Professional Documents

Culture Documents

ROAO Overdraftnotice Otherstates PDF

ROAO Overdraftnotice Otherstates PDF

Uploaded by

Patricia BostCopyright:

Available Formats

You might also like

- Instruction Manual: AH-250H Automatic Hitch Feed Metal Cutting Band Saw (415V) 280 X 250mm (W X H) RectangleDocument134 pagesInstruction Manual: AH-250H Automatic Hitch Feed Metal Cutting Band Saw (415V) 280 X 250mm (W X H) Rectanglemaicon sulivanNo ratings yet

- Citibank, N.ADocument3 pagesCitibank, N.AjohnwregNo ratings yet

- Sarajevo S Landscape First Look 20140417Document46 pagesSarajevo S Landscape First Look 20140417ado080992aodNo ratings yet

- Asterisk-Free Checking Account: 1 Everyday TransactionsDocument3 pagesAsterisk-Free Checking Account: 1 Everyday TransactionsMarcells Danyel JordanNo ratings yet

- BofA CoreChecking en ADADocument2 pagesBofA CoreChecking en ADAFrank TilemanNo ratings yet

- Overdraft BrochureDocument6 pagesOverdraft BrochureStone pobeeNo ratings yet

- Elite Gold NCDocument2 pagesElite Gold NCAakash AgarwalNo ratings yet

- Overdraft Payment Service DisclosureDocument2 pagesOverdraft Payment Service DisclosureMaltro ChooNo ratings yet

- No. 3Document1 pageNo. 3johnnywong1504No ratings yet

- ATM and Debit Card Overdraft Coverage Confirmation NoDocument2 pagesATM and Debit Card Overdraft Coverage Confirmation NoSucreNo ratings yet

- Bac Core Checking EnusDocument2 pagesBac Core Checking Enusapi-285070305No ratings yet

- Overdraft NoticeDocument1 pageOverdraft Noticeleinbergerwife1No ratings yet

- Smart Advantage C Reg DDDocument4 pagesSmart Advantage C Reg DDekinediepreyeNo ratings yet

- Document Set (For JESUS HENRIQUE HERNANDEZ ALBORNOZ) - EncryptedDocument9 pagesDocument Set (For JESUS HENRIQUE HERNANDEZ ALBORNOZ) - Encryptedjesushernandez.alNo ratings yet

- Most Important Terms & ConditionsDocument93 pagesMost Important Terms & Conditionslancy_dsuzaNo ratings yet

- 3584 CS MyAccess ALL 8 2013Document2 pages3584 CS MyAccess ALL 8 2013rasheed-aliNo ratings yet

- Sign Here X - : Product Disclosure SheetDocument4 pagesSign Here X - : Product Disclosure SheetJosh lamNo ratings yet

- Pds Lifestyle-0223en PDFDocument5 pagesPds Lifestyle-0223en PDFWilfred ImangNo ratings yet

- OverraftDocs 1234Document8 pagesOverraftDocs 1234KimberlyNo ratings yet

- Most Important Terms & ConditionsDocument75 pagesMost Important Terms & Conditionsjamin2020No ratings yet

- Credit Card PDS V42 (Eng) - CompressedDocument4 pagesCredit Card PDS V42 (Eng) - Compressedrf_1238No ratings yet

- October 2023Document5 pagesOctober 2023isaiahdesmondbrown1No ratings yet

- Nfcu Secured Credit Card Application - 800nDocument2 pagesNfcu Secured Credit Card Application - 800nKako The 66th ChannelNo ratings yet

- Your Account Statement: Contact UsDocument2 pagesYour Account Statement: Contact UsKelleyNo ratings yet

- Welcome To M&T Bank.: New Account GuideDocument49 pagesWelcome To M&T Bank.: New Account Guideraymond myoNo ratings yet

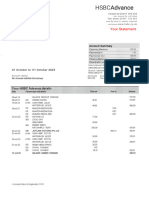

- HSBCBank Estatment202310Document3 pagesHSBCBank Estatment202310aksesorissamsulNo ratings yet

- Fees and limitsغزاليDocument5 pagesFees and limitsغزاليdiego maradonianNo ratings yet

- Screenshot 2023-11-26 at 12.01.23 AMDocument73 pagesScreenshot 2023-11-26 at 12.01.23 AMqt5tggw8k8No ratings yet

- Yield Pledge Checking: Account Opening & UsageDocument2 pagesYield Pledge Checking: Account Opening & Usageshenzo_No ratings yet

- My Productdisclosure SheetDocument8 pagesMy Productdisclosure SheetNesa rachenamotyNo ratings yet

- PDS Revision Eng & BM Online (Final)Document6 pagesPDS Revision Eng & BM Online (Final)Faiziya BanuNo ratings yet

- Credit CardsDocument5 pagesCredit CardsCemitoXNo ratings yet

- Product Disclosure Sheet: Page 1 of 4 (PDS027/REV201115)Document4 pagesProduct Disclosure Sheet: Page 1 of 4 (PDS027/REV201115)Lipsin LeeNo ratings yet

- Direct Debit - FAQ's: Uaedds Faq Page 1 of 9Document9 pagesDirect Debit - FAQ's: Uaedds Faq Page 1 of 9MAdhuNo ratings yet

- In LMRK Other TNCDocument4 pagesIn LMRK Other TNCKashi-Guru GyanNo ratings yet

- HCBC CC InfoDocument5 pagesHCBC CC Infooninx26No ratings yet

- Secured Personal Terms enDocument8 pagesSecured Personal Terms enluiscelis01No ratings yet

- Chase AgreementDocument30 pagesChase AgreementDijana MitrovicNo ratings yet

- VN 04 Credit Cards FaqDocument5 pagesVN 04 Credit Cards FaqdhakaeurekaNo ratings yet

- This Is A Summary Only. Please See Below This Box For Full DetailsDocument10 pagesThis Is A Summary Only. Please See Below This Box For Full DetailsSequencersNo ratings yet

- Bankciwamb Bank PH Pds Fast Plus AccountDocument6 pagesBankciwamb Bank PH Pds Fast Plus AccountChuckie TajorNo ratings yet

- Credit Card I PdsDocument11 pagesCredit Card I PdsIskandar ZulqarnainNo ratings yet

- PT CAP BasicBankingDocument3 pagesPT CAP BasicBankingRayan PaulNo ratings yet

- Mitc For Bob Lite Savings AccountDocument4 pagesMitc For Bob Lite Savings AccountramsanjayyNo ratings yet

- Product Disclosure Sheet: What Is This Product About?Document6 pagesProduct Disclosure Sheet: What Is This Product About?faisal_ahsan7919No ratings yet

- Citi Payall Frequently Asked QuestionsDocument14 pagesCiti Payall Frequently Asked QuestionsM ANo ratings yet

- CC DCBDocument7 pagesCC DCBHugo DivalNo ratings yet

- BN Credit Cards v11Document41 pagesBN Credit Cards v11shekharsap284No ratings yet

- Balance Transfer: Tenure Rate of Interest Processing FeeDocument14 pagesBalance Transfer: Tenure Rate of Interest Processing FeeMunmun SinhaNo ratings yet

- Disclosure RetrieverDocument30 pagesDisclosure RetrievermattloyaltyNo ratings yet

- Overview of Regular Savings Key Policies and Fees: Bank of America Clarity StatementDocument2 pagesOverview of Regular Savings Key Policies and Fees: Bank of America Clarity StatementJacob DaleNo ratings yet

- Easy SavingsDocument2 pagesEasy SavingsPepper JackNo ratings yet

- Product Disclosure SheetDocument4 pagesProduct Disclosure SheetCY TNo ratings yet

- P0543778 NatWest Changes To Your Account TermsDocument4 pagesP0543778 NatWest Changes To Your Account Termsderek49cleanerNo ratings yet

- CaracteristicsandFeesEaccount enDocument3 pagesCaracteristicsandFeesEaccount enCharlie BobNo ratings yet

- AkimboNow AkimboNowMCCHA 0719-1Document11 pagesAkimboNow AkimboNowMCCHA 0719-1lindsaysalirah258No ratings yet

- Standard Checking Summary PDFDocument2 pagesStandard Checking Summary PDFBobby BakerNo ratings yet

- What You Need To Know About Overdrafts and Overdraft FeesDocument1 pageWhat You Need To Know About Overdrafts and Overdraft Feesmetreus30No ratings yet

- 05-Cont Chase PDFDocument1 page05-Cont Chase PDFPlus CompNo ratings yet

- Product Disclosure Sheet: 1. What Is This Product About?Document8 pagesProduct Disclosure Sheet: 1. What Is This Product About?Yusdaud DaudNo ratings yet

- Understanding Bank of America Interest Checking: An Overview of Key Policies and FeesDocument2 pagesUnderstanding Bank of America Interest Checking: An Overview of Key Policies and FeesGheorghiu GheorgheNo ratings yet

- Close: Lession ADocument9 pagesClose: Lession ARoymarSanchezCubasNo ratings yet

- Strengthening Family RelationshipsDocument7 pagesStrengthening Family RelationshipsMonica Sario Policina100% (2)

- JavascriptDocument15 pagesJavascriptRajashekar PrasadNo ratings yet

- Reo Speedwagon - in My Dreams - Guitar ChordsDocument1 pageReo Speedwagon - in My Dreams - Guitar ChordsArch Dela CruzNo ratings yet

- What Exactly Is ShivlingDocument1 pageWhat Exactly Is ShivlingApoorva BhattNo ratings yet

- Enable or Disable Macros in Office FilesDocument4 pagesEnable or Disable Macros in Office Filesmili_ccNo ratings yet

- El Diablo II - M. RobinsonDocument277 pagesEl Diablo II - M. RobinsonEdina Szentpéteri100% (2)

- Keiko DilbeckDocument4 pagesKeiko DilbeckizaikellyNo ratings yet

- Bahasa Inggris Kelas 5Document2 pagesBahasa Inggris Kelas 5Bimbeldec Depok100% (1)

- Alliance Lite2: Your Connection To The Financial WorldDocument2 pagesAlliance Lite2: Your Connection To The Financial WorldtheatresonicNo ratings yet

- MCQ ON - Chapter 1 - Artificial Intelligence (AI)Document18 pagesMCQ ON - Chapter 1 - Artificial Intelligence (AI)Adinath Baliram ShelkeNo ratings yet

- Content For Year 5 - Learning Area Content DescriptionsDocument4 pagesContent For Year 5 - Learning Area Content Descriptionsapi-298473661No ratings yet

- Seneca On The Analysis and Therapy of Oc PDFDocument24 pagesSeneca On The Analysis and Therapy of Oc PDFsteppenwolf88No ratings yet

- FDRDocument5 pagesFDRMariam SalimNo ratings yet

- 56 5 3 ChemistryDocument24 pages56 5 3 ChemistrygettotonnyNo ratings yet

- Caltex Vs PalomarDocument1 pageCaltex Vs PalomarNMNGNo ratings yet

- Sales Operation Management of SINGER Bangladesh LTDDocument17 pagesSales Operation Management of SINGER Bangladesh LTDMd.Minhaz AkterNo ratings yet

- Coass in Charge: Fara/Vicia/Yanti/ Eva/Tryas/Desi Supervisor: Dr. Mulyo Hadi Sungkono, SP - OG (K)Document15 pagesCoass in Charge: Fara/Vicia/Yanti/ Eva/Tryas/Desi Supervisor: Dr. Mulyo Hadi Sungkono, SP - OG (K)Tryas YulithaNo ratings yet

- Ost-Kerala Solar Energy Policy 2013Document7 pagesOst-Kerala Solar Energy Policy 2013Mahi On D RockzzNo ratings yet

- Ethics of Management 7th Edition Hosmer Solutions ManualDocument17 pagesEthics of Management 7th Edition Hosmer Solutions Manualscottmichaelojbcfapdkq100% (18)

- Experimental Investigation and Nonlinear FE Analysis of Historical Masonry Buildings - A Case StudyDocument38 pagesExperimental Investigation and Nonlinear FE Analysis of Historical Masonry Buildings - A Case StudyRuben OñateNo ratings yet

- Prepare A Report On Smart City 'Document12 pagesPrepare A Report On Smart City 'Ringtones WorldsNo ratings yet

- Question Bank SUBJECT: GSM (06EC844) Part-A: Unit 1 (GSM Architecture and Interfaces)Document6 pagesQuestion Bank SUBJECT: GSM (06EC844) Part-A: Unit 1 (GSM Architecture and Interfaces)Santhosh VisweswarappaNo ratings yet

- IS 16700 PosterDocument1 pageIS 16700 Postersoham trivediNo ratings yet

- Institutionalizing Alliance Capabilities: A Platform For Repeatable SuccessDocument64 pagesInstitutionalizing Alliance Capabilities: A Platform For Repeatable SuccessNischal RamNo ratings yet

- OTC Asia 2024 Conference PreviewDocument20 pagesOTC Asia 2024 Conference PreviewAmmirul AzmanNo ratings yet

- The Customer Value JourneyDocument11 pagesThe Customer Value JourneyMichael JenkinsNo ratings yet

- Annexure ADocument1 pageAnnexure Atoocool_sashi100% (2)

ROAO Overdraftnotice Otherstates PDF

ROAO Overdraftnotice Otherstates PDF

Uploaded by

Patricia BostOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ROAO Overdraftnotice Otherstates PDF

ROAO Overdraftnotice Otherstates PDF

Uploaded by

Patricia BostCopyright:

Available Formats

BB&T Overdraft Decision Notice

What You Need to Know about Overdrafts and Overdraft Fees

An overdraft occurs when you do not have enough money in your account to cover a transaction, but BB&T pays it

as a courtesy. BB&T can cover your overdrafts in two ways:

1. BB&T has an Overdraft Review process that comes with your account.

2. BB&T also offers overdraft protection options, such as a link to a BB&T savings account, BB&T Visa® Platinum Credit

Card1, Constant Credit Account1, BB&T Preferred Line1, or BB&T Home Equity Line1, which may be less expensive than

our Overdraft Review process. To learn more, ask us about these plans.

1

Subject to credit approval. BB&T Home Equity Lines cannot be linked in Texas.

This notice explains BB&T's Overdraft Review process.

What is the Overdraft Review process that comes with my account?

BB&T does authorize and pay overdrafts for the following types of transactions unless you ask us to opt-out (see below):

· Checks and other transactions made using your checking account number

· Automatic bill payments

*If you opt-out, all of your checks, ACH, recurring debits and all other transfers and withdrawals will generally be returned unpaid or declined. However, recurring debit card

payments that are authorized when funds are available in your account but post at a later date when funds are no longer available, may overdraw your account and these items

will be subject to overdraft fees even if you are opted out of Overdraft Review. Fees will apply to this Overdraft Review whether the checks or transactions are paid (Overdraft Fee)

or declined (Returned Item Fee).

BB&T does not authorize and pay overdrafts for the following types of transactions unless you ask us to by opting-in (see below):

· ATM transactions

· Everyday debit card transactions (also known as one-time debit card transactions)

BB&T pays overdrafts at its discretion, which means we do not guarantee that we will always authorize and pay any

type of transaction. If we do not authorize and pay an overdraft, your transaction will be declined or returned.

What fees will I be charged if BB&T pays my overdraft?

Under BB&T's Overdraft Review process:

BB&T will charge you an overdraft fee of $36 each time we pay an overdraft on your behalf.

BB&T limits the total number of Overdraft and Returned Item Fees to 6 per day.

BB&T will not charge you an overdraft fee if your account balance is negative by less than $5.00 at the end of

processing.

BB&T will charge you a Negative Account Balance Fee of $36 if your account remains negative for seven

consecutive days.

What fees will I be charged if BB&T declines or returns my transaction?

Under BB&T’s Overdraft Review process:

If opted out for ATM and everyday debit card transactions, you will not be charged a fee for declined everyday debit card

transactions or declined ATM withdrawals.

BB&T will charge you a Returned Item Fee of $36 each time we return a check, ACH, or other transaction.

BB&T limits the total number of Overdraft and Returned Item Fees to 6 per day.

What if I want BB&T to consider authorizing and What if I do not want BB&T to consider

paying overdrafts on my ATM and everyday debit paying overdrafts on my check, ACH,

card transactions? recurring debit card, and other

transactions?

If you also want us to authorize and pay overdrafts on

ATM and everyday debit card transactions, please contact If you do not want us to authorize and pay

us by: overdrafts on check, ACH, recurring debit card,

· Calling 1-800-BANK BBT (800-226-5228) and other transactions, please contact us by:

· Visiting BBT.com/overdraftchanges · Visiting BBT.com/overdraftchanges

· Logging into online banking · Logging into online banking

· Stopping by your local BB&T financial center · Stopping by your local BB&T financial center

· Accessing a BB&T 24 ATM (ATMs owned / operated by

BB&T)

Your decision will be effective next business day for all transactions initiated after the effective date. Your decision will be effective until you make another

decision for this account. Please note that you can change your Overdraft Review decisions at any time using the contact options listed above. This notice is

only applicable for your consumer deposit account.

8056 AL DC FL GA MD NC SC TN TX VA WV CREATED 2/2017

You might also like

- Instruction Manual: AH-250H Automatic Hitch Feed Metal Cutting Band Saw (415V) 280 X 250mm (W X H) RectangleDocument134 pagesInstruction Manual: AH-250H Automatic Hitch Feed Metal Cutting Band Saw (415V) 280 X 250mm (W X H) Rectanglemaicon sulivanNo ratings yet

- Citibank, N.ADocument3 pagesCitibank, N.AjohnwregNo ratings yet

- Sarajevo S Landscape First Look 20140417Document46 pagesSarajevo S Landscape First Look 20140417ado080992aodNo ratings yet

- Asterisk-Free Checking Account: 1 Everyday TransactionsDocument3 pagesAsterisk-Free Checking Account: 1 Everyday TransactionsMarcells Danyel JordanNo ratings yet

- BofA CoreChecking en ADADocument2 pagesBofA CoreChecking en ADAFrank TilemanNo ratings yet

- Overdraft BrochureDocument6 pagesOverdraft BrochureStone pobeeNo ratings yet

- Elite Gold NCDocument2 pagesElite Gold NCAakash AgarwalNo ratings yet

- Overdraft Payment Service DisclosureDocument2 pagesOverdraft Payment Service DisclosureMaltro ChooNo ratings yet

- No. 3Document1 pageNo. 3johnnywong1504No ratings yet

- ATM and Debit Card Overdraft Coverage Confirmation NoDocument2 pagesATM and Debit Card Overdraft Coverage Confirmation NoSucreNo ratings yet

- Bac Core Checking EnusDocument2 pagesBac Core Checking Enusapi-285070305No ratings yet

- Overdraft NoticeDocument1 pageOverdraft Noticeleinbergerwife1No ratings yet

- Smart Advantage C Reg DDDocument4 pagesSmart Advantage C Reg DDekinediepreyeNo ratings yet

- Document Set (For JESUS HENRIQUE HERNANDEZ ALBORNOZ) - EncryptedDocument9 pagesDocument Set (For JESUS HENRIQUE HERNANDEZ ALBORNOZ) - Encryptedjesushernandez.alNo ratings yet

- Most Important Terms & ConditionsDocument93 pagesMost Important Terms & Conditionslancy_dsuzaNo ratings yet

- 3584 CS MyAccess ALL 8 2013Document2 pages3584 CS MyAccess ALL 8 2013rasheed-aliNo ratings yet

- Sign Here X - : Product Disclosure SheetDocument4 pagesSign Here X - : Product Disclosure SheetJosh lamNo ratings yet

- Pds Lifestyle-0223en PDFDocument5 pagesPds Lifestyle-0223en PDFWilfred ImangNo ratings yet

- OverraftDocs 1234Document8 pagesOverraftDocs 1234KimberlyNo ratings yet

- Most Important Terms & ConditionsDocument75 pagesMost Important Terms & Conditionsjamin2020No ratings yet

- Credit Card PDS V42 (Eng) - CompressedDocument4 pagesCredit Card PDS V42 (Eng) - Compressedrf_1238No ratings yet

- October 2023Document5 pagesOctober 2023isaiahdesmondbrown1No ratings yet

- Nfcu Secured Credit Card Application - 800nDocument2 pagesNfcu Secured Credit Card Application - 800nKako The 66th ChannelNo ratings yet

- Your Account Statement: Contact UsDocument2 pagesYour Account Statement: Contact UsKelleyNo ratings yet

- Welcome To M&T Bank.: New Account GuideDocument49 pagesWelcome To M&T Bank.: New Account Guideraymond myoNo ratings yet

- HSBCBank Estatment202310Document3 pagesHSBCBank Estatment202310aksesorissamsulNo ratings yet

- Fees and limitsغزاليDocument5 pagesFees and limitsغزاليdiego maradonianNo ratings yet

- Screenshot 2023-11-26 at 12.01.23 AMDocument73 pagesScreenshot 2023-11-26 at 12.01.23 AMqt5tggw8k8No ratings yet

- Yield Pledge Checking: Account Opening & UsageDocument2 pagesYield Pledge Checking: Account Opening & Usageshenzo_No ratings yet

- My Productdisclosure SheetDocument8 pagesMy Productdisclosure SheetNesa rachenamotyNo ratings yet

- PDS Revision Eng & BM Online (Final)Document6 pagesPDS Revision Eng & BM Online (Final)Faiziya BanuNo ratings yet

- Credit CardsDocument5 pagesCredit CardsCemitoXNo ratings yet

- Product Disclosure Sheet: Page 1 of 4 (PDS027/REV201115)Document4 pagesProduct Disclosure Sheet: Page 1 of 4 (PDS027/REV201115)Lipsin LeeNo ratings yet

- Direct Debit - FAQ's: Uaedds Faq Page 1 of 9Document9 pagesDirect Debit - FAQ's: Uaedds Faq Page 1 of 9MAdhuNo ratings yet

- In LMRK Other TNCDocument4 pagesIn LMRK Other TNCKashi-Guru GyanNo ratings yet

- HCBC CC InfoDocument5 pagesHCBC CC Infooninx26No ratings yet

- Secured Personal Terms enDocument8 pagesSecured Personal Terms enluiscelis01No ratings yet

- Chase AgreementDocument30 pagesChase AgreementDijana MitrovicNo ratings yet

- VN 04 Credit Cards FaqDocument5 pagesVN 04 Credit Cards FaqdhakaeurekaNo ratings yet

- This Is A Summary Only. Please See Below This Box For Full DetailsDocument10 pagesThis Is A Summary Only. Please See Below This Box For Full DetailsSequencersNo ratings yet

- Bankciwamb Bank PH Pds Fast Plus AccountDocument6 pagesBankciwamb Bank PH Pds Fast Plus AccountChuckie TajorNo ratings yet

- Credit Card I PdsDocument11 pagesCredit Card I PdsIskandar ZulqarnainNo ratings yet

- PT CAP BasicBankingDocument3 pagesPT CAP BasicBankingRayan PaulNo ratings yet

- Mitc For Bob Lite Savings AccountDocument4 pagesMitc For Bob Lite Savings AccountramsanjayyNo ratings yet

- Product Disclosure Sheet: What Is This Product About?Document6 pagesProduct Disclosure Sheet: What Is This Product About?faisal_ahsan7919No ratings yet

- Citi Payall Frequently Asked QuestionsDocument14 pagesCiti Payall Frequently Asked QuestionsM ANo ratings yet

- CC DCBDocument7 pagesCC DCBHugo DivalNo ratings yet

- BN Credit Cards v11Document41 pagesBN Credit Cards v11shekharsap284No ratings yet

- Balance Transfer: Tenure Rate of Interest Processing FeeDocument14 pagesBalance Transfer: Tenure Rate of Interest Processing FeeMunmun SinhaNo ratings yet

- Disclosure RetrieverDocument30 pagesDisclosure RetrievermattloyaltyNo ratings yet

- Overview of Regular Savings Key Policies and Fees: Bank of America Clarity StatementDocument2 pagesOverview of Regular Savings Key Policies and Fees: Bank of America Clarity StatementJacob DaleNo ratings yet

- Easy SavingsDocument2 pagesEasy SavingsPepper JackNo ratings yet

- Product Disclosure SheetDocument4 pagesProduct Disclosure SheetCY TNo ratings yet

- P0543778 NatWest Changes To Your Account TermsDocument4 pagesP0543778 NatWest Changes To Your Account Termsderek49cleanerNo ratings yet

- CaracteristicsandFeesEaccount enDocument3 pagesCaracteristicsandFeesEaccount enCharlie BobNo ratings yet

- AkimboNow AkimboNowMCCHA 0719-1Document11 pagesAkimboNow AkimboNowMCCHA 0719-1lindsaysalirah258No ratings yet

- Standard Checking Summary PDFDocument2 pagesStandard Checking Summary PDFBobby BakerNo ratings yet

- What You Need To Know About Overdrafts and Overdraft FeesDocument1 pageWhat You Need To Know About Overdrafts and Overdraft Feesmetreus30No ratings yet

- 05-Cont Chase PDFDocument1 page05-Cont Chase PDFPlus CompNo ratings yet

- Product Disclosure Sheet: 1. What Is This Product About?Document8 pagesProduct Disclosure Sheet: 1. What Is This Product About?Yusdaud DaudNo ratings yet

- Understanding Bank of America Interest Checking: An Overview of Key Policies and FeesDocument2 pagesUnderstanding Bank of America Interest Checking: An Overview of Key Policies and FeesGheorghiu GheorgheNo ratings yet

- Close: Lession ADocument9 pagesClose: Lession ARoymarSanchezCubasNo ratings yet

- Strengthening Family RelationshipsDocument7 pagesStrengthening Family RelationshipsMonica Sario Policina100% (2)

- JavascriptDocument15 pagesJavascriptRajashekar PrasadNo ratings yet

- Reo Speedwagon - in My Dreams - Guitar ChordsDocument1 pageReo Speedwagon - in My Dreams - Guitar ChordsArch Dela CruzNo ratings yet

- What Exactly Is ShivlingDocument1 pageWhat Exactly Is ShivlingApoorva BhattNo ratings yet

- Enable or Disable Macros in Office FilesDocument4 pagesEnable or Disable Macros in Office Filesmili_ccNo ratings yet

- El Diablo II - M. RobinsonDocument277 pagesEl Diablo II - M. RobinsonEdina Szentpéteri100% (2)

- Keiko DilbeckDocument4 pagesKeiko DilbeckizaikellyNo ratings yet

- Bahasa Inggris Kelas 5Document2 pagesBahasa Inggris Kelas 5Bimbeldec Depok100% (1)

- Alliance Lite2: Your Connection To The Financial WorldDocument2 pagesAlliance Lite2: Your Connection To The Financial WorldtheatresonicNo ratings yet

- MCQ ON - Chapter 1 - Artificial Intelligence (AI)Document18 pagesMCQ ON - Chapter 1 - Artificial Intelligence (AI)Adinath Baliram ShelkeNo ratings yet

- Content For Year 5 - Learning Area Content DescriptionsDocument4 pagesContent For Year 5 - Learning Area Content Descriptionsapi-298473661No ratings yet

- Seneca On The Analysis and Therapy of Oc PDFDocument24 pagesSeneca On The Analysis and Therapy of Oc PDFsteppenwolf88No ratings yet

- FDRDocument5 pagesFDRMariam SalimNo ratings yet

- 56 5 3 ChemistryDocument24 pages56 5 3 ChemistrygettotonnyNo ratings yet

- Caltex Vs PalomarDocument1 pageCaltex Vs PalomarNMNGNo ratings yet

- Sales Operation Management of SINGER Bangladesh LTDDocument17 pagesSales Operation Management of SINGER Bangladesh LTDMd.Minhaz AkterNo ratings yet

- Coass in Charge: Fara/Vicia/Yanti/ Eva/Tryas/Desi Supervisor: Dr. Mulyo Hadi Sungkono, SP - OG (K)Document15 pagesCoass in Charge: Fara/Vicia/Yanti/ Eva/Tryas/Desi Supervisor: Dr. Mulyo Hadi Sungkono, SP - OG (K)Tryas YulithaNo ratings yet

- Ost-Kerala Solar Energy Policy 2013Document7 pagesOst-Kerala Solar Energy Policy 2013Mahi On D RockzzNo ratings yet

- Ethics of Management 7th Edition Hosmer Solutions ManualDocument17 pagesEthics of Management 7th Edition Hosmer Solutions Manualscottmichaelojbcfapdkq100% (18)

- Experimental Investigation and Nonlinear FE Analysis of Historical Masonry Buildings - A Case StudyDocument38 pagesExperimental Investigation and Nonlinear FE Analysis of Historical Masonry Buildings - A Case StudyRuben OñateNo ratings yet

- Prepare A Report On Smart City 'Document12 pagesPrepare A Report On Smart City 'Ringtones WorldsNo ratings yet

- Question Bank SUBJECT: GSM (06EC844) Part-A: Unit 1 (GSM Architecture and Interfaces)Document6 pagesQuestion Bank SUBJECT: GSM (06EC844) Part-A: Unit 1 (GSM Architecture and Interfaces)Santhosh VisweswarappaNo ratings yet

- IS 16700 PosterDocument1 pageIS 16700 Postersoham trivediNo ratings yet

- Institutionalizing Alliance Capabilities: A Platform For Repeatable SuccessDocument64 pagesInstitutionalizing Alliance Capabilities: A Platform For Repeatable SuccessNischal RamNo ratings yet

- OTC Asia 2024 Conference PreviewDocument20 pagesOTC Asia 2024 Conference PreviewAmmirul AzmanNo ratings yet

- The Customer Value JourneyDocument11 pagesThe Customer Value JourneyMichael JenkinsNo ratings yet

- Annexure ADocument1 pageAnnexure Atoocool_sashi100% (2)