Professional Documents

Culture Documents

Eurozone Global Outlook

Eurozone Global Outlook

Uploaded by

shaan1001gbOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Eurozone Global Outlook

Eurozone Global Outlook

Uploaded by

shaan1001gbCopyright:

Available Formats

GLOBAL ECONOMICS

| SCOTIABANK’S GLOBAL OUTLOOK

January 17, 2017

CONTACTS

Eurozone

Frédéric Prêtet

Eurozone growth is re-accelerating, and stronger-than-expected 33.1.703.77705 (Paris)

Fixed Income Strategy

external demand could create an upside surprise. frederic.pretet@scotiabank.com

Inflation will temporarily move closer to 2.0% y/y in Q1, while core

inflation is forecast to gradually rise.

The ECB could gradually turn more hawkish.

ACCELERATING ECONOMIC GROWTH…

Recent months have strengthened our scenario of stronger growth at the turn of Chart 1: Exports To Pick Up

the year. German Exports & Estimate

40

Although the recovery on the supply side of the economy is still lagging with y/y % change

Eurozone manufacturing production showing flat growth in October/November 30

Forecast

relative to Q3, the demand and export side of the Eurozone has clearly

20

strengthened in the final quarter of 2016. Indeed, retail sales sharply rebounded in

October, while consumer confidence reached its highest level in almost two years 10

in December. In the meantime, exports increased for the third month in a row in

0

October. In view of this data, Q4 Eurozone real GDP could expand by around

0.5% q/q, up from 0.3% in the previous two quarters. -10 * R2 = 0.88

with US ISM

Furthermore, rising business confidence points to ongoing strength at the -20 manufacturing

beginning of the year. In view of historical elasticity, Eurozone real GDP in Q1 China PMI

-30 EUR/USD

could register growth of close to 2.0% y/y, implying a 0.5/0.7% q/q increase. This

German Exports *Estimate

would likely create arguments for a potential upward revision to the ECB’s -40

Eurozone growth projection this year, which is presently forecast to rise by 1.7%. 2007 2009 2011 2013 2015 2017

Looking beyond this short-term cyclical acceleration, it is also helpful to address

the other underlying drivers of Eurozone growth. Compared to three months ago,

there have not been many changes in the stimulus offered to the area. Indeed,

while the recent drop of the euro offers a stronger support for corporates’

competitiveness, it is offset by the adverse impact of higher oil prices on

households’ purchasing power and consumption. In the meantime, the stimulus

offered by fiscal policy to Eurozone real GDP seems to be roughly the same as

assumed three months ago, at around 0.2% of GDP and the rise in interest rates

has, so far, remained limited, thus continuing to offer favourable financial

conditions. So, all in all, we maintain the view that the positive impact of both

monetary and fiscal policy could add roughly 0.5 percentage points to GDP this

year. With Eurozone potential growth estimated at around 1.1% by the EU

Commission, a growth scenario of between 1.5% and 1.7% for 2017 looks valid.

However, the upward surprise could come from stronger-than-expected external

demand. Indeed, global business sentiment has remained surprisingly resilient

despite rising political uncertainties following the UK’s vote to exit the European

Union and the surprise election of Donald Trump as the US President in

November. The global PMI manufacturing index has returned to its highest level in

two years, which points to stronger export growth than previously anticipated. As

an example, we estimate that German export growth—the benchmark by which to

assess how global demand is supporting Eurozone exports—could be rising by

Visit our web site at scotiabank.com/economics or contact us by email at scotia.economics@scotiabank.com 21

You might also like

- Farfetch: Sales InvoiceDocument1 pageFarfetch: Sales Invoiceason lifeNo ratings yet

- India On The Move Case AnalysisDocument3 pagesIndia On The Move Case Analysis17crush67% (3)

- Postpay Bill: VAT Registration Number VAT: 0113241A PIN Number: P051129820X 1-308238601847Document4 pagesPostpay Bill: VAT Registration Number VAT: 0113241A PIN Number: P051129820X 1-308238601847pius mulatyaNo ratings yet

- HDFC Rtgs Neft Form PDF DownloadDocument1 pageHDFC Rtgs Neft Form PDF DownloadJJ JJ73% (11)

- Operations QuestionsDocument1 pageOperations QuestionsSur Shah50% (2)

- FEL Newsletter January 2010Document4 pagesFEL Newsletter January 2010FirstEquityLtdNo ratings yet

- S&P Credit Research - Europe's Growth As Good As It Gets 2010 08 31Document6 pagesS&P Credit Research - Europe's Growth As Good As It Gets 2010 08 31thebigpicturecoilNo ratings yet

- Fashion Economic Trends - 2011 - 02Document4 pagesFashion Economic Trends - 2011 - 02f_tundaNo ratings yet

- Economic Update Nov201Document12 pagesEconomic Update Nov201admin866No ratings yet

- Argonaut Capital May 2010Document14 pagesArgonaut Capital May 2010naieliqbalNo ratings yet

- Today's Calendar: Friday 15 November 2013Document9 pagesToday's Calendar: Friday 15 November 2013api-239816032No ratings yet

- These Green Shoots Will Need A Lot of Watering: Economic ResearchDocument10 pagesThese Green Shoots Will Need A Lot of Watering: Economic Researchapi-231665846No ratings yet

- Pantheon Eurozone Economic Monitor, May 12Document5 pagesPantheon Eurozone Economic Monitor, May 12Pantheon MacroeconomicsNo ratings yet

- Convergence Programme November 2007 2 Macroeconomic ScenarioDocument10 pagesConvergence Programme November 2007 2 Macroeconomic Scenariocristi313No ratings yet

- The Global Economy No 1/2011Document3 pagesThe Global Economy No 1/2011Swedbank AB (publ)No ratings yet

- Eeo 20110411 deDocument2 pagesEeo 20110411 demotlaghNo ratings yet

- Recent Economic Developments in Singapore: HighlightsDocument14 pagesRecent Economic Developments in Singapore: HighlightsEstelle PohNo ratings yet

- Europe Is Moving From Subzero To Subpar Growth: Economic ResearchDocument11 pagesEurope Is Moving From Subzero To Subpar Growth: Economic Researchapi-227433089No ratings yet

- PIMCO CyclicalOutlook Amey Bosomworth Pagani Sep2015Document4 pagesPIMCO CyclicalOutlook Amey Bosomworth Pagani Sep2015kunalwarwickNo ratings yet

- Empirical Method in Finance and AccountingDocument14 pagesEmpirical Method in Finance and Accountingbarkha tyagiNo ratings yet

- EU Breaking NewsDocument4 pagesEU Breaking Newsknk333No ratings yet

- FEL Newsletter October 2009Document4 pagesFEL Newsletter October 2009FirstEquityLtdNo ratings yet

- FEL Newsletter June 2010Document4 pagesFEL Newsletter June 2010FirstEquityLtdNo ratings yet

- Tracking The World Economy... - 30/07/2010Document3 pagesTracking The World Economy... - 30/07/2010Rhb InvestNo ratings yet

- Outlook For The German Economy - Macroeconomic Projections For 2011 and 2012Document14 pagesOutlook For The German Economy - Macroeconomic Projections For 2011 and 2012Ravi KantNo ratings yet

- ScotiaBank AUG 06 Europe Weekly OutlookDocument3 pagesScotiaBank AUG 06 Europe Weekly OutlookMiir ViirNo ratings yet

- Euro Area - Economic Outlook by Ifo, Insee and IstatDocument2 pagesEuro Area - Economic Outlook by Ifo, Insee and IstatEduardo PetazzeNo ratings yet

- The Economic Outlook For Germany May 8, 2010Document16 pagesThe Economic Outlook For Germany May 8, 2010Ankit_modi2000No ratings yet

- Market Report JuneDocument17 pagesMarket Report JuneDidine ManaNo ratings yet

- Forum Van Ark 0Document4 pagesForum Van Ark 0Rachel RobinsonNo ratings yet

- Tracking The World Economy... - 16/08/2010Document3 pagesTracking The World Economy... - 16/08/2010Rhb InvestNo ratings yet

- LSR Macro Picture: Danger ZoneDocument11 pagesLSR Macro Picture: Danger Zonenelson ongNo ratings yet

- Economic Pulse Asia Pacific CushmanWakefieldDocument8 pagesEconomic Pulse Asia Pacific CushmanWakefieldSorin IonescuNo ratings yet

- Global Strategy Q2 2021Document37 pagesGlobal Strategy Q2 2021Batsheba EverdeneNo ratings yet

- State of The Economy and Prospects: Website: Http://indiabudget - Nic.inDocument22 pagesState of The Economy and Prospects: Website: Http://indiabudget - Nic.inNDTVNo ratings yet

- India Econimic Survey 2010-11Document296 pagesIndia Econimic Survey 2010-11vishwanathNo ratings yet

- UniCredit Markets Today 20240517Document4 pagesUniCredit Markets Today 20240517Mustafa KhanNo ratings yet

- EMEA Real Estate Market PDFDocument36 pagesEMEA Real Estate Market PDFSamraNo ratings yet

- Country Strategy 2011-2014 GreeceDocument19 pagesCountry Strategy 2011-2014 GreeceBeeHoofNo ratings yet

- On Our Minds - : Week AheadDocument28 pagesOn Our Minds - : Week AheadnoneNo ratings yet

- RF EconomyDocument9 pagesRF EconomyLupu TitelNo ratings yet

- Click Here For A Brief Note About Quarterly Review of EconomyDocument4 pagesClick Here For A Brief Note About Quarterly Review of Economygrovermegha12No ratings yet

- KOF Bulletin: Economy and ResearchDocument15 pagesKOF Bulletin: Economy and Researchpathanfor786No ratings yet

- PHP 4 e JCIuDocument5 pagesPHP 4 e JCIufred607No ratings yet

- EconomiaDocument120 pagesEconomialuna salome alejo prietoNo ratings yet

- The World EconomyDocument12 pagesThe World EconomyeconstudentNo ratings yet

- The Impact of The Financial Crisis On The Real EconomyDocument17 pagesThe Impact of The Financial Crisis On The Real EconomyRajbir BhatiaNo ratings yet

- Tracking The World Economy... - 18/08/2010Document3 pagesTracking The World Economy... - 18/08/2010Rhb InvestNo ratings yet

- 1Q2011-Africa and Global Economic TrendsDocument15 pages1Q2011-Africa and Global Economic TrendsTaruna FadillahNo ratings yet

- Economic Highlights - Manufacturing Sales Inched Up in August - 11/10/2010Document2 pagesEconomic Highlights - Manufacturing Sales Inched Up in August - 11/10/2010Rhb InvestNo ratings yet

- ScotiaBank JUL 30 Daily PointsDocument2 pagesScotiaBank JUL 30 Daily PointsMiir ViirNo ratings yet

- Economic Highlights: Real GDP Picked Up Strongly by 10.1% Yoy in The 1Q, But Growth Will Likely Slow Down in The 2H - 13/05/2010Document4 pagesEconomic Highlights: Real GDP Picked Up Strongly by 10.1% Yoy in The 1Q, But Growth Will Likely Slow Down in The 2H - 13/05/2010Rhb InvestNo ratings yet

- Eurobank Monthly Global Economic Market Monitor September 2016Document24 pagesEurobank Monthly Global Economic Market Monitor September 2016nikoulisNo ratings yet

- The World Economy... - 23/04/2010Document3 pagesThe World Economy... - 23/04/2010Rhb InvestNo ratings yet

- Collapsing Dow Jones: IndiaDocument6 pagesCollapsing Dow Jones: IndiaPriyanka PaulNo ratings yet

- JPM Global Data Watch Se 2012-09-21 946463Document88 pagesJPM Global Data Watch Se 2012-09-21 946463Siddhartha SinghNo ratings yet

- Greece Southeastern 200706Document16 pagesGreece Southeastern 200706Andronikos KapsalisNo ratings yet

- Fashion Economic Trends 2010 - 09Document4 pagesFashion Economic Trends 2010 - 09f_tundaNo ratings yet

- Deutsche Industriebank German Market Outlook 2014 Mid Cap Financial Markets in Times of Macro Uncertainty and Tightening Bank RegulationsDocument32 pagesDeutsche Industriebank German Market Outlook 2014 Mid Cap Financial Markets in Times of Macro Uncertainty and Tightening Bank RegulationsRichard HongNo ratings yet

- Sabbatini-Locarno Economic Outlook 7marzo2011Document13 pagesSabbatini-Locarno Economic Outlook 7marzo2011flag7No ratings yet

- Market Report 2011 OctoberDocument18 pagesMarket Report 2011 OctoberAndra Elena AlexandrescuNo ratings yet

- DB Special ReportDocument10 pagesDB Special ReportMorris CabrioliNo ratings yet

- ABNAMRO Soccernomics enDocument8 pagesABNAMRO Soccernomics enNeha AnandaniNo ratings yet

- An Interim Assessment: What Is The Economic Outlook For OECD Countries?Document23 pagesAn Interim Assessment: What Is The Economic Outlook For OECD Countries?Jim MiddlemissNo ratings yet

- Innovation investment in Central, Eastern and South-Eastern Europe: Building future prosperity and setting the ground for sustainable upward convergenceFrom EverandInnovation investment in Central, Eastern and South-Eastern Europe: Building future prosperity and setting the ground for sustainable upward convergenceNo ratings yet

- When Coal Turned GoldDocument1 pageWhen Coal Turned Goldshaan1001gbNo ratings yet

- Style Game Celebration TimeDocument1 pageStyle Game Celebration Timeshaan1001gbNo ratings yet

- Vice Power PhenomenaDocument1 pageVice Power Phenomenashaan1001gbNo ratings yet

- Buzz Sentiment IllustrationDocument1 pageBuzz Sentiment Illustrationshaan1001gbNo ratings yet

- Rental Business MarketplaceDocument1 pageRental Business Marketplaceshaan1001gbNo ratings yet

- Ultramet 2507: Stainless Steel Electrodes Product Data SheetDocument1 pageUltramet 2507: Stainless Steel Electrodes Product Data Sheetshaan1001gbNo ratings yet

- Solid Housing ProspectsDocument1 pageSolid Housing Prospectsshaan1001gbNo ratings yet

- Notes On Aviation BankrupcyDocument1 pageNotes On Aviation Bankrupcyshaan1001gbNo ratings yet

- Overwatch Tracer Fan ArtDocument1 pageOverwatch Tracer Fan Artshaan1001gbNo ratings yet

- Special Business LegacyDocument1 pageSpecial Business Legacyshaan1001gbNo ratings yet

- Play For Failure... If You Are Not Failing, It Means Achieve Your Dreams.Document1 pagePlay For Failure... If You Are Not Failing, It Means Achieve Your Dreams.shaan1001gbNo ratings yet

- Barrelling ThroughDocument1 pageBarrelling Throughshaan1001gbNo ratings yet

- Milindshore Kottarappappi PDFDocument1 pageMilindshore Kottarappappi PDFshaan1001gbNo ratings yet

- The Art of The Lightsaber: Feature FeatureDocument1 pageThe Art of The Lightsaber: Feature Featureshaan1001gbNo ratings yet

- CG Art To Inspire: ShowcaseDocument1 pageCG Art To Inspire: Showcaseshaan1001gbNo ratings yet

- 3D World ContributionsDocument1 page3D World Contributionsshaan1001gbNo ratings yet

- Point Light Basic ShadingDocument1 pagePoint Light Basic Shadingshaan1001gbNo ratings yet

- Eye Weighting Edge LoopsDocument1 pageEye Weighting Edge Loopsshaan1001gbNo ratings yet

- ModellingDocument1 pageModellingshaan1001gb0% (1)

- WatchDocument1 pageWatchshaan1001gbNo ratings yet

- Project Pfofile For Setting Up of Bio-Fertilizer Production UnitDocument3 pagesProject Pfofile For Setting Up of Bio-Fertilizer Production UnitsuryasanNo ratings yet

- Indian Economy in 2050Document18 pagesIndian Economy in 2050pshinestarNo ratings yet

- Study QuestionsDocument6 pagesStudy QuestionsAli Nasser Ahmed AlbaihaniNo ratings yet

- AEC7 - Tañote - BSA-2A - UNIT III - Assignment 2Document2 pagesAEC7 - Tañote - BSA-2A - UNIT III - Assignment 2Daisy TañoteNo ratings yet

- 254 AssignmentDocument3 pages254 AssignmentSavera Mizan ShuptiNo ratings yet

- Foreign InvestmentDocument7 pagesForeign InvestmentÄkãsh ÑàúghtyNo ratings yet

- Research Paper Final Presentation1Document19 pagesResearch Paper Final Presentation1Satyendra DhakreNo ratings yet

- Number SeriesDocument72 pagesNumber SeriesAmit RajdhanNo ratings yet

- Forex Mantra Currency Dec 28Document4 pagesForex Mantra Currency Dec 28gevariyaNo ratings yet

- Brain Drain To Brain Gain of The PhilippinesDocument1 pageBrain Drain To Brain Gain of The PhilippinesQueen CatastropheNo ratings yet

- Shi Home Decor: Tax Is Payable On Reverse Charge (Yes/NO)Document1 pageShi Home Decor: Tax Is Payable On Reverse Charge (Yes/NO)sunil tapariaNo ratings yet

- Rich Countries Are Getting Richer While Poor Countries Are Getting PoorerDocument1 pageRich Countries Are Getting Richer While Poor Countries Are Getting PoorerErika PatrascaNo ratings yet

- Macro Exercise Ch.4Document1 pageMacro Exercise Ch.4Daisy MistyNo ratings yet

- The US-China Trade WarDocument7 pagesThe US-China Trade WarEbad KhanNo ratings yet

- Macro EconomicsdiagnosticDocument10 pagesMacro Economicsdiagnosticgspkishore7953No ratings yet

- Lý thuyết Line GraphDocument7 pagesLý thuyết Line GraphThiên ThiênNo ratings yet

- Growth Vs Value GSDocument21 pagesGrowth Vs Value GSSamay Dhawan0% (3)

- Fun With Graphs-Graphing The Great DepressionDocument7 pagesFun With Graphs-Graphing The Great Depressionokapi1245No ratings yet

- Fruits Market - Delhi & MumbaiDocument6 pagesFruits Market - Delhi & Mumbaisamiksha gurbaxaniNo ratings yet

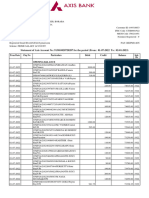

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument3 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceLavanya JagadeesNo ratings yet

- Statement of Axis Account No:913010028728287 For The Period (From: 01-07-2022 To: 02-01-2023)Document41 pagesStatement of Axis Account No:913010028728287 For The Period (From: 01-07-2022 To: 02-01-2023)Shreshtha Suffix Financial ServicesNo ratings yet

- Q92 - Balance of PaymentDocument3 pagesQ92 - Balance of PaymentcelinebcvNo ratings yet

- Vission N Mission of SbiDocument19 pagesVission N Mission of Sbianand_lihinarNo ratings yet

- National IncomeDocument1 pageNational IncomeAnmol SinghNo ratings yet

- Price List For Fiesta Homes by SJR PrimecorpDocument1 pagePrice List For Fiesta Homes by SJR PrimecorpAswath FarookNo ratings yet