Professional Documents

Culture Documents

Wage Easy ATO Payment Summaries (2018 Jun 28)

Wage Easy ATO Payment Summaries (2018 Jun 28)

Uploaded by

Haillander Lopes viannaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wage Easy ATO Payment Summaries (2018 Jun 28)

Wage Easy ATO Payment Summaries (2018 Jun 28)

Uploaded by

Haillander Lopes viannaCopyright:

Available Formats

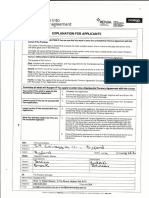

PAYG Payment Summary - Individual Non-business

Payment Summary for year ending 30 June 2018

Payee details NOTICE TO PAYEE

If this payment summary shows an amount in the total tax

withheld box, you must lodge a tax return. If no tax was

withheld, you may still have to lodge a tax return.

For more information on whether you have to lodge, or

about this payment and how it is taxed, you can:

visit www.ato.gov.au

Daiane Pires Da Silva Santos

phone 13 28 61 between 8.00am and 6.00pm (EST),

130 Holden Street

Monday to Friday

Ashfield NSW 2131

Australia

Day/Month/Year Day/Month/Year

Period during which payments were made 15 / 1 / 2018 to 30/6/2018

Payee's tax file number 970692225 TOTAL TAX WITHHELD $ 2,976

Type Lump sum payments Type

Gross payments $ 11,214 S A $ 0

CDEP payments $ 0 B $ 0

Reportable employer

superannuation contributions $ 0 D $ 0

Reportable fringe benefits amount

FBT year 1 April to 31 March $ 0 E $ 0

Is the employer exempt from FBT under

section 57A of the FBTAA 1986? No Yes

Total allowances are not included in Gross payments above. This

Total allowances $ 0 amount needs to be shown separately in your tax return.

Payer details

Payer's ABN or withholding payer number 16008749031 Branch number 1

Payer's name Airport Retail Enterprises Pty Ltd

Privacy - For information about your privacy, go to ato.gov.au/privacy

Signature of authorised person PETER BUTTS Date 28/6/2018

You might also like

- Notice of Assessment - Year Ended 30 June 2020: !Msî15U (P4 Î#BabäDocument4 pagesNotice of Assessment - Year Ended 30 June 2020: !Msî15U (P4 Î#BabäClaudia AttardNo ratings yet

- Australian Payslip Generator TemplateDocument1 pageAustralian Payslip Generator TemplateFarzinNo ratings yet

- Your Centrelink Statement For Disability Support Pension: Reference: 204 552 505CDocument3 pagesYour Centrelink Statement For Disability Support Pension: Reference: 204 552 505CChellii McgrailNo ratings yet

- Notice of Assessment - Year Ended 30 June 2020: Ms Elaine S Ross 64 Corrofin ST Ferny Grove QLD 4055Document2 pagesNotice of Assessment - Year Ended 30 June 2020: Ms Elaine S Ross 64 Corrofin ST Ferny Grove QLD 4055Vaccine ScamNo ratings yet

- Derivative Markets Solutions PDFDocument30 pagesDerivative Markets Solutions PDFSteven Hyosup KimNo ratings yet

- Supply Chain ManagementDocument17 pagesSupply Chain ManagementAjakumbi Ajax Baba100% (1)

- View AttachmentDocument6 pagesView AttachmentAlvin NgNo ratings yet

- Centrelink PaygDocument1 pageCentrelink PaygChandra BhattNo ratings yet

- Child Care Subsidy (0028112904)Document9 pagesChild Care Subsidy (0028112904)ammar naeemNo ratings yet

- Income Statement: Llillliltll) Ilililtil)Document1 pageIncome Statement: Llillliltll) Ilililtil)Indy EfuNo ratings yet

- Your Centrelink Statement For Parenting Payment: Reference: 207 828 705JDocument3 pagesYour Centrelink Statement For Parenting Payment: Reference: 207 828 705JLupe VakaNo ratings yet

- 29 Calneggia DRDocument6 pages29 Calneggia DRJohn ReidNo ratings yet

- Your Centrelink Statement For Parenting Payment: Reference: 207 828 705JDocument3 pagesYour Centrelink Statement For Parenting Payment: Reference: 207 828 705JhanhNo ratings yet

- Pandemic Leave Disaster Payment: Claim ForDocument8 pagesPandemic Leave Disaster Payment: Claim ForSarah VirziNo ratings yet

- 26082021-PAYG Payment Summary-G Khajarian (CLAIM-00464429)Document1 page26082021-PAYG Payment Summary-G Khajarian (CLAIM-00464429)Garo KhatcherianNo ratings yet

- PAYG Payment Summary Individual Non-Business: Ai Thi Hoai Nguyen 1/3 Mary ST North Melbourne Vic 3051Document1 pagePAYG Payment Summary Individual Non-Business: Ai Thi Hoai Nguyen 1/3 Mary ST North Melbourne Vic 3051hungdahoangNo ratings yet

- Pre-Filling Report 2017: Taxpayer DetailsDocument2 pagesPre-Filling Report 2017: Taxpayer DetailsUsama AshfaqNo ratings yet

- Business Activity Statement: Summary of AmountsDocument2 pagesBusiness Activity Statement: Summary of AmountsSimona StratulatNo ratings yet

- Chorinho Pacoqui o Du SilvaDocument9 pagesChorinho Pacoqui o Du SilvaAlejo GarciaNo ratings yet

- Your Centrelink Statement For Youth Allowance: Reference: 280 993 398VDocument3 pagesYour Centrelink Statement For Youth Allowance: Reference: 280 993 398Vbob0% (1)

- CV Daniel PDFDocument3 pagesCV Daniel PDFDanielWildSheepZaninNo ratings yet

- Medicare Enrolment Form (MS004) PDFDocument13 pagesMedicare Enrolment Form (MS004) PDFDanielWildSheepZaninNo ratings yet

- PAYG Payment Summary - Individual Non-Business: Matthew Burn 1933b/702 Harris Street Ultimo NSW 2007Document1 pagePAYG Payment Summary - Individual Non-Business: Matthew Burn 1933b/702 Harris Street Ultimo NSW 2007Anonymous JytY5quhSgNo ratings yet

- PAYG Payment Summary - Individual Non-BusinessDocument1 pagePAYG Payment Summary - Individual Non-BusinessShubham SurekaNo ratings yet

- PAYG Payment Summary - Individual Non-Business: Fook Ngo 139 Railway Avenue Laverton VIC 3028Document1 pagePAYG Payment Summary - Individual Non-Business: Fook Ngo 139 Railway Avenue Laverton VIC 3028Fook NgoNo ratings yet

- Prefill 2019Document2 pagesPrefill 2019Usama AshfaqNo ratings yet

- PAYG Payment Summary - Individual Non-Business: Muhammad Danish 22/324 Woodstock Avenue Mount Druitt NSW 2770Document1 pagePAYG Payment Summary - Individual Non-Business: Muhammad Danish 22/324 Woodstock Avenue Mount Druitt NSW 2770Danish MuhammadNo ratings yet

- Nat14869 01.2006Document1 pageNat14869 01.2006stive007No ratings yet

- Manpreet Kaur USQ Application FormDocument5 pagesManpreet Kaur USQ Application FormGagandeep KaurNo ratings yet

- Income Tax Account Statement of Account: MR Brock W Johnson 177 Barrabool RD Highton Vic 3216Document2 pagesIncome Tax Account Statement of Account: MR Brock W Johnson 177 Barrabool RD Highton Vic 3216Annie LamNo ratings yet

- Visa Application Form NA EnglishDocument9 pagesVisa Application Form NA EnglishVamshi UkoNo ratings yet

- Barry 2003 ITRDocument6 pagesBarry 2003 ITRGreg O'MearaNo ratings yet

- The Property Investors Alliance: Electricity Gas Phone Internet Pay TV InsuranceDocument4 pagesThe Property Investors Alliance: Electricity Gas Phone Internet Pay TV InsuranceRaza RNo ratings yet

- Child Care Subsidy (0028112904) PDFDocument9 pagesChild Care Subsidy (0028112904) PDFammar naeemNo ratings yet

- About Sanda Islam Your Family Assistance: Reference: 605 730 292XDocument3 pagesAbout Sanda Islam Your Family Assistance: Reference: 605 730 292XAriful RussellNo ratings yet

- Emergency Recovery Payment Grant A199480158Document2 pagesEmergency Recovery Payment Grant A199480158HenhamNo ratings yet

- HR Manager Digital Technology & Innovation 1 Charles ST, Level 3A ParramattaDocument3 pagesHR Manager Digital Technology & Innovation 1 Charles ST, Level 3A ParramattaKiran PNo ratings yet

- Print - Australian Taxation OfficeDocument2 pagesPrint - Australian Taxation OfficeThi MaiNo ratings yet

- Your Statement: Smart AccessDocument16 pagesYour Statement: Smart AccessDanielWildSheepZaninNo ratings yet

- Customer Services OnlineDocument1 pageCustomer Services OnlineBrendan Han YungNo ratings yet

- Grant For Crisis Payment S303833612Document2 pagesGrant For Crisis Payment S303833612anthony rudduck100% (1)

- Customer Reference Number: 306 934 336C: We Have Balanced Your Child Care SubsidyDocument3 pagesCustomer Reference Number: 306 934 336C: We Have Balanced Your Child Care SubsidyawalNo ratings yet

- MyafDocument2 pagesMyaffNo ratings yet

- PDF Payment Summary 2022 - 2023Document1 pagePDF Payment Summary 2022 - 2023Ashley RouxNo ratings yet

- SR Notice of Assessment 2015Document1 pageSR Notice of Assessment 2015Ded MarozNo ratings yet

- Application 14 - NISHADIDocument3 pagesApplication 14 - NISHADIamal_post100% (1)

- NRAS Tenancy Managers - Australian Government Department Families, Housing, Community Services and Indigenous AffairsDocument12 pagesNRAS Tenancy Managers - Australian Government Department Families, Housing, Community Services and Indigenous Affairsbackch9011No ratings yet

- Tax Statement 2014 CbhsDocument1 pageTax Statement 2014 CbhsChandra BhattNo ratings yet

- Income Tax Account Statement of Account: MR Daniel Zanin 25 Bulgoon CR Ocean Shores NSW 2483Document2 pagesIncome Tax Account Statement of Account: MR Daniel Zanin 25 Bulgoon CR Ocean Shores NSW 2483DanielWildSheepZaninNo ratings yet

- Emergency Recovery Payment Grant S311610943Document2 pagesEmergency Recovery Payment Grant S311610943Tsubodh Zirkovic GhimireNo ratings yet

- Https Download - Ib.nab - Com.au Ibdownload Download 947636060-22aug2014Document2 pagesHttps Download - Ib.nab - Com.au Ibdownload Download 947636060-22aug2014gizzeleneNo ratings yet

- Income and Asset Statement (Financial Planner) - G324503937Document2 pagesIncome and Asset Statement (Financial Planner) - G324503937Adam BookerNo ratings yet

- 58 Kingaroy DRDocument9 pages58 Kingaroy DRJohn ReidNo ratings yet

- Personal Loan ApplicationDocument5 pagesPersonal Loan ApplicationNateNo ratings yet

- Application For Housing Assistance: Use This Form To Apply For Social Housing Assistance in New South WalesDocument18 pagesApplication For Housing Assistance: Use This Form To Apply For Social Housing Assistance in New South WalesVincent HardyNo ratings yet

- 2015 Noa Elena - 1Document1 page2015 Noa Elena - 1Ded MarozNo ratings yet

- Dfadsfadfagffdfasdfadfadfas FaDocument16 pagesDfadsfadfagffdfasdfadfadfas FaTyrone DomingoNo ratings yet

- Important Information - M269602760Document2 pagesImportant Information - M269602760jason masciNo ratings yet

- Adam Rizk Tenancy Application FormDocument2 pagesAdam Rizk Tenancy Application FormRam PNo ratings yet

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeFrom EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeNo ratings yet

- All You Need to Know About Payday LoansFrom EverandAll You Need to Know About Payday LoansRating: 5 out of 5 stars5/5 (1)

- Pay SumDocument1 pagePay SumEdward LehmannNo ratings yet

- Opportunities and Challenges in Online Marketplace Lending White PaperDocument45 pagesOpportunities and Challenges in Online Marketplace Lending White PaperCrowdFunding BeatNo ratings yet

- Intro To Topic: Module 2.1 ObjectivesDocument3 pagesIntro To Topic: Module 2.1 ObjectivesMeilin Denise MEDRANANo ratings yet

- Crisis of MasculinityDocument7 pagesCrisis of MasculinityStevie VorceNo ratings yet

- ENT300 Chapter 4Document20 pagesENT300 Chapter 4Hisyammudin Roslan100% (1)

- Original For Buyer: Tax InvoiceDocument2 pagesOriginal For Buyer: Tax InvoiceawlyxiqafNo ratings yet

- MARK5814 - T1 2022 Digital Marketing of Cotton:On Individual Assignment Student Name: Word CountDocument11 pagesMARK5814 - T1 2022 Digital Marketing of Cotton:On Individual Assignment Student Name: Word Countpooja jainNo ratings yet

- 2012 Pioneer Bank Pre-Reading 1 - LOP v2 PDFDocument8 pages2012 Pioneer Bank Pre-Reading 1 - LOP v2 PDFjoe2605No ratings yet

- What WHY AND: Business Problems Solved Through Desi Network-Bouncing BoardsDocument4 pagesWhat WHY AND: Business Problems Solved Through Desi Network-Bouncing BoardsMotivational ExpeditiousNo ratings yet

- SABV Topic 4 QuestionsDocument2 pagesSABV Topic 4 QuestionsNgoc Hoang Ngan NgoNo ratings yet

- Pratt's: Guide To Private Equity & Venture Capital SourcesDocument9 pagesPratt's: Guide To Private Equity & Venture Capital SourcesDaodu Ladi BusuyiNo ratings yet

- Banking Unbound Origins To The Digital FrontiersDocument229 pagesBanking Unbound Origins To The Digital FrontiersUmar WyneNo ratings yet

- Theories of Medical Anthropology2Document14 pagesTheories of Medical Anthropology2Joy PistaNo ratings yet

- Accounting For Government and Non Profit Organizations - ASSESSMENTSDocument21 pagesAccounting For Government and Non Profit Organizations - ASSESSMENTSArn KylaNo ratings yet

- Price Determination Under Perfect CompetitionDocument6 pagesPrice Determination Under Perfect CompetitionDr. Swati Gupta100% (9)

- Feasibility Study OF Gujarat International Finance Tec-City Phase IDocument12 pagesFeasibility Study OF Gujarat International Finance Tec-City Phase IAlocinNo ratings yet

- UAL Reorganization Memo 5.29 FINALDocument2 pagesUAL Reorganization Memo 5.29 FINALAnn DwyerNo ratings yet

- Payslip 4 2022Document1 pagePayslip 4 2022Sunil B R SunilshettyNo ratings yet

- Chapter Four: Learning, Training and DevelopmentDocument43 pagesChapter Four: Learning, Training and DevelopmentyonasNo ratings yet

- 27 Waysto Buy Real Estate With No Money DownDocument10 pages27 Waysto Buy Real Estate With No Money DownBlvsr100% (1)

- Gross Income Quiz With Answer KeyDocument10 pagesGross Income Quiz With Answer KeyMylene AlfantaNo ratings yet

- Britania Case StudyDocument20 pagesBritania Case StudyWeevy Khernamnuai100% (1)

- Attock Cement Ratio Analysis 2019 by RizwanDocument8 pagesAttock Cement Ratio Analysis 2019 by RizwanHayat budhoooNo ratings yet

- Circular No. 329 - Amended Guidelines On The Pag-IBIG Direct Developmental Loan ProgramDocument5 pagesCircular No. 329 - Amended Guidelines On The Pag-IBIG Direct Developmental Loan ProgramjmlafortezaNo ratings yet

- Final Withholding Tax On Passive IncomeDocument1 pageFinal Withholding Tax On Passive IncomeChelsea Anne VidalloNo ratings yet

- AFAR 2 DiscussionDocument3 pagesAFAR 2 DiscussionAngela Miles DizonNo ratings yet

- CJ Diesel Refilling Gasoline StationDocument47 pagesCJ Diesel Refilling Gasoline StationMaricar Oca de LeonNo ratings yet

- Greil EisgruberDocument18 pagesGreil EisgruberSimone DecarliNo ratings yet

- Annotated Bibliography On Land Research in Nepal (2011)Document50 pagesAnnotated Bibliography On Land Research in Nepal (2011)Kristoff Sven100% (1)