Professional Documents

Culture Documents

Nomor 1 TAX 45% I 7,9 % Year CFBT Depreciation Taxable Taxes Cfat Book Value CPI Income P Gi - Oe (3) - (4) (3) - (6) (Pn-Po) /po 3 4 5 6 7 8

Nomor 1 TAX 45% I 7,9 % Year CFBT Depreciation Taxable Taxes Cfat Book Value CPI Income P Gi - Oe (3) - (4) (3) - (6) (Pn-Po) /po 3 4 5 6 7 8

Uploaded by

alfi jauharo0 ratings0% found this document useful (0 votes)

7 views2 pages- The document presents a table showing cash flows, depreciation, taxable income, taxes, cash flows after tax, and book value over 10 years for an asset.

- It calculates the net present value (NPV) of the cash flows using discount rates of 5%, 6%, and 7.9% to determine the internal rate of return (IRR).

- The IRR is calculated to be 0.464% or 4.64% when using discount rates of 5% and 6%.

- When using a discount rate of 7.9%, the NPV equals 0, indicating the IRR is 7.9%.

Original Description:

Jawaban soal ekonomi teknik

Original Title

Book1

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document- The document presents a table showing cash flows, depreciation, taxable income, taxes, cash flows after tax, and book value over 10 years for an asset.

- It calculates the net present value (NPV) of the cash flows using discount rates of 5%, 6%, and 7.9% to determine the internal rate of return (IRR).

- The IRR is calculated to be 0.464% or 4.64% when using discount rates of 5% and 6%.

- When using a discount rate of 7.9%, the NPV equals 0, indicating the IRR is 7.9%.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

7 views2 pagesNomor 1 TAX 45% I 7,9 % Year CFBT Depreciation Taxable Taxes Cfat Book Value CPI Income P Gi - Oe (3) - (4) (3) - (6) (Pn-Po) /po 3 4 5 6 7 8

Nomor 1 TAX 45% I 7,9 % Year CFBT Depreciation Taxable Taxes Cfat Book Value CPI Income P Gi - Oe (3) - (4) (3) - (6) (Pn-Po) /po 3 4 5 6 7 8

Uploaded by

alfi jauharo- The document presents a table showing cash flows, depreciation, taxable income, taxes, cash flows after tax, and book value over 10 years for an asset.

- It calculates the net present value (NPV) of the cash flows using discount rates of 5%, 6%, and 7.9% to determine the internal rate of return (IRR).

- The IRR is calculated to be 0.464% or 4.64% when using discount rates of 5% and 6%.

- When using a discount rate of 7.9%, the NPV equals 0, indicating the IRR is 7.9%.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

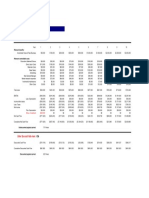

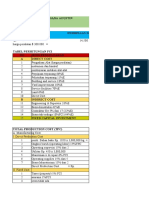

Nomor 1

TAX =45% i= 7,9 %

YEAR CFBT DEPRECIATION TAXABLE TAXES CFAT BOOK VALUE CPI

INCOME P

GI - OE (3) - (4) (5) X 45% (3) - (6) (Pn-Po)/Po

3 4 5 6 7 8

0 $ (100,000,000.00) $ (100,000,000.00) 100

1 $ 20,000,000.00 $ 10,000,000.00 $ 10,000,000.00 $ (4,500,000.00) $ 24,500,000.00 $ 75,500,000.00 -75.5

2 $ 20,000,000.00 $ 10,000,000.00 $ 10,000,000.00 $ (4,500,000.00) $ 24,500,000.00 $ 51,000,000.00 208.1632653

3 $ 20,000,000.00 $ 10,000,000.00 $ 10,000,000.00 $ (4,500,000.00) $ 24,500,000.00 $ 26,500,000.00 108.1632653

4 $ 20,000,000.00 $ 10,000,000.00 $ 10,000,000.00 $ (4,500,000.00) $ 24,500,000.00 $ 2,000,000.00 8.163265306

5 $ 20,000,000.00 $ 10,000,000.00 $ 10,000,000.00 $ (4,500,000.00) $ 24,500,000.00 $ (22,500,000.00) -91.83673469

6 $ 20,000,000.00 $ 10,000,000.00 $ 10,000,000.00 $ (4,500,000.00) $ 24,500,000.00 $ (47,000,000.00) -191.8367347

7 $ 20,000,000.00 $ 10,000,000.00 $ 10,000,000.00 $ (4,500,000.00) $ 24,500,000.00 $ (71,500,000.00) -291.8367347

8 $ 20,000,000.00 $ 10,000,000.00 $ 10,000,000.00 $ (4,500,000.00) $ 24,500,000.00 $ (96,000,000.00) -391.8367347

9 $ 20,000,000.00 $ 10,000,000.00 $ 10,000,000.00 $ (4,500,000.00) $ 24,500,000.00 $ (120,500,000.00) -491.8367347

10 $ 20,000,000.00 $ 10,000,000.00 $ 10,000,000.00 $ (4,500,000.00) $ 24,500,000.00 $ (145,000,000.00) -591.8367347

$ 200,000,000.00 $ (45,000,000.00) $ 245,000,000.00

CFBT = Gross Income - Operating Expense

CFBT/year = CFBT/12

a NPW = 0= -100.000.000 + 20.000.000(P/A,5%,10)

i= 54.434.000

NPW = 0= -100.000.000 + 20.000.000(P/A,6%,10)

i=47.201.740

NPW = (0,01)(47201740)/(54434000+47201740)

0,00464

b NPW= 0=-100000000 + 200000000 (P/A,7,9%,10)

0=34809053,4

C NPW 0=-100000000+20000000 (P/A,7,9%,10)

$ 42,915,000,000.00

You might also like

- Sneakers 2013Document5 pagesSneakers 2013priyaa0367% (12)

- Case 4 (1-6) GabungDocument12 pagesCase 4 (1-6) GabungFadhila HanifNo ratings yet

- Capital Budgeting DCFDocument38 pagesCapital Budgeting DCFNadya Rizkita100% (4)

- Walt Disney Yen Financing I - Group 8Document6 pagesWalt Disney Yen Financing I - Group 8Sonal Choudhary100% (1)

- Sample of Commission BillDocument1 pageSample of Commission BillmanojNo ratings yet

- Actualbill DownloadDocument4 pagesActualbill DownloadYahya Almarzooqi100% (2)

- Essay QuestionsDocument16 pagesEssay Questionssheldon100% (1)

- 05 Park ISM ch05 PDFDocument39 pages05 Park ISM ch05 PDFBenn DoucetNo ratings yet

- CREATING Tourism Awareness atDocument29 pagesCREATING Tourism Awareness atMonette de GuzmanNo ratings yet

- PAS 10 Events After The Reporting PeriodDocument2 pagesPAS 10 Events After The Reporting PeriodJennicaBailonNo ratings yet

- Project Human Resources ManagementDocument57 pagesProject Human Resources ManagementAndreas Cahyo100% (2)

- UntitledDocument47 pagesUntitledapi-228714775No ratings yet

- Exel Calculation (Version 1)Document10 pagesExel Calculation (Version 1)Timotius AnggaraNo ratings yet

- Sneakers 2013Document5 pagesSneakers 2013Felicia FrancisNo ratings yet

- Example 5.7Document7 pagesExample 5.7Omar KhalilNo ratings yet

- Midterm Exam - Saeful Aziz (29118389) PDFDocument44 pagesMidterm Exam - Saeful Aziz (29118389) PDFSaeful AzizNo ratings yet

- Assignment 10 - ShivaDocument21 pagesAssignment 10 - ShivaShiva KashyapNo ratings yet

- Chapter 05Document26 pagesChapter 05slee11829% (7)

- Business Finance Week 5Document5 pagesBusiness Finance Week 5Ahlam KassemNo ratings yet

- Assignment 7 ROR Multiple AlternativeDocument5 pagesAssignment 7 ROR Multiple AlternativeKHANSA DIVA NUR APRILIANo ratings yet

- Model Scheme IS CFS Fcfe BS Irr Coc NPV/DCF Development ScheduleDocument11 pagesModel Scheme IS CFS Fcfe BS Irr Coc NPV/DCF Development ScheduleMilind VatsiNo ratings yet

- P10-10 & P10-21 Managerial FinanceDocument5 pagesP10-10 & P10-21 Managerial Financevincent alvinNo ratings yet

- XLSXDocument12 pagesXLSXShashwat JhaNo ratings yet

- c4 Van, Tir, PaybackDocument13 pagesc4 Van, Tir, PaybackLinsy ValenzuelaNo ratings yet

- Jaxworks PaybackAnalysis1Document1 pageJaxworks PaybackAnalysis1Jo Ann RangelNo ratings yet

- Kitchen Aid Products, Inc., Manufactures Small Kitchen AppliancesDocument7 pagesKitchen Aid Products, Inc., Manufactures Small Kitchen AppliancesGalina FateevaNo ratings yet

- Alifaldo Daffa Darmawan - 242221075 - Calculating NPV EtcDocument9 pagesAlifaldo Daffa Darmawan - 242221075 - Calculating NPV EtcFaldo DaffaNo ratings yet

- Cost Acct Capital BudgetingDocument4 pagesCost Acct Capital BudgetingKerrice RobinsonNo ratings yet

- Capital Budgeting Answer KeyDocument31 pagesCapital Budgeting Answer KeyEsel DimapilisNo ratings yet

- Developing Financial InsightsDocument3 pagesDeveloping Financial InsightsRahma Putri HapsariNo ratings yet

- Bullock Gold MiningDocument3 pagesBullock Gold MiningWalterNo ratings yet

- Case 2 DCF Analysis - Sindikat 2 (Final - Rev)Document22 pagesCase 2 DCF Analysis - Sindikat 2 (Final - Rev)Nadya RizkitaNo ratings yet

- Assignment 4 - Contemporary Engineering BookDocument9 pagesAssignment 4 - Contemporary Engineering BookDhiraj NayakNo ratings yet

- SneakerDocument8 pagesSneakerFelicity YuanNo ratings yet

- 2Document1 page2bomzterNo ratings yet

- SFC 2022Document3 pagesSFC 2022Ben YipNo ratings yet

- Net Present ValueDocument10 pagesNet Present ValueDreamer_ShopnoNo ratings yet

- Making Capital Investment DecisionsDocument42 pagesMaking Capital Investment Decisionsgabisan1087No ratings yet

- ARR Practice QuestionsDocument6 pagesARR Practice QuestionsAnanya VasishthaNo ratings yet

- Home Work 1 Corporate FinanceDocument8 pagesHome Work 1 Corporate FinanceAlia ShabbirNo ratings yet

- FINC 721 Project 3Document6 pagesFINC 721 Project 3Sameer BhattaraiNo ratings yet

- EVA, VPL e CVA 2003Document4 pagesEVA, VPL e CVA 2003Pedro CoutinhoNo ratings yet

- It App - WorkbookDocument8 pagesIt App - WorkbookAsi Cas JavNo ratings yet

- FM Assaignment Second SemisterDocument9 pagesFM Assaignment Second SemisterMotuma Abebe100% (1)

- EEE Assignment 6Document5 pagesEEE Assignment 6shirleyNo ratings yet

- EEE Assignment 6Document5 pagesEEE Assignment 6shirleyNo ratings yet

- Ms. Excel International Brews: Income StatementDocument9 pagesMs. Excel International Brews: Income StatementAphol Joyce MortelNo ratings yet

- Financial StatDocument11 pagesFinancial StatYaqin YusufNo ratings yet

- Financial StatDocument11 pagesFinancial StatYaqin YusufNo ratings yet

- Financial StatDocument11 pagesFinancial StatYaqin YusufNo ratings yet

- FM Homework6Document18 pagesFM Homework6subinamehtaNo ratings yet

- Issues in Capital Budgeting: 9-1 Project Investment NPV PIDocument6 pagesIssues in Capital Budgeting: 9-1 Project Investment NPV PILyam Cruz FernandezNo ratings yet

- Excel RepublicDocument4 pagesExcel RepublicAlfia safraocNo ratings yet

- J SMytheDocument4 pagesJ SMytheSyed TabrezNo ratings yet

- Solution CF Cash Flow Practice Problem 2Document12 pagesSolution CF Cash Flow Practice Problem 2Zarieq EricNo ratings yet

- Wanda Firdiana Agustin - Paralel ADocument19 pagesWanda Firdiana Agustin - Paralel AintanNo ratings yet

- Book 1Document8 pagesBook 1Alejandra LamasNo ratings yet

- Example Sensitivity AnalysisDocument4 pagesExample Sensitivity Analysismc lim100% (1)

- IFRS 15 Contract MathDocument5 pagesIFRS 15 Contract MathFeruz Sha RakinNo ratings yet

- NPV Caselet Project AssessmentDocument4 pagesNPV Caselet Project AssessmentFurqanTariqNo ratings yet

- Solutions On Capital Budgeting AssignmentsDocument3 pagesSolutions On Capital Budgeting AssignmentsjakezzionNo ratings yet

- Solution Assignment Chapter 9 10 1Document14 pagesSolution Assignment Chapter 9 10 1Huynh Ng Quynh NhuNo ratings yet

- 3 Statement Financial Model: How To Build From Start To FinishDocument9 pages3 Statement Financial Model: How To Build From Start To FinishMiks EnriquezNo ratings yet

- Cuota Fina Cuota Fija y Recalculo de Cuota Fija Fija para Todos Los PeriodosDocument16 pagesCuota Fina Cuota Fija y Recalculo de Cuota Fija Fija para Todos Los PeriodosPaula GómezNo ratings yet

- Chapter 7 Supplement 1Document9 pagesChapter 7 Supplement 1nigam34No ratings yet

- IA2 Ch. 5 6Document12 pagesIA2 Ch. 5 6JessaNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Case Study - 修平Document44 pagesCase Study - 修平mellindaNo ratings yet

- 1978-1985 Class Results Adam Baxter 4-12-16 Mastering Negotiation - PrintDocument4 pages1978-1985 Class Results Adam Baxter 4-12-16 Mastering Negotiation - PrintDivyaNo ratings yet

- The Social Economy: Professor Erik Olin WrightDocument14 pagesThe Social Economy: Professor Erik Olin WrightMike daryll NakigoNo ratings yet

- ExibitionDocument90 pagesExibitionsalmanpkplusNo ratings yet

- SummaryDocument24 pagesSummaryankit yadavNo ratings yet

- Green BuildingDocument79 pagesGreen BuildingSURJIT DUTTANo ratings yet

- Government Subsidies and Income Support For The PoorDocument46 pagesGovernment Subsidies and Income Support For The PoorOdie SetiawanNo ratings yet

- Fundamental of Taxation and Auditing (Mgt.218) - BBS Third Year - 4 Years Program - Model Question - With SOLUTIONDocument21 pagesFundamental of Taxation and Auditing (Mgt.218) - BBS Third Year - 4 Years Program - Model Question - With SOLUTIONRiyaz RangrezNo ratings yet

- WAABERI ACADEMY (AutoRecovered)Document31 pagesWAABERI ACADEMY (AutoRecovered)yaxyesahal123No ratings yet

- Unit - 3: Service MarketingDocument19 pagesUnit - 3: Service MarketingcharangowdaNo ratings yet

- Data TechDocument34 pagesData TechPartha ChakaravartiNo ratings yet

- Sales PPT - GRP 3Document14 pagesSales PPT - GRP 321324jesikaNo ratings yet

- LicDocument56 pagesLicvarshaNo ratings yet

- 2 Effective and Nominal RateDocument19 pages2 Effective and Nominal RateKelvin BarceLonNo ratings yet

- Marketing AuditDocument7 pagesMarketing AudithrsrinivasNo ratings yet

- Case StudiesDocument9 pagesCase StudiesMUHAMMAD WALEED BIN NASIRNo ratings yet

- Customer Centricity in McDonaldsDocument8 pagesCustomer Centricity in McDonaldsabhigoldyNo ratings yet

- Partnership FirmDocument7 pagesPartnership FirmPranit AutiNo ratings yet

- Successful Entrepreneur: Iqbal Quadir Iqbal Z. Quadir (Born August 13, 1958 in Jessore, East Pakistan, Present Day Bangladesh)Document1 pageSuccessful Entrepreneur: Iqbal Quadir Iqbal Z. Quadir (Born August 13, 1958 in Jessore, East Pakistan, Present Day Bangladesh)Nafiz AhmedNo ratings yet

- Chapter # 16 - Marketing GloballyDocument23 pagesChapter # 16 - Marketing GloballyAnonymous gf3tINCNo ratings yet

- DATEM Portfolio 1Document21 pagesDATEM Portfolio 1allyssa monica duNo ratings yet

- Edgistify Company ProfileDocument9 pagesEdgistify Company ProfileANJALI AGARWAL Jaipuria JaipurNo ratings yet

- Public Borrowing and Debt Management by Mario RanceDocument47 pagesPublic Borrowing and Debt Management by Mario RanceWo Rance100% (2)