Professional Documents

Culture Documents

Paystubs

Paystubs

Uploaded by

api-418014547Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Paystubs

Paystubs

Uploaded by

api-418014547Copyright:

Available Formats

------------------------------------------------------------------------------------------------------------

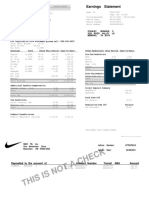

FINDINGLUV SPECIALISTS 10451 Mill Run Circle, Owings Mills, Md. 21117

DATE: 12/28/18 PAY PERIOD ENDING: 12/22/18

Christina L. Aston SS# 211-62-9830 EMPLOYEE NO: 06506094

EARNINGS Federal Income Tax 71.32 1,426.40

$1,215.49 Social Security Tax 65.11 1,302.20

Medicare Tax 15.23 304.60

MD State Income Tax 58.98 1,179.60

Medical 57.46 1,149.20

GROSS TOTAL TAXES NET PAY

$1,215.49 $268.10 $947.39

GROSS YTD

$35,675.71

______________________________________________________________________________

---------------------------------------------------------------------------------------------------------------------

------------------------------------------------------------------------------------------------------------

FINDINGLUV SPECIALISTS 10451 Mill Run Circle, Owings Mills, Md. 21117

DATE: 12/21/18 PAY PERIOD ENDING: 12/15/18

Christina L. Aston SS# 211-62-9830 EMPLOYEE NO: 06506094

EARNINGS Federal Income Tax 54.89 1,097.80

$1,109.00 Social Security Tax 56.63 1,132.60

Medicare Tax 13.24 264.80

MD State Income Tax 48.10 962.00

Medical 57.46 1,149.20

GROSS TOTAL TAXES NET PAY

$1,109.00 $230.32 $878.68

GROSS YTD

$34,460.22

______________________________________________________________________________

---------------------------------------------------------------------------------------------------------------------

---------------------------------------------------------------------------------------------------------------------

FINDINGLUV SPECIALISTS 10451 Mill Run Circle, Owings Mills, Md. 21117

DATE: 12/14/18 PAY PERIOD ENDING: 12/08/18

Christina L. Aston SS# 211-62-9830 EMPLOYEE NO: 06506094

EARNINGS Federal Income Tax 86.32 3,220.10

$1,115.73 Social Security Tax 75.11 1,536.43

Medicare Tax 18.44 649.48

MD State Income Tax 69.82 1,031.34

Medical 57.46 1,264.22

GROSS TOTAL TAXES NET PAY

$1,115.73 $307.15 $808.58

GROSS YTD

$33,351.22

______________________________________________________________________________

---------------------------------------------------------------------------------------------------------------------

---------------------------------------------------------------------------------------------------------------------

FINDINGLUV SPECIALISTS 10451 Mill Run Circle, Owings Mills, Md. 21117

DATE: 12/07/18 PAY PERIOD ENDING: 12/01/18

Christina L. Aston SS# 211-62-9830 EMPLOYEE NO: 06506094

EARNINGS Federal Income Tax 87.43 3,307.53

$1,198.00 Social Security Tax 76.22 1,612.65

Medicare Tax 19.51 668.99

MD State Income Tax 79.93 1,111.27

Medical 57.46 1,321.68

GROSS TOTAL TAXES NET PAY

$1,198.00 $320.55 $877.45

GROSS YTD

$32,235.49

______________________________________________________________________________

---------------------------------------------------------------------------------------------------------------------

You might also like

- PDFDocument1 pagePDFBrian SmithNo ratings yet

- DJ L Pay Stubs 2Document1 pageDJ L Pay Stubs 2jase0% (1)

- Anth 60666@Document5 pagesAnth 60666@anth60666100% (1)

- Adp QUANIC MARTIN-converted (1st Try)Document12 pagesAdp QUANIC MARTIN-converted (1st Try)Quanic Martin100% (1)

- Earnings Statement Only Non NegotiableDocument1 pageEarnings Statement Only Non NegotiableLiz MatzNo ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableTJ JanssenNo ratings yet

- Paystub 3Document1 pagePaystub 3J RequenaNo ratings yet

- View PDF Form PaycheckDocument1 pageView PDF Form Paychecknodropcarwash100% (1)

- SSPOFADVDocument1 pageSSPOFADVKaren OHareNo ratings yet

- Earnings Statement: Stanley, Monique S 3232 River Valley LN Memphis, TN 38119Document1 pageEarnings Statement: Stanley, Monique S 3232 River Valley LN Memphis, TN 38119Miquel JonesNo ratings yet

- Earnings Statement Earnings Statement Earnings Statement Earnings StatementDocument1 pageEarnings Statement Earnings Statement Earnings Statement Earnings StatementAbu Mohammad Omar Shehab Uddin AyubNo ratings yet

- Global Cash Card - Paystub Detail PDFDocument1 pageGlobal Cash Card - Paystub Detail PDFVerónica Del RioNo ratings yet

- 2 BXooo 006610620000 R 969253 A0 FFC521Document1 page2 BXooo 006610620000 R 969253 A0 FFC521Pily AguilarNo ratings yet

- Paperless StatementsDocument4 pagesPaperless StatementsAlamin009No ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableMorenita Pareles100% (1)

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableYanet AlvarezNo ratings yet

- Screenshot 2019-12-04 at 17.37.04Document1 pageScreenshot 2019-12-04 at 17.37.04Arthur LottieNo ratings yet

- Paystub Green 03-25-2022Document1 pagePaystub Green 03-25-2022Juan Ignacio Ramirez Jaramillo100% (2)

- Paycheck 20211203 002360 Maurisha 202112231136Document1 pagePaycheck 20211203 002360 Maurisha 202112231136saraNo ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableAdam MartensNo ratings yet

- Manuel Medel Paystubs PDFDocument7 pagesManuel Medel Paystubs PDFSantiago ManuelNo ratings yet

- 201 East 4th Street, Suite 800 Cincinnati OH 45202 513.852.4899Document1 page201 East 4th Street, Suite 800 Cincinnati OH 45202 513.852.4899Tera's TarotNo ratings yet

- Non-Negotiable: 1033 Massachusetts Avenue 2nd Floor Cambridge, MA 02138Document1 pageNon-Negotiable: 1033 Massachusetts Avenue 2nd Floor Cambridge, MA 02138DearNoodlesNo ratings yet

- Earnings: Hourly OT On CallDocument1 pageEarnings: Hourly OT On CallpabloNo ratings yet

- Keon MillerDocument4 pagesKeon MillerKeon MillerNo ratings yet

- J6Hooo009310710000r0313131DE64F521 PDFDocument1 pageJ6Hooo009310710000r0313131DE64F521 PDFRoll KingsNo ratings yet

- ICL-Coding Operative ReportDocument33 pagesICL-Coding Operative ReportHIMOfficial100% (2)

- Brain MappingDocument41 pagesBrain MappingFrank NobodNo ratings yet

- Gina L Eggleton 22965 NE Albertson RD Gaston, OR 97119: Company: Check No. Group: Loc. Dept: Check Date: HoursDocument4 pagesGina L Eggleton 22965 NE Albertson RD Gaston, OR 97119: Company: Check No. Group: Loc. Dept: Check Date: HoursGigi EggletonNo ratings yet

- Paystub Golden Limousine, Inc 20210906 20210919Document2 pagesPaystub Golden Limousine, Inc 20210906 20210919Alexander Weir-WitmerNo ratings yet

- Total Deduction This Perio: Earnings StatementDocument1 pageTotal Deduction This Perio: Earnings StatementPepe DecaroNo ratings yet

- Earnings Current YTD Amount Current Units YTD Units: Town of Guttenberg 6808 Park Avenue Guttenberg, NJ 07093Document1 pageEarnings Current YTD Amount Current Units YTD Units: Town of Guttenberg 6808 Park Avenue Guttenberg, NJ 07093Alfredo MurrugarraNo ratings yet

- PaystubDocument1 pagePaystubAlberto MoralesNo ratings yet

- Lever Mcalilly LLC Paystubs 2015 06 30Document4 pagesLever Mcalilly LLC Paystubs 2015 06 30api-289189037No ratings yet

- Payroll 08142020Document2 pagesPayroll 08142020Shana RushNo ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableMikkyNo ratings yet

- Paystub For 10-08-2021Document1 pagePaystub For 10-08-2021DP Creativos ImprentaNo ratings yet

- Franklyn Solano Cruz: Earnings StatementDocument1 pageFranklyn Solano Cruz: Earnings StatementFranky CruzNo ratings yet

- Earnings: Our Lady of Peace Ruth MbaDocument1 pageEarnings: Our Lady of Peace Ruth MbaNanga wolosoNo ratings yet

- JF PaycheckDocument1 pageJF Paycheckapi-285511542No ratings yet

- Gil Rental Payroll - 105 - 022019Document1 pageGil Rental Payroll - 105 - 022019Steven LinNo ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableKatrin Joyce PenaredondaNo ratings yet

- Nieves 1Document1 pageNieves 1carterNo ratings yet

- Paycheck 20201230 001387 Pravallika 202101241910Document1 pagePaycheck 20201230 001387 Pravallika 202101241910Prabhakar AenugaNo ratings yet

- Pay StatementDocument1 pagePay Statementjmatos_297262No ratings yet

- State Farm Proof of Insurance PDFDocument1 pageState Farm Proof of Insurance PDFAnonymous RZZiNulNo ratings yet

- Paystub For 11-08-2019Document1 pagePaystub For 11-08-2019Roberin SegarNo ratings yet

- Justice Brown: One Thousand Four Hundred Nine Dollars and 45/100 Justice BrownDocument1 pageJustice Brown: One Thousand Four Hundred Nine Dollars and 45/100 Justice BrownLindsay SimmsNo ratings yet

- Pay Stub Edmondson - 1Document1 pagePay Stub Edmondson - 1Mary AndresonNo ratings yet

- 7258a013 9ad0 496f 8340 2b6368 PDFDocument1 page7258a013 9ad0 496f 8340 2b6368 PDFLadis andradeNo ratings yet

- Attachment 1 4Document1 pageAttachment 1 4Tabbitha CampfieldNo ratings yet

- Check Ais-3Document1 pageCheck Ais-3JOHNNo ratings yet

- Earnings Statement: Earnings Other Benefits and Information DepositsDocument1 pageEarnings Statement: Earnings Other Benefits and Information Depositshitta100% (1)

- Earnings: Hourly Ot Sick Cctips Mealper Prempay RetailcomDocument1 pageEarnings: Hourly Ot Sick Cctips Mealper Prempay Retailcomalfredo velezNo ratings yet

- SSPUSADVDocument1 pageSSPUSADVJamesNo ratings yet

- 08 - 05 - 2021 Foods Off Cycle 119644 Supplemental PDFDocument1 page08 - 05 - 2021 Foods Off Cycle 119644 Supplemental PDFVictoria ChevalierNo ratings yet

- The Texas A&M University System: Statement of Earnings For: Jadhav, Sangramsinh PDocument1 pageThe Texas A&M University System: Statement of Earnings For: Jadhav, Sangramsinh PSangram JadhavNo ratings yet

- Hersey K Delynn PayStubDocument1 pageHersey K Delynn PayStubSharon JonesNo ratings yet

- Earnings Statement: D Lane Agency Inc. 3348 Peachtree RD NE Suite 700 Atlanta, GA 30326Document1 pageEarnings Statement: D Lane Agency Inc. 3348 Peachtree RD NE Suite 700 Atlanta, GA 30326Muhammad AdeelNo ratings yet

- Pay StubDocument1 pagePay StubLulu HuttonNo ratings yet

- Fix Your Credit Score: Add Up To 100 Points in 30 Days or LessFrom EverandFix Your Credit Score: Add Up To 100 Points in 30 Days or LessRating: 1 out of 5 stars1/5 (1)

- Pay 2023-11-03Document1 pagePay 2023-11-03gregorykerr388No ratings yet

- DMActDocument18 pagesDMActsaikrishna muddu100% (1)

- HR Standard Operating ProceduresDocument3 pagesHR Standard Operating Proceduresabmainkyakaru0% (1)

- Project ReportDocument10 pagesProject ReportPranoti nagesh SolapureNo ratings yet

- QA D 005 General SpecificationDocument80 pagesQA D 005 General SpecificationMichael RidgerNo ratings yet

- The Guardian 09.11.2012Document50 pagesThe Guardian 09.11.2012pardostNo ratings yet

- Set 1 (Sta. Rosa)Document3 pagesSet 1 (Sta. Rosa)jhomaeNo ratings yet

- Chap 1 & 2Document18 pagesChap 1 & 2James GanaNo ratings yet

- Implementation of Anti-Drug CampaignDocument40 pagesImplementation of Anti-Drug Campaignjake beseraNo ratings yet

- How HMRC Handle Tax Credit OverpaymentsDocument15 pagesHow HMRC Handle Tax Credit OverpaymentsiamchrisliNo ratings yet

- Padilla - Nursing Profession ProtectionDocument20 pagesPadilla - Nursing Profession ProtectionJoril SarteNo ratings yet

- Statement On ICE-ICDC Disclosure To CongressDocument2 pagesStatement On ICE-ICDC Disclosure To CongressLaw&CrimeNo ratings yet

- Demolition Procurement Process ReportDocument36 pagesDemolition Procurement Process ReportClickon DetroitNo ratings yet

- It Works For Me: Benefits@Wipro - Career Level B2 and B3Document2 pagesIt Works For Me: Benefits@Wipro - Career Level B2 and B3Jyotshna DhandNo ratings yet

- 2 Policy Di Usion. Seven Lessons For Scholars and PractitionersDocument9 pages2 Policy Di Usion. Seven Lessons For Scholars and PractitionersDiegoNo ratings yet

- PD 626 Labor Compensation LawDocument18 pagesPD 626 Labor Compensation LawUlysses RallonNo ratings yet

- Consolidated CCSRulesi Amw PDocument72 pagesConsolidated CCSRulesi Amw PGK TiwariNo ratings yet

- Begging Laws in India - Why They Need Urgent ReformDocument10 pagesBegging Laws in India - Why They Need Urgent Reformsweta rajputNo ratings yet

- March 28 2014 WebDocument48 pagesMarch 28 2014 WebfijitimescanadaNo ratings yet

- Conditions With The Largest Number of Adult Hospital Readmissions by Payer, 2011Document10 pagesConditions With The Largest Number of Adult Hospital Readmissions by Payer, 2011David HarlowNo ratings yet

- Press Release On: Provisional Summary Results of 6 Population and Housing Census-2017Document2 pagesPress Release On: Provisional Summary Results of 6 Population and Housing Census-2017abdul raufNo ratings yet

- History SEHBDocument169 pagesHistory SEHBWebmanNo ratings yet

- The Contract Labour (Regulation and Abolition) Act, 1970: Presented By: Ajay Krishna S4 MbaDocument32 pagesThe Contract Labour (Regulation and Abolition) Act, 1970: Presented By: Ajay Krishna S4 Mbavaishu nairNo ratings yet

- Standart Management SystemDocument16 pagesStandart Management SystemKapil HarchekarNo ratings yet

- October 2016 - Waterfront Seattle FEISDocument328 pagesOctober 2016 - Waterfront Seattle FEISThe UrbanistNo ratings yet

- Noise Exposure StandardsDocument4 pagesNoise Exposure StandardsarfanNo ratings yet

- Environmental Management SystemDocument22 pagesEnvironmental Management SystemLester GarciaNo ratings yet

- Law Foundation: of Silicon ValleyDocument15 pagesLaw Foundation: of Silicon ValleyAnne ElkNo ratings yet