Professional Documents

Culture Documents

Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)

Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)

Uploaded by

Nida KhanCopyright:

Available Formats

You might also like

- Form - Notice To ExplainDocument2 pagesForm - Notice To ExplainMyra Coronado100% (3)

- Chapter 5 Cdi 1 Final EditedDocument16 pagesChapter 5 Cdi 1 Final EditedBelinda Viernes50% (2)

- BAKER, William J. The Making of A Working-Class Football CultureDocument12 pagesBAKER, William J. The Making of A Working-Class Football CultureGabriela Marta Marques de Oliveira100% (1)

- Dictionary of The Later New Testament & Its Developments (The IVP Bible Dictionary Series) 1997aDocument660 pagesDictionary of The Later New Testament & Its Developments (The IVP Bible Dictionary Series) 1997aHerbert Adam Storck85% (13)

- Doctrine of Ultra Vires-Effects FalDocument11 pagesDoctrine of Ultra Vires-Effects FalFalguni ParekhNo ratings yet

- Sukhjeet Singh 2018-19 (Itr) PDFDocument1 pageSukhjeet Singh 2018-19 (Itr) PDFAnonymous XgLFw9IcQNo ratings yet

- 2019 03 29 18 20 50 494 - 1553863850494 - XXXPC3953X - ItrvDocument1 page2019 03 29 18 20 50 494 - 1553863850494 - XXXPC3953X - ItrvIshaan ChawlaNo ratings yet

- Itr 2018-19 S B Mishra PDFDocument1 pageItr 2018-19 S B Mishra PDFJITENDRA DUBEBYNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageSheila George SorkarNo ratings yet

- 2018 08 25 21 26 43 822 - 1535212603822 - XXXPV9294X - AcknowledgementDocument1 page2018 08 25 21 26 43 822 - 1535212603822 - XXXPV9294X - Acknowledgementanusha.veldandiNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagehealth with wealthNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDhanu goswamiNo ratings yet

- Itr-V Indian Income Tax Return VerificatDocument1 pageItr-V Indian Income Tax Return VerificatMOHD AslamNo ratings yet

- 2018 08 22 17 18 09 004 - 1534938489004 - XXXPK5111X - ItrvDocument1 page2018 08 22 17 18 09 004 - 1534938489004 - XXXPK5111X - ItrvSooraj KanojiyaNo ratings yet

- 2020 07 17 19 34 40 654 - 1594994680654 - XXXPM6958X - ItrvDocument1 page2020 07 17 19 34 40 654 - 1594994680654 - XXXPM6958X - ItrvAmiya SinghNo ratings yet

- 2018 12 16 12 25 37 908 - 1544943337908 - XXXPR1749X - Itrv PDFDocument1 page2018 12 16 12 25 37 908 - 1544943337908 - XXXPR1749X - Itrv PDFJayanta Sur RoyNo ratings yet

- Itr5 271352350310818$Document1 pageItr5 271352350310818$Ajay DiwanNo ratings yet

- 2018 07 19 12 06 41 640 - 1531982201640 - XXXPS3223X - Acknowledgement PDFDocument1 page2018 07 19 12 06 41 640 - 1531982201640 - XXXPS3223X - Acknowledgement PDFHarshal A ShahNo ratings yet

- 2019 05 28 11 48 40 077 - 1559024320077 - XXXPP0859X - ItrvDocument1 page2019 05 28 11 48 40 077 - 1559024320077 - XXXPP0859X - Itrvpoluri vinayNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageSAI MOHANNo ratings yet

- Itr 18-19Document1 pageItr 18-19aarushi singhNo ratings yet

- Letsgettin Fraud CompanyDocument1 pageLetsgettin Fraud CompanyAnonymous A3CiCzvNo ratings yet

- 2018 08 31 18 26 34 022 - 1535720194022 - XXXPB3542X - ItrvDocument1 page2018 08 31 18 26 34 022 - 1535720194022 - XXXPB3542X - Itrvdibyan dasNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)santoshkumarNo ratings yet

- 2018 08 31 20 46 27 108 - 1535728587108 - XXXPG5982X - Acknowledgement PDFDocument1 page2018 08 31 20 46 27 108 - 1535728587108 - XXXPG5982X - Acknowledgement PDFAnupam GauravNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageTaiyabaNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageBimal Kumar MaityNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageAditya SharmaNo ratings yet

- 2018 07 22 16 36 36 674 - 1532257596674 - XXXPK4739X - Itrv PDFDocument1 page2018 07 22 16 36 36 674 - 1532257596674 - XXXPK4739X - Itrv PDFakshay guptaNo ratings yet

- 2018 08 05 18 45 12 530 - 1533474912530 - XXXPR6541X - Acknowledgement PDFDocument1 page2018 08 05 18 45 12 530 - 1533474912530 - XXXPR6541X - Acknowledgement PDFGajendra Kumar VermaNo ratings yet

- Itr Receipt A.Y 2018-19Document1 pageItr Receipt A.Y 2018-19Parminder SinghNo ratings yet

- 2020 12 20 20 11 24 733 - 1608475284733 - XXXPP4894X - ItrvDocument1 page2020 12 20 20 11 24 733 - 1608475284733 - XXXPP4894X - ItrvHARI KRISHAN PALNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageO P TulsyanNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageBibhu Datta SenapatiNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageLingesh MaharajanNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageSuresh raaviNo ratings yet

- 2018 08 16 16 36 49 755 - 1534417609755 - XXXPB8989X - Acknowledgement PDFDocument1 page2018 08 16 16 36 49 755 - 1534417609755 - XXXPB8989X - Acknowledgement PDFAkshya BhoiNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villageitkrishna1988No ratings yet

- 2018 08 31 08 56 38 421 - 1535685998421 - XXXPR9465X - Acknowledgement PDFDocument1 page2018 08 31 08 56 38 421 - 1535685998421 - XXXPR9465X - Acknowledgement PDFVarun MgNo ratings yet

- Maadhavan Chandhiran 16-Mar-2018 454072340Document1 pageMaadhavan Chandhiran 16-Mar-2018 454072340samaadhuNo ratings yet

- Itr 19-20 PDFDocument1 pageItr 19-20 PDFAnonymous fM5CtB8Qm7No ratings yet

- ITRDocument1 pageITRpradip_jsr13No ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagesanthosh kumarNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageSai SanthoshNo ratings yet

- Itr-V Bogpp6352h 2017-18 225020870280917Document1 pageItr-V Bogpp6352h 2017-18 225020870280917DEVIL RDXNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageZa HidNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageutsavgautamNo ratings yet

- 17 18 SaleemDocument1 page17 18 Saleembalaji xeroxNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageAshwini oRNo ratings yet

- Aman Jain Itr (A.y.2017-18)Document1 pageAman Jain Itr (A.y.2017-18)ramanNo ratings yet

- PDF 759518980120718Document1 pagePDF 759518980120718HARDIK BANSALNo ratings yet

- Sellakkili Ramaiah 31-Jul-2018 969570370Document1 pageSellakkili Ramaiah 31-Jul-2018 969570370samaadhuNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageGolu GuptaNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDrsex DrsexNo ratings yet

- 2018 12 18 14 20 55 960 - 1545123055960 - XXXPS8841X - Acknowledgement PDFDocument1 page2018 12 18 14 20 55 960 - 1545123055960 - XXXPS8841X - Acknowledgement PDFLEo GEnji KhunnuNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagejaipal sharmaNo ratings yet

- 2018 08 08 14 20 22 467 - 1533718222467 - XXXPP1510X - Itrv PDFDocument1 page2018 08 08 14 20 22 467 - 1533718222467 - XXXPP1510X - Itrv PDFKrishnaNo ratings yet

- Alrpr6574n Itr VDocument1 pageAlrpr6574n Itr Vanon-511097100% (1)

- Edjpb0287g Itrv PDFDocument1 pageEdjpb0287g Itrv PDFArun BhatnagarNo ratings yet

- 102 1500880491102 XXXPP4297X ItrvDocument1 page102 1500880491102 XXXPP4297X Itrvramarao_pandNo ratings yet

- Ack F.y.2017-18Document1 pageAck F.y.2017-18NishantNo ratings yet

- 2018 07 28 13 20 32 119 - 1532764232120 - XXXPC9710X - Acknowledgement PDFDocument1 page2018 07 28 13 20 32 119 - 1532764232120 - XXXPC9710X - Acknowledgement PDFvscomputersNo ratings yet

- Itr-V Ajqpy0100n 2017-18 775756550170517Document1 pageItr-V Ajqpy0100n 2017-18 775756550170517Raj RajNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageamitNo ratings yet

- Purchase Order: Page 1 / 2Document2 pagesPurchase Order: Page 1 / 2Nida KhanNo ratings yet

- Purchase OrderDocument1 pagePurchase OrderNida KhanNo ratings yet

- Purchase OrderDocument1 pagePurchase OrderNida KhanNo ratings yet

- Purchase Order: Page 1 / 2Document2 pagesPurchase Order: Page 1 / 2Nida KhanNo ratings yet

- Purchase Order: Page 1 / 2Document2 pagesPurchase Order: Page 1 / 2Nida KhanNo ratings yet

- ChangedDocument2 pagesChangedNida KhanNo ratings yet

- Purchase Order: Page 1 / 2Document2 pagesPurchase Order: Page 1 / 2Nida KhanNo ratings yet

- Purchase Order: Page 1 / 2Document2 pagesPurchase Order: Page 1 / 2Nida KhanNo ratings yet

- Purchase Order: Page 1 / 2Document2 pagesPurchase Order: Page 1 / 2Nida KhanNo ratings yet

- Purchase Order: Page 1 / 2Document2 pagesPurchase Order: Page 1 / 2Nida KhanNo ratings yet

- Purchase Order: Page 1 / 2Document2 pagesPurchase Order: Page 1 / 2Nida KhanNo ratings yet

- Purchase OrderDocument1 pagePurchase OrderNida KhanNo ratings yet

- Purchase Order: Page 1 / 3Document3 pagesPurchase Order: Page 1 / 3Nida KhanNo ratings yet

- PDF 0010Document3 pagesPDF 0010Nida KhanNo ratings yet

- Purchase Order: Page 1 / 2Document2 pagesPurchase Order: Page 1 / 2Nida KhanNo ratings yet

- Purchase Order: Page 1 / 2Document2 pagesPurchase Order: Page 1 / 2Nida KhanNo ratings yet

- 2 Nagraj NagpashaDocument28 pages2 Nagraj NagpashaNida Khan0% (2)

- Lesson Plan-Test Taking FinalDocument7 pagesLesson Plan-Test Taking FinalStefanNo ratings yet

- in Re Michael Medado To Sign Roll of Attorneys After Taking OathDocument8 pagesin Re Michael Medado To Sign Roll of Attorneys After Taking OathMath DownloaderNo ratings yet

- Organizational BehaviorDocument5 pagesOrganizational BehaviorIrin ChhinchaniNo ratings yet

- Kandiyoti. Women, Islam and The StateDocument8 pagesKandiyoti. Women, Islam and The StateArticulación ProvincialNo ratings yet

- Birth Day QuotesDocument2 pagesBirth Day QuotesNazmus SakibNo ratings yet

- Micro-Teach LPDocument5 pagesMicro-Teach LPapi-509217128No ratings yet

- January 1 - 7, 2020 Sports ReporterDocument8 pagesJanuary 1 - 7, 2020 Sports ReporterSportsReporterNo ratings yet

- Effects, Side Effects and Contraindications of Relaxation Massage During Pregnancy: A Systematic Review of Randomized Controlled TrialsDocument17 pagesEffects, Side Effects and Contraindications of Relaxation Massage During Pregnancy: A Systematic Review of Randomized Controlled TrialsPutri AgriNo ratings yet

- Torres V Satsatin DigestDocument3 pagesTorres V Satsatin DigestSecret SecretNo ratings yet

- Ob2 Sas 14Document5 pagesOb2 Sas 14Ralph Louie ManagoNo ratings yet

- Pubs Usgs GovDocument418 pagesPubs Usgs GovShadin Asari ArabaniNo ratings yet

- 2014 - Afulugencia vs. Metropolitan Bank & Trust Co., 715 SCRA 399, G.R. No. 185145 February 5, 2014 - Remedial Law - CourtsDocument7 pages2014 - Afulugencia vs. Metropolitan Bank & Trust Co., 715 SCRA 399, G.R. No. 185145 February 5, 2014 - Remedial Law - CourtsDaysel FateNo ratings yet

- #24 Filoil Refinery Corp. v. Filoil Supervisory, 46 SCRA 512Document3 pages#24 Filoil Refinery Corp. v. Filoil Supervisory, 46 SCRA 512ROCELLE TANGINo ratings yet

- Auld Lang Syne AnalysisDocument5 pagesAuld Lang Syne AnalysisLucia GiovagnottiNo ratings yet

- Sun 1 Feb15Document106 pagesSun 1 Feb15Tom Kiely100% (1)

- Vicente D. Millora For de Guzman. Jacinto Callanta For Private RespondentDocument3 pagesVicente D. Millora For de Guzman. Jacinto Callanta For Private RespondentYodh Jamin OngNo ratings yet

- 1100 Series Thermos Tatted Column Compartment Reference Manual G1316-90004Document222 pages1100 Series Thermos Tatted Column Compartment Reference Manual G1316-90004meharis0No ratings yet

- Warrior Poet Scaled Skald: Adventurers League Build GuideDocument5 pagesWarrior Poet Scaled Skald: Adventurers League Build Guidematthew russieNo ratings yet

- Ats Menjawab Soal Gin Nov21 Final 50Document14 pagesAts Menjawab Soal Gin Nov21 Final 50anton suponoNo ratings yet

- Math TriviaDocument1 pageMath TriviaAnonymous V0YlTN100% (1)

- Automater PLDocument2 pagesAutomater PLЖељко БонџићNo ratings yet

- Practice Bulletin: Fetal Growth RestrictionDocument12 pagesPractice Bulletin: Fetal Growth RestrictionCarolina Garcia FuentesNo ratings yet

- Davies, Norman - Moorhouse, Roger - Microcosm - A Portrait of A Central European City (2011, Random House - Vintage Digital)Document450 pagesDavies, Norman - Moorhouse, Roger - Microcosm - A Portrait of A Central European City (2011, Random House - Vintage Digital)GeorgLuxemburgNo ratings yet

- Unfinished Movie Script "Call of The Sea"Document3 pagesUnfinished Movie Script "Call of The Sea"Typo ProteccNo ratings yet

Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)

Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)

Uploaded by

Nida KhanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)

Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)

Uploaded by

Nida KhanCopyright:

Available Formats

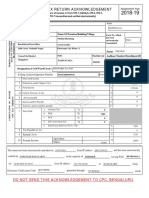

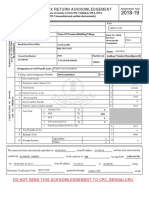

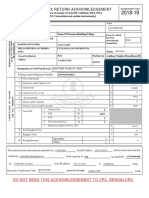

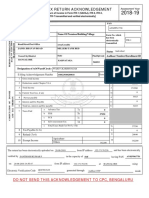

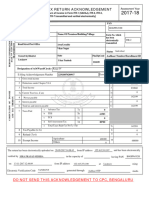

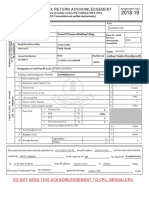

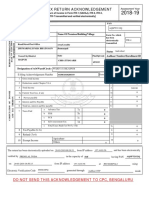

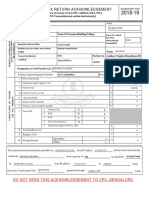

INDIAN INCOME TAX RETURN VERIFICATION FORM Assessment Year

FORM 2018-19

ITR-V [Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-3,

ITR-4(SUGAM), ITR-5, ITR-7 transmitted electronically without digital signature] .

(Please see Rule 12 of the Income-tax Rules, 1962)

Name PAN

RAJ KUMAR MANJHI

PERSONAL INFORMATION AND THE

ALYPM7015J

Form No. which

DATE OF ELECTRONIC

Flat/Door/Block No Name Of Premises/Building/Village

has been ITR-1

TRANSMISSION

162

electronically

transmitted

Road/Street/Post Office Area/Locality

SECTOR-5 RK PURAM Individual

Status

Town/City/District State Pin/ZipCode Aadhaar Number/ Enrollment ID

NEW DELHI

DELHI 110022 XXXX XXXX 6951

Designation of AO (Ward / Circle) WARD 72(2), DELHI Original or Revised ORIGINAL

E-filing Acknowledgement Number 252049880310818 Date(DD-MM-YYYY) 31-08-2018

1 Gross Total Income 1 201937

2 Deductions under Chapter-VI-A 2 300

3 Total Income 3 201640

COMPUTATION OF INCOME

a Current Year loss, if any 3a 0

4

AND TAX THEREON

4 Net Tax Payable 0

5 Interest and Fee Payable 5 0

6 Total Tax, Interest and Fee Payable 6 0

7 Taxes Paid

a Advance Tax 7a 0

b TDS 7b 1219

c TCS 7c 0

d Self Assessment Tax 7d 0

e Total Taxes Paid (7a+7b+7c +7d) 7e 1219

8 Tax Payable (6-7e) 8 0

9 Refund (7e-6) 9 1220

10 Exempt Income Agriculture 0

10

Others 19200 19200

VERIFICATION

I, RAJ KUMAR MANJHI son/ daughter of PARSHU RAM MANJHI , holding Permanent Account Number ALYPM7015J

solemnly declare to the best of my knowledge and belief, the information given in the return and the schedules thereto which have been transmitted

electronically by me vide acknowledgement number mentioned above is correct and complete and that the amount of total income and other particulars

shown therein are truly stated and are in accordance with the provisions of the Income-tax Act, 1961, in respect of income chargeable to income-tax for

the previous year relevant to the assessment year 2018-19. I further declare that I am making this return in my capacity as

Self and I am also competent to make this return and verify it.

Sign here Date 31-08-2018 Place DELHI

If the return has been prepared by a Tax Return Preparer (TRP) give further details as below:

Identification No. of TRP Name of TRP Counter Signature of TRP

For Office Use Only

Receipt No Filed from IP address 180.151.238.40

Date

Seal and signature of ALYPM7015J012520498803108188E85B135AF3768200431F0709E7BE99F73BE7BAF

receiving official

Please send the duly signed Form ITR-V to “Centralized Processing Centre, Income Tax Department, Bengaluru 560500”, by ORDINARY

POST OR SPEED POST ONLY, within 120 days from date of transmitting the data electronically. Form ITR-V shall not be received in any other

office of the Income-tax Department or in any other manner. The confirmation of receipt of this Form ITR-V at ITD-CPC will be sent to the e-mail

address RAJKUMARMANJHITLC@GMAIL.COM

You might also like

- Form - Notice To ExplainDocument2 pagesForm - Notice To ExplainMyra Coronado100% (3)

- Chapter 5 Cdi 1 Final EditedDocument16 pagesChapter 5 Cdi 1 Final EditedBelinda Viernes50% (2)

- BAKER, William J. The Making of A Working-Class Football CultureDocument12 pagesBAKER, William J. The Making of A Working-Class Football CultureGabriela Marta Marques de Oliveira100% (1)

- Dictionary of The Later New Testament & Its Developments (The IVP Bible Dictionary Series) 1997aDocument660 pagesDictionary of The Later New Testament & Its Developments (The IVP Bible Dictionary Series) 1997aHerbert Adam Storck85% (13)

- Doctrine of Ultra Vires-Effects FalDocument11 pagesDoctrine of Ultra Vires-Effects FalFalguni ParekhNo ratings yet

- Sukhjeet Singh 2018-19 (Itr) PDFDocument1 pageSukhjeet Singh 2018-19 (Itr) PDFAnonymous XgLFw9IcQNo ratings yet

- 2019 03 29 18 20 50 494 - 1553863850494 - XXXPC3953X - ItrvDocument1 page2019 03 29 18 20 50 494 - 1553863850494 - XXXPC3953X - ItrvIshaan ChawlaNo ratings yet

- Itr 2018-19 S B Mishra PDFDocument1 pageItr 2018-19 S B Mishra PDFJITENDRA DUBEBYNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageSheila George SorkarNo ratings yet

- 2018 08 25 21 26 43 822 - 1535212603822 - XXXPV9294X - AcknowledgementDocument1 page2018 08 25 21 26 43 822 - 1535212603822 - XXXPV9294X - Acknowledgementanusha.veldandiNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagehealth with wealthNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDhanu goswamiNo ratings yet

- Itr-V Indian Income Tax Return VerificatDocument1 pageItr-V Indian Income Tax Return VerificatMOHD AslamNo ratings yet

- 2018 08 22 17 18 09 004 - 1534938489004 - XXXPK5111X - ItrvDocument1 page2018 08 22 17 18 09 004 - 1534938489004 - XXXPK5111X - ItrvSooraj KanojiyaNo ratings yet

- 2020 07 17 19 34 40 654 - 1594994680654 - XXXPM6958X - ItrvDocument1 page2020 07 17 19 34 40 654 - 1594994680654 - XXXPM6958X - ItrvAmiya SinghNo ratings yet

- 2018 12 16 12 25 37 908 - 1544943337908 - XXXPR1749X - Itrv PDFDocument1 page2018 12 16 12 25 37 908 - 1544943337908 - XXXPR1749X - Itrv PDFJayanta Sur RoyNo ratings yet

- Itr5 271352350310818$Document1 pageItr5 271352350310818$Ajay DiwanNo ratings yet

- 2018 07 19 12 06 41 640 - 1531982201640 - XXXPS3223X - Acknowledgement PDFDocument1 page2018 07 19 12 06 41 640 - 1531982201640 - XXXPS3223X - Acknowledgement PDFHarshal A ShahNo ratings yet

- 2019 05 28 11 48 40 077 - 1559024320077 - XXXPP0859X - ItrvDocument1 page2019 05 28 11 48 40 077 - 1559024320077 - XXXPP0859X - Itrvpoluri vinayNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageSAI MOHANNo ratings yet

- Itr 18-19Document1 pageItr 18-19aarushi singhNo ratings yet

- Letsgettin Fraud CompanyDocument1 pageLetsgettin Fraud CompanyAnonymous A3CiCzvNo ratings yet

- 2018 08 31 18 26 34 022 - 1535720194022 - XXXPB3542X - ItrvDocument1 page2018 08 31 18 26 34 022 - 1535720194022 - XXXPB3542X - Itrvdibyan dasNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)santoshkumarNo ratings yet

- 2018 08 31 20 46 27 108 - 1535728587108 - XXXPG5982X - Acknowledgement PDFDocument1 page2018 08 31 20 46 27 108 - 1535728587108 - XXXPG5982X - Acknowledgement PDFAnupam GauravNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageTaiyabaNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageBimal Kumar MaityNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageAditya SharmaNo ratings yet

- 2018 07 22 16 36 36 674 - 1532257596674 - XXXPK4739X - Itrv PDFDocument1 page2018 07 22 16 36 36 674 - 1532257596674 - XXXPK4739X - Itrv PDFakshay guptaNo ratings yet

- 2018 08 05 18 45 12 530 - 1533474912530 - XXXPR6541X - Acknowledgement PDFDocument1 page2018 08 05 18 45 12 530 - 1533474912530 - XXXPR6541X - Acknowledgement PDFGajendra Kumar VermaNo ratings yet

- Itr Receipt A.Y 2018-19Document1 pageItr Receipt A.Y 2018-19Parminder SinghNo ratings yet

- 2020 12 20 20 11 24 733 - 1608475284733 - XXXPP4894X - ItrvDocument1 page2020 12 20 20 11 24 733 - 1608475284733 - XXXPP4894X - ItrvHARI KRISHAN PALNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageO P TulsyanNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageBibhu Datta SenapatiNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageLingesh MaharajanNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageSuresh raaviNo ratings yet

- 2018 08 16 16 36 49 755 - 1534417609755 - XXXPB8989X - Acknowledgement PDFDocument1 page2018 08 16 16 36 49 755 - 1534417609755 - XXXPB8989X - Acknowledgement PDFAkshya BhoiNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villageitkrishna1988No ratings yet

- 2018 08 31 08 56 38 421 - 1535685998421 - XXXPR9465X - Acknowledgement PDFDocument1 page2018 08 31 08 56 38 421 - 1535685998421 - XXXPR9465X - Acknowledgement PDFVarun MgNo ratings yet

- Maadhavan Chandhiran 16-Mar-2018 454072340Document1 pageMaadhavan Chandhiran 16-Mar-2018 454072340samaadhuNo ratings yet

- Itr 19-20 PDFDocument1 pageItr 19-20 PDFAnonymous fM5CtB8Qm7No ratings yet

- ITRDocument1 pageITRpradip_jsr13No ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagesanthosh kumarNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageSai SanthoshNo ratings yet

- Itr-V Bogpp6352h 2017-18 225020870280917Document1 pageItr-V Bogpp6352h 2017-18 225020870280917DEVIL RDXNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageZa HidNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageutsavgautamNo ratings yet

- 17 18 SaleemDocument1 page17 18 Saleembalaji xeroxNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageAshwini oRNo ratings yet

- Aman Jain Itr (A.y.2017-18)Document1 pageAman Jain Itr (A.y.2017-18)ramanNo ratings yet

- PDF 759518980120718Document1 pagePDF 759518980120718HARDIK BANSALNo ratings yet

- Sellakkili Ramaiah 31-Jul-2018 969570370Document1 pageSellakkili Ramaiah 31-Jul-2018 969570370samaadhuNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageGolu GuptaNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDrsex DrsexNo ratings yet

- 2018 12 18 14 20 55 960 - 1545123055960 - XXXPS8841X - Acknowledgement PDFDocument1 page2018 12 18 14 20 55 960 - 1545123055960 - XXXPS8841X - Acknowledgement PDFLEo GEnji KhunnuNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagejaipal sharmaNo ratings yet

- 2018 08 08 14 20 22 467 - 1533718222467 - XXXPP1510X - Itrv PDFDocument1 page2018 08 08 14 20 22 467 - 1533718222467 - XXXPP1510X - Itrv PDFKrishnaNo ratings yet

- Alrpr6574n Itr VDocument1 pageAlrpr6574n Itr Vanon-511097100% (1)

- Edjpb0287g Itrv PDFDocument1 pageEdjpb0287g Itrv PDFArun BhatnagarNo ratings yet

- 102 1500880491102 XXXPP4297X ItrvDocument1 page102 1500880491102 XXXPP4297X Itrvramarao_pandNo ratings yet

- Ack F.y.2017-18Document1 pageAck F.y.2017-18NishantNo ratings yet

- 2018 07 28 13 20 32 119 - 1532764232120 - XXXPC9710X - Acknowledgement PDFDocument1 page2018 07 28 13 20 32 119 - 1532764232120 - XXXPC9710X - Acknowledgement PDFvscomputersNo ratings yet

- Itr-V Ajqpy0100n 2017-18 775756550170517Document1 pageItr-V Ajqpy0100n 2017-18 775756550170517Raj RajNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageamitNo ratings yet

- Purchase Order: Page 1 / 2Document2 pagesPurchase Order: Page 1 / 2Nida KhanNo ratings yet

- Purchase OrderDocument1 pagePurchase OrderNida KhanNo ratings yet

- Purchase OrderDocument1 pagePurchase OrderNida KhanNo ratings yet

- Purchase Order: Page 1 / 2Document2 pagesPurchase Order: Page 1 / 2Nida KhanNo ratings yet

- Purchase Order: Page 1 / 2Document2 pagesPurchase Order: Page 1 / 2Nida KhanNo ratings yet

- ChangedDocument2 pagesChangedNida KhanNo ratings yet

- Purchase Order: Page 1 / 2Document2 pagesPurchase Order: Page 1 / 2Nida KhanNo ratings yet

- Purchase Order: Page 1 / 2Document2 pagesPurchase Order: Page 1 / 2Nida KhanNo ratings yet

- Purchase Order: Page 1 / 2Document2 pagesPurchase Order: Page 1 / 2Nida KhanNo ratings yet

- Purchase Order: Page 1 / 2Document2 pagesPurchase Order: Page 1 / 2Nida KhanNo ratings yet

- Purchase Order: Page 1 / 2Document2 pagesPurchase Order: Page 1 / 2Nida KhanNo ratings yet

- Purchase OrderDocument1 pagePurchase OrderNida KhanNo ratings yet

- Purchase Order: Page 1 / 3Document3 pagesPurchase Order: Page 1 / 3Nida KhanNo ratings yet

- PDF 0010Document3 pagesPDF 0010Nida KhanNo ratings yet

- Purchase Order: Page 1 / 2Document2 pagesPurchase Order: Page 1 / 2Nida KhanNo ratings yet

- Purchase Order: Page 1 / 2Document2 pagesPurchase Order: Page 1 / 2Nida KhanNo ratings yet

- 2 Nagraj NagpashaDocument28 pages2 Nagraj NagpashaNida Khan0% (2)

- Lesson Plan-Test Taking FinalDocument7 pagesLesson Plan-Test Taking FinalStefanNo ratings yet

- in Re Michael Medado To Sign Roll of Attorneys After Taking OathDocument8 pagesin Re Michael Medado To Sign Roll of Attorneys After Taking OathMath DownloaderNo ratings yet

- Organizational BehaviorDocument5 pagesOrganizational BehaviorIrin ChhinchaniNo ratings yet

- Kandiyoti. Women, Islam and The StateDocument8 pagesKandiyoti. Women, Islam and The StateArticulación ProvincialNo ratings yet

- Birth Day QuotesDocument2 pagesBirth Day QuotesNazmus SakibNo ratings yet

- Micro-Teach LPDocument5 pagesMicro-Teach LPapi-509217128No ratings yet

- January 1 - 7, 2020 Sports ReporterDocument8 pagesJanuary 1 - 7, 2020 Sports ReporterSportsReporterNo ratings yet

- Effects, Side Effects and Contraindications of Relaxation Massage During Pregnancy: A Systematic Review of Randomized Controlled TrialsDocument17 pagesEffects, Side Effects and Contraindications of Relaxation Massage During Pregnancy: A Systematic Review of Randomized Controlled TrialsPutri AgriNo ratings yet

- Torres V Satsatin DigestDocument3 pagesTorres V Satsatin DigestSecret SecretNo ratings yet

- Ob2 Sas 14Document5 pagesOb2 Sas 14Ralph Louie ManagoNo ratings yet

- Pubs Usgs GovDocument418 pagesPubs Usgs GovShadin Asari ArabaniNo ratings yet

- 2014 - Afulugencia vs. Metropolitan Bank & Trust Co., 715 SCRA 399, G.R. No. 185145 February 5, 2014 - Remedial Law - CourtsDocument7 pages2014 - Afulugencia vs. Metropolitan Bank & Trust Co., 715 SCRA 399, G.R. No. 185145 February 5, 2014 - Remedial Law - CourtsDaysel FateNo ratings yet

- #24 Filoil Refinery Corp. v. Filoil Supervisory, 46 SCRA 512Document3 pages#24 Filoil Refinery Corp. v. Filoil Supervisory, 46 SCRA 512ROCELLE TANGINo ratings yet

- Auld Lang Syne AnalysisDocument5 pagesAuld Lang Syne AnalysisLucia GiovagnottiNo ratings yet

- Sun 1 Feb15Document106 pagesSun 1 Feb15Tom Kiely100% (1)

- Vicente D. Millora For de Guzman. Jacinto Callanta For Private RespondentDocument3 pagesVicente D. Millora For de Guzman. Jacinto Callanta For Private RespondentYodh Jamin OngNo ratings yet

- 1100 Series Thermos Tatted Column Compartment Reference Manual G1316-90004Document222 pages1100 Series Thermos Tatted Column Compartment Reference Manual G1316-90004meharis0No ratings yet

- Warrior Poet Scaled Skald: Adventurers League Build GuideDocument5 pagesWarrior Poet Scaled Skald: Adventurers League Build Guidematthew russieNo ratings yet

- Ats Menjawab Soal Gin Nov21 Final 50Document14 pagesAts Menjawab Soal Gin Nov21 Final 50anton suponoNo ratings yet

- Math TriviaDocument1 pageMath TriviaAnonymous V0YlTN100% (1)

- Automater PLDocument2 pagesAutomater PLЖељко БонџићNo ratings yet

- Practice Bulletin: Fetal Growth RestrictionDocument12 pagesPractice Bulletin: Fetal Growth RestrictionCarolina Garcia FuentesNo ratings yet

- Davies, Norman - Moorhouse, Roger - Microcosm - A Portrait of A Central European City (2011, Random House - Vintage Digital)Document450 pagesDavies, Norman - Moorhouse, Roger - Microcosm - A Portrait of A Central European City (2011, Random House - Vintage Digital)GeorgLuxemburgNo ratings yet

- Unfinished Movie Script "Call of The Sea"Document3 pagesUnfinished Movie Script "Call of The Sea"Typo ProteccNo ratings yet