financial Sector Firms in Pakistanumar farooqNo ratings yet

- Title: Lending and Investing Framework and Its Relevance To A Corporate EntityDocument3 pagesTitle: Lending and Investing Framework and Its Relevance To A Corporate Entitykalaimani25No ratings yet

- First VisitDocument8 pagesFirst VisitJahed EmonNo ratings yet

- Banking SectorDocument27 pagesBanking SectorMiss IqbalNo ratings yet

- Article 1Document7 pagesArticle 1Wijdan Saleem EdwanNo ratings yet

- Synthesis of The Reviewed Studies (Udarbe Part)Document3 pagesSynthesis of The Reviewed Studies (Udarbe Part)Aimee UdarbeNo ratings yet

- Article 1 PDFDocument7 pagesArticle 1 PDFWijdan Saleem EdwanNo ratings yet

- Sources of FundsDocument64 pagesSources of FundsravikumarreddytNo ratings yet

- Research Project On Financial LeverageDocument42 pagesResearch Project On Financial LeverageMarryam Majeed63% (8)

- Harvard Paper On Capital StructureDocument34 pagesHarvard Paper On Capital StructureSagarSuryavanshiNo ratings yet

- Thesis Optimal Capital StructureDocument5 pagesThesis Optimal Capital Structurejennysmithportland100% (1)

- The Effect of Sales Growth On The Determinants of Capital Structure of Listed Companies in Tehran Stock ExchangeDocument6 pagesThe Effect of Sales Growth On The Determinants of Capital Structure of Listed Companies in Tehran Stock ExchangeJonathan SangimpianNo ratings yet

- Corporate Finance Dissertation TitlesDocument7 pagesCorporate Finance Dissertation TitlesPayToDoPaperCanada100% (1)

- Empirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveFrom EverandEmpirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveNo ratings yet

- Degree of Leverage: Empirical Analysis from the Insurance SectorFrom EverandDegree of Leverage: Empirical Analysis from the Insurance SectorNo ratings yet

- EIB Working Papers 2019/10 - Structural and cyclical determinants of access to finance: Evidence from EgyptFrom EverandEIB Working Papers 2019/10 - Structural and cyclical determinants of access to finance: Evidence from EgyptNo ratings yet

- Company Profile - V2Document4 pagesCompany Profile - V2bhuvaneshelango2209No ratings yet

- Consumer Redress: Fair Trade Enforcement BureauDocument47 pagesConsumer Redress: Fair Trade Enforcement BureauMaria LovesongorNo ratings yet

- AC ResidentialDocument18 pagesAC ResidentialHiten VadkareNo ratings yet

- Norway Joint Venture Audit GuidelinesDocument31 pagesNorway Joint Venture Audit GuidelinesPatekJoaquinNo ratings yet

- Athul AjiDocument5 pagesAthul AjiAsif SNo ratings yet

- Operating System (5th Semester) : Prepared by Sanjit Kumar Barik (Asst Prof, Cse) Module-IiiDocument41 pagesOperating System (5th Semester) : Prepared by Sanjit Kumar Barik (Asst Prof, Cse) Module-IiiJeevanantham KannanNo ratings yet

- Sheik Md. Maadul Hoque (ID 150201010035)Document49 pagesSheik Md. Maadul Hoque (ID 150201010035)Mizanur RahmanNo ratings yet

- Malinta PDFDocument8 pagesMalinta PDFAngelina CruzNo ratings yet

- Blueberry Jam Export Plan-1Document22 pagesBlueberry Jam Export Plan-1Nicole PortalNo ratings yet

- Pemanfaatan Media Sosial Dan Ecommerce Sebagai Media Pemasaran Dalam Mendukung Peluang Usaha Mandiri Pada Masa Pandemi Covid 19Document12 pagesPemanfaatan Media Sosial Dan Ecommerce Sebagai Media Pemasaran Dalam Mendukung Peluang Usaha Mandiri Pada Masa Pandemi Covid 19Min HwagiNo ratings yet

- MPBPL00213180000011849 NewDocument4 pagesMPBPL00213180000011849 NewWorld WebNo ratings yet

- Pdms List Error CaptureDocument4 pagesPdms List Error Capturehnguyen_698971No ratings yet

- A Profect Report On Star Claytech Pvt. LTDDocument44 pagesA Profect Report On Star Claytech Pvt. LTDraj danichaNo ratings yet

- History of Insurance-WWW - SELUR.TKDocument9 pagesHistory of Insurance-WWW - SELUR.TKselurtimaNo ratings yet

- Bathroom Items Any RFQDocument8 pagesBathroom Items Any RFQarqsarqsNo ratings yet

- Business Unit Performance Measurement: Mcgraw-Hill/IrwinDocument17 pagesBusiness Unit Performance Measurement: Mcgraw-Hill/Irwinimran_chaudhryNo ratings yet

- Name: Najma Said Salad Faculty: Computer Science Semester: OneDocument2 pagesName: Najma Said Salad Faculty: Computer Science Semester: OneAbdifatah SaidNo ratings yet

- Hotel Administration and Management Network - AbstractDocument3 pagesHotel Administration and Management Network - AbstractMehadi Hasan RoxyNo ratings yet

- 9601/DM9601 Retriggerable One Shot: General Description FeaturesDocument6 pages9601/DM9601 Retriggerable One Shot: General Description FeaturesMiguel Angel Pinto SanhuezaNo ratings yet

- July 2011 Jacksonville ReviewDocument36 pagesJuly 2011 Jacksonville ReviewThe Jacksonville ReviewNo ratings yet

- Cdi 3Document39 pagesCdi 3Argencel MaddelaNo ratings yet

- Gender Informality and PovertyDocument15 pagesGender Informality and Povertygauravparmar1No ratings yet

- Norma ASTM B733Document14 pagesNorma ASTM B733diegohrey239100% (3)

- Franchise Application Form: (I) APPLICANT INFORMATION (For Individuals, Please Fill in Applicable Fields)Document2 pagesFranchise Application Form: (I) APPLICANT INFORMATION (For Individuals, Please Fill in Applicable Fields)Nha Nguyen HoangNo ratings yet

- Oracle Demand Management Cloud DsDocument6 pagesOracle Demand Management Cloud DsmrssabaNo ratings yet

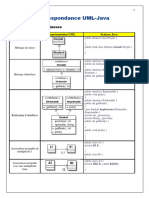

- 8 - Correspondance UML-JAVADocument3 pages8 - Correspondance UML-JAVAoussama sfiriNo ratings yet

Capital Structure Decision

Capital Structure Decision

Uploaded by

sushantscalper0 ratings0% found this document useful (0 votes)

24 views2 pagesThis document discusses a case study of capital structure decisions in small and medium enterprises (SMEs) in the road freight industry. It analyzes how management in these firms reason about their capital structure choices. The study found that most companies prefer internal financing through retained earnings and see bank loans as a secondary option. Management's desire for independence, past experiences, and risk tolerance influence this preferred financing order. The capital structure strategy is shaped by beliefs about debt and perceived needs for debt. While growth is usually debt-financed, these SMEs have a restrictive view of debt that limits their desire to grow rapidly. All companies used some debt financing despite a preference for retained earnings.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses a case study of capital structure decisions in small and medium enterprises (SMEs) in the road freight industry. It analyzes how management in these firms reason about their capital structure choices. The study found that most companies prefer internal financing through retained earnings and see bank loans as a secondary option. Management's desire for independence, past experiences, and risk tolerance influence this preferred financing order. The capital structure strategy is shaped by beliefs about debt and perceived needs for debt. While growth is usually debt-financed, these SMEs have a restrictive view of debt that limits their desire to grow rapidly. All companies used some debt financing despite a preference for retained earnings.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

24 views2 pagesCapital Structure Decision

Capital Structure Decision

Uploaded by

sushantscalperThis document discusses a case study of capital structure decisions in small and medium enterprises (SMEs) in the road freight industry. It analyzes how management in these firms reason about their capital structure choices. The study found that most companies prefer internal financing through retained earnings and see bank loans as a secondary option. Management's desire for independence, past experiences, and risk tolerance influence this preferred financing order. The capital structure strategy is shaped by beliefs about debt and perceived needs for debt. While growth is usually debt-financed, these SMEs have a restrictive view of debt that limits their desire to grow rapidly. All companies used some debt financing despite a preference for retained earnings.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

Capital Structure Decision : A case study of

SMEs in the road freight industry

Companies need capital in order to run their business, do

necessary investments and grow larger. These actions are

combined with high costs where both internal and

external financing might be appropriate. Capital structure

is the relation between debt and equity.

In this thesis we have focused on the decision behind the

capital structure. We have focused on the road freight

industry and we have tried to find out how management

reason about their decision. The purpose of this thesis is

therefore to describe and analyze SMEs’ decision of

capital structure within the road freight sector in the

Jönköping region. Emphasise is put on the different

aspects that influence the capital structure decision and to

what extent this is a strategic issue coloured by personal

beliefs.

To fulfill the purpose mainly a qualitative approach with

primary data from structured interviews has been used.

The interviews were conducted face-to-face with six

owner and/or managers. Further on, secondary data from

the firms’ annual reports were used and analyzed.

The pecking order theory explains that firms, especially

SMEs, prefer to finance their businesses with internally

generated funds. Focus of the theoretical part are on

theories of what factors that affects the capital structure

decision, how this can be argued to be a strategic question

for SMEs, how risk affects the capital structure decision

and how this decision is made in a family business. These

theories are presented to shed light on the capital structure

decision making process of SMEs.

From this study it is found that the majority of the

companies’ prefer internal financing i.e. reinvested

earnings, and as a second alternative to use debt in form

of bank loans. The study also shows that the reasons

behind this preferred order are the will of being

independent, previous experience and managements’ risk-

taking propensity. We believe that these factors combined

with beliefs about debt and realized need for debt works

as a base for how a capital structure strategy is discussed,

formed and developed. From this study it can also be

concluded that risk indirect affects the capital structure

decision and that a restrictive view on debt leads to a

restrictive desire to grow since a fast growth in most

cases needs to be financed by debt. Last, the study

concludes that even though the studied firms prefer to

finance with retained earnings they all use debt more or

less.

You might also like

- Training Manual For DFS Production For The Salt ProcessorsDocument115 pagesTraining Manual For DFS Production For The Salt ProcessorsSyed AhamedNo ratings yet

- Comunicaciones Digitales Avanzadas DEBER 1 (Select Max. 10 Problems and Answer The Two Questions)Document3 pagesComunicaciones Digitales Avanzadas DEBER 1 (Select Max. 10 Problems and Answer The Two Questions)Cristian Sancho LopezNo ratings yet

- Final Report of SIPDocument56 pagesFinal Report of SIPRahul Parashar100% (1)

- Dubai's Golden SandsDocument17 pagesDubai's Golden SandsscrbdfanNo ratings yet

- Capital Structure Decisions: Research in Estonian Non-Financial CompaniesDocument3 pagesCapital Structure Decisions: Research in Estonian Non-Financial CompaniesMridul LuthraNo ratings yet

- The Impact of Capital StructureDocument27 pagesThe Impact of Capital StructureJoy JepchirchirNo ratings yet

- Capital Structure On Bank Performance Report.Document25 pagesCapital Structure On Bank Performance Report.Aniba ButtNo ratings yet

- Post - Mid Assignment 2: Zahra Faiz June 2020Document5 pagesPost - Mid Assignment 2: Zahra Faiz June 2020Laiba ManzoorNo ratings yet

- Literature Review Capital StructureDocument4 pagesLiterature Review Capital Structureea793wsz100% (1)

- Thesis Capital Structure and Firm PerformanceDocument8 pagesThesis Capital Structure and Firm Performancelaurasmithkansascity100% (2)

- Capital Structure and Firm Performance EDocument12 pagesCapital Structure and Firm Performance EBasilio MaliwangaNo ratings yet

- Dividend Policy of Everest Bank Limited: A Thesis Proposal byDocument9 pagesDividend Policy of Everest Bank Limited: A Thesis Proposal byRam khadkaNo ratings yet

- The Impact of Debt Financing On CompanyDocument25 pagesThe Impact of Debt Financing On CompanykasmshahabNo ratings yet

- How Do CFOs mak-WPS OfficeDocument12 pagesHow Do CFOs mak-WPS OfficeLaiqaNo ratings yet

- Financing Decision - SMEs Data - V1Document17 pagesFinancing Decision - SMEs Data - V1Trịnh Hồng HàNo ratings yet

- Proposal ThesisDocument8 pagesProposal ThesisFahad Ali 3516-FBAS/BSSE/F17No ratings yet

- Summary Graham and HarveyDocument2 pagesSummary Graham and HarveyJingwen WangNo ratings yet

- Capital Structure Dessertation FinalDocument29 pagesCapital Structure Dessertation FinalBasavaraj MtNo ratings yet

- Research Paper Capital Structure PDFDocument7 pagesResearch Paper Capital Structure PDFfvfmxb2y100% (1)

- Research Paper in Finance ManagementDocument8 pagesResearch Paper in Finance Managementggsmsyqif100% (1)

- Dissertation On Access To FinanceDocument6 pagesDissertation On Access To FinancePayToDoPaperCanada100% (1)

- The Effect of Financial Constraints On Corporate Investment DecisionsDocument5 pagesThe Effect of Financial Constraints On Corporate Investment DecisionsJames ShamaunNo ratings yet

- Dissertation On Impact of Capital Structure On ProfitabilityDocument5 pagesDissertation On Impact of Capital Structure On ProfitabilityWriteMyPaperForMeUKNo ratings yet

- GROUP 1 Article Review FM 8 The Relationship Between The Cash Flow and InvestmentsDocument5 pagesGROUP 1 Article Review FM 8 The Relationship Between The Cash Flow and InvestmentsJUDIL BANASTAONo ratings yet

- Term Paper New SeniDocument7 pagesTerm Paper New SeniBiniyam YitbarekNo ratings yet

- Back GroundDocument8 pagesBack GroundAli ShahanNo ratings yet

- Analytical Study of Capital Structure of Icici BankDocument22 pagesAnalytical Study of Capital Structure of Icici BankKuldeep Ban100% (2)

- The Speed of Adjustment Towards Optimal Capital Structure A Test of Dynamic Trade-Off ModelDocument12 pagesThe Speed of Adjustment Towards Optimal Capital Structure A Test of Dynamic Trade-Off ModelaliefNo ratings yet

- Finance Dissertation StructureDocument5 pagesFinance Dissertation StructurePayToDoPaperNewHaven100% (1)

- Synphosis On Project FinanceDocument3 pagesSynphosis On Project FinanceSatya KumarNo ratings yet

- Corporate Finance Term PaperDocument19 pagesCorporate Finance Term Paperabirhossain20031No ratings yet

- Article Review MohammedDocument13 pagesArticle Review MohammedG.A.A.P PRO ACCTNo ratings yet

- Literature Review On Optimal Capital StructureDocument6 pagesLiterature Review On Optimal Capital Structureafmzaoahmicfxg100% (2)

- Literature Review On Capital Budgeting PDFDocument7 pagesLiterature Review On Capital Budgeting PDFc5g10bt2100% (1)

- Capital Budgeting JobelleDocument5 pagesCapital Budgeting JobelleSheena PretestoNo ratings yet

- Term Paper Seni2Document6 pagesTerm Paper Seni2Biniyam YitbarekNo ratings yet

- Credit Banking Romanian Eco Joural June 2016Document15 pagesCredit Banking Romanian Eco Joural June 2016noor ul hqNo ratings yet

- Zuhuur 1Document15 pagesZuhuur 1Khader MohamedNo ratings yet

- Term Paper of Financial ManagementDocument6 pagesTerm Paper of Financial Managementafmzmxkayjyoso100% (1)

- MSCTHESISDocument84 pagesMSCTHESISPtomsa KemuelNo ratings yet

- An Evaluation of Capital Structure and Profitability of Business OrganizationDocument16 pagesAn Evaluation of Capital Structure and Profitability of Business OrganizationPushpa Barua0% (1)

- Finance Dissertation SampleDocument8 pagesFinance Dissertation SampleSomeoneToWriteMyPaperForMeEvansville100% (1)

- The Small Medium-Free Trade Zone That Able To Acquire DebtDocument10 pagesThe Small Medium-Free Trade Zone That Able To Acquire DebtTest AccountNo ratings yet

- The Capital Budgeting Decisions of Small BusinessesDocument21 pagesThe Capital Budgeting Decisions of Small BusinessesKumar KrisshNo ratings yet

- CF SummaryDocument1 pageCF SummaryVikram RatneNo ratings yet

- Literature Review On Sme FinancingDocument5 pagesLiterature Review On Sme Financingaflsimgfs100% (1)

- Strategic Financial ManagementDocument19 pagesStrategic Financial Managementsai krishnaNo ratings yet

- Research Final - AccountingDocument45 pagesResearch Final - Accountingamith chathurangaNo ratings yet

- Published Version Impact of Banking Sector Development On Capital Structure of Non-Financial Sector Firms in PakistanDocument12 pagesPublished Version Impact of Banking Sector Development On Capital Structure of Non-Financial Sector Firms in Pakistanumar farooqNo ratings yet

- Title: Lending and Investing Framework and Its Relevance To A Corporate EntityDocument3 pagesTitle: Lending and Investing Framework and Its Relevance To A Corporate Entitykalaimani25No ratings yet

- First VisitDocument8 pagesFirst VisitJahed EmonNo ratings yet

- Banking SectorDocument27 pagesBanking SectorMiss IqbalNo ratings yet

- Article 1Document7 pagesArticle 1Wijdan Saleem EdwanNo ratings yet

- Synthesis of The Reviewed Studies (Udarbe Part)Document3 pagesSynthesis of The Reviewed Studies (Udarbe Part)Aimee UdarbeNo ratings yet

- Article 1 PDFDocument7 pagesArticle 1 PDFWijdan Saleem EdwanNo ratings yet

- Sources of FundsDocument64 pagesSources of FundsravikumarreddytNo ratings yet

- Research Project On Financial LeverageDocument42 pagesResearch Project On Financial LeverageMarryam Majeed63% (8)

- Harvard Paper On Capital StructureDocument34 pagesHarvard Paper On Capital StructureSagarSuryavanshiNo ratings yet

- Thesis Optimal Capital StructureDocument5 pagesThesis Optimal Capital Structurejennysmithportland100% (1)

- The Effect of Sales Growth On The Determinants of Capital Structure of Listed Companies in Tehran Stock ExchangeDocument6 pagesThe Effect of Sales Growth On The Determinants of Capital Structure of Listed Companies in Tehran Stock ExchangeJonathan SangimpianNo ratings yet

- Corporate Finance Dissertation TitlesDocument7 pagesCorporate Finance Dissertation TitlesPayToDoPaperCanada100% (1)

- Empirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveFrom EverandEmpirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveNo ratings yet

- Degree of Leverage: Empirical Analysis from the Insurance SectorFrom EverandDegree of Leverage: Empirical Analysis from the Insurance SectorNo ratings yet

- EIB Working Papers 2019/10 - Structural and cyclical determinants of access to finance: Evidence from EgyptFrom EverandEIB Working Papers 2019/10 - Structural and cyclical determinants of access to finance: Evidence from EgyptNo ratings yet

- Company Profile - V2Document4 pagesCompany Profile - V2bhuvaneshelango2209No ratings yet

- Consumer Redress: Fair Trade Enforcement BureauDocument47 pagesConsumer Redress: Fair Trade Enforcement BureauMaria LovesongorNo ratings yet

- AC ResidentialDocument18 pagesAC ResidentialHiten VadkareNo ratings yet

- Norway Joint Venture Audit GuidelinesDocument31 pagesNorway Joint Venture Audit GuidelinesPatekJoaquinNo ratings yet

- Athul AjiDocument5 pagesAthul AjiAsif SNo ratings yet

- Operating System (5th Semester) : Prepared by Sanjit Kumar Barik (Asst Prof, Cse) Module-IiiDocument41 pagesOperating System (5th Semester) : Prepared by Sanjit Kumar Barik (Asst Prof, Cse) Module-IiiJeevanantham KannanNo ratings yet

- Sheik Md. Maadul Hoque (ID 150201010035)Document49 pagesSheik Md. Maadul Hoque (ID 150201010035)Mizanur RahmanNo ratings yet

- Malinta PDFDocument8 pagesMalinta PDFAngelina CruzNo ratings yet

- Blueberry Jam Export Plan-1Document22 pagesBlueberry Jam Export Plan-1Nicole PortalNo ratings yet

- Pemanfaatan Media Sosial Dan Ecommerce Sebagai Media Pemasaran Dalam Mendukung Peluang Usaha Mandiri Pada Masa Pandemi Covid 19Document12 pagesPemanfaatan Media Sosial Dan Ecommerce Sebagai Media Pemasaran Dalam Mendukung Peluang Usaha Mandiri Pada Masa Pandemi Covid 19Min HwagiNo ratings yet

- MPBPL00213180000011849 NewDocument4 pagesMPBPL00213180000011849 NewWorld WebNo ratings yet

- Pdms List Error CaptureDocument4 pagesPdms List Error Capturehnguyen_698971No ratings yet

- A Profect Report On Star Claytech Pvt. LTDDocument44 pagesA Profect Report On Star Claytech Pvt. LTDraj danichaNo ratings yet

- History of Insurance-WWW - SELUR.TKDocument9 pagesHistory of Insurance-WWW - SELUR.TKselurtimaNo ratings yet

- Bathroom Items Any RFQDocument8 pagesBathroom Items Any RFQarqsarqsNo ratings yet

- Business Unit Performance Measurement: Mcgraw-Hill/IrwinDocument17 pagesBusiness Unit Performance Measurement: Mcgraw-Hill/Irwinimran_chaudhryNo ratings yet

- Name: Najma Said Salad Faculty: Computer Science Semester: OneDocument2 pagesName: Najma Said Salad Faculty: Computer Science Semester: OneAbdifatah SaidNo ratings yet

- Hotel Administration and Management Network - AbstractDocument3 pagesHotel Administration and Management Network - AbstractMehadi Hasan RoxyNo ratings yet

- 9601/DM9601 Retriggerable One Shot: General Description FeaturesDocument6 pages9601/DM9601 Retriggerable One Shot: General Description FeaturesMiguel Angel Pinto SanhuezaNo ratings yet

- July 2011 Jacksonville ReviewDocument36 pagesJuly 2011 Jacksonville ReviewThe Jacksonville ReviewNo ratings yet

- Cdi 3Document39 pagesCdi 3Argencel MaddelaNo ratings yet

- Gender Informality and PovertyDocument15 pagesGender Informality and Povertygauravparmar1No ratings yet

- Norma ASTM B733Document14 pagesNorma ASTM B733diegohrey239100% (3)

- Franchise Application Form: (I) APPLICANT INFORMATION (For Individuals, Please Fill in Applicable Fields)Document2 pagesFranchise Application Form: (I) APPLICANT INFORMATION (For Individuals, Please Fill in Applicable Fields)Nha Nguyen HoangNo ratings yet

- Oracle Demand Management Cloud DsDocument6 pagesOracle Demand Management Cloud DsmrssabaNo ratings yet

- 8 - Correspondance UML-JAVADocument3 pages8 - Correspondance UML-JAVAoussama sfiriNo ratings yet